RenaissanceRe Holdings Ltd. (NYSE: RNR) (the “Company” or

“RenaissanceRe”) today reported net income available to

RenaissanceRe common shareholders of $273.7 million, or $6.43 per

diluted common share, in the first quarter of 2019, compared to

$56.7 million, or $1.42 per diluted common share, in the first

quarter of 2018. Operating income available to RenaissanceRe common

shareholders was $154.4 million, or $3.60 per diluted common share,

in the first quarter of 2019, compared to $122.1 million, or $3.07

per diluted common share, in the first quarter of 2018. The Company

reported an annualized return on average common equity of 23.5% and

an annualized operating return on average common equity of 13.3% in

the first quarter of 2019, compared to 5.7% and 12.2%,

respectively, in the first quarter of 2018. Book value per common

share increased $6.92, or 6.6%, to $111.05 in the first quarter of

2019, compared to a 0.6% increase in the first quarter of 2018.

Tangible book value per common share plus accumulated dividends

increased $6.88, or 7.0%, to $124.05 in the first quarter of 2019,

compared to a 0.8% increase in the first quarter of 2018.

Kevin J. O’Donnell, President and Chief Executive Officer of

RenaissanceRe, commented: “Our strong first quarter was

distinguished by solid profits, material growth and strategic

advancement. We achieved an annualized operating return on average

common equity of 13.3% and growth in tangible book value per common

share plus accumulated dividends of 7.0%. At the same time, we grew

our business materially by leveraging into an improving rate

environment. The purchase of Tokio Millennium Re advanced our

strategy, and we have moved from planning to execution on what we

are optimistic will be a quick and successful integration.”

Acquisition of Tokio Millennium Re

On March 22, 2019, the Company's wholly owned subsidiary

RenaissanceRe Specialty Holdings (UK) Limited completed its

previously announced purchase of all the share capital of Tokio

Millennium Re AG (now known as RenaissanceRe Europe AG), Tokio

Millennium Re (UK) Limited (now known as RenaissanceRe (UK)

Limited) and their subsidiaries (collectively, the “TMR Group

Entities”) (the “TMR Stock Purchase”). The operating activities of

the TMR Group Entities from the acquisition date, March 22, 2019,

through March 31, 2019 were not material and as a result were not

included in the Company’s consolidated statements of operations for

the first quarter of 2019. At March 31, 2019, the Company’s

consolidated balance sheet reflects the combined entities.

During the first quarter of 2019, the Company recorded $25.5

million of corporate expenses associated with the acquisition,

comprised of $12.9 million of transaction-related costs, $5.9

million of integration-related costs, and $6.7 million of

compensation-related costs. In addition, the Company recognized

$18.0 million of net identifiable intangible assets and $13.1

million of goodwill in connection with the acquisition, further

detailed in the table below, or a total of $0.74 per diluted common

share in the first quarter of 2019.

March 31, 2019 Top broker relationships $

10,000 Renewal rights 1,200 Insurance licenses 6,800 Net

identifiable intangible assets at March 31, 2019 related to the

acquisition of the TMR Group Entities 18,000 Excess purchase price

over the fair value of net assets acquired assigned to goodwill

13,094 Total net identifiable intangible assets and goodwill

recognized related to the acquisition of the TMR Group Entities $

31,094

First Quarter of 2019 Summary

- Underwriting income of $154.1 million

and a combined ratio of 72.0% in the first quarter of 2019,

compared to $129.6 million and 70.6%, respectively, in the first

quarter of 2018. The Property segment generated underwriting income

of $152.4 million and had a combined ratio of 47.6%. The Casualty

and Specialty segment generated underwriting income of $1.7 million

and had a combined ratio of 99.3%.

- Gross premiums written increased by

$404.6 million, or 34.9%, to $1.6 billion, in the first quarter of

2019, compared to the first quarter of 2018, driven by an increase

of $325.4 million in the Property segment and an increase of $79.2

million in the Casualty and Specialty segment.

- Total investment result was a gain of

$252.1 million in the first quarter of 2019, generating an

annualized total investment return of 8.0%.

