Announces $1 Billion Share Repurchase

Authorization

Tapestry, Inc. (NYSE: TPR), a leading New York-based house of

modern luxury accessories and lifestyle brands, today reported

third quarter results for the period ended March 30, 2019.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190509005239/en/

(Photo: Business Wire)

Discussion of Financial Results:

Victor Luis, Chief Executive Officer of Tapestry, Inc., said,

“We are pleased with our third quarter performance, highlighted by

increases in sales and gross margin on a constant currency basis in

each of our three brands. Most notably, we again drove positive

comps at Coach and generated a significant sequential comp

improvement at Kate Spade with Nicola Glass’s new collection

resonating with consumers globally. Further, we continued to make

key investments across our portfolio and to realize meaningful

synergies from the successful integration of Kate Spade as we

harness the power of our multi-brand model. Taken together,

adjusted EPS was in-line with our expectations for the

quarter.”

Share Repurchase Authorization:

The Company announced its Board of Directors has authorized the

repurchase of up to $1 billion of its outstanding common stock.

Pursuant to this program, purchases of shares of the Company's

common stock will be made subject to market conditions and at

prevailing market prices, through open market purchases.

Repurchased shares of common stock will become authorized but

unissued shares. These shares may be issued in the future for

general corporate and other purposes. In addition, the Company may

terminate or limit the stock repurchase program at any time.

Mr. Luis continued, “We’re also excited to announce the approval

of a $1 billion share repurchase authorization, demonstrating our

confidence in driving long-term, sustainable growth and value.

Through this program we will optimize our capital deployment and

enhance shareholder return, while maintaining our financial and

strategic flexibility. Importantly, we remain committed to our

longstanding capital allocation priorities supported by our strong

balance sheet and free cash flow: investing in our brands and

business, pursuing strategic acquisitions on an opportunistic basis

and maintaining our dividend.”

Non-GAAP Reconciliation:

During the fiscal third quarter, the Company recorded certain

charges associated with its Integration and Acquisition activities

and ERP implementation efforts as well as the benefit of Tax

Legislation changes. Taken together, these items decreased the

Company’s third quarter reported net income by approximately $4

million or about $0.02 per diluted share. Please refer to the

financial tables included herein for a detailed reconciliation of

the Company’s reported to non-GAAP results.

Overview of Third Quarter 2019

Tapestry, Inc. Results:

- Net sales totaled $1.33 billion

for the third fiscal quarter as compared to $1.32 billion in the

prior year, an increase of 1% on a reported basis and 2% in

constant currency.

- Gross profit totaled $916

million on a reported basis, while gross margin for the quarter was

68.8% compared to $908 million and 68.6%, respectively, in the

prior year. On a non-GAAP basis, gross profit totaled $921 million,

while gross margin was 69.2% as compared to $912 million and 68.9%,

respectively, in the prior year.

- SG&A expenses totaled $810

million on a reported basis and represented 60.8% of sales compared

to $749 million and 56.6%, respectively in the year-ago quarter. On

a non-GAAP basis, SG&A expenses were $780 million and

represented 58.6% of sales as compared to approximately $727

million and 55.0%, respectively, in the year-ago period.

- Operating income totaled $106

million on a reported basis, while operating margin was 7.9% versus

$159 million and an operating margin of 12.0% in the prior year. On

a non-GAAP basis, operating income was $141 million, while

operating margin was 10.6% versus $184 million and an operating

margin of 13.9% in the prior year.

- Net interest expense was $11

million in the quarter as compared to $17 million in the year ago

period.

- Net income for the quarter was

$117 million on a reported basis, with earnings per diluted share

of $0.40. This compared to net income of $140 million with earnings

per diluted share of $0.48 in the prior year period. The reported

tax rate for the quarter of (23.4)% compared to the prior year

reported rate of 1.3%. Additional Transition Tax guidance was

released by the U.S. Treasury this quarter, which resulted in the

reduction of the tax rate for the third fiscal quarter as compared

to prior year. On a non-GAAP basis, net income for the quarter

totaled $122 million, with earnings per diluted share of $0.42.

This compared to non-GAAP net income of $158 million with earnings

per diluted share of $0.54 in the prior year period. The non-GAAP

tax rate for the quarter was 6.8% compared to a 5.6% in the prior

year.

