Bristol-Myers Squibb Company (NYSE:BMY) (“Bristol-Myers

Squibb”) today announced that it priced its previously announced

private offering (the “Offering”) of senior unsecured notes in a

combined aggregate principal amount of $19 billion (collectively,

the “Notes”). The Notes will be issued in nine tranches: (i)

$750,000,000 in aggregate principal amount of floating rate notes

due 2020, (ii) $500,000,000 in aggregate principal amount of

floating rate notes due 2022, (iii) $1,000,000,000 in aggregate

principal amount of 2.550% notes due 2021, (iv) $1,500,000,000 in

aggregate principal amount of 2.600% notes due 2022, (v)

$3,250,000,000 in aggregate principal amount of 2.900% notes due

2024, (vi) $2,250,000,000 in aggregate principal amount of 3.200%

notes due 2026, (vii) $4,000,000,000 in aggregate principal amount

of 3.400% notes due 2029, (viii) $2,000,000,000 in aggregate

principal amount of 4.125% notes due 2039 and (ix) $3,750,000,000

in aggregate principal amount of 4.250% notes due 2049.

Bristol-Myers Squibb expects that the closing of the Offering will

occur on May 16, 2019, subject to the satisfaction of customary

closing conditions.

The Offering is being conducted in connection with the

previously announced proposed acquisition (the “Merger”) of Celgene

Corporation (“Celgene”), which is expected to occur in the third

quarter of calendar year 2019. Bristol-Myers Squibb intends to use

the net proceeds from the Offering to fund a portion of the

aggregate cash portion of the merger consideration to be paid to

Celgene shareholders in connection with the Merger and to pay

related fees and expenses, with any remaining proceeds being used

for general corporate purposes. The Offering is not conditioned

upon the consummation of the Merger. However, if (i) the Merger has

not been consummated on or prior to July 30, 2020 or (ii) prior to

such date, Bristol-Myers Squibb notifies the trustee in respect of

the Notes that Bristol-Myers Squibb will not pursue the

consummation of the Merger, then Bristol-Myers Squibb will be

required to redeem all outstanding Notes at a special mandatory

redemption price equal to 101% of the aggregate principal amount of

the Notes, plus accrued and unpaid interest, if any, to, but not

including, applicable special mandatory redemption date.

The Notes have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), any state securities laws

or the securities laws of any other jurisdiction, and may not be

offered or sold in the United States, or for the benefit of U.S.

persons, except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and applicable state securities or blue sky laws.

Accordingly, the Notes are being offered in the United States only

to persons reasonably believed to be “qualified institutional

buyers,” as that term is defined under Rule 144A of the Securities

Act, or outside the United States to persons other than “U.S.

persons” in accordance with Regulation S under the Securities

Act.

A confidential offering memorandum for the Offering of the

Notes, dated today, will be made available to such eligible

persons. The offering is being conducted in accordance with the

terms and subject to the conditions set forth in such confidential

offering memorandum.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, the

Notes or any other security. No offer, solicitation, purchase or

sale will be made in any jurisdiction in which such an offer,

solicitation or sale would be unlawful.

About Bristol-Myers Squibb

Bristol-Myers Squibb is a global biopharmaceutical company whose

mission is to discover, develop and deliver innovative medicines

that help patients prevail over serious diseases.

Cautionary Notes on Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. You can identify these forward-looking statements by the

fact that they use words such as “should,” “expect,” “anticipate,”

“estimate,” “target,” “may,” “project,” “guidance,” “intend,”

“plan,” “believe” and others words and terms of similar meaning and

expression in connection with any discussion of future operating or

financial performance. You can also identify forward-looking

statements by the fact that they do not relate strictly to

historical or current facts. These statements are likely to relate

to, among other things, statements about the expected timing of

completion of the Offering and the intended use of proceeds from

the proposed Offering, the consummation of the Merger, projections

as to the anticipated benefits thereof, and are based on current

expectations and involve inherent risks and uncertainties,

including factors that could delay, divert or change any of them,

and could cause actual outcomes to differ materially from current

expectations.

Important risk factors could cause actual future results and

other future events to differ materially from those currently

estimated by management, including, but not limited to, the risks

that: the completion of the Merger may not occur on the anticipated

terms and timing or at all; a condition to the closing of the

Merger may not be satisfied; the combined company will have

substantial indebtedness following the completion of the Merger;

Bristol-Myers Squibb is unable to achieve the synergies and value

creation contemplated by the Merger; Bristol-Myers Squibb is unable

to promptly and effectively integrate Celgene’s businesses;

management’s time and attention is diverted on transaction related

issues; disruption from the transaction makes it more difficult to

maintain business, contractual and operational relationships; the

credit ratings of the combined company decline following the

Merger; legal proceedings are instituted against Bristol-Myers

Squibb, Celgene or the combined company; Bristol-Myers Squibb,

Celgene or the combined company is unable to retain key personnel;

and the announcement or the consummation of the Merger has a

negative effect on the market price of the capital stock of

Bristol-Myers Squibb and Celgene or on Bristol-Myers Squibb’s and

Celgene’s operating results.

Additional information concerning these risks, uncertainties and

assumptions can be found in Bristol-Myers Squibb’s and Celgene’s

respective filings with the Securities and Exchange Commission (the

“SEC”), including the risk factors discussed in Bristol-Myers

Squibb’s and Celgene’s most recent Annual Reports on Form 10-K, as

updated by their Quarterly Reports on Form 10-Q and future filings

with the SEC. Except as otherwise required by law, Bristol-Myers

Squibb undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190508005247/en/

Media:Carrie L.

Fernandez609-252-5222carrie.fernandez@bms.comInvestors:Tim

Power609-252-7509timothy.power@bms.com

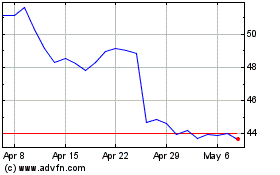

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

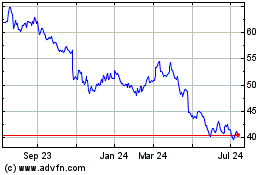

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024