As filed with the Securities and Exchange

Commission on May 10, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2 TO FORM

S-1 ON

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Jerash Holdings (US), Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

81-4701719

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

260 East Main Street, Suite 2706

Rochester, New York 14604

(212) 575-9085

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Choi Lin Hung

Chairman, Chief Executive Officer, President

and Treasurer

260 East Main Street, Suite 2706

Rochester, New York 14604

(212) 575-9085

(Name, address, including zip code and telephone

number, including area code, of agent for service)

C

OPIES

T

O

:

James M. Jenkins, Esq.

Alexander R. McClean, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New York 14604

(585) 232-6500

Approximate date of commencement of

proposed sale of the securities to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box:

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering:

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering:

¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box:

¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box:

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

|

|

|

|

|

Non-accelerated filer

|

|

x

|

|

Smaller reporting company

|

|

x

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

x

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act:

x

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount

to be

registered

(1)

|

|

|

Proposed

maximum

offering price

per share

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

registration fee

(2)

|

|

|

Primary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shelf Offering

|

|

|

—

|

|

|

|

—

|

|

|

$

|

40,000,000

|

|

|

$

|

4,848

|

|

|

Common Stock, par value $0.001 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock Underlying Warrants

|

|

|

131,200

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Secondary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.001 per share

|

|

|

2,685,896

|

(5)

|

|

$

|

6.90

|

(6)

|

|

$

|

8,556,000

|

(6)

|

|

$

|

1,037

|

(7)

|

|

Total

|

|

|

|

|

|

|

|

|

|

$

|

48,556,000

|

|

|

$

|

5,792

|

(2)

|

|

(1)

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”).

|

|

(2)

|

Calculated in accordance with Rule 457(o) under the Securities Act, $1,220.67 of the registration fee has been previously paid, and $93.47 of this filing fee is offset pursuant to Rule 457(p) by the filing fee previously paid by the registrant on January 18, 2018 for a total of 85,800 shares of common stock underlying warrants that were not issued under the registration statement on Form S-1 (File No. 333-222596).

|

|

|

|

|

(3)

|

Consists of (a) up to 74,000 shares of common stock underlying warrants held by the selling securityholders, originally registered on Form S-1 (File No. 333-218991); and (b) up to 57,200 shares of common stock underlying warrants held by the underwriter of the registrant’s initial public offering and its affiliates, originally registered on Form S-1 (File No. 333-222596).

|

|

|

|

|

(4)

|

All applicable filing fees relating to the shares of common stock underlying warrants were paid at the time of filing the Prior Registration Statements (File Nos. 333-218991 and 333-222596).

|

|

|

|

|

(5)

|

Consists of (a) up to 1,445,896 shares of common stock for resale by selling securityholders, originally registered on Form S-1 (File No. 333-218991); and (b) up to 1,240,000 shares of common stock for resale by the selling securityholders, registered herewith.

|

|

|

|

|

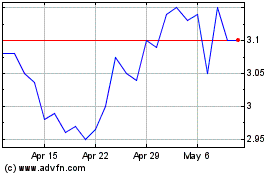

(6)

|

Estimated for the sole purpose of computing the registration fee in accordance with Rule 457(c) under the Securities Act for the shares of common stock for resale by the selling securityholders and not previously registered under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low prices of the registrant’s common stock on May 9, 2019, as reported on the Nasdaq Capital Market.

|

|

|

|

|

(7)

|

All applicable filing fees relating to the resale of up to 1,445,896 shares of common stock by the selling securityholders were paid at the time of filing the registration statement on Form S-1 (File No. 333-218991).

|

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine

.

EXPLANATORY NOTE

Pursuant to Rule 429(a) under the Securities

Act of 1933, as amended, the prospectus included in this registration statement is a combined prospectus relating to (1) the issuance

of up to $40 million of the registrant’s securities to be sold from time to time by the registrant as described herein; (2)

the resale of up to 1,240,000 shares of the registrant’s common stock to be sold by the selling stockholders named herein;

(3) the resale of up to 1,445,896 shares of the registrant’s common stock which were registered for resale and remain unsold

under the registrant’s Registration Statement on Form S-1 (File No. 333-218991), which was initially declared effective by

the Securities and Exchange Commission on October 27, 2017; (4) the exercise of warrants to purchase up to 74,000 shares of common

stock, which was registered under the registrant’s Registration Statement on Form S-1 (File No. 333-218991), which was initially

declared effective by the Securities and Exchange Commission on October 27, 2017; and (5) the exercise of warrants to purchase

up to 57,200 shares of common stock, which was registered under the registrant’s Registration Statement on Form S-1 (File

No. 333-222596), which was initially declared effective by the Securities and Exchange Commission on March 14, 2018.

We refer to the registration statements

on Form S-1 (File Nos. 333-218991 and 333-222596) collectively herein as the “Prior Registration Statements.”

Pursuant

to Rule 429(b), this registration statement, upon effectiveness, also constitutes a Post-Effective Amendment to the Prior Registration

Statements, which post-effective amendments shall hereafter become effective concurrently with the effectiveness of this registration

statement and in accordance with Section 8(c) of the Act. If securities previously registered under the Prior Registration Statements

are offered and sold before the effective date of this registration statement, the amount of previously registered securities so

sold will not be included in the prospectus hereunder.

The information in this

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, dated

May 10, 2019

PRELIMINARY PROSPECTUS

Jerash Holdings (US), Inc.

$40,000,000

Shares of Common Stock

Warrants

Units

Exercise of up to 131,200 Shares of Common

Stock Underlying Warrants and

2,685,896 Shares of Common Stock offered

by the selling stockholders

We may offer and sell from time to time

up to $40,000,000 of shares of our common stock, par value $0.001 per share (“common stock”), warrants to purchase

other securities and units consisting of any combination of these securities.

This prospectus also relates to the exercise

of warrants to purchase up to an aggregate of 131,200 shares of our common stock, consisting of (a) 74,000 shares relating to warrants

issued in connection with a private placement of our securities that initially closed on May 15, 2017, with subsequent closings

on August 18, 2017 and September 27, 2017 (the “Private Placement”); and (b) 57,200 shares relating to warrants issued

to the underwriter of our initial public offering which closed on May 2, 2018 (“IPO”).

