Wynn Resorts, Limited (NASDAQ: WYNN) ("the Company") today

reported financial results for the quarter ended March 31,

2019.

Operating revenues were $1.65 billion for the first quarter of

2019, a decrease of 3.7%, or $64.0 million, from $1.72 billion for

the first quarter of 2018. Operating revenues increased $60.8

million at Wynn Palace and decreased $94.4 million and $30.5

million at Wynn Macau and our Las Vegas Operations,

respectively.

On a U.S. generally accepted accounting principles ("GAAP")

basis, net income attributable to Wynn Resorts, Limited was $104.9

million, or $0.98 per diluted share, for the first quarter of 2019,

compared to a net loss attributable to Wynn Resorts, Limited of

$204.3 million, or $1.99 per diluted share, in the first quarter of

2018. The change was primarily due to a litigation settlement of

$463.6 million, partially offset by an income tax benefit of $111.0

million, recorded in the first quarter of 2018. Adjusted net income

attributable to Wynn Resorts, Limited (1) was $172.6 million, or

$1.61 per diluted share, for the first quarter of 2019, compared to

$237.0 million, or $2.30 per diluted share, for the first quarter

of 2018.

Adjusted Property EBITDA (2) was $494.8 million for the first

quarter of 2019, a decrease of 12.3%, or $69.6 million, from $564.3

million for the first quarter of 2018. Adjusted Property EBITDA

increased $10.7 million at Wynn Palace and decreased $45.9 million

and $34.3 million at Wynn Macau and our Las Vegas Operations,

respectively.

Wynn Resorts, Limited also announced today that the Company has

approved a cash dividend of $1.00 per share, payable on

May 30, 2019 to stockholders of record as of May 22,

2019.

Macau Operations

Wynn Palace

Operating revenues from Wynn Palace were $726.6 million for the

first quarter of 2019, a 9.1% increase from $665.8 million for the

first quarter of 2018. Adjusted Property EBITDA from Wynn Palace

was $222.6 million for the first quarter of 2019, a 5.0% increase

from $211.9 million for the first quarter of 2018.

Casino revenues from Wynn Palace were $623.2 million for the

first quarter of 2019, a 9.6% increase from $568.5 million for the

first quarter of 2018. Table games turnover in VIP operations was

$12.63 billion, a 17.9% decrease from $15.39 billion for the first

quarter of 2018. VIP table games win as a percentage of turnover

was 3.91%, above the expected range of 2.7% to 3.0% and above the

2.60% experienced in the first quarter of 2018. Table drop in mass

market operations was $1.30 billion, a 7.1% increase from $1.22

billion in the first quarter of 2018. Table games win in mass

market operations was $315.5 million, a 1.7% increase from $310.2

million for the first quarter of 2018. Table games win percentage

in mass market operations was 24.2%, below the 25.5% experienced in

the first quarter of 2018. Slot machine handle was $975.0 million,

a 7.8% decrease from $1.06 billion for the first quarter of 2018.

Slot machine win decreased 7.9% to $51.4 million for the first

quarter of 2019, compared to $55.8 million for the first quarter of

2018.

Non-casino revenues from Wynn Palace were $103.4 million for the

first quarter of 2019, a 6.2% increase from $97.4 million for the

first quarter of 2018. Room revenues were $43.3 million for the

first quarter of 2019, a 7.1% increase from $40.4 million for the

first quarter of 2018. Average daily rate ("ADR") was $271, a 7.7%

increase from $252 for the first quarter of 2018. Occupancy

increased to 97.2% for the first quarter of 2019, from 96.8% for

the first quarter of 2018. Revenue per available room ("REVPAR")

was $264, an 8.2% increase from $244 for the first quarter of

2018.

Wynn Macau

Operating revenues from Wynn Macau were $523.9 million for the

first quarter of 2019, a 15.3% decrease from $618.2 million for the

first quarter of 2018. Adjusted Property EBITDA was $163.9 million

for the first quarter of 2019, a 21.9% decrease from $209.8 million

for the first quarter of 2018.

