UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material under §240.14a-12

ZIONS BANCORPORATION,

NATIONAL ASSOCIATION

(Name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

Title of each class of securities to which the transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of the transaction:

|

¨

Fee paid previously with preliminary materials.

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

April 18, 2019

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Zions Bancorporation, N.A. The meeting will be held on Friday, May 31, 2019, at 1:00 p.m., local time, in the Zions Bank Building Founders Room, One South Main Street, 18th Floor, on the corner of South Temple and Main Street in Salt Lake City, Utah.

We are furnishing our proxy materials to you over the Internet as allowed by the rules of the Securities and Exchange Commission. Accordingly, on or about April 19, 2019, you will receive a Notice of Internet Availability of Proxy Materials, or Notice, which will provide instructions on how to access our Proxy Statement and annual report online. This is designed to reduce our printing and mailing costs and the environmental impact of our proxy materials. A paper copy of our proxy materials may be requested through one of the methods described in the Notice.

It is important that all shareholders attend or be represented at the meeting. Whether or not you plan to attend the meeting, please promptly submit your proxy over the Internet by following the instructions found on your Notice. As an alternative, you may follow the procedures outlined in your Notice to request a paper proxy card to submit your vote by mail. The prompt submission of proxies will save the Bank the expense of further requests for proxies, which might otherwise be necessary in order to ensure a quorum.

Shareholders, media representatives, analysts, and the public are welcome to listen to the Annual Meeting via a live webcast accessible at www.zionsbancorporation.com.

Sincerely,

Harris H. Simmons

Chairman and Chief Executive Officer

ZIONS BANCORPORATION, N.A.

One South Main Street, 11th Floor

Salt Lake City, Utah 84133-1109

|

|

|

|

|

NOTICE OF THE 2019 ANNUAL MEETING OF SHAREHOLDERS

|

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be held on May 31, 2019

The Proxy Statement and Annual Report are available at www.zionsbancorporation.com/annualreport.

Date:

May 31, 2019

Time:

1:00 p.m., local time

Place

: Zions Bank Building Founders Room, 18th Floor

One South Main Street, Salt Lake City, Utah 84133

Webcast of the Annual Meeting:

You may listen to a live webcast of the Annual Meeting on our website at www.zionsbancorporation.com.

Purpose of the Annual Meeting:

|

|

|

|

1.

|

To elect 11 directors for a one-year term (Proposal 1)

|

|

|

|

|

2.

|

To ratify the appointment of our independent registered public accounting firm for our fiscal year ending December 31, 2019 (Proposal 2)

|

|

|

|

|

3.

|

To approve, on a nonbinding advisory basis, the compensation paid to our named executive officers with respect to the fiscal year ended December 31, 2018 (Proposal 3)

|

|

|

|

|

4.

|

To establish through a nonbinding advisory vote the preference of our shareholders regarding whether the nonbinding advisory vote on executive compensation should occur every one, two or three years

|

(Proposal 4).

Record Date:

Only shareholders of record on March 28, 2019, are entitled to notice of, and to vote at, the Annual Meeting.

Admission to the Meeting:

Space at the location of the Annual Meeting is limited, and admission will be on a first-come, first-served basis. Before admission to the Annual Meeting, you may be asked to present valid picture identification, such as a driver’s license or passport. If you hold your shares in the name of a brokerage, bank, trust, or other nominee as a custodian (“street name” holders), you will need to bring a copy of a brokerage statement reflecting your share ownership as of the record date. Cameras, recording devices, and other electronic devices will not be permitted at the Annual Meeting.

By order of the Board of Directors

Thomas E. Laursen

Corporate Secretary

Salt Lake City, Utah

April

18, 2019

|

|

|

|

|

|

Table of Contents

|

|

|

SOLICITATION AND VOTING INFORMATION

|

|

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

|

|

|

BOARD AND CORPORATE GOVERNANCE HIGHLIGHTS

|

|

|

CORPORATE GOVERNANCE ENHANCEMENT AND PRACTICES

|

|

|

SHAREHOLDER OUTREACH

|

|

|

DIRECTOR NOMINEES

|

|

|

BOARD MEETINGS AND ATTENDANCE

|

|

|

CORPORATE GOVERNANCE

|

|

|

CORPORATE GOVERNANCE GUIDELINES AND POLICIES

|

|

|

BOARD INDEPENDENCE AND LEADERSHIP STRUCTURE

|

|

|

INDEPENDENT COMMITTEE LEADERSHIP AND LEAD DIRECTOR

|

|

|

BOARD COMMITTEES

|

|

|

BOARD INVOLVEMENT IN RISK OVERSIGHT

|

|

|

OTHER DIRECTOR MATTERS

|

|

|

EXECUTIVE OFFICERS OF THE BANK

|

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

|

|

EXECUTIVE SUMMARY

|

|

|

2018 PERFORMANCE HIGHLIGHTS

|

|

|

2018 COMPENSATION HIGHLIGHTS

|

|

|

COMPENSATION DECISIONS FOR THE 2018 PERFORMANCE PERIOD

|

|

|

PLAN DESIGN AND AWARD HIGHLIGHTS

|

|

|

COMPENSATION DECISIONS FOR NAMED EXECUTIVE OFFICERS

|

|

|

COMPENSATION PHILOSOPHY AND OBJECTIVES

|

|

|

PHILOSOPHY, OBJECTIVES, AND PRACTICES

|

|

|

ROLES AND RESPONSIBILITIES

|

|

|

PEER GROUP

|

|

|

BENCHMARKING

|

|

|

COMPENSATION ELEMENTS

|

|

|

BASE SALARY

|

|

|

ANNUAL CASH INCENTIVE

|

|

|

LONG-TERM INCENTIVES

|

|

|

PERQUISITES

|

|

|

|

|

|

|

|

HEALTH AND WELFARE BENEFITS

|

|

|

RETIREMENT BENEFITS

|

|

|

OTHER COMPENSATION PRACTICES AND POLICIES

|

|

|

CHANGE IN CONTROL AGREEMENTS

|

|

|

EMPLOYMENT CONTRACTS

|

|

|

INCENTIVE COMPENSATION CLAWBACK POLICY

|

|

|

SHARE OWNERSHIP AND RETENTION GUIDELINES

|

|

|

ANTI-HEDGING AND PLEDGING POLICY

|

|

|

DEDUCTIBILITY AND EXECUTIVE COMPENSATION

|

|

|

NON-QUALIFIED DEFERRED COMPENSATION

|

|

|

2018 CEO PAY RATIO DISCLOSURE

|

|

|

ACCOUNTING FOR STOCK-BASED COMPENSATION

|

|

|

COMPENSATION COMMITTEE REPORT

|

|

|

COMPENSATION TABLES

|

|

|

2018 SUMMARY COMPENSATION TABLE

|

|

|

2018 GRANTS OF PLAN-BASED AWARDS

|

|

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END 2018

|

|

|

OPTION EXERCISES AND STOCK VESTED IN 2018

|

|

|

2018 PENSION BENEFITS TABLE

|

|

|

2018 NONQUALIFIED DEFERRED COMPENSATION TABLE

|

|

|

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

|

|

|

RECONCILIATION OF NON-GAAP PERFORMANCE METRICS

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

|

|

ORDINARY COURSE LOANS

|

|

|

RELATED PARTY TRANSACTIONS POLICY

|

|

|

COMPENSATION OF DIRECTORS

|

|

|

DEFERRED COMPENSATION PLAN FOR NONEMPLOYEE DIRECTORS

|

|

|

2018 DIRECTOR SUMMARY COMPENSATION TABLE

|

|

|

PRINCIPAL HOLDERS OF VOTING SECURITIES

|

|

|

|

|

|

|

|

PROPOSALS

|

|

|

Proposal 1: NOMINATION AND ELECTION OF DIRECTORS

|

|

|

Proposal 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

Proposal 3: ADVISORY (NONBINDING) VOTE REGARDING 2018 EXECUTIVE COMPENSATION (“SAY ON PAY”)

