UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the

Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for

Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional

Materials

|

|

|

x

|

Soliciting Material Pursuant

to §240.14a-12

|

BIOSCRIP,

INC.

(Name of the Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table

below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

¨

Fee

paid previously with preliminary materials.

¨

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

LENDER PRESENTATION MAY 7, 2019

DISCLAIMER 2 This communication, in addition to historical information, contains “forward - looking statements” (as defined in the Private Securities Litigation Reform Act of 1995 ) regarding, among other things, future events or the future financial performance of BioScrip and Option Care . All statements other than statements of historical facts are forward - looking statements . In addition, words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward - looking statements . Forward - looking statements relating to the proposed transaction include, but are not limited to : statements about the benefits of the proposed transaction between BioScrip and Option Care, including future financial and operating results ; expected synergies ; BioScrip’s and Option Care’s plans, objectives, expectations and intentions ; the expected timing of completion of the proposed transaction ; and other statements relating to the acquisition that are not historical facts . Forward - looking statements are based on information currently available to BioScrip and Option Care and involve estimates, expectations and projections . Investors are cautioned that all such forward - looking statements are subject to significant risks and uncertainties (both known and unknown ), many of which are beyond BioScrip’s and Option Care’s control, and many factors could cause actual events or results to differ materially from those indicated by such forward - looking statements . With respect to the proposed transaction between BioScrip and Option Care, these factors could include, but are not limited to : the risk that BioScrip or Option Care may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction ; the risk that a condition to closing of the transaction may not be satisfied ; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons ; the risk that the businesses will not be integrated successfully ; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected ; the diversion of management time on transaction - related issues ; the effect of future regulatory or legislative actions on the companies or the industries in which they operate ; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect ; economic and foreign exchange rate volatility ; and the other risks contained in BioScrip’s most recently filed Annual Report on Form 10 - K . Many of these risks, uncertainties and assumptions are beyond BioScrip’s ability to control or predict . Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward - looking statements . Furthermore, forward - looking statements speak only as of the information currently available to the parties on the date they are made, and neither BioScrip nor Option Care undertakes any obligation to update publicly or revise any forward - looking statements to reflect events or circumstances that may arise after the date of this communication . Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per BioScrip share for the current or any future financial years or those of the combined company, will necessarily match or exceed the historical published earnings per BioScrip share, as applicable . Neither BioScrip nor Option Care gives any assurance ( 1 ) that either BioScrip or Option Care will achieve its expectations, or ( 2 ) concerning any result or the timing thereof, in each case, with respect to any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decrees, cost reductions, business strategies, earnings or revenue trends or future financial results . All subsequent written and oral forward - looking statements concerning BioScrip, Option Care, the proposed transaction, the combined company or other matters and attributable to BioScrip or Option Care or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above . Option Care and BioScrip and their respective subsidiaries do not make any representation or warranty, either express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation . This presentation is based on information provided by BioScrip and Option Care . information is being furnished on a confidential basis solely for the use of the recipient in making its own evaluation of BioScrip and Option Care and their respective businesses, assets and financial condition and prospects . The information does not purport to contain all of the information that may be required or desired by a recipient to evaluate BioScrip and Option Care . In all cases, interested parties should conduct their own independent investigation and analysis of BioScrip and OptionCare and their respective businesses, assets, financial condition and prospects . By accepting this information, the recipient agrees (in addition to any obligations it may have under any confidentiality agreement) that neither it nor its agents, representatives, directors, officers, affiliates or employees will copy, reproduce or distribute to other the information contained herein, in whole or in part, at any time without prior written consent of the BioScrip and Option Care and that it will keep permanently confidential all information contained herein not already in the public domain . Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future . OptionCare and BioSCrip expressly disclaim any and all liability relating to or resulting from this presentation . ADDITIONAL INFORMATION AND WHERE TO FIND IT On April 30 , 2019 , BioScrip, Inc . (“BioScrip” or the “Company”) filed with the Securities and Exchange Commission (“SEC”) a preliminary proxy statement in connection with the proposed transaction . The definitive proxy statement will be sent to the stockholders of BioScrip and will contain important information about the proposed transaction and related matters . INVESTORS AND SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE PRELIMINARY PROXY STATEMENT AND THE DEFINITIVE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION . The proxy statement and other relevant materials (when they become available) and any other documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at www . sec . gov . In addition, security holders will be able to obtain free copies of the proxy statement and other relevant materials from the Company by contacting Investor Relations by mail at 1600 Broadway, Suite 700 , Denver, CO 80202 , Attn : Investor Relations, by telephone at ( 720 ) 697 - 5200 , or by going to the Company’s Investor Relations page on its corporate web site at https : //investors . bioscrip . com . PARTICIPANTS IN THE SOLICITATION The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the matters discussed above . Information about the Company’s directors and executive officers is set forth in the Proxy Statement on Schedule 14 A for the Company’s 2019 annual meeting of stockholders, which was filed with the SEC on April 30 , 2019 . This document can be obtained free of charge from the sources indicated above . Information regarding the ownership of the Company’s directors and executive officers in the Company’s securities is included in the Company’s SEC filings on Forms 3 , 4 , and 5 , which can be found through the SEC’s website at www . sec . gov . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the preliminary proxy statement and will be contained in the definitive proxy statement and other relevant materials to be filed with the SEC when they become available .

