Amended Current Report Filing (8-k/a)

May 14 2019 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

FORM 8-K/A

Amendment No. 1

CURRENT

REPORT

PURSUANT TO SECTION 13 OR

15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported):

December 19,

2018

CHROMADEX CORPORATION

(Exact name of registrant as specified in its

charter)

|

Delaware

|

001-37752

|

26-2940963

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

10900 Wilshire Blvd. Suite 650, Los Angeles, California,

90024

(Address

of principal executive offices, including zip code)

(310) 388-6706

(Registrant's telephone number, including area

code)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[

]Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[

]Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[

]Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[

]Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the

registrant is an emerging growth company as defined in

Rule

405 of the Securities

Act of 1933 (

§

230.405 of

this chapter) or Rule

12b-2 of the Securities Exchange Act

of 1934 (

§

240.12b-2 of

this chapter).

Emerging growth

company

☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section

13(a)

of the Exchange Act.

☐

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

Trading Symbol

|

Name of Each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

CDXC

|

The Nasdaq Capital Market

|

Explanatory Note

On

December 20, 2018, ChromaDex Corporation (the

“Company”) filed with the Securities and Exchange

Commission a Current Report on Form 8-K (the “Initial

Report”) for the purpose of announcing its entry into a

supply agreement (the “Supply Agreement”) with Nestec

Ltd. (“Nestec”). This Amendment No. 1 (the

“Amendment”) to the Initial Report corrects a

scrivener’s error contained in

clause (a) of the second sentence of the third paragraph of the

Initial Report to change a reference from “June 30,

2019” to the correct date of “December 31, 2019”,

so that the relevant clause now reads “(a) Nestec may

terminate the Supply Agreement if Nestec’s technical

feasibility in desired food forms is not achieved by December 31,

2019 by providing the Company 60 days written notice”. Item

1.01 has been replaced in its entirety below. No other changes have

been made to the Initial Report. The Company continues to make

progress on achieving technical feasibility under the Supply

Agreement, but at this time cannot predict when such technical

feasibility will be achieved by the Company or Nestec.

Item 1.01

Entry into a Material

Definitive Agreement

.

On

December 19, 2018, ChromaDex, Inc. (the “Company”) and

Nestec Ltd. (“Nestec”) entered into a supply agreement

(the “Supply Agreement”), pursuant to which Nestec will

exclusively purchase nicotinamide riboside marketed under the brand

name Tru Niagen (“NR”) from the Company, and Nestec

will be entitled to develop, manufacture, sell, promote, import and

distribute products using NR for human use in the (i) medical

nutritional and (ii) functional food and beverage categories (the

“Approved Products”) in certain territories, including

North America, Europe, Latin America, Australia, New Zealand and

Japan (the “Territory”), subject to certain territory

reversion provisions. Subject to certain conditions and reversion

rights, during the term of the Supply Agreement, the Company will

not sell NR to any third party or itself use NR in any medical

nutritional products for human use in the Territory. Subject to

certain conditions and reversion rights, the Company will not sell

NR to any third party for use in the manufacture of third party

functional food and beverage products that consist of protein based

ready to drink or loose powder beverages sold under a third party

brand in the Territory. The Company reserved rights for

co-exclusive sales of functional food and beverages consisting of

protein based ready to drink or loose powder beverages. Approved

Products do not include, among other things, supplements or sports

nutrition products.

As

consideration for the rights granted to Nestec under the Supply

Agreement, Nestec agreed to pay to the Company an upfront fee of

$4,000,000. Following the launch of the first Approved Product in

each sub-Territory for each of the (i) medical nutrition and (ii)

functional food and beverages categories (each, a “Product

Category”), Nestec will pay the Company a one-time fee for a

potential total aggregate payment of $6,000,000. The Supply

Agreement additionally provides that Nestec is obligated to pay to

the Company sales fees at tiered percentage rates ranging from the

low-single digit to high-single digit percent of worldwide annual

net sales of the Approved Products, subject to a minimum annual

royalty for each Product Category applied against actual sales fees

due starting 24 months after Nestec has launched an Approved

Product in the relevant Product Category. No sales fees will be due

after the expiration or abandonment of all of the Company’s

applicable issued patents and applicable filed patent applications

for NR.

The

Supply Agreement may be terminated by (i) a party for cause if the

other party commits a material breach of the Supply Agreement and

does not cure such breach within 30 days following such

party’s receipt of written notice; (ii) a party immediately

upon the giving of written notice if the other party files a

petition for bankruptcy, is adjudicated bankrupt, takes advantage

of the insolvency laws of any state, territory or country, or has a

receiver, trustee, or other court officer appointed for its

property; or (iii) a party if a force majeure event with respect to

the other party shall have continued for 90 days or is reasonably

expected to continue for more than 180 days. Additionally, (a)

Nestec may terminate the Supply Agreement if Nestec’s

technical feasibility in desired food forms is not achieved by

December 31, 2019 by providing the Company 60 days written notice;

(b) after the first anniversary of the Supply Agreement until the

24th month after the launch of the first Approved Product in each

Product Category, Nestec may terminate the Supply Agreement as to

one or both Product Categories upon the payment of a $500,000

termination fee (the “Termination Fee”) for each

terminated Product Category; and (c) after the 25th month of the

launch of the first Approved Product, Nestec may terminate the

Supply Agreement with 12 months written notice, with no Termination

Fee due. Upon the termination of the Supply Agreement, Nestec may

complete and sell any work-in-progress and inventory of Approved

Products within six months after the effective date of the

termination (unless such termination is based on cause or a breach

by Nestec of the Company’s intellectual property rights or

Nestec’s confidentiality rights therein), following which

Nestec will have no further right to use NR or sell the Approved

Products.

The

foregoing is only a summary of the material terms of the Supply

Agreement, and does not purport to be complete and is qualified in

its entirety by reference to the full text of the Supply Agreement,

which will be filed, with confidential terms redacted, with the

Securities and Exchange Commission as an exhibit to ChromaDex

Corporation’s Annual Report on Form 10-K for the year ending

December 31, 2018.

On

December 20, 2018, the Company issued a press release announcing

the Supply Agreement. A copy of this press release is attached

hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

Press

Release dated December

20,

2018

.

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CHROMADEX CORPORATION

|

|

|

|

|

|

Dated:

May 14, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kevin M.

Farr

|

|

|

|

|

|

|

|

Name:

Kevin M. Farr

|

|

|

|

|

|

|

|

Chief

Financial Officer

|

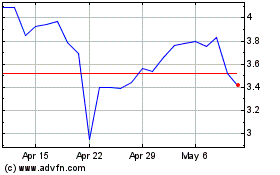

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Apr 2023 to Apr 2024