- Inventory was $811 million at

the end of quarter versus ending inventory of $714 million in the

year ago period.

Third fiscal quarter results in each of the Company’s reportable

segments were as follows:

Coach Third Quarter of 2019

Results:

- Net sales for Coach totaled $965

million for the third fiscal quarter, as compared to $969 million

in the prior year on a reported basis, or an increase of 1% on a

constant currency basis. Global comparable store sales increased

1%, including a benefit of approximately 100 basis points driven by

an increase in global e-commerce.

- Gross profit for Coach totaled

$692 million, while gross margin was 71.7% on a reported and

non-GAAP basis. This compared to reported gross profit and margin

in the prior year of $691 million and 71.3%, respectively. On a

non-GAAP basis, gross profit was $692 million, while gross margin

was 71.4% in the prior year’s third quarter.

- SG&A expenses for Coach were

$452 million on a reported basis and represented 46.8% of sales. On

a non-GAAP basis, SG&A expenses were $447 million and

represented 46.3% of sales. This compared to expenses of $441

million or 45.5% of sales in the year-ago quarter on both a

reported and non-GAAP basis.

- Operating income for Coach

totaled $239 million compared to reported operating income of $250

million in the prior year, while operating margin was 24.8% versus

25.8% a year ago. On a non-GAAP basis, operating income was $245

million compared to $252 million in the prior year, while operating

margin was 25.4% versus 26.0% a year ago.

Kate Spade Third Quarter of 2019

Results:

- Net sales for Kate Spade totaled

$281 million for the third fiscal quarter as compared to $269

million in the prior year, an increase of 4% on a reported basis

and 5% in constant currency. Global comparable store sales declined

3%, including the positive impact of approximately 700 basis points

from global e-commerce.

- Gross profit for Kate Spade

totaled $178 million on a reported basis, while gross margin for

the quarter was 63.3% as compared to $171 million and 63.5%,

respectively, in the prior year. On a non-GAAP basis, third quarter

gross profit was $182 million, while gross margin was 64.8% as

compared to $172 million and 63.9%, respectively, in the year ago

period.

- SG&A expenses for Kate Spade

were $172 million on a reported basis and represented 61.2% of

sales. This compared to reported SG&A expenses of $158 million

in the year ago period, which represented 58.8% of sales. On a

non-GAAP basis, SG&A expenses were $169 million and represented

60.1% of sales. This compared to expenses of $149 million or 55.4%

of sales on a non-GAAP basis in the previous year.

- Operating income for Kate Spade

was $6 million on a reported basis, representing an operating

margin of 2.2%. This compared to operating income of $13 million

and an operating margin of 4.7% on a reported basis in the year ago

period. On a non-GAAP basis, operating income totaled $13 million,

while operating margin was 4.7%. This compared to operating income

of $23 million and an operating margin of 8.4% on a non-GAAP basis

in the previous year.

Stuart Weitzman Third Quarter of 2019

Results:

- Net sales for Stuart Weitzman

totaled $85 million for the third fiscal quarter compared to $84

million reported in the same period of the prior year, an increase

of 2% on a reported basis and 4% in constant currency.

- Gross profit for Stuart Weitzman

totaled $46 million on a reported basis, while gross margin for the

quarter was 54.3% as compared to $45 million and 54.1%,

respectively, in the prior year. On a non-GAAP basis, third quarter

gross profit was $47 million, while gross margin was 55.2% as

compared to $47 million and 56.6%, respectively, in the year ago

period. Excluding the impact of currency, non-GAAP gross margin

increased 70 basis points versus prior year.

- SG&A expenses for Stuart

Weitzman were $60 million on a reported basis and represented 70.2%

of sales as compared to $56 million or 67.3% of sales in the prior

year’s third quarter. On a non-GAAP basis, SG&A expenses were

approximately $60 million or 70.0% of sales as compared to $52

million or 61.8% of sales in the prior year.

- Operating income for Stuart

Weitzman was a loss of $14 million on a reported basis, while

operating margin was (15.9)% versus a loss of $11 million and

(13.2)%, respectively, in the prior year. On a non-GAAP basis, the

operating loss was $13 million or (14.9)% of sales versus a loss of

$4 million or (5.1)% of sales, respectively, in the prior

year.

