|

April 15, 2019 -- InvestorsHub NewsWire --

Ximen Mining Corp. (TSXV:

XIM)(USOTC:

XXMMF) (FRA: 1XMA) Although this report

may seem a bit long, I can only urge you to read it all carefully

as today’s news may also have broad implications for Ximen Mining

Corp. going forward.

Golden Dawn Minerals Inc. announced that Christopher Anderson

has agreed to accept an appointment as the company’s Interim CEO

and Director. Mr. Anderson also serves as President and CEO of

Ximen Mining Corp.

Mr. Anderson intends to switch Golden Dawn’s lights back on,

which may also greatly benefit Ximen as the company owns 3

precious/base metals projects in southern British Columbia, with

the Gold Drop Project being in proximity to Golden Dawn’s Greenwood

Mill.

Today, Ximen and its option partner reported that the spring 2019

drilling program on the Gold Drop Property has

begun. This could turn out as one of North America’s highest grade

gold-silver-tellurium projects, potentially advancing towards bulk

sampling faster than many would have thought (until today). Same

applies to Ximen’s 100% owned Brett Gold Project

(2h drive to the Greenwood Mill), where underground workings

already exist.

Furthermore, Ximen last week reported its focus to acquire

the past producing Kenville Gold Mine located in

trucking distance to the Greenwood Mill. In 2009, a historic

(non-compliant with NI 43-101) inferred resource was estimated with

522,321 tonnes averaging 23.01 g/t gold, translating into 356,949

ounces of gold.*

With today’s news adding the highly experienced mine manager

Lloyd Penner to the Ximen team, the company obviously aims to

aggressively advance towards developing its mining activities on

its various assetsa. He oversaw a large drill program in 2010-2012,

discovering several new high-grade veins at Kenville.

Overall, the road(s) to success may begin today. Enjoy the

ride!

The Greenwood Mill: In 2016, Golden

Dawn acquired this asset, along with the past producing Lexington

and Golden Crown mines, whereas the previous owner invested

approximately $35 million to develop these

assets.

The Kenville Gold Mine

Last week, Ximen announced its plans on acquiring

the past producing Kenville Gold Mine located near Nelson in

southern British Columbia, Canada.

When you connect the dots of the Greenwood Mill and the Kenville

Mine on a map, the result is a mere distance of around 150 km on

Highway #3 and #3A. That’s not a long trucking distance, especially

when talking about high-grade gold quartz vein material.

When the Kenville Mine ceased operations in the 1950s, a total

production of over 2 tonnes of gold (plus silver, lead, zinc,

copper and cadmium) was recorded from the processing of 181,395

tonnes.

Historically successful drilling programs by the previous

operator discovered additional high-grade gold quartz veins

striking beyond the historical footprint of the Kenville Mine,

indicating potential for new gold mineralization with silver-copper

enrichment.

Excerpts from Ximen’s news:

“The mine deposit consists of multiple, gold-silver quartz veins

hosted by diorite. Between 2007 and 2008, 13,000 meters of diamond

drilling was conducted that targeted previously un-tested areas

southwest of the historic mine, and detailed sampling was conducted

within the mine on the 257 Level. There are six other historical

levels within the mine footprint; only this level was rehabilitated

and remains open and accessible. Based on the mine sampling and

drill hole information available at the time, new zones of gold

mineralization were identified, and mineral resources were

estimated (see table below).”

*A qualified person has not done

sufficient work to classify the historic estimate as current

mineral resources or mineral reserves. As such the issuer, Ximen

Mining Corp., is not treating this historical estimate as current

mineral resources or mineral reserves. Ximen considers this

historic mineral resource estimate to be relevant and reliable in

that it was based upon the results of underground sampling and

diamond drill information available at the time. The historic

estimate uses the categories of Measured, Indicated and Inferred

mineral resources as defined by the Canadian Institute of Mining,

Metallurgy and Petroleum. Measured and Indicated Resources are

based on projections of mineralized veins exposed on the 257 Level.

Inferred Resources in the historical estimate are based on assumed

continuity beyond measured and (or) indicated resources. The

inferred mineral resources are based on historical drill and assay

information verified by underground channel samples collected in

2007/8. The resource tonnages were estimated using an assumed

specific gravity. A cut-off grade of 1.1 grams per tonne was used.

