Revenues Grow 14% Year-Over-Year to $2.7

Billion, Marking Fifteen Consecutive Record Quarters

Core Net New Assets Total $51.7 Billion and

Total Client Assets Reach a Record $3.59 Trillion

The Charles Schwab Corporation announced today that its net

income for the first quarter of 2019 was a record $964 million, up

3% from $935 million for the prior quarter, and up 23% from

$783 million for the first quarter of 2018.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190415005169/en/

Three Months Ended March 31, % Financial Highlights

2019 2018 Change Net revenues (in

millions) $ 2,723 $ 2,398 14% Net income (in millions) $ 964 $ 783

23% Diluted earnings per common share $ .69 $ .55 25% Pre-tax

profit margin 46.4 % 41.8 %

Return on average common stockholders’

equity (annualized)

20 % 18 % Note: All per-share results are rounded to the

nearest cent, based on weighted-average diluted common shares

outstanding.

CEO Walt Bettinger said, “Over the past quarter, our Virtuous

Cycle, driven by our “Through Clients’ Eyes” strategy, continued to

attract client accounts and assets at a robust pace. The equity

markets gathered momentum during the quarter, with the S&P 500

rising 21% from the December correction and posting its best first

quarter since 1998. At the same time, investors faced a mixed

geopolitical and economic landscape, including international trade

negotiations, the evolving Brexit debate, and a potential slowing

in Fed rate hikes. While we believe that this environment impacted

investor sentiment and activity, demand for help and support from

Schwab remained strong. New brokerage accounts totaled 386,000

during the quarter and client account openings have now exceeded

100,000 for 28 consecutive months. In addition, clients

entrusted us with total core net new assets of $51.7 billion for

the quarter, representing a 6% annualized growth rate, consistent

with our long-term average and a noteworthy start to 2019,

particularly given the unsettled environment. Total client assets

reached a record $3.59 trillion at month-end March, up 8%

year-over-year.”

“We remain steadfast in our ‘no-trade offs’ approach to serving

clients, diligently seeking to offer straightforward and

transparent products and services that provide investors with

greater choice and value,” Mr. Bettinger continued. “Recently, we

marked the sixth anniversary of Schwab ETF OneSourceTM, already one

of the largest commission-free exchange-traded fund programs in the

industry, by doubling its lineup to 500 ETFs covering 79

Morningstar® categories. Client assets held in program ETFs have

grown at a compound annual rate of approximately 50% since

inception, reaching $180.9 billion at quarter end. In addition, as

part of our ongoing efforts to provide clients with the help and

advice needed to pursue their investing goals, we recently replaced

Schwab Intelligent AdvisoryTM with Schwab Intelligent Portfolios

PremiumTM. This solution combines automated investing with guidance

from a certified planning professional in a subscription-based

package designed to offer a simpler, more modern and more

approachable planning and investing experience. Client assets

enrolled in our digital advisory solutions at quarter end reached

$37.7 billion, up 23% from a year ago. Overall assets receiving

ongoing advice grew faster than total client assets over the past

year, and totaled $1.87 trillion at March 31, 2019.”

Mr. Bettinger added, “Recently, Schwab was selected as one of

the 2019 FORTUNE Top 50 ‘World’s Most Admired Companies®’, as well

as rated #1 Overall in the 2019 Investor’s Business Daily Best

Online Brokers Survey. In addition, we ranked Highest in Investor

Satisfaction with DIY Self-Directed Services in the J.D. Power 2019

U.S. Self-Directed Investor Satisfaction Study.* While these

accolades come from distinct perspectives, we believe they all

reflect the importance of our emphasis on value, service,

transparency, and trust as we attract and support a growing share

of U.S. investable wealth.”

CFO Peter Crawford commented, “Our unwavering focus on

championing our clients’ goals translated into strong first quarter

financial performance as well as business growth, indicating the

Schwab financial formula continues to operate as intended. Overall,

revenues rose by 14% year-over-year to a record $2.7 billion. Net

interest revenue grew 33% to a record $1.7 billion largely due to

higher interest-earning assets stemming from the transfer of sweep

money market funds to bank and broker-dealer sweep as well as

client cash allocations. Additionally, our net interest margin

expanded to 2.46%, up from 2.12% a year earlier, following the

Fed’s four rate hikes in 2018. Asset management and administration

fees decreased 11% to $755 million, mainly as a result of lower

money market fund revenue as we executed on sweep transfers.

