SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section

14 (c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

|

|

|

|

|

O

|

Preliminary Information Statement

|

o

.

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

|

|

X

|

Definitive Information Statement

|

|

|

Ameritek Ventures

(Name of Registrant as Specified in Its

Charter)

______________________________

Payment of Filing Fee (Check the appropriate box):

X

.

No

fee required.

o

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1)

Title of each class of securities to which transaction applies:

2)

Aggregate number of securities to which transaction applies:

3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4)

Proposed maximum aggregate value of transaction:

5)

Total fee paid:

o

.

Fee

paid previously with preliminary materials.

o

.

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule

and the date of its filing.

1)

Amount Previously Paid:

2)

Form, Schedule or Registration Statement No:

3)

Filing Party:

4)

Date Filed:

Ameritek Ventures

1980 Festival Plaza Drive, Suite 530

Las Vegas, NV 89135

877-571-1776

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND

US A PROXY

To the Holders of Common Stock of AMERITEK VENTURES:

AMERITEK VENTURES (the “Company”, “we”,

“us”, or “our”) is providing to you the following Information Statement to notify you that our Board of

Directors and the holders of a majority of our outstanding shares of common stock have executed and delivered a written consent

to effect the following corporate actions.

The actions to be effective 20-days

after the mailing of this Information Statement are as follows:

|

|

1.

|

To increase our authorized shares of Common Stock from 185,000,000 to 435,000,000.

|

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF AN ANNUAL

MEETING OR SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED

HEREIN

.

Pursuant to Rule 14c-2 under the Securities

Exchange Act of 1934, as amended, the corporate actions will not be effective until at least 20-calendar days after the mailing

of this Information Statement to our stockholders. Therefore, this Information Statement is being sent to you for informational

purposes only.

Stockholders of record at the close

of business on

April 17, 2019

(the “Record”) are entitled to notice of this stockholder

action by written consent. Stockholders representing a majority of our issued and outstanding shares of Common Stock have consented

in writing to the actions to be taken. Accordingly, your approval is not required and is not being sought. Moreover, you will not

have dissenters' rights.

Attached hereto for your review is an

Information Statement relating to the above described action.

By Order of the Board of Directors,

/s/ Kenneth Mayeaux

Kenneth Mayeaux

Vice-President, Secretary, Treasurer and Director

April 17, 2019

THIS INFORMATION STATEMENT IS BEING PROVIDED

TO

YOU BY THE BOARD OF DIRECTORS OF THE

COMPANY

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE

REQUESTED NOT TO SEND US A PROXY

INFORMATION STATEMENT

April 17, 2019

GENERAL INFORMATION

This Information Statement has been

filed with the U. S. Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”) of the common stock (the

“Common Stock”) and voting preferred ("Voting Preferred Stock"), par value $0.001 per share, of AMERITEK

VENTURES, a Nevada corporation (the “Company”), to notify such Stockholders of the following:

On or about

March 27, 2019, the Company received written consents in lieu of a meeting of Stockholders from one stockholder, who owns 1,000,000

shares of the Company’s Series C Voting Preferred Stock, which carries a vote of 84.8% of the

589,744,426 (89,744,426

common shares issued and outstanding plus 500,000,000 voting

shares) of the total issued and outstanding

shares of voting stock of the Company (the “Majority Stockholders”) authorizing the Company’s Board of Directors

to increase the authorized shares of the Company’s Common Stock from 185,000,000 to 435,000,000.

On March

27, 2019, the Board of Directors of the Company approved the above-mentioned actions. The Majority Stockholders approved the action

by written consent in lieu of a meeting on March 27, 2019, in accordance with the

Nevada Corporate law

.

Accordingly, your consent is not required and is not being solicited in connection with the approval of the action.

