Report of Foreign Issuer (6-k)

May 03 2019 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2019

Commission File No. 001-32500

TANZANIAN GOLD CORPORATION

(Translation of registrant’s name into English)

82 Richmond Street East, Suite 200, Toronto, Ontario M5C 1P1 Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under

the cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(7): ☐

On May 2, 2019, Tanzanian Gold Corporation (the

"Company") filed a prospectus supplement ("Supplement") pursuant to which the Company may offer and sell,

from time to time, through R.F. Lafferty Co., Inc., as sales agent ("R.F. Lafferty "), up to an aggregate of

$3,000,000 of common shares, no par value per share (the "Shares"), under the Sales Agreement dated May 2, 2019

with the Company (the "Agreement"). Under the Agreement, R.F. Lafferty may sell Shares by any method deemed to be

an "at-the-market" offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended,

including sales made directly on the NYSE American, on any other existing trading market for the Shares or to or through a

market maker. In addition, pursuant to the terms and conditions of the Agreement and subject to the instructions of the

Company, R.F. Lafferty may sell Shares by any other method permitted by law, including in negotiated transactions.

The Company intends to use the net proceeds of this offering for

its drilling program at the Buckreef Project, for working capital and for other general corporate purposes. Although the Company

intends to use the net proceeds of this offering for the foregoing purposes, the planned expenditures are estimates and may change

significantly. Subject to the terms and conditions of the Agreement, R.F. Lafferty will use commercially reasonable efforts, consistent

with its normal trading and sales practices and applicable state and federal law, rules and regulations and the rules of the NYSE

American, to sell the Shares from time to time based upon the Company's instructions, including any price, time or size limits

or other customary parameters or conditions the Company may impose.

The Company will pay R.F. Lafferty a commission of 3.0% of the aggregate

gross proceeds from each sale of Shares and has agreed to provide R.F. Lafferty with customary indemnification and contribution

rights. The Company has also agreed to reimburse R.F. Lafferty for legal fees and disbursements in connection with entering into

the Agreement.

The opinion of Miller Thomson, LLP regarding the validity of the

Shares that will be issued pursuant to the Agreement is also filed herewith as Exhibit 5.1.

The Shares will be issued pursuant to the Company's previously filed

and effective Registration Statement on Form F-3 (File No. 333-226949) filed with the Securities and Exchange Commission (the "SEC").

This Report on Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy Shares, nor shall there be

any sale of the Shares in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or jurisdiction.

Cautionary Statement Regarding Forward-Looking Statements

This Report on Form 6-K contains forward-looking statements. Forward-looking

statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions

and other statements that are other than statements of historical facts, such as statements regarding the sale of Shares under

the Agreement, if any, the intended use of proceeds, as well as termination of the Agreement. The statements in this Report related

to the completion, timing and size of the offering are “forward-looking” statements. These forward-looking statements

are based upon the Company’s current expectations. Forward-looking statements involve risks and uncertainties. The Company’s

actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a

result of these risks and uncertainties, which include, without limitation, risks related to market conditions and the satisfaction

of customary closing conditions related to the offering. There can be no assurance that the Company will be able to complete the

offering on the anticipated terms, or at all. These statements are subject to uncertainties and risks including, but not limited

to the risks identified in reports filed from time to time with the SEC. All such forward-looking statements are expressly qualified

by these cautionary statements and any other cautionary statements which may accompany the forward-looking statements. In addition,

we disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

Incorporation by Reference

The information set forth in this report on Form 6-K, including the

exhibits hereto (excluding Exhibit 99.1), is hereby incorporated by reference into the Company’s Registration Statement on

Form F-3 as filed on August 20, 2018, and declared effective on September 5, 2018 (No. 333-226949).

Exhibits

The following exhibits are filed as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Tanzanian Gold Corporation

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

/s/ James E. Sinclair

|

|

|

|

James E. Sinclair

|

|

|

|

Executive Chairman

|

Date: May 3, 2019

3

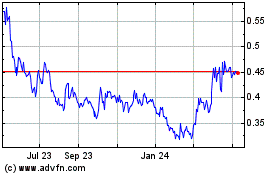

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Apr 2023 to Apr 2024