No allowance for dilution was included based on an anticipated

“resue” mining method, which would separate mineralized material

from waste rock. (Source: Ximen Mining)

“Significant diamond

drilling was conducted after the above mineral resource estimate

was made between 2009 and 2012. At least 4 new veins were

identified with potential strike lengths of over 700 metres. The

results of this drilling have not yet been reviewed by the

Company’s Qualified Person. A complete review of the technical

information is required with the aim of completing a new resource

estimate that includes the more recent diamond drill results.”

“The property is

located 8 km west of Nelson, BC, is accessible by paved road and is

connected to the power grid. Existing infrastructure includes

mining equipment, offices, mechanic shop, core storage and

accommodation.”

Chris Anderson of Ximen Mining commented that, “The Kenville

Gold Mine has played a major role in the rich history of BC Gold

mining. It was the first underground lode gold mines in British

Columbia and was once the largest producer in the Nelson Mining

Camp. There have been multiple new targets and veins discovered in

the last several years and Ximen is looking forward to the

potential opportunity that exists ahead.”

In mid-2010, the previous owner said that the Kenville Mine was

“in production-ready state”, but the concurrent beginning of a bear

market in gold appears to have put an end to that plan.

However even more importantly, the previous owner did not have a

processing facility, not to speak of a tailings pond which would be

difficult or impossible to get permitted as the mine property is

located on the slope of a mountain, likely to even make the

alternative of dry stack tailings

unfeasible/unpermissable.

With gold prices on the rise again, the time could be ripe now

for Ximen to write history in one of Canada’s most prolific gold

mining districts, especially if an opportunity with an existing

processing facility in southern British Columbia evolves.

Frankly put: The

Kenville Gold Mine has everything to lift your heart higher than

the clouds – with the exception of a processing plant and a

tailings pond. This missing key might have been the main reason why

the previous operator could not succeed into production.

The Greenwood Mill: In 2016, Golden Dawn acquired this asset,

along with the past producing Lexington and Golden Crown mines,

whereas the previous owner invested approximately $35 million to develop these

assets.

The Key(s) to Success

There is something of utmost importance when planning to go into

production: People.

Today, Ximen announced the addition of

Lloyd Penner to the Ximen team. Previously, he

worked as mine manager for several projects and was also

instrumental in discovering new high-grade vein systems in

previously unexplored areas of the Kenville Mine property. He knows

Kenville by heart, lives in Nelson, and thus is believed to be the

perfect match for Ximen “focusing on assisting the company with its

future plans and aspirations towards developing its mining

activities on its various assets”, as Ximen noted.

Another key for any exploration company with an intention to go

into production: Processing Plant. However, the

construction of a new processing facility, including a tailings

pond and ancillary equipment, is not only very expensive but also

highly time consuming, and oftentimes difficult or impossible to

permit even in mining-friendly jurisdictions.

“Part of the infrastructure for the

Greenwood Precious Metals Project includes a modern

crushing-grinding-gravity-flotation facility with a mill rated at

212 tonnes per day capacity, assay laboratory and tailing

facilities, all fully permitted and under care and maintenance

since operations ceased in late 2008. This mill and tailings

facility was constructed on the Zip claims within the Golden Crown

Property by Merit between September 2007 and May 2008, when the

mill was commissioned to process material from the

Lexington-Grenoble Mine. Merit operated the Greenwood Mill and

tailings facility processing Lexington-Grenoble mill feed from May

2008 until the end of December 2008. The operation is currently

under care and maintenance. The crushing and conveyor belts are

outside the mill building and appear in reasonable shape. The

equipment inside the mill building includes a ball mill, a regrind

ball mill, a centrifugal gravity concentrator system, a series of

flotation banks and a filter that all appear in good shape. There

is a dry and lunch room also inside the building. There is a fork

lift and one portable living trailer also inside the mill building.

The assay laboratory is fully equipped for gold and copper assaying

inside a Seacan and sits near the mill building. This laboratory

was not available to the mining operation until days before the

mining ceased.“ (See more details about the existing

infrastructure at the Greenwood Mill and Tailings Facility on pages

43-44 in Golden Dawn‘s Updated June 2017 PEA)

Thousands of exploration companies exist globally, eager to

spend millions of dollars for drill programs and economic studies,

to hopefully delineate a mineable deposit over time. Yet even if a

mining project turns out feasible on paper after many years, the

essential question must be addressed: How to go into

production? How to finance a required processing

facility?

