UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 25, 2019

________________________________________________________________

SOUTHWESTERN ENERGY COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________________________

Delaware

(State or other jurisdiction of incorporation)

|

| | |

001-08246 | | 71-0205415 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

10000 Energy Drive Spring, Texas | | 77,389 |

(Address of principal executive offices) | | (Zip Code) |

(832) 796-1000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Explanatory Note

The information in this report provided under Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SECTION 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On April 25, 2019, Southwestern Energy Company (the "Company") issued a press release announcing the Company's financial results for the first quarter ended March 31, 2019 (Exhibit 99.1). The press release is being furnished as Exhibit 99.1.

SECTION 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | SOUTHWESTERN ENERGY COMPANY |

| | |

Dated: April 25, 2019 | | By: | | /s/ JULIAN M. BOTT |

| | Name: | | Julian M. Bott |

| | Title: | | Executive Vice President and |

| | | | Chief Financial Officer |

NEWS RELEASE

SOUTHWESTERN ENERGY ANNOUNCES FIRST QUARTER 2019 RESULTS

Continuing operational outperformance, with cost savings driving cash flow higher

SPRING, Texas - April 25, 2019...Southwestern Energy Company (NYSE: SWN) today announced financial and operating results for the quarter ended March 31, 2019, the Company’s first quarter as a single-basin Appalachia producer. These results include net income of $594 million, or $1.10 per share, and adjusted net income of $145 million, or $0.27 per share. Unless otherwise noted, results are compared to the first quarter of 2018, which included contribution from Fayetteville Shale assets sold in December 2018.

| |

• | Appalachia production up 14 percent to 182 Bcfe, liquids up 33 percent to 71,740 barrels per day, Appalachia revenue up 13 percent; |

| |

• | Generated Adjusted EBITDA of $319 million, net cash provided by operating activities of $442 million and net cash flow of $309 million; |

| |

• | Invested capital totaling $325 million in the quarter, consistent with front-loaded capital plan; |

| |

• | Improved E&P margin by 14 percent to $1.79 per Mcfe, as a result of improved differentials and lower expenses; |

| |

• | Realized a $46 million, or 32 percent, reduction in general and administrative and interest savings in the first quarter; |

| |

• | Continued strength of balance sheet with net debt to EBITDA of 1.7 times, excluding 2018 Fayetteville EBITDA, liquidity in excess of $2 billion; |

| |

• | Reduced well cost on wells to sales by 10 percent from 2018 full year average, on track to meet guidance of $875 per lateral foot for the year; and |

| |

• | Drilled five wells in excess of 15,000 feet, including an 18,683 foot state record lateral in Pennsylvania. |

“These results demonstrate the exceptional quality of our Appalachia assets and the strength, resilience and operational execution capabilities of our teams, who successfully navigate through changing operating conditions,” said Bill Way, President and Chief Executive Officer, Southwestern Energy. “Having deleveraged the balance sheet with the monetization of Fayetteville, ongoing operational improvements are driving costs lower and production higher, proof points that we are well down the transitional path back to free cash flow clearly outlined in our strategy.”

Financial Results

Southwestern Energy reported net income of $594 million or $1.10 per share for the first quarter of 2019, including a $426 million non-cash deferred income tax benefit, resulting from the release of a tax valuation allowance previously recorded against a deferred tax asset. The Company reported adjusted net income of $145 million, excluding the deferred tax benefit.

|

| | | | | | | | |

FINANCIAL STATISTICS | | For the three months ended |

| | March 31, |

(in millions) | | 2019 | | 2018 |

Net income attributable to common stock | | $ | 594 |

| | $ | 205 |

|

Adjusted net income attributable to common stock (non-GAAP) | | $ | 145 |

| | $ | 162 |

|

Adjusted EBITDA (non-GAAP) | | $ | 319 |

| | $ | 396 |

|

Net cash provided by operating activities | | $ | 442 |

| | $ | 364 |

|

Net cash flow (non-GAAP) | | $ | 309 |

| | $ | 358 |

|

Total capital investments (1) | | $ | 325 |

| | $ | 338 |

|

| |

(1) | Capital investments includes increases of $66 million and $33 million for the three months ended March 31, 2019 and 2018, respectively, relating to the change in capital accruals between periods. |

Weighted average realized pricing, excluding settled derivatives, was $2.98 per Mcfe, 6 percent above the prior year. Realized pricing for natural gas was $2.95 per Mcf and reflects a discount to NYMEX of $0.20 per Mcf, $0.08 per Mcf better than the first quarter 2018. Natural gas liquids realized pricing was $14.45 per barrel, or 26 percent of West Texas Intermediate (WTI), and realized oil pricing was $45.48 per barrel, reflecting a $9.42 per barrel discount to WTI.

