Texas Roadhouse, Inc. Announces First Quarter 2019 Results

April 29 2019 - 4:03PM

Texas Roadhouse, Inc. (NasdaqGS: TXRH), today announced financial

results for the 13 week period ended March 26, 2019.

| |

First Quarter |

| ($000's) |

|

2019 |

|

|

2018 |

|

% Change |

| |

|

|

|

|

|

| Total revenue |

$ |

690,608 |

|

$ |

627,705 |

|

10.0 |

% |

| Income from

operations |

|

60,445 |

|

|

64,871 |

|

(6.8 |

%) |

| Net income |

|

50,390 |

|

|

54,541 |

|

(7.6 |

%) |

| Diluted EPS |

$ |

0.70 |

|

$ |

0.76 |

|

(8.1 |

%) |

| |

|

|

|

|

|

|

|

|

Results for the first quarter included the

following highlights:

- Comparable restaurant sales increased 5.2% at company

restaurants and 4.3% at domestic franchise restaurants;

- Restaurant margin, as a percentage of restaurant and other

sales, decreased 128 basis points to 17.9%, primarily due to labor

costs which increased 118 basis points. Restaurant margin

dollars increased 2.7% to $122.6 million from $119.4 million in the

prior year;

- Diluted earnings per share decreased 8.1% to $0.70 from $0.76

in the prior year primarily due to higher general and

administrative expenses and higher depreciation and amortization

expense, partially offset by higher restaurant margin dollars;

and

- Four Texas Roadhouse company restaurants were opened and two

international franchise restaurants were opened.

Scott Colosi, President of Texas Roadhouse, Inc., commented,

“Our top-line momentum continued this quarter highlighted by

comparable restaurant sales growth of 5.2%. Despite our

ongoing sales strength, our profits continue to be pressured by

higher labor costs. Much of the labor increase was driven by

wage rate and other labor inflation that currently does not show

signs of abating. As a result, we are updating our labor

inflation expectations for 2019. The additional 1.5% of

pricing we put in place at the beginning of the second quarter will

provide a significant benefit for the remainder of 2019.

While we are certainly facing some challenges in our business right

now, I have no doubt that our brand positioning is stronger than

ever.”

Kent Taylor, Chief Executive Officer of Texas Roadhouse, Inc.,

commented, “I am proud of our operators who continue to be

committed to actively protecting the guest experience and taking

care of our employees in this very competitive labor market.

We will continue to manage our business with a long-term view that

includes growing average unit volumes from just over $5.0 million

to $6.0 million in the coming years. We believe this

approach, along with the strength of our operations and our

legendary brand, well positions our business for long-term sales

and profit growth.”

2019 Outlook

Comparable restaurant sales at company

restaurants for the first four weeks of our second quarter of

fiscal 2019 increased approximately 2.9% compared to the prior year

period.

Management updated the following expectation for

2019:

- Approximately 7.0% to 8.0% growth in total labor dollars per

store week.

Management reiterated the following expectations

for 2019:

- Positive comparable restaurant sales growth including a menu

price increase of approximately 1.5% implemented at the beginning

of the second quarter;

- 25 to 30 company restaurant openings, including as many as four

Bubba’s 33 restaurants;

- Commodity cost inflation of approximately 1.0% to 2.0%;

- An income tax rate of approximately 15.0%; and

- Total capital expenditures of approximately $210 million to

$220 million.

Non-GAAP Measures

We prepare our consolidated financial statements

in accordance with U.S. generally accepted accounting principles

(“GAAP”). Within our press release, we make reference to

restaurant margin (in dollars and as a percentage of sales).

Restaurant margin represents restaurant and other sales less

restaurant-level operating costs, including cost of sales, labor,

rent and other operating costs. Restaurant margin should not

be considered in isolation, or as an alternative, to income from

operations. This non-GAAP measure is not indicative of

overall company performance and profitability in that this measure

does not accrue directly to the benefit of shareholders due to the

nature of the costs excluded. Restaurant margin is widely

regarded as a useful metric by which to evaluate restaurant-level

operating efficiency and performance. In calculating

restaurant margin, we exclude certain non-restaurant-level costs

that support operations, including pre-opening and general and

administrative expenses, but do not have a direct impact on

restaurant-level operational efficiency and performance. We

also exclude depreciation and amortization expense, substantially

all of which relates to restaurant-level assets, as it represents a

non-cash charge for the investment in our restaurants. We

also exclude impairment and closure expense as we believe this

provides a clearer perspective of ongoing operating performance and

a more useful comparison to prior period results. Restaurant

margin as presented may not be comparable to other similarly titled

measures of other companies in our industry. A reconciliation

of income from operations to restaurant margin is included in the

accompanying financial tables.

