Risk

Factors

Our

business is subject to numerous risks, as more fully described in the section titled “Risk Factors” immediately following

this prospectus summary. You should read and carefully consider these risks and all of the other information in this prospectus,

including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest

in the ADSs. In particular, such risks include, but are not limited to, the following:

|

|

●

|

We

are a clinical stage biopharmaceutical company with a history of operating losses, are not currently profitable, do not expect

to become profitable in the near future and may never become profitable.

|

|

|

●

|

We

have not yet commercialized any products or technologies, and we may never do so.

|

|

|

●

|

We

depend heavily on the success of our current Phase 3 clinical trial of M-001 in Europe, and if we are unable to complete our

Phase 3 clinical trial and then fail to obtain marketing approvals for the commercialization of M-001, our business will be

materially harmed.

|

|

|

●

|

We

may never receive FDA regulatory approval for the conduct of Phase 3 clinical trials in the U.S.

|

|

|

●

|

Our

product candidate is subject to extensive regulation and may never obtain regulatory approval.

|

|

|

●

|

Our

product candidate and future product candidates will remain subject to ongoing regulatory requirements even if they receive

marketing approval, and if we fail to comply with these requirements, we may not obtain such approvals or could lose those

approvals that have been obtained, and the sales of any approved commercial products could be suspended.

|

|

|

●

|

If

we, or the parties from whom we license intellectual property, fail to adequately protect, enforce or secure rights to the

patents which we own or that were licensed to us or any patents we may own in the future, the value of our intellectual property

rights would diminish, and our business and competitive position would suffer.

|

|

|

●

|

We

face significant competition. If we cannot successfully compete with new or existing products, M-001 or any other product

candidate that we develop may be rendered non-competitive or obsolete.

|

|

|

●

|

We

are subject to extensive and costly government regulations relating to our business, we may be subject to fines and other

penalties that could harm our business.

|

|

|

●

|

Our

U.S. shareholders may suffer adverse tax consequences if we are characterized as a passive foreign investment company, or

PFIC, for U.S. federal income tax purposes.

|

Our

Corporate Information

We

were incorporated in Israel in 2003 as a privately held company. In February 2007, we completed an initial public offering of

our ordinary shares on the Tel Aviv Stock Exchange, or TASE, and in January 2018 we voluntarily delisted from TASE. American Depositary

Shares and ADS warrants have been traded on the NASDAQ Capital Market under the symbols “BVXV” and “BVXVW”,

respectively, since our initial public offering in the United States in May 2015.

As

of April 2019, our principal executive offices are located at Jerusalem BioPark, 2nd floor, Hadassah Ein Kerem Campus, Jerusalem,

Israel, and our telephone number is +972-8-930-2529. Our website is www.biondvax.com. Information contained on, or accessible

through, our website is not incorporated by reference herein and shall not be considered part of this prospectus. Our agent for

service of process in the United States is Puglisi & Associates, whose address is 850 Library Avenue, Suite 204, Newark, Delaware,

and whose telephone number is (302) 738-6680.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, or JOBS Act.

For as long as we are deemed an emerging growth company, we are permitted to and intend to take advantage of specified reduced

reporting and other regulatory requirements that are generally unavailable to other public companies, including:

|

|

●

|

an

exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting required

by Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; and

|

|

|

●

|

an

exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB,

requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required

to provide additional information about our audit and our financial statements.

|

We

may take advantage of these provisions until December 31, 2020 or such earlier time that we are no longer an emerging growth company.

If we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0

billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to December 31,

2020.

In

addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards

would otherwise apply to private companies. However, we have chosen to “opt out” of such extended transition period,

and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards

is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended

transition period for complying with new or revised accounting standards is irrevocable.

Implications

of being a Foreign Private Issuer

We

are subject to the information reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, that are applicable

to “foreign private issuers,” and under those requirements we will file reports with the U.S. Securities and Exchange

Commission, or the SEC. As a foreign private issuer, we will not be subject to the same requirements that are imposed upon U.S.

domestic issuers by the SEC, and we may be exempt from certain regulations of the NASDAQ Stock Market. Under the Exchange Act,

we will be subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic

reporting companies. For example, although we report our financial results on a quarterly basis, we are not be required to issue

quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual

executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We will also have

four months after the end of each fiscal year to file our annual reports with the SEC and will not be required to file current

reports as frequently or promptly as U.S. domestic reporting companies. We may also present financial statements pursuant to International

Financial Reporting Standards, or IFRS, instead of pursuant to U.S. generally accepted accounting principles, or U.S. GAAP. Furthermore,

our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity securities

and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer,

we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. These exemptions

and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable

to U.S. domestic reporting companies. We intend to take advantage of the exemptions available to us as a foreign private issuer

during and after the period we qualify as an emerging growth company.

summary

of THE rights OFFERING

The

following summary describes the principal terms of the rights offering but is not intended to be complete. See the information

under the heading “The Rights Offering” in this prospectus for a more detailed description of the terms and conditions

of the rights offering.

|

Offering

to ADS holders

|

|

|

|

|

|

ADS

rights offering

|

ADS

holders will receive 1 ADS right for each (1) ADS owned. The subscription rights may be exercised at any time beginning on

the date of this prospectus and ending at the expiration time of the ADS rights offering. Fractional ADS rights will not be

issued, and all ADS rights entitlement will be reduced to the next smaller whole number of ADS rights.

|

|

|

|

|

Basic

Subscription Privilege

|

The

basic subscription privilege of each ADS right will entitle you to purchase one ADS at a subscription price of $ per

ADS.

|

|

|

|

|

No

Over-Subscription Privilege

|

We

do not provide an over-subscription privilege to purchase additional ADSs that remain unsubscribed at the expiration of the

rights offering.

|

|

|

|

|

Record

Date

|

5:00

p.m., New York City time, on , 2019

|

|

|

|

|

Expiration

Time of the ADS Rights Offering

|

5:00

p.m., New York City time, on , 2019

|

|

|

|

|

Subscription

Price

|

$5.69

per ADS, payable in cash. To be effective, any payment related to the exercise of a right must clear prior to the expiration

of the rights offering.

|

|

|

|

|

ADS

Rights Deposit Amount

|

ADS

holders wishing to exercise ADS rights must deposit $5.705 per new ADS subscribed for, which equals the ADS subscription price

of $5.69 plus $0.015 per ADSs to cover the depositary’s fee for issuance of the new ADSs.

|

|

|

|

|

ADS

Rights Agent

|

The

Bank of New York Mellon. Holders of ordinary shares wishing to exercise share rights should contact the Company directly to

receive instructions.

