Rockwell Medical, Inc. (NASDAQ:RMTI) (“Rockwell Medical” or the

"Company"), a biopharmaceutical company dedicated to improving

outcomes for patients with anemia, with an initial focus on

end-stage renal disease (ESRD) and chronic kidney disease (CKD),

today reported business updates and financial results for the three

months ended March 31, 2019.

Recent Business and Financial Highlights:

- The Company announced the commencement of commercial sales of

the first formulation in its Triferic portfolio, Dialysate

Triferic, on May 6, 2019.

- The Company expects to submit a New Drug Application (“NDA”)

for I.V. Triferic in the U.S. during the second quarter of

2019.

- Received a preliminary recommendation from the Centers for

Medicare and Medicaid Services (“CMS”) on April 26, 2019 that, if

finalized, would result in a unique J-code for the powder packet

formulation of Dialysate Triferic.

- The Company presented positive data from two studies evaluating

intravenous and peritoneal dialysate formulations of Triferic at

the 39th Annual Dialysis Conference in March 2019.

- Sales for the first quarter of 2019 were $15.6 million compared

to $14.9 million for the first quarter of 2018, an increase of

4%.

- As of March 31, 2019, the Company had cash, cash equivalents

and investments available-for-sale of $27.8 million. Cash used in

operating activities for the first quarter of 2019 was $5.4

million.

“The commercial launch of Dialysate Triferic marks an important

milestone for Rockwell Medical. Triferic offers a much-needed

alternative for healthcare providers who treat anemia in their

hemodialysis patients. Our efforts during the first quarter of 2019

were primarily focused on completing our market and pricing

research, enhancing our medical education platform, and building a

strong commercial and medical infrastructure to execute on our

launch plans,” stated Stuart Paul, President and Chief Executive

Officer of Rockwell Medical.

“We are also in the process of advancing I.V. Triferic, and we

anticipate a large global opportunity for that formulation. We

believe I.V. Triferic will potentially be eligible for

separate reimbursement in the U.S., if approved by CMS, for a

period of two years. It also allows for Triferic administration

with dry bicarbonate bags/cartridges, which are commonly used in

Europe, China and other countries around the globe. We are pleased

with our progress and excited about the opportunities that lie

ahead,” continued Mr. Paul.

Selected First Quarter 2019 Financial

Results

Net sales for the first quarter of 2019 were $15.6 million, an

increase of 4% compared to sales of $14.9 million for the first

quarter of 2018. The increase was primarily due to higher domestic

dialysis concentrate sales to Baxter and an increase in

international sales compared to the three months ended March 31,

2018. Revenue recognized from licensing fees was $0.6 million for

both the three months ended March 31, 2019 and 2018.

Cost of sales for the first quarter of 2019 was $14.6 million,

resulting in gross profit of $1.0 million, compared to cost of

sales of a $15.7 million and a gross loss of $0.7 million during

the first quarter of 2018. Gross profit increased by $1.7 million

in the first quarter of 2019 compared to the first quarter of 2018,

due primarily to an inventory reserve for Triferic of $2.2 million

for the first quarter of 2018, partially offset by a gross profit

decrease of $0.7 million in our dialysis concentrates products. The

decrease in gross profit for our dialysis concentrates products was

primarily attributable to increased labor, materials and overhead

costs, partially offset by increased net sales.

Selling and marketing expenses were $3.1 million for the first

quarter of 2019 compared to $0.2 million in the first quarter of

2018. The increase was due primarily to marketing costs incurred to

prepare for the launch of Triferic and increased headcount.

General and administrative expenses were $6.2 million for the

first quarter of 2019 compared with $3.1 million for the first

quarter of 2018. The increase was primarily due to the reversal of

certain compensation-related accruals in the first quarter of 2018

and an increase in annual reporting and consulting fees.

Research and product development expenses were $0.5 million for

the first quarter of 2019 compared to $1.7 million for the first

quarter of 2018. The decrease was due primarily to a reduction in

clinical trial and other product development costs.

Net loss for the first quarter of 2019 was $8.7 million, or

$0.15 per basic and diluted share, compared to a net loss

of $5.5 million, or $0.11 per basic and diluted share, in

the first quarter of 2018.

The Company encourages shareholders to also review its Form 10-Q

for the quarter ended March 31, 2019, as filed by the Company with

the Securities and Exchange Commission ("SEC").

Key Objectives for 2019

- Increase awareness of Triferic in the dialysis community, build

and enhance relationships with key opinion leaders, and support

medical education of nephrologists and other clinicians, while

generating real-world evidence to support the use of Triferic in

adult hemodialysis patients.

- File an NDA with the U.S. Food and Drug Administration (FDA)

for I.V. Triferic during the second quarter of 2019.

