Washington Federal, Inc. (Nasdaq: WAFD) (the "Company"), parent

company of Washington Federal, National Association, today

announced quarterly earnings of $51,098,000 or $0.63 per diluted

share for the quarter ended March 31, 2019, compared to

$49,271,000 or $0.57 per diluted share for the quarter ended

March 31, 2018, a $0.06 or 11% increase in fully diluted

earnings per share. Return on equity for the quarter ended

March 31, 2019 was 10.20% compared to 9.81% for the quarter

ended March 31, 2018. Return on assets for the quarter ended

March 31, 2019 was 1.24% compared to 1.26% for the same

quarter in the prior year.

President and Chief Executive Officer Brent J. Beardall

commented, “We are pleased to report another solid quarter of

growth in core earnings, loans and deposits. Credit quality

continues to improve with the economic expansion. We acknowledge

that this is a challenging interest rate environment. Over the past

three and a half years, the Federal Reserve Bank has increased

short-term interest rates from 0.25% to 2.50% while long-term rates

remained relatively flat at around 2.50%. Despite this flattening

of the yield curve, Washington Federal’s net interest margin

declined only 3 basis points from 3.18% to 3.15% and net interest

income grew by 12%1. Those results were possible due to the

progress we have made in growing our commercial banking

capabilities, demonstrated by the significant growth of our

transaction deposits and commercial loans.

"During the quarter we launched a program designed specifically

to help government workers (both current clients and non-clients)

impacted by the government shutdown. In the span of three weeks,

the program generated over 14,000 visits to Washington Federal's

website, 1,700 new loan approvals totaling $24 million of available

credit and 1,700 new checking account openings. Outstanding loan

balances are down to $4 million since, when the government

re-opened, most of those clients chose to repay us immediately. We

expect the remaining loan balances will be repaid over time. Most

importantly, by doing the right thing we were able to help

neighbors in their time of need and gain customers for life. As one

client told us in a letter, it is nice to be with a bank that has

'heart.' We believe that making a reasonable profit and doing what

is right to help our communities often go hand-in-hand."

Total assets were $16.4 billion as of March 31, 2019,

compared to $15.9 billion as of September 30, 2018, the

Company's fiscal year-end. Asset growth since September 30,

2018 is primarily attributable to a $418 million increase in net

loans receivable.

Customer deposits increased by $335 million or 2.9% since

September 30, 2018, reaching a total of $11.7 billion as of

March 31, 2019. Transaction accounts increased by $201 million

or 3.0% during that period, while time deposits increased $135

million or 2.8%. The Company continues to focus on growing

transaction accounts to lessen sensitivity to rising interest rates

and manage interest expense. As of March 31, 2019, 58% of the

Company’s deposits were in transaction accounts. Core deposits,

defined as all transaction accounts and time deposits less than

$250,000, totaled 93.1% of deposits at March 31, 2019.

In 2013 - 2014, the Company acquired 74 branches and $1.9

billion of deposits from Bank of America in rural areas of Arizona,

New Mexico, Nevada, Idaho and Washington. Since the close of those

transactions, the number of accounts in those branches has fallen

by approximately 48%, but the amount of deposit dollars has

increased by 25%.

Borrowings from the Federal Home Loan Bank ("FHLB") totaled $2.6

billion as of March 31, 2019, versus $2.3 billion at

September 30, 2018. The weighted average rate of FHLB

borrowings was 2.77% as of March 31, 2019, versus 2.66% at

September 30, 2018, the increase being due to higher rates on

short-term FHLB advances.

Loan originations totaled $1.0 billion for the second fiscal

quarter 2019, an increase of 22.0% from the $819 million of

originations in the same quarter one year ago. Partially offsetting

loan originations in each of these quarters were loan repayments of

$773 million and $744 million, respectively. Commercial loans

represented 77% of all loan originations during the second fiscal

quarter 2019 and consumer loans accounted for the remaining 23%.