Trading revenue declined by 8% to $185 million largely due to

client first quarter trading activity that was strong but below

last year’s then-record pace. Finally, other revenue rose 23%,

driven by a gain on the assignment of leased office space in our

215 Fremont building in San Francisco. Turning to expenses, our 5%

increase in spending was consistent with our expectations.

Compensation was 10% higher in the first quarter as we hired to

serve our expanding client base. Professional services rose by 9%,

primarily due to our investments in projects to further drive

efficiency and scale. Our disciplined expense management helped

result in a 900 basis point gap between year-over-year revenue and

expense growth, and a 46.4% pre-tax profit margin. We believe this

focus positions us well to maintain and even improve our ratio of

expenses to client assets, which was just 17 bps for the quarter

using average balances, and 16 bps based on the quarter-end

total.”

Mr. Crawford concluded, “During the first quarter, we continued

to emphasize effective balance sheet management. While clients

sorted through their invested and transactional cash allocations,

we transferred $11.6 billion from sweep money market funds to bank

and broker-dealer sweep. This activity contributed to consolidated

balance sheet assets of $283 billion at quarter end. A small amount

of the $14.4 billion in sweep money market fund balances

outstanding as of month-end March remains to be transferred; we

expect to complete those transfers by the end of April. In January

2019, we announced a 31% increase in our dividend and a $4 billion

stock repurchase authorization, which we expect to access in coming

quarters to return excess capital to stockholders. Our preliminary

Tier 1 Leverage Ratio ended the quarter at 7.2%, modestly above our

operating objective of 6.75%-7%. We achieved a 20% return on equity

for the third consecutive quarter – our strongest performance since

early 2009 – exemplifying our commitment to being good stewards of

our stockholders’ capital.”

Supporting schedules and selected balances are either attached

or located at: https://www.aboutschwab.com/financial-reports.

*Disclaimer: From FORTUNE Magazine, February 2019, ©2019 Fortune

Media IP Limited. FORTUNE and The World’s Most Admired Companies

are registered trademarks of Fortune Media IP Limited and are used

under license. FORTUNE and Fortune Media IP Limited are not

affiliated with, and do not endorse the products or services of,

Charles Schwab.

From Investor’s Business Daily, January 28, 2019, ©2019

Investor’s Business Daily, Inc. All rights reserved. Used by

permission and protected by the Copyright Laws of the United

States. The printing, copying, redistribution or retransmission of

this Content without express written permission is prohibited.

Charles Schwab received the highest numerical score in the DIY

segment of the J.D. Power 2019 Self-Directed Investor Satisfaction

Study of investors’ satisfaction who use self-directed investment

firms. Visit https://jdpower.com/awards.

Commentary from the CFO

Periodically, our Chief Financial Officer provides insight and

commentary regarding Schwab’s financial picture at: https://www.aboutschwab.com/cfo-commentary. The

most recent commentary, which provides perspective on crossing the

$250 billion consolidated asset threshold for heightened

regulatory requirements, was posted on August 14, 2018.

Forward-Looking Statements

This press release contains forward-looking statements relating

to Fed rate hikes; growth in the client base, accounts and assets;

efficiency and scale; ratio of expenses to client assets; transfers

to sweep; capital returns to stockholders; and Tier 1 Leverage

Ratio operating objective. Achievement of these expectations and

objectives is subject to risks and uncertainties that could cause

actual results to differ materially from the expressed

expectations.

Important factors that may cause such differences include, but

are not limited to, general market conditions, including the level

of interest rates, equity valuations, and trading activity; the

company’s ability to attract and retain clients and registered

investment advisors and grow those relationships and client assets;

competitive pressures on pricing, including deposit rates; the

company’s ability to develop and launch new products, services,

infrastructure and capabilities in a timely and successful manner;

client use of the company’s advisory solutions and other products

and services; the company’s ability to manage expenses; client

sensitivity to interest rates; capital and liquidity needs and

management; and other factors set forth in the company’s most

recent report on Form 10-K.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with more than 360 offices and

11.8 million active brokerage accounts, 1.7 million corporate

retirement plan participants, 1.3 million banking

accounts, and $3.59 trillion in client assets as of March 31, 2019.