Mr. Luis added, “As we look ahead, we are committed to executing

our strategic plan and achieving our near-term and long-range

financial targets. This includes our expectation of delivering

positive comps at both Coach and Kate Spade along with

profitability improvements at Stuart Weitzman, both in the fourth

fiscal quarter and in the years ahead. As such, we are maintaining

our EPS guidance for fiscal 2019 and our outlook for double-digit

operating income and EPS growth in fiscal 2020.”

“We are confident in the clarity of our vision, the strength of

our team and the benefits of our global, multi-brand platform. Our

model is distinctive – we are brand-led and consumer-centric – with

a culture built upon the values of optimism, innovation and

inclusivity. Each of our brands have differentiated attitudes,

bringing diversification to our portfolio. At the same time, each

can leverage Tapestry’s core capabilities and infrastructure to

drive meaningful synergies. Taken together, we are uniquely

positioned to capture the vast opportunities within the attractive

and growing global accessories, footwear and outerwear markets,”

Mr. Luis concluded.

Fiscal Year 2019 Outlook

The following fiscal 2019 outlook is provided on a non-GAAP

basis and replaces all previous guidance.

The Company expects revenues for fiscal 2019 to increase at a

low-to-mid-single-digit rate from fiscal 2018.

In addition, the Company projects earnings per diluted share in

the range of $2.55 to $2.60. This guidance continues to reflect

cost savings resulting from expected synergies related to the Kate

Spade acquisition of $100 to $115 million as well as the impact of

distributor consolidations and buybacks and systems investments.

This guidance includes the expectation for net interest expense to

be in the area of $50 million for the year. Further, the full year

fiscal 2019 tax rate is projected at about 18%.

Fiscal Year 2019 Outlook - Non-GAAP Adjustments:

The Company is not able to provide a full reconciliation of the

non-GAAP financial measures to GAAP presented in this release and

on the Company’s conference call because certain material items

that impact these measures, such as the timing and exact amount of

charges related to Integration and Acquisition and the costs

associated with the Company’s ERP implementation have not yet

occurred. Accordingly, a reconciliation of our non-GAAP financial

measure guidance to the corresponding GAAP measures is not

available without unreasonable effort. Where possible, the Company

has identified the estimated impact of the items excluded from its

fiscal 2019 guidance.

This fiscal 2019 non-GAAP guidance excludes (1) expected pre-tax

charges of approximately $35 million attributable to the Company’s

ERP implementation efforts; (2) estimated pre-tax Integration and

Acquisition charges of approximately $80 to $90 million (of which

approximately $15 million is estimated to be non-cash); and (3) the

impact of Tax Legislation of $9 million incurred in the second and

third quarters of fiscal 2019. The Company continues to refine its

integration plan and estimates for the ERP implementation

efforts.

Conference Call Details:

The Company will host a conference call to review these results

at 8:30 a.m. (ET) today, May 9, 2019. Interested parties may listen

to the conference call via live webcast by accessing

www.tapestry.com/investors on the Internet or calling

1-877-510-8087 or 1-862-298-9015 and providing the Conference ID

9287715. A telephone replay will be available starting at 12:00

p.m. (ET) today, for a period of five business days. To access the

telephone replay, call 1-800-585-8367 or 1-404-537-3406 and enter

the Conference ID 9287715. A webcast replay of the earnings

conference call will also be available for five business days on

the Tapestry website. Presentation slides have also been posted to

the Company’s website at www.tapestry.com/investors.

The Company expects to report fiscal 2019 fourth quarter and

full year financial results on Thursday August 15, 2019. To receive

notification of future announcements, please register at

www.tapestry.com/investors ("Subscribe to E-Mail Alerts").

Tapestry, Inc. is a New York-based house of modern luxury

lifestyle brands. The Company’s portfolio includes Coach, Kate

Spade and Stuart Weitzman. Our Company and our brands are founded

upon a creative and consumer-led view of luxury that stands for

inclusivity and approachability. Each of our brands are unique and

independent, while sharing a commitment to innovation and

authenticity defined by distinctive products and differentiated

customer experiences across channels and geographies. To learn more

about Tapestry, please visit www.tapestry.com. The Company’s common

stock is traded on the New York Stock Exchange under the symbol

TPR.

