Huazhu Group Limited Announces Its Preliminary Results for Hotel Operation in the First Quarter of 2019

April 18 2019 - 3:00AM

Huazhu Group Limited (NASDAQ: HTHT) (“Huazhu”, or the “Company”), a

leading and fast-growing multi-brand hotel group in China, today

announced its preliminary results for the hotel operation in the

first quarter ended March 31, 2019.

Operating Metrics

| |

|

|

| |

For the quarter

ended |

|

| |

March 31, |

December 31, |

March 31, |

yoy |

| |

2018 |

2018 |

2019 |

change |

| Average daily room rate (in RMB) |

|

|

|

| Leased and owned

hotels |

243 |

275 |

258 |

6.3% |

| Manachised

hotels |

194 |

216 |

210 |

8.0% |

| Franchised

hotels |

228 |

248 |

237 |

3.6% |

|

Blended |

207 |

230 |

221 |

6.9% |

| Occupancy rate (as a percentage) |

|

|

|

| Leased and owned

hotels |

85.6% |

86.7% |

83.6% |

-2.0pp |

| Manachised

hotels |

84.0% |

85.5% |

80.5% |

-3.5pp |

| Franchised

hotels |

69.8% |

74.5% |

68.6% |

-1.2pp |

|

Blended |

83.7% |

85.2% |

80.6% |

-3.1pp |

| RevPAR (in

RMB) |

|

|

|

|

| Leased and owned

hotels |

208 |

238 |

216 |

3.8% |

| Manachised

hotels |

163 |

185 |

169 |

3.5% |

| Franchised

hotels |

159 |

185 |

162 |

1.8% |

|

Blended |

173 |

196 |

178 |

2.9% |

| |

|

|

|

|

| Same-hotel operational data (Like-for-like

performance for hotels opened for at least 18 months during the

current quarter) |

|

| |

As of and for the

quarter ended |

|

| |

March 31, |

yoy |

| |

2018 |

2019 |

change |

| Total |

3,189 |

3,189 |

|

| Leased and owned

hotels |

608 |

608 |

|

| Manachised and

franchised hotels |

2,581 |

2,581 |

|

| Occupancy rate (as a

percentage) |

86.1% |

83.4% |

-2.8pp |

| Average daily room rate

(in RMB) |

205 |

211 |

2.9% |

| RevPAR

(in RMB) |

176 |

176 |

-0.4% |

| Note: Excluding hotel

rooms under renovations for product upgrades, the normalized

same-hotel RevPAR growth would be flat (0). |

Hotel Development

| |

|

|

|

| |

Number of hotels in operation |

|

Number of rooms in operation |

| |

Opened |

Closed (1) |

Net

added |

As

of |

|

Net

added |

As

of |

| |

in Q1 2019 |

in Q1 2019 |

in Q1 2019 |

March 31, 2019 |

|

in Q1 2019 |

March 31, 2019 |

| Leased and owned

hotels |

11 |

(12) |

(1) |

698 |

|

979 |

87,766 |

| Manachised and

franchised hotels |

215 |

(48) |

167 |

3,698 |

|

15,888 |

351,848 |

|

Total |

226 |

(60) |

166 |

4,396 |

|

16,867 |

439,614 |

| (1) Reasons for closures include property-related

issues, operating loss and non-compliance issues. In Q1 2019, eight

hotels were temporarily closed for brand upgrade. |

| |

|

| |

Number of hotels in pipeline as of March

31, 2019 |

| Leased hotels |

50 |

| Manachised and

franchised hotels |

1,261 |

|

Total(2) |

1,311 |

| (2) Including 202 hotels under brands of

ibis, ibis Styles, Mercure, Grand Mercure and Novotel; 148 hotels

under brands of Orange Select and Crystal Orange,22 hotels under

brand of Blossom Hill. |

Business Update by Segment

| Hotel breakdown by segment |

|

| |

|

| |

Number of hotels in

operation |

| |

Net added |

As of |

| |

in Q1 2019 |

March 31, 2019 |

| Economy

hotels |

24 |

2,916 |

| HanTing

Hotel |

20 |

2,303 |

| Hi Inn |

(3) |

399 |

| Elan Hotel |

7 |

207 |

|

Orange Hotel |

0 |

7 |

| Midscale and

upscale hotels |

142 |

1,480 |

| JI Hotel |

58 |

611 |

| Starway

Hotel |

18 |

230 |

| Joya Hotel |

0 |

6 |

| Manxin Hotels

& Resorts |

4 |

28 |

| HanTing Premium

Hotel |

17 |

91 |

| Ibis Hotel |

12 |

149 |

| Ibis Styles

Hotel |

3 |

37 |

| Mercure

Hotel |

6 |

45 |

| Novotel

Hotel |

0 |

7 |

| Grand

Mercure |

1 |

7 |

| Orange

Select |

17 |

189 |

| Crystal

Orange |

4 |

60 |

| Blossom

Hill |

2 |

20 |

|

Total |

166 |

4,396 |

| |

|

|

|

|

|

|

|

|

|

|

|

Same-hotel operational data by segment |

|

|

|

|

|

|

|

|

|

|

| |

Number of hotels in operation |

Same-hotel RevPAR |

|

Same-hotel ADR |

|

Same-hotel Occupancy |

|

| |

As of |