This prospectus also relates to the offer

and resale by the selling securityholders identified herein of up to 2,685,896 shares of common stock.

This prospectus provides you with a general

description of the securities listed above. Each time we or the selling stockholders offer any securities pursuant to this prospectus,

we will provide a prospectus supplement and, if necessary, a pricing supplement that will contain specific information about the

terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. This

prospectus may not be used to offer or sell our securities without a prospectus supplement describing the method and terms of the

offering. You should read this prospectus, any amendments to this prospectus, and any prospectus supplement together with the information

described under the heading “Incorporation of Certain Information by Reference” before you make your investment decision.

The registration of the shares of common

stock hereunder does not mean that we or the selling securityholders will actually offer or sell the full number of shares being

registered pursuant to this prospectus. We and the selling securityholders may sell the shares of common stock and other securities

registered hereby from time to time. We and selling securityholders may offer and sell the securities in a variety of transactions

described under the headings “Plan of Distribution for the Company” beginning on page 10 and “Plan of Distribution

for the Selling Securityholders” beginning on page 12, including transactions on any stock exchange, market or facility on

which the common stock may be traded, in block trades, in other privately negotiated transactions or otherwise at market prices

prevailing at the time of sale, at prices related to such market prices or at negotiated prices.

We will not receive any of the proceeds

from the sale of our common stock by the selling securityholders, but, if any warrants are exercised, we will receive the exercise

price of the warrants exercised by their holders. We are registering these shares of common stock on behalf of the selling securityholders.

We are bearing all of the expenses in connection with the registration of the shares of common stock, but all selling and other

expenses incurred by the selling securityholders, including commissions and discounts, if any, attributable to the sale or disposition

by such selling securityholders will be borne by the selling securityholders.

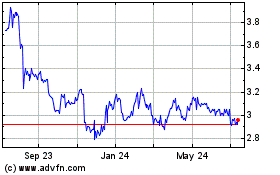

Our common stock is listed on the Nasdaq

Capital Market under the symbol “JRSH.” On March 27, 2019, the closing price as reported on the Nasdaq Capital Market

was $7.99 per share. This price will fluctuate based on the demand for our common stock. Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell securities registered in a public primary offering with a value exceeding more than

one-third of our public float

(the market value of our common stock held by our non-affiliates)

in

any 12 calendar month period so long as our public float remains below $75.0 million. We have not offered any securities pursuant

to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

As of March 27, 2019, one-third of our public float is equal to approximately $8,339,296.

We are an “emerging growth company,”

as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with reduced public

company reporting requirements.

Investing in our securities involves

risk. You should carefully read the information included and incorporated by reference into this prospectus for a discussion of

the factors you should carefully consider in determining whether to invest in our securities, including the discussion of risks

described under “Risk Factors” on page 5 of this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 10, 2019.

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus, any prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to

which we have referred you. We have not authorized anyone to provide you with information that is different. If anyone provides

you with different or inconsistent information, you should not rely upon it. This prospectus is not an offer to sell, nor

are we or the selling securityholders seeking an offer to buy, securities in any state were such offer or solicitation is not permitted.

The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless

of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations

and prospects may have changed since these dates.

For investors outside the United States:

neither we nor the selling securityholders have done anything that would permit this offering or possession or distribution of

this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside

the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of our securities and the distribution of this prospectus outside the United States.

About this

Prospectus

This prospectus is part of a registration

statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf”

registration process. Under this shelf registration process, we may issue and sell any combination of the securities described

in this prospectus in one or more offerings with a maximum aggregate offering price of up to $40,000,000.

In addition, the exercise of warrants to

purchase up to an aggregate of 131,200 shares of common stock is registered under this registration statement. These warrant shares

consist of (a) 74,000 shares issuable upon the exercise of warrants issued in connection with the Private Placement and (b) 57,200

shares issuable upon the exercise of warrants issued to the underwriter of our IPO.

The selling securityholders named herein

may also offer and sell up to 2,685,896 shares of our common stock under this registration statement.

This prospectus provides you with a general

description of the securities we may offer. Each time we sell securities under this shelf registration, we will provide a prospectus

supplement that will contain specific information about the terms of that offering, including a description of any risks relating

to the offering, if those terms and risks are not described in this prospectus. A prospectus supplement may also add, update or

change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the

applicable prospectus supplement, you should rely on the information in the prospectus supplement. The registration statement we

filed with the SEC includes exhibits that provide more details of the matters discussed in this prospectus. You should read this

prospectus and the related exhibits filed with the SEC and the accompanying prospectus supplement together with additional information

described under the headings “Available Information” and “Information Incorporated by Reference” before

investing in any of the securities offered.

We note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this

prospectus were made solely for the benefit of the parties to such agreement, including in some cases, for the purpose of allocating

risk among the parties to the agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover,

those representations, warranties and covenants should not be relied upon as accurately representing the current state of our affairs.

We may sell securities to or through underwriters

or dealers, and also may sell securities directly to other purchasers or through agents. To the extent not described in this prospectus,

the names of any underwriters, dealers or agents employed by us or any selling stockholder in the sale of the securities covered

by this prospectus, the principal amounts or number of shares or other securities, if any, to be purchased by such underwriters

or dealers and the compensation, if any, of such underwriters, dealers or agents will be set forth in an accompanying prospectus

supplement.

The information in this prospectus is accurate

as of the date on the front cover. Information incorporated by reference into this prospectus is accurate as of the date of the

document from which the information is incorporated. You should not assume that the information contained in this prospectus is

accurate as of any other date.