PRESENTERS John Rademacher Chief Executive Officer Mike Shapiro Chief Financial Officer • Nearly two decades of experience in the healthcare industry, successfully deploying technology solutions and expanding professional services capabilities • Joined Option Care in 2015 as COO and was appointed CEO in 2018 • Previous executive experience at leading healthcare companies, including President and General Manager at Cardinal Health Ambulatory Care and Nuclear and Pharmacy Services divisions, President at CareAllies and COO of the CIGNA Behavioral Health business • Joined Option Care in 2015 as CFO • Served as SVP and CFO of Catamaran Corporation and as CFO of Rexnord Corporation. Mr. Shapiro also spent fifteen years with Baxter International, holding multiple positions of increasing responsibility • Managing Director • Option Care board member since 2015 Elizabeth Betten Madison Dearborn Partners 3 Mike Dolce Madison Dearborn Partners • Managing Director, Head of Capital Markets

AGENDA 4 Section I. Transaction Overview II. Combination Overview III. Key Investment Highlights IV. Financial Summary V. Syndication Overview Appendix I. Supplementary Information

I. TRANSACTION OVERVIEW

EXECUTIVE SUMMARY On March 14 th , Option Care, Inc. (“Option Care”) entered into a definitive merger agreement with BioScrip, Inc. (“BioScrip”) (NasdaqGS:BIOS) creating a leading independent provider of home and alternate site infusion therapy services – Transformational combination of two best - in - breed platforms with highly complementary therapy portfolios and footprints – Option Care reported TTM 3/31/2019 net revenue of $1,959 million and Adjusted EBITDA of $98 million. BioScrip reported TTM 3/31/2019 net revenue of $719 million and Adjusted EBITDA of $47 million Under the terms of the merger agreement, BioScrip will issue new shares to Option Care in an all - stock transaction whereby Optio n Care shareholders will own approximately 80% of the combined publicly traded company on a fully diluted basis, and current Bi oSc rip shareholders will own the remaining 20% The combined company will be led by Option Care CEO John Rademacher and Option Care CFO Mike Shapiro with headquarters in Bannockburn, IL and will draw on the best talent from both organizations The Board of the Company will be comprised of 8 members from Option Care’s Board and 2 members from BioScrip’s Board All existing Option Care and BioScrip debt and preferred equity will be refinanced and the pro forma capital structure is exp ect ed to be structured as follows: – $150 million, 5 - year ABL Revolving Credit Facility (“ABL Revolver”) expected to be unfunded at close – $925 million, 7 - year First Lien Term Loan (“Term Loan B”) – $400 million, 8 - year Senior Secured Notes (“Secured Notes”), privately placed Pro forma for the transaction, First Lien Leverage and Total Leverage will be 4.3x and 6.2x , respectively, based on TTM 3/31/2019 Pro Forma Adjusted EBITDA of $214 million – Pro Forma Implied Total Enterprise Value of ~$2.6 bn, or ~12.3x TEV / PF Adj. EBITDA (1) The transaction is subject to customary closing conditions and shareholder approval, and is expected to close in the third qu art er of 2019 (2) – On April 8, 2019, early termination of HSR was granted for the proposed transaction – On April 30, 2019, the preliminary Option Care merger proxy statement was filed with the SEC 6 (1) TEV calculated using trading value, calculated by multiplying the ~680 million pro forma diluted shares outstanding as of merger close by BioScrip’s share price as of May 3, 2019, pro forma total debt of $1,325 million, and pro forma cash of $35 million (2) Timing could be delayed depending on the time required to clear SEC Review