- Advance international opportunities for the Triferic portfolio

through strategic partnerships and licensing agreements.

- Expand and improve operating margin for the Company’s

concentrates business.

Conference Call

As previously announced, Rockwell Medical management will host

its first quarter 2019 conference call as follows:

| Date |

Thursday, May 9, 2019 |

| Time |

4:30 PM EDT |

| Telephone |

U.S: |

(877) 383-7438 |

| |

International: |

(678) 894-3975 |

| Webcast (live and

archive) |

https://edge.media-server.com/m6/p/7ci5to7r |

About Triferic Triferic is the only

FDA-approved therapy indicated to replace iron and maintain

hemoglobin in hemodialysis patients via dialysate during each

dialysis treatment. Triferic delivers approximately 5-7 mg iron

with every hemodialysis treatment to the bone marrow and maintains

hemoglobin without increasing iron stores (ferritin). Unlike

traditional IV iron products, Triferic donates iron immediately and

completely to transferrin (carrier of iron in the body) upon entry

into the blood and is then transported directly to the bone marrow

to be incorporated into hemoglobin, with no increase in ferritin

(stored iron and inflammation) and no reports of anaphylaxis in

over 675,000 patient administrations, addressing a significant

medical need in overcoming Functional Iron Deficiency (FID) in ESRD

patients. Please visit www.triferic.com to view the Triferic

mode-of-action (MOA) video and for more information.

About Rockwell Medical Rockwell Medical is a

biopharmaceutical company dedicated to improving outcomes for

patients with anemia, with an initial focus on end-stage renal

disease (ESRD) and chronic kidney disease (CKD). Rockwell Medical's

exclusive renal drug therapy, Triferic, supports disease management

initiatives to improve the quality of life and care of dialysis

patients and is intended to deliver safe and effective therapy,

while decreasing drug administration costs and improving patient

convenience. The Company has developed multiple formulations of

Triferic, the only FDA-approved therapeutic indicated for iron

replacement and maintenance of hemoglobin in hemodialysis patients.

The Company’s strategy is to bring its therapeutics to market in

the United States and to utilize partners to develop and

commercialize such therapeutics in international markets. Rockwell

Medical is also an established manufacturer, supplier and leader in

delivering high-quality hemodialysis concentrates/dialysates to

dialysis providers and distributors in the U.S. and abroad. Please

visit www.rockwellmed.com for more information.

Forward-Looking Statements Certain statements

in this press release may constitute "forward-looking statements"

within the meaning of the federal securities laws, including, but

not limited to, Rockwell Medical’s intention to bring to market

Triferic, and I.V. Triferic. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "could," "plan," "potential," "predict," "forecast,"

"project," "plan", "intend" or similar expressions, or statements

regarding intent, belief, or current expectations, are

forward-looking statements. While Rockwell Medical believes these

forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are

based on information available to us on the date of this release.

These forward-looking statements are based upon current estimates

and assumptions and are subject to various risks and uncertainties

(including, without limitation, those set forth in Rockwell

Medical's SEC filings), many of which are beyond our control and

subject to change. Actual results could be materially different.

Risks and uncertainties include: statements about the issuance of a

unique J code for our Triferic Powder Packet; timing and success of

our planned NDA submission for I.V. Triferic; the potential market

opportunity for I.V. Triferic and other Rockwell products; pricing

and reimbursement status for I.V. Triferic, Triferic and other

Rockwell products, including eligibility for add-on reimbursement

under TDAPA; liquidity and capital resources; expected duration of

Rockwell Medical's existing working capital; success of our

recently announced commercialization plans for Dialysate Triferic;

and timing and success of our efforts to renegotiate economic terms

of our concentrate business Rockwell Medical expressly disclaims

any obligation to update or alter any statements whether as a

result of new information, future events or otherwise, except as

required by law.

Triferic® is a registered trademark of Rockwell Medical,

Inc.

Contact Investor Relations: Lisa M. Wilson,

In-Site Communications, Inc. T: 212-452-2793 E:

lwilson@insitecony.com

Source: Rockwell Medical, Inc.