The Company views organic loan growth, funded by low cost core

deposits, as the highest and best use of its capital. Commercial

loans are preferable in this interest rate environment because they

generally have floating interest rates and shorter durations. The

weighted average interest rate on the loan portfolio was 4.61% as

of March 31, 2019, an increase from 4.48% as of

September 30, 2018, due primarily to variable rate loans

increasing in yield with rising short-term rates.

Asset quality remained strong and the ratio of non-performing

assets to total assets improved to 0.36% as of March 31, 2019,

compared to 0.45% at March 31, 2018 and 0.44% at

September 30, 2018. Since September 30, 2018, real estate

owned decreased by $4 million, or 33%, and non-accrual loans

decreased by $7 million, or 12%. Delinquent loans were 0.40% of

total loans at March 31, 2019, compared to 0.40% at

March 31, 2018 and 0.42% at September 30, 2018. The

allowance for loan losses and reserve for unfunded commitments

totaled $139 million as of March 31, 2019, and was 1.05% of

gross loans outstanding, as compared to $137 million, or 1.06%, of

gross loans outstanding at September 30, 2018. Net recoveries

were $1.2 million for the second fiscal quarter of 2019, compared

to $1.4 million for the prior year's quarter. The Company has

recorded net recoveries for 15 consecutive quarters, and in 22 of

the last 23 quarters.

On February 22, 2019, the Company paid a regular cash

dividend of $0.20 per share, which represented the 144th

consecutive quarterly cash dividend. During the quarter, the

Company repurchased 698,705 shares of common stock at a weighted

average price of $29.65 per share and has authorization to

repurchase 9,593,701 additional shares. The Company varies the pace

of share repurchases depending on several factors, including share

price, lending opportunities and capital levels. Since

September 30, 2018, tangible common stockholders’ equity per

share increased by $0.68, or 3.3%, to $21.06, and the ratio of

tangible common equity to tangible assets remained strong at 10.51%

as of March 31, 2019.

Net interest income was $120 million for the quarter, an

increase of $2.8 million or 2.4% from the same quarter in the prior

year. The increase in net interest income from the prior year was

primarily due to higher balances as average earning assets

increased by $822 million, or 5.7%. Net interest margin decreased

to 3.15% in the second fiscal quarter of 2019, from 3.25% for the

same quarter in the prior year as the average rate earned on

interest-earning assets rose by 26 basis points while the average

rate paid on interest-bearing liabilities increased 40 basis

points. The compression in the net interest margin is the result of

the flat to inverted yield curve.

The Company recorded a provision for loan losses of $750,000 in

the second fiscal quarter of 2019, compared with a release of loan

loss allowance of $950,000 in the same quarter of fiscal 2018. The

increased provision was due to loan growth and a smaller net

recovery of prior charge-offs.

Total other income was $12.8 million for the second fiscal

quarter of 2019, an increase from $12.6 million in the same quarter

of the prior year.

Total operating expenses were $68.0 million in the second fiscal

quarter of 2019, an increase of $2.2 million, or 3.3%, from the

prior year's quarter. Increased operating expenses are the result

of ongoing investments in people, process and technology with the

objective of growing market share and ultimately earnings.

Compensation and benefits costs increased by $1.1 million over the

prior year quarter primarily due to headcount increases, the

aforementioned salary increases and cost of living adjustments

since last year. Other expenses increased by $1.2 million,

primarily due to Bank Secrecy Act (BSA) program enhancements. In

the second fiscal quarter of 2019, the Company had approximately

$1.2 million of non-recurring BSA related costs and estimates that

it will incur an additional $1 million of non-recurring costs for

BSA improvements in the third fiscal quarter. The Company’s

efficiency ratio in the second fiscal quarter of 2019 was 51.2%,

compared to 50.7% for the same period one year ago. The increase in

the efficiency ratio is primarily due to the elevated expenses

noted above.