Conference Call

Texas Roadhouse is hosting a conference call

today, April 29, 2019 at 5:00 p.m. Eastern Time to discuss these

results. The dial-in number is (877) 699-0953 or (647)

689-5456 for international calls. A replay of the call will

be available for one week following the conference call. To

access the replay, please dial (800) 585-8367 or (416) 621-4642 for

international calls, and use 4384729 as the pass code. There

will be a simultaneous Web cast conducted at

www.texasroadhouse.com.

About the Company

Texas Roadhouse is a casual dining concept that

first opened in 1993 and today has grown to over 590 restaurants

system-wide in 49 states and ten foreign countries. For more

information, please visit the Company’s Web site at

www.texasroadhouse.com.

Forward-looking Statements

Certain statements in this release that are not

historical facts, including, without limitation, those relating to

our anticipated financial performance, are forward-looking

statements that involve risks and uncertainties. Such

statements are based upon the current beliefs and expectations of

the management of Texas Roadhouse. Actual results may vary

materially from those contained in forward-looking statements based

on a number of factors including, without limitation, the actual

number of restaurants opening; the sales at these and our other

company and franchise restaurants; changes in restaurant

development or operating costs, such as food and labor; our ability

to acquire franchise restaurants; our ability to integrate the

franchise restaurants we acquire or other concepts we develop; our

ability to continue to generate the necessary cash flows to fund

our new restaurant growth, continue our share repurchase program

and pay a quarterly cash dividend; strength of consumer spending;

pending or future legal claims; breaches of security; conditions

beyond our control such as weather, natural disasters, disease

outbreaks, epidemics or pandemics impacting our customers or food

supplies; food safety and food-borne illness concerns; acts of war

or terrorism and other factors disclosed from time to time in our

filings with the U.S. Securities and Exchange Commission.

Investors should take such risks into account when making

investment decisions. Shareholders and other readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are

made. We undertake no obligation to update any

forward-looking statements.

Contacts:

Investor RelationsTonya Robinson(502)