As of March 31, 2019, the Company had $2.3 billion of outstanding, long-term, fixed rate notes and had $2.2 billion of liquidity, including cash of $366 million. There are no material senior note maturities before 2025. The Company has no borrowings under its $2.0 billion secured credit facility, and the borrowing base was recently reaffirmed.

In the first quarter, the Company completed its $200 million authorized share repurchase program, repurchasing a total of approximately 44 million shares at an average price of $4.53 per share, resulting in an 8 percent reduction in shares outstanding.

Operational Results

Total production for the quarter was 182 Bcfe, or 2.0 Bcfe per day including natural gas production of 143 Bcf, oil production of 854 MBbls and natural gas liquids of 5.6 MMBbls. SWN invested $325 million in the first quarter, drilling 30 wells, completing 31 and placing 19 to sales.

Southwest Appalachia’s net gas production averaged 345 MMcf per day, with total liquids production averaging 71,680 barrels per day. The Company placed nine wells to sales in the quarter, with a combined initial production rate of 99 MMcfe per day, including 67% liquids, of which 4,800 barrels per day were oil, all targeting the Marcellus super rich gas window. Well costs on wells to sales were reduced 22 percent in the quarter compared to fourth quarter 2018 with an average lateral length of 8,644 feet. The Company also drilled and cased an ultra-long lateral of approximately 18,000 feet, a division record in West Virginia.

Northeast Appalachia’s net gas production averaged 1.24 Bcf per day. The Company placed 10 wells to sales in the first quarter in Susquehanna and Tioga Counties. One of the wells in Tioga County achieved a Company record initial production rate of 39 MMcf per day on an 11,130 foot lateral. The Company also drilled a Pennsylvania state record lateral of 18,683 feet.

|

| | | | | | | | |

OPERATING STATISTICS | | For the three months ended |

| | March 31, |

| | 2019 | | 2018 |

Production | | | | |

Gas production (Bcf) | | 143 |

| | 197 |

|

Oil production (MBbls) | | 854 |

| | 613 |

|

NGL production (MBbls) | | 5,603 |

| | 4,230 |

|

Total production (Bcfe) | | 182 |

| | 226 |

|

| | | | |

Division Production | | | | |

Northeast Appalachia (Bcf) | | 112 |

| | 108 |

|

Southwest Appalachia (Bcfe) | | 70 |

| | 51 |

|

Fayetteville Shale (Bcf) (1) | | — |

| | 67 |

|

| | | | |

Average unit costs per Mcfe | | | | |

Lease operating expenses | | $ | 0.90 |

| | $ | 0.94 |

|

General & administrative expenses | | $ | 0.19 |

| (2) | $ | 0.21 |

|

Taxes, other than income taxes | | $ | 0.10 |

| | $ | 0.09 |

|

Full cost pool amortization | | $ | 0.57 |

| | $ | 0.48 |

|

| |

(1) | The Fayetteville Shale assets were sold on December 3, 2018. |

| |

(2) | Excludes $3 million of restructuring charges (including severance) for the three months ended March 31, 2019. |

|

| | | | | | | | |

Realized Prices | | For the three months ended |

| | March 31, |

| | 2019 | | 2018 |

Natural Gas Price: | | | | |

NYMEX Henry Hub price ($/MMBtu) (1) | | $ | 3.15 |

| | $ | 3.00 |

|

Discount to NYMEX (2) | | (0.20 | ) | | (0.28 | ) |

Average realized gas price per Mcf, excluding derivatives | | $ | 2.95 |

| | $ | 2.72 |

|

Loss on settled financial basis derivatives ($/Mcf) | | (0.03 | ) | | (0.11 | ) |