|

|

|

Proposal 4: ADVISORY (NONBINDING) VOTE ON FREQUENCY OF FUTURE SAY ON PAY VOTES ON EXECUTIVE COMPENSATION (“SAY ON FREQUENCY”)

|

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

|

|

OTHER MATTERS

|

|

|

OTHER BUSINESS BEFORE THE ANNUAL MEETING

|

|

|

SHAREHOLDER PROPOSALS FOR 2020 ANNUAL MEETING

|

|

|

COMMUNICATING WITH THE BOARD OF DIRECTORS

|

|

|

“HOUSEHOLDING” OF PROXY MATERIALS

|

|

|

VOTING THROUGH THE INTERNET OR BY TELEPHONE

|

|

|

FORWARD-LOOKING STATEMENTS

|

|

ZIONS BANCORPORATION, N.A.

One South Main Street, 11th Floor

Salt Lake City, Utah 84133-1109

PROXY STATEMENT

|

|

|

|

|

SOLICITATION AND VOTING INFORMATION

|

Your proxy is solicited by the Board of Directors (referred to as the “Board”) of Zions Bancorporation, N.A. (referred to as “Zions,” “we,” “our,” “us,” or the “Bank”) for use at the Annual Meeting of our shareholders to be held in the Zions Bank Building Founders Room, One South Main Street, 18th Floor, on the corner of South Temple and Main Street in Salt Lake City, Utah, on Friday, May 31, 2019, at 1:00 p.m. local time.

In accordance with rules and regulations of the Securities and Exchange Commission, we have elected to provide our shareholders with access to our proxy materials over the Internet rather than in paper form. Accordingly, on or about April 19, 2019, we will send a Notice of Internet Availability of Proxy Materials rather than a printed copy of the materials to our shareholders of record as of March 28, 2019, the record date for the Annual Meeting.

If you validly submit a proxy solicited by the Board, the shares represented by the proxy will be voted on the proposals in the manner you specify. If no contrary direction is given, your proxy will be voted as follows:

|

|

|

|

Ø

|

FOR

the election of the 11 directors listed on page 67 to a one-year term of office (Proposal 1)

|

|

|

|

|

Ø

|

FOR

ratification of the appointment of our independent registered public accounting firm for 2019 (Proposal 2)

|

|

|

|

|

Ø

|

FOR

approval, on a nonbinding advisory basis, of the compensation paid to our named executive officers identified in this Proxy Statement with respect to the year ended December 31, 2018 (Proposal 3)

|

|

|

|

|

Ø

|

ONE YEAR

in response to a proposal establishing the preference of our shareholders regarding whether the nonbinding advisory vote to approve compensation paid to our named executive officers should occur every one, two or three years (Proposal 4)

|

If you submit your proxy but indicate that you want to

ABSTAIN

with respect to any proposal, your shares will be counted for purposes of whether a quorum exists. An abstention will have no effect on the outcome of any proposal. You may

REVOKE

your proxy at any time before it is voted at the Annual Meeting by giving written notice to our Corporate Secretary, or by submitting a later dated proxy through the mail, Internet, or telephone (in which case the later submitted proxy will be recorded and the earlier proxy revoked), or by voting in person at the Annual Meeting.

The only shares that may be voted at the Annual Meeting are the 182,512,940 common shares outstanding at the close of business on the record date. Each share is entitled to one vote.

On all matters other than the election of directors, the action will be approved if the number of shares validly voted “for” the action exceeds the number of shares validly voted “against” the action. The same majority vote standard also applies in the uncontested election of directors. In all elections of directors, each shareholder entitled to vote shall have the right to vote, in person or by proxy, each share owned by him or her for as many persons as there are directorships to be voted on. Each nominee will be elected as director for a full term if, and only if, the nominee receives the affirmative vote of the majority of the votes cast with respect to that nominee (meaning the number of shares validly voted “for” the nominee exceeds the number of shares voted “against” that nominee). If a nominee fails to receive such a majority of votes, he or she will be required by our corporate governance guidelines to promptly tender his or her resignation following certification of the vote. Please see “Board and Corporate Governance Highlights” at page 3 of this proxy statement for further information about this resignation process. At a contested election, the directors will be elected by a plurality of the votes cast (meaning the nominees with the greatest number of shares voted “for” shall be elected without regard to votes cast “against” any nominee). A quorum of our shares must be present or represented by proxy before any action can be taken at the meeting. A quorum of our shares is a majority of the shares entitled to vote on the record date. In order for a shareholder proposal to be acted on at the meeting, the proposal will need to be validly presented at the Annual Meeting by a shareholder proponent.

Please note that under the New York Stock Exchange, or NYSE, rules governing broker-dealers, brokers that have not received voting instructions from their customers 10 days prior to the Annual Meeting date may vote their customers’ shares in the brokers’ discretion on the proposal regarding the ratification of the appointment of our independent registered public accounting firm (Proposal 2) because this is considered “discretionary” under NYSE rules. If your broker is an affiliate of the Bank, NYSE policy states that, in the absence of your specific voting instructions, your shares may be voted only in the same proportion as all other shares are voted with respect to each discretionary item. Under the NYSE rules, each other proposal is a “non-discretionary” item, which means that member brokers who have not received instructions from the beneficial owners of the Bank’s common stock do not have discretion to vote the shares of our common stock held by those beneficial owners on those proposals. This means that brokers may not vote your shares in the election of directors (Proposal 1), on the proposal to approve 2018 compensation of our named executive officers on a nonbinding advisory basis (Proposal 3), or on the proposal establishing the frequency preferred by shareholders for the nonbinding advisory vote to approve executive compensation (Proposal 4), unless you provide specific instructions on how to vote. Broker non-votes will have no effect on the outcome of these proposals. We encourage you to provide instructions to your broker regarding the voting of your shares.

We will bear the cost of soliciting proxies. We will reimburse brokers and others who incur costs to send proxy materials to beneficial owners of shares held in a broker or nominee name. Our directors, officers, and employees may solicit proxies in person, by mail, or by telephone, but they will receive no extra compensation for doing so.

|

|

|

|

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

|

|

|

|

|

|

BOARD AND CORPORATE GOVERNANCE HIGHLIGHTS

|

We are committed to high standards of ethics and sound corporate governance, including oversight of the Bank’s affairs by a strong, qualified, and independent Board of Directors. We regularly review and consider enhancements to our corporate governance guidelines and practices.