This information to be made available in this press release may

contain forward-looking statements based on management's current

expectations. Forward-looking statements include, but are not

limited to, the statements under “Fiscal Year 2019 Outlook,” as

well as statements that can be identified by the use of

forward-looking terminology such as "may," "will," “can,” "should,"

"expect," "intend," "estimate," "continue," "project," "guidance,"

"forecast," “outlook,” "anticipate," “excited,” “moving,”

“leveraging,” “capitalizing,” “developing,” “drive,” “targeting,”

“assume,” “plan,” “build,” “pursue,” “maintain,” “on track,” “well

positioned to,” “look forward to,” “looking ahead,” “to acquire,”

“achieve,” “strategic vision,” “growth opportunities” or comparable

terms. Future results may differ materially from management's

current expectations, based upon a number of important factors,

including risks and uncertainties such as expected economic trends,

the ability to anticipate consumer preferences, the ability to

control costs and successfully execute our ERP implementation and

growth strategies, our ability to achieve intended benefits, cost

savings and synergies from acquisitions, the risk of cybersecurity

threats and privacy or data security breaches, and the impact of

tax legislation, etc. Please refer to the Company’s latest Annual

Report on Form 10-K and its other filings with the Securities and

Exchange Commission for a complete list of risks and important

factors. The Company assumes no obligation to revise or update any

such forward-looking statements for any reason, except as required

by law.

TAPESTRY,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Quarters

and Nine Months Ended March 30, 2019 and March 31,

2018

(in millions,

except per share data)

(unaudited) (unaudited) QUARTER ENDED

NINE MONTHS ENDED March 30,

2019

March 31,

2018

March 30,

2019

March 31,

2018

Net sales $ 1,331.4 $ 1,322.4 $ 4,513.4 $ 4,396.3

Cost of sales 415.5 414.8 1,458.9

1,549.6 Gross profit 915.9 907.6 3,054.5 2,846.7

Selling, general and administrative expenses 810.1

748.6 2,410.3 2,363.1 Operating

income 105.8 159.0 644.2 483.6 Interest expense, net

10.6 16.9 36.9 59.6 Income

before provision for income taxes 95.2 142.1 607.3 424.0

Provision for income taxes (22.2 ) 1.8 112.8

238.2 Net income $ 117.4 $ 140.3 $ 494.5 $

185.8 Net income per share: Basic $ 0.40 $

0.49 $ 1.71 $ 0.65 Diluted $ 0.40 $ 0.48 $ 1.70 $

0.65 Shares used in computing net income per share:

Basic 290.0 286.2 289.5 284.7

Diluted 290.9 290.1 291.2

287.8

TAPESTRY,

INC.

GAAP TO NON-GAAP

RECONCILIATION

For the Quarters

Ended March 30, 2019 and March 31, 2018

(in millions,

except per share data)

(unaudited)

March 30, 2019

GAAP Basis(As Reported)

ERPImplementation(1)

Integration

&Acquisition(2)

Impact of

TaxLegislation(3)

Non-GAAP Basis(Excluding

Items)

Gross profit $ 915.9 $ - $ (5.0 ) $ - $ 920.9

Selling, general and administrative expenses 810.1 14.7 15.6 -

779.8 Operating income 105.8 (14.7 ) (20.6 ) - 141.1

Income before provision for income taxes 95.2 (14.7 ) (20.6 ) -

130.5 Provision for income taxes (22.2 ) (3.7 ) (2.4 ) (24.9

) 8.8 Net income 117.4 (11.0 ) (18.2 ) 24.9 121.7

Diluted net income per share 0.40 (0.05 ) (0.06 ) 0.09 0.42

March 31, 2018

GAAP Basis(As Reported)

OperationalEfficiency

Plan(4)

Integration

&Acquisition(2)

Impact of

TaxLegislation(3)

Non-GAAP Basis(Excluding

Items)

Gross profit $ 907.6 $ - $ (4.1 ) $ - $ 911.7

Selling, general and administrative expenses 748.6 2.9 18.3 - 727.4

Operating income 159.0 (2.9 ) (22.4 ) - 184.3 Income

before provision for income taxes 142.1 (2.9 ) (22.4 ) - 167.4

Provision for income taxes 1.8 (1.0 ) (12.1 ) 5.4 9.5

Net income 140.3 (1.9 ) (10.3 ) (5.4 ) 157.9 Diluted net

income per share 0.48 - (0.04 ) (0.02 ) 0.54 (1) Amounts as of

March 30, 2019 represent technology implementation costs. (2)