WE ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND A PROXY

CORPORATE ACTION #1

INCREASE

OF AUTHORIZED SHARES OF COMMON STOCK

ACTIONS TO BE TAKEN

Our Board of Directors and majority

shareholders approved increasing the authorized shares of the Company’s Common Stock from 185,000,000 to 435,000,000 authorized

shares.

The Company's Certificate of Amendment

to the Articles of Incorporation shall be filed with the Nevada Secretary of State so that Article 1 of the Certificate of Incorporation

shall be as follows:

Article 3. Authorized Stock: The total authorized

stock of the corporation shall be as follows: Four Hundred Thirty-Five Million (435,000,000) authorized shares of Common Stock

with a par value of $0.001, all of which shall be entitled to voting power of one vote per share and shall have the same rights

and preferences. Five Million (5,000,000) authorized Series A Preferred Shares with a par value of $0.001 per share. Five Million

(5,000,000) authorized Series B Preferred Shares with a par value of $0.001 per share. Five Million (5,000,000) authorized Series

C Preferred Shares with a par value of $0.001 per share.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors of the Company

believes that the stockholders of the Company will benefit from the increase of authorized shares of Common Stock. No assurances

can be made that the increase of authorized shares of Common Stock will have any effect on the business.

REGARDING THIS INFORMATION STATEMENT

The entire cost of furnishing this Information

Statement will be borne by the Company. The Company will request brokerage houses, nominees, custodians, fiduciaries and other

like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will

reimburse such persons for their reasonable charges and expenses in connection therewith. The Board of Directors has fixed the

close of business on April 17, 2019, as the record date (the “Record Date”) for the determination of Stockholders,

Warrant Holders and Options Holders who are entitled to receive this Information Statement.

Each share of our common stock entitles

its holder to one vote on each matter submitted to the stockholders. However, because the stockholders holding at least a majority

of the voting rights of all outstanding shares of capital stock as of the Record Date have voted in favor of the foregoing actions

by resolution; and having sufficient voting power to approve such proposals through their ownership of the capital stock, no other

consents will be solicited in connection with this Information Statement.

You are being provided with this Information

Statement pursuant to Section 14C of the Exchange Act and Regulation 14C and Schedule 14C thereunder, and, in accordance therewith,

the forgoing action will not become effective until at least 20 calendar days after the mailing of this Information Statement.

This Information Statement is being

mailed on or about April 17, 2019 to all Stockholders of record as of the Record Date.

OUTSTANDING VOTING SECURITIES

On or about

March 27, 2019, the Company received written consents in lieu of a meeting of Stockholders from one stockholder, who owns 1,000,000

shares of the Company’s Series C Voting Preferred Stock, which carries a vote of 84.78% of the

589,744,426 (89,744,426

common shares issued and outstanding plus 500,000,000 voting

shares) of the total issued and outstanding

shares of voting stock of the Company (the “Majority Stockholders”) authorizing the Company’s Board of Directors

to increase the authorized shares of the Company’s Common Stock from 185,000,000 to 435,000,000.

The Majority Shareholder executed and delivered to the Company

a written consent approving the action set forth herein. Since the action has been approved by the Majority Stockholders, no proxies

are being solicited with this Information Statement.

On March

27, 2019, the Board of Directors of the Company approved the above-mentioned actions. The Majority Stockholders approved the action

by written consent in lieu of a meeting on March 27, 2019, in accordance with the

Nevada Corporate law

.

Accordingly, your consent is not required and is not being solicited in connection with the approval of the action.