|

|

|

|

|

Use

of Proceeds

|

We

are conducting the rights offering to raise capital that we intend to use for working capital and general corporate purposes

including completion of the pivotal Phase 3 clinical trial (second cohort) expected through the end of 2020. See “Use

of Proceeds.”

|

|

|

|

|

Non-Transferability

of Rights

|

The

subscription rights may not be sold, transferred or assigned and will not be listed for trading on the NASDAQ Capital Market

or any stock exchange or market.

|

|

|

|

|

No

Board Recommendation

|

Although

members of our board of directors may invest their own money in the rights offering, our board of directors is making no recommendation

regarding your exercise of the subscription rights. You are urged to make your decision based on your own assessment of our

business and the rights offering. Please see “Risk Factors” for a discussion of some of the risks involved in

investing in ADSs.

|

|

No Revocation

|

All exercises of ADS rights

are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your ADS rights

and even if the rights offering is extended by our board of directors. However, if we amend the rights offering to allow for

an extension of the rights offering for a period of more than 30 days or make a fundamental change to the terms of the rights

offering set forth in this prospectus, you may cancel your subscription and receive a refund of any money you have advanced.

You should not exercise your ADS rights unless you are certain that you wish to purchase additional ADSs at a subscription

price of $5.69 per ADS.

|

|

|

|

|

No Minimum Requirements

|

There is no minimum purchase requirement

for closing this offering, and no minimum purchase requirement for any ADS rights holder.

|

|

|

|

|

Extension, Cancellation and Amendment

|

We have the option to extend

the expiration of the rights offering for a period not to exceed 30 days by giving oral or written notice to the ADS rights

agent prior to the expiration date of the rights offering, although we do not presently intend to do so. If we elect to

extend the expiration of the rights offering, we will issue a press release announcing such extension no later than 9:00

a.m., New York City time, on the next business day after the most recently announced ADS rights expiration time. We will

extend the duration of the rights offering as required by applicable law or regulation and may choose to extend it if

we decide to give investors more time to exercise their ADS rights in the rights offering.

Our board of directors may

cancel the rights offering at any time prior to the expiration of the rights offering for any reason. In the event the

rights offering is cancelled, all subscription payments received by the ADS rights agent will be promptly returned, without

interest.

Our board of directors also

reserves the right to amend or modify the terms of the rights offering in its sole discretion. If we should make any fundamental

changes to the terms of the rights offering set forth in this prospectus, we will file a post-effective amendment to the

registration statement in which this prospectus is included, offer potential purchasers who have subscribed for ADSs the

opportunity to cancel such subscriptions and issue a refund of any money advanced by such holders and recirculate an updated

prospectus after the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend

the expiration date of the rights offering to allow holders of rights ample time to make new investment decisions and

for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing

any changes with respect to the rights offering and the new expiration date. The terms of the rights offering cannot be

modified or amended after the expiration date of the rights offering. Although we do not presently intend to do so, we

may choose to amend or modify the terms of the rights offering for any reason, including, without limitation, in order

to increase participation in the rights offering. Such amendments or modifications may include a change in the subscription

price, although no such change is presently contemplated.

|

|

|

|

|

Procedures for Exercise

|

If you hold ADSs and wish to exercise

your ADS rights, you should contact your broker or other securities intermediary through which you hold the ADSs and instruct

it to subscribe on your behalf through the automated system of The Depository Trust Company, or DTC, prior to the ADS expiration

time. Your intermediary will charge the applicable ADS rights deposit amount to your account. Your broker or other securities

intermediary will set a cutoff date and time to receive instructions that is earlier than the ADS rights expiration time stated

above. You should contact your securities intermediary to determine the cutoff date and time that applies to you.

|

|

ADS

Rights Agent

|

With

respect to ADS holders, The Bank of New York Mellon. For information regarding the ADS Rights Offering, please contact MacKenzie

Partners, Inc., the information agent, at 1-(212) 929-5500 or toll free at 800-322-2885, or by email at rightsoffer@mackenziepartners.com,

Monday- Friday, from 09:00 a.m. to 5:00 p.m. New York City time.

|

|

|

|

|

Unexercised

rights

|

If

you do not exercise your ADS rights within the ADS rights exercise period, they will expire and have no further value.

|

|

|

|

|

Listing

|

ADSs

and ADS warrants are traded on the NASDAQ Capital Market under the symbols “BVXV” and “BVXVW”, respectively.

The ADSs issued in the rights offering will also be traded on the NASDAQ Capital Market under the symbol “BVXV”.

|

|

|

|

|

Potential

offering of unsubscribed rights

|

At

our shareholders meeting held on 2019, the Company’s shareholders approved and we have agreed to grant to our largest

shareholder, Angels Investments in Hi Tech Ltd., a company controlled by Mr. Marius Nacht, or aMoon 2 Fund Limited Partnership,

a health-tech and life-sciences venture fund in which Mr. Marius Nacht is the anchor investor, (together “

Angels

”),

(i) an option to purchase, at the ADS subscription price, in addition to the full entitlement as a holder of ordinary shares

and ADSs under this rights offering, all ordinary shares and ADSs offered in this rights offering that are not purchased upon

exercise of share rights or ADS rights; and (ii) if the aggregate subscription for those unsubscribed ordinary shares and

ADSs is less than $10 million, to purchase, at the ADS subscription price in a private placement, an amount of additional

ADSs so that the total investment by Angels is $10 million (the “

Option

”), excluding the full entitlement

as a holder of ordinary shares and ADSs under this rights offering. In return for this Option, Angels has undertaken a firm

commitment to purchase at least its full entitlement as a holder of ordinary shares and the ADSs under this rights offering.

|

|

|

|

|

Delivery

of new ADSs

|

The

depositary will deliver new ADSs subscribed for in the rights offering as soon as practicable after confirmation of receipt

of the underlying new ordinary shares by the depositary’s custodian, which is expected to be on or about ______________.