The costs of a new processing plant are typically in the tens to

hundreds of millions of dollars, sometimes even in the

billion-dollar sphere. For such reason, many explorers do not

bother about planning to go into production but rather wait (and

hope) that eventually a major mining company comes by and buys the

project. That’s because the alternative would be risky debt or

dilutive equity financings, both of which can have devastating

consequences for the company and/or shareholders as the past has

shown countless times.

For example, take a look at the well-known company Nemaska

Lithium Inc. (TSX: NMX), which successfully delineated a

“world-class” lithium deposit in Canada with hundreds of drill

holes and highly positive project economics, only to subsequently

undertake painfully dilutive equity financings to build a

processing facility. Since its all-time high at $2.44, Nemaska’s

stock imploded, currently trading at $0.32 CAD: An uninspiring

performance of -87% despite being “successful” in what most others

never accomplish: Going into production.

This recent example demonstrates that for a company to be also

successful at the stock exchange (i.e. producing happy

shareholders) it is not decisive that you

go into production but how.

All the more brilliant may today’s move by Chris Anderson turn

out in the future, on the one hand for Golden Dawn and potentially

also for Ximen.

The Alpha and Omega: Protecting Shareholders

Ximen currently has around 33 million shares issued and

outstanding. Alone Mr. Anderson increased his holdings in Ximen to

more than 4.3 million shares last year, whereas he also held some 2

million warrants and options (as per December 31, 2018), thus, if all

exercised, controlling in excess of 6.3 million shares.

Simply put: Ximen’s

management and insiders have serious “skin in the game“, i.e. they

put their money where their mouth is and have, accordingly, a

lesser degree of interest for heavy dilution.

Chris Anderson now has the reins in his hands to produce happy

shareholders for Ximen and Golden Dawn as he is

already a major shareholder of Ximen and possibly soon the

principal shareholder of Golden Daw, too (last week, it was

announced that Mr. Anderson has

the opportunity to earn up to 15.5 million shares of Golden

Dawn).

A tight share structure with management and insiders holding

large equity positions is one of the prerequisites of having

sustainable success as a publicly listed company (in respect of

creating shareholder value).

Hand in Hand Pursuing the Same Goal?

Mr. Anderson could be setting the course for what he may see

ahead for Golden Dawn and Ximen: A golden opportunity for both

companies pursuing the same goal synergistically. If Anderson can

turn Golden Dawn’s lights back on, this could also have positive

implications for Ximen as, for example, bulk samples from its

projects could be tested at the Greenwood Mill processing

plant.