Casino revenues from Wynn Macau were $450.2 million for the

first quarter of 2019, a 16.5% decrease from $539.0 million for the

first quarter of 2018. Table games turnover in VIP operations was

$10.19 billion, a 40.3% decrease from $17.09 billion for the first

quarter of 2018. VIP table games win as a percentage of turnover

was 2.90%, within the expected range of 2.7% to 3.0% and above the

2.61% experienced in the first quarter of 2018. Table drop in mass

market operations was $1.35 billion, a 2.2% increase from $1.32

billion for the first quarter of 2018. Table games win in mass

market operations was $264.5 million, a 3.1% increase from $256.5

million for the first quarter of 2018. Table games win percentage

in mass market operations was 19.6%, above the 19.4% experienced in

the first quarter of 2018. Slot machine handle was $794.4 million,

a 20.8% decrease from $1.00 billion for the first quarter of 2018.

Slot machine win decreased 9.3% to $37.9 million for the first

quarter of 2019, compared to $41.8 million for the first quarter of

2018.

Non-casino revenues from Wynn Macau were $73.6 million for the

first quarter of 2019, a 7.0% decrease from $79.2 million for the

first quarter of 2018. Room revenues were $28.9 million for the

first quarter of 2019, a 1.6% increase from $28.4 million for the

first quarter of 2018. ADR was relatively flat at $290 when

compared to the same period of 2018. Occupancy increased to 99.3%

for the first quarter of 2019, from 99.0% for the same period of

2018. REVPAR was flat at $288 when compared to the same period of

2018.

Las Vegas Operations

Operating revenues from our Las Vegas Operations were $401.0

million for the first quarter of 2019, a 7.1% decrease from $431.5

million for the first quarter of 2018. Adjusted Property EBITDA

from our Las Vegas Operations was $108.3 million, a 24.0% decrease

from $142.6 million for the first quarter of 2018.

Casino revenues from our Las Vegas Operations were $111.7

million for the first quarter of 2019, a 17.1% decrease from $134.6

million for the first quarter of 2018. Table games drop was $404.1

million, a 24.7% decrease from $536.6 million for the first quarter

of 2018. Table games win was $111.4 million, a 27.9% decrease from

$154.4 million for the first quarter of 2018. Table games win

percentage was 27.6%, above the property’s expected range of 22% to

26%, but below the 28.8% experienced in the first quarter of 2018.

Slot machine handle was $789.3 million, a 6.1% increase from $744.1

million for the first quarter of 2018. Slot machine win increased

10.7% to $54.5 million, compared to $49.3 million for the first

quarter of 2018.

Non-casino revenues from our Las Vegas Operations were $289.3

million for the first quarter of 2019, a 2.5% decrease from $296.8

million for the first quarter of 2018. Room revenues were $119.1

million for the first quarter of 2019, a 1.9% decrease from $121.5

million for the first quarter of 2018. ADR was $338, a 0.6%

decrease from $340 in the first quarter of 2018. Occupancy

decreased to 82.6% for the first quarter of 2019, from 83.9% for

the first quarter of 2018. REVPAR was $279, a 2.1% decrease from

$285 for the first quarter of 2018. Food and beverage revenues

decreased 1.8%, to $123.6 million for the first quarter of 2019,

compared to $125.8 million for the first quarter of 2018.

Entertainment, retail and other revenues decreased 5.9%, to $46.6

million for the first quarter of 2019, compared to $49.6 million in

the first quarter of 2018.

Development Projects

We are currently constructing Encore Boston Harbor, an

integrated casino resort in Everett, Massachusetts, located

adjacent to Boston along the Mystic River. The resort will contain

a hotel, a waterfront boardwalk, meeting and convention space,

casino space, a spa, retail offerings and food and beverage

outlets. The total project budget, including gaming license fees,

construction costs, capitalized interest, pre-opening expenses and

land costs, is estimated to be approximately $2.6 billion. As of

March 31, 2019, we have incurred $2.26 billion in total

project costs. We expect to open Encore Boston Harbor in

mid-2019.