SIGNIFICANT PROGRESS ON INVESTMENT THESIS HAS LAID FOUNDATION FOR COMBINATION 7 • Since spin - off from Walgreens in 2015, Option Care has recruited an experienced leadership team • 7 of the 10 top management team members recruited under MDP ownership including CEO and CFO • In the past three years, Option Care generated ~$150mm in operating cash flow • Aggressively reinvested in corporate infrastructure, quality and clinical excellence, and industry - leading information technology • ~$90 million has been invested in IT and facilities • Conversion to hub and spoke model to optimize regional infrastructure by centralizing fulfilment through regional compounding centers • Consolidated revenue cycle footprint to create larger teams with enhanced leadership • Completed 18 - month deployment of new technology platform in 2018 • All pharmacies and revenue cycle centers on a single technology platform to drive efficiencies in customer management, referral processing, and billing automation • Well - positioned to leverage investment in corporate infrastructure and drive advantages of scale • Leadership team has deep experience with each synergy category having continuously optimized cost structure, pharmacy footprint, and procurement capabilities • High confidence synergy targets with meaningful upside and multiple levers of value creation Operational Efficiencies Technology Transformation Ability to Drive Value from Combination Leadership Team Option Care Is Well Positioned To Create Meaningful Value from Combination Free Cash Flow Reinvestment

II. OPTION CARE + BIOSCRIP COMBINATION OVERVIEW

OPTION CARE + BIOSCRIP: THE LEADING HOME INFUSION COMPANY • Creates the #1 provider of home and alternate site infusion therapy services (1) • 96% of U.S. population covered by 600+ frontline selling resources in 46 states • Powerful value creation potential, with cost synergies alone exceeding $60 million annualized • Merger of two best - in - breed platforms with complementary therapy offerings and footprints • The only pure - play, independent, publicly - traded home infusion company in an estimated ~$12 billion home infusion market growing 5 - 7% per year • The total infusion market is estimated at ~$100 billion , and the combined company will continue to lead the shift in site of care from higher cost institutional settings such as hospitals, to the lower - cost home setting , with high quality patient outcomes • Strong historical growth profile at both Option Care and BioScrip, with pro forma combined FY 2016 - 2018 Net Revenue and Adjusted EBITDA CAGR of 7.0 % (2 ) and 23.6% (2) , respectively Value Creation Pure - Play Track Record of Growth Leadership Large Market with Significant Runway for Opportunity 9 (1) Market share in terms of revenue based on management estimates (2) Pro forma for the impact of 21st Century Cures Act reimbursement reductions which became effective Jan. 1, 2017 and BioScrip’ s U nitedHealthcare exit and other exited products

OPTION CARE + BIOSCRIP: COMBINATION AT A GLANCE Headquar te r s: Bannockburn , Illinois Headquar te r s: Denver , Colorado Significant Scale TTM 3/31 Metrics Expansive and Complementary Footprints Therapeutic Solutions • 52 full service pharmacies • 66 ambulatory infusion suites • Locations in 27 states • 76 full service pharmacies • 90 ambulatory infusion suites • Locations in 42 states • Anti - infectives • Nutrition support • Revenue: $719mm • Adj. EBITDA: $47mm • Employees: ~2,100 • Clinicians: ~1,100 (1) • 81% commercial payors (2) • 2016 - 2018 Revenue CAGR: ~3% (4) • Revenue: $1,959mm • Adj. EBITDA: $98mm • Employees: ~4,500 • Clinicians: ~1,800 • 88% commercial payors (2) • 2016 - 2018 Revenue CAGR: ~9% (3) • Autoimmune • Bleeding disorders • Immunoglobin • Heart failure 10 (1) Includes pharmacy technicians (2) Commercial includes Medicare Advantage, Managed Medicaid, and self - pay patients (3) Pro forma for the impact of 21st Century Cures Act reimbursement reductions which became effective Jan. 1, 2017 (4) Pro forma for the impact of 21st Century Cures Act reimbursement reductions which became effective Jan. 1, 2017 and BioScrip’ s U nitedHealthcare exit and other exited products

OPTION CARE + BIOSCRIP: #1 POSITION IN A LARGE AND GROWING MARKET 11 $100 B $12 B $ 2.7 B Option Care / BioScrip Largest independent provider and only publicly - traded “pure play” U.S. Home Infusion Market Lowest - cost setting; growing penetration of overall market U.S. Infusion Market Incudes: hospitals, physician outpatient offices, SNFs and home infusion The U.S. Home Infusion Market is Growing by an Estimated 5 - 7% Per Year

U.S. INFUSION MARKET OVERVIEW 12 1% 6% 10% 17% 21% 45% U.S. Infusion Market (1) U.S. Competitive Landscape – Home (1) 12% 20% 28% 40% $100B Hospital Physician Office Outpatient Skilled Nursing Facility Home / $12B Top 5 providers account for approximately half of the U.S. market Highly fragmented market Significant consolidation opportunity with 800+ infusion companies in the U.S. / (1) Based on management estimates

III. KEY INVESTMENT HIGHLIGHTS

Leading Home Infusion Platform with National Reach and Scale Largest Independent Home Infusion Provider Creating Value Across the Healthcare Ecosystem Right Side of Healthcare – Low Cost Care Setting and Patient Centric Diversified Portfolio of Therapies with Attractive Pipeline of Growth Opportunities Payor Diversity and Low Pen - Stroke Risk Sizable and Actionable Expected Synergies Seasoned Management Team and Board of Directors OPTION CARE + BIOSCRIP: KEY INVESTMENT HIGHLIGHTS 1 2 3 4 5 6 14 7