Underwriting Results by Segment

Property Segment

Gross premiums written in the Property segment were $1.0 billion

in the first quarter of 2019, an increase of $325.4 million, or

46.0%, compared to $707.0 million in the first quarter of 2018.

Gross premiums written in the catastrophe class of business were

$845.2 million in the first quarter of 2019, an increase of $254.9

million, or 43.2%, compared to the first quarter of 2018. The

increase in gross premiums written in the catastrophe class of

business in the first quarter of 2019 was driven primarily by

expanded participation on existing transactions and certain new

transactions.

Gross premiums written in the other property class of business

were $187.2 million in the first quarter of 2019, an increase of

$70.5 million, or 60.5%, compared to the first quarter of 2018. The

increase in gross premiums written in the other property class of

business was primarily driven by growth across a number of the

Company’s underwriting platforms, both from existing relationships

and through new opportunities.

Ceded premiums written in the Property segment were $468.2

million in the first quarter of 2019, an increase of $115.3

million, or 32.7%, compared to the first quarter of 2018. The

increase in ceded premiums written in the first quarter of 2019 was

principally due to a significant portion of the increase in gross

premiums written in the catastrophe class of business noted above

being ceded to third-party investors in the Company’s managed joint

venture, Upsilon RFO.

The Property segment generated underwriting income of $152.4

million and had a combined ratio of 47.6% in the first quarter of

2019, compared to $127.2 million and 43.5%, respectively, in the

first quarter of 2018. Principally impacting the Property segment

underwriting result and combined ratio in the first quarter of 2019

was lower current accident year net claims and claim expenses

driven by a relatively lower level of insured catastrophe events,

compared to the first quarter of 2018. Partially offsetting this

was net adverse development on prior accident years net claims and

claim expenses of $1.9 million, or 0.7% percentage points, during

the first quarter of 2019, primarily driven by higher than expected

losses in the other property class of business.

Casualty and Specialty Segment

Gross premiums written in the Casualty and Specialty segment

were $531.9 million in the first quarter of 2019, an increase of

$79.2 million, or 17.5%, compared to the first quarter of 2018. The

increase was due to continued growth from new and existing business

opportunities across various classes of business within the

segment.

The Casualty and Specialty segment generated underwriting income

of $1.7 million and had a combined ratio of 99.3% in the first

quarter of 2019, compared to $2.6 million and 98.8%, respectively,

in the first quarter of 2018.

During the first quarter of 2019, the Casualty and Specialty

segment experienced net favorable development on prior accident

years net claims and claim expenses of $6.2 million, or 2.4

percentage points, compared to net favorable development of $3.8

million, or 1.8 percentage points, in the first quarter of 2018.

The net favorable development during the first quarter of 2019 was

principally driven by reported losses generally coming in lower

than expected on attritional net claims and claim expenses from

various lines of business within the segment.

Other Items

- The Company’s total investment result,

which includes the sum of net investment income and net realized

and unrealized gains and losses on investments, was a gain of

$252.1 million in the first quarter of 2019, compared to a loss of

$25.7 million in the first quarter of 2018, an increase of $277.8

million. The increase in the total investment result was

principally due to significant net unrealized gains from the

Company’s fixed maturity and public equity portfolios and higher

net investment income primarily driven by the Company’s fixed

maturity, short term and private equity investments.

- Net income attributable to redeemable

noncontrolling interests in the first quarter of 2019 was $70.2

million, compared to $29.9 million in the first quarter of 2018.

The result for the first quarter of 2019 was primarily driven by

DaVinciRe generating net income of $80.3 million in the first

quarter of 2019, compared to $26.9 million in the first quarter of

2018. The Company’s ownership in DaVinciRe was 22.1% at both

March 31, 2019 and March 31, 2018. The Company expects

its noncontrolling economic ownership in DaVinciRe to fluctuate

over time.

- In connection with the TMR Stock

Purchase, the Company issued 1,739,071 of its common shares to

Tokio Marine & Nichido Fire Insurance Co. Ltd.