We are currently constructing an approximately 430,000 square

foot meeting and convention facility at Wynn Las Vegas and have

begun construction activities in connection with the

reconfiguration of the Wynn Las Vegas golf course, which we closed

in the fourth quarter of 2017. Based on current designs, we

estimate the total project budget to be approximately $425 million.

As of March 31, 2019, we have incurred $181.5 million in total

project costs. We expect to reopen the golf course in the fourth

quarter of 2019 and open the additional meeting and convention

space in the first quarter of 2020.

Balance Sheet

Our cash and cash equivalents and restricted cash as of

March 31, 2019 totaled $1.83 billion.

Total current and long-term debt outstanding at March 31,

2019 was $9.17 billion, comprised of $3.73 billion of Macau related

debt, $3.10 billion of Wynn Las Vegas debt, $983 million of Wynn

America debt, $740 million of Wynn Resorts debt, and $611 million

of debt held by the retail joint venture which we consolidate.

As previously disclosed, on March 8, 2019, the Company entered

into an Incremental Joinder Agreement that amended the Wynn Resorts

Term Loan Credit Agreement to, among other things, provide the

Company with an additional $250 million term loan on substantially

similar terms as the Wynn Resorts Term Loan.

Conference Call and Other Information

The Company will hold a conference call to discuss its results,

including the results of Wynn Las Vegas, LLC, on May 9, 2019

at 1:30 p.m. PT (4:30 p.m. ET). Interested parties are invited to

join the call by accessing a live audio webcast at

http://www.wynnresorts.com.

On May 9, 2019, the Company will make Wynn Las Vegas, LLC

financial information for the quarter ended March 31, 2019

available to noteholders, prospective investors, broker-dealers and

securities analysts. Please contact our investor relations office

at 702-770-7555 or at investorrelations@wynnresorts.com, to obtain

access to such financial information.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, controversy, regulatory action,

litigation and investigations related to Stephen A. Wynn and his

separation from the Company, extensive regulation of our business,

pending or future claims and legal proceedings, ability to maintain

gaming licenses and concessions, dependence on key employees,

general global political and economic conditions, adverse tourism

trends, dependence on a limited number of resorts, competition in

the casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction risks, cybersecurity risk and our leverage and debt

service. Additional information concerning potential factors that

could affect the Company’s financial results is included in the

Company’s Annual Report on Form 10-K for the year ended

December 31, 2018 and the Company’s other periodic reports

filed with the Securities and Exchange Commission. The Company is

under no obligation to (and expressly disclaims any such obligation

to) update or revise its forward-looking statements as a result of

new information, future events or otherwise.

Non-GAAP Financial Measures

(1) “Adjusted net income attributable to Wynn Resorts, Limited”

is net income (loss) attributable to Wynn Resorts, Limited before

litigation settlement expense, nonrecurring regulatory expense,

pre-opening expenses, property charges and other, change in

derivatives fair value, change in Redemption Note fair value, gain

on extinguishment of debt, foreign currency remeasurement loss, net

of noncontrolling interests and income taxes calculated using the

specific tax treatment applicable to the adjustments based on their

respective jurisdictions. Adjusted net income (loss) attributable

to Wynn Resorts, Limited and adjusted net income (loss)

attributable to Wynn Resorts, Limited per diluted share are

presented as supplemental disclosures to financial measures in

accordance with GAAP because management believes that these

non-GAAP financial measures are widely used to measure the

performance, and as a principal basis for valuation, of gaming

companies. These measures are used by management and/or evaluated

by some investors, in addition to net income (loss) and earnings

per share computed in accordance with GAAP, as an additional basis

for assessing period-to-period results of our business. Adjusted

net income (loss) attributable to Wynn Resorts, Limited and

adjusted net income (loss) attributable to Wynn Resorts, Limited

per diluted share may be different from the calculation methods

used by other companies and, therefore, comparability may be

limited.