Option Care locations OPTION CARE + BIOSCRIP: NATIONAL REACH AND COMPREHENSIVE SOLUTIONS $ 2.7bn combined TTM 3/31/19 revenue 46 states 96% of U.S. population covered 2,900+ skilled clinicians (1) Top 10 payors all in network BioScrip locations 600+ frontline selling resources 15 National Reach Makes the Combined Company a Logical Partner to Payors (1) Includes pharmacy technicians 1

OPTION CARE + BIOSCRIP: THE ONLY SCALED AND NATIONAL INDEPENDENT PROVIDER Logical preferred partner for non - vertically integrated payors Productive, in - network relationships with Aetna and UnitedHealthcare — Compelling network choice given unparalleled service area (96% of U.S. population) and exclusive access to select Limited Distribution Drugs (“LDDs”) Nimble and focused with 100% dedication to the home infusion market Captive Independent Captive Payors Leading Home Infusion Providers 10% 17% 21% / Market Share (1) 2 16 Value of Independence: (1) Market share in terms of revenue based on management estimates

OPTION CARE + BIOSCRIP: ON THE RIGHT SIDE OF HEALTHCARE TRENDS 3 17 …to the Home • Lowest cost site of care • Safest site of care; lower risk of infection • Patient preference, empowerment, quality of life • Healthcare reform moving from fee - for - service to fee - for - outcomes • The home is becoming the general ward • Democratization of healthcare (physical, mental and financial health of the patient) Care is moving from the Hospital … • Waste in healthcare system in large part driven by hospitals • Up to 1/3 of total healthcare spend is waste (est. $1 trillion) • Higher costs and worse outcomes , including death ( 440k preventable deaths each year in the hospital) • 50% of hospitals are not financially sound The right place , the right team , and the right time. The Home is the Disruptive Service Model within the Infusion Market

Acute ~ 40% Chronic ~ 60% OPTION CARE + BIOSCRIP: COMPLEMENTARY, SYNERGISTIC PORTFOLIOS 4 18 • Balanced Across Acute and Chronic Therapies ‒ Acute: key therapies include anti - infectives, total parental nutrition and enteral nutrition ‒ Chronic: key therapies include immunoglobulin, factor, and Remicade • Limited Distribution Drugs (“LDDs”) ‒ Pharma manufacturer partnerships for limited distribution of innovative therapies; robust large molecule pipeline ‒ High dollar revenue and EBITDA therapies • Longer duration therapy given predominantly chronic conditions • Lower gross profit margins but higher gross profit dollars per patient • Lower operating expenses to service patient ‒ Helps with referrals, network access and can be levered across BioScrip’s platform ‒ LDDs aligned with medical specialists strategy; exclusive therapies provide differentiated talking points for account managers No Single Therapy Category Accounts for >20% of Pro Forma Revenue

0 5 10 15 20 2019 2020 2021 OPTION CARE + BIOSCRIP: PIPELINE FOR LDD OPPORTUNITIES CONTINUES TO EXPAND 4 19 Increasing complexity of pharmaceuticals is leading to an increase in the number of drugs that require healthcare professional oversight Combined company will possess specialized capabilities enabling it to handle LDDs at scale — Over the last 2 years, Option Care has launched 4 meaningful LDDs Aligned with the trends in drug development including shift towards large molecule drugs and personalized medicine Estimated Pipeline of Home Infusion Drugs Coming to Market Products Anticipated to Launch in Remaining 2019 Products Anticipated to Launch in 2020 Products Anticipated to Launch in 2021

OPTION CARE + BIOSCRIP: PAYOR DIVERSITY AND LOW PEN - STROKE RISK 5 20 14% 86% Pro Forma Revenue By Payor Type (1) Commercial (1) Government No Single Payor Relationship Accounts for >15% of Pro Forma Sales (1) Commercial includes Medicare Advantage, Managed Medicaid, and self - pay patients

OPTION CARE + BIOSCRIP: SIGNIFICANT SYNERGY OPPORTUNITY Identifiable and achievable cost synergies with meaningful additional upside 6 21 Streamline corporate and administrative functions including labor and non - labor costs SG&A $35 - 40mm (gross) Optimize assets where applicable to best serve the market Includes associated costs Network Optimization $20 - 25mm (gross) Purchasing at the “best of” price where overlap exists Purchasing done independently of WBA today Procurement $10 - 15mm (gross) Breakdown of Synergies: (1) Net of negative synergies related to, among other items, harmonizing compensation, employer 401(k) match expense, accounting policies and IT resources and investments Total Net $60mm+ (1) Represents high - confidence level synergies estimate before cost to implement Synergies expected within 24 months post - closing