Cautionary

Statement Regarding Forward-Looking Statements

Statements in this prospectus that are

based on other than historical data are forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and include, among others:

|

|

·

|

statements with respect to the beliefs, plans, objectives, goals, guidelines, expectations, anticipations,

and future financial condition, results of operations and performance of Jerash Holdings (US), Inc. and its direct and indirect

subsidiaries (collectively, “Jerash,” the “Company,” the “Group,” “we,” “us,”

and “our”); and

|

|

|

·

|

statements preceded by, followed by or that include the words “may,” “could,”

“should,” “would,” “believe,” “anticipate,” “estimate,” “expect,”

“intend,” “plan,” “projects” or similar expressions.

|

These forward-looking statements are not

guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent

date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those

presented, either expressed or implied, in this prospectus, any prospectus supplement, and our Annual Report on Form 10-K for the

fiscal year ended March 31, 2018 (the “Form 10-K”), which is incorporated by reference into this prospectus, including,

but not limited to, those presented in the Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Factors that might cause such material differences include, but are not limited to:

|

|

·

|

We rely on one key customer for substantially all of our revenue;

|

|

|

·

|

We are dependent on a single product segment comprised of a limited number of products;

|

|

|

·

|

Our customers are in the clothing retail industry, which is subject to substantial cyclical variations

and may impact our revenues and cash requirements;

|

|

|

·

|

We could experience product quality or late delivery problems with our products;

|

|

|

·

|

Our business could suffer if we violate labor laws, fail to conform to our customers’ or

other generally accepted labor standards, or if our products fail to comply with industry and governmental regulations;

|

|

|

·

|

We face intense competition in the worldwide apparel manufacturing industry;

|

|

|

·

|

All of our manufacturing facilities are located in Amman, Jordan, and we are subject to the risks

of doing business abroad, including regulatory and political uncertainty in Jordan;

|

|

|

·

|

If we fail to establish and maintain an effective system of internal control over financial reporting,

we may not be able to accurately and timely disclose information about our financial results or prevent fraud;

|

|

|

·

|

A default under our credit facilities could result in a foreclosure of our assets;

|

|

|

·

|

We may require additional financing to fund our operations and capital expenditures; if we are

unable to obtain such additional financing our business operations may be harmed;

|

|

|

·

|

We rely on dividends, distributions and other payments, advances and transfers from our operating

subsidiaries to meet our obligations due to our status as a holding company;

|

|

|

·

|

Exercises of currently outstanding or committed warrants and options, and any future sales and

issuances of our common stock or rights to purchase common stock, could result in substantial dilution to our stockholders;

|

|

|

·

|

We rely on our management team and other key employees, who may face competing demands relating

to their time and resources;

|

|

|

·

|

We may have conflicts of interest with our affiliates and related parties;

|

|

|

·

|

The reduced disclosure requirements applicable to emerging growth companies may make our common

stock less attractive to investors, which may lead to volatility and a decrease in the market price of our common stock; and

|

|

|

·

|

Our majority stockholders will control the Company for the foreseeable future, including the outcome

of matters requiring stockholder approval.

|

We caution readers not to place undue reliance

on any forward-looking statements, which speak only as of the date made, and advise readers that various factors, including those

described above, could affect our financial performance and could cause our actual results or circumstances for future periods

to differ materially from those anticipated or projected. Please see the Risk Factors in Item 1A of the Form 10-K incorporated

herein by reference for further information. Except as required by law, we do not undertake, and specifically disclaim any obligation

to publicly release any revisions to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events

or circumstances after the date of such statements.

Prospectus

Summary

About the Company

Through our wholly-owned operating subsidiaries,

we are principally engaged in manufacturing and exporting customized, ready-made sport and outerwear from knitted fabric produced

in our facilities in Jordan.

We are a manufacturer utilized by many

well-known brands and retailers, such as Walmart, Costco, Sears, Hanes, Columbia, Land’s End, VF Corporation (which owns

brands such as The North Face, Timberland, Wrangler, Lee, Jansport, etc.), and PVH Corp., formerly known as Phillips-Van Heusen,

(which owns brands such as Calvin Klein, Tommy Hilfiger, IZOD, Speedo, etc.). Our production facilities are made up of four factory

units and three warehouses and currently employ approximately 3,000 people. Our employees include local Jordanian workers as well

as migrant workers from Bangladesh, Sri Lanka, India, Myanmar and Nepal. The total annual capacity at our facilities is approximately

6.5 million pieces. Our products, consisting of jackets, polo shirts, crew neck shirts, pants and shorts made from knitted fabric,

are in the customized, ready-made sport and outerwear segment, and we derive all of our revenue from the manufacture and sale of

sport and outerwear.

Implications of Being an Emerging

Growth Company

We qualify as an emerging growth company

as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”). An emerging growth company may take

advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions

include being permitted to:

|

|

·

|

have only two years of audited financial statements and only two years of related Management’s

Discussion and Analysis;

|

|

|

·

|

omit the auditor attestation of our internal control over financial reporting under Section 404

of the Sarbanes-Oxley Act of 2002; and

|

|

|

·

|

provide limited disclosure about our executive compensation arrangements.

|

We have already taken advantage of these

reduced reporting burdens in this prospectus and the reports we file with the SEC, some of which are also available to us as a

smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We could remain an emerging growth company

until the earlier of October 2022 and the earliest of (1) the last day of the first fiscal year in which our annual gross revenues

exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange

Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last

business day of our most recently completed second fiscal quarter, or (3) the date on which we have issued more than $1 billion

in non-convertible debt during the preceding three year period.

In addition, the JOBS Act provides that

an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private

companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore,

we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

The Offering

This prospectus is part of a registration

statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration process, we may sell

any combination of the following in one or more offerings up to an aggregate of $40 million:

|

|

·

|

warrants to purchase common stock; and/or

|

|

|

·

|

units consisting of one or more of the foregoing.

|

This prospectus provides you with a general

description of the securities we may offer pursuant to the shelf registration process. Each time we sell securities, we will provide

a prospectus supplement that will contain specific information about the terms of that specific offering and include a discussion

of any risk factors or other special considerations that apply to those securities. The prospectus supplement may also add, update

or change information contained in this prospectus. You should read this prospectus, any amendment to this prospectus and any prospectus

supplement, including the section entitled “Risk Factors,” together with the additional information described under

the heading “Where You Can Find More Information.”