CORPORATE GOVERNANCE ENHANCEMENT AND PRACTICES

|

|

|

|

•

|

Four new, independent members have been added to the Board since 2015. The average tenure of the Board as of the date of this Proxy Statement is 12 years.

|

|

|

|

|

•

|

Our Board includes an independent lead director selected by our independent Board members, with clearly defined duties to complement the leadership of our Chairman and CEO, Harris H. Simmons.

|

|

|

|

|

•

|

Directors regularly review and approve corporate strategy, providing oversight and effective challenge of management as needed, to help facilitate the creation of value for our shareholders, employees, and the communities we serve.

|

|

|

|

|

•

|

Nine of our eleven director nominees are independent. Members of management serving on the Board include Chairman and CEO Harris H. Simmons and President and Chief Operating Officer Scott McLean. The National Bank Act requires a bank’s president to serve on its Board of Directors.

|

|

|

|

|

•

|

With the exception of the Executive Committee, all of the Board’s Committees are comprised entirely of independent Board members.

|

|

|

|

|

•

|

All directors are elected for one-year terms.

|

|

|

|

|

•

|

We use a majority vote standard in uncontested director elections and recently adopted a resignation policy in the Bank’s corporate governance guidelines. If the votes cast to elect a nominee fail to constitute a majority of the votes cast with respect to that nominee, the nominee must tender his or her resignation, and the Board of Directors, through a process managed by the Nominating and Corporate Governance Committee, will decide whether to accept the resignation. The Board must take action within 90 days following certification of the vote, unless the action would cause the Bank to fail to comply with any listing or legal requirement, in which event the Board will take action as promptly as is practicable while continuing to meet such requirements. The Board must publicly disclose whether they accepted or rejected the nominee’s resignation and the reasons for the decision.

|

|

|

|

|

•

|

Board candidates are selected with consideration given to diversity in background, viewpoint, and experience.

|

|

|

|

|

•

|

The Bank recently amended its bylaws to provide that shareholder nominees for director may be included in the Bank’s proxy materials. Please see the Bank’s Second Amended and Restated Bylaws (“Bylaws”) included as an Exhibit to its current report on Form 8-K filed on April 4, 2019 for further information.

|

|

|

|

|

•

|

Directors and executive officers are subject to stock ownership and retention requirements.

|

|

|

|

|

•

|

Hedging of Bank stock by directors and executive officers is strictly prohibited.

|

|

|

|

|

•

|

Pledging of Bank stock by directors and executive officers is restricted; such pledging is subject to approval, and is reviewed annually by the Board’s Compensation Committee.

|

Throughout the year, we meet regularly with investors and actively seek their feedback on a wide variety of topics related to our performance, including business strategy, industry trends, capital management, governance, risk management, keys to core earnings growth, portfolio concentrations and compensation. During 2018, we held more than 270 meetings with nearly 170 unique institutional investment firms, primarily those investing in or analyzing the common equity of the Bank. As part of this outreach, we traveled to see investors in 20 cities located in the United States and Europe, presented at 9 investor conferences, hosted approximately 100 face-to-face interactions with shareholders in their offices and held one-on-one or small group meetings with more than 170 investors in investor conference settings. We hosted a full day investor conference on March 1, 2018, in Salt Lake City, Utah, which was also available via webcast. In 2018, the Bank issued senior bank debt for the first time and therefore we conducted fixed income investor outreach, meeting with dozens of fixed income investors and soliciting feedback. We strive to be transparent and responsive to the ever-changing interests of the investor community. The feedback received from investors and analysts at these meetings and events is discussed regularly in management and Board-level meetings.

At our 2018 Annual Meeting, our shareholders approved a non-binding advisory say-on-pay proposal with approximately 96% of the votes cast voting in favor of that proposal. The Compensation Committee of the Board reviewed the results of the shareholder vote, which indicates there is strong support among shareholders for our compensation structure and decisions.

As we design our compensation programs, we are mindful of balancing the objectives of our various constituencies, including our investors, regulators, customers, and employees. Industry-wide guidance from regulators has focused on ensuring that incentive compensation programs do not encourage excessive or unnecessary risk-taking. Our shareholders also have a wide variety of perspectives on compensation and we were pleased to engage with a number of them over the course of 2018 to learn more about their viewpoints.

In recent years, our Board has worked to incorporate feedback from investors to more closely align pay with performance, in part by making the following refinements to our incentive compensation award determination processes:

|

|

|

|

•

|

Created greater transparency regarding incentive compensation targets for members of the Bank’s Executive Management Committee (“EMC”)

|

|

|

|

|

•

|

Formalized guidance on how performance appraisals for each EMC member should inform cash bonus payments for respective EMC members, as described under “Compensation Discussion and Analysis”

|

|

|

|

|

•

|

Expanded the scope of the risk management assessment of each EMC member, which is an important input into each EMC member’s overall Performance Appraisal Rating, to include a more comprehensive assessment of each EMC member’s risk management performance

|

We intend to continue to manage our current compensation structures and approach to ensure that there is ongoing support for our pay programs among various constituencies, including our investors, regulators, and employees.

You are being asked to elect 11 directors, each to hold office until the next Annual Meeting of shareholders or until his or her successor is duly elected or qualified. The proposal for the election of these directors (Proposal 1) begins on page 67 of this Proxy Statement.

The names, ages, and biographical information for each nominee to our Board are set forth below. See page 11 of this Proxy Statement for a listing of the Board committee membership of each nominee.

|

|

|

|

|

|

|

Principal Occupation, Directorships of Publicly Traded Companies

During the Past Five Years, and Qualifications, Attributes, and Skills

|

|

Jerry C. Atkin

Age 70

Director since 1993

|

Mr. Atkin is chairman and retired CEO of SkyWest, Inc., based in St. George, Utah.

Mr. Atkin brings his skills and experience as the head of a publicly traded company for 40 years as well as an accounting background to our Board. At SkyWest, he led the company’s growth from annual revenue of less than $1 million to more than $3 billion. Prior to becoming CEO of SkyWest, Mr. Atkin was its chief financial officer.

|

|

Gary L. Crittenden

Age 65

Director since 2016

|

Mr. Crittenden is a private investor and has been a non-employee executive director of HGGC, LLC, a California-based middle market private equity firm, since January 2017. He also serves on the Board of Directors of Pluralsight, Inc., where he is a member of the nominating and corporate governance committee. During the period of 2009 to January 2017 he served in various capacities at HGGC, including managing director, chairman, and CEO. He is a member of the board of Primerica, where he serves on the audit committee. He previously served as chairman of Citi Holdings, and as chief financial officer at Citigroup, American Express Company, Monsanto, Sears Roebuck, Melville Corporation and Filene’s Basement following a consulting career at Bain & Company.

Mr. Crittenden brings substantial experience in banking and financial services, mergers and acquisitions, investment management, public markets, finance and accounting, risk management and regulatory relations.

|

|

Suren K. Gupta

Age 58

Director Since 2015

|

Mr. Gupta is executive vice president of Technology, Global Operations and Strategic Ventures at Allstate Insurance Company, where he has served since 2011. From 2003 to 2011, he served as executive vice president and group chief information officer, Home & Consumer Finance Group, at Wells Fargo & Company.

Mr. Gupta’s deep experience in technology, operations, and business strategy adds depth to our Board’s knowledge about data, technology, and security, areas of evolving and increasing risk to the financial services industry. He has held senior technology, operations, sales, marketing and strategic development roles at GMAC Residential, INTELSAT, a telecommunications company, and at Thomson Corp., an information company.

|

|

J. David Heaney

Age 70

Director since 2005

|

Mr. Heaney is chairman of Heaney Rosenthal Inc., a Houston, Texas-based financial organization specializing in investment in private companies in various industry sectors.

Mr. Heaney contributes financial and legal expertise, and broad knowledge of the Texas market to our Board. He was a founding director of Amegy Bancorporation, Inc., which we acquired in December 2005. He has also served as vice president of finance and chief financial officer of Sterling Chemicals, Inc. Mr. Heaney was a partner of the law firm Bracewell & Patterson (now Bracewell).

|

|

|

|

|

|

|

|

Principal Occupation, Directorships of Publicly Traded Companies

During the Past Five Years, and Qualifications, Attributes, and Skills

|

|

Vivian S. Lee

Age 52

Director since 2015

|

Dr. Lee is the president of Health Platforms at Verily Life Sciences, where she has served since 2018. From 2011 to 2017, she was senior vice president of Health Sciences at the University of Utah, dean of the university’s School of Medicine, and CEO of University of Utah Health Care. She was previously the vice dean for science, senior vice president, and chief scientific officer of New York University Medical Center. From 2014 until 2015, Dr. Lee also served on the Board of Directors of Zions First National Bank.