- On April 2, 2019, the Company issued

$400.0 million of its 3.600% Senior Notes due April 15, 2029. A

portion of the net proceeds were used to repay, in full, $200.0

million outstanding under the Company’s revolving credit facility,

which was drawn on March 20, 2019 in connection with the

acquisition of the TMR Group Entities. The remainder of the net

proceeds will be used for general corporate purposes.

This Press Release includes certain non-GAAP financial measures

including “operating income available to RenaissanceRe common

shareholders”, “operating income available to RenaissanceRe common

shareholders per common share - diluted”, “operating return on

average common equity - annualized”, “tangible book value per

common share” and “tangible book value per common share plus

accumulated dividends.” A reconciliation of such measures to the

most comparable GAAP figures in accordance with Regulation G is

presented in the attached supplemental financial data.

Please refer to the “Investors - Financial Reports - Financial

Supplements” section of the Company’s website at www.renre.com for a copy of the Financial

Supplement which includes additional information on the Company’s

financial performance.

RenaissanceRe will host a conference call on Wednesday, May 8,

2019 at 10:00 a.m. ET to discuss this release. Live broadcast of

the conference call will be available through the “Investors -

Webcasts & Presentations” section of the Company’s website at

www.renre.com.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching well-structured risks with efficient

sources of capital. The Company provides property, casualty and

specialty reinsurance and certain insurance solutions to customers,

principally through intermediaries. Established in 1993, the

Company has offices in Bermuda, Australia, Ireland, Singapore,

Switzerland, the United Kingdom and the United States.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this Press Release

reflect RenaissanceRe’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements are subject to numerous factors that could cause

actual results to differ materially from those set forth in or

implied by such forward-looking statements, including the

following: the frequency and severity of catastrophic and other

events that the Company covers; the effectiveness of the Company’s

claims and claim expense reserving process; risks that the TMR

Stock Purchase disrupts or distracts from current plans and

operations; the ability to recognize the benefits of the TMR Stock

Purchase; the amount of the costs, fees, expenses and charges

related to the TMR Stock Purchase; the Company’s ability to

maintain its financial strength ratings; the effect of climate

change on the Company’s business; collection on claimed

retrocessional coverage, and new retrocessional reinsurance being

available on acceptable terms and providing the coverage that we

intended to obtain; the effects of U.S. tax reform legislation and

possible future tax reform legislation and regulations, including

changes to the tax treatment of the Company’s shareholders or

investors in the Company’s joint ventures or other entities the

Company manages; the effect of emerging claims and coverage issues;

soft reinsurance underwriting market conditions; the Company’s

reliance on a small and decreasing number of reinsurance brokers

and other distribution services for the preponderance of its

revenue; the Company’s exposure to credit loss from counterparties

in the normal course of business; the effect of continued

challenging economic conditions throughout the world; a contention

by the Internal Revenue Service that Renaissance Reinsurance Ltd.,

or any of the Company’s other Bermuda subsidiaries, is subject to

taxation in the U.S.; the success of any of the Company’s strategic

investments or acquisitions, including the Company’s ability to

manage its operations as its product and geographical diversity

increases; the Company’s ability to retain key senior officers and

to attract or retain the executives and employees necessary to

manage its business; the performance of the Company’s investment

portfolio; losses that the Company could face from terrorism,

political unrest or war; the effect of cybersecurity risks,

including technology breaches or failure on the Company’s business;

the Company’s ability to successfully implement its business

strategies and initiatives; the Company’s ability to determine the

impairments taken on investments; the effects of inflation; the

ability of the Company’s ceding companies and delegated authority

counterparties to accurately assess the risks they underwrite; the

effect of operational risks, including system or human failures;

the Company’s ability to effectively manage capital on behalf of

investors in joint ventures or other entities it manages; foreign

currency exchange rate fluctuations; the Company’s ability to raise

capital if necessary; the Company’s ability to comply with

covenants in its debt agreements; changes to the regulatory systems

under which the Company operates, including as a result of

increased global regulation of the insurance and reinsurance

industries; changes in Bermuda laws and regulations and the

political environment in Bermuda; the Company’s dependence on the

ability of its operating subsidiaries to declare and pay dividends;