To better understand the terms of the ADSs, you should carefully read “Description of American Depositary Shares”

in this prospectus. You should also read the deposit agreement, which is an exhibit to the registration statement of which

this prospectus forms a part.

|

|

|

|

|

Fees

and Expenses

|

We

will pay all fees charged by the ADS rights agent in connection with this rights offering, except the ADS issuance fee of

$0.015 per new ADS issued. You are responsible for paying any other commissions, fees, taxes or other expenses incurred

in connection with the exercise of the ADS rights, and the ADS issuance fee of $0.015 per new ADS issued, payable to the

depositary. The ADS rights agent will deduct the ADS issuance fee from the ADS rights deposit amount in respect of each

holder’s subscription.

|

|

|

|

|

Information

Agent

|

For

information regarding the ADS Rights Offering, please contact MacKenzie Partners, Inc., the information agent, at 1-(212)

929-5500 or toll free at 800-322-2885, or by email at rightsoffer@mackenziepartners.com, Monday- Friday, from 09:00 a.m. to

5:00 p.m. New York City time.

|

For additional information regarding the rights offering to holders of ADSs, see “Rights Offering – Offering to ADS Holders”, which also contains a summary timetable containing important dates relating to the ADS rights offering.

|

Offering to shareholders

|

|

|

|

|

|

Ordinary Share rights offering

|

Shareholders will receive one subscription

right for each (1) ordinary share owned, at a subscription price of $0.14225 per new ordinary share. The ordinary share rights

may be exercised at any time beginning on the date of this prospectus. Fractional ordinary share rights will not be issued,

and ordinary share right entitlement will be reduced to the next smaller whole number of ordinary share rights.

|

|

|

|

|

Ordinary Share Record Date

|

5:00 p.m., Israel time, on , 2019

|

|

|

|

|

Expiration Time of the share rights Offering

|

5:00 p.m., Israel time, on , 2019

|

|

|

|

|

Subscription Price

|

$0.14225

per ordinary share, payable in cash. To be effective, any payment related to the exercise of a right must clear prior to the

expiration of the rights offering.

|

|

|

|

|

Procedure for exercising ordinary share rights

|

You may exercise your ordinary share rights

by delivering to us, via our legal counsel, Pearl Cohen Zedek Latzer Baratz, at 121 Menachem Begin Rd., 53

rd

Floor,

Tel-Aviv, Israel, attn: Mark Hamilton, Adv., a properly completed subscription form before the expiration time of the share

rights offering. To validly subscribe for new ordinary shares pursuant to your ordinary share rights we must receive the subscription

price for your new ordinary shares in full before the expiration time of the share rights offering.

|

|

|

|

|

Non-Transferability of Rights

|

The ordinary share subscription rights may not be sold, transferred or assigned and will not be listed for trading on any stock exchange or market in the U.S. or elsewhere.

|

|

|

|

|

No Board Recommendation

|

Although members of our board of directors

may invest their own money in the rights offering, our board of directors is making no recommendation regarding your exercise

of the subscription rights. You are urged to make your decision based on your own assessment of our business and the rights

offering. Please see “Risk Factors” for a discussion of some of the risks involved in investing in ADSs.

|

|

|

|

|

No Revocation

|

All exercises of subscription rights are

irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your subscription

rights and even if the rights offering is extended by our board of directors. However, if we amend the rights offering to

allow for an extension of the rights offering for a period of more than 30 days or make a fundamental change to the terms

of the rights offering set forth in this prospectus, you may cancel your subscription and receive a refund of any money you

have advanced. You should not exercise your subscription rights unless you are certain that you wish to purchase additional

ordinary shares at a subscription price of $0.14225 per ordinary share.

|

|

|

|

|

Unexercised rights

|

If you do not exercise your ordinary share rights within the ordinary share rights exercise period, they will expire and have no further value.

|

|

|

|

|

Listing

|

The ordinary shares and ordinary share rights are not listed on any securities market or exchange in the U.S. or elsewhere.

|

|

|

|

|

Delivery of new ordinary shares

|

We expect to deliver the new ordinary shares subscribed in this rights offering as soon as practicable after the closing of the offering.

|

For

additional information regarding the rights offering to shareholders, see “Rights Offering – Offering to Shareholders”,

which also contains a summary timetable containing important dates relating to the ordinary share rights offering.

QUESTIONS

AND ANSWERS ABOUT THE RIGHTS OFFERING

What

is the rights offering?

We

are distributing to our shareholders and holders of ADSs, at no charge, non-transferable subscription rights. ADS holders

and shareholders will receive one subscription right for each ADS or ordinary share, respectively, owned at 5:00 p.m., New York

City time, on , 2019, and 5:00 p.m., Israel time, on , 2019, respectively (the “

rights offering

”); Each subscription

right will entitle the holder to a basic subscription privilege.

What

is the basic subscription privilege?

The

basic subscription privilege of each subscription right gives ADS holders the opportunity to purchase one ADS at a subscription

price of $5.69 per ADS and our shareholders the opportunity to purchase one ordinary

share at $0.14225 per ordinary share. You may exercise the basic subscription privilege

of any number of your subscription rights, or you may choose not to exercise any subscription rights.

Will

the Rights Offering include an oversubscription privilege?

No.

You will not be entitled to an oversubscription privilege to acquire rights remaining unpurchased after the expiration of all

subscription rights.

Why

are we conducting the rights offering?

We

are conducting the rights offering to raise capital that we intend to use to fund operations, including completion of the pivotal

Phase 3 trial (second cohort), expected through the end of 2020. See “Use of Proceeds.”

How

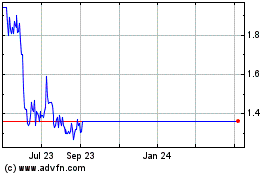

was the subscription price determined?

In

determining the subscription price, our board of directors considered a number of factors, including: the likely cost of capital

from other sources, the price at which our shareholders and ADS holders might be willing to participate in the rights offering,

historical and current trading prices of ADSs, our need for liquidity and capital and the desire to provide an opportunity to

ADS holders to participate in the rights offering on a

pro rata

basis. In conjunction with its review of these factors,

our board of directors has determined the subscription price to be the volume based weighted average price for the sixty calendar

days to April 8, 2019 inclusive, and the median of the volume based weighted average prices for the thirty, sixty and ninety calendar

days respectively to April 8, 2019. The subscription price is not necessarily related to our book value, net worth or any other

established criteria of value and may or may not be considered the fair value of the ADSs to be offered in the rights offering.

We cannot give any assurance that ADSs will trade at or above the subscription price in any given time period.

Am

I required to exercise all of the subscription rights I receive in the rights offering?

No.

You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. However, if

you choose not to exercise your subscription rights in full, the relative percentage of the ordinary shares or ADSs that you own

will decrease, and your voting and other rights will be diluted.

How

soon must I act to exercise my subscription rights?

The

subscription rights may be exercised at any time beginning on the date of this prospectus and prior to the ADS expiration time

or share rights expiration time, which are 5:00 p.m., New York City time, on ,

2019 or 5:00 p.m., Israel time, on , 2019, respectively. If you elect to exercise

ADS rights, the ADS rights agent must actually receive all required documents and payments from you prior to the expiration of

the rights offering. Brokers and other securities intermediaries through which ADSs are held will set their own cut-off dates

and times to receive instructions to exercise ADS rights, which will be earlier than the ADS rights expiration time stated above.

You should contact your broker or other securities intermediary to determine the cut-off date and time that applies to you. Although

we have the option of extending the expiration of the rights offering for a period not to exceed 30 days, we currently do not

intend to do so.