OPTION CARE + BIOSCRIP: POTENTIAL ADDITIONAL VALUE CREATION 6 22 • Revenue opportunities excluded from $60mm cost synergies estimate • Potential upside through: ‒ 600 member sales force with optimized coverage by location; ‒ Cross - selling solution sets, such as Option Care’s broader portfolio sold through BioScrip accounts; ‒ Optimization of payor relations and contracting ; ‒ Support payor redirection efforts with a larger ambulatory infusion suite network ; and ‒ Improve revenue cycle performance through strengthened processes

OPTION CARE + BIOSCRIP: INVESTING FOR INTEGRATION SUCCESS 23 Pre - Signing Sign to Close Post - Close Deep due diligence and granular quantification of savings • Engaged multiple experienced third party advisors to conduct a series of clean room - based analyses • Quantified savings through bottoms - up review of org structure, geospatial analysis of network, and NDC - level drug spend and volume data Integration planning is underway • Partnered with experienced consulting firm with deep merger integration experience • Standing up Integration Management Office (IMO) and have hired IMO Lead • IMO governance includes reps from both companies to lead workstreams across: – Refine baseline & targets – Day 1 priorities – Culture integration – Organization design – Operating process alignment – Communications plan Positioned to launch coordinated, efficient execution • Implement restructuring measures and track progress • Ongoing enablement and support from consulting firm • Functional workstreams across Finance & Accounting, HR, IT, Licensing, Commercial, Revenue Cycle, Communications, etc. Own & Execute Targets High - Confidence Targets 6

OPTION CARE + BIOSCRIP: PROVEN, EXPERIENCED LEADERSHIP John Rademacher Chief Executive Officer Mike Shapiro Chief Financial Officer • Nearly two decades of experience in the healthcare industry, successfully deploying technology solutions and expanding professional services capabilities • Joined Option Care in 2015 as COO and was appointed CEO in 2018 • Previous executive experience at leading healthcare companies, including President and General Manager at Cardinal Health Ambulatory Care and Nuclear and Pharmacy Services divisions, President at CareAllies and COO of the CIGNA Behavioral Health business • Joined Option Care in 2015 as CFO • Served as SVP and CFO of Catamaran Corporation and as CFO of Rexnord Corporation. Mr. Shapiro also spent fifteen years with Baxter International, holding multiple positions of increasing responsibility 7 • Will draw on best management talent from both organizations • 10 member Board to be comprised of 8 directors from Option Care’s Board – including Harry Kraemer, Jr., John Arlotta, Nitin Sahney, and representatives from Walgreens and MDP – and 2 directors from BioScrip’s Board – including Carter Pate and David Golding • Dan Greenleaf – current BioScrip CEO – to serve as special advisor to the Board of Directors Other Management & Board of Directors Seasoned Management and Directors Bring Decades of Leadership in Driving Growth and Market Penetration 24

IV. FINANCIAL SUMMARY

$1,647 $1,782 $1,942 2016 2017 2018 Adjusted EBITDA (in mm) 1 $72 $84 $95 2016 2017 2018 Over last three years, Option Care generated $150mm in cash flow from operations, invested $90mm in technology and facilities, and improved leverage profile by 1x EBITDA Option Care: Net Revenue (in mm) 1 OPTION CARE + BIOSCRIP: COMBINING TWO STRONG BUSINESSES 26 $5 $45 $45 2016 2017 2018 Net Revenue (in mm) 2,3 Adjusted EBITDA (in mm) 2 BioScrip: $673 $688 $709 2016 2017 2018 (1) Excludes approximately $26 million of Revenue and Adjusted EBITDA in 2016 to normalize 2016 results for the impact of 21st Ce ntu ry Cures Act reimbursement reductions which became effective Jan. 1, 2017 (2) Excludes approximately $24 million of Revenue and Adjusted EBITDA in 2016 to normalize 2016 results for the impact of 21st Ce ntu ry Cures Act reimbursement reductions which became effective Jan. 1, 2017 (3) Excludes approximately $212 million of Revenue in 2016, and approximately $105 million of Revenue in 2017, to normalize for t he impact of the UnitedHealthcare exit and other exited products

Adjusted EBITDA (in mm) Option Care: Net Revenue (in mm) $460.6 $478.0 1Q'18 1Q'19 $16.2 $19.4 1Q'18 1Q'19 OPTION CARE + BIOSCRIP: Q1 2019 FINANCIAL HIGHLIGHTS 27 • On day - rate basis, Option Care and BioScrip revenue growth of 5% and 8%, respectively • Both companies on track to deliver on full year expectations Net Revenue (in mm) Adjusted EBITDA (in mm) BioScrip: $168.6 $179.0 1Q'18 1Q'19 $5.6 $7.1 1Q'18 1Q'19