Dr. Lee brings a wealth of experience as a CEO focused on streamlining processes and improving efficiency in the highly regulated and rapidly evolving health care industry. She has been responsible for an annual budget of more than $3.5 billion, and led a healthcare system comprising four hospitals, numerous clinical and research specialty centers, neighborhood health centers, an insurance plan, and more than 1,200 board-certified physicians.

|

|

Scott J. McLean

Age 62

Director since 2006

|

Mr. McLean is President and Chief Operating Officer, or COO, of Zions Bancorporation, N.A. He is a director of CenterPoint Energy.

With 39 years of banking experience, Mr. McLean has served for 17 years in leadership positions for the Zions organization, including as CEO of its Amegy Bank affiliate prior to assuming his current position in 2014. Mr. McLean is active in the community, including having served as chairman of the board of the United Way in Houston.

|

|

Edward F. Murphy

Age 66

Director since 2014

|

Mr. Murphy is a former executive vice president of the Federal Reserve Bank of New York where he served as the principal financial officer and was responsible for enterprise wide operational risk management. He is also a former executive vice president of JP Morgan Chase Incorporated.

Mr. Murphy is a Certified Public Accountant who contributes significant expertise in accounting and financial reporting in the banking industry, as well as extensive experience in operational risk management and internal control processes. During his 21-year career at JP Morgan Chase, he held several senior leadership positions, including principal accounting officer, global director of internal audit, chief operating officer of Asia Pacific operations, and chief financial officer of the consumer and middle markets businesses.

|

|

Stephen D. Quinn

Age 63

Director since 2002

|

Mr. Quinn is a former managing director and general partner of Goldman, Sachs & Co. He is a director of Group 1 Automotive, Inc. and was a director of American Express Bank Ltd. prior to its sale in 2009.

Mr. Quinn contributes financial and investment banking expertise to the Board. At Goldman Sachs, he specialized in corporate finance, spending two decades structuring mergers and acquisitions, debt and equity financings, and other transactions for some of America’s best-known corporations. At Group 1 Automotive, he is currently the non-executive Chairman; he chairs the nominating/governance committee and is a member of the audit and compensation committees. At American Express Bank Ltd., Mr. Quinn chaired the risk committee and served as a member of its audit committee.

|

|

Harris H. Simmons

Age 64

Director since 1989

|

Mr. Simmons is Chairman and Chief Executive Officer, or CEO, of Zions Bancorporation, N.A. He was previously a director of Questar Corporation.

Mr. Simmons’ over 40 years of experience in banking and leadership of the Bank is invaluable to the Board. During his tenure as our president and then chairman and CEO, the Bank has grown from $3 billion in assets to our present $69 billion in assets. He is past chairman of the American Bankers Association.

|

|

|

|

|

|

|

|

Principal Occupation, Directorships of Publicly Traded Companies

During the Past Five Years, and Qualifications, Attributes, and Skills

|

|

Aaron B. Skonnard

Age 46

New Nominee

|

Mr. Skonnard is the co-founder, chairman of the board, and CEO of Pluralsight, Inc., a publicly traded enterprise software-as-a-service company focused on teaching technology skills through its leading technology skills development platform used by 70% of the Fortune 500 companies.

Mr. Skonnard is a founder and board member of the Silicon Slopes organization, a nonprofit designed to empower Utah’s startup and tech community. His anticipated contributions to the Board include his expertise in technology and his valuable perspective as a philanthropist, entrepreneur, and chief executive officer of a publicly traded company.

|

|

Barbara A. Yastine

Age 59

Director since 2017

|

Ms. Yastine is a private investor. She served as a director and co-CEO of privately-held Lebenthal Holdings, LLC from September 2015 to June 2016. Ms. Yastine previously served as chair, president and CEO of Ally Bank from March 2012 to June 2015. From May 2010 to March 2012, she served as either chair or executive chair of Ally Bank and chief administrative officer of Ally Financial, overseeing the risk, compliance, legal and technology areas. Prior to joining Ally Financial, she served in various capacities in the financial industry, including with Credit Suisse First Boston and Citigroup. Ms. Yastine is a member of the boards of directors of Primerica, Inc. (chair, compensation committee); First Data Corp. (chair, audit committee); and Axis Capital holdings (member, Audit Committee, Governance Committee and Risk Committee).

Ms. Yastine brings to our Board her expertise in general management, consumer and commercial banking, digital strategies, branding, investment banking and capital markets, wealth management, risk and asset management, finance, strategic planning, and bank regulatory matters from her broad experience serving in financial services.

|

With the exception of Aaron Skonnard, who is a new nominee standing for election to the Board, and Scott McLean, the Bank’s president, each member of the Bank’s Board of Directors was previously a director of Zions Bancorporation, the Bank’s former holding company, which merged with and into the Bank effective September 30, 2018. The National Bank Act requires the Bank’s president to serve on its Board of Directors.

|

|

|

|

|

BOARD MEETINGS AND ATTENDANCE

|

During 2018, our full Board held nine meetings and the non-management directors met in confidential “executive sessions” seven times. Our independent lead director presided at each such executive session. All directors attended at least 75% of the total number of all Board and applicable committee meetings. All Board members also attended last year’s Annual Meeting of shareholders. All of our directors are expected to attend the regularly scheduled meetings of the Board, including the organizational meeting held in conjunction with the Annual Meeting, meetings of committees of which they serve as members, and our Annual Meeting of shareholders.

The Board regularly schedules educational presentations during its regular meetings to stay current on market, regulatory and industry issues. In addition, our Board members periodically attend industry conferences, meetings with regulatory agencies, and training and educational sessions pertaining to their service on the Board and its committees.

The Board typically invites members of management, including our chief financial officer, or CFO; general counsel; chief risk officer, or CRO; chief credit officer; and director of Internal Audit to attend Board meetings and Board committee meetings (or portions thereof) to provide information relating to their areas of responsibility. Members of management do not attend executive sessions of the Board, except when requested by the Board.

CORPORATE GOVERNANCE GUIDELINES AND POLICIES

In addition to the elements of corporate governance reflected in our Board structure and responsibilities, we maintain a comprehensive set of corporate governance guidelines and policies. These are adopted and updated by the Board upon the recommendation of the Nominating and Corporate Governance Committee and include the following:

|

|

|

|

•

|

Corporate Governance Guidelines, which address our Board’s structure and responsibilities, including the Board’s role in management succession planning and the evaluation and compensation of executive officers

|

|

|

|

|

•

|

Code of Business Conduct and Ethics, which applies to all of our officers and employees, including the CEO, president and COO, CFO, and controller

|

|

|

|

|

•

|

Code of Business Conduct and Ethics for members of the Board of Directors

|

|

|

|

|

•

|

Related-Party Transactions Policy, which prohibits certain transactions between the Bank and its directors, executive officers, and 5% shareholders without necessary disclosure and approval or ratification

|

|

|

|

|

•

|

Stock Ownership and Retention Guidelines, under which our executive officers and directors are expected to hold specified amounts of our common shares

|

|

|

|

|

•

|

Policies prohibiting hedging and restricting pledging of Bank stock by directors or executive officers

|

|

|

|

|

•

|

Incentive Compensation Clawback Policy, which allows the Bank to, among other actions, recapture prior incentive compensation or cancel all or a portion of long-term incentive awards granted to an employee

|

These guidelines and policies

are posted on our website at www.zionsbancorporation.com and can be accessed by clicking on “Corporate Governance.” Our Board committee charters and information concerning purchases and sales of our equity securities by our executive officers and directors are also available on our website.

