Infrastructure and Energy Alternatives, Inc. Announces $50 Million Equity Commitment

May 14 2019 - 8:00AM

Infrastructure and Energy Alternatives, Inc. (NASDAQ: IEA) (“IEA”

or the “Company”), a leading infrastructure construction company

with specialized energy and heavy civil expertise, today announced

that it has entered into a $50 million equity commitment agreement

with a fund managed by the Private Equity Group of Ares Management

Corporation (NYSE: ARES), a leading global alternative asset

manager, and funds managed by Oaktree Capital Management, L.P.

("Oaktree"). Under the terms of the commitment, the funds have

agreed to purchase $50 million of newly created Series B Preferred

Stock from the Company, subject to certain terms and conditions,

including making certain amendments to the Company’s credit

agreement and approval of the issuances by NASDAQ. Ares and Oaktree

will receive warrants with an exercise price of $.01 per share for

the purchase of up to 10% of the Company’s common stock on a fully

diluted basis with the opportunity to obtain warrants for up to an

additional 6% of the Company’s outstanding fully diluted common

stock based on the Company’s failure to meet certain performance

targets. The proceeds from the sale of the Series B Preferred

Stock will be used for working capital and to reduce outstanding

borrowings under the Company’s revolving credit facility. The

transaction is expected to close on or before May 20, 2019, subject

to satisfaction of applicable closing conditions. Following

the closing of the transaction, Ares will be entitled to appoint

one director to the Company’s Board of Directors. A special

committee of the Company’s Board of Directors consisting solely of

independent disinterested directors reviewed and approved the terms

of the preferred stock issuance.

JP Roehm, Chief Executive Officer of IEA

commented, “We are honored to have Ares as an investor in our

company. Their commitment, as well as Oaktree’s continued

support, underscore the strength of our larger, more diversified

platform. This capital will further strengthen our balance

sheet and provide us the financial flexibility we need to execute

our 2019 business plan and drive value creation for our

shareholders.”

“IEA is a market leader across multiple

specialty end markets and we are pleased to support management’s

business objectives and help recapitalize the company for continued

growth,” said Scott Graves, Partner and Co-Head of North American

Private Equity at Ares Management.

Guggenheim Securities, LLC acted as the

Company’s sole placement agent and Jefferies acted as a

financial advisor in connection with the transaction.

The Company will provide additional details on

the transaction on its previously announced earnings call scheduled

for Thursday, May 16, 2019 at 11:00 a.m. EDT.

About IEA

Infrastructure and Energy Alternatives, Inc.

(IEA) is a leading infrastructure construction company with

specialized energy and heavy civil expertise. Headquartered in

Indianapolis, Indiana, with operations throughout the country,

IEA’s service offering spans the entire construction process. The

Company offers a full spectrum of delivery models including full

engineering, procurement, and construction, turnkey, design-build,

balance of plant, and subcontracting services. IEA is one of three

Tier 1 wind energy contractors in the United States and has

completed more than 200 wind and solar projects across North

America. In the heavy civil space, IEA offers a number of specialty

services including environmental remediation, industrial

maintenance, specialty transportation infrastructure and other site

development for public and private projects. For more information,

please visit IEA’s website at www.iea.net or follow IEA on

Facebook, LinkedIn and Twitter for the latest company news and

events.

About Ares Management

Corporation

Ares Management Corporation is a publicly

traded, leading global alternative asset manager with approximately

$137 billion of assets under management as of March 31, 2019 and 18

offices in the United States, Europe, Asia and Australia. Since its

inception in 1997, Ares has adhered to a disciplined investment

philosophy that focuses on delivering strong risk-adjusted

investment returns throughout market cycles. Ares believes each of

its three distinct but complementary investment groups in Credit,

Private Equity and Real Estate is a market leader based on assets

under management and investment performance. Ares was built upon

the fundamental principle that each group benefits from being part

of the greater whole. For more information, visit

www.aresmgmt.com.