PRO FORMA ADJUSTED EBITDA RECONCILIATION 28 Pro Forma EBITDA - LTM 3/31/2019 ($ in millions) Option Notes Care BioScrip Combined Loss from continuing operations ($3.9) ($48.9) ($52.8) Interest 45.6 59.3 104.9 Depreciation & amortization 41.9 22.2 64.1 Tax expense (benefit) (1.8) 0.5 (1.3) Reported EBITDA $81.8 $33.1 $114.9 Restructuring 6.8 10.6 17.4 Stock-based compensation 2.3 4.7 7.0 Other 1. 7.5 (1.8) 5.6 Adjusted EBITDA $98.3 $46.6 $144.9 Adjustments: Bad debt normalization 2. 3.8 3.1 6.9 Cost reduction initiatives 3. 4.2 -- 4.2 Product disruptions 4. 1.3 1.8 3.1 Acquisitions / start-up 5. 3.6 -- 3.6 Non-recurring professional fees 6. -- 1.8 1.8 Out-of-period / other 7. 0.5 (0.9) (0.4) Bonus normalization 8. (7.6) (2.3) (9.9) Total adjustments $5.8 $3.5 $9.3 Adjusted Normalized EBITDA $104.1 $50.1 $154.2 Total Net Synergies 60.0 Adjusted Pro Forma EBITDA $214.2 Note: Adjusted Pro Forma EBITDA intended to reflect combination of each company’s Adjusted EBITDA, normalization adjustments, and t ota l net synergies • Other adjustments: change in fair value of equity linked securities, loss on dispositions, loss on debt extinguishment, and management fees, among other items • Bad debt normalization: Option Care normalized given non - recurring impact of implementing new revenue management system; BioScrip normalized to historical write - off activity • Cost reduction initiatives: annualizes Option Care cost savings through headcount reductions and facility closures realized in FY18 • Product disruptions: reflects increases in product costs due to FY18 hurricanes, winter storms, and product shortages • Acquisitions / start - up: reflects pro forma impact of two Option Care acquisitions closed in FY18, an additional acquisition under LOI, and adds back negative EBITDA incurred related to start - up activities in a new market • Non - recurring professional fees: reflects various one - time service fees including Cures Act lobbying and consulting • Out - of - period / other: relates to reversal of certain non - cash Income • Bonus normalization: reflects normalized annual bonus assuming FY18 results incorporate adjustments #2 - 7 1 2 3 4 5 6 7 8

V. SYNDICATION OVERVIEW

Sources & Uses Pro Forma Capitalization ($ in millions) ($ in millions) Sources of Funds Amount Amount ABL Revolver ($150) $-- Cash and Equivalents (1) $35 Term Loan B 925 ABL Revolver ($150) -- Senior Secured Notes 400 Term Loan B 925 Balance Sheet Cash (1) 8 Senior Secured Notes 400 Total Sources $1,333 Total Debt $1,325 Uses of Funds Amount Pro Forma Financials Refinance BioScrip Existing Debt (2) $557 LTM 3/31/19 Pro Forma Adjusted EBITDA $214 Refinance Option Care Existing Debt (2) 555 Redeem BioScrip Preferred Equity (3) 121 Credit Statistics Expected Transaction Fees and Expenses 100 First Lien Debt / Pro Forma Adjusted EBITDA 4.3x Total Uses $1,333 Total Debt / Pro Forma Adjusted EBITDA 6.2x (1) Implies pre - close cash balance of $43 million, net of restricted cash (2) Debt balances as of 3/31/19. BioScrip debt figures do not include $1 million of capital leases expected to remain outstanding. Includes call premium on BioScrip’s first lien notes, second lien notes, senior notes, and accrued interest on senior notes. Includes Option Care’s first lien term loan, second lien notes and accrued interest on second lien notes (3) Preferred equity liquidation preference as of 3/31/19 and redeemed at 20% premium (4) Trading value calculated by multiplying the ~680 million pro forma diluted shares outstanding as of merger close by BioScrip’ s s hare price as of May 3, 2019 SOURCES & USES AND PRO FORMA CAPITALIZATION Current trading value implies significant equity cushion of ~$1.3BN / ~50% of total capitalization (4) 30