Gain (loss) on settled commodity derivatives ($/Mcf) | | (0.08 | ) | | 0.06 |

|

Average realized gas price per Mcf, including derivatives | | $ | 2.84 |

| | $ | 2.67 |

|

Oil Price: | | | | |

WTI oil price ($/Bbl) | | $ | 54.90 |

| | $ | 62.87 |

|

Discount to WTI | | (9.42 | ) | | (6.86 | ) |

Average oil price per Bbl, excluding derivatives | | $ | 45.48 |

| | $ | 56.01 |

|

Average oil price per Bbl, including derivatives | | $ | 47.82 |

| | $ | 56.01 |

|

NGL Price: | | | | |

Average net realized NGL price per Bbl, excluding derivatives | | $ | 14.45 |

| | $ | 15.42 |

|

Average net realized NGL price per Bbl, including derivatives | | $ | 15.05 |

| | $ | 15.43 |

|

Percentage of WTI | | 26 | % | | 25 | % |

Average net realized C3+ price per Bbl, excluding derivatives | | $ | 27.11 |

| | $ | 36.01 |

|

Average net realized C3+ price per Bbl, including derivatives | | $ | 28.01 |

| | $ | 36.00 |

|

Percentage of WTI | | 49 | % | | 57 | % |

Total Weighted Average Realized Price: | | | | |

Excluding derivatives ($/Mcfe) | | $ | 2.98 |

| | $ | 2.81 |

|

Including derivatives ($/Mcfe) | | $ | 2.92 |

| | $ | 2.77 |

|

| |

(1) | Based on last day monthly futures settlement prices. |

| |

(2) | This discount includes a basis differential, a heating content adjustment, physical basis sales, third-party transportation charges and fuel charges, and excludes financial basis derivatives. |

|

| | | | | | | | |

Three Months Ended March 31, 2019 E&P Division Results | | Appalachia |

| | Northeast | | Southwest |

Gas Production (Bcf) | | 112 |

| | 31 |

|

Liquids Production | | | | |

Oil (MBbls) | | — |

| | 849 |

|

NGL (MBbls) | | — |

| | 5,602 |

|

Production (Bcfe) | | 112 |

| | 70 |

|

Gross operated production (MMcfe/d) | | 1,497 |

| | 1,237 |

|

Net operated production (MMcfe/d) | | 1,227 |

| | 767 |

|

| | | | |

Capital investments ($ in millions) | | | | |

Exploratory and development drilling, including workovers | | $ | 94 |

| | $ | 154 |

|

Acquisition and leasehold | | 2 |

| | 5 |

|

Seismic and other | | 1 |

| | — |

|

Capitalized interest and expense | | 9 |

| | 39 |

|

Total capital investments | | $ | 106 |

| | $ | 198 |

|

| | | | |

Gross operated well activity summary | | | | |

Drilled | | 11 |

| | 19 |

|

Completed | | 11 |

| | 20 |

|

Wells to sales | | 10 |

| | 9 |

|

| | | | |

Average well cost on wells to sales (in millions) | | $ | 7.8 |

| | $ | 8.6 |

|

Average lateral length (in ft) | | 7,502 |

| | 8,644 |

| | | | |

Total weighted average realized price per Mcfe, excluding derivatives | | $ | 3.12 |

| | $ | 2.76 |

|

Conference Call

Southwestern Energy will host a conference call and webcast on Friday, April 26, 2019 at 9:30 a.m. Central to discuss first quarter 2019 results. To participate, dial US toll-free 877-883-0383, or international 412-902-6505 and enter access code 6562032. The conference call will be webcast live at www.swn.com.

To listen to a replay of the call, dial 877-344-7529, international 412-317-0088, or Canada Toll Free 855-669-9658. Enter replay access code 10130076. The replay will be available until May 17, 2019.

About Southwestern Energy

Southwestern Energy Company is an independent energy company engaged in natural gas, natural gas liquids and oil exploration, development, production and marketing. For additional information, visit our website www.swn.com.