This prospectus also relates to the exercise

of warrants to purchase up to 131,200 shares of our common stock that are currently held by the selling securityholders and the

underwriter, or affiliates of the underwriter, of our IPO. Further information regarding the exercise of these warrants is found

below. We do not expect to provide a prospectus supplement containing further information regarding the exercise of these warrants.

|

Securities offered by us:

|

|

Exercise of warrants to purchase up to 131,200 shares of our common stock

|

|

Common stock outstanding prior to this offering:

|

|

11,325,000 shares

(1)

|

|

Common stock to be outstanding following this offering:

|

|

11,456,200 shares

(2)

|

|

Exercise of warrants:

|

|

Holders of warrants issued in our Private

Placement may exercise the warrant for $6.25 per share for a period of five years from the date the warrant was issued.

Holders of warrants issued to the underwriter

and its affiliates in our IPO may exercise the warrant for $8.75 per share for a period of five years from the date the warrant

was issued, or May 2, 2023.

|

|

Use of proceeds:

|

|

We will use the proceeds from the exercise of warrants for general corporate purposes.

|

|

Listing:

|

|

Our common stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “JRSH”

|

|

Risk Factors:

|

|

You should read the section of this prospectus entitled “Risk Factors” for a discussion of factors to carefully consider before deciding to invest in shares of our common stock

|

|

(1)

|

This amount is based on the number of shares outstanding as of May 9, 2019 and excludes shares issuable upon the exercise of outstanding warrants described in the table above and presently exercisable options to purchase 989,500 shares of our common stock.

|

|

(2)

|

This amount assumes the exercise of all of the warrants registered pursuant to this registration statement. The number of shares that may be outstanding following an offering pursuant to the shelf registration statement cannot be determined at this time.

|

Risk Factors

Investing in our securities involves risks.

Before making an investment decision, you should carefully consider the specific risks set forth under the caption “Risk

Factors” in our filings with the SEC, which are incorporated by reference into this prospectus.

Use of Proceeds

Offerings by the Company

We intend to use the net proceeds from

the sale of the securities and exercise of warrants for general corporate purposes unless otherwise indicated in the prospectus

supplement relating to a specific issue of securities. The prospectus supplement with respect to an offering of securities may

identify different or additional uses for the proceeds of such offering. Until we use the net proceeds from the sale of any of

the securities for general corporate purposes, we expect to use the net proceeds for temporary investments.

Offerings by Selling Securityholders

We will not receive any proceeds from the

sale of shares of common stock by the selling securityholders pursuant to this prospectus. The selling securityholders will sell

the shares in accordance with the “Plan of Distribution for the Selling Securityholders” section of this prospectus

and will receive all of the net proceeds from the sale of any shares of common stock offered by them under this prospectus. We

have agreed to pay all costs, expenses and fees relating to registering the shares referenced in this prospectus. The selling securityholders

will pay any fees, discounts, concessions or commissions of broker-dealers or agents, any applicable transfer taxes and any other

expenses incurred in connection with the sale or other disposition of the shares covered hereby.

Dividend

Policy

Since November 2018, we have declared and

paid quarterly cash dividends on our common stock. The board of directors currently intends to continue the payment of regular

quarterly cash dividends, dependent on our results of operations, tax considerations and other factors the board of directors may

consider and subject to the need for those funds for other purposes and restrictions set by law. The board of directors will determine

whether to declare dividends on a quarterly basis. We cannot guarantee that we will continue to pay dividends, or that, if paid,

we will not reduce or eliminate dividends in the future.

Selling

Securityholders

This prospectus covers the resale from

time to time by the selling securityholders identified in the table below of up to an aggregate of 2,817,096 shares of our common

stock, including 131,200 shares of common stock underlying warrants. None of the selling securityholders are licensed broker-dealers

nor affiliates of licensed broker-dealers.

Other than as described in the table below, the

selling securityholders and their affiliates have not held a position or office, or had any other material relationship, with us

within the past three years. For more information about these relationships, please see the descriptions under the heading “Certain

Relationships and Related Party Transactions” in reports that we file with the SEC.

The

table below (1) lists the selling securityholders and other information regarding the beneficial ownership (as determined under

Section 13(d) of the Exchange Act and the rules and regulations thereunder) of our common stock by the selling securityholders;

(2) has been prepared based upon information furnished to us by the selling securityholders; and (3) to our knowledge, is accurate

as of the date of this prospectus. The selling securityholders may sell all, some or none of their securities in this offering.

The selling securityholders identified in the table below may have sold, transferred or otherwise disposed of some or all of their

securities since the date of this prospectus in transactions exempt from or not subject to the registration requirements of the

Securities Act of 1933, as amended (the “Securities Act”). Other than as noted below, these shares were originally

registered for resale pursuant to our registration statement on Form S-1 (File No, 333-218991), which was originally declared effective

by the SEC on October 27, 2017 (the “Prior Resale Registration Statement”). Information concerning the selling securityholders

may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

|

Selling Securityholder

|

|

Number of

Shares

Beneficially

Owned

Prior

to this

Offering

|

|

|

Maximum

Number of

Shares to

be Sold

in this

Offering

|

|

|

Number of

Shares

Beneficially

Owned

After this

Offering

(1)

|

|

|

Percentage of

Common

Stock

Beneficially

Owned

After this

Offering

(2)

|

|

|

Merlotte Enterprise Limited

(3)

|

|

|

4,305,875

|

|

|

|

430,588

|

|

|

|

3,875,287

|

|

|

|

34.2

|

%

|

|

Lee Kian Tjiauw

|

|

|

2,798,031

|

|

|

|

1,322,303

|

(4)

|

|

|

1,475,728

|

|

|

|

13.0

|

%

|

|

Ng Tsze Lun

(5)

|

|

|

1,324,631

|

(5)

|

|

|

98,859

|

|

|

|

1,225,772

|

|

|

|

10.5

|

%

|

|

Eric Tang

(6)

|

|

|

220,000

|

(6)

|

|

|

100,000

|

|

|

|

120,000

|

|

|

|

*

|

|

|

Chow Chung Yan

|

|

|

220,000

|

|

|

|

200,000

|

|

|

|

20,000

|

|

|

|

*

|

|

|

Shell Creek, LLC

(7)

|

|

|

176,000

|

(7)