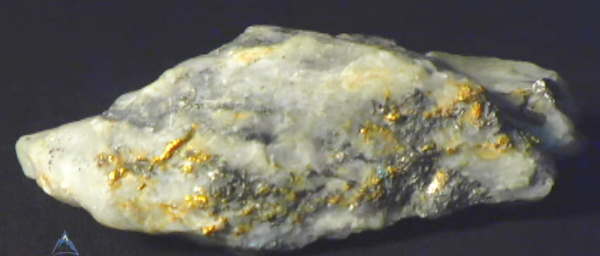

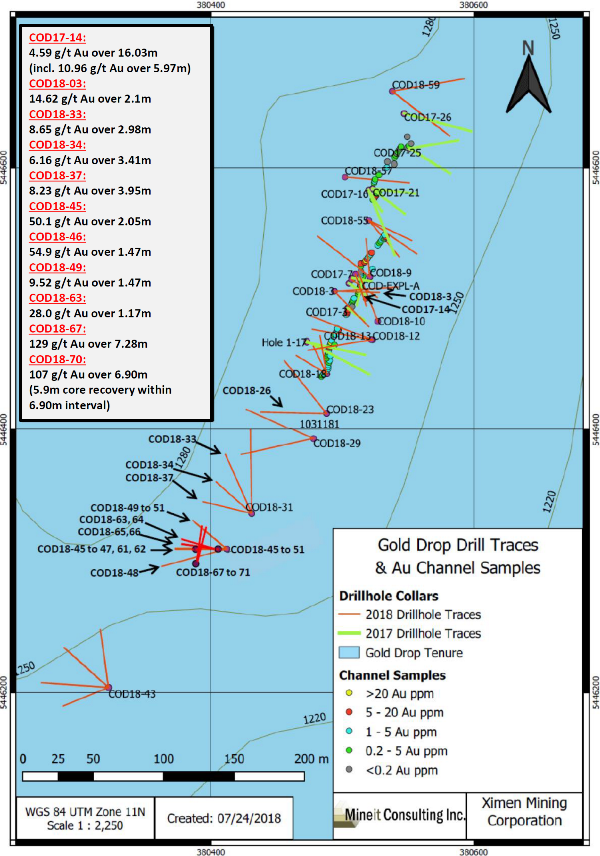

The Gold Drop Project

Ximen currently owns 100% of the Gold Drop Project, located only

a few kilometers from the Greenwood Mill. Ximen‘s option partner,

GGX Gold Corp., recently made headlines with drill results of “129

g/t gold and 1,154 g/t silver over 7.28 meter core length“, which

ranks as the world‘s 7th best drill intercept

of 2019.

Map showing Ximen‘s Gold Drop Property in proximity to Golden

Dawn‘s Greenwood Mill. According to the NI 43-101 Technical Report on the

Gold Drop Property (2014): ”Since custom milling opportunities

exist in the district, the property does not necessarily need to

support a stand-alone mine/mill operation to be viable. Even a

small or modest tonnage of high grade ore could potentially be

profitable to extract, given the excellent infrastructure of the

region and the property itself.”

On top of that, these assays showed that tellurium grades have

exceeded the upper analytical limits at the lab (i.e. 500 g/t

tellurium), which prompted Ximen’s option partner to re-analyze the

core for tellurium, also “due to multiple industry inquiries” as

Ximen stated. On March 18, the exact

tellurium grades were announced with “up to 3,860 g/t

tellurium”, including “823 g/t tellurium over 7.28-meter core

length” and “640 g/t tellurium over 6.90-meter core length”.

(Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining

Corp. and a Qualified Person as defined by NI 43-101, approved the

technical information contained in those Ximen

news-releases.)

Fortis Metals, the world’s leading producer of minor metals,

recently forecasted a tellurium supply deficit that, “as of 2020

could be as big as a staggering 370 metric tonnes.” Noting the

rapidly-growing use of tellurium for thin-film solar panels, Fortis

stated: “At the moment, we are still seeing (tellurium) inventories

in China but these are being eaten away by the two main suppliers

of First Solar (the world’s largest thin-film solar manufacturer).

It is only a matter of time before the market will understand the

new dynamics and prices will start to reflect the growing deficit.

We would not be surprised to see prices break the previous record

seen in 2011.”

Ximen’s option partner has produced some of the highest grade

tellurium drill intercepts in the world over the 2018 drill season.

See also Rockstone Report #8 “Industry inquiries persuade Ximen‘s

partner to re-assay drill core for tellurium“ for more

information on the importance of tellurium for the solar industry

as well as Ximen’s note on “Tellurium’s Unique Value”.

What makes above mentioned assays from hole COD18-70 at the

C.O.D. Vein so impressive is that the high-grade quartz vein

intersection occurs near surface, indicating a

so-called “ore shoot“, possibly being, or leading to a

“motherlode”-style feeder system, as GGX stated.

The NI 43-101 Technical Report on the

Gold Drop Property (2014) explains why such an outstanding

discovery could have been made recently:

“The Gold Drop property covers geologically prospective ground

in the well mineralized Greenwood District, and hosts 8 or more

known gold-bearing veins or vein systems. On the adjoining Dentonia

property, significant historic production has come from similar

veins. There has been little effective modern exploration on the

Gold Drop property, and in the author’s opinion, the property is

unique in this respect. Good opportunities remain untested on this

property while most properties in the area that host showings of

similar quality have been more thoroughly explored.“

The near-by Dentonia Vein on the Dentonia

Property averaged about 1 m in width,

historically producing approximately 125,000 tonnes at an average

grade of 10.8 g/t gold and 64.6 g/t silver (Minfile 082ESE055).

Key to success: Ximen’s

team member, Alex Mcpherson, worked underground at

the Dentonia Mine and thus knows the area well, and how such veins

are mined. He worked on many notable projects in North America. In

British Columbia, he was also sinking shafts for Bralorne Gold

Mines (note that Ximen‘s VP Exploration, Dr. Ball, held positions

as President and COO at the Bralorne Gold Mine). Mr. Mcpherson has

decades of experience in mining and exploration, has done extensive

underground work including drifting, stoping, sinking shafts,

driving raises, timbering, blasting and much more for several

companies.