Investor Contact

Paige Penchas

Vice President, Investor Relations

(832) 796-4068

paige_penchas@swn.com

Media Contact

Jim Schwartz

Director, Corporate Communications

(832) 796-2716

jim_schwartz@swn.com

Forward Looking Statement

This news release contains forward-looking statements. Forward-looking statements relate to future events and anticipated results of operations, business strategies, and other aspects of our operations or operating results. In many cases you can identify forward-looking statements by terminology such as “anticipate,” “intend,” “plan,” “project,” “estimate,” “continue,” “potential,” “should,” “could,” “may,” “will,” “objective,” “guidance,” “outlook,” “effort,” “expect,” “believe,” “predict,” “budget,” “projection,” “goal,” “forecast,” “target” or similar words. Statements may be forward looking even in the absence of these particular words. Where, in any forward-looking statement, the Company expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, there can be no assurance that such expectation or belief will result or be achieved. The actual results of operations can and will be affected by a variety of risks and other matters including, but not limited to, changes in commodity prices (including geographic basis differentials); changes in expected levels of natural gas and oil reserves or production; operating hazards, drilling risks, unsuccessful exploratory activities; natural disasters; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; international monetary conditions; the risks related to the discontinuation of LIBOR and/or other reference rates that may be introduced following the transition, including increased expenses and litigation and the effectiveness of interest rate hedge strategies; unexpected cost increases; potential liability for remedial actions under existing or future environmental regulations; failure or delay in obtaining necessary regulatory approvals; potential liability resulting from pending or future litigation; general domestic and international economic and political conditions; the impact of a prolonged federal, state or local government shutdown and threats not to increase the federal government’s debt limit; as well as changes in tax, environmental and other laws, including court rulings, applicable to our business. Other factors that could cause actual results to differ materially from those described in the forward-looking statements include other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with the Securities and Exchange Commission. Unless legally required, Southwestern Energy Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

###

|

| | | | | | | | |

SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited) |

| | For the three months ended |

| | March 31, |

(in millions, except share/per share amounts) | | 2019 | | 2018 |

Operating Revenues: | | | | |

Gas sales | | $ | 430 |

| | $ | 540 |

|

Oil sales | | 39 |

| | 35 |

|

NGL sales | | 81 |

| | 65 |

|

Marketing | | 438 |

| | 253 |

|

Gas gathering | | — |

| | 24 |

|

Other | | 2 |

| | 3 |

|

| | 990 |

| | 920 |

|

Operating Costs and Expenses: | | | | |

Marketing purchases | | 441 |

| | 255 |

|

Operating expenses | | 165 |

| | 189 |

|

General and administrative expenses | | 37 |

| | 55 |

|

Restructuring charges | | 3 |

| | — |

|

Depreciation, depletion and amortization | | 112 |

| | 143 |

|

Taxes, other than income taxes | | 19 |

| | 23 |

|

| | 777 |

| | 665 |

|

Operating Income | | 213 |

| | 255 |

|

Interest Expense: | | | | |

Interest on debt | | 42 |

| | 65 |

|

Other interest charges | | 1 |

| | 2 |

|

Interest capitalized | | (29 | ) | | (28 | ) |

| | 14 |

| | 39 |

|

| | | | |

Loss on Derivatives | | (32 | ) | | (7 | ) |

Other Income (Loss), Net | | 1 |

| | (1 | ) |

| | | | |

Income Before Income Taxes | | 168 |

| | 208 |

|

Benefit from Income Taxes: | | | | |

Current | | — |

| | — |

|

Deferred | | (426 | ) | | — |

|

| | (426 | ) | | — |

|

Net Income | | $ | 594 |

| | $ | 208 |

|

Participating securities - mandatory convertible preferred stock | | — |

| | 3 |

|

Net Income Attributable to Common Stock | | $ | 594 |

| | $ | 205 |

|

| | | | |

Earnings Per Common Share | | | | |

Basic | | $ | 1.10 |

| | $ | 0.36 |

|

Diluted | | $ | 1.10 |

| | $ | 0.36 |

|

| | | | |

Weighted Average Common Shares Outstanding: | | | | |

Basic | | 539,721,751 |

| | 571,297,804 |

|

Diluted | | 541,320,487 |

| | 573,844,459 |

|

|

| | | | | | | | |

SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

| | March 31, 2019 | | December 31, 2018 |

ASSETS | | (in millions) |

Current assets: | | | | |

Cash and cash equivalents | | $ | 366 |

| | $ | 201 |

|

Accounts receivable, net | | 390 |

| | 581 |

|

Derivative assets | | 87 |

| | 130 |

|

Other current assets | | 44 |

| | 44 |

|

Total current assets | | 887 |

| | 956 |

|

Natural gas and oil properties, using the full cost method, including $1,673 million as of March 31, 2019 and $1,755 million as of December 31, 2018 excluded from amortization | | 24,486 |

| | 24,180 |

|

Gathering systems | | 38 |

| | 38 |

|

Other | | 509 |

| | 487 |

|

Less: Accumulated depreciation, depletion and amortization | | (20,162 | ) | | (20,049 | ) |