Forward Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). The

forward-looking statements can be identified by the use of

forward-looking terminology including “may,” “should,” “likely,”

“will,” “believe,” “expect,” “anticipate,” “estimate,” “forecast,”

“seek,” “target,” “continue,” “plan,” “intend,” “project,” or other

similar words. All statements, other than statements of historical

fact included in this press release, regarding expectations for

executing the transactions described herein, our use of proceeds,

future financial performance, business strategies, expectations for

our business, future operations, financial position, estimated

revenues and losses, projected costs, prospects, plans, objectives

and beliefs of management are forward-looking statements.

These forward-looking statements are based on information available

as of the date of this release and our management’s current

expectations, forecasts and assumptions, and involve a number of

judgments, risks and uncertainties. Although we believe that the

expectations reflected in such forward-looking statements are

reasonable, we cannot give any assurance that such expectations

will prove correct. Forward-looking statements should not be relied

upon as representing our views as of any subsequent date. As a

result of a number of known and unknown risks and uncertainties,

our actual results or performance may be materially different from

those expressed or implied by these forward-looking statements.

Some factors that could cause actual results to differ include:

- our ability to execute the

transactions described herein;

- availability of commercially

reasonable and accessible sources of liquidity;

- our ability to generate cash flow

and liquidity to fund operations;

- the timing and extent of

fluctuations in geographic, weather and operational factors

affecting our customers, projects and the industries in which we

operate;

- our ability to identify acquisition

candidates, integrate acquired businesses and realize upon the

expected benefits of the acquisition of CCS and William

Charles;

- consumer demand;

- our ability to grow and manage

growth profitably;

- the possibility that we may be

adversely affected by economic, business, and/or competitive

factors;

- market conditions, technological

developments, regulatory changes or other governmental policy

uncertainty that affects us or our customers;

- our ability to manage projects

effectively and in accordance with management estimates, as well as

the ability to accurately estimate the costs associated with our

fixed price and other contracts, including any material changes in

estimates for completion of projects;

- the effect on demand for our

services and changes in the amount of capital expenditures by

customers due to, among other things, economic conditions,

commodity price fluctuations, the availability and cost of

financing, and customer consolidation;

- the ability of customers to

terminate or reduce the amount of work, or in some cases, the

prices paid for services, on short or no notice;

- customer disputes related to the

performance of services;

- disputes with, or failures of,

subcontractors to deliver agreed-upon supplies or services in a

timely fashion;

- our ability to replace

non-recurring projects with new projects;

- the impact of U.S. federal, local,

state, foreign or tax legislation and other regulations affecting

the renewable energy industry and related projects and

expenditures;

- the effect of state and federal

regulatory initiatives, including costs of compliance with existing

and future safety and environmental requirements;

- fluctuations in maintenance,

materials, labor and other costs;

- our beliefs regarding the state of

the renewable wind energy market generally; and

- the “Risk Factors” described in our

Annual Report on Form 10-K for the year ended December 31, 2018,

and in our quarterly reports, other public filings and press

releases.

We do not undertake any obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Contact

Andrew LaymanChief Financial

OfficerAndrew.Layman@iea.net765-828-2580

Financial Profiles, Inc.Larry Clark, Senior Vice

Presidentlclark@finprofiles.com310-622-8223

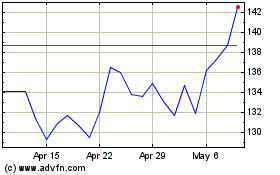

Ares Management (NYSE:ARES)

Historical Stock Chart

From Mar 2024 to Apr 2024

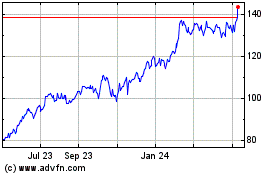

Ares Management (NYSE:ARES)

Historical Stock Chart

From Apr 2023 to Apr 2024