Income tax expense totaled $13.9 million for the three months

ended March 31, 2019, as compared to $15.5 million for the

same period one year ago. The effective tax rate for the six months

ended March 31, 2019 was 21.35% compared to 19.51% for the six

months ended March 31, 2018 and 20.76% for the full fiscal

year ended September 30, 2018. The effective tax rate for the

six months ended March 31, 2018 and the full fiscal year ended

September 30, 2018 was lower mainly due to discrete tax

benefits related to the revaluation of deferred tax assets and

liabilities based on the new federal statutory rate enacted in

December 2017. The Company estimates that its annual effective tax

rate for fiscal 2019 will be between 20 - 22%.

Washington Federal, a national bank with headquarters in

Seattle, Washington, has 235 branches in eight western states. To

find out more about Washington Federal, please visit our website

www.washingtonfederal.com. Washington

Federal uses its website to distribute financial and other material

information about the Company.

1 Periods being compared are the quarters ended December

31, 2015 and March 31, 2019. The Federal Reserve Bank increased its

target rate upper bound from 0.25% to 0.50% on December 17, 2015

and the target rate upper bound was 2.50% as of March 31, 2019. The

10-year Treasury rate was 2.30% on December 16, 2015 versus 2.41%

on March 31, 2019.

Important Cautionary

Statements

The foregoing information should be read in conjunction with the

financial statements, notes and other information contained in the

Company’s 2018 Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s

future that are not statements of historical fact. These statements

are “forward looking statements” for purposes of applicable

securities laws, and are based on current information and/or

management's good faith belief as to future events. The words

"estimate," “believe,” “expect,” “anticipate,” “project,” and

similar expressions signify forward-looking statements.

Forward-looking statements should not be read as a guarantee of

future performance. By their nature, forward-looking statements

involve inherent risk and uncertainties, which change over time;

and actual performance could differ materially from those

anticipated by any forward-looking statements. The Company

undertakes no obligation to update or revise any forward-looking

statement.

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION

(UNAUDITED)

March 31, 2019 September 30, 2018 (In thousands,

except share and ratio data)

ASSETS Cash and cash

equivalents

$ 279,554 $ 268,650 Available-for-sale

securities, at fair value

1,545,606 1,314,957

Held-to-maturity securities, at amortized cost

1,553,683

1,625,420 Loans receivable, net of allowance for loan losses of

$133,086 and $129,257

11,894,836 11,477,081 Interest

receivable

50,790 47,295 Premises and equipment, net

277,010 267,995 Real estate owned

7,522 11,298 FHLB

and FRB stock

138,390 127,190 Bank owned life insurance

219,167 216,254 Intangible assets, including goodwill of

$301,368 and $301,368

310,266 311,286 Federal and state

income tax assets, net

— 1,804 Other assets

158,384

196,494

$ 16,435,208 $

15,865,724

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities Customer accounts Transaction deposits