Total property and equipment, net | | 4,871 |

| | 4,656 |

|

Deferred tax assets | | 426 |

| | — |

|

Other long-term assets | | 262 |

| | 185 |

|

TOTAL ASSETS | | $ | 6,446 |

| | $ | 5,797 |

|

LIABILITIES AND EQUITY | | | | |

Current liabilities: | | | | |

Current portion of long-term debt | | $ | 52 |

| | $ | — |

|

Accounts payable | | 626 |

| | 609 |

|

Taxes payable | | 62 |

| | 58 |

|

Interest payable | | 58 |

| | 52 |

|

Derivative liabilities | | 50 |

| | 79 |

|

Other current liabilities | | 95 |

| | 48 |

|

Total current liabilities | | 943 |

| | 846 |

|

Long-term debt | | 2,267 |

| | 2,318 |

|

Pension and other postretirement liabilities | | 43 |

| | 46 |

|

Other long-term liabilities | | 256 |

| | 225 |

|

Total long-term liabilities | | 2,566 |

| | 2,589 |

|

Commitments and contingencies | | | | |

Equity: | | | | |

Common stock, $0.01 par value; 1,250,000,000 shares authorized; issued 585,548,726 shares as of March 31, 2019 and 585,407,107 as of December 31, 2018 | | 6 |

| | 6 |

|

Additional paid-in capital | | 4,717 |

| | 4,715 |

|

Accumulated deficit | | (1,548 | ) | | (2,142 | ) |

Accumulated other comprehensive loss | | (36 | ) | | (36 | ) |

Common stock in treasury, 44,353,224 shares as of March 31, 2019 and 39,092,537 shares as of December 31, 2018 | | (202 | ) | | (181 | ) |

Total equity | | 2,937 |

| | 2,362 |

|

TOTAL LIABILITIES AND EQUITY | | $ | 6,446 |

| | $ | 5,797 |

|

|

| | | | | | | | |

SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

(Unaudited) |

| | For the three months ended |

| | March 31, |

(in millions) | | 2019 | | 2018 |

Cash Flows From Operating Activities: | | | | |

Net income | | $ | 594 |

| | $ | 208 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation, depletion and amortization | | 112 |