May

I transfer my subscription rights?

No.

You may not sell or transfer your subscription rights to anyone.

Are

we requiring a minimum subscription to complete the rights offering?

No.

Are

there any conditions to completing the rights offering?

No

(other than this registration statement being declared effective by the SEC).

Can

our board of directors extend, cancel or amend the rights offering?

We have the option

to extend the expiration of the rights offering for a period not to exceed 30 days by giving oral or written notice to the ADS

rights agent prior to the expiration date of the rights offering, although we do not presently intend to do so. If we elect to

extend the expiration of the rights offering, we will issue a press release announcing such extension no later than 9:00 a.m.,

New York City time, on the next business day after the most recently announced expiration time of the rights offering. We will

extend the duration of the rights offering as required by applicable law or regulation and may choose to extend it if we decide

to give investors more time to exercise their subscription rights in the rights offering.

Our board of directors

may cancel the rights offering at any time prior to the expiration of the rights offering for any reason. In the event the rights

offering is cancelled, all subscription payments received by the ADS rights agent will be promptly returned, without interest.

Our board of directors also reserves the right to amend or

modify the terms of the rights offering in its sole discretion. If we should make any fundamental changes to the terms of the

rights offering set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this

prospectus is included, offer potential purchasers who have subscribed for

ADSs

the opportunity to cancel such subscriptions and receive a refund of any money deposited by such ADS holder and recirculate an

updated prospectus after the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend

the expiration date of the rights offering to allow holders of subscription rights ample time to make new investment decisions

and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing

any changes with respect to the rights offering and the new expiration date. The terms of the rights offering cannot be modified

or amended after the expiration date of the rights offering. Although we do not presently intend to do so, we may choose to amend

or modify the terms of the rights offering for any reason, including, without limitation, in order to increase participation in

the rights offering. Such amendments or modifications may include a change in the subscription price, although no such change

is presently contemplated.

Has

our board of directors made a recommendation to shareholders and ADS holders regarding the rights offering?

Our

board of directors is not making any recommendation to shareholders and ADS holders regarding the exercise of subscription rights

in the rights offering. You should make an independent investment decision about whether or not to exercise your subscription

rights. Shareholders and ADS holders who exercise subscription rights risk investment loss on new money invested. We cannot assure

you that the market price for ADSs will remain above the subscription price or that anyone purchasing ADSs at the subscription

price will be able to sell those ADSs in the future at the same price or a higher price. If you do not exercise your rights, you

will lose any value represented by your rights and your percentage ownership interest in us will be diluted. Please see “Risk

Factors” for a discussion of some of the risks involved in investing in ADSs.

What

will happen if I choose not to exercise my subscription rights?

If

you do not exercise any subscription rights, the number of ordinary shares or ADSs you own will not change; however, due to the

fact that ordinary shares and ADSs may be purchased by other shareholders and ADS holders in the rights offering, your percentage

of ownership in the Company after the completion of the rights offering will be diluted.

How

do I exercise my subscription rights? What forms and payment are required to purchase ADSs?

If

you hold ADSs and wish to exercise your ADS rights, you should contact your broker or other securities intermediary through which

you hold the ADSs and instruct it to subscribe on your behalf through the automated system of The Depository Trust Company, or

DTC, prior to , the ADS expiration time. Your intermediary will charge

the applicable ADS rights deposit amount to your account. Your broker or other securities intermediary will set a cutoff date

and time to receive instructions that is earlier than the ADS rights expiration time stated above. You should contact your securities

intermediary to determine the cutoff date and time that applies to you.

You

may exercise your ordinary share rights by delivering to us, via our legal counsel, Pearl Cohen Zedek Latzer Baratz, at 121 Menachem

Begin Rd., 53

rd

Floor, Tel-Aviv, Israel, Attn: Mark Hamilton, Adv., a properly completed subscription from before the

share rights expiration time, that is 5:00 p.m., Israel time, on , 2019. To validly

subscribe for new ordinary shares pursuant to your ordinary share rights we must receive the subscription price for your new ordinary

shares in full before the share rights expiration time.

When

will I receive my new ADSs?

If

you purchase ADSs through the rights offering, you will receive your new securities as soon as practicable after the closing of

the offering.

After

I send in my payment, may I cancel my exercise of subscription rights?

No.

All exercises of subscription rights are irrevocable, even if you later learn information that you consider to be unfavorable

to the exercise of your subscription rights and even if the rights offering is extended by our board of directors. However, if

we amend the rights offering to allow for an extension of the rights offering for a period of more than 30 days or make a fundamental

change to the terms of the rights offering set forth in this prospectus, you may cancel your subscription and receive a refund

of any money you have deposited. You should not exercise your subscription rights unless you are certain that you wish to purchase

additional securities at the subscription price of $5.69

per ADS or $0.14225

per ordinary share.

How

many ordinary shares will be outstanding after the rights offering?

Assuming ordinary

shares are issued in the rights offering through the exercise of subscription rights, and assuming the full exercise of the ADS

rights and share rights and the exercise of the Option we anticipate that ordinary

shares will be outstanding following the completion of the rights offering.

How

much proceeds will the Company receive from the rights offering?

Assuming

full participation in the rights offering and exercise of the Option, we estimate that the gross proceeds from the rights offering

will be approximately $20,000,000, after deducting expenses related to this offering payable by us estimated at approximately

$ . Please see “Use of Proceeds.”

Are

there risks in exercising my subscription rights?

Yes.

The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional

ADSs or ordinary shares and should be considered as carefully as you would consider any other equity investment. Among other things,

you should carefully consider the risks described under the headings “Risk Factors” in this prospectus.

If

the rights offering is not completed, will my subscription payment be refunded to me?

Yes.

If the rights offering is not completed, all subscription payments received will be promptly returned, without interest.

Will

the ADS rights be listed on a stock exchange or market?

The

ADS rights may not be sold, transferred or assigned and will not be listed for trading on the NASDAQ Capital Market or any stock

exchange or market. However, the ADSs issued in the rights offering will be traded on the NASDAQ Capital Market under the symbol

“BVXV.”

May

I exercise my subscription rights if I live outside the United States?

No

action has been taken to register or qualify this rights offering outside the U.S. and Israel. Holders located anywhere else are

responsible for determining if they can subscribe without violating the securities laws of the jurisdictions in which they are

located. The rights are not to be exercised by anyone in a way that would violate applicable laws.

What

is the option granted to the largest shareholder of the Company in connection with this rights offering and why have we granted

such option?