|

|

|

160,000

|

|

|

|

16,000

|

|

|

|

*

|

|

|

Wei Yang

(8)

|

|

|

141,350

|

(8)

|

|

|

40,000

|

|

|

|

101,350

|

|

|

|

*

|

|

|

Gary J. Haseley and GH Global Enterprises

(9)

|

|

|

116,000

|

(9)

|

|

|

100,000

|

|

|

|

16,000

|

|

|

|

*

|

|

|

Baiju Chellamma

(10)

|

|

|

87,075

|

(10)

|

|

|

50,000

|

|

|

|

37,075

|

|

|

|

*

|

|

|

PAT Amicus Investments, LLC

(11)

|

|

|

44,000

|

|

|

|

40,000

|

|

|

|

4,000

|

|

|

|

*

|

|

|

Yang Yu Tsen

|

|

|

44,000

|

|

|

|

40,000

|

|

|

|

4,000

|

|

|

|

*

|

|

|

Philip Tsz Fung Lo

|

|

|

38,146

|

|

|

|

24,146

|

|

|

|

14,000

|

|

|

|

*

|

|

|

Ronald Billitier

|

|

|

22,000

|

|

|

|

20,000

|

|

|

|

2,000

|

|

|

|

*

|

|

|

Lau Lin Ling Helen

|

|

|

22,000

|

|

|

|

20,000

|

|

|

|

2,000

|

|

|

|

*

|

|

|

Jared Penney

|

|

|

22,000

|

|

|

|

20,000

|

|

|

|

2,000

|

|

|

|

*

|

|

|

Craig D. Cairns

|

|

|

11,000

|

|

|

|

10,000

|

|

|

|

1,000

|

|

|

|

*

|

|

|

The Entrust Group Inc. fbo David F Barden IRA #7230002696

|

|

|

11,000

|

|

|

|

10,000

|

|

|

|

1,000

|

|

|

|

*

|

|

|

*

|

Indicates less than 1%

|

|

(1)

|

The totals reported in this column assume that (a) all of the securities to be registered by the registration statement of which this prospectus is a part are sold in this offering; (b) the selling securityholders do not (i) sell any of the securities, if any, that have been issued to them other than those covered by this prospectus; and (ii) acquire additional shares of our common stock after the date of this prospectus and prior to completion of this offering.

|

|

(2)

|

Percentage ownership for the selling securityholders is determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations thereunder and is based on 11,325,000 outstanding shares of our common stock as of the date of this prospectus.

|

|

(3)

|

Merlotte Enterprise Limited (“Merlotte”) is wholly owned by Choi Lin Hung, our Chairman, Chief Executive Officer, President and Treasurer. Mr. Choi was appointed a director of Global Trend International Limited (“Global Trend”) on March 21, 2012, and became our President, Treasurer and director upon consummation of the merger between us and Global Trend on May 11, 2017. Mr. Choi has held various positions with our wholly-owned subsidiaries, including director of Jerash Garments and Fashions Manufacturing Company Limited (“Jerash Garments”) since 2012, general manager of Chinese Garments and Fashions Manufacturing Company Limited and Jerash for Industrial Embroidery Company Limited since 2015, and director of Treasure Success International Limited (“Treasure Success”) since 2016. For a description of relationships between us, Mr. Choi, Merlotte and affiliates of Merlotte, please see

“Certain Relationships and Related Party Transactions” in reports we file with the SEC.

|

|

(4)

|

Includes (i) 322,303 shares of common stock originally registered pursuant to the Prior Resale Registration Statement and (ii) 1,000,000 shares of common stock registered pursuant to the registration statement of which this prospectus forms a part.

|

|

(5)

|

Ng Tsze Lun serves as the Company’s Head of Marketing pursuant to a consulting agreement between Treasure Success, the Company’s wholly-owned subsidiary, and Multi-Glory Corporation Ltd (“Multi-Glory”), a company wholly owned by Mr. Ng. This consulting agreement became effective as of January 16, 2018. The number of shares beneficially owned by Mr. Ng include (i) 988,594 shares of common stock; and (ii) immediately exercisable stock option grants entitling Mr. Ng to purchase 336,037 shares granted on April 9, 2018 pursuant to the Stock Incentive Plan (the “Plan”), which expire on April 9, 2023. For a description of relationships between us, Mr. Ng, and Multi-Glory, please see

“Certain Relationships and Related Party Transactions” in reports we file with the SEC.

|

|

(6)

|

Eric Tang is the spouse of Wei Yang, our Vice President and Secretary and a member of our board of directors. Mr. Tang has served as the Administration Manager for Treasure Success since December 2016, and prior to that provided consulting services to the Company. The number of shares beneficially owned by Mr. Tang include (i) 200,000 shares of common stock and (ii) immediately exercisable stock option grants entitling Mr. Tang to purchase 20,000 shares granted on April 9, 2018 pursuant to the Plan, which expire on April 9, 2023. 100,000 of Mr. Tang’s shares are originally registered under the registration statement of which this prospectus forms a part. For a description of the relationship between us and Mr. Tang, please see

“Certain Relationships and Related Party Transactions” in reports we file with the SEC.

|

|

(7)

|

Paul Hamlin, Al Hamlin and Theodore Kachris, as managers of Shell Creek, LLC, have shared voting and dispositive power over the securities held for the account of this selling securityholder.

|

|

(8)

|

Wei Yang is our Vice President and Secretary and a member of our board of directors. She is also the spouse of Eric Tang, the Administration Manager for Treasure Success. The number of shares beneficially owned by Ms. Yang include (i) 41,350 shares of common stock originally registered under the registration statement of which this prospectus forms a part and (ii) immediately exercisable stock option grants entitling Ms. Yang to purchase 100,000 shares granted on April 9, 2018 pursuant to the Plan, which expire on April 9, 2023.