| | 143 |

|

Amortization of debt issuance costs | | 1 |

| | 2 |

|

Deferred income taxes | | (426 | ) | | — |

|

(Gain) loss on derivatives, unsettled | | 22 |

| | (2 | ) |

Stock-based compensation | | 2 |

| | 4 |

|

Other | | 1 |

| | 3 |

|

Change in assets and liabilities | | 136 |

| | 6 |

|

Net cash provided by operating activities | | 442 |

| | 364 |

|

| | | | |

Cash Flows From Investing Activities: | | | | |

Capital investments | | (258 | ) | | (302 | ) |

Proceeds from sale of property and equipment | | — |

| | 6 |

|

Other | | — |

| | 2 |

|

Net cash used in investing activities | | (258 | ) | | (294 | ) |

| | | | |

Cash Flows From Financing Activities: | | | | |

Change in bank drafts outstanding | | 3 |

| | — |

|

Purchase of treasury stock | | (21 | ) | | — |

|

Preferred stock dividend | | — |

| | (27 | ) |

Cash paid for tax withholding | | (1 | ) | | (1 | ) |

Net cash used in financing activities | | (19 | ) | | (28 | ) |

| | | | |

Increase in cash and cash equivalents | | 165 |

| | 42 |

|

Cash and cash equivalents at beginning of year | | 201 |

| | 916 |

|

Cash and cash equivalents at end of period | | $ | 366 |

| | $ | 958 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

SEGMENT INFORMATION |

(Unaudited) |

| | Exploration | | | | | | | | |

| | and | | Midstream | | | | | | |

| | Production | | Services | | Other | | Eliminations | | Total |

| | (in millions) |

Three months ended March 31, 2019 | | | | | | | | | | |

Revenues | | $ | 542 |

| | $ | 941 |

| | $ | — |

| | $ | (493 | ) | | $ | 990 |

|

Marketing purchases | | — |

| | 934 |

| | — |

| | (493 | ) | | 441 |

|

Operating expenses | | 166 |

| | (1 | ) | | — |

| | — |

| | 165 |

|

General and administrative expenses | | 34 |

| | 3 |

| | — |

| | — |

| | 37 |

|

Restructuring charges | | 3 |

| | — |

| | — |

| | — |

| | 3 |

|

Depreciation, depletion and amortization | | 110 |

| | 2 |

| | — |

| | — |

| | 112 |

|

Taxes, other than income taxes | | 19 |

| | — |

| | — |

| | — |

| | 19 |

|

Operating income | | 210 |

| | 3 |

| | — |

| | — |

| | 213 |

|

Capital investments (1) | | 325 |

| | — |

| | — |

| | — |

| | 325 |

|

| | | | | | | | | | |

Three months ended March 31, 2018 | | | | | | | | | | |

Revenues | | $ | 637 |

| | $ | 896 |

| | $ | — |

| | $ | (613 | ) | | $ | 920 |

|

Marketing purchases | | — |

| | 819 |

| | — |

| | (564 | ) | | 255 |

|

Operating expenses | | 213 |

| | 25 |

| | — |

| | (49 | ) | | 189 |

|

General and administrative expenses | | 48 |

| | 7 |

| | — |

| | — |

| | 55 |

|

Depreciation, depletion and amortization | | 117 |

| | 26 |

| (2) | — |

| | — |

| | 143 |

|

Taxes, other than income taxes | | 21 |

| | 2 |

| | — |

| | — |

| | 23 |

|

Operating income | | 238 |

| | 17 |

| | — |

| | — |

| | 255 |

|

Capital investments (1) | | 334 |

| | 4 |

| | — |

| | — |

| | 338 |

|

| |

(1) | Capital investments includes increases of $66 million and $33 million for the three months ended March 31, 2019 and 2018, respectively, relating to the change in capital accruals between periods. |

| |

(2) | Includes a $10 million impairment related to certain non-core gathering assets. |

Hedging Summary

A detailed breakdown of Southwestern Energy’s derivative financial instruments and financial basis positions as of March 31, 2019 is shown below. Please refer to the quarterly report on Form 10-Q filed with the Securities and Exchange Commission for complete information on the Company’s commodity, basis and interest rate protection.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Weighted Average Price per MMBtu |

| Volume | | | | Sold | | Purchased | | Sold | | Basis |

| (Bcf) | | Swaps | | Puts | | Puts | | Calls | | Differential |

Natural Gas | | | | | | | | | | | |

2019 | | | | | | | | | | | |

Fixed price swaps | 195 |

| | $ | 2.90 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Two-way costless collars | 44 |

| | — |

| | — |

| | 2.78 |

| | 2.92 |

| | — |

|

Three-way costless collars | 101 |

| | — |

| | 2.46 |

| | 2.88 |

| | 3.22 |

| | — |

|

Total | 340 |

| | | | | | | | | | |

2020 | | | | | | | | | | | |

Fixed price swaps | 24 |

| | $ | 2.88 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Three-way costless collars | 122 |