Through its operating subsidiaries, the company provides a full

range of wealth management, securities brokerage, banking, asset

management, custody, and financial advisory services to individual

investors and independent investment advisors. Its broker-dealer

subsidiary, Charles Schwab & Co., Inc. (member SIPC,

https://www.sipc.org), and affiliates

offer a complete range of investment services and products

including an extensive selection of mutual funds; financial

planning and investment advice; retirement plan and equity

compensation plan services; referrals to independent fee-based

investment advisors; and custodial, operational and trading support

for independent, fee-based investment advisors through Schwab

Advisor Services. Its banking subsidiary, Charles Schwab Bank

(member FDIC and an Equal Housing Lender), provides banking and

lending services and products. More information is available at

https://www.schwab.com and

https://www.aboutschwab.com.

THE CHARLES SCHWAB CORPORATION

Consolidated Statements of Income

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended March 31, 2019

2018

Net Revenues Interest revenue $ 1,998 $

1,421 Interest expense (317 ) (158 ) Net interest revenue 1,681

1,263 Asset management and administration fees 755 851 Trading

revenue 185 201 Other 102 83 Total net

revenues 2,723 2,398

Expenses

Excluding Interest Compensation and benefits 850 770

Professional services 170 156 Occupancy and equipment 131 122

Advertising and market development 69 73 Communications 62 62

Depreciation and amortization 83 73 Regulatory fees and assessments

32 51 Other 62 89 Total expenses

excluding interest 1,459 1,396 Income

before taxes on income 1,264 1,002 Taxes on income 300

219

Net Income 964

783 Preferred stock dividends and other 39

37

Net Income Available to Common Stockholders

$ 925 $ 746

Weighted-Average Common

Shares Outstanding: Basic 1,333 1,347 Diluted 1,344

1,362

Earnings Per Common Shares

Outstanding: Basic $ .69 $ .55 Diluted $ .69

$ .55 THE CHARLES SCHWAB CORPORATION

Financial and Operating Highlights (Unaudited)

Q1-19 % change 2019

2018 vs. vs. First Fourth Third Second

First (In millions, except per share amounts and as noted)