aspects of the Company’s corporate structure that may discourage

third-party takeovers or other transactions; the cyclical nature of

the reinsurance and insurance industries; adverse legislative

developments that reduce the size of the private markets the

Company serves or impede their future growth; consolidation of

competitors, customers and insurance and reinsurance brokers; the

effect on the Company’s business of the highly competitive nature

of its industry, including the effect of new entrants to, competing

products for and consolidation in the (re)insurance industry; other

political, regulatory or industry initiatives adversely impacting

the Company; the Company’s ability to comply with applicable

sanctions and foreign corrupt practices laws; increasing barriers

to free trade and the free flow of capital; international

restrictions on the writing of reinsurance by foreign companies and

government intervention in the natural catastrophe market; the

effect of Organisation for Economic Co-operation and Development or

European Union (“EU”) measures to increase the Company’s taxes and

reporting requirements; the effect of the vote by the U.K. to leave

the EU; changes in regulatory regimes and accounting rules that may

impact financial results irrespective of business operations; the

Company’s need to make many estimates and judgments in the

preparation of its financial statements; and other factors

affecting future results disclosed in RenaissanceRe’s filings with

the Securities and Exchange Commission, including its Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q.

RenaissanceRe Holdings Ltd. Summary Consolidated

Statements of Operations (in thousands of United States

Dollars, except per share amounts and percentages) (Unaudited)

Three months ended March 31, 2019

March 31, 2018 Revenues Gross premiums

written $ 1,564,295 $ 1,159,652 Net premiums written

$ 929,031 $ 663,044 Increase in unearned premiums (379,003 )

(222,762 ) Net premiums earned 550,028 440,282 Net investment

income 81,462 56,476 Net foreign exchange (losses) gains (2,846 )

3,757 Equity in earnings of other ventures 4,661 857 Other income

(loss) 3,171 (1,242 ) Net realized and unrealized gains (losses) on

investments 170,645 (82,144 )

Total revenues 807,121

417,986

Expenses Net claims and claim expenses

incurred 227,035 171,703 Acquisition expenses 123,951 97,711

Operational expenses 44,933 41,272 Corporate expenses 38,789 6,733

Interest expense 11,754 11,767

Total expenses

446,462 329,186 Income before taxes 360,659 88,800

Income tax (expense) benefit (7,531 ) 3,407

Net

income 353,128 92,207 Net income attributable to noncontrolling

interests (70,222 ) (29,899 )

Net income attributable to

RenaissanceRe 282,906 62,308 Dividends on preference shares

(9,189 ) (5,595 )

Net income available to RenaissanceRe common

shareholders $ 273,717 $ 56,713 Net income

available to RenaissanceRe common shareholders per common share -

basic $ 6.43 $ 1.42 Net income available to RenaissanceRe common

shareholders per common share - diluted $ 6.43 $ 1.42 Operating

income available to RenaissanceRe common shareholders per common

share - diluted (1) $ 3.60 $ 3.07 Average shares outstanding

- basic 42,065 39,552 Average shares outstanding - diluted 42,091

39,599 Net claims and claim expense ratio 41.3 % 39.0 %

Underwriting expense ratio 30.7 % 31.6 % Combined ratio 72.0 % 70.6

% Return on average common equity - annualized 23.5 % 5.7 %

Operating return on average common equity - annualized (1) 13.3 %

12.2 % (1) See Comments on Regulation G for a reconciliation

of non-GAAP financial measures.

RenaissanceRe

Holdings Ltd. Summary Consolidated Balance Sheets (in

thousands of United States Dollars, except per share amounts)