(2) “Adjusted Property EBITDA” is net income (loss) before

interest, income taxes, depreciation and amortization, litigation

settlement expense, pre-opening expenses, property charges and

other, management and license fees, corporate expenses and other,

stock-based compensation, gain on extinguishment of debt, change in

derivatives fair value, change in Redemption Note fair value and

other non-operating income and expenses. Adjusted Property EBITDA

is presented exclusively as a supplemental disclosure because

management believes that it is widely used to measure the

performance, and as a basis for valuation, of gaming companies.

Management uses Adjusted Property EBITDA as a measure of the

operating performance of its segments and to compare the operating

performance of its properties with those of its competitors, as

well as a basis for determining certain incentive compensation. The

Company also presents Adjusted Property EBITDA because it is used

by some investors to measure a company’s ability to incur and

service debt, make capital expenditures and meet working capital

requirements. Gaming companies have historically reported EBITDA as

a supplement to GAAP. In order to view the operations of their

casinos on a more stand-alone basis, gaming companies, including

Wynn Resorts, Limited, have historically excluded from their EBITDA

calculations pre-opening expenses, property charges, corporate

expenses and stock-based compensation, that do not relate to the

management of specific casino properties. However, Adjusted

Property EBITDA should not be considered as an alternative to

operating income as an indicator of the Company’s performance, as

an alternative to cash flows from operating activities as a measure

of liquidity, or as an alternative to any other measure determined

in accordance with GAAP. Unlike net income, Adjusted Property

EBITDA does not include depreciation or interest expense and

therefore does not reflect current or future capital expenditures

or the cost of capital. The Company has significant uses of cash

flows, including capital expenditures, interest payments, debt

principal repayments, income taxes and other non-recurring charges,

which are not reflected in Adjusted Property EBITDA. Also, Wynn

Resorts’ calculation of Adjusted Property EBITDA may be different

from the calculation methods used by other companies and,

therefore, comparability may be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income (loss) attributable

to Wynn Resorts, Limited to adjusted net income attributable to

Wynn Resorts, Limited, (ii) operating income (loss) to

Adjusted Property EBITDA, and (iii) net income (loss) attributable

to Wynn Resorts, Limited to Adjusted Property EBITDA.

WYNN RESORTS, LIMITED AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except

per share data) (unaudited) Three

Months Ended March 31, 2019

2018 Operating revenues: Casino $ 1,185,101 $

1,242,139 Rooms 191,270 190,310 Food and beverage 173,219 172,222

Entertainment, retail and other 101,956

110,907

Total operating revenues

1,651,546 1,715,578 Operating

expenses: Casino 750,071 764,401 Rooms 63,706 63,197 Food and

beverage 148,761 137,658 Entertainment, retail and other 44,044

48,030 General and administrative 217,322 169,585 Litigation

settlement — 463,557 Provision for doubtful accounts 5,422 691

Pre-opening 27,713 10,345 Depreciation and amortization 136,557

136,357 Property charges and other 2,774 3,051

Total operating expenses 1,396,370

1,796,872 Operating income

(loss) 255,176 (81,294

) Other income (expense): Interest income 7,287 7,220

Interest expense, net of amounts capitalized (93,180 ) (98,227 )

Change in derivatives fair value (1,509 ) — Change in Redemption

Note fair value — (69,331 ) Gain on extinguishment of debt — 2,329

Other (6,358 ) (9,220 )

Other income (expense),

net (93,760 ) (167,229

) Income (loss) before income taxes 161,416

(248,523 ) Benefit (provision) for income taxes

(1,685 ) 111,045

Net income (loss)

159,731 (137,478 ) Less: net income

attributable to noncontrolling interests (54,859 )

(66,829 )

Net income (loss) attributable to Wynn Resorts,

Limited $ 104,872 $ (204,307

) Basic and diluted income (loss) per common share: Net

income (loss) attributable to Wynn Resorts, Limited: Basic $ 0.98 $

(1.99 ) Diluted $ 0.98 $ (1.99 ) Weighted average common shares

outstanding: Basic 106,792 102,570 Diluted 107,073 102,570

Dividends declared per common share: $ 0.75 $ 0.50

WYNN

RESORTS, LIMITED AND SUBSIDIARIES RECONCILIATION OF NET

INCOME (LOSS) ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per share data) (unaudited)