|

|

(9)

|

Gary J. Haseley was appointed as a director of the Company on May 3, 2018. The number of shares beneficially owned by Mr. Haseley include (i) 50,000 shares of common stock held by Mr. Haseley and 5,000 shares of common stock issuable upon the exercise of warrants, which were originally registered pursuant to the Prior Resale Registration Statement; (ii) 57,000 shares of common stock of which Mr. Haseley may be deemed to be the beneficial owner due to his interest in GH Global Enterprises LLC, 50,000 shares of which are originally registered under the registration statement of which this prospectus forms a part; (iii) 1,000 shares of common stock held by Mr. Haseley’s spouse; and (iv) 3,000 shares of common stock held in Haseley family trusts.

|

|

(10)

|

Baiju Chellamma is the General Manager of Jerash Garments. The number of shares beneficially owned by Mr. Chellamma include (i) 58,650 shares of common stock originally registered under the registration statement of which this prospectus forms a part and (ii) immediately exercisable stock option grants entitling Mr. Chellamma to purchase 28,425 shares granted on April 9, 2018 pursuant to the Plan, which expire on April 9, 2023.

|

|

(11)

|

Paul Hamlin, Al Hamlin and Theodore Kachris, as managers of PAT Amicus Investments, LLC, and Peter Kachris, as manager of Storgic, LLC, a member of PAT Amicus Investments, LLC, have shared voting and dispositive power over the securities held for the account of this selling securityholder.

|

The Securities

We May Offer

Description of Common Stock

The following description includes the

material attributes of our common stock. This description is not complete, and we qualify it by referring to our amended and restated

certificate of incorporation (“certificate of incorporation”) and our bylaws. Our certificate of incorporation authorizes

us to issue up to 30,000,000 shares of common stock, par value $0.001 per share (“common stock”) and up to 500,000

shares of preferred stock, par value $0.001 per share.

Our common stock has one vote per share.

The holders of our common stock are entitled to vote on all matters to be voted on by stockholders. The holders of our common stock

do not have cumulative voting rights.

Directors are elected by a plurality vote

of the shares represented in person or by proxy. All other actions by stockholders will be approved by a majority of votes present

in person or by proxy and entitled to vote except as otherwise required by law.

The holders of common stock are entitled

to receive dividends ratably when, as and if declared by the board of directors out of funds legally available therefor. In the

event of our liquidation, dissolution or winding up, the holders of common stock are entitled to share equally and ratably in all

assets remaining available for distribution after payment of liabilities and after provision is made for each class of stock, if

any, having preference over the common stock. Holders of common stock have no preemptive, subscription, redemption, sinking fund,

or conversion rights. The outstanding shares of common stock are validly issued, fully paid and non-assessable.

Registration Rights

On May 15, 2017, in connection with the

Private Placement, we entered into a registration rights agreement with the investors participating in the Private Placement. Pursuant

to the registration rights agreement, we filed the Prior Resale Registration Statement to register the securities sold in the Private

Placement, which was initially declared effective by the SEC on October 27, 2017. 1,591,750 shares of common stock and up to 74,000

shares of common stock underlying warrants were eligible to be sold under the Prior Resale Registration Statement, and the shares

remaining unsold under the Prior Resale Registration Statement are registered under the registration statement of which this prospectus

forms a part. Additionally, the Private Placement investors are entitled to certain piggyback registration rights for the securities

in the event they are not otherwise registered for resale, which registration rights require us to notify the investors if we propose

to register any shares of common stock under the Securities Act, and to include the securities for which we receive timely requests

from such investors for inclusion in connection with such offering.

Effects on our Common Stock

if We Issue Preferred Stock

Our board of directors has authority, without

further action by the stockholders, to issue up to 500,000 shares of preferred stock in one or more series. Our board of directors

has the authority to determine the terms of each series of preferred stock, within the limits of the certificate of incorporation

and the laws of the state of Delaware. These terms include the number of shares in a series, dividend rights, liquidation preferences,

terms of redemption, conversion rights and voting rights. The issuance of any preferred stock may negatively affect the holders

of our common stock. These possible negative effects include diluting the voting power of shares of our common stock and affecting

the market price of our common stock.

Anti-Takeover Effects of Provisions

of our Certificate of Incorporation and Bylaws

Preferred Stock

We believe that the availability of the

preferred stock under our certificate of incorporation provides us with flexibility in addressing corporate issues that may arise.

Having these authorized shares available for issuance allows us to issue shares of preferred stock without the expense and delay

of a special stockholders’ meeting. The authorized shares of preferred stock, as well as shares of common stock, will be

available for issuance without further action by our stockholders, unless action is required by applicable law or the Nasdaq rules

or the rules of any stock exchange on which our securities may be listed. The board of directors has the power, subject to applicable

law, to issue series of preferred stock that could, depending on the terms of the series, impede the completion of a merger, tender

offer or other takeover attempt that some, or a majority, of the stockholders might believe to be in their best interests or in

which stockholders might receive a premium for their stock over the then-prevailing market price of the stock.

Exclusive Forum for Certain Actions

Our certificate of incorporation provides

that derivative actions brought in the name of the Company, actions against directors, officers and employees for breach of fiduciary

duty and other similar actions may be brought only in the Court of Chancery of the State of Delaware. Although we believe this

provision benefits the Company and its stockholders by providing increased consistency in the law to be applied in lawsuits brought

against or on behalf of the Company, this provision may have the effect of discouraging lawsuits against us or our directors, officers

and employees.

Amendment of Bylaws

Our certificate of incorporation grants

our board of directors the power to adopt, amend or repeal our bylaws, except as otherwise set forth in the bylaws.

Transfer Agent and Registrar

The transfer agent and registrar for our

common stock is V Stock Transfer, LLC. The transfer agent and registrar’s address is 18 Lafayette Place, Woodmere, New York

11598.

Description of Warrants

We may issue warrants to purchase shares

of our common stock. We may offer warrants separately or together with one or more additional warrants or shares of common stock,

or any combination of those securities in the form of units, as described in the appropriate prospectus supplement. If we issue

warrants as part of a unit, the accompanying prospectus supplement will specify whether those warrants may be separated from the

other securities in the unit prior to the warrants’ expiration date. Below is a description of certain general terms and

provisions of the warrants that we may offer. Further terms of the warrants will be described in the prospectus supplement.