SUMMARY OF TERMS NEW FIRST LIEN TERM LOAN B Borrower HC Group Holdings II, LLC (the “Initial Borrower”) and following the Debt Assumption, Bioscrip, Inc. (the “Company”) (such re lev ant entity, the “Borrower”); and certain other domestic subsidiaries Guarantors Each existing and subsequently acquired or organized direct or indirect wholly - owned U.S. subsidiary of the Company, subject to certain exceptions Facility First Lien Term Loan B (the “Term Loan”) Security First lien on substantially all assets (other than ABL collateral) of the Borrower and guarantors, including capital stock directly held by the Borrower or any Subsidiary Guarantor in any material wholly - owned restricted subsidiary of the Borrower or Subsidiary Guarantor, subject to certain exceptions (“Term Loan Collateral”); second lien on ABL Collateral of Borrower and guarantors (excluding, for the avoidance of doubt, an y r eal estate) Incremental “Free and Clear” Basket : The greater of $210 million and 100% of LTM EBITDA Ratio Debt : Additional First Lien Debt, Junior Lien Debt and Unsecured Debt subject to closing date First Lien Net Leverage, closing da te Secured Net Leverage or 2.0x FCCR, respectively (if incurred in connection with a permitted acquisition or investment, additional Unsecur ed Debt provided FCCR does not decrease) Subject to 50 bps MFN for 12 months, subject to certain exceptions Amount $925 million Maturity 7 years (2026) Amortization 1% per annum, payable quarterly Optional Prepayments 101 soft - call for 6 months Mandatory Prepayments ECF sweep of 50%, commencing the first full fiscal year after the closing date, with step - downs to 25% and 0% at 0.5x and 1.0x i nside closing First Lien Net Leverage 100% of net cash proceeds from asset sales (subject to reinvestment rights) and incurrence of debt that is not permitted Financial Covenants None (Cov - lite) Negative Covenants Usual and customary for financings of this type including limitations on indebtedness, liens and restricted payments 31

TRANSACTION TIMELINE Date: Key Event: Tuesday, May 7 th • Hold Lender Meeting in NYC Tuesday, May 21 st • Commitments Due from Lenders • Expected Completion of Shareholder Vote • Close Transaction and Financing (1) Q3 2019 (1) May 2019 June 2019 July 2019 Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 1 1 2 3 4 5 6 5 6 7 8 9 10 11 2 3 4 5 6 7 8 7 8 9 10 11 12 13 12 13 14 15 16 17 18 9 10 11 12 13 14 15 14 15 16 17 18 19 20 19 20 21 22 23 24 25 16 17 18 19 20 21 22 21 22 23 24 25 26 27 26 27 28 29 30 31 23 24 25 26 27 28 29 28 29 30 31 Bank Holiday Key Event 32 (1) Timing could be delayed depending on the time required to clear SEC review

ORGANIZATIONAL STRUCTURE New $150mm ABL Revolver New $925mm Term Loan B New $400mm Senior Secured Notes ~80 % Common Stock Bioscrip Subsidiaries (Various) Public Bioscrip, Inc. (Delaware) HC Group Holdings II, LLC (Delaware) HC Group Holdings III, Inc. (Delaware) Option Care Infusion Services, Inc. (Delaware) Option Care Subsidiaries (Various) ~20 % Common Stock New Lenders HC Group Holdings I, LLC (Delaware) Guarantors expected to be same entities that guaranty existing Option Care and BioScrip facilities 33 Existing $80mm Revolver Existing $400mm Term Loan B Existing $150mm Second Lien Notes Existing Lenders

APPENDIX

Borrower BioScrip, Inc.; HC Group Holdings II, LLC; and certain other domestic subsidiaries Guarantors Each existing and subsequently acquired or organized direct or indirect wholly - owned U.S. subsidiary of the Company, subject to certain exceptions Facility $150 million Asset - Based Revolver (“ABL Revolver”), $50 million Accordion Security First lien on receivables, cash, deposit and securities accounts, inventory, and proceeds thereof (“ABL Collateral”) Third lien on Term Loan Collateral (which excludes real estate) Borrowing Base a) 85% of net eligible accounts receivable (including Medicare / Medicaid (subject to a cap at 35% of the borrowing base) and unbilled accounts receivable (subject to a cap TBD); plus b) The lesser of 75% of the cost of eligible inventory and 85% of the NOLV of eligible inventory (a cap TBD); plus c) 100% of eligible cash; minus d) Customary Reserves Note: Deemed borrowing base of $125 million if a field exam and inventory appraisal is not completed prior to close (for 90 d ays post - close) Maturity 5 years Pricing Note: Pricing to be at Tier II for the first full fiscal quarter post - closing Financial Covenants • Minimum FCCR of 1.0x, tested at any time Excess Availability < the greater of 10% of the Line Cap and $10 million. (“Line Cap ” i s the lesser of the aggregate commitments and the Borrowing Base) Cash Dominion • Springing when (a) Excess Availability < the greater of 10% of the Line Cap and $10 million for 5 consecutive business days o r ( b) upon certain events of default Other Covenants Unlimited acquisitions, investments, unsecured debt incurrence, restricted payments and certain debt prepayments subject to either: • PF Excess Availability (20 - day lookback) ≥ the greater of 17.5% of the Line Cap and $17.5 million (20% / $20 million for RPs and debt prepayments); or • Both (a) PF FCCR ≥ 1.0x and (b) PF Excess Availability (20 consecutive day lookback) ≥ the greater of 12.5% of the Line Cap and $12.5 million (15% / $15 million for RPs and debt prepayments) SUMMARY OF TERMS NEW ASSET - BASED REVOLVER Tier Average Excess Avail % of Line Cap LIBOR Rate I ≥ 66.7% L + 225 bps II < 66.7% but ≥ 33.3% L + 250 bps III < 33.3% L + 275 bps Utilization Unused Fee ≥ 50% 25 bps < 50% 37.5 bps 35 Note: Excess Availability includes suppressed availability up to 2.5% of the aggregate commitments