515-7269

MediaTravis Doster(502) 638-5457

| Texas Roadhouse, Inc. and

Subsidiaries |

| Condensed Consolidated Statements of

Income |

| (in thousands, except per share

data) |

| (unaudited) |

| |

|

|

|

|

| |

|

| |

13 Weeks Ended |

| |

March 26, 2019 |

|

March 27, 2018 |

| |

|

|

|

|

| Revenue: |

|

|

|

|

| Restaurant and other

sales |

$ |

685,117 |

|

|

$ |

622,402 |

|

| Franchise

royalties and fees |

|

5,491 |

|

|

|

5,303 |

|

| |

|

|

|

|

| Total revenue |

|

690,608 |

|

|

|

627,705 |

|

| |

|

|

|

|

| Costs and

expenses: |

|

|

|

|

| Restaurant

operating costs (excluding depreciation and amortization shown

separately below): |

|

|

|

|

| |

|

|

|

|

| Cost of

sales |

|

223,712 |

|

|

|

202,786 |

|

|

Labor |

|

223,880 |

|

|

|

196,030 |

|

| Rent |

|

13,128 |

|

|

|

11,851 |

|

| Other

operating |

|

101,802 |

|

|

|

92,378 |

|

|

Pre-opening |

|

3,868 |

|

|

|

5,044 |

|

|

Depreciation and amortization |

|

27,773 |

|

|

|

24,484 |

|

|

Impairment and closure |

|

17 |

|

|

|

86 |

|

| General

and administrative |

|

35,983 |

|

|

|

30,175 |

|

| |

|

|

|

|

| Total costs and

expenses |

|

630,163 |

|

|

|

562,834 |

|

| |

|

|

|

|

| Income from

operations |

|

60,445 |

|

|

|

64,871 |

|

| |

|

|

|

|

| Interest income

(expense), net |

|

754 |

|

|

|

(359 |

) |

| Equity income from

investments in unconsolidated affiliates |

|

113 |

|

|

|

324 |

|

| |

|

|

|

|

| Income before

taxes |

|

61,312 |

|

|

|

64,836 |

|

| Provision for income

taxes |

|

9,119 |

|

|

|

8,457 |

|

| |

|

|

|

|

| Net income including

noncontrolling interests |

|

52,193 |

|

|

|

56,379 |

|

| Less: Net income

attributable to noncontrolling interests |

|

1,803 |

|

|

|

1,838 |

|

| Net income attributable

to Texas Roadhouse, Inc. and subsidiaries |

$ |

50,390 |

|

|

$ |

54,541 |

|

| |

|

|

|

|

| Net income per common

share attributable to Texas Roadhouse, Inc. and subsidiaries: |

|

|

|

|

|

Basic |

$ |

0.70 |

|

|

$ |

0.76 |

|

|

Diluted |

$ |

0.70 |

|

|

$ |

0.76 |

|

| |

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

Basic |

|

71,753 |

|

|

|

71,333 |

|

|

Diluted |

|

72,187 |

|

|

|

71,805 |

|

| |

|

|

|

|

| Cash dividends declared

per share |

$ |

0.30 |

|

|

$ |

0.25 |

|

| |

|

|

|

|

|

|

|

| Texas Roadhouse, Inc. and

Subsidiaries |

| Condensed Consolidated Balance

Sheets |

| (in thousands) |

| (unaudited) |

| |

|

|

|

|

|

| |

March 26, 2019 |

|

December 25, 2018 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Cash and cash

equivalents |

$ |

252,107 |

|

|

$ |

210,125 |

|

| Other current assets,

net |

|

70,891 |

|

|

|

134,894 |

|

| Property and equipment,

net |

|

971,135 |

|

|

|

956,676 |

|

| Operating lease

right-of-use asset, net |

|

472,122 |

|

|

|

- |

|

| Goodwill |

|

123,220 |

|

|

|

123,220 |

|

| Intangible assets,

net |

|

1,711 |

|

|

|

1,959 |

|

| Other assets |

|

46,764 |

|

|

|

42,402 |

|

| |

|

|

|

|

|

| Total assets |

$ |

1,937,950 |

|

|

$ |

1,469,276 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Other current

liabilities |

|

362,450 |

|

|

|

385,142 |

|

| Operating lease

liabilities, net of current portion |

|

506,973 |

|

|

|

- |

|

| Other liabilities,

net |

|

80,380 |

|

|

|

123,426 |

|

| Texas Roadhouse, Inc.

and subsidiaries stockholders' equity |

|

973,493 |

|

|

|

945,569 |

|

| Noncontrolling

interests |

|

14,654 |

|

|

|

15,139 |

|

| |

|

|

|

|

|

| Total liabilities and

equity |

$ |

1,937,950 |

|

|

$ |

1,469,276 |

|

| |

|

|

|

|

|

| Note: Beginning in 2019, we adopted

Accounting Standards Codification 842, Leases, which requires the

recognition of an operating lease right-of-use asset and operating

lease liability for virtually all leases. |

| |

|

|

|

|

|

|

|

| Texas Roadhouse, Inc. and

Subsidiaries |

| Condensed Consolidated Statements of Cash

Flows |

| (in thousands) |

| (unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

13 Weeks Ended |

| |

March 26, 2019 |

|

March 27, 2018 |

| |

|

|

|

|

| |

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

| Net income including

noncontrolling interests |

$ |

52,193 |

|

|

|

$ |

56,379 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities |

|

|

|

|

|

Depreciation and amortization |

|

27,773 |

|

|

|

|

24,484 |

|

|

Share-based compensation expense |

|

9,132 |

|

|

|

|

7,475 |

|

| Other

noncash adjustments, net |

|

360 |

|

|

|

|

4,661 |

|

| Change in working

capital |

|

21,957 |

|

|

|

|

13,808 |

|

| Net cash

provided by operating activities |

|

111,415 |

|

|

|

|

106,807 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Capital expenditures -