Q1-18 Q4-18 Quarter Quarter Quarter

Quarter Quarter

Net Revenues Net interest revenue 33

% 3 % $ 1,681 $ 1,626 $ 1,527 $ 1,407 $ 1,263 Asset management and

administration fees (11 )% — 755 755 809 814 851 Trading revenue (8

)% (10 )% 185 206 176 180 201 Other 23 % 24 % 102

82 67 85 83

Total net revenues 14 % 2 % 2,723 2,669

2,579 2,486 2,398

Expenses Excluding Interest Compensation and benefits 10 % 6

% 850 805 737 745 770 Professional services 9 % (4 )% 170 178 164

156 156 Occupancy and equipment 7 % 2 % 131 128 124 122 122

Advertising and market development (5 )% (26 )% 69 93 70 77 73

Communications — (2 )% 62 63 59 58 62 Depreciation and amortization

14 % 4 % 83 80 78 75 73 Regulatory fees and assessments (37 )% 3 %

32 31 57 50 51 Other (30 )% (23 )% 62 81

71 72 89 Total

expenses excluding interest 5 % — 1,459 1,459

1,360 1,355 1,396

Income before taxes on income 26 % 4 % 1,264 1,210 1,219 1,131

1,002 Taxes on income 37 % 9 % 300 275

296 265 219

Net

Income 23 % 3 % $ 964 $ 935

$ 923 $ 866 $ 783 Preferred

stock dividends and other 5 % (22 )% 39 50

38 53 37

Net

Income Available to Common Stockholders 24 % 5 % $ 925

$ 885 $ 885 $ 813

$ 746 Earnings per common share: Basic 25 % 5 % $ .69

$ .66 $ .66 $ .60 $ .55 Diluted 25 % 6 % $ .69 $ .65 $ .65 $ .60 $

.55 Dividends declared per common share 70 % 31 % $ .17 $ .13 $ .13

$ .10 $ .10 Weighted-average common shares outstanding: Basic (1 )%

(1 )% 1,333 1,343 1,351 1,350 1,347 Diluted (1 )% (1 )%

1,344 1,354 1,364 1,364

1,362

Performance Measures Pre-tax

profit margin 46.4 % 45.3 % 47.3 % 45.5 % 41.8 % Return on average

common stockholders’ equity (annualized) (1) 20 % 20

% 20 % 19 % 18 %

Financial Condition

(at quarter end, in billions) Cash and investments segregated 9 % 2

% $ 13.9 $ 13.6 $ 8.5 $ 11.0 $ 12.8 Receivables from brokerage

clients — net (3 )% (6 )% 20.5 21.7 22.4 22.4 21.2 Bank loans — net

1 % (1 )% 16.5 16.6 16.6 16.6 16.4 Total assets 14 % (5 )% 282.8

296.5 272.1 261.9 248.3 Bank deposits 15 % (5 )% 219.5 231.4 213.4

199.9 190.2 Payables to brokerage clients (5 )% (9 )% 29.7 32.7

27.9 30.3 31.1 Long-term debt 66 % (1 )% 6.8 6.9 5.8 5.8 4.1

Stockholders’ equity 12 % 4 % 21.6 20.7

20.8 20.1 19.3

Other Full-time equivalent employees (at quarter end, in

thousands) 10 % 3 % 20.0 19.5 19.1 18.7 18.2 Capital expenditures —

purchases of equipment, office facilities, andproperty, net (in

millions) 34 % 14 % $ 181 $ 159 $ 156 $ 126 $ 135 Expenses

excluding interest as a percentage of average client

assets(annualized) 0.17 % 0.17 % 0.15 %

0.16 % 0.17 %

Clients’ Daily Average Trades (in

thousands) Revenue trades (2) (10 )% (10 )% 418 466 382 376 462

Asset-based trades (3) 7 % (21 )% 149 188 129 149 139 Other trades

(4) — (1 )% 210 213 172

179 211 Total (4 )% (10 )% 777

867 683 704

812

Average Revenue Per Revenue Trade (2) (1 )% 1 %

$ 7.19 $ 7.13 $ 7.27

$ 7.30 $ 7.24

(1) Return on average common stockholders’

equity is calculated using net income available to common

stockholders divided by average common stockholders’ equity. (2)

Includes all client trades that generate trading revenue (i.e.,

commission revenue or principal transaction revenue); also known as

DART. (3) Includes eligible trades executed by clients who

participate in one or more of the company’s asset-based pricing

relationships. (4) Includes all commission-free trades, including

Schwab Mutual Fund OneSource® funds and ETFs, and other proprietary

products.

THE CHARLES SCHWAB CORPORATION

Net Interest Revenue Information

(In millions)

(Unaudited)

Three Months Ended March 31, 2019

2018 Interest Average Interest

Average Average Revenue/ Yield/ Average Revenue/ Yield/

Balance Expense Rate

Balance Expense Rate

Interest-earning assets

Cash and cash equivalents $ 24,983 $ 151 2.42 % $ 17,084 $ 66 1.53

% Cash and investments segregated 13,533 83 2.44 % 13,969 48 1.37 %

Broker-related receivables 257 2 2.75 % 287 1 1.32 % Receivables

from brokerage clients 18,972 214 4.52 % 18,872 179 3.79 %

Available for sale securities (1) 66,853 451 2.70 % 50,371 240 1.91

% Held to maturity securities 132,427 916 2.77 % 121,412 721 2.38 %

Bank loans 16,578 149 3.61 %

16,456 130 3.19 % Total

interest-earning assets 273,603 1,966

2.88 % 238,451 1,385

2.33 % Other interest revenue 32

36

Total interest-earning assets $ 273,603 $

1,998 2.92 % $ 238,451 $

1,421 2.39 %

Funding sources Bank deposits $

219,987 $ 226 0.42 % $ 176,988 $ 64 0.15 % Payables to brokerage

clients 22,184 23 0.43 % 22,469 7 0.14 % Short-term borrowings (2)

30 — 2.48 % 12,170 47 1.55 % Long-term debt 6,845

62 3.61 % 4,392 37

3.37 % Total interest-bearing liabilities

249,046 311 0.51 %

216,019 155 0.29 % Non-interest-bearing

funding sources 24,557 22,432 Other interest expense

6 3

Total funding sources $ 273,603

$ 317 0.46 % $ 238,451 $

158 0.27 %

Net interest revenue

$ 1,681 2.46 %

$ 1,263

2.12 % (1) Amounts have been calculated based

on amortized cost. (2) Interest expense was less than $500,000 in

the period presented.