Pursuant

to the approval of our shareholders provided at the special meeting held on _______, 2019, or the “

Special Meeting

”,

we have agreed to grant our largest shareholder, Angels Investments in Hi Tech Ltd., a company controlled by Mr. Marius Nacht,

or aMoon 2 Fund Limited Partnership, a health-tech and life-sciences venture fund in which Mr. Marius Nacht is the anchor investor,

(together “

Angels

” or “

option holder

”), (i) an option to purchase, at the ADS subscription

price, all ADSs offered in this rights offering that are not purchased upon exercise of share rights or ADS rights; and (ii) if

the aggregate subscription for those unpurchased ADSs is less than $10 million, to purchase, at the ADS subscription price in

a private placement, an amount of additional ADSs so that the total investment by Angels is $10 million (the “

Option

”),

excluding the full entitlement as a holder of ordinary shares and ADSs under this rights offering. In return for this Option,

Angels has undertaken a firm commitment to purchase at least its full entitlement as a holder of ordinary shares and the ADSs

under this rights offering. The option will be exercised upon Angels’ discretion.

In

accordance with section 328(b)(1) of the Israeli Companies Law, we will sell Angels additional ADSs at the ADS subscription price

in a private placement, so that as a result Angels may hold ordinary shares of the Company which constitute more than 25% or 45%

of the voting rights in the general meeting of the shareholders of the Company (where no other person or entity holds 25% or 45%

or more of the voting rights) and thus may become a controlling shareholder (as defined under the Israeli Companies Law). We anticipate

that if Angels exercises the Option, Angles will increase its holdings to over 25% of the voting rights of the Company. However,

we anticipate that Angels will increase its holdings to over 45% of the voting rights of the Company only if very few or no other

shareholders participate in the rights offering.

aMoon

2 is an Israeli health-tech and life-sciences venture fund in which Marius Nacht is the anchor investor. With funds under management

in excess of $650 million, aMoon 2 is one of the largest life-science fund in Israel and, in the view of the board of the Company,

a desirable value-added investor. In addition, the funds provided to the Company through the Rights Offering and Angels’

additional investment would enable the Company to plan the second season of the Phase 3 pivotal trial with a larger number of

participants than originally contemplated and thereby enhancing the statistical power of the trial, and to provide additional

working capital for staffing and other operational needs through 2020.

We

have received a letter of commitment from Angels agreeing to purchase at least its full entitlement as a holder of ordinary shares

and ADSs under this rights offering, subject to the approval of the Option grant, which was provided by the shareholders of the

Company at the Special Meeting. Under the letter of commitment, if the total consideration of the unsubscribed rights is less

than $10 million, Angels shall be entitled to receive additional ADSs in a private placement under the same terms of the rights

offering, so that the total unsubscribed rights together with the additional ADSs issued shall be for a consideration of $10 million,

excluding the full entitlement of Angels as a holder of ordinary shares and ADSs under this rights offering.

Is

the Option holder being compensated in this rights offering?

No.

When

is the Option exercisable and when will it expire?

The

Option shall be exercisable subject to the following conditions: (i) Angels has undertaken to purchase at least its full entitlement

as a holder; (ii) the shareholders meeting approved the Option grant. We intend to publish a notice of a shareholders meeting

to be convened prior to the closing of the rights offering. The Option shall become exercisable on the date the rights offering

prospectus is declared effective by the Securities and Exchange Commission and shall expire on the closing date of the rights

offering.

Why

was shareholder’s approval required in connection with this Option?

Subject

to the execution of the rights offering, Angels, including Angels Investments in Hi Tech Ltd., currently holding 20.56% of the

issued and outstanding capital of the Company, may be precluded from purchasing part of the rights, due to a restriction under

the Israeli law which will not permit Angels to increase its holdings over 25% and 45% of the voting rights of the Company, without

first submitting a tender offer to all shareholders of the Company.

Section

328 of the Israeli Companies Law provides that any acquisition of shares of over 25% and 45% of the voting rights of the Company

must be executed by submitting a tender offer to the shareholders of the Company, provided there is no other shareholder holding

25% or 45% or more of the voting rights of the Company. However, Section 328(b)(1) exempts a purchaser from filing a tender offer

in the event the Company issues the purchaser securities in a private placement equal to such amount that following such private

placement the purchaser shall hold over 25% and 45% of the voting rights of the Company.

The

issuance of ADSs under the abovementioned terms and conditions, as approved by the shareholders of the Company, shall allow Angels

to purchase ADSs in the rights offering, including unsubscribed ADSs, and increase the maximum capital potentially raised by the

Company.

We

anticipate that if Angels exercises the Option, Angles will increase its holdings to over 25% of the voting rights of the Company.

However, we anticipate that Angels will increase its holdings to over 45% of the voting rights of the Company only if very few

or no other shareholders participate in the rights offering.

What

fees or charges apply if I purchase ADSs?

We

are not charging any fee or sales commission to issue subscription rights to you or to deliver ADSs or ordinary shares to you

if you exercise your subscription rights. If you exercise ADS rights, you are responsible for paying any fees your broker or other

securities intermediary may charge you, and an ADS issuance fee of $0.015 per new ADS issued.

What

are the tax consequences of receipt of or exercise of subscription rights?

For

U.S. federal income tax purposes, it is intended that U.S. holders of our ordinary shares and warrants generally should not recognize

income or loss in connection with the receipt or exercise of subscription rights. You are urged to consult your own tax advisor

as to your particular tax consequences resulting from the receipt and exercise of subscription rights. For further information,

please see “Taxation – U.S. Federal Income Tax Consequences.”

If

I am a holder of ordinary shares, to whom should I send my forms and payment?

You

may exercise your ordinary share rights by delivering to us, via our legal counsel, Pearl Cohen Zedek Latzer Baratz, at 121 Menachem

Begin Rd., 53rd Floor, Tel-Aviv, Israel, attn: Mark Hamilton, Adv., a properly completed subscription from before the expiration

time of the share rights offering, that is 5:00 p.m., Israel time, on , 2019. To validly subscribe

for new ordinary shares pursuant to your ordinary share rights we must receive the subscription price for your new ordinary shares

in full before the expiration time of the share rights offering.

You

are solely responsible for completing delivery to the subscription agent of your subscription documents, rights certificate and

payment. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent.

Whom

should I contact if I have other questions?

If

you have other questions or need assistance, please contact MacKenzie Partners, Inc., the information agent, at 1-(212) 929-5500

or toll free at 800-322-2885, or by email at rightsoffer@mackenziepartners.com, Monday- Friday, from 09:00 a.m. to 5:00 p.m, New

York City time.

RISK

FACTORS

An

investment in these securities involves a high degree of risk. We operate in a dynamic industry that involves numerous risks and

uncertainties. You should carefully consider the factors described below, together with all of the other information contained

in this prospectus, including the audited and unaudited financial statements and the related notes included elsewhere in this

prospectus, before deciding whether to invest in the ADSs. The following risks may adversely affect our business, financial condition,

operating results and cash flows and cause the trading price of the ADSs to decline, and you could lose all or part of your investment.

