Climate Forces Oil Cos to Improve

Efficiency

May 3, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

Oil has climbed more than 40% this year, underpinned mainly by

production cuts from the OPEC-led group of exporters, and drop in

supply from Venezuela and Iran. The so-called OPEC+ deal (an

alliance of OPEC, Russia and other non-member countries) is

withholding output by around 1.2 million barrels per day until the

end of June. U.S. sanctions against Venezuela and Iran also

continue to tighten the commodity’s fundamentals.

Meanwhile, natural gas prices rebounded slightly from their

three-year lows despite a government report showing

higher-than-expected increase in supplies. The gain could be

attributed to weather-associated tailwinds that might lead to

robust heating demand. While the fundamentals of natural gas

consumption continue to be favorable, record high production in the

United States and expectations for explosive growth through 2020

means that supply will keep pace with demand.

One oil & gas exploration deal that has done a great job

improving its efficiency over the past 12 months and is set to

complete a major deal is Camber Energy (AMEX:

CEI). CEI has worked very hard recently to

improve their standing with the NYSE American, and spent a lot of

2018 cleaning up its balance sheet and improving its

efficiency. Their hard work is starting to receive

recognition as CEI received a letter from the NYSE American about

regaining several of their continued listing standards.

WHY NOW? The company is set to close on an acquisition

within the next couple weeks. It has already received

preliminary non-binding approval from the staff of the NYSE

American of the planned terms of its contemplated acquisition of

Lineal Star Holdings www.LinealStar.com in an all-stock

transaction. Lineal's primary operating subsidiary has been

in the pipeline integrity, construction and services industry for

64 years. It has Master Service Agreements in Pennsylvania, Ohio

and West Virginia, with planned growth in Texas, the Gulf South and

the Mid-Continent. Today, it announced that it has entered

into a revised letter of intent with Lineal Star Holdings.

Today we’re highlighting: Camber Energy, Inc. (AMEX:

CEI), Obsidian Energy Ltd. (OBE), Diamond Offshore Drilling,

Inc. (NYSE:

DO), BP Prudhoe Bay Royalty Trust (NYSE:

BPT), and Pacific Ethanol, Inc. (NASDAQ:

PEIX).

Camber Energy, Inc. (AMEX:

CEI) (Market Cap:

$6.23M;

Share Price: $0.3117)

turned a nearly $30 million shareholder deficit into $2.3 million

of positive shareholders’ equity, increasing liquidity,

extinguishing debt and fast tracking the company for regaining NYSE

American compliance. Investors are starting to show support

to management’s progress and as more investors learn the story, the

trend could continue. Oil & Gas investors seeking

competent fiscal management and efficient operations should

research CEI.

_________

Obsidian Energy Ltd. (OBE) (Market

Cap:

$141.265M;

Share Price

$0.2800) announced an

operational update on its Cardium drilling program on April

16. “We are examining every facet of the business to ensure

we are always making improvements, including a continual review of

our capital allocation, cost structure, and portfolio composition."

commented Michael Faust, Interim President and CEO.

Obsidian Energy Ltd. explores for, develops, and produces oil

and natural gas in western Canada. It holds interests in the

Alberta Viking, Cardium, Deep Basin, and Peace River areas. The

company was formerly known as Penn West Petroleum Ltd. and changed

its name to Obsidian Energy Ltd. in June 2017. Obsidian

Energy Ltd. was founded in 1979 and is headquartered in Calgary,

Canada.

________

Diamond Offshore Drilling, Inc. (NYSE:

DO) (Market Cap:

$1.239B;

Share Price:

$9.00) recently reported

results for the first quarter of 2019. “We had a solid start to the

year with fleet-wide operational efficiency of 97% and zero

recordable incidents for the first quarter," said Marc Edwards,

President and Chief Executive Officer. As of April 1, 2019, the

company's total contracted backlog was $1.8 billion, which excludes

over $450 million of backlog secured in April 2019 associated with

the Ocean BlackRhino, Ocean BlackHawk and Ocean GreatWhite

contracts discussed above and a $135 million margin commitment from

one of the Company's customers.