BOARD INDEPENDENCE AND LEADERSHIP STRUCTURE

Our Board continues to be strongly independent. The Board has determined that 9 of our 11 Board nominees are “independent” as defined by the rules of The Nasdaq Stock Market LLC, or Nasdaq, and our Corporate Governance Guidelines. In addition, the Board’s lead director, the chairpersons of each of the Board’s committees, and all of the members of the Board’s committees, other than the Executive Committee, are independent. As noted elsewhere in this proxy statement, members of management serving on the Board include Chairman and CEO Harris H. Simmons and President and Chief Operating Officer Scott McLean. The National Bank Act requires a bank’s president to serve on its Board of Directors.

Under our Corporate Governance Guidelines, a director will be considered independent only if he or she: (i) is “independent” under Nasdaq rules, and (ii) does not have any relationship which, in the opinion of the Board, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Each director is required to inform the chairperson of the Bank’s Nominating and Corporate Governance Committee of any such direct or indirect relationship between the director and the Bank or its subsidiaries (such as where the director is a partner, shareholder or officer of an organization that has any relationship with the Bank or any of its subsidiaries) that could interfere with the director’s exercise of independent judgment. In determining whether any such relationship in fact would interfere with a director’s exercise of independent judgment, the Board considers such factors as it deems appropriate, such as the relative magnitude of the relationship, the financial or other importance of the relationship to the director and the Bank and its subsidiaries, and whether the relationship was made in the ordinary course on arms-length terms for which substitute arrangements are readily available to the director and the Bank and its subsidiaries. Applying this definition, the Board has determined that all of our directors are independent except for Harris H. Simmons, who is the chairman and CEO of the Bank, and Scott J. McLean, president and COO of the Bank. In addition, members of the Board committees must meet all other independence and experience standards required by law or rules and regulations of governmental agencies or self-regulatory bodies.

Our Board considers its governance periodically and believes, at this time, that combining the roles of chairman and CEO is the most appropriate leadership structure for the Bank. In reaching this view, the Board took into consideration several factors. Our CEO, Harris H. Simmons, has over 40 years of experience with the Bank, including 28 years of service as our CEO. His knowledge, experience, and personality allow him to serve ably as both chairman and CEO. Combining the roles of chairman and CEO facilitates a single, focused structure to implement the Bank’s strategic initiatives and business plans.

At the same time, the Board feels that the current governance structure—which includes regular executive sessions each chaired by an independent lead director; meetings with the Bank’s external auditors, internal auditors, and other consultants; meetings with members of our management; and active Board and committee members—provides effective challenge and appropriate oversight of the Bank’s policies and business. The Board believes that separating the chairman and CEO positions would not strengthen the effectiveness of the Board.

This structure was affirmed by votes of the shareholders in 2010, and each of 2013-2017, and allows the Board discretion to select the person or persons most qualified to lead the Bank.

INDEPENDENT COMMITTEE LEADERSHIP AND LEAD DIRECTOR

Each member of our Board of Directors is charged with exercising independent judgment and critically evaluating management’s performance and decisions. In order to facilitate and support an active and independent Board, and in keeping with our corporate governance philosophy and commitment to effective oversight, the Bank’s Corporate Governance Guidelines provide that, in the event the chairman of the Board is an executive officer of the Bank, an independent director selected solely by the Bank’s independent directors will serve as the “Lead Director.” The role of the lead director is to provide an independent counterbalance to our structure of a combined CEO/chairman role, by exercising the following duties:

|

|

|

|

•

|

Presiding at all meetings of the Board at which the chairman of the Board is not present, including executive sessions of the independent directors

|

|

|

|

|

•

|

Calling meetings of independent directors

|

|

|

|

|

•

|

Serving as a liaison between the chairman of the Board and the independent directors, including providing feedback to the chairman from the Board’s executive sessions and discussing with other directors any concerns they may have about the Bank and its performance, and relaying those concerns, where appropriate, to the full Board

|

|

|

|

|

•

|

Conducting calls with each Board member as part of the Board’s effectiveness review process

|

|

|

|

|

•

|

Consulting with the CEO regarding the concerns of the directors

|

|

|

|

|

•

|

Being available for consultation with the senior executives of the Bank as to any concerns any such executive might have

|

|

|

|

|

•

|

Communicating with shareholders upon request

|

|

|

|

|

•

|

Advising the chairman of the Board regarding, and approving, Board meeting schedules, agendas, and information provided to the Board

|

|

|

|

|

•

|

Otherwise providing Board leadership when the chairman of the Board cannot or should not act in that role

|

Further, our Board’s Audit, Compensation, Risk Oversight, and Nominating and Corporate Governance Committees are composed entirely of independent directors, while five of the six members of our Executive Committee are independent. All five of our standing committees are chaired by independent directors.

BOARD COMMITTEES

Our Board’s standing committees are:

|

|

|

|

•

|

Risk Oversight Committee

|

|

|

|

|

•

|

Nominating and Corporate Governance Committee

|

Members of committees are appointed by the Board following recommendation by the Nominating and Corporate Governance Committee and serve at the pleasure of the Board for such term as the Board determines. All committees other than the Executive Committee have written charters. The Executive Committee’s authority is incorporated in the Bank’s Bylaws. The current versions of the written committee charters are posted on our website at www.zionsbancorporation.com and can be accessed by clicking on the “Corporate Governance” link. Periodically, our general counsel (with the assistance of outside counsel and other advisors, as appropriate) reviews all committee charters in light of any changes in exchange listing rules, SEC regulations or other evidence of “best practices.” The results of the review and any recommended changes are discussed with the committees, which review their charters periodically. The full Board then approves the charters, with any revisions it deems appropriate, based on the committees’ recommendations. In addition, each Board committee conducts an annual effectiveness review. All of the committee charters were reviewed and minor updates made as needed during 2018.

The Board appoints one member of each committee as its chairperson. Chair positions are rotated periodically at the Board’s discretion. The committee calendars, meetings, and meeting agendas are set by the chairperson of the respective committee. As with full Board meetings, the CEO and other members of management are frequently invited to attend various committee meetings (or portions thereof) to provide information relating to their areas of responsibility. Members of management attend executive sessions only on invitation.

According to their charters, each of the Board’s committees has the authority to select, retain, terminate, and approve the fees of experts or consultants, as it deems appropriate, without seeking approval of the Board or management.

The following table provides membership information for each of the Board’s standing committees as of the record date of this Proxy Statement.

|

|

|

|

|

|

|

|

|

|

Name

|

Executive

Committee

|

Audit Committee

|

Risk Oversight Committee

|

Compensation Committee

|

Nominating and Corporate Governance Committee

|

|

Jerry C. Atkin

|

|

ü

|

|

ü

|

ü

|

|

Gary L. Crittenden

|

ü

|

ü

|

|

|

ü

*

|

|

Suren K. Gupta

|

|

|

ü

|

|

|

|

J. David Heaney

|

ü

|

|

ü

*

|

ü

|

|

|

Vivian S. Lee

|

ü

|

|

|

ü

*

|

|

|

Edward F. Murphy

|

ü

|

ü

*

|

ü

|

|

|

|

Roger B. Porter**

|

|

|

|

ü

|

ü

|

|

Stephen D. Quinn, Lead Director

|

ü

*

|

ü

|

|

|

ü

|

|

Harris H. Simmons

|

ü

|

|

|

|

|

|

Barbara A. Yastine

|

|

|

ü

|

|

|

|

* Committee Chair

|

|

|

|

|

|

|

**Mr. Porter reached retirement age as specified in the Bank’s Corporate Governance Guidelines and therefore has not been nominated to stand for reelection at the 2019 annual meeting.

|

Executive Committee

Our Executive Committee had six members during 2018. The Executive Committee reviews projects or proposals that require prompt action from the Bank. Subject to certain exceptions, the Executive Committee is authorized to exercise all powers of the full Board of Directors with respect to such projects or proposals when it is not practical to delay action pending approval by the entire Board. The Executive Committee does not have authority to approve or adopt, or recommend to the shareholders, any action or matter expressly required by law to be submitted to the shareholders for approval; adopt, amend, or repeal the Restated Articles of Incorporation or Restated Bylaws of the Bank; or remove or indemnify directors. The chairman of the Executive Committee is an independent director and serves as the lead director. The Executive Committee did not meet in 2018.