March 31, 2019 December 31,

2018 Assets (Unaudited) (Audited) Fixed maturity

investments trading, at fair value $ 9,473,160 $ 8,088,870 Short

term investments, at fair value 4,012,815 2,586,520 Equity

investments trading, at fair value 389,937 310,252 Other

investments, at fair value 878,373 784,933 Investments in other

ventures, under equity method 98,563 115,172 Total

investments 14,852,848 11,885,747 Cash and cash equivalents

1,021,275 1,107,922 Premiums receivable 2,753,098 1,537,188 Prepaid

reinsurance premiums 1,086,027 616,185 Reinsurance recoverable

2,908,343 2,372,221 Accrued investment income 64,615 51,311

Deferred acquisition costs and value of business acquired 841,528

476,661 Receivable for investments sold 411,172 256,416 Other

assets 353,543 135,127 Goodwill and other intangibles 267,151

237,418

Total assets $ 24,559,600 $

18,676,196

Liabilities, Noncontrolling Interests and

Shareholders’ Equity Liabilities Reserve for claims and

claim expenses $ 8,391,484 $ 6,076,271 Unearned premiums 3,188,678

1,716,021 Debt 1,191,499 991,127 Reinsurance balances payable

3,009,492 1,902,056 Payable for investments purchased 679,596

380,332 Other liabilities 435,418 513,609

Total

liabilities 16,896,167 11,579,416 Redeemable

noncontrolling interest 2,109,400 2,051,700

Shareholders’

Equity Preference shares 650,000 650,000 Common shares 44,159

42,207 Additional paid-in capital 543,889 296,099 Accumulated other

comprehensive loss (1,470 ) (1,433 ) Retained earnings 4,317,455

4,058,207

Total shareholders’ equity attributable

to RenaissanceRe 5,554,033 5,045,080

Total

liabilities, noncontrolling interests and shareholders’ equity

$ 24,559,600 $ 18,676,196

Book value per

common share $ 111.05 $ 104.13

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Segment Information (in thousands of United States Dollars,

except percentages) (Unaudited)

Three months ended March

31, 2019 Property

Casualty and Specialty

Other Total Gross premiums written $

1,032,384 $ 531,911 $ — $ 1,564,295 Net

premiums written $ 564,230 $ 364,801 $ — $

929,031 Net premiums earned $ 290,745 $ 259,283 $ — $

550,028 Net claims and claim expenses incurred 56,083 170,933 19

227,035 Acquisition expenses 53,739 70,212 — 123,951 Operational

expenses 28,544 16,389 — 44,933

Underwriting income (loss) $ 152,379 $ 1,749 $ (19 )

154,109 Net investment income 81,462 81,462 Net foreign exchange

losses (2,846 ) (2,846 ) Equity in earnings of other ventures 4,661

4,661 Other income 3,171 3,171 Net realized and unrealized gains on

investments 170,645 170,645 Corporate expenses (38,789 ) (38,789 )

Interest expense (11,754 ) (11,754 ) Income before taxes and

redeemable noncontrolling interests 360,659 Income tax expense

(7,531 ) (7,531 ) Net income attributable to redeemable

noncontrolling interests (70,222 ) (70,222 ) Dividends on

preference shares (9,189 ) (9,189 ) Net income available to

RenaissanceRe common shareholders $ 273,717 Net

claims and claim expenses incurred – current accident year $ 54,206

$ 177,135 $ — $ 231,341 Net claims and claim expenses incurred –

prior accident years 1,877 (6,202 ) 19 (4,306 ) Net

claims and claim expenses incurred – total $ 56,083 $

170,933 $ 19 $ 227,035 Net claims and

claim expense ratio – current accident year 18.6 % 68.3 % 42.1 %

Net claims and claim expense ratio – prior accident years 0.7 %

(2.4 )% (0.8 )% Net claims and claim expense ratio – calendar year

19.3 % 65.9 % 41.3 % Underwriting expense ratio 28.3 % 33.4 % 30.7

% Combined ratio 47.6 % 99.3 % 72.0 %

Three months ended

March 31, 2018 Property

Casualty and Specialty

Other Total Gross premiums written $ 706,968 $

452,684 $ — $ 1,159,652 Net premiums written $

354,077 $ 308,967 $ — $ 663,044 Net

premiums earned $ 225,049 $ 215,233 $ — $ 440,282 Net claims and

claim expenses incurred 30,607 141,078 18 171,703 Acquisition

expenses 40,721 56,990 — 97,711 Operational expenses 26,546

14,593 133 41,272 Underwriting income (loss) $

127,175 $ 2,572 $ (151 ) 129,596 Net investment

income 56,476 56,476 Net foreign exchange gains 3,757 3,757 Equity

in earnings of other ventures 857 857 Other loss (1,242 ) (1,242 )