Nevada Revised Statute 78.2055

,

provides in substance that unless the Company’s Articles of Incorporation provides otherwise, stockholders

holding

a majority of the voting power of the affected class or series

may take action without a meeting of

stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the

holders of outstanding stock having not less than the minimum number of votes that would be necessary to take such action at a

meeting at which all shares entitled to vote thereon were present.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain

information regarding the beneficial ownership of all shares of the Company’s common stock owned on the Record Date for (i)

each person who owns beneficially more than five percent of the outstanding shares of common stock, (ii) each of our directors

and named executive officers, and (iii) all directors and officers in a group:

|

Shares Beneficially Owned

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Total

|

|

|

|

|

Common

|

|

|

Voting Preferred

|

|

|

Voting

|

|

|

Name of Beneficial Owner

|

|

Shares

|

|

|

%

|

|

|

Shares

|

|

|

%

|

|

|

Power

(1)

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinton L. Stokes (2)

|

|

|

19,770,000

|

|

|

|

22.0

|

%

|

|

|

|

|

|

|

-

|

|

|

|

3.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (1 person)

|

|

|

19,770,000

|

|

|

|

22.0

|

%

|

|

|

|

|

|

|

-

|

|

|

|

3.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other 5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Cole (3)

|

|

|

5,100,000

|

|

|

|

5.6

|

%

|

|

|

|

|

|

|

-

|

|

|

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chaka Renee Mann (4)

|

|

|

-

|

|

|

|

-

|

|

|

|

1,000,000

|

|

|

|

100

|

%

|

|

|

84.8

|

%

|

(1) Percent

of Class based on 89,744,426 shares issued and outstanding.

Percentage of total voting power

represents voting power with respect to all shares of our common stock (89,744,426 issued and outstanding) and Preferred Voting

stock (1,000,000 shares issued and outstanding), as a single class. The holders of our Preferred Voting Stock are entitled to five

hundred votes per share, and holders of our common stock are entitled to one vote per share. The 1,000,000 preferred shares have

voting rights equal to 500,000,000 common shares. Percentage of Total Voting Power is calculated based on an aggregate of 589,744,426

(89,744,426 common + 500,000,000 Preferred Voting Rights) shares issued and outstanding.

(2)

Clinton L. Stokes, 1980 Festival Plaza Drive, Suite 530, Las Vegas, NV 89135

,

is the beneficial owner of these shares.

(3)

Mark Cole,

9788 Gilespie St., Unit 400, Las Vegas, NV

89113,

is the beneficial owner of these shares.

(4) Chaka Renee

Mann, 9121 Sepulveda Blvd., Unit 506, North Hills, CA 91343

.

ADDITIONAL INFORMATION

The Company is subject to the informational

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files

reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q (the “1934 Act

Filings”) with the Securities and Exchange Commission (the “Commission”). Reports and other information filed

by the Company can be inspected and copied at the public reference facilities maintained at the Commission at Room 1024, 450 Fifth

Street, N.W., Washington, DC 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public

Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. The Commission maintains a web site on

the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers

that file electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”).

The following documents as filed with

the Commission by the Company are incorporated herein by reference:

1.

Annual Report on Form 10-K for the year ended May 31, 2018.

2.

Periodic Reports on Form 10-Q for the quarters ended August 31, 2018 and November 30, 2018.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies

of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share

a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a

separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement

was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your

shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the

Company at Chief Executive Officer,

1980 Festival Plaza Drive, Suite 530, Las Vegas, Nevada 89135

,

telephone:

877-571-1776.

If multiple stockholders sharing an

address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail

each stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal executive

offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or

other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address,

notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

By Order of the Board of Directors

/s/ Kenneth Mayeaux

Kenneth Mayeaux

Vice-President, Secretary, Treasurer

and Director

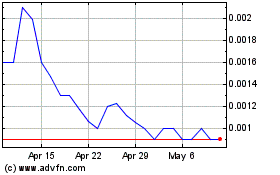

Ameritek Ventures (PK) (USOTC:ATVK)

Historical Stock Chart

From Mar 2024 to Apr 2024

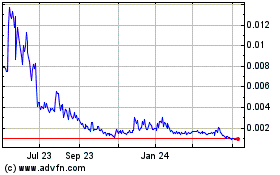

Ameritek Ventures (PK) (USOTC:ATVK)

Historical Stock Chart

From Apr 2023 to Apr 2024