Financial Tables Follow

| ROCKWELL

MEDICAL, INC. AND SUBSIDIARIES Condensed

Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2019 |

|

2018 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

20,919,518 |

|

|

$ |

22,713,980 |

|

|

|

Investments Available-for -Sale |

|

|

6,876,221 |

|

|

|

10,818,059 |

|

|

|

Accounts Receivable, net of a reserve of $2,240 in 2019 and $2,104

in 2018 |

|

|

6,711,410 |

|

|

|

6,979,514 |

|

|

|

Insurance Receivable |

|

|

— |

|

|

|

371,217 |

|

|

|

Inventory |

|

|

4,001,570 |

|

|

|

4,038,778 |

|

|

|

Prepaid and Other Current Assets |

|

|

1,680,818 |

|

|

|

1,903,682 |

|

|

|

Total Current Assets |

|

|

40,189,537 |

|

|

|

46,825,230 |

|

|

|

Property and Equipment, net |

|

|

2,572,680 |

|

|

|

2,638,293 |

|

|

|

Inventory, Non-Current |

|

|

1,501,000 |

|

|

|

1,637,000 |

|

|

|

Right of Use Assets, net |

|

|

3,005,792 |

|

|

|

— |

|

|

|

Goodwill |

|

|

920,745 |

|

|

|

920,745 |

|

|

|

Other Non-current Assets |

|

|

555,310 |

|

|

|

536,516 |

|

|

|

Total Assets |

|

$ |

48,745,064 |

|

|

$ |

52,557,784 |

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Accounts Payable |

|

$ |

4,522,225 |

|

|

$ |

4,492,071 |

|

|

|

Accrued Liabilities |

|

|

6,272,040 |

|

|

|

5,129,761 |

|

|

|

Settlement Payable |

|

|

166,669 |

|

|

|

416,668 |

|

|

|

Lease Liability - Current |

|

|

1,680,475 |

|

|

|

— |

|

|

|

Deferred License Revenue - Current |

|

|

2,248,062 |

|

|

|

2,252,868 |

|

|

|

Customer Deposits |

|

|

240,239 |

|

|

|

63,143 |

|

|

|

Other Current Liability - Related Party |

|

|

600,000 |

|

|

|

850,000 |

|

|

|

Total Current Liabilities |

|

|

15,729,710 |

|

|

|

13,204,511 |

|

|

|

|

|

|

|

|

|

|

|

|

Lease Liability - Long-Term |

|

|

1,336,319 |

|

|

|

— |

|

|

|

Deferred License Revenue - Long-Term |

|

|

11,517,988 |

|

|

|

12,076,399 |

|

|

|

Total Liabilities |

|

|

28,584,017 |

|

|

|

25,280,910 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity: |

|

|

|

|

|

|

|

|

Preferred Shares, no par value, no shares issued and outstanding at

March 31, 2019 andDecember 31, 2018 |

|

|

— |

|

|

|

— |

|

|

|

Common Shares, no par value, 57,128,327 and 57,034,154 shares

issued and outstanding atMarch 31, 2019 and December 31, 2018,

respectively |

|

|

301,171,733 |

|

|

|

299,601,960 |

|

|

|

Accumulated Deficit |

|

|

(281,066,581 |

) |

|

|

(272,388,234 |

) |

|

|

Accumulated Other Comprehensive Income |

|

|

55,895 |

|

|

|

63,148 |

|

|

|

Total Shareholders’

Equity |

|

|

20,161,047 |

|

|

|

27,276,874 |

|

|

|

Total Liabilities And Shareholders’ Equity |

|

$ |

48,745,064 |

|

|

$ |

52,557,784 |

|

|

| |

|

|

|

|

|

|

| ROCKWELL

MEDICAL, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Operations

(unaudited) |

|

|

|

|

|

Three Months EndedMarch 31, 2019 |

|

Three Months EndedMarch 31, 2018 |

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

15,559,439 |

|

|

$ |

14,948,579 |

|

|

|

Cost of Sales |

|

|

14,549,047 |

|

|

|

15,669,072 |

|

|

|

Gross Profit (Loss) |

|

|

1,010,392 |

|

|

|

(720,493 |

) |

|

|

Selling and Marketing |

|

|

3,102,378 |

|

|

|

215,083 |

|

|

|

General and Administrative |

|

|

6,220,499 |

|

|

|

3,116,872 |

|

|

|

Research and Product Development |

|

|

497,276 |

|

|

|

1,666,356 |

|

|

|

Operating Loss |

|

|

(8,809,761 |

) |

|

|

(5,718,804 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

Realized Gain (Loss) on Investments |

|

|

13,888 |

|

|

|

(2,892 |

) |

|

|

Interest Income |

|

|

117,526 |

|

|

|

175,307 |

|

|

|

Other Income |

|

|

— |

|

|

|

(3,132 |

) |

|

|

Total Other Income (Expense) |

|

|

131,414 |

|

|

|

169,283 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(8,678,347 |

) |

|

$ |

(5,549,521 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss per Share |

|

$ |

(0.15 |

) |

|

$ |

(0.11 |

) |

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Weighted Average Shares

Outstanding |

|

|

57,098,947 |

|

|

|

51,288,424 |

|

|

| |

|

|

|

|

|

|

|

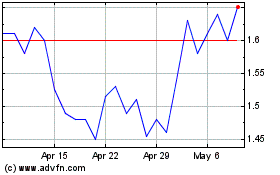

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2023 to Apr 2024