Diamond Offshore Drilling, Inc. provides contract drilling

services to the energy industry worldwide. The company

operates a fleet of 17 offshore drilling rigs, including 4 drill

ships and 13 semisubmersible rigs. It serves independent oil

and gas companies, and government-owned oil companies. The

company was founded in 1953 and is headquartered in Houston, Texas.

Diamond Offshore Drilling, Inc. operates as a subsidiary of Loews

Corporation.

________

BP Prudhoe Bay Royalty Trust (NYSE:

BPT) (Market Cap: $409.81M; Share Price:

$19.15) announced in April the dividend information

for the First Quarter of 2019 as follows:

|

|

|

|

|

|

|

|

Ex-Dividend Date:

|

|

|

|

|

April 15, 2019

|

|

Record Date:

|

|

|

|

|

April 16, 2019

|

|

Payable Date:

|

|

|

|

|

April 22, 2019

|

|

|

|

|

|

|

|

|

Dividend Rate:

|

|

|

|

|

$0.3449262 per Unit*

|

|

|

|

|

|

|

|

*Actual average daily production for the quarter was 77,371

BBLS.

Any questions, please feel free to contact The Bank of New York

Mellon Trust Company, N.A. at 713-483-6020.

BP Prudhoe Bay Royalty Trust operates as a grantor trust in the

United States. The company holds overriding royalty interest

comprising a non-operational interest in minerals in the Prudhoe

Bay oil field located on the North Slope of Alaska. The

Prudhoe Bay field extends approximately 12 miles by 27 miles and

contains approximately 150,000 gross productive acres.

________

Pacific Ethanol, Inc. (NASDAQ:

PEIX) (Market Cap: $50.847M; Share Price:

$1.04) announced in March that Pacific Ethanol Pekin,

LLC and Kinergy Marketing LLC, each a direct or indirect

wholly-owned subsidiary of Pacific Ethanol, Inc., entered into

amendments to their credit agreements and related agreements with

their respective lenders which returns Pekin to full compliance

with its credit facility and provides additional liquidity under

the Kinergy credit agreement to help facilitate the company’s

strategic initiatives.

Pacific Ethanol, Inc. produces and markets low-carbon renewable

fuels and alcohol products in the United States. The company

operates in two segments, Production and Marketing. It

produces and markets ethanol and co-products, such as wet and dry

distillers’ grains, wet and dry corn gluten feed, condensed

distillers soluble, corn gluten meal, corn germ, corn oil,

distillers- yeast, and CO2, as well as markets ethanol produced by

third parties.

________

Signed by

Priyanka Goel, CFA

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a six-month term

consulting agreement with CEI dated 11/15/18. The agreement

calls for $28,000 in cash, and 200,000 restricted 144 shares of CEI

per month. Regal Consulting and CEI have agreed to

amend the current agreement and extend it until October 2019, the

amendment calls for $50,000 in cash, and 50,000 restricted 144

shares of CEI. All payments were made directly by Camber

Energy, Inc. to Regal Consulting, LLC. to provide investor

relations services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. CEI was

given an opportunity to edit this article. This article

contains forward-looking statements that are subject to certain

risks and uncertainties that could cause actual results to differ

materially from any results predicted herein. Regal

Consulting is not registered with any financial or securities

regulatory authority, and does not provide or claim to provide

investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

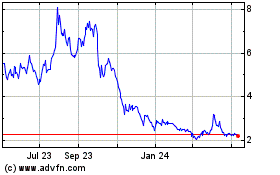

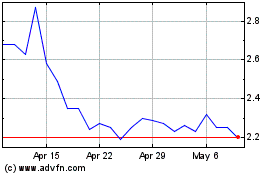

BP Prudhoe Bay Royalty (NYSE:BPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

BP Prudhoe Bay Royalty (NYSE:BPT)

Historical Stock Chart

From Apr 2023 to Apr 2024