Risks

Related to Our Financial Position and Capital Requirements

We

are a clinical stage biopharmaceutical company with a history of operating losses, are not currently profitable, do not expect

to become profitable in the near future and may never become profitable.

We

are a clinical stage biopharmaceutical company that was incorporated in 2003. Since our incorporation, we have primarily focused

our efforts on research and development and clinical trials of our product candidate, M-001. M-001 is in clinical trials and has

not yet been approved for commercial sale. We may not receive the necessary regulatory approvals to commercialize our product

candidate. We are not profitable and have incurred losses since inception, principally as a result of research and development,

clinical trials and general administrative expenses in support of our operations. We have not generated any revenue, expect to

incur substantial losses for the foreseeable future and may never become profitable. For the years ended December 31, 2016, 2017

and 2018, we had net losses of $2,452, $9,220 and $23,407 thousands respectively, and we expect such losses to continue for the

foreseeable future. In addition, as of December 31, 2018, we had an accumulated deficit of approximately $56,335 thousands and

we expect to experience negative cash flow for the foreseeable future. As a result, we will ultimately need to generate significant

revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability

in the future. If M-001 fails in clinical trials or does not gain regulatory clearance or approval, or if M-001 does not achieve

market acceptance, we may never become profitable. Our failure to achieve or maintain profitability, or substantial delays in

achieving profitability, could negatively impact the value of the securities and our ability to raise additional financing. A

substantial decline in the value of the securities would also affect the price at which we could sell them to secure future funding,

which could dilute the ownership interest of current shareholders. Even if we achieve profitability in the future, we may not

be able to sustain profitability in subsequent periods. Accordingly, it is difficult to evaluate our business prospects. Moreover,

our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company in highly regulated

and competitive markets, such as the biopharmaceutical market, where regulatory approval and market acceptance of our products

are uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

We

will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed

could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

As

of December 31, 2018, we had approximately $20,246 thousands in cash and cash equivalents, a working capital of $14,688 thousands

and an accumulated deficit of $56,335 thousands. As of December 31, 2018, we had sufficient cash and cash commitments to fund

operations for at least 15 months if we do not raise additional capital. Since our inception, most of our resources have been

dedicated to the development of M-001. In particular, we have expended and believe that we will continue to expend significant

operating and capital expenditures for the foreseeable future developing M-001 and any future product candidate. These expenditures

will include, but are not limited to, costs associated with research and development, manufacturing, conducting clinical trials,

contracting CMOs, hiring additional management and other personnel and obtaining regulatory approvals, as well as commercializing

any products approved for sale. Furthermore, we incur additional costs associated with operating as a public company in the United

States. Because the outcome of our current Phase 3 clinical trials is highly uncertain, we cannot reasonably estimate the actual

amounts necessary to successfully complete the development and commercialization of our product candidates. We also expect to

incur additional costs for the purpose of conducting our ongoing and future clinical trials.

As

a result of these and other factors currently unknown to us, we will require additional funds, through public or private equity

or debt financings or non-dilutive sources or other sources, such as strategic partnerships and alliances and licensing arrangements.

In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe

we have sufficient funds for our current or future operating plans. A failure to fund these activities may harm our growth strategy,

competitive position, quality compliance and financial condition.

Our

future capital requirements depend on many factors, including:

|

|

●

|

the

scope, progress, results and costs of researching and developing M-001 and any future product candidate, and conducting preclinical

and clinical trials;

|

|

|

|

|

|

|

●

|

the

timing of, and the costs involved in, obtaining regulatory approvals for M-001 and any future product candidate;

|

|

|

|

|

|

|

●

|

the

cost of commercialization activities if any of M-001 and any future product candidate are approved for sale, including marketing,

sales and distribution costs;

|

|

|

|

|

|

|

●

|

the

cost of manufacturing of M-001 and any future product candidate and any products we successfully commercialize;

|

|

|

|

|

|

|

●

|

our

ability to establish and maintain strategic partnerships, licensing or other arrangements and the financial terms of such

agreements;

|

|

|

|

|

|

|

●

|

the

costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation

costs and the outcome of such litigation;

|

|

|

|

|

|

|

●

|

the

timing, receipt and amount of sales of, or royalties on, any future products;

|

|

|

|

|

|

|

●

|

the

expenses needed to attract and retain skilled personnel; and

|

|

|

|

|

|

|

●

|

any

product liability or other lawsuits related to any future products.

|

Additional

funds may not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available

to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other

research and development activities for M-001 or any future product candidate or delay, limit, reduce or terminate our establishment

of sales and marketing capabilities or other activities that may be necessary to commercialize M-001 or any future product candidate.

We have entered into a finance

contract with the European Investment Bank, or EIB, for the receipt of a loan of 20 million euros, which was extended to 24 million

euros as described in this prospectus, and into a security agreement and creation of a first ranking floating charge over all

assets of the Company in favor of EIB, and a breach of such finance contract or security agreement may cause EIB to exercise the

pledge and materialize certain of our assets.

We

entered into a finance contract, or the Finance Contract, with the European Investment Bank, or EIB, for the financing of up to

20 million euros, which was extended to 24 million euros as described in this prospectus, and up to 50% of the Company’s

expected cost of developing and marketing our product candidate, M-001. A description of the main provisions of the Finance Contract

is described in this prospectus. To the date of this prospectus, we have drawn down an amount of the loan equal to 20 million

euros.

We have also entered

into a security agreement, or the Security Agreement, whereby we created a first ranking floating charge over all of our assets

in favor of EIB, excluding assets and/or intellectual property rights subject to the license agreement with YEDA Research and

Development Company Limited. While intellectual property rights are excluded from the floating charge pledge, any breach of the

Finance Contract or the Security Agreement may cause the EIB to exercise the floating charge pledge and to materialize certain

of our assets at the time of such exercise.

Raising

additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights

to our technologies or product candidates.

We

may seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships

and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible

debt securities, the ownership interests of existing shareholders will be diluted, and the terms may include liquidation or other

preferences that adversely affect shareholder rights. Debt financing, if available, may involve agreements that include covenants

limiting or restricting our ability to take certain actions, such as incurring debt, making capital expenditures or declaring

dividends. If we raise additional funds through strategic partnerships, alliances and licensing arrangements with third parties,

we may have to relinquish valuable rights to our technologies or any product candidate, or grant licenses on terms that are not

favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to

delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market product

candidates that we would otherwise prefer to develop and market ourselves.