THE CHARLES SCHWAB CORPORATION

Asset Management and Administration Fees Information

(In millions)

(Unaudited)

Three Months Ended March 31, 2019 2018

Average Average Client Average Client

Average Assets Revenue Fee

Assets Revenue Fee Schwab money market funds $

158,268 $ 122 0.31 % $ 156,362 $ 182 0.47 % Schwab equity and bond

funds, ETFs, and collective trust funds (CTFs) (1) 244,314 70 0.12

% 212,519 74 0.14 % Mutual Fund OneSource® and other

non-transaction fee funds 187,223 147 0.32 % 222,669 178 0.32 %

Other third-party mutual funds and ETFs (2) 452,461

75 0.07 % 319,722

70 0.09 % Total mutual funds, ETFs, and CTFs (3)

$ 1,042,266 414 0.16 %

$ 911,272 504 0.22 % Advice

solutions (3) Fee-based $ 230,394 278 0.49 % $ 224,760 282 0.51 %

Non-fee-based 66,756 — —

59,762 — — Total

advice solutions $ 297,150 278

0.38 % $ 284,522 282 0.40

% Other balance-based fees (1,4) 392,191 52 0.05 % 410,443 55 0.05

% Other (5) 11

10

Total asset

management and administration fees

$ 755

$ 851 (1)

Beginning in the first quarter of 2019, a change was made to move

CTFs from other balance-based fees. Prior periods have been recast

to reflect this change. (2) Includes Schwab ETF OneSourceTM. (3)

Advice solutions include managed portfolios, specialized

strategies, and customized investment advice such as Schwab Private

ClientTM, Schwab Managed PortfoliosTM, Managed Account Select®,

Schwab Advisor Network®, Windhaven® Strategies, ThomasPartners®

Strategies, Schwab Index Advantage® advised retirement plan

balances, Schwab Intelligent Portfolios®, Institutional Intelligent

Portfolios®, and Schwab Intelligent Portfolios PremiumTM; as well

as legacy non-fee advice solutions including Schwab Advisor Source

and certain retirement plan balances. Average client assets for

advice solutions may also include the asset balances contained in

the mutual fund and/or ETF categories listed above. For the total

end of period view, please see the Monthly Activity Report. (4)

Includes various asset-related fees, such as trust fees, 401(k)

recordkeeping fees, and mutual fund clearing fees and other service

fees. (5) Includes miscellaneous service and transaction fees

relating to mutual funds and ETFs that are not balance-based.

THE CHARLES SCHWAB CORPORATION

Growth in Client Assets and Accounts

(Unaudited)