Another key to success:

Ximen also has Peter Cooper on board who was

involved in 3 successful new gold mine start-ups and oversaw

projects from the exploration stage right up to production. He

played a significant role in the exploration, pre-production and

development of Kinross Gold Corp.‘s Buckhorn Gold Mine located in

northern Washington State, close to Ximen’s Gold Drop Project. For

many years, he served as Chief Geologist and then Manager of

Operations at Kinross‘ Kettle River Mill, where the ore of the

Buckhorn Gold Mine was processed. With the recent closure of

Kinross‘ Buckhorn Gold Mine (depleted), Kinross might be looking

for replacement feedstock to keep its large Kettle River Mill

(capacity: 1,800 t/day) alive. However, there are also indications

that Kinross is in the process of shutting down its Kettle River

Mill, which would make the Greenwood Mill the only processing

facility available in the camp.

With only about 400 m of the potential 1,500 m strike length

(based on soil and rock sampling) already being drilled off, the

COD Vein remains open at depth, to the south, and to the north

where gold showings are present some 100 m away, as a video from Ximen demonstrates.

Ximen, GGX and Golden Dawn are controlling some of the largest

properties in the Greenwood Mining Camp, whereas staking and

acquisitions by others have increased lately.

Today, Ximen also announced that its option

partner has begun the spring 2019 drilling on the Gold Drop

Property, focussing on the C.O.D. Vein (C.O.D. stands for

“Continuation of Dentonia”; the Dentonia is another gold-quartz

vein in the camp that was historically mined). The C.O.D Vein was

first targeted in 2017. For 2019, the drilling will be initially

aimed at extending and in-filling the ore shoot of high-grade

gold-silver-tellurium mineralization that was intersected in 2018.

Following this, the Everest vein to the south, and the C.O.D.

extension to the north will be drill-tested. Below pictures from

Ximen’s news-release show the arrival of drilling equipment and an

excavator.

The Brett Gold Project

Rockstone is looking forward to follow Ximen‘s 2019 plans to

aggressively advance its 100% owned Brett Epithermal Gold Project

near the city of Vernon in southern British Columbia (a 2h drive to

the Greenwood Mill).

This large property (~20,000 hectares) hosts potential for both

high-grade (bonanza grades) and low-grade (bulk tonnage)

mineralization, possibly evolving as a candidate for

blending with material from other projects

stockpiled at a central processing facility. In this respect: What

makes this project attractive is the low sulfide

mineralization, which translates into simple

metallurgy (95% gold recovery).

“The Brett Gold property was acquired by Ximen in late 2013...

Prior to its acquisition, previous work on the Brett property from

the early 1980’s through to 2004 included over 15,000 metres of

diamond drilling and 459 meters of underground development.

Exploration work on the epithermal gold property by Ximen in 2014

included ground magnetics/VLF-EM, soil geochemistry,

biogeochemistry, rock sampling, geological mapping, induced

polarization and 2,977 meters of diamond drilling. Thirteen drill

holes were drilled to test geological, geochemical and geophysical

targets. All of the holes were drilled to test new targets that

were untested, or only minimally tested, by historic work on the

property. Widespread alteration was identified in several areas.

Some core samples from the drilling program reveled high gold

intersections. Two new high-grade gold-bearing zones were

identified, with results including 34.18 g/t Au over 0.9 m from one

zone and 16.7 g/t Au over 1.5 m from the second. Significant

intervals of bulk tonnage gold mineralization were also

intercepted, including 1.77 g/t Au over 31 m, 1.88 g/t Au over

16.55 m and 0.82 g/t Au over 33 m. In 2016, Ximen drilled sixteen

drill holes totaling 2,364 m on specific targets which resulted

from geological interpretation conducted on cross-sections. Some

core samples from the drilling program revealed high gold

intersections. Drill hole 16-1 intercepted an interval with 18.95

g/t Au over 1 m, drill hole 16-2 intercepted an interval with 3.13

g/t Au over 1.1 m, drill hole 16-11 intercepted 13.35 g/t Au over

0.58 m and drill hole 16-17 intercepted 5.7 g/t Au over 0.5

m.“ (Source: Ximen‘s news-release of October 31,

2018)

Background

During strongly rising gold prices in 2007 and early 2008, the

Greenwood Mill and the underground access of the Lexington Mine was

completed.