Net realized and unrealized losses on investments (82,144 ) (82,144

) Corporate expenses (6,733 ) (6,733 ) Interest expense (11,767 )

(11,767 ) Income before taxes and redeemable noncontrolling

interests 88,800 Income tax benefit 3,407 3,407 Net income

attributable to redeemable noncontrolling interests (29,899 )

(29,899 ) Dividends on preference shares (5,595 ) (5,595 ) Net

income available to RenaissanceRe common shareholders $ 56,713

Net claims and claim expenses incurred – current

accident year $ 58,169 $ 144,869 $ — $ 203,038 Net claims and claim

expenses incurred – prior accident years (27,562 ) (3,791 ) 18

(31,335 ) Net claims and claim expenses incurred – total $

30,607 $ 141,078 $ 18 $ 171,703

Net claims and claim expense ratio – current accident year 25.8 %

67.3 % 46.1 % Net claims and claim expense ratio – prior accident

years (12.2 )% (1.8 )% (7.1 )% Net claims and claim expense ratio –

calendar year 13.6 % 65.5 % 39.0 % Underwriting expense ratio 29.9

% 33.3 % 31.6 % Combined ratio 43.5 % 98.8 % 70.6 %

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Gross Premiums Written (in thousands of United States Dollars)

(Unaudited)

Three months ended March

31, 2019 March 31, 2018

Property

Segment

Catastrophe $ 845,213 $ 590,337 Other property 187,171

116,631 Property segment gross premiums written $ 1,032,384

$ 706,968

Casualty and

Specialty Segment

General casualty (1) $ 153,334 $ 126,626 Professional liability (2)

149,377 157,113 Financial lines (3) 127,356 93,267 Other (4)

101,844 75,678 Casualty and Specialty segment gross premiums

written $ 531,911 $ 452,684 (1) Includes automobile

liability, casualty clash, employer’s liability, umbrella or excess

casualty, workers’ compensation and general liability (2) Includes

directors and officers, medical malpractice, and professional

indemnity. (3) Includes financial guaranty, mortgage guaranty,

political risk, surety and trade credit. (4) Includes accident and

health, agriculture, aviation, cyber, energy, marine, satellite and

terrorism. Lines of business such as regional multi-line and whole

account may have characteristics of various other classes of

business, and are allocated accordingly.

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Total Investment Result (in thousands of United States Dollars,

except percentages) (Unaudited)

Three months

ended March 31, 2019 March 31, 2018

Fixed maturity investments $ 61,483 $ 45,643 Short term investments

11,844 5,304 Equity investments trading 1,027 698 Other investments

Private equity investments 2,454 (434 ) Other 7,245 8,023 Cash and

cash equivalents 1,517 565 85,570 59,799 Investment

expenses (4,108 ) (3,323 )

Net investment income 81,462

56,476 Gross realized gains 24,373 4,583 Gross

realized losses (22,943 ) (25,853 ) Net realized gains (losses) on

fixed maturity investments 1,430 (21,270 ) Net unrealized gains

(losses) on fixed maturity investments trading 103,922 (55,372 )

Net realized and unrealized gains (losses) on investments-related

derivatives 13,796 (4,364 ) Net realized (losses) gains on equity

investments trading (1,161 ) 234 Net unrealized gains (losses) on

equity investments trading 52,658 (1,372 )

Net realized

and unrealized gains (losses) on investments 170,645

(82,144 )

Total investment result $ 252,107 $ (25,668

)

Total investment return - annualized (1) 8.0 % (1.0

)% (1) Total investment return for the three months ended

March 31, 2019 does not include the investment results related to

the invested assets of the TMR Group Entities, which were acquired

on March 22, 2019.