| | — |

| | 2.35 |

| | 2.68 |

| | 2.96 |

| | — |

|

Total | 146 |

| | | | | | | | | | |

2021 | | | | | | | | | | | |

Three-way costless collars | 37 |

| | $ | — |

| | $ | 2.35 |

| | $ | 2.60 |

| | $ | 2.93 |

| | $ | — |

|

| | | | | | | | | | | |

Basis Swaps | | | | | | | | | | | |

2019 | 85 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | (0.50 | ) |

2020 | 59 |

| | — |

| | — |

| | — |

| | — |

| | (0.44 | ) |

Total | 144 |

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

| | | Weighted Average Price per Bbl |

| Volume | | | | Sold | | Purchased | | Sold |

| (MBbls) | | Swaps | | Puts | | Puts | | Calls |

Oil | | | | | | | | | |

2019 | | | | | | | | | |

Fixed price swaps (1) | 921 |

| | $ | 62.13 |

| | $ | — |

| | $ | — |

| | $ | — |

|

Two-way costless collars | 248 |

| | — |

| | — |

| | 65.00 |

| | 72.30 |

|

Three-way costless collars | 412 |

| | — |

| | 45.00 |

| | 55.00 |

| | 63.67 |

|

Total | 1,581 |

| | | | | | | | |

2020 | | | | | | | | | |

Fixed price swaps | 366 |

| | $ | 65.68 |

| | $ | — |

| | $ | — |

| | $ | — |

|

Two-way costless collars | 366 |

| | — |

| | — |

| | 60.00 |

| | 69.80 |

|

Total | 732 |

| | | | | | | | |

| | | | | | | | | |

Propane | | | | | | | | | |

2019 | | | | | | | | | |

Fixed price swaps | 2,028 |

| | $ | 31.25 |

| | $ | — |

| | $ | — |

| | $ | — |

|

2020 | | | | | | | | | |

Fixed price swaps | 824 |

| | $ | 27.35 |

| | $ | — |

| | $ | — |

| | $ | — |

|

Two-way costless collars | 366 |

| | — |

| | — |

| | 25.20 |

| | 29.40 |

|

Total | 1,190 |

| | | | | | | | |

| | | | | | | | | |

Ethane | | | | | | | | | |

2019 | | | | | | | | | |

Fixed price swaps | 2,778 |

| | $ | 13.90 |

| | $ | — |

| | $ | — |

| | $ | — |

|

2020 | | | | | | | | | |

Fixed price swaps | 732 |

| | $ | 13.49 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| |

(1) | Includes 206 MBbls of purchased fixed price oil swaps hedged at $69.10 per barrel and 1,127 MBbls of sold fixed price oil swaps hedged at $63.41 per barrel. |

|

| | | | | | | |

| | | | |

Financial basis positions | | Volume | | Basis Differential |

(excludes physical positions) | | (Bcf) | | ($/MMbtu) |

| | | | |

Q2 2019 | | | | |

TCO | | 2 |

| | $ | (0.38 | ) |

Dominion South | | 23 |

| | $ | (0.54 | ) |

TETCO M3 | | 9 |

| | $ | (0.43 | ) |

Total | | 34 |

| | $ | (0.50 | ) |

| | | | |

2019 | | | | |

TCO | | 4 |

| | $ | (0.38 | ) |

Dominion South | | 60 |

| | $ | (0.54 | ) |

TETCO M3 | | 21 |

| | $ | (0.43 | ) |

Total | | 85 |

| | $ | (0.50 | ) |

| | | | |

2020 | | | | |

TCO | | 17 |

| | $ | (0.51 | ) |

Dominion South | | 18 |

| | $ | (0.58 | ) |

TETCO M3 | | 24 |

| | $ | (0.27 | ) |

Total | | 59 |

| | $ | (0.44 | ) |

Explanation and Reconciliation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide financial statement users with additional meaningful comparisons between current results, the results of its peers and of prior periods.

One such non-GAAP financial measure is net cash flow. Management presents this measure because (i) it is accepted as an indicator of an oil and gas exploration and production company’s ability to internally fund exploration and development activities and to service or incur additional debt, (ii) changes in operating assets and liabilities relate to the timing of cash receipts and disbursements which the Company may not control and (iii) changes in operating assets and liabilities may not relate to the period in which the operating activities occurred.

Additional non-GAAP financial measures the Company may present from time to time are net debt, adjusted net income, adjusted diluted earnings per share, adjusted EBITDA and its E&P and Midstream segment operating income, all which exclude certain charges or amounts. Management presents these measures because (i) they are consistent with the manner in which the Company’s position and performance are measured relative to the position and performance of its peers, (ii) these measures are more comparable to earnings estimates provided by securities analysts, and (iii) charges or amounts excluded cannot be reasonably estimated and guidance provided by the Company excludes information regarding these types of items. These adjusted amounts are not a measure of financial performance under GAAP.