In April 2008, production commenced at a time when the gold

price was starting to trend lower due to the global financial

crisis. During the 9 months of operation, the gold price dropped

sharply from around $1,000 to $700 USD/ounce.

Upated Chart

In December 2008, when the gold price just started to trend

higher again, the previous owner (Merit Mining Corp.) ceased

operations as the metal prices were obviously too low and costs too

high. Golden Dawn´s 2016 Preliminary Economic Assessment (PEA)

calculated all-in sustaining cash costs of 820 USD/oz gold, whereas

the updated June 2017 PEA indicated

all-in sustaining cash costs of 786/oz gold). Subsequently, the

Lexington Mine and the Greenwood Mill were put on care and

maintenance.

In early 2016, Golden Dawn acquired the Greenwood Mill along

with the past producing Lexington and Golden Crown Mines, just

about when the gold price ended a 4 year downtrend.

The Greenwood Mill is a modern processing

facility with a nominal daily throughput capacity of 212 t/day

(72,000 t/year), upgradable to 424 t/day with the addition of a

second primary grinding mill and modifications to existing rougher

flotation circuit. The mill‘s conventional processing can produce a

gold gravity concentrate and copper-gold flotation concentrate,

both marketable to smelters for immediate cash-flow. The near-by

tailings pond, pictured above in the background, has a permitted

capacity of 400,000 t. The Greenwood Mill is a modern processing

facility with a nominal daily throughput capacity of 212 t/day

(72,000 t/year), upgradable to 424 t/day with the addition of a

second primary grinding mill and modifications to existing rougher

flotation circuit. The mill‘s conventional processing can produce a

gold gravity concentrate and copper-gold flotation concentrate,

both marketable to smelters for immediate cash-flow. The near-by

tailings pond, pictured above in the background, has a permitted

capacity of 400,000 t.

As of March 2018, Golden Dawn was progressing towards production

at the Lexington Mine and Greenwood Mill: “Permits have been

obtained, the Lexington Mine has been dewatered (which took longer

than anticipated due to greater water volume), the mill has been

organized and readied to be operational within a month’s notice,

underground equipment has been repaired, and the shop and offices

at the portals of the Lexington Mine have been rebuilt.“

In May, the company was eyeing to initiate trial mining

in August 2018. A month later in June, Golden Dawn provided a last project update

before announcing in July that Mr.

Wiese is “unable to carry out the duties of his office due to a

medical situation“.

As no project or management update was reported thereafter – and

as it became increasingly clear that Mr. Wiese may never return to

the business world – Golden Dawn‘s share price declined from

>$0.50 in early 2018 to $0.025 in late 2018, and currently

trades at $0.055 with a market capitalization of around $4 million

CAD (69,712,345 shares issued).

Anderson to the Rescue!

Now, Chris Anderson has the opportunity to take the reins in his

hands to achieve a turnaround for Golden Dawn and its shareholders,

while simultaneously being the President and CEO of Ximen.

Christopher R. Anderson (pictured above) is President, CEO and

Director of Ximen Mining Corp. He brings over 30 years of

entrepreneurial experience with an astute emphasis on strategic

planning, communications and creative marketing. He has been

instrumental in facilitating tens of millions of dollars of

financing for both public and private enterprises. With a specific

focus on mining over the last decade, Mr. Anderson successfully

navigated the waters of one of the toughest bear markets in mining

history.

Golden Dawn stated in today‘s news-release, “The Company’s board

believes that his success, prior to this appointment and working

for his own account, in negotiating a debt restructuring

opportunity with the Company’s major credit makes him ideally

situated provide this assistance to the Company. The Company

expects that Mr. Anderson’s role as interim CEO will be reviewed by

the board of directors by the end of July 2019.“

In February 2019, Ximen announced that Dr. Mathew Ball

(P. Geo.) – Golden Dawn‘s Chief Geologist, COO, and Interim CEO –

has been appointed as Ximen‘s Vice President of Exploration. Dr.