Three Months Ended March 31,

2019 2018 Net income

(loss) attributable to Wynn Resorts, Limited $ 104,872 $ (204,307 )

Litigation settlement expense — 463,557 Nonrecurring regulatory

expense 35,000 — Pre-opening expenses 27,713 10,345 Property

charges and other 2,774 3,051 Change in derivatives fair value

1,509 — Change in Redemption Note fair value — 69,331 Gain on

extinguishment of debt — (2,329 ) Foreign currency remeasurement

loss 6,358 9,220 Income tax impact on adjustments (2,692 ) (108,827

) Noncontrolling interests impact on adjustments (2,950 )

(3,068 )

Adjusted net income attributable to Wynn

Resorts, Limited $ 172,584 $

236,973 Adjusted net income attributable to Wynn

Resorts, Limited per diluted share $ 1.61

$ 2.30 Weighted average common shares

outstanding - diluted 107,073 103,155

WYNN RESORTS,

LIMITED AND SUBSIDIARIES RECONCILIATION OF OPERATING INCOME

(LOSS) TO ADJUSTED PROPERTY EBITDA (in thousands)

(unaudited) Three Months Ended March 31,

2019

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expenses

and other

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Palace $ 125,791 $ — $ 66,066 $ 1,120 $

27,220 $ 1,284 $ 1,105 $ 222,586 Wynn Macau 118,397 — 21,912 393

18,986 1,495 2,706 163,889 Other Macau (3,303 ) —

1,117 6 — 1,913

267 —

Total Macau Operations 240,885 —

89,095 1,519 46,206 4,692 4,078

386,475 Las Vegas Operations 38,924 — 44,590 510 18,721

3,965 1,592 108,302 Corporate and Other (24,633 )

27,713 2,872 745 (64,927 )

53,892 4,338 —

Total $ 255,176

$ 27,713 $ 136,557 $

2,774 $ — $ 62,549

$ 10,008 $ 494,777 Three

Months Ended March 31, 2018

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expenses and

other (1)

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Palace $ 119,471 $ — $ 64,424 $ 1,027 $

24,225 $ 1,452 $ 1,312 $ 211,911 Wynn Macau 159,461 — 22,170 768

23,366 1,864 2,193 209,822 Other Macau (3,970 ) —

1,106 9 — 2,690

165 —

Total Macau Operations 274,962 —

87,700 1,804 47,591 6,006 3,670

421,733 Las Vegas Operations 71,874 6 45,783 1,329 20,039

2,948 617 142,596 Corporate and Other (1) (428,130 )

10,339 2,874 (82 ) (67,630 ) 479,612

3,017 —

Total $ (81,294 )

$ 10,345 $ 136,357 $

3,051 $ — $

488,566 $ 7,304 $ 564,329

(1) Corporate expense and other includes

the litigation settlement expense of $463.6 million in the first

quarter of 2018.

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO WYNN

RESORTS, LIMITED TO ADJUSTED PROPERTY EBITDA (in

thousands) (unaudited) Three Months

Ended March 31, 2019

2018 Net income (loss) attributable to Wynn Resorts,

Limited $ 104,872 $ (204,307 ) Net income attributable to

noncontrolling interests 54,859 66,829 Litigation settlement

expense — 463,557 Pre-opening expenses 27,713 10,345 Depreciation

and amortization 136,557 136,357 Property charges and other 2,774

3,051 Corporate expenses and other 62,549 25,009 Stock-based

compensation 10,008 7,304 Interest income (7,287 ) (7,220 )

Interest expense, net of amounts capitalized 93,180 98,227 Change

in derivatives fair value 1,509 — Change in Redemption Note fair

value — 69,331 Gain on extinguishment of debt — (2,329 ) Other

6,358 9,220 (Benefit) provision for income taxes 1,685

(111,045 )