The applicable prospectus supplement will

contain, where applicable, the following terms of and other information relating to the warrants:

|

|

·

|

the specific designation and aggregate number of, and the price at which we will issue, the warrants;

|

|

|

·

|

the currency or currency units in which the offering price, if any, and the exercise price are

payable;

|

|

|

·

|

the date on which the right to exercise the warrants will begin and the date on which that right

will expire or, if you may not continuously exercise the warrants throughout that period, the specific date or dates on which you

may exercise the warrants;

|

|

|

·

|

any applicable anti-dilution provisions;

|

|

|

·

|

any applicable redemption or call provisions;

|

|

|

·

|

the circumstances under which the warrant exercise price may be adjusted;

|

|

|

·

|

whether the warrants will be issued in fully registered form or bearer form, in definitive or global

form or in any combination of these forms, although, in any case, the form of a warrant included in a unit will correspond to the

form of the unit and of any security included in that unit;

|

|

|

·

|

any applicable material United States federal income tax consequences;

|

|

|

·

|

if applicable, the identity of the warrant agent for the warrants and of any other depositaries,

execution or paying agents, transfer agents, registrars or other agents;

|

|

|

·

|

the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the

warrants on any securities exchange;

|

|

|

·

|

the designation and terms of the shares of common stock purchasable upon exercise of the warrants;

|

|

|

·

|

if applicable, the designation and terms of the shares of common stock with which the warrants

are issued and the number of warrants issued with each security;

|

|

|

·

|

if applicable, the date from and after which the warrants and the related shares of common stock

will be separately transferable;

|

|

|

·

|

the number of shares of common stock purchasable upon exercise of a warrant and the price at which

those shares may be purchased;

|

|

|

·

|

if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

·

|

information with respect to book-entry procedures, if any;

|

|

|

·

|

whether the warrants are to be sold separately or with other securities as parts of units; and

|

|

|

·

|

any additional terms of the warrants, including terms, procedures and limitations relating to the

exchange and exercise of the warrants.

|

Outstanding Warrants

In connection with the Private Placement,

we issued to the investors participating in the Private Placement five-year warrants to purchase up to an aggregate of 79,000 shares

of common stock at an exercise price of $6.25 per share. If at any time after six months following the issuance date of the warrants

and prior to the expiration date there is not an effective registration statement on file with the SEC covering the resale of the

shares underlying the warrants, the warrants may be exercised by means of a “cashless exercise.” Up to 74,000 shares

of common stock underlying warrants were eligible to be sold under the Prior Resale Registration Statement, and the shares remaining

unsold under the Prior Resale Registration Statement are registered under the registration statement of which this prospectus forms

a part.

In connection with our IPO, we issued Network

1 Financial Securities, Inc. and its affiliates warrants to purchase an aggregate of 57,200 shares of our common stock. These warrants

are exercisable for $8.75 per share and expire on May 2, 2023. If there is not an effective registration statement on file with

the SEC covering the resale of the shares underlying the warrants, the warrants may be exercised by means of a “cashless

exercise.” The resale of these warrant shares is registered under the registration statement of which this prospectus forms

a part.

Description of Units

We may issue units comprised of two or

more of the other securities described in this prospectus in any combination. Each unit will be issued so that the holder of the

unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations

of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included

in the unit may not be held or transferred separately, at any time or at any time before a specified date.

The applicable prospectus supplement may

describe:

|

|

·

|

the designation and terms of the units and of the securities comprising the units, including whether

and under what circumstances those securities may be held or transferred separately;

|

|

|

·

|

any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the

securities comprising the units;

|

|

|

·

|

the terms of the unit agreement governing the units;

|

|

|

·

|

any applicable material United States federal income tax consequences; and

|

|

|

·

|

whether the units will be issued in fully registered or global form.

|

The preceding description and any description

of units in the applicable prospectus supplement does not purport to be complete and is subject to and is qualified in its entirety

by reference to the form of unit agreement which will be filed with the SEC in connection with the offering of such units.

Plan of

Distribution for the Company

We may sell our securities in any of the

following ways:

|

|

·

|

to or through underwriters;

|

|

|

·

|

through broker-dealers (acting as agent or principal);

|

|

|

·

|

directly by us to purchasers, through a specific bidding or auction process or otherwise; or

|

|

|

·

|

through a combination of any such methods of sale.

|

Each time that we use this prospectus to

sell our securities, we will also provide a prospectus supplement that contains the specific terms of such offering. The prospectus

supplement will set forth the terms of the offering of such securities, including:

|

|

·

|

the name or names of any underwriters, dealers or agents and the type and amounts of securities

underwritten or purchased by each of them;

|

|

|

·

|

the public offering price of the securities and the proceeds to us and any discounts, commissions

or concessions allowed or reallowed or paid to underwriters, dealers or agents;

|

|

|

·

|

any exchange on which the securities will be issued; and

|

|

|

·

|

all other items constituting underwriting compensation.

|

If we use underwriters in the sale of any

securities on a firm commitment basis, the securities will be acquired by the underwriters for their own account and may be resold

from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying

prices determined at the time of sale. The securities may be either offered to the public through underwriting syndicates represented

by managing underwriters, or directly by underwriters. Generally, the underwriters’ obligations to purchase the securities

will be subject to certain conditions precedent. The underwriters will be obligated to purchase all of the securities if they purchase

any of the securities. We may also engage underwriters on a best efforts basis.

We may sell the securities through agents

from time to time. The prospectus supplement will name any agent involved in the offer or sale of our securities and any commissions

we pay to them. Generally, any agent will be acting on a best efforts basis for the period of its appointment.

To the extent that we make sales to or

through one or more underwriters or agents in at-the-market offerings, we will do so pursuant to the terms of a distribution agreement

between us and the underwriters or agents. If we engage in at-the-market sales pursuant to a distribution agreement, we will issue

and sell shares of our common stock to or through one or more underwriters or agents, which may act on an agency basis or on a

principal basis. During the term of any such agreement, we may sell shares on a daily basis in exchange transactions or otherwise

as we agree with the underwriters or agents. The distribution agreement will provide that any shares of our common stock sold will

be sold at prices related to the then prevailing market prices for our common stock. Therefore, exact figures regarding proceeds

that will be raised or commissions to be paid cannot be determined at this time and will be described in a prospectus supplement.