Amounts as of March 30, 2019 and March 31, 2018 represent charges

primarily attributable to acquisition and integration costs related

to the purchase of Kate Spade & Company, certain distributors

for the Coach and Stuart Weitzman brands and assumed operational

control of Kate Spade joint ventures. These charges include:

- Organization-related costs

- Limited life purchase accounting

adjustments

- Professional fees

(3) Amounts as of March 30, 2019 represent a tax benefit primarily

due to the transition tax related to foreign earnings deemed to be

repatriated. Amounts as of March 31, 2018 represent charges due to

the transition tax related to foreign earnings deemed to be

repatriated partially offset by the re-measurement of deferred tax

assets and liabilities. (4) Amounts as of March 31, 2018 represent

technology infrastructure costs.

TAPESTRY,

INC.

GAAP TO NON-GAAP

RECONCILIATION

For the Nine

Months Ended March 30, 2019 and March 31, 2018

(in millions,

except per share data)

(unaudited)

March 30, 2019

GAAP Basis(As Reported)

ERPImplementation(1)

Integration

&Acquisition(2)

Impact of TaxLegislation

(3)

Non-GAAP Basis(Excluding

Items)

Gross profit $ 3,054.5 $ - $ (9.1 ) $ - $ 3,063.6

Selling, general and administrative expenses 2,410.3 25.1 46.2 -

2,339.0 Operating income 644.2 (25.1 ) (55.3 ) - 724.6

Income before provision for income taxes 607.3 (25.1 ) (55.3

) - 687.7 Provision for income taxes 112.8 (6.3 ) (4.5 ) 9.2

114.4 Net income 494.5 (18.8 ) (50.8 ) (9.2 ) 573.3

Diluted net income per share 1.70 (0.06 ) (0.17 ) (0.04 ) 1.97

March 31, 2018

GAAP Basis(As Reported)

OperationalEfficiency

Plan(4)

Integration

&Acquisition(2)

Impact of TaxLegislation

(3)

Non-GAAP Basis(Excluding

Items)

Gross profit $ 2,846.7 $ - $ (110.9 ) $ - $ 2,957.6

Selling, general and administrative expenses 2,363.1 9.5 160.4 -

2,193.2 Operating income 483.6 (9.5 ) (271.3 ) - 764.4

Income before provision for income taxes 424.0 (9.5 ) (271.3

) - 704.8 Provision for income taxes 238.2 (3.1 ) (79.3 )

199.6 121.0 Net income 185.8 (6.4 ) (192.0 ) (199.6 ) 583.8

Diluted net income per share 0.65 (0.02 ) (0.67 ) (0.69 )

2.03 (1) Amounts as of March 30, 2019 primarily represent

technology implementation costs. (2) Amounts as of March 30, 2019

and March 31, 2018 represent charges primarily attributable to

acquisition and integration costs related to the purchase of Kate

Spade & Company, certain distributors of the Coach and Stuart

Weitzman brands and assumed operational control of Kate Spade joint

ventures. These charges include:

- Limited life purchase accounting

adjustments

- Professional fees

- Severance and other costs related to

contractual payments with certain Kate Spade executives

- Organization-related costs

- Inventory reserves established for the

destruction of inventory

(3) Amounts as of March 30, 2019 represent charges primarily due to

the transition tax related to foreign earnings deemed to be

repatriated. Amounts as of March 31, 2018 represent charges due to

the transition tax related to foreign earnings deemed to be

repatriated partially offset by the re-measurement of deferred tax

assets and liabilities. (4) Amounts as of March 31, 2018 primarily

represent technology infrastructure costs.

TAPESTRY,

INC.