property and equipment |

|

(42,044 |

) |

|

|

|

(35,307 |

) |

| Acquisition of

franchise restaurants, net of cash acquired |

|

- |

|

|

|

|

- |

|

| Net cash

used in investing activities |

|

(42,044 |

) |

|

|

|

(35,307 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Dividends paid |

|

(17,904 |

) |

|

|

|

(14,945 |

) |

| Other financing

activities, net |

|

(9,485 |

) |

|

|

|

(9,644 |

) |

| Net cash

used in financing activities |

|

(27,389 |

) |

|

|

|

(24,589 |

) |

| |

|

|

|

|

| Net

increase in cash and cash equivalents |

|

41,982 |

|

|

|

|

46,911 |

|

| Cash and cash

equivalents - beginning of period |

|

210,125 |

|

|

|

|

150,918 |

|

| Cash and cash

equivalents - end of period |

$ |

252,107 |

|

|

|

$ |

197,829 |

|

| |

|

|

|

|

| Texas Roadhouse, Inc. and

Subsidiaries |

| Reconciliation of Income from Operations to

Restaurant Margin |

| (in thousands) |

| (unaudited) |

| |

|

|

|

| |

13 Weeks Ended |

| |

March 26, 2019 |

|

March 27, 2018 |

| |

|

|

|

| Income from

operations |

$ |

60,445 |

|

|

$ |

64,871 |

|

| |

|

|

|

| Less: |

|

|

|

| Franchise royalties and

fees |

|

5,491 |

|

|

|

5,303 |

|

| |

|

|

|

| Add: |

|

|

|

| Pre-opening |

|

3,868 |

|

|

|

5,044 |

|

| Depreciation and

amortization |

|

27,773 |

|

|

|

24,484 |

|

| Impairment and

closure |

|

17 |

|

|

|

86 |

|

| General and

administrative |

|

35,983 |

|

|

|

30,175 |

|

| |

|

|

|

| Restaurant margin |

$ |

122,595 |

|

|

$ |

119,357 |

|

| |

|

|

|

| Restaurant margin (as a

percentage of restaurant and other sales) |

|

17.9 |

% |

|

|

19.2 |

% |

| |

|

|

|

|

|

|

|

| Texas Roadhouse, Inc. and

Subsidiaries |

| Supplemental Financial and Operating

Information |

| ($ amounts in thousands, except weekly sales

by group) |

| (unaudited) |

| |

|

|

|

|

|

|

|

| |

First Quarter |

|

Change |

| |

2019 |

|

2018 |

|

vs LY |

| |

|

|

|

|

|

|

|

| Restaurant

openings |

|

|

|

|

|

|

|

| Company - Texas

Roadhouse |

|

4 |

|

|

6 |

|

(2 |

) |

|

| Company -

Bubba's 33 |

|

0 |

|

|

1 |

|

(1 |

) |

|

| Company -

Other |

|

0 |

|

|

0 |

|

0 |

|

|

| Franchise

- Texas Roadhouse - U.S. |

|

0 |

|

|

0 |

|

0 |

|

|

| Franchise

- Texas Roadhouse - International |

|

2 |

|

|

2 |

|

0 |

|

|

|

Total |

|

6 |

|

|

9 |

|

(3 |

) |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Restaurants open at the

end of the quarter |

|

|

|

|

|

|

|

| Company -

Texas Roadhouse |

|

468 |

|

|

446 |

|

22 |

|

|

| Company -

Bubba's 33 |

|

25 |

|

|

21 |

|

4 |

|

|

| Company -

Other |

|

2 |

|

|

2 |

|

0 |

|

|

| Franchise

- Texas Roadhouse - U.S. |

|

69 |

|

|

70 |

|

(1 |

) |

|

| Franchise

- Texas Roadhouse - International |

|

24 |

|

|

19 |

|

5 |

|

|

|

Total |

|

588 |

|

|

558 |

|

30 |

|

|

| |

|

|

|

|

|

|

|

| Company

restaurants |

|

|

|

|

|

|

|

|

Restaurant and other sales |

$ |

685,117 |

|

$ |

622,402 |

|

10.1 |

% |

|

| Store

weeks |

|

6,386 |

|

|

6,048 |

|

5.6 |