$

6,782,998 $ 6,582,343 Time deposits

4,939,365

4,804,803

11,722,363 11,387,146 FHLB advances

2,610,000 2,330,000 Advance payments by borrowers for taxes

and insurance

25,839 57,417 Federal and state income tax

liabilities, net

4,180 — Accrued expenses and other

liabilities

68,546 94,253

14,430,928

13,868,816

Stockholders’ equity Common stock, $1.00 par

value, 300,000,000 shares authorized; 135,506,620 and 135,343,417

shares issued; 80,435,217 and 82,710,911 shares outstanding

135,507 135,343 Additional paid-in capital

1,669,860

1,666,609 Accumulated other comprehensive (loss) income, net of

taxes

8,634 8,294 Treasury stock, at cost; 55,071,403 and

52,632,506 shares

(1,071,957 ) (1,002,309 ) Retained

earnings

1,262,236 1,188,971

2,004,280

1,996,908

$ 16,435,208 $

15,865,724

CONSOLIDATED FINANCIAL HIGHLIGHTS Common

stockholders' equity per share

$ 24.92 $ 24.14

Tangible common stockholders' equity per share

21.06 20.38

Stockholders' equity to total assets

12.20 % 12.59 %

Tangible common stockholders' equity to tangible assets

10.51 % 10.84 %

Weighted average rates at

period end Loans and mortgage-backed securities

4.32

% 4.19 % Combined loans, mortgage-backed securities and

investments

4.20 4.07 Customer accounts

1.09 0.87

Borrowings

2.77 2.66 Combined cost of customer accounts and

borrowings

1.39 1.17 Net interest spread

2.81 2.90

WASHINGTON FEDERAL, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended March 31, Six Months Ended March 31,

2019 2018

2019 2018 (In thousands,

except share and ratio data) (In thousands, except share and ratio

data)

INTEREST INCOME Loans receivable

$

141,061 $ 126,529

$ 278,126 $ 251,040

Mortgage-backed securities

19,343 17,667

38,535

34,566 Investment securities and cash equivalents

7,178

4,883

13,543 9,253

167,582 149,079

330,204 294,859

INTEREST

EXPENSE Customer accounts

29,666 16,414

56,245

31,052 FHLB advances and other borrowings

17,846

15,364

34,737 30,771

47,512

31,778

90,982 61,823

Net interest income

120,070 117,301

239,222 233,036 Provision (release)

for loan losses

750 (950 )

250 (950 )

Net interest income after provision (release) 119,320

118,251

238,972 233,986

OTHER INCOME Gain

(loss) on sale of investment securities

— —

(9

) — FDIC loss share valuation adjustments

— —

— (8,550 ) Loan fee income

667 780

1,637 1,815

Deposit fee income

5,886 6,403

12,129 13,089 Other

Income

6,257 5,404

18,062 13,028

12,810 12,587

31,819 19,382

OTHER

EXPENSE Compensation and benefits

32,774 31,625

66,657 61,244 Occupancy

9,830 9,013

19,098

17,684 FDIC insurance premiums

1,978 2,852

4,840

5,672 Product delivery

3,545 3,665

7,566 7,621

Information technology

8,755 8,781

17,795 16,710

Other

11,085 9,851

23,683 18,797

67,967 65,787

139,639 127,728 Gain (loss) on

real estate owned, net

808 (278 )

1,128

(232 ) Income before income taxes

64,971 64,773

132,280 125,408 Income tax provision

13,873

15,502

28,240 24,467

NET INCOME

$ 51,098 $ 49,271

$

104,040 $ 100,941

PER SHARE DATA

Basic earnings per share

$ 0.63 $ 0.58

$

1.28 $ 1.17 Diluted earnings per share

0.63 0.57

1.28 1.17 Cash dividends per share

0.20 0.17

0.38 0.32 Basic weighted average shares outstanding

80,968,050 85,647,494

81,384,456 86,299,885 Diluted

weighted average shares outstanding

80,990,126 85,747,167

81,415,697 86,422,077

PERFORMANCE RATIOS

Return on average assets

1.24 % 1.26 %

1.28

% 1.31 % Return on average common equity

10.20 9.81

10.42 10.03 Net interest margin

3.15 3.25

3.18

3.26 Efficiency ratio

51.15 50.65

51.52 48.94

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190415005859/en/

Washington Federal, Inc.Brad Goode, SVP, Director of

Communications206-626-8178brad.goode@wafd.com

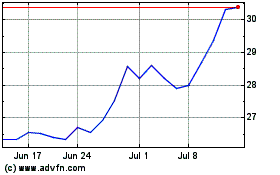

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

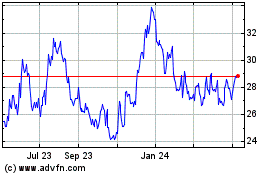

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Apr 2023 to Apr 2024