Ball is a highly experienced geologist who knows well the Greenwood

District and the permitting procedures in British Columbia as he

was working to get the Greenwood Mill facility, along with the

Lexington Mine, permitted and operational for Golden Dawn. Before

the many years that he worked for Golden Dawn, Dr. Ball was

President and COO of the Bralorne Gold Mines in British

Columbia.

As per today‘s news from Golden Dawn, Dr. Ball “has agreed to

continue to provide his services as Chief Operating Officer and has

further agreed to accept an appointment as President of the

Company“.

“Every sunset brings the promise of a new dawn.” — Ralph W.

Emerson

As I have visited Golden Dawn‘s properties and its Greenwood

Mill in May 2017, and personally met Dr. Ball, Mr. Wiese and his

team for the first time there, I sincerely hope that Mr. Anderson

can turn Golden Dawn around for the benefit of its shareholders and

that he can finish the job which Dr. Ball and Mr. Wiese were

working hard to achieve, and for what they successfully laid the

essential groundwork.

Mr. Wiese‘s many years of hard work to the age of 72 – along

with his vision to revive the historic Greenwood Mining District

with modern exploration, mining and processing for decades to come

– will be remembered.

Wolf Wiese underground at the Lexington Mine in March 2018.

(Source)

Interview with Chris Anderson, CEO of Ximen, at the PDAC

2019:

Ellis Martin Interview with Chris Anderson (April 14,

2019):

Link to the interview: http://www.abnnewswire.net/press/en/96839/Ximen

Previous Coverage

Report #9: “Ximen takes a

shot at history, focuses on acquiring the Kenville Gold Mine“

Report #8: “Industry

inquiries persuade Ximen‘s partner to re-assay drill core for

tellurium“

Report #7: “Ximen Hires

B.C. Mining Expert Dr. Mathew Ball“

Report #6: “Location is Key

for Ximen‘s Treasure Mountain Project in Southern British

Columbia“

Report #5: “The

Unprecedented Gold-Silver-Tellurium Strikes in the Historic

Greenwood Mining Camp Continue“

Report #4: “Record-Breaking

Gold Hit in Southern British Columbia“

Report #3: “Strong drill

results and appreciating precious metals prices may herald golden

times for Ximen Mining“

Report #2: “Ximen Mining reveals

striking drill core observations ahead of assays“

Report #1: “Ximen Mining:

Hunting for Multi-Million Ounces in British Columbia“

Technical Perspective

Link to updated chart (15 min. delayed): http://schrts.co/nVvegNqV

Link to updated chart (15 min. delayed): http://schrts.co/pFkjWngW

Company Details

Ximen Mining Corp.

888 Dunsmuir Street – Suite 888

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 33,136,125

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.78 CAD (04/12/2019)

Market Capitalization: $26 Million CAD

Chart

German Symbol / WKN (Frankfurt): 1XMA / A2JBKL

Current Price: €0.497 EUR (04/12/2019)

Market Capitalization: €17 Million EUR

Disclaimer: This report

contains forward-looking information or forward-looking statements

(collectively "forward-looking information") within the meaning of

applicable securities laws. Forward-looking information is

typically identified by words such as: "believe", "expect",

"anticipate", "intend", "estimate", "potentially" and similar

expressions, or are those, which, by their nature, refer to future

events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital

Corp. caution investors that any forward-looking information

provided herein is not a guarantee of future results or

performance, and that actual results may differ materially from

those in forward-looking information as a result of various

factors. The reader is referred to the Ximen Mining Corp.´s and

Zimtu Capital Corp.´s public filings for a more complete discussion

of such risk factors and their potential effects which may be

accessed through the Ximen Mining Corp.´s and Zimtu

Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full

disclaimer within the full research report as a PDF (here) as fundamental risks and

conflicts of interest exist. The author, Stephan

Bogner, holds a long position in Ximen Mining Corp., Golden Dawn

Minerals Inc. and Zimtu Capital Corp. and is being paid by Zimtu

Capital Corp. for the preparation, publication and distribution of

this report, whereas Zimtu Capital also holds a long position in

Ximen Mining Corp. and Golden Dawn Minerals Inc. The author

currently does not hold any equity positions or other kind of

interest in GGX Gold Corp. or any other mentioned company. Ximen

Mining Corp. has paid Zimtu Capital Corp. to provide this report

and other investor awareness services.

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein,

Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

|