Comments on Regulation G

In addition to the GAAP financial measures set forth in this

Press Release, the Company has included certain non-GAAP financial

measures within the meaning of Regulation G. The Company has

provided these financial measures in previous investor

communications and the Company’s management believes that these

measures are important to investors and other interested persons,

and that investors and such other persons benefit from having a

consistent basis for comparison between quarters and for comparison

with other companies within the industry. These measures may not,

however, be comparable to similarly titled measures used by

companies outside of the insurance industry. Investors are

cautioned not to place undue reliance on these non-GAAP measures in

assessing the Company’s overall financial performance.

The Company uses “operating income available to RenaissanceRe

common shareholders” as a measure to evaluate the underlying

fundamentals of its operations and believes it to be a useful

measure of its corporate performance. “Operating income

available to RenaissanceRe common shareholders” as used herein

differs from “net income (loss) available (attributable) to

RenaissanceRe common shareholders,” which the Company believes is

the most directly comparable GAAP measure, by the exclusion of net

realized and unrealized gains and losses on investments

attributable to RenaissanceRe common shareholders, transaction and

integration expenses associated with the acquisition of Tokio

Millennium Re and the income tax expense or benefit associated with

net realized and unrealized gains and losses on investments

attributable to RenaissanceRe common shareholders. The Company’s

management believes that “operating income available to

RenaissanceRe common shareholders” is useful to investors because

it more accurately measures and predicts the Company’s results of

operations by removing the variability arising from: fluctuations

in the Company’s fixed maturity investment portfolio, equity

investments trading and investments-related derivatives and the

associated income tax expense or benefit of those fluctuations; and

certain transaction and integration expenses associated with the

acquisition of Tokio Millennium Re. The Company also uses

“operating income available to RenaissanceRe common shareholders”

to calculate “operating income available to RenaissanceRe common

shareholders per common share - diluted” and “operating return on

average common equity - annualized”. The following is a

reconciliation of: 1) net income (loss) available

(attributable) to RenaissanceRe common shareholders to operating

income available to RenaissanceRe common shareholders; 2) net

income (loss) available (attributable) to RenaissanceRe common

shareholders per common share - diluted to operating income

available to RenaissanceRe common shareholders per common share -

diluted; and 3) return on average common equity - annualized to

operating return on average common equity - annualized:

Three months ended (in thousands of United States

Dollars, except per share amounts and percentages)

March 31,

2019 March 31, 2018 Net income

available to RenaissanceRe common shareholders $ 273,717 $ 56,713

Adjustment for net realized and unrealized (gains) losses on

investments attributable to RenaissanceRe common shareholders (1)

(153,164 ) 69,028 Adjustment for transaction and integration

expenses associated with the acquisition of Tokio Millennium Re (2)

25,520 — Adjustment for income tax expense (benefit) (3) 8,287

(3,648 ) Operating income available to RenaissanceRe common

shareholders $ 154,360 $ 122,093 Net income

available to RenaissanceRe common shareholders per common share -

diluted $ 6.43 $ 1.42 Adjustment for net realized and unrealized

(gains) losses on investments attributable to RenaissanceRe common

shareholders (1) (3.64 ) 1.74 Adjustment for transaction and

integration expenses associated with the acquisition of Tokio

Millennium Re (2) 0.61 — Adjustment for income tax expense

(benefit) (3) 0.20 (0.09 ) Operating income available to

RenaissanceRe common shareholders per common share - diluted $ 3.60

$ 3.07 Return on average common equity -

annualized 23.5 % 5.7 % Adjustment for net realized and unrealized

(gains) losses on investments attributable to RenaissanceRe common

shareholders (1) (13.2 )% 6.9 % Adjustment for transaction and

integration expenses associated with the acquisition of Tokio

Millennium Re (2) 2.2 % — % Adjustment for income tax expense

(benefit) (3) 0.8 % (0.4 )% Operating return on average common

equity - annualized 13.3 % 12.2 % (1) Adjustment for net

realized and unrealized (gains) losses on investments attributable

to RenaissanceRe common shareholders represents: net realized and

unrealized gains (losses) on investments as set forth in the

Company's consolidated statement of operations less net realized

and unrealized gains (losses) attributable to redeemable

noncontrolling interests, which is included in net income

attributable to redeemable noncontrolling interests in the

Company's consolidated statement of operations. Comparative

information for all prior periods has been updated to conform to

the current methodology and presentation. (2)

Adjustment for transaction and integration

expenses associated with the acquisition of Tokio Millennium Re for

the three months ended March 31, 2019 represents $25.5 million of

corporate expenses associated with the acquisition, comprised of

$12.9 million of transaction-related costs, $5.9 million of

integration-related costs, and $6.7 million of compensation-related

costs. Comparative information for all prior periods has been

updated to conform to the current methodology and presentation.