SUMMARY OF TERMS NEW SENIOR SECURED NOTES Issuer HC Group Holdings II, LLC (the “Initial Issuer”) and following the Debt Assumption, Bioscrip, Inc. (the “Company”) (such rele van t entity, the “Issuer”) Guarantors Each existing and subsequently acquired or organized direct or indirect wholly - owned U.S. subsidiary of the Company, subject to certain exceptions Issue Senior Secured Notes (the “Notes”) (Privately Placed) Security Second Lien on all Term Loan Collateral, Third Lien on ABL Collateral Amount $400 million Maturity 8 years (2027) Pricing L + 875 bps cash interest rate; at the borrower’s option PIK 100% for first year and 50% for second year at +100 bps and +50 bps, respectively Amortization None Optional Redemption 103% / 102% / 101% (Hard Call) Negative Covenants Usual and customary for financings of this type including limitations on indebtedness, liens and restricted payments 36

OPTION CARE + BIOSCRIP: STRONG POSITION TO CAPITALIZE ON THERAPY TRENDS Key therapies include anti - infectives, total parental nutrition and enteral nutrition Shorter duration therapy regiments Higher gross margins Requires significant sales & marketing and clinical expertise Key therapies include IVIG, TNF (ex: Remicade) and Factor products Longer duration therapies Lower gross margins but significant Adj. EBITDA (1) dollars Payor strategies for site of care redirection Pharma manufacturer partnerships for limited distribution of innovative therapies; robust large molecule pipeline Drive above - market revenue growth and Adj. EBITDA (1) margin expansion Acute Therapies (40% of Revenue) Chronic Therapies (60% of Revenue) Focus on therapies that require provider oversight, allowing company to leverage clinical competencies and drive meaningful EBITDA 37 (1) Adj. EBITDA includes adjustments related to stock - based compensation, loss on dispositions, non - cash portion of debt extinguishm ent, management fees, and restructuring and other charges Broad Product Portfolio In Network Payor Base Unique Referral Management Strong Drug Pipeline

OVERVIEW OF HOME INFUSION CARE 38 Why Home Infusion? How is it Administered? Benefits Infusion therapy involves administering medication through a catheter or needle – typically prescribed when conditions are too severe for oral medications Infusion therapy can treat a wide range of acute and chronic conditions, including: — Infections — Nutritional deficiencies — Cancer — Immunological / neurological disorders — Pain — Pallative care There are five common methods for administering infusion therapy: — Intravenous (IV) – into the vein (most common) — Subcutaneous – into the fatty layer under the skin — Intramuscular – into the muscle — Intraspinal – into the membranes around the spinal cord — Enteral – into the gastrointestinal tract Benefits to the Patients Patient Experience – Ability to receive treatment in comfort of home or community setting Cost Savings – Long - term therapy for chronic conditions can be extremely expensive in the hospital setting Benefits to the Healthcare System Lowest cost setting while delivering high quality outcomes Proven therapy adherence, which limits readmission rates and future complications Increased access to care with minimal infrastructure requirements Proactive coordination of care improves efficiency Care Delivery Process Patient Discharge (Referral) Pharmaceutical Preparation Pharmaceutical Delivery Pharmaceutical Administration Clinical Monitoring Patients referred by physicians, hospital discharge planners and MCOs Compounded and dispensed under supervision of a registered pharmacist Dispensed to service locations Intravenous Subcutaneous Intramuscular Intra - spinal Enteral Ongoing monitoring and communication with physicians to encourage patients to follow prescribed therapies

BioPlus Acquisition (NASDAQ:BIOS)

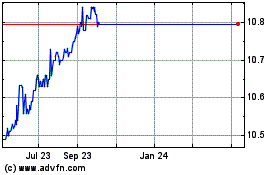

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024