Current Report Filing (8-k)

May 07 2019 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

M

ay 3

,

2019

Nuo Therapeutics, Inc.

(Exact name of Registrant as Specified in Charter)

|

Delaware

|

001-32518

|

23-3011702

|

|

(State or Other Jurisdiction

|

(Commission

|

(IRS Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

207A Perry Parkway, Suite 1, Gaithersburg, MD 20877

(Address of Principal Executive Offices) (Zip Code)

(240) 499-2680

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: None

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

Item

1.01 Entry

into

a

Material

Definitive

Agreement

On May 3, 2019, Nuo Therapeutics, Inc. (the “Company”) entered into second amendments to the convertible promissory notes issued to Auctus Fund, LLC (“Auctus”) and EMA Financial, LLC (“EMA” and, collectively with Auctus, the “Investors”) on September 17, 2018. The amendments further extend the date when the Company may prepay the notes and defer the date upon which the Investors can initiate conversion of the notes into common shares of the Company pursuant to the notes’ terms, until May 31, 2019. The Company paid the Investors an amendment fee totaling $17,000, representing approximately five percent (5%) of the face value of the notes.

The above description of the convertible note amendments does not purport to be complete and is qualified in its entirety by the full text of each amendment, attached as Exhibits 10.1 and 10.2, respectively, which are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Forward-Looking Statements

This Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and may contain the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “the facts suggest,” “will be,” “will continue,” “will likely result” or, in each case, their negative, or words or expressions of similar meaning.

These statements reflect the Company’s current view of future events and are subject to certain risks and uncertainties, which include, among others, the following:

|

|

●

|

the Company’s ability to receive any commitment from CAG to reopen the NCD for Aurix in time to prevent the Company from ceasing its operations;

|

|

|

●

|

significant uncertainty surrounding an agreed path forward for Aurix as an accessible product option for physicians treating Medicare beneficiaries with chronic wounds – in the absence of such a path, the Company will likely have to cease operations;

|

|

|

●

|

the possibility that a more comprehensive and definitive analysis of the wound healing data submitted to CAG could come to materially different conclusions than the results of the Company’s limited and preliminary analysis;

|

|

|

●

|

the continuing rapid depletion of the Company’s cash resources, the Company’s need for immediate and substantial additional financing (without which it faces liquidation) and its ability to obtain that financing, including in light of its outstanding convertible notes, Series A preferred stock and the low share price and significant volatility with respect to its common stock - if the Company were required to liquidate today, the holders of its common stock would not receive any consideration for their common stock;

|

|

|

●

|

the fact that the Company has no significant assets left to monetize other than the Aurix System itself;

as well as other risks and uncertainties referenced in the Company’s other SEC filings.

|

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results could differ materially from those anticipated in these forward-looking statements, and the Company’s business, results of operations, financial condition and cash flows may be materially and adversely affected. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Except to the extent required by applicable law or rules, the Company undertakes no obligation and does not intend to update, revise or otherwise publicly release any revisions to its forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Nuo Therapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David E. Jorden

|

|

|

|

|

David E. Jorden

|

|

|

|

|

Chief Executive Officer and

Chief Financial Officer

|

|

Date: May 7, 2019

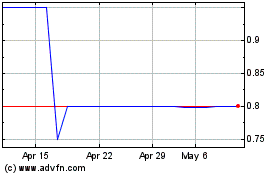

Nuo Therapeutics (QB) (USOTC:AURX)

Historical Stock Chart

From Mar 2024 to Apr 2024

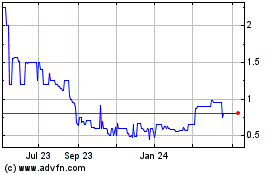

Nuo Therapeutics (QB) (USOTC:AURX)

Historical Stock Chart

From Apr 2023 to Apr 2024