(3) Adjustment for income tax expense (benefit) represents the

income tax expense (benefit) associated with the adjustment for net

realized and unrealized (gains) losses on investments attributable

to RenaissanceRe common shareholders. The income tax impact is

estimated by applying the statutory rates of applicable

jurisdictions, after consideration of other relevant factors.

The Company has included in this Press Release “tangible book

value per common share” and “tangible book value per common share

plus accumulated dividends”. “Tangible book value per common share”

is defined as book value per common share excluding goodwill and

intangible assets per share. “Tangible book value per common share

plus accumulated dividends” is defined as book value per common

share excluding goodwill and intangible assets per share, plus

accumulated dividends. The Company’s management believes “tangible

book value per common share” and “tangible book value per common

share plus accumulated dividends” are useful to investors because

they provide a more accurate measure of the realizable value of

shareholder returns, excluding the impact of goodwill and

intangible assets. The following is a reconciliation of book value

per common share to tangible book value per common share and

tangible book value per common share plus accumulated

dividends:

At March 31, 2019 December

31, 2018 September 30, 2018

June 30, 2018 March 31, 2018

Book value per common share $ 111.05 $ 104.13 $ 105.21 $ 104.56 $

100.29 Adjustment for goodwill and other intangibles (1) (2) (6.66

) (6.28 ) (6.63 ) (6.69 ) (6.66 ) Tangible book value per common

share 104.39 97.85 98.58 97.87 93.63 Adjustment for accumulated

dividends 19.66 19.32 18.99 18.66 18.33

Tangible book value per common share plus accumulated

dividends $ 124.05 $ 117.17 $ 117.57 $ 116.53

$ 111.96 Quarterly change in book value per

common share 6.6 % (1.0 )% 0.6 % 4.3 % 0.6 % Quarterly change in

tangible book value per common share plus change in accumulated

dividends 7.0 % (0.4 )% 1.1 % 4.9 % 0.8 % Year to date change in

book value per common share 6.6 % 4.4 % 5.5 % 4.9 % 0.6 % Year to

date change in tangible book value per common share plus change in

accumulated dividends 7.0 % 6.4 % 6.8 % 5.7 % 0.8 % (1) At

March 31, 2019, December 31, 2018, September 30, 2018, June 30,

2018 and March 31, 2018, goodwill and other intangibles included

$27.0 million, $27.7 million, $28.4 million, $29.1 million and

$26.3 million, respectively, of goodwill and other intangibles

included in investments in other ventures, under equity method. (2)

At March 31, 2019, goodwill and other intangibles included $18.0

million of identifiable intangible assets and $13.1 million of

goodwill, respectively, recognized by the Company in connection

with the acquisition of the TMR Group Entities on March 22, 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190507006081/en/

INVESTOR CONTACT:Keith McCueSenior Vice President,

Finance & Investor RelationsRenaissanceRe Holdings Ltd.(441)

239-4830MEDIA CONTACT:Keil GuntherVice President, Marketing

& CommunicationsRenaissanceRe Holdings Ltd.(441)

239-4932orKekst CNCDawn Dover(212) 521-4800

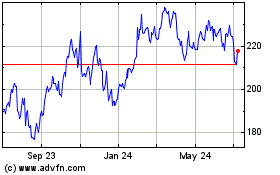

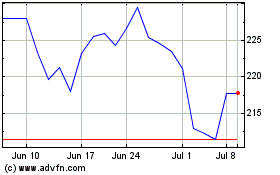

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Apr 2023 to Apr 2024