% |

|

|

Comparable restaurant sales growth (1) |

|

5.2 |

% |

|

4.9 |

% |

|

|

|

| Texas

Roadhouse restaurants only: |

|

|

|

|

|

|

|

|

Comparable restaurant sales growth (1) |

|

5.1 |

% |

|

4.9 |

% |

|

|

|

| Average

unit volume (2) |

$ |

1,418 |

|

$ |

1,356 |

|

4.6 |

% |

|

| Weekly

sales by group: |

|

|

|

|

|

|

Comparable restaurants (429 units) |

$ |

109,634 |

|

|

|

|

|

|

| Average

unit volume restaurants (22 units) (3) |

$ |

98,938 |

|

|

|

|

|

|

|

Restaurants less than 6 months old (17 units) |

$ |

113,880 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Restaurant operating

costs (as a % of restaurant and other sales) |

|

|

|

|

|

|

|

| Cost of sales |

|

32.7 |

% |

|

32.6 |

% |

7 |

|

bps |

| Labor |

|

32.7 |

% |

|

31.5 |

% |

118 |

|

bps |

| Rent |

|

1.9 |

% |

|

1.9 |

% |

1 |

|

bps |

| Other operating |

|

14.9 |

% |

|

14.8 |

% |

2 |

|

bps |

| Total |

|

82.1 |

% |

|

80.8 |

% |

128 |

|

bps |

| |

|

|

|

|

|

|

|

|

Restaurant margin |

|

17.9 |

% |

|

19.2 |

% |

(128 |

) |

bps |

| |

|

|

|

|

|

|

|

|

Restaurant margin ($ in thousands) |

$ |

122,595 |

|

$ |

119,357 |

|

2.7 |

% |

|

|

Restaurant margin $/Store week |

$ |

19,197 |

|

$ |

19,735 |

|

(2.7 |

)% |

|

| |

|

|

|

|

|

|

|

| Franchise

restaurants |

|

|

|

|

|

|

|

| Franchise

royalties and fees |

$ |

5,491 |

|

$ |

5,303 |

|

3.5 |

% |

|

| Store

weeks |

|

1,191 |

|

|

1,139 |

|

4.6 |

% |

|

|

Comparable restaurant sales growth (1) |

|

2.8 |

% |

|

1.8 |

% |

|

|

|

| U.S.

franchise restaurants only: |

|

|

|

|

|

|

|

|

Comparable restaurant sales growth (1) |

|

4.3 |

% |

|

3.9 |

% |

|

|

|

| Average

unit volume (2) |

$ |

1,461 |

|

$ |

1,401 |

|

4.3 |

% |

|

| |

|

|

|

|

|

|

|

| Pre-opening

expense |

$ |

3,868 |

|

$ |

5,044 |

|

(23.3 |

)% |

|

| |

|

|

|

|

|

|

|

| Depreciation and

amortization |

$ |

27,773 |

|

$ |

24,484 |

|

13.4 |

% |

|

| As a % of

revenue |

|

4.0 |

% |

|

3.9 |

% |

12 |

|

bps |

| |

|

|

|

|

|

|

|

| General and

administrative expenses |

$ |

35,983 |

|

$ |

30,175 |

|

19.2 |

% |

|

| As a % of

revenue |

|

5.2 |

% |

|

4.8 |

% |

40 |

|

bps |

| |

|

|

|

|

|

|

|

(1) Comparable restaurant sales growth reflects the change

in year-over-year sales for restaurants open a full 18 months

before the beginning of the period measured, excluding sales from

restaurants closed during the period.(2) Average unit volume

includes sales from Texas Roadhouse restaurants open for a full six

months before the beginning of the period measured, excluding any

sales at restaurants closed during the period.(3) Average

unit volume restaurants include restaurants open a full six and up

to 18 months before the beginning of the period measured.Amounts

may not foot due to rounding.

Texas Roadhouse (NASDAQ:TXRH)

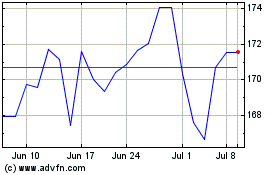

Historical Stock Chart

From Mar 2024 to Apr 2024

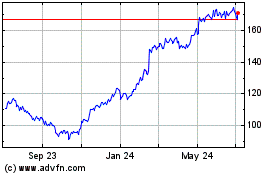

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024