Audit Committee

Our Audit Committee had four members and met 12 times during 2018, and held one additional joint session with the Bank’s Risk Oversight Committee. A written charter approved by the Board governs the Audit Committee. Each of its members is independent, determined as described in its committee charter. Information regarding the functions performed by the Audit Committee and its membership is set forth in its charter and highlighted in the “Report of the Audit Committee” included in this Proxy Statement. The Board has determined that each member of the Audit Committee as listed on page 11 of this Proxy Statement is an audit committee financial expert with experience and attributes in accordance with the rules of the SEC and Nasdaq’s listing standards.

Risk Oversight Committee

Our Risk Oversight Committee had four members and met seven times during 2018, and held one additional joint session with the Bank’s Audit Committee. A written charter approved by the Board governs the Risk Oversight Committee. Each of its members is independent, determined as described in its committee charter. The Risk Oversight Committee serves to provide oversight of the Bank’s enterprise-wide risk management framework, including the strategies, policies, procedures, and systems established by management to assess, understand, measure, monitor, and manage the Bank’s significant risks. The Board has also determined that the experience and backgrounds of the members of the Risk Oversight Committee collectively satisfy the pertinent requirements under its committee charter and the Dodd-Frank Act that its members have experience in identifying, assessing, and managing the risks of large, complex, financial firms.

Compensation Committee

Our Compensation Committee had four members and met five times during 2018. Each of its members is independent, determined as described in its committee charter. The purpose of the Compensation Committee is to discharge the Board’s responsibilities relating to the evaluation and compensation of our executives, including reviewing the Bank’s executive compensation arrangements with a view toward assuring proper balance of objectives, eliminating elements that could encourage unnecessary and excessive risks, and avoiding jeopardy to the safety and soundness of the Bank. The Compensation Committee considers the perspectives of shareholders, regulators, and outside consultants regarding executive compensation and produces reports, filings, and certifications related to compensation, in accordance with the rules and regulations of the SEC and other governmental agencies. The manner in which the Compensation Committee oversees and determines the compensation of our CEO and other executive officers is described in this Proxy Statement under “Compensation Discussion and Analysis.”

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during 2018 or as of the date of this Proxy Statement is or has been an officer or employee of the Bank, and no executive officer of the Bank served on the compensation committee or board of any company that employed any member of the Bank’s Compensation Committee or Board. None of the members had a relationship that would require disclosure under the “Certain Relationships and Related Transactions” caption of any of our filings with the SEC during the past three fiscal years, except as may be described under “Ordinary Course Loans” in this Proxy Statement.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee had four members who met three times during 2018. Each of its members is independent, determined as described in its committee charter. The purpose of the committee is to identify and recommend individuals to the Board for nomination as members of the Board and its committees and to assist the Board in oversight of the corporate governance principles of the Bank.

In identifying and recommending nominees for positions on the Board, the Nominating and Corporate Governance Committee places primary emphasis on the following criteria, which are set forth under “Candidates for Board Membership” in our Corporate Governance Guidelines:

|

|

|

|

•

|

Personal qualities and characteristics, accomplishments, and professional reputation

|

|

|

|

|

•

|

Current knowledge and understanding of the communities in which we do business and in our industry or other industries relevant to our business

|

|

|

|

|

•

|

Ability and willingness to commit adequate time to Board and committee matters

|

|

|

|

|

•

|

Fit of the individual’s skills and qualities with those of other directors and potential directors in building a Board that is effective, collegial, and responsive to the needs of the Bank

|

|

|

|

|

•

|

Diversity of viewpoints, backgrounds, and experience

|

|

|

|

|

•

|

Ability and skill set required to chair committees of the Board

|

|

|

|

|

•

|

Relevant and significant experience in public companies

|

The Nominating and Corporate Governance Committee does not assign specific weights to these criteria. Its objective is to assemble a Board whose members collectively meet the criteria and possess the talents and characteristics necessary to enable the Board to fulfill its responsibilities effectively.

The Nominating and Corporate Governance Committee evaluates each nominee based on the nominee’s individual merits, taking into account our needs and the composition of the Board. Members of the committee discuss and evaluate possible candidates in detail and suggest individuals to explore in more depth. Once a candidate is identified whom the committee wants to seriously consider and move toward nomination, the matter is discussed with the Board. Thereafter, the chairperson of the committee or his or her designee enters into a discussion with that candidate to determine interest and availability.

The Nominating and Corporate Governance Committee also considers candidates recommended by shareholders. The policy adopted by the committee provides that nominees recommended by shareholders are given appropriate consideration in the same manner as other nominees. Shareholders who wish to submit director nominees for consideration by the Nominating and Corporate Governance Committee should follow the process set forth in the Bank’s Bylaws. For more information on this process, see “Shareholder Proposals for 2020 Annual Meeting.”

BOARD INVOLVEMENT IN RISK OVERSIGHT

Risk Management Philosophy and Framework

The Bank has developed a multifaceted and comprehensive approach to risk management. We recognize that risk is inherent in our business and central to everything we do. As a result, we have established a risk management process and philosophy that encourage enterprise-wide involvement in understanding and managing risks so that we may align levels and types of risk that we undertake with our business strategies, Risk Management Framework, and the interests of shareholders and other stakeholders.

The Bank’s Risk Management Framework is a fundamental component of the Bank’s risk management process. The framework enables the Board and management to better assess, understand, measure, monitor, and manage the risks posed by the Bank’s business. The Risk Management Framework is organized into three lines of defense. The first line of defense rests with the business lines, which are closest to the Bank’s day-to-day activities, have the greatest understanding of key risks, and own and manage those risks. The second line of defense comprises the Bank’s enterprise risk management functions, which are charged with the oversight and monitoring of risks that have been taken by the business lines. Enterprise risk management includes, without limitation, the Bank’s Enterprise Risk Management Committee, which is responsible for adopting and implementing the Risk Management Framework and related procedures. The third line of defense rests with the internal audit function. Internal Audit performs reviews independent of the Bank’s business activities and provides the Board and senior management with independent and objective assurance on the overall effectiveness of governance, risk management, and internal controls. The Board’s Risk Oversight Committee reviews the Risk Management Framework at least biannually and refers any recommended amendments to the Board for consideration and approval.

The Board oversees our overall risk management process, and monitors, reviews, and responds to reports and recommendations presented by its committees, management, internal and external auditors, legal counsel, and regulators. Through this ongoing oversight, the Board obtains an understanding of and provides significant input into how our management assesses, quantifies, and manages risk throughout the enterprise. The Board’s active involvement in risk oversight helps to hold management accountable for implementing the Bank’s Risk Management Framework, policies, and practices in a manner that does not encourage unnecessary or excessive risk taking.

