5 Gold Gainers to Watch

April 24, 2019 -- InvestorsHub NewsWire -- Microcap Speculators

-- Whichever way stocks go in the near term, one area that looks

prime for growth is gold. Today we are highlighting gold

stocks that could breakout.

The first on our list, Inception Mining, Inc (USOTC:

IMII), which owns and operates a producing mine with

the capacity to produce 1000 tons per day, looks like it may be

heating up. Let’s begin research today.

The 5 Gold Stocks we are highlighting: Inception Mining,

Inc. (USOTC:

IMII), Gold Resource Corporation (AMEX:

GORO), Agnico Eagle Mines Limited (NYSE:

AEM), Osisko Gold Royalties Ltd (NYSE:

OR) and Golden Star Resources Ltd. (GSS).

Inception Mining, Inc. (USOTC:

IMII) (Market Cap: $14.804M; Share Price:

$0.262) announced in March that the company has

completed a National Instrument 43-101 Technical Report that

includes an estimate on its Clavo Rico Project located in El

Corpus, Departamento Choluteca, Honduras. The Technical

Report has an effective date of 15 March 2019 and can be found on

the company’s website at http://inceptionmining.com/clavorico/43-101-report/.

Highlights of the Report include:

- Economic mineralization at Clavo Rico is contained in three

distinct zones, including an oxide zone, a supergene enrichment

zone, and a sulfide zone.

- Data on 96 recent and historic drill holes totaling 6264 meters

of drill core yielding 2552 assays together with 827 channel

samples collected from historic adits.

- Data on an oxide zone. The oxide zone has been producing since

2015.

- Data on a sulfide zone that was calculated using two different

modeling techniques to reflect geologic uncertainties:

- Data of the supergene enrichment zone

- The conceptual geologic model, supported by field mapping,

production records and both recent and historic drill programs

suggests that significant potential exists to increase the known

mineral resource with additional drilling.

Inception Mining is a producing gold mining company engaged in

the identification, exploration, acquisition and development of

mineral properties. IMII owns and operates the Clavo Rico

mine.

Now’s a good time to start your research on IMII.

________

Gold Resource Corporation (AMEX:

GORO) (Market Cap: $230.873M; Share Price:

$3.76) recently declared its monthly instituted

dividend of 1/6 of a cent per common share for March 2019 payable

on April 23, 2019 to shareholders of record as of April 11, 2019.

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with operations in Oaxaca, Mexico and

Nevada, USA. The company has returned $111 million to its

shareholders in monthly dividends since commercial production

commenced July 1, 2010 and offered the shareholders the option to

convert their cash dividends and take delivery in physical gold and

silver.

Gold Resource Corporation explores for, develops, produces, and

sells gold and silver in Mexico and the United States. It

also explores for copper, lead, and zinc. The company's

flagship property is the Aguila project comprising 18 mining

concessions aggregating approximately 25,264 hectares located in

the State of Oaxaca, Mexico. Gold Resource Corporation was

founded in 1998 and is headquartered in Colorado Springs,

Colorado.

_________

Agnico Eagle Mines Limited (NYSE:

AEM) (Market Cap: $9.482B; Share Price:

$40.49) announced recently that it will release its

first quarter 2019 results on Thursday, April 25, 2019, after

normal trading hours. Additionally, the ompany will host its

Annual and Special Meeting of Shareholders the following day,

Friday, April 26, 2019, in Toronto.

Agnico Eagle Mines Limited engages in the exploration,

development, and production of mineral properties in Canada,

Mexico, and Finland. The company operates through Northern

Business and Southern Business segments. It primarily

produces and sells gold deposit, as well as explores for silver,

zinc, and copper deposits. The company's flagship property is

the LaRonde mine located in the Abitibi region of northwestern

Quebec, Canada. Agnico Eagle is a senior Canadian gold mining

company that has produced precious metals since 1957. The

company and its shareholders have full exposure to gold prices due

to its long-standing policy of no forward gold sales. It has

also declared a cash dividend every year since 1983.

_________

Osisko Gold Royalties Ltd (NYSE:

OR) (Market Cap: $1.705B; Share Price:

$10.95) announced in 1st week of April

that it had subscribed for and received 34,090,909 common shares of

Victoria Gold Corp. at a price of $0.44 per common share for an

aggregate subscription price of $14,999,999.96 pursuant to a

private placement purchase agreement.

Immediately prior to the closing of the Subscription, Osisko

held, directly or indirectly, 120,427,087 common shares of Victoria

Gold, representing approximately 15.3% of Victoria Gold's common

shares prior to the closing. Immediately following the

closing of the Subscription, Osisko owns, directly or indirectly,

154,517,996 common shares of Victoria Gold representing

approximately 18.1% of Victoria Gold's common shares.

Osisko Gold Royalties Ltd acquires and manages precious metal

and other royalties, streams, and similar interests in Canada and

internationally. Its assets include the 5% net smelter return (NSR)

royalty on the Canadian Malartic mine; the 2.0% to 3.5% NSR royalty

on the Eleonore mine; a 9.6% diamond stream on the Renard diamond

mine; a 4% gold and silver stream on the Brucejack gold; a 3% NSR

royalty on the Seabee gold operations located in Saskatchewan,

Canada and the 1.38% to 2.55% NSR royalty on the Island Gold

mine. The company also has a 100% silver stream on the Mantos

Blancos copper mine in Chile.

_________

Golden Star Resources Ltd. (GSS) (Market Cap:

$455.769M; Share Price: $4.17) announced in March its

Mineral Reserves and Mineral Resources estimate as of December 31,

2018 with a 6% increase in total Mineral Reserves after depletion,

including a 47% increase in Wassa Underground Gold Mine ("Wassa

Underground") Mineral Reserves.

Some of the Highlights, include:

- Proven and Probable Mineral Reserves increased by 6% to 1.8

million ounces of gold after mined depletion

- Measured and Indicated Mineral Resources stable at 5.9 million

ounces of gold

- Inferred Mineral Resources increased by 12% to 7.2 million

ounces of gold

- Wassa Underground Mineral Reserve increased by 47% after mined

depletion

- Prestea Mineral Reserve decreased by 36% including mined

depletion

Golden Star Resources Ltd. operates as a gold mining and

exploration company. The company owns and operates the Wassa

open-pit gold mine, the Wassa underground mine, and a

carbon-in-leach processing plant located to the northeast of the

town of Tarkwa, Ghana and the Bogoso gold mining and processing

operation, the Prestea open-pit mining operations, and the Prestea

underground mine located near the town of Prestea, Ghana. It

also holds and manages interests in various gold exploration

properties in Ghana and Brazil.

Gold production guidance for 2019 is 220,000-240,000 ounces at a

cash operating cost per ounce of $620-$680. As the winner of

the PDAC 2018 Environmental and Social Responsibility Award, Golden

Star is committed to leaving a positive and sustainable legacy in

its areas of operation.

_________

Signed by

Priyanka Goel, CFA

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with IMII signed 02/12/2019. The

agreement calls for $25,000 in cash and 10,000 restricted shares of

IMII per month. All payments were made directly by Inception

Mining, Inc. to Regal Consulting, LLC to provide investor relations

services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. IMII was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/disclaimer/ legal

disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

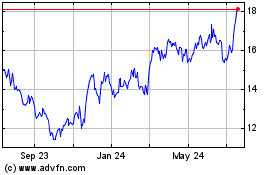

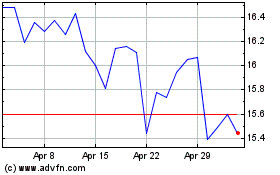

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Apr 2023 to Apr 2024