For the quarter ended |

|

For the quarter ended |

|

For the quarter ended |

|

| |

March 31, |

March 31, |

yoy change |

March 31, |

yoy change |

March 31, |

yoy change (p.p.) |

|

|

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

| Economy

hotels |

2,481 |

2,481 |

152 |

152 |

0.1% |

170 |

176 |

3.7% |

89% |

86% |

(3.1) |

| Leased

hotels |

439 |

439 |

161 |

167 |

4.0% |

181 |

191 |

5.4% |

89% |

88% |

(1.1) |

| Manachised and

franchised hotels |

2,042 |

2,042 |

149 |

148 |

-1.1% |

167 |

172 |

3.1% |

89% |

86% |

(3.6) |

|

Midscale and upscale hotels |

708 |

708 |

240 |

237 |

-1.1% |

306 |

310 |

1.3% |

78% |

76% |

(1.9) |

| Leased and owned

hotels |

169 |

169 |

295 |

287 |

-2.8% |

360 |

362 |

0.4% |

82% |

79% |

(2.6) |

| Manachised and

franchised hotels |

539 |

539 |

216 |

216 |

-0.1% |

281 |

286 |

2.0% |

77% |

75% |

(1.6) |

|

Total |

3,189 |

3,189 |

176 |

176 |

-0.4% |

205 |

211 |

2.9% |

86% |

83% |

(2.8) |

| |

|

|

|

|

|

|

|

|

|

|

|

About Huazhu Group

LimitedHuazhu Group Limited is a leading hotel operator

and franchisor in China. As of March 31, 2019, the Company had

4,396 hotels or 439,614 rooms in operation. With a primary focus on

economy and midscale hotel segments, Huazhu’s brands include Hi

Inn, Elan Hotel, HanTing Hotel, HanTing Premium Hotel, JI Hotel,

Starway Hotel, Manxin Hotel, Joya Hotel, Crystal Orange Hotel,

Orange Hotel Select, Orange Hotel and Blossom Hill. The Company

also has the rights as master franchisee for Mercure, Ibis and Ibis

Styles, and co-development rights for Grand Mercure and Novotel, in

Pan-China region.The Company's business includes leased and owned,

manachised and franchised models. Under the lease and ownership

model, the Company directly operates hotels typically located on

leased or owned properties. Under the manachise model, the Company

manages manachised hotels through the on-site hotel managers it

appoints and collects fees from franchisees. Under the franchise

model, the Company provides training, reservation and support

services to the franchised hotels and collects fees from

franchisees but does not appoint on-site hotel managers. The

Company applies a consistent standard and platform across all of

its hotels. As of March 31, 2019, Huazhu Group operates 20 percent

of its hotel rooms under lease and ownership model, 80 percent

under manachise and franchise models.

For more information, please visit the Company’s

website: http://ir.huazhu.com.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995: The information in this

release contains forward-looking statements which involve risks and

uncertainties. Such factors and risks include our anticipated

growth strategies; our future results of operations and financial

condition; the economic conditions of China; the regulatory

environment in China; our ability to attract customers and leverage

our brand; trends and competition in the lodging industry; the

expected growth of the lodging market in China; and other factors

and risks detailed in our filings with the Securities and Exchange

Commission. Any statements contained herein that are not statements

of historical fact may be deemed to be forward-looking statements,

which may be identified by terminology such as “may,” “should,”

“will,” “expect,” “plan,” “intend,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “forecast,” “project,” or

“continue,” the negative of such terms or other comparable

terminology. Readers should not rely on forward-looking statements

as predictions of future events or results. The Company undertakes

no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

unless required by applicable law.

Contact InformationInvestor RelationsTel: 86

(21) 6195 9561Email: ir@huazhu.comhttp://ir.huazhu.com

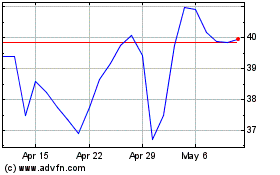

H World (NASDAQ:HTHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

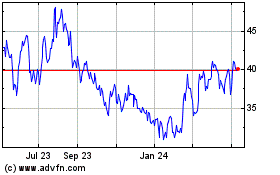

H World (NASDAQ:HTHT)

Historical Stock Chart

From Apr 2023 to Apr 2024