Board Committee Risk Oversight

The Board oversees risk through actions of the full Board and the activities of its Risk Oversight, Audit, and Compensation Committees.

Risk Oversight Committee.

The Risk Oversight Committee reviews management’s assessment of the Bank’s aggregate enterprise-wide risk profile and the alignment of the risk profile with the Bank’s strategic plan, goals, and objectives. It reviews and oversees the operation of the Bank’s Risk Management Framework. It formally reports to the full Board periodically and reviews and recommends the articulation of the Bank’s Risk Management Framework and the overall risk capacity and risk management limits. The Risk Oversight Committee assists the Board and its other committees with their risk related activities. The Risk Oversight Committee coordinates with the Audit Committee and other committees of the Board with regard to areas of overlapping responsibility. The CRO reports directly to the Risk Oversight Committee and directly to the Bank’s CEO. The Risk Oversight Committee and the CEO jointly review the performance of the CRO and, when necessary, oversee the selection of his or her replacement.

Audit Committee.

The Audit Committee plays a key role in risk management through its oversight of management’s responsibility to maintain an effective system of controls over financial reporting. Among other

responsibilities, the Audit Committee regularly reviews our earnings releases and annual and quarterly filings with the SEC, and, where appropriate, reviews other selected SEC filings and disclosures regarding financial matters. It also receives formal reports from the Bank’s chief audit executive, the CFO and our general counsel on significant matters. The chief audit executive reports directly to the Audit Committee and administratively to the Bank’s CEO. The Audit Committee reviews the performance of the chief audit executive annually, determines the individual’s compensation and, when necessary, oversees the selection of his or her replacement.

Compensation Committee.

The Compensation Committee reviews our executive compensation programs and overall compensation arrangements, when appropriate, with external consultants and our senior risk officers, including our CRO, with a view to designing compensation in ways that discourage unnecessary and excessive risk taking. As noted in the section titled “Compensation Discussion and Analysis,” the Compensation Committee also evaluates the compliance of our compensation arrangements with any applicable laws and guidance or limitations issued by regulatory agencies.

OTHER DIRECTOR MATTERS

Gary Crittenden served as CFO of Citigroup from March 2007 to March 2009. In July 2010, Mr. Crittenden entered into an order with the SEC in which it found that he should have known that certain statements made by Citigroup, while he was chief financial officer, were materially misleading and he paid a civil monetary penalty of $100,000. Mr. Crittenden did not admit any wrongdoing in connection with the matter or disgorge any amount to Citigroup, and he did not face a ban from any future activities. In considering Mr. Crittenden’s nomination to our Board in 2016, our Nominating and Corporate Governance Committee reviewed the SEC Order and related matters and concluded that they do not raise any concerns about his qualification to serve on our Board.

|

|

|

|

|

EXECUTIVE OFFICERS OF THE BANK

|

The following information is furnished with respect to certain of the executive officers of the Bank. Unless otherwise noted, the positions listed are those the officers hold with the Bank

1

as of the date of this Proxy Statement.

|

|

|

|

|

|

Individual

2

|

Principal Occupation During Past Five Years

1

|

|

Harris H. Simmons

Age 64

Officer since 1981

|

Chairman and Chief Executive Officer

|

|

James R. Abbott

Age 45

Officer since 2009

|

Senior Vice President, Investor Relations

|

|

Bruce K. Alexander

Age 66

Officer since 2000

|

Executive Vice President. President and Chief Executive Officer – Vectra Bank Colorado

|

|

A. Scott Anderson

Age 72

Officer since 1997

|

Executive Vice President. President and Chief Executive Officer – Zions Bank

|

|

Paul E. Burdiss

Age 53

Officer since 2015

|

Executive Vice President and Chief Financial Officer. Prior to May 2015, Corporate Treasurer at SunTrust Banks, Inc. and SunTrust Bank

|

|

David E. Blackford

Age 70

Officer since 2001

|

Executive Vice President. Chief Executive Officer

–

California Bank & Trust

|

|

Kenneth J. Collins

Age 53

Officer since 2018

|

Executive Vice President, Business Technology. Officer of Bank subsidiaries or divisions holding various positions from 2014-2018

|

|

|

|

|

|

|

Individual

2

|

Principal Occupation During Past Five Years

1

|

|

Alan M. Forney

Age 58

Officer since 2018

|

Executive Vice President. President and Chief Executive Officer – The Commerce Bank of Washington. Prior to 2018, officer of The Commerce Bank of Washington holding various positions, including chief lending officer

|

|

Olga Hoff

Age 45

Officer since 2018

|

Executive Vice President, Retail Banking. Prior to 2018, officer of Bank subsidiaries or divisions holding various positions

|

|

Alexander J. Hume

Age 45

Officer since 2006

|

Senior Vice President and Corporate Controller

|

|

Dianne R. James

Age 65

Officer since 2012

|

Executive Vice President and Chief Human Resources Officer

|

|

Thomas E. Laursen

Age 67

Officer since 2004

|

Executive Vice President, General Counsel and Secretary

|

|

Scott J. McLean

Age 62

Officer since 2006

|

President and Chief Operating Officer. Mr. McLean also serves on the Board of the Bank

|

|

Keith D. Maio

Age 61

Officer since 2005

|

Executive Vice President and Chief Banking Officer. Prior to 2015, President and Chief Executive Officer of National Bank of Arizona

|

|

Michael Morris

Age 60

Officer since 2013

|

Executive Vice President and Chief Credit Officer

|

|

Rebecca K. Robinson

Age 44

Officer since 2016

|

Executive Vice President and Director of Wealth Management. Prior to 2016, President of Zions Trust

|

|

Edward P. Schreiber

Age 60

Officer since 2013

|

Executive Vice President and Chief Risk Officer

|

|

Terry A. Shirey

Age 47

Officer since 2017

|

Executive Vice President. President and CEO

–

Nevada State Bank. Prior to 2017, officer of Nevada State Bank holding various positions

|

|

Jennifer A. Smith

Age 46

Officer since 2015

|

Executive Vice President and Chief Information Officer. Prior to 2015, officer of Bank subsidiaries holding various positions

|

|

Steve D. Stephens

Age 60

Officer since 2010

|

Executive Vice President. President and Chief Executive Officer – Amegy Bank

|

|

Randy R. Stewart

Age 59

Officer since 2018

|

Executive Vice President, Enterprise Mortgage Lending. Prior to 2018, officer of Amegy Bank holding various positions

|

|

Mark R. Young

Age 59

Officer since 2015

|

Executive Vice President. President and Chief Executive Officer – National Bank of Arizona. From 2011 to 2015, Executive Vice President, Real Estate Banking of National Bank of Arizona

|

|

|

|

|

1

|

Many of the individuals held the same or similar position for Zions Bancorporation, the Bank’s former holding company, which merged with and into the Bank effective September 30, 2018, and various positions with one or more of the Bank’s former bank affiliates for some or all of the period from 2014 to December 31, 2015, when such affiliates were consolidated with the Bank.

|

|

|

|

|

2

|

Officers are appointed for indefinite terms of office and may be removed or replaced by the Board or by the supervising officer to whom the officer reports.