Pursuant to the terms of the distribution agreement, we also may agree to sell, and the relevant underwriters or agents may agree

to solicit offers to purchase, blocks of our common stock or other securities. The terms of each such distribution agreement will

be set forth in more detail in a prospectus supplement to this prospectus. If any underwriter or agent acts as principal, or broker

dealer acts as underwriter, it may engage in certain transactions that stabilize, maintain or otherwise affect the price of our

securities. We will describe any such activities in the prospectus supplement relating to the transaction.

In the sale of the securities, underwriters

or agents may receive compensation from us in the form of underwriting discounts or commissions and may also receive compensation

from purchasers of the securities, for whom they may act as agents, in the form of discounts, concessions or commissions. Underwriters

may sell the securities to or through dealers, and such dealers may receive compensation in the form of discounts, concessions

or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. Discounts, concessions

and commissions may be changed from time to time. Dealers and agents that participate in the distribution of the securities may

be deemed to be underwriters under the Securities Act, and any discounts, concessions or commissions they receive from us and any

profit on the resale of securities they realize may be deemed to be underwriting compensation under applicable federal and state

securities laws.

We may authorize underwriters, dealers

or agents to solicit offers by certain purchasers to purchase our securities at the public offering price set forth in the prospectus

supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts

will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any

commissions or discounts we pay for solicitation of these contracts.

Agents and underwriters may be entitled

to indemnification by us against certain civil liabilities, including liabilities under the Securities Act or to contribution with

respect to payments which the agents or underwriters may be required to make in respect thereof. Agents and underwriters may be

customers of, engage in transactions with, or perform services for us in the ordinary course of business.

We may enter into derivative transactions

with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. The

applicable prospectus supplement may indicate that the third parties may sell securities covered by this prospectus and the applicable

prospectus supplement, including in short sale transactions in connection with those derivatives. If so, the third party may use

securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock,

and may use securities received from us in settlement of those derivatives to close out any related open borrowings of securities.

The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement

(or a post-effective amendment).

Until the distribution of the securities

is completed, rules of the SEC may limit the ability of any underwriters and selling group members to bid for and purchase the

securities. As an exception to these rules, underwriters are permitted to engage in some transactions that stabilize the price

of the securities. Such transactions consist of bids or purchases for the purpose of pegging, fixing or maintaining the price of

the securities.

Underwriters may engage in overallotment.

If an underwriter creates a short position in offered securities by selling more securities than are set forth on the cover page

of the applicable prospectus supplement, the underwriters may reduce that short position by purchasing the securities in the open

market.

The lead underwriters may also impose a

penalty bid on other underwriters and selling group members participating in an offering. This means that if the lead underwriters

purchase securities in the open market to reduce the underwriters’ short position or to stabilize the price of the securities,

they may reclaim the amount of any selling concession from the underwriters and selling group members who sold those securities

as part of the offering.

If more than 10% of the net proceeds of

any offering of securities made under this prospectus will be received by Financial Industry Regulatory Authority (“FINRA”)

members participating in the offering, or affiliates or associated persons of such FINRA members, the offering will be conducted

in accordance with FINRA Rule 5110.

Plan of

Distribution for Selling Securityholders

The shares may be sold or distributed from

time to time by the selling securityholders, directly to one or more purchasers or through brokers or dealers who act solely as

agents, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices

or at fixed prices, which may be changed. The distribution of the shares may be effected in one or more of the following methods:

|

|

·

|

ordinary brokers transactions, which may include long or short sales;

|

|

|

·

|

transactions involving cross or block trades on any securities market where our common stock is

trading;

|

|

|

·

|

through direct sales to purchasers or sales effected through agents;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

any combination of the foregoing; or

|

|

|

·

|

any other method permitted by law.

|

In addition, the selling securityholders

may enter into hedging transactions with broker-dealers who may engage in short sales, if short sales were permitted, of shares

in the course of hedging the positions they assume with the selling securityholders. The selling securityholders may also enter

into option or other transactions with broker-dealers that require the delivery by such broker-dealers of the shares, which shares

may be resold thereafter pursuant to this prospectus. None of the selling securityholders are broker-dealers or affiliates of broker

dealers.

Each selling securityholder has informed

us that it is not a registered broker-dealer and does not have any written or oral agreement or understanding, directly or indirectly,

with any person to engage in a distribution of the common stock as an underwriter or agent. Upon us being notified in writing by

a selling securityholder that any material arrangement has been entered into with a broker-dealer acting as an underwriter or agent

for the distribution of common stock, a prospectus supplement, if required, will be distributed, which will set forth the aggregate

amount of shares of common stock being distributed and the terms of the offering, including the name or names of any broker-dealers

or agents, any discounts, commissions and other terms constituting compensation from the selling securityholders and any discounts,

commissions or concessions allowed or re-allowed or paid to broker-dealers.

Each selling securityholder may sell all,

some or none of the securities registered pursuant to the registration statement of which this prospectus forms a part. If sold

under the registration statement of which this prospectus forms a part, the shares of common stock registered hereunder will be

freely tradable in the hands of persons other than our affiliates that acquire such shares.

The selling securityholders and any other

person participating in such distribution will be subject to applicable provisions of the Exchange Act and the rules and regulations

thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing

of purchases and sales of any of the shares of common stock by the selling securityholders and any other participating person.

To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the shares of

common stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect

the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with

respect to the shares of common stock.

Offers Outside the United States

Other than in the United States, no action

has been taken by us that would permit a public offering of the securities offered by this prospectus in any jurisdiction where

action for that purpose is required. The securities offered by this prospectus may not be offered or sold, directly or indirectly,

nor may this prospectus or any other offering material or advertisements in connection with the offer and sale of any such securities

be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable

rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes are advised to inform themselves

about and to observe any restrictions relating to the offering and the distribution of this prospectus. This prospectus does not

constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in any jurisdiction

in which such an offer or a solicitation is unlawful.

Where You

Can Find More Information

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. You may access and read our SEC filings, including the complete registration