|

| | | | | | | | |

| | 3 Months Ended March 31, |

| | 2019 | | 2018 |

| | (in millions) |

Net income attributable to common stock: | | | | |

Net income attributable to common stock | | $ | 594 |

| | $ | 205 |

|

Add back: | | | | |

Participating securities – mandatory convertible preferred stock | | — |

| | 1 |

|

Restructuring charges | | 3 |

| | — |

|

Gain on sale of assets, net | | (2 | ) | | (1 | ) |

(Gain) loss on certain derivatives | | 22 |

| | (2 | ) |

Impairment of non-core gathering assets | | — |

| | 10 |

|

Adjustments due to inventory valuation and other | | — |

| | 3 |

|

Adjustments due to discrete tax items (1) | | (466 | ) | | (51 | ) |

Tax impact on adjustments | | (6 | ) | | (3 | ) |

Adjusted net income attributable to common stock | | $ | 145 |

| | $ | 162 |

|

| |

(1) | 2018 primarily relates to the exclusion of certain discrete tax adjustments associated with the valuation allowance against deferred tax assets. The Company expects its 2019 income tax rate to be 24.5%. |

|

| | | | | | | | |

| | 3 Months Ended March 31, |

| | 2019 | | 2018 |

Diluted earnings per share: | | | | |

Diluted earnings per share | | $ | 1.10 |

| | $ | 0.36 |

|

Add back: | | | | |

Participating securities – mandatory convertible preferred stock | | — |

| | 0.00 |

|

Restructuring charges | | 0.00 |

| | — |

|

Gain on sale of assets, net | | (0.00 | ) | | (0.00 | ) |

(Gain) loss on certain derivatives | | 0.04 |

| | 0.00 |

|

Impairment of non-core gathering assets | | — |

| | 0.02 |

|

Adjustments due to inventory valuation and other | | — |

| | 0.00 |

|

Adjustments due to discrete tax items (1) | | (0.86 | ) | | (0.09 | ) |

Tax impact on adjustments | | (0.01 | ) | | (0.01 | ) |

Adjusted diluted earnings per share | | $ | 0.27 |

| | $ | 0.28 |

|

| |

(1) | 2018 primarily relates to the exclusion of certain discrete tax adjustments associated with the valuation allowance against deferred tax assets. The Company expects its 2019 income tax rate to be 24.5%. |

|

| | | | | | | | |

| | 3 Months Ended March 31, |

| | 2019 | | 2018 |

| | (in millions) |

Net cash flow provided by operating activities: | | | | |

Net cash provided by operating activities | | $ | 442 |

| | $ | 364 |

|

Add back: | | | | |

Changes in operating assets and liabilities | | 136 |

| | 6 |

|

Restructuring charges | | 3 |

| | — |

|

Net cash flow | | $ | 309 |

| | $ | 358 |

|

|

| | | | | | | | |

| | 3 Months Ended March 31, |

| | 2019 | | 2018 |

| | (in millions) |

EBITDA: | | | | |

Net income | | $ | 594 |

| | $ | 208 |

|

Add back: | | | | |

Interest expense | | 14 |

| | 39 |

|

Income tax expense (benefit) | | (426 | ) | | — |

|

Depreciation, depletion and amortization | | 112 |

| | 143 |

|

Restructuring charges | | 3 |

| | — |

|

Gain on sale of assets, net | | (2 | ) | | (1 | ) |

Loss on foreign currency adjustment | | — |

| | 3 |

|

(Gain) loss on certain derivatives | | 22 |

| | (2 | ) |

Stock based compensation expense | | 2 |

| | 6 |

|

Adjusted EBITDA | | $ | 319 |

| | $ | 396 |

|

|

| | | | |

| | March 31, 2019 |

| | (in millions) |

Total debt | | $ | 2,319 |

|

Subtract: | | |

Cash and cash equivalents | | (366 | ) |

Net debt | | $ | 1,953 |

|

|

| | | | |

| | March 31, 2019 |

| | (in millions) |

Net debt | | $ | 1,953 |

|

Adjusted EBITDA (1) | | $ | 1,131 |

|

Net debt to EBITDA | | 1.7x |

|

| |

(1) | Includes Adjusted EBITDA of $1,408 million for the twelve months ended March 31, 2019 less $277 million of EBITDA generated by Fayetteville E&P and Midstream prior to the December 2018 divestiture. |

This regulatory filing also includes additional resources:

swn20190425xex991.pdf

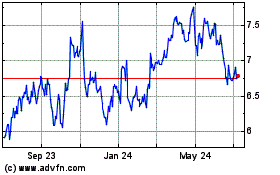

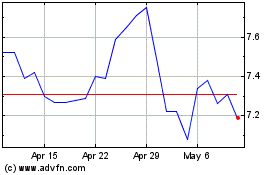

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024