|

|

|

|

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

|

|

|

|

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

|

|

EXECUTIVE SUMMARY

|

|

|

2018 PERFORMANCE HIGHLIGHTS

|

|

|

2018 COMPENSATION HIGHLIGHTS

|

|

|

COMPENSATION DECISIONS FOR THE 2018 PERFORMANCE PERIOD

|

|

|

PLAN DESIGN AND AWARD HIGHLIGHTS

|

|

|

COMPENSATION DECISIONS FOR NAMED EXECUTIVE OFFICERS

|

|

|

COMPENSATION PHILOSOPHY AND OBJECTIVES

|

|

|

PHILOSOPHY, OBJECTIVES, AND PRACTICES

|

|

|

ROLES AND RESPONSIBILITIES

|

|

|

PEER GROUP

|

|

|

BENCHMARKING

|

|

|

COMPENSATION ELEMENTS

|

|

|

BASE SALARY

|

|

|

ANNUAL CASH INCENTIVE

|

|

|

LONG-TERM INCENTIVES

|

|

|

PERQUISITES

|

|

|

HEALTH AND WELFARE BENEFITS

|

|

|

RETIREMENT BENEFITS

|

|

|

OTHER COMPENSATION PRACTICES AND POLICIES

|

|

|

CHANGE IN CONTROL AGREEMENTS

|

|

|

EMPLOYMENT CONTRACTS

|

|

|

INCENTIVE COMPENSATION CLAWBACK POLICY

|

|

|

SHARE OWNERSHIP AND RETENTION GUIDELINES

|

|

|

ANTI-HEDGING AND PLEDGING POLICY

|

|

|

DEDUCTIBILITY AND EXECUTIVE COMPENSATION

|

|

|

NON-QUALIFIED DEFERRED COMPENSATION

|

|

|

2018 CEO PAY RATIO DISCLOSURE

|

|

|

ACCOUNTING FOR STOCK-BASED COMPENSATION

|

|

|

COMPENSATION COMMITTEE REPORT

|

|

|

COMPENSATION TABLES

|

|

In this Compensation Discussion and Analysis, or CD&A, we provide an overview of our executive compensation philosophy and decision-making process for 2018 compensation paid or awarded to our Named Executive Officers, or NEOs, and the factors we considered in making those decisions. Our NEOs for 2018 are:

|

|

|

|

•

|

Harris H. Simmons, Chairman and Chief Executive Officer (CEO)

|

|

|

|

|

•

|

Paul E. Burdiss, Chief Financial Officer (CFO)

|

|

|

|

|

•

|

Scott J. McLean, President & Chief Operating Officer (COO)

|

|

|

|

|

•

|

Edward P. Schreiber, Chief Risk Officer (CRO)

|

|

|

|

|

•

|

David E. Blackford, CEO of California Bank & Trust

|

All of the NEOs are members of our Executive Management Committee, or EMC, which is made up of our CEO and his senior leadership team. Compensation for members of the EMC is determined by the Compensation Committee, or the Committee.

2018 PERFORMANCE HIGHLIGHTS

The Bank had many accomplishments in 2018, some of which are as summarized below. The Bank

achieved record income, both pretax and after-tax, through prudent loan and deposit growth and a focus on careful cost control and simplifying the way we do business to produce better results with less risk.

Net earnings applicable to common shareholders increased 55% to $850 million, and earnings per share increased 57% to $4.08. The strong improvement in earnings was due in part to the reduction in the corporate tax rate from 35% to 21% resulting from the Tax Cuts and Jobs Act of 2017, but pretax income growth was also very strong, increasing 22% to $1,143 million.

Credit results in 2018 were strong. The Bank experienced net recoveries of previously charged-off loans equal to 0.04% of average loans and leases, with recoveries of previously charged-off loans exceeding gross charge-offs by $16 million, including net recoveries in three of the year’s four calendar quarters.

In mid-2015, management announced a series of initiatives designed to improve performance. The Bank achieved each of the objectives established at that time. Over the past three years taxable-equivalent revenues have grown at a compounded rate of 7.8% while operating expenses have compounded at just 1.9%, resulting in pretax pre-provision net revenue (PPNR) nearly doubling. The Bank’s efficiency ratio has declined from 70.7% in 2015 to 59.6% in 2018.

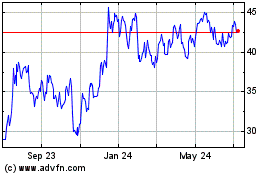

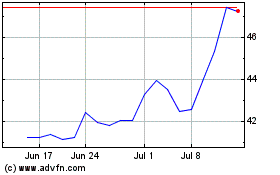

Some of the Bank’s major 2018 performance achievements are highlighted in the following charts. For additional information on the Bank’s 2018 performance, see the Bank’s 2018 annual report on Form 10-K filed with the SEC.

2018 PERFORMANCE SNAPSHOT

|

|

|

|

1

|

Reported tax equivalent net interest income minus net loan charge-offs as a percentage of average earning assets

|

For purposes of these charts, peer median is the median of the relevant metric for the Zions custom peer group described later in this document under the section labeled “Peer Group.”

2018 COMPENSATION HIGHLIGHTS

The Committee awarded the Bank’s NEOs total compensation with respect to 2018 that the Committee believes is generally commensurate with the Bank’s strong performance in 2018.

The total compensation awarded to the Bank’s NEOs for the 2018 performance year increased 13.8% over total compensation awarded to these executives for the prior year. In aggregate the total compensation for the NEOs is within 6% of the estimated total target compensation median for similarly situated executives in the 2018 custom peer group (described below).

The 2018 combined annual cash incentive awards for the Bank’s NEOs (excluding the CEO) increased 18% year-over-year and the total grant date value of the long-term incentive awards made to these four executives was up 1% in aggregate from the prior year.

The total compensation for the Bank’s CEO is less than the peer median. For 2018, the total compensation for Mr. Simmons is estimated to be 16% less than the market median for CEOs in the Bank’s 2018 custom peer group. The 2018 total compensation for the Bank’s other NEOs is competitive with market medians. For 2018, the aggregate total compensation for Messrs. Burdiss, McLean, Schreiber, and Blackford is estimated to be approximately 2% greater than the median for similarly situated executives in the Bank’s 2018 custom peer group.

The Bank continues to promote accountability on the part of all employees, focus on the creation of long-term shareholder value, and strengthen the connections between executive pay and performance.

Given the Bank’s emphasis on incentive-based compensation, as illustrated below, we provide our executives and employees with the incentive to achieve our ultimate goal of generating competitive rates of return and value for our shareholders.

In 2018, the Bank’s shareholders approved a non-binding advisory say-on-pay proposal with over 96% of the votes cast voting in favor of that proposal. The Committee reviewed the results of the shareholder vote, which indicates that there is strong support among shareholders for our compensation structure and decisions.

We believe that our executive compensation

program strikes an appropriate balance between fixed and variable pay as well as short and long-term pay. The exhibits below present the mix of

direct compensation at target performance for our CEO and other NEOs in 2018.

|

|

|

|

1

|

2018 Target Direct Compensation is computed as the sum of the following compensation elements: (i) 2018 base salary; (ii) 2018 target annual cash incentive for the CEO (i.e., an estimate of the cash award for expected performance results achieved by the CEO in 2018 and awarded/paid in March 2019); (iii) grant value of Value Sharing Plan units awarded to the CEO in 2018; and (iv) combined grant value of restricted stock, restricted stock units and stock options granted to the CEO in 2018.

|

|

|

|

|

2

|

Multi-year cash incentives refer to Value Sharing Plans.

|

|

|

|

|

1

|

2018 Target Direct Compensation is computed as the sum of the following compensation elements: (i) 2018 base salaries for the other NEOs; (ii) 2018 target annual cash incentives for the other NEOs (i.e., an estimate of the cash awards for expected performance results achieved by the other NEOs in 2018 and awarded/paid in March 2019); (iii) grant value of Value Sharing Plan units awarded to the other NEOs in 2018; and (iv) combined grant value of restricted stock, restricted stock units and stock options granted to the other NEOs in 2018.

|

|

|

|

|

2

|

Multi-year cash incentives refer to Value Sharing Plans.

|