GAAP TO NON-GAAP

RECONCILIATION - FOR SEGMENT RESULTS

For the Quarters

Ended March 30, 2019 and March 31, 2018

(in

millions)

(unaudited)

March 30, 2019 GAAP

Coach Kate Spade Stuart Weitzman

Corporate Non-GAAP Cost of sales

Integration & Acquisition - (4.3 )

(0.7 ) -

Gross profit $ 915.9 $

- $ (4.3 ) $ (0.7 ) $ - $ 920.9

SG&A

expenses Integration & Acquisition 5.5 3.0 0.1 7.0 ERP

Implementation - - -

14.7

SG&A expenses $ 810.1 $

5.5 $ 3.0 $ 0.1 $ 21.7 $ 779.8

Operating income $ 105.8 $ (5.5 ) $ (7.3 ) $ (0.8 ) $ (21.7

) $ 141.1

March 31, 2018 GAAP Coach

Kate Spade Stuart Weitzman Corporate

Non-GAAP Cost of sales Integration & Acquisition

(1.0 ) (1.0 ) (2.1 ) -

Gross profit $ 907.6 $ (1.0 ) $ (1.0 ) $ (2.1 ) $ -

$ 911.7

SG&A expenses Integration &

Acquisition 0.2 9.1 4.7 4.3 Operational Efficiency Plan

- - - 2.9

SG&A expenses $ 748.6 $ 0.2 $ 9.1 $

4.7 $ 7.2 $ 727.4

Operating income $

159.0 $ (1.2 ) $ (10.1 ) $ (6.8 ) $ (7.2 ) $ 184.3

TAPESTRY,

INC.

GAAP TO NON-GAAP

RECONCILIATION - FOR SEGMENT RESULTS

For the Nine

Months Ended March 30, 2019 and March 31, 2018

(in

millions)

(unaudited)

March 30, 2019 GAAP

Coach Kate Spade Stuart Weitzman

Corporate Non-GAAP Cost of sales

Integration & Acquisition (2.0 ) (5.4 )

(1.7 ) -

Gross profit $ 3,054.5

$ (2.0 ) $ (5.4 ) $ (1.7 ) $ - $ 3,063.6

SG&A

expenses Integration & Acquisition 5.5 10.1 12.2 18.4 ERP

Implementation - - -

25.1

SG&A expenses $ 2,410.3

$ 5.5 $ 10.1 $ 12.2 $ 43.5 $ 2,339.0

Operating income $ 644.2 $ (7.5 ) $ (15.5 ) $ (13.9 )

$ (43.5 ) $ 724.6

March 31, 2018 GAAP

Coach Kate Spade Stuart Weitzman

Corporate Non-GAAP Cost of sales Integration

& Acquisition (1.0 ) (106.4 ) (3.5

) -

Gross profit $ 2,846.7 $ (1.0 ) $

(106.4 ) $ (3.5 ) $ - $ 2,957.6

SG&A

expenses Integration & Acquisition 0.2 106.6 6.5 47.1

Operational Efficiency Plan - -

- 9.5

SG&A expenses $

2,363.1 $ 0.2 $ 106.6 $ 6.5 $ 56.6 $

2,193.2

Operating income $ 483.6 $ (1.2 ) $ (213.0 )

$ (10.0 ) $ (56.6 ) $ 764.4

The Company reports information in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP"). The Company's

management does not, nor does it suggest that investors should,

consider non-GAAP financial measures in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Further, the non-GAAP measures utilized by the Company may be

unique to the Company, as they may be different from non-GAAP

measures used by other companies. The financial information

presented above, as well as gross margin, SG&A expense ratio,

and operating margin, have been presented both including and

excluding the effect of certain items related to Integration &

Acquisition-Related Costs and ERP Implementation-Related costs for

Tapestry, Inc. and separately by segment and the impact of tax

legislation for Tapestry, Inc.

The Company operates on a global basis and reports financial

results in U.S. dollars in accordance with GAAP. Percentage

increases/decreases in net sales for the Company and each segment

and gross margin for the Stuart Weitzman segment have been

presented both including and excluding currency fluctuation effects

from translating foreign-denominated sales into U.S. dollars and

compared to the same periods in the prior quarter and fiscal year.

The Company calculates constant currency revenue results by

translating current period revenue in local currency using the

prior year period’s currency conversion rate.

Guidance for certain financial information for the fiscal year

ending June 29, 2019 has also been presented on a non-GAAP

basis.

Management utilizes these non-GAAP and constant currency

measures to conduct and evaluate its business during its regular

review of operating results for the periods affected and to make

decisions about Company resources and performance. The Company

believes presenting these non-GAAP measures, which exclude items

that are not comparable from period to period, is useful to

investors and others in evaluating the Company’s ongoing operating

and financial results in a manner that is consistent with

management’s evaluation of business performance and understanding

how such results compare with the Company’s historical performance.