Adjusted Property EBITDA $

494,777 $ 564,329 WYNN

RESORTS, LIMITED AND SUBSIDIARIES SUPPLEMENTAL DATA

SCHEDULE (dollars in thousands, except for win per unit per

day, ADR and REVPAR) (unaudited) Three

Months Ended March 31, 2019

2018 Macau Operations: Wynn Palace:

VIP: Average number of table games 111 115 VIP turnover $

12,627,262 $ 15,385,833 VIP table games win (1) $ 493,184 $ 399,891

VIP table games win as a % of turnover 3.91 % 2.60 % Table games

win per unit per day $ 49,156 $ 38,533 Mass market: Average number

of table games 211 211 Table drop (2) $ 1,303,924 $ 1,217,201 Table

games win (1) $ 315,469 $ 310,159 Table games win % 24.2 % 25.5 %

Table games win per unit per day $ 16,646 $ 16,341 Average number

of slot machines 1,091 1,062 Slot machine handle $ 975,048 $

1,058,096 Slot machine win (3) $ 51,401 $ 55,785 Slot machine win

per unit per day $ 524 $ 584 Room statistics: Occupancy 97.2 % 96.8

% ADR (4) $ 271 $ 252 REVPAR (5) $ 264 $ 244

Wynn

Macau: VIP: Average number of table games 113 114 VIP turnover

$ 10,194,031 $ 17,087,455 VIP table games win (1) $ 295,298 $

445,189 VIP table games win as a % of turnover 2.90 % 2.61 % Table

games win per unit per day $ 29,099 $ 43,531 Mass market: Average

number of table games 206 203 Table drop (2) $ 1,351,693 $

1,322,815 Table games win (1) $ 264,542 $ 256,481 Table games win %

19.6 % 19.4 % Table games win per unit per day $ 14,283 $ 14,042

Average number of slot machines 826 939 Slot machine handle $

794,367 $ 1,002,819 Slot machine win (3) $ 37,894 $ 41,765 Slot

machine win per unit per day $ 510 $ 494 Room statistics: Occupancy

99.3 % 99.0 % ADR (4) $ 290 $ 291 REVPAR (5) $ 288 $ 288

WYNN RESORTS, LIMITED AND SUBSIDIARIES SUPPLEMENTAL DATA

SCHEDULE (dollars in thousands, except for win per unit per

day, ADR and REVPAR) (unaudited) (continued)

Three Months Ended March 31, 2019

2018 Las Vegas

Operations: Average number of table games 238 238 Table drop

(2) $ 404,073 $ 536,581 Table games win (1) $ 111,370 $ 154,433

Table games win % 27.6 % 28.8 % Table games win per unit per day $

5,198 $ 7,212 Average number of slot machines 1,807 1,829 Slot

machine handle $ 789,310 $ 744,133 Slot machine win (3) $ 54,544 $

49,264 Slot machine win per unit per day $ 335 $ 299 Room

statistics: Occupancy 82.6 % 83.9 % ADR (4) $ 338 $ 340 REVPAR (5)

$ 279 $ 285 (1) Table games win is shown before discounts,

commissions and the allocation of casino revenues to rooms, food

and beverage and other revenues for services provided to casino

customers on a complimentary basis. (2) In Macau, table drop is the

amount of cash that is deposited in a gaming table’s drop box plus

cash chips purchased at the casino cage. In Las Vegas, table drop

is the amount of cash and net markers issued that are deposited in

a gaming table’s drop box. (3) Slot machine win is calculated as

gross slot machine win minus progressive accruals and free play.

(4) ADR is average daily rate and is calculated by dividing total

room revenues including complimentaries (less service charges, if

any) by total rooms occupied. (5) REVPAR is revenue per available

room and is calculated by dividing total room revenues including

complimentaries (less service charges, if any) by total rooms

available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190509005769/en/

Vincent Zahn702-770-7555investorrelations@wynnresorts.com

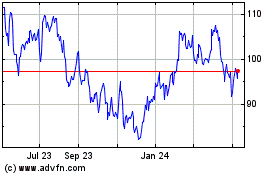

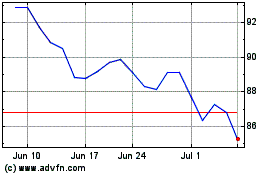

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024