Datametrex Reports 2018 Financial Results

April 30 2019 - 8:01PM

Datametrex AI Limited (the “

Company” or

“

Datametrex”) (

TSXV: DM, FSE:

D4G) announces its 2018 audited annual consolidated

financial statements, notes hereto, and management’s discussion and

analysis in respect of the annual consolidated financial

statements.

The revenue in 2018 was $2,230,296 compared to

$228,019 in the previous year, an increase of 878%. The net loss in

2018 was ($19,399,366) compared to ($5,319,339) in the previous

year, resulting in an increase of (265%). The Adjusted EBITDA was

($2,610,992) compared to ($3,244,101), thereby improving by

20%.

“We achieved key milestones in 2018, including;

the successful spin-out of Graph Blockchain Inc. (CSE: GBLC) in the

fourth quarter of 2018, restructuring Nexalogy, additional sales to

our Canadian Federal Government clients, achieving vendor status

with the United States Federal Government, generating revenues from

Asia with multi-national clients including LOTTE, initiating new

product development including our AI Agent and Fake News Filter

which will be commercial in 2019. I am proud of the work our team

accomplished in 2018, despite the challenging markets we were able

to stay focused on building our AI and Machine Learning division

and act swiftly to reduce additional financial exposure to the

crypto markets as it imploded around us. We now have the team in

place and product roadmap required to take advantage of the

technology platform we own,” says Andrew Ryu, CEO and Chairman of

the Company.

Financial

Highlights

The following table summarizes revenue, net

loss, EBITDA* and Adjusted EBITDA* for the year ended December 31,

2018 and 2017.

| |

|

|

|

|

|

December 31, 2018 |

December 31, 2017 |

% Increase |

|

|

$ |

$ |

|

| Revenue |

2,230,296 |

228,019 |

878% |

| Net

loss |

(19,399,366) |

(5,319,339) |

-265% |

|

EBITDA¹ * |

(17,082,721) |

(5,239,222) |

-226% |

| EBITDA per

share |

(0.086) |

(0.070) |

-23% |

| Adjusted

EBITDA² * |

(2,610,992) |

(3,244,101) |

20% |

| Adjusted EBITDA

per share |

(0.013) |

(0.044) |

70% |

|

|

|

|

|

| |

|

|

|

| ¹ EBITDA (non-IFRS measures) is calculated as Net

Loss ($19,399,366) adjusted for 1. Income taxes of $648,983, 2.

Depreciation and amortization of $2,835,109, and 3. Interest and

accretion of $130,519. |

| |

| ² Adjusted EBITDA (non-IFRS measures) is

calculated as EBITDA noted above adjusted for 1. Impairment of

$12,915,925 mainly relating to Ronin Blockchain Corp. and the

Cryptocurrency Mining segment, and 2. Share based compensation of

$1,555,804. |

| |

Andrew Ryu, CEO and Chairman of the Company also

commented: “We will continue to pursue opportunities that create

shareholder value utilizing our Big Data, Artificial Intelligence,

and Blockchain platforms. We see tremendous potential in these

sectors and are highly optimistic in our ability to position the

Company for growth.”

The filings, along with additional information

regarding the Company, are available on SEDAR at www.sedar.com.

About Datametrex AI Limited

Datametrex AI Limited is a technology focused

company with exposure to Artificial Intelligence and Machine

Learning through its wholly owned subsidiary, Nexalogy

(www.nexalogy.com) and Implementing Blockchain technology for

secure Data Transfers through its investee company, Graph

Blockchain (www.graphblockchain.com).

Additional information on Datametrex is

available at: www.datametrex.com

To stay informed about Datametrex,

please join our Investor Group on 8020

Connect http://bit.ly/2fPUNwF for all upcoming news

releases, articles comments and questions.

For further information, please

contact:

Jeffrey Stevens – President & COOPhone:

(647) 400-8494Email: jstevens@datametrex.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

EBITDA and Adjusted EBITDA*

Management believes that EBITDA and Adjusted

EBITDA are effective measures for analyzing the performance of the

Company. The term “EBITDA” refers to earnings before deducting

interest, taxes, depreciation and amortization. The Company

calculates Adjusted EBITDA as earnings before deducting interest

and accretion, taxes, depreciation and amortization, impairment

charges, listing expense, other reverse take-over fees, acquisition

related costs, and share based compensation. “EBITDA”, “EBITDA per

share”, “Adjusted EBITDA”, and “Adjusted EBITDA per share” are

non-GAAP measures. The Company believes that Adjusted EBITDA is

useful additional information to management, the Board and

investors as it provides an indication of the operational results

generated by its business activities prior to taking into

consideration how those activities are financed and taxed and also

prior to taking into consideration asset depreciation and

amortization and it excludes items that could affect the

comparability of our operational results and could potentially

alter the trends analysis in business performance. Excluding these

items does not necessarily imply they are non-recurring, infrequent

or unusual. Adjusted EBITDA is also used by some investors and

analysts for the purpose of valuing a company. Investors are

cautioned that Adjusted EBITDA should not be construed as an

alternative to operating earnings or net earnings determined in

accordance with IFRS as an indicator of the Company’s financial

performance or as a measure of the Company’s liquidity and cash

flows. Adjusted EBITDA does not take into account the impact of

working capital changes, capital expenditures, debt principal

reductions and other sources and uses of cash, which are disclosed

in the consolidated statements of cash flows.

Forward-Looking Statements

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws. Forward-looking information is not a guarantee of future

performance or results, since it involves risks and uncertainties.

There is no assurance that forward-looking statements will prove to

be accurate, and actual results and future events could differ

materially from those anticipated in forward-looking statements.

Except as required by law, the Company does not assume and

expressly renounces any obligation to update any forward-looking

information, which is only applicable on the date on which it is

given.

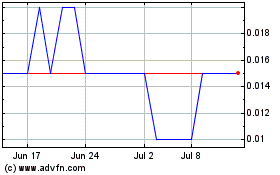

DataMetrex AI (TSXV:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

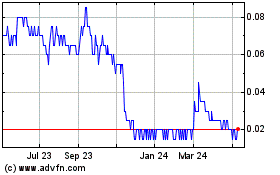

DataMetrex AI (TSXV:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024