Additionally, the Company believes presenting these metrics on a

constant currency basis will help investors and analysts to

understand the effect of significant year-over-year foreign

currency exchange rate fluctuations on these performance measures

and provide a framework to assess how business is performing and

expected to perform excluding these effects.

TAPESTRY,

INC.

SEGMENT

INFORMATION

For the Quarters

and Nine Months Ended March 30, 2019 and March 31,

2018

(in

millions)

(unaudited)

Coach Kate

Spade Stuart Weitzman Corporate

Total

Three Months

Ended March 30, 2019

Net sales $ 965.0 $ 281.1 $ 85.3 $ - $ 1,331.4 Gross profit

691.7 177.9 46.3 - 915.9 Operating income (loss) 239.5 6.1 (13.6 )

(126.2 ) 105.8 Income (loss) before provision for income taxes

239.5 6.1 (13.6 ) (136.8 ) 95.2

Three Months

Ended March 31, 2018

Net sales $ 969.3 $ 269.3 $ 83.8 $ - $ 1,322.4 Gross profit

691.3 171.0 45.3 - 907.6 Operating income (loss) 250.4 12.7 (11.0 )

(93.1 ) 159.0 Income (loss) before provision for income taxes 250.4

12.7 (11.0 ) (110.0 ) 142.1

Nine Months Ended

March 30, 2019

Net sales $ 3,174.3 1,034.9 $ 304.2 $ - $ 4,513.4 Gross

profit 2,231.5 658.0 165.0 - 3,054.5 Operating income (loss) 848.9

140.1 (20.8 ) (324.0 ) 644.2 Income (loss) before provision for

income taxes 848.9 140.1 (20.8 ) (360.9 ) 607.3

Nine Months Ended

March 31, 2018

Net sales $ 3,122.6 $ 972.8 $ 300.9 $ - $ 4,396.3 Gross

profit 2,169.4 502.6 174.7 - 2,846.7 Operating income (loss) 826.7

(55.8 ) 19.7 (307.0 ) 483.6 Income (loss) before provision for

income taxes 826.7 (55.8 ) 19.7 (366.6 ) 424.0

TAPESTRY,

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

At March 30, 2019

and June 30, 2018

(in

millions)

(unaudited) (audited) March 30,

2019

June 30,

2018

ASSETS Cash, cash equivalents and short-term

investments $ 1,337.3 $ 1,250.0 Receivables 285.7 314.1 Inventories

811.1 673.8 Other current assets 228.3 194.7

Total current assets 2,662.4 2,432.6 Property and equipment,

net 921.6 885.4 Other noncurrent assets 3,385.9

3,360.3 Total assets $ 6,969.9 $ 6,678.3

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable

$ 260.6 $ 264.3 Accrued liabilities 735.3 673.2 Current debt

0.7 0.7 Total current liabilities 996.6 938.2

Long-term debt 1,601.5 1,599.9 Other liabilities 840.6 895.6

Stockholders' equity 3,531.2 3,244.6 Total

liabilities and stockholders' equity $ 6,969.9 $ 6,678.3

TAPESTRY,

INC.

STORE

COUNT

At December 29,

2018 and March 30, 2019

(unaudited)

As of As of

Directly-Operated Store Count:

December 29, 2018 Openings

(Closures) March 30, 2019

Coach

North America 399 1 (8) 392 International 585 11 (7) 589

Kate

Spade

North America 218 1 (7) 212 International 176 7 (2) 181

Stuart

Weitzman

North America 68 3 (1) 70 International 50 8 - 58

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190509005239/en/

Tapestry, Inc.Analysts & Media:Andrea Shaw ResnickInterim

Chief Financial OfficerGlobal Head of Investor Relations and

Corporate Communications212/629-2618Christina ColoneVice President,

Investor Relations212/946-7252

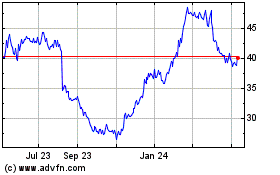

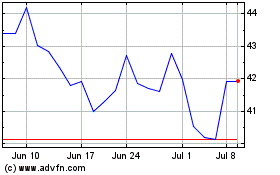

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024