Risks

Related to Development, Clinical Testing and Regulatory Approval of M-001 and Any Future Product Candidate

We

have not yet commercialized any products, and we may never become profitable.

We

currently have one product candidate, M-001, in Phase 3 clinical development and no products on the market or close to entering

the market. We do not know when or if we will complete our product development efforts, obtain regulatory approval for M-001 or

successfully commercialize M-001. Even if we are successful in developing M-001 or any product candidate that we may develop in

the future (if any), we will not be successful unless such product gains market acceptance for appropriate indications at favorable

reimbursement rates. The degree of market acceptance of these products will depend on a number of factors, including, but not

limited to:

|

|

●

|

the

timing of regulatory approvals in the U.S. and other countries, and for the uses, we intend to pursue with respect to the

commercialization of M-001 or any future product candidate;

|

|

|

|

|

|

|

●

|

the

competitive environment;

|

|

|

|

|

|

|

●

|

the

establishment and demonstration in, and acceptance by, the medical community of the safety and clinical efficacy of our product

candidate and its potential advantages over other competitive products;

|

|

|

|

|

|

|

●

|

our

ability to enter into supply agreements with health organizations and governments around the world for the supply of our product

candidate or our ability to enter into strategic agreements with pharmaceutical and biopharmaceutical companies with strong

marketing and sales capabilities;

|

|

|

|

|

|

|

●

|

the

establishment of external, and potentially, internal, sales and marketing capabilities to effectively market and sell M-001

or any future product candidate in the United States, Israel, Europe and other jurisdictions;

|

|

|

|

|

|

|

●

|

the

adequacy and success of our distribution, sales and marketing efforts; and

|

|

|

|

|

|

|

●

|

the

pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations

and other plan administrators.

|

Physicians,

participants, third-party payors or the medical community in general may be unwilling to accept, utilize or recommend, and in

the case of third-party payors, cover payment for M-001 or any future product candidate. As a result, we are unable to predict

the extent of our future losses or the time required for us to achieve profitability, if at all. Even if we successfully develop

one or more products, we may not become profitable.

We

depend heavily on the success of our M-001. If we are unable to successfully complete our Phase 3 clinical trial for M-001 as

and when expected and obtain marketing approvals for M-001, or if thereafter we fail to commercialize M-001 or experience significant

delays in doing so, our business will be materially harmed.

We

have invested a significant portion of our efforts and financial resources in the development of M-001. There remains significant

risk that we will fail to successfully develop M-001 for any indication. We do not expect to have top line data from our pivotal

clinical efficacy Phase 3 trial for M-001 available until the end of 2020. The timing of the availability of such top-line data

and the completion of our pivotal clinical efficacy Phase 3 trial is dependent in part on our ability to locate and enroll a sufficient

number of eligible participants in our pivotal clinical efficacy Phase 3 trial on a timely basis. A significant delay in enrolment

would result in delays to our development timeline and additional development costs beyond what we have budgeted. If we ultimately

obtain favorable results from our pivotal clinical efficacy Phase 3 trial of M-001, we will submit application(s) for marketing

approval for M-001.

We

may experience numerous unforeseen events during, or as a result of, our Phase 3 clinical trial of M-001, that could delay or

prevent our ability to receive marketing approvals to commercialize M-001, including:

|

|

●

|

Possible

negative or inconclusive results, compelling us to conduct additional clinical trials or abandon product development programs;

|

|

|

●

|

Slower

or insufficient enrolment rate of trial participants than anticipated;

|

|

|

●

|

Higher

dropout rate of trial participants than anticipated;

|

|

|

●

|

Our

third party contactors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely

manner;

|

|

|

●

|

Regulators,

institutional review board or independent ethics committees may not authorize us or our investigators to commence a clinical

trial or conduct a clinical trial at a prospective trial site, or may require that we or our investigators suspend or terminate

clinical research for various reasons, including noncompliance with regulatory requirements or a finding that the participants

are being exposed to unacceptable health risks;

|

|

|

●

|

The

cost of clinical trials of our product candidate may be greater than we anticipate;

|

|

|

●

|

The

supply or quality of our product candidate or other materials necessary to conduct clinical trials may be insufficient or

inadequate; and

|

|

|

●

|

Our

M-001 may have undesirable side effects or other unexpected characteristics, causing us or our investigators, regulators,

institutional review board or independent ethics committees to suspend or terminate the trial(s).

|

|

|

●

|

The

naturally occurring influenza attack rate may be lower than anticipated, thereby compelling us to increase the number of trial

participants and/or extend the trial to an additional season, as per our flexible enrollment trial protocol design.

|

We

may not develop additional product candidates other than M-001.

M-001

is our only product candidate in development. Other than M-001, we may not develop additional product candidates based on our

research and know-how and we may never attempt to develop other peptide-based products. As a result, our business and future success

depends on our ability to obtain regulatory approval of and then successfully commercialize M-001.

We

may never receive FDA regulatory approval for the performance of Phase 3 clinical trials in the U.S.

We

have entered into a pivotal clinical efficacy phase 3 trial in Europe and a clinical trial agreement with NIAID, for a Phase 2

clinical trial in the U.S. using M-001, for which the first participants were enrolled in 2018. We intend, subject to the successful

results of our Phase 3 clinical trial in Europe, to enter into discussions with the FDA, regarding market approval of M-001 in

the U.S., and to comply with the applicable requirements. Although we believe that the previous approved preclinical and clinical

trials we performed will serve as an adequate basis for future FDA regulated clinical trials in the U.S., we may not receive FDA

approval to conduct Phase 3 clinical trials in the U.S. Failure to receive FDA approval to conduct Phase 3 clinical trials in

the U.S. will materially reduce our target market and the future profitability of M-001, may have a material adverse effect on

our business and could potentially cause us to cease operations. It is also possible that we may decide or that the FDA may require

that we conduct further clinical trials, provide additional data and information, and meet additional standards for receipt of

approval. If this were to occur, the time and financial resources required for obtaining FDA approval for Phase 3 clinical trials,

and complications and risks associated therewith, would likely substantially increase. Moreover, while receipt of clinical trial

approval by the FDA does not ensure the receipt of clinical trial approval in other countries, failure or delay in obtaining clinical

trial approval by the FDA may have a negative effect on the regulatory process in other countries. Any failure or any delay or

setback in obtaining clinical trial approval in the U.S. or in other countries would impair our ability to develop and commercialize

M-001.

M-001

is subject to extensive regulation and may never obtain regulatory approval.

M-001

must satisfy rigorous standards of safety and efficacy before it can be approved for commercial use by the FDA or foreign regulatory

authorities for all or any of the indications for which it has undergone or is planned to undergo testing. The FDA and foreign

regulatory authorities have full discretion over this approval process. We may need to conduct significant additional research,

including testing in animals and in humans, before we can file applications for product approval. Typically, in the pharmaceutical

industry, there is a high rate of attrition for product candidates in preclinical testing and clinical trials. Satisfying FDA

and foreign regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product

and requires the expenditure of substantial resources. Success in preclinical testing and early clinical trials does not ensure

that later clinical trials will be successful. For example, a number of companies in the pharmaceutical industry have suffered

significant setbacks in advanced clinical trials, even after promising results in earlier trials. In addition, delays or rejections

may be encountered based upon additional government regulation, including any changes in legislation or EMA, FDA or foreign regulatory

policy, during the process of product development, clinical trials and regulatory reviews. Failure to obtain EMA, FDA or foreign

regulatory approval of M-001 in a timely manner or at all will severely undermine our business by delaying or halting commercialization

of our products, imposing costly procedures, diminishing competitive advantages and reducing the number of saleable products and,

therefore, corresponding product revenues.

M-001

and any product candidate we may develop in the future will remain subject to ongoing regulatory requirements even if we receive

regulatory approval to market such product, and if we fail to comply with such requirements, we may not obtain such approvals

or could lose those approvals that have been obtained, and the sales of any approved commercial products could be suspended.

Even

if we receive regulatory approval to market M-001 and/or other product candidates, any such product will remain subject to extensive

regulatory requirements, including requirements relating to manufacturing, labeling, packaging, adverse event reporting, storage,

advertising, promotion, distribution and record keeping. Even if regulatory approval of a product is granted, the approval may

be subject to limitations on the uses for which the product may be marketed or the conditions of approval, or may contain requirements

for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product, which could negatively impact

us or our collaboration partners by reducing revenues or increasing expenses, and cause the approved product candidate not to

be commercially viable. In addition, as clinical experience with a drug expands after approval, typically because it is used by

a greater number and more diverse group of people after approval than during clinical trials, side effects and other problems

may be observed over time after approval that were not seen or anticipated during pre-approval clinical trials or other studies.

Any adverse effects observed after the approval and marketing of a product candidate could result in limitations on the use of,

withdrawal of FDA or foreign regulatory approval or withdrawal of any approved products from the marketplace. Absence of long-term

safety data may also limit the approved uses of our products, if any. If we fail to comply with the regulatory requirements of

the FDA and other applicable U.S. and foreign regulatory authorities, or previously unknown problems with any approved commercial

products, manufacturers or manufacturing processes are discovered, we could be subject to administrative or judicially imposed

sanctions or other setbacks, including, without limitation, the following:

|

|

●

|

suspension

or imposition of restrictions on the products, manufacturers or manufacturing processes, including costly new manufacturing

requirements;

|

|

|

●

|

civil

or criminal penalties, fines and/or injunctions;

|

|

|

●

|

product

seizures or detentions;

|

|

|

●

|

import

or export bans or restrictions;

|

|

|

●

|

voluntary

or mandatory product recalls and related publicity requirements;

|

|

|

●

|

suspension

or withdrawal of regulatory approvals;

|

|

|

●

|

total

or partial suspension of production; and

|

|

|

●

|

refusal

to approve pending applications for marketing approval of new products or supplements to approved applications.

|

If

we or our collaborators are slow to adapt, or are unable to adapt, to changes in existing regulatory requirements or adoption

of new regulatory requirements or policies, marketing approval for our product candidates may be lost or cease to be achievable,

resulting in decreased revenue from milestones, product sales or royalties, which would have a material adverse effect on our

business, financial condition or results of operations.

If

clinical trials for M-001 are prolonged or delayed, we would be unable to commercialize our M-001 on a timely basis, which would

require us to incur additional costs and delay our receipt of any revenues from potential M-001 sales.

We

cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause

us or any regulatory authority to delay or suspend those clinical trials or delay the analysis of data derived from them. A number

of events, including any of the following, could delay the completion of our ongoing and planned clinical trials and negatively

impact our ability to obtain regulatory approval for, and to market and sell, a particular product candidate:

|

|

●

|

conditions

imposed on us by the FDA or any applicable foreign regulatory authority regarding the scope or design of our clinical trials;

|

|

|

●

|

delays

in recruiting and enrolling participants or volunteers into clinical trials;

|

|

|

|

|

|

|

●

|

delays

in obtaining, or our inability to obtain, required approvals from institutional review boards or other reviewing entities

at clinical sites selected for participation in our clinical trials;

|

|

|

|

|

|

|

●

|

insufficient

supply or deficient quality of our product candidates or other materials necessary to conduct our clinical trials;

|

|

|

|

|

|

|

●

|

lower

than anticipated retention rate of subjects and participants in clinical trials;

|

|

|

|

|

|

|

●

|

negative

or inconclusive results from clinical trials, or results that are inconsistent with earlier results, that necessitate additional

clinical studies;

|

|

|

|

|

|

|

●

|

serious

and unexpected drug-related side effects experienced by subjects and participants in clinical trials; or

|

|

|

|

|

|

|

●

|

failure

of our third-party contractors to comply with regulatory requirements or otherwise meet their contractual obligations to us

in a timely manner.

|

Clinical

trials require sufficient participant enrollment, which is a function of many factors, including the size of the participant population,

the nature of the trial protocol, the proximity of participants to clinical sites, the availability of effective treatments for

the relevant disease and the eligibility criteria for the clinical trial. Delays in participant enrollment can result in increased

costs and longer development times. The failure to enroll participants in a clinical trial could delay the completion of the clinical

trial beyond our current expectations. In addition, the FDA or foreign applicable regulatory authorities could require us to conduct

clinical trials with a larger number of subjects than we have projected for any of our product candidates. We may not be able

to enroll a sufficient number of participants in a timely or cost-effective manner. Furthermore, enrolled participants may drop

out of clinical trials, which could impair the validity or statistical significance of those clinical trials.

Prior

to commencing clinical trials in the United States, we must submit an IND application to the FDA and the IND application must

become effective.

We

do not know whether additional clinical trials will begin as planned, will need to be restructured or will be completed on schedule,

if at all. Delays in our clinical trials will result in increased development costs for M-001. In addition, if our clinical trials

are delayed, our competitors may be able to bring products to market before we do and the commercial viability of M-001 or any

other future candidates could be limited.

Clinical

trials are very expensive, time-consuming and difficult to design and implement, and, as a result, we may suffer delays or suspensions

in future trials which would have a material adverse effect on our ability to generate revenues

Human

clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory

requirements. Regulatory authorities, such as the EMA and FDA, may preclude clinical trials from proceeding. Additionally, the

clinical trial process is time-consuming, failure can occur at any stage of the trials and we may encounter problems that cause