Q1-19 % Change

2019 2018 vs. vs. First Fourth

Third Second First (In billions, at quarter end,

except as noted) Q1-18 Q4-18 Quarter Quarter

Quarter Quarter Quarter

Assets in client

accounts Schwab One®, certain cash equivalents and bank

deposits 13 % (5 )% $ 247.0 $ 261.2 $ 239.5 $ 228.2 $ 219.4

Proprietary mutual funds (Schwab Funds® and Laudus Funds®) and CTFs

Money market funds (1) 10 % 4 % 159.7 153.5 128.5 134.2 145.0

Equity and bond funds and CTFs (2,3) 8 % 13 % 106.2

94.3 107.4 102.1

98.7 Total proprietary mutual funds and CTFs 9 % 7 %

265.9 247.8 235.9 236.3

243.7 Mutual Fund Marketplace® (4) Mutual Fund

OneSource® and other non-transaction fee funds (12 )% 8 % 195.1

180.5 212.6 212.5 221.6 Mutual fund clearing services 2 % 11 %

182.7 164.4 182.2 175.3 178.3 Other third-party mutual funds 6 % 13

% 737.2 650.4 740.1

716.1 693.4 Total Mutual Fund

Marketplace 2 % 12 % 1,115.0 995.3

1,134.9 1,103.9 1,093.3

Total mutual fund assets 3 % 11 % 1,380.9

1,243.1 1,370.8 1,340.2

1,337.0 Exchange-traded funds (ETFs) Proprietary ETFs (3) 29

% 17 % 134.7 115.2 125.2 114.8 104.5 Schwab ETF OneSource™ (4) 177

% 170 % 82.5 30.6 33.3 30.8 29.8 Other third-party ETFs (3 )% (2 )%

303.7 309.9 338.6

322.1 314.7 Total ETF assets 16 % 14 %

520.9 455.7 497.1 467.7

449.0 Equity and other securities (2) 7 % 13 %

1,131.3 1,005.4 1,186.7 1,106.2 1,060.6 Fixed income securities 25

% 6 % 324.1 306.1 290.4 275.1 258.8 Margin loans outstanding (3 )%

(3 )% (18.8 ) (19.3 ) (20.8 ) (20.4 )

(19.4 )

Total client assets 8 % 10 %

$

3,585.4 $ 3,252.2

$ 3,563.7 $ 3,397.0

$ 3,305.4 Client assets by

business Investor Services 8 % 11 % $ 1,886.7 $ 1,701.7 $

1,876.9 $ 1,784.8 $ 1,740.8 Advisor Services 9 % 10 %

1,698.7 1,550.5 1,686.8

1,612.2 1,564.6

Total client assets 8 %

10 %

$ 3,585.4 $

3,252.2 $ 3,563.7

$ 3,397.0 $ 3,305.4

Net growth in assets in client accounts (for the

quarter ended)

Net new assets by business Investor Services

(5) N/M 2 % $ 29.2 $ 28.7 $ 27.8 $ 13.7 $ (50.8 ) Advisor Services

(30 )% (15 )% 22.5 26.6 25.7

30.2 32.0

Total net new

assets N/M (7 )%

$ 51.7

$ 55.3 $ 53.5

$ 43.9 $ (18.8

) Net market gains (losses) N/M N/M 281.5

(366.8 ) 113.2 47.7 (37.6

)

Net growth (decline) N/M N/M

$ 333.2

$ (311.5 ) $

166.7 $ 91.6

$ (56.4 ) New brokerage accounts (in

thousands, for the quarter ended) (13 )% 2 % 386 380 369 384 443

Client accounts (in thousands) Active brokerage accounts (6)

7 % 2 % 11,787 11,593 11,423 11,202 11,005 Banking accounts 6 % —

1,300 1,302 1,283 1,250 1,221 Corporate retirement plan

participants 6 % 2 % 1,684 1,655

1,627 1,599 1,594

(1)

Total client assets in purchased money

market funds are located at:

https://www.aboutschwab.com/investor-relations.

(2) Beginning in the first quarter of 2019, a change was made to

move CTFs from equity and other securities. Prior periods have been

recast to reflect this change. (3) Includes balances held on and

off the Schwab platform. As of March 31, 2019, off-platform equity

and bond funds, CTFs, and ETFs were $11.8 billion, $4.4 billion,

and $36.3 billion, respectively. (4) Excludes all proprietary

mutual funds and ETFs. (5) Second quarter of 2018 includes outflows

of $9.5 billion from certain mutual fund clearing services clients.

First quarter of 2018 includes outflows of $84.4 billion from

certain mutual fund clearing services clients. (6) In September

2018, the definition of active brokerage accounts was standardized

across all account types as accounts with activity within the

preceding 270 days. This change increased active accounts by

approximately 63,000.

N/M Not meaningful.

The Charles Schwab Corporation Monthly

Activity Report For March 2019

2018

2019

Change

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Mo.

Yr.

Market Indices (at month end) Dow Jones Industrial Average

24,103 24,163 24,416 24,271 25,415 25,965 26,458 25,116 25,538

23,327 25,000 25,916 25,929 — 8 % Nasdaq Composite 7,063 7,066

7,442 7,510 7,672 8,110 8,046 7,306 7,331 6,635 7,282 7,533 7,729 3

% 9 % Standard & Poor’s 500 2,641 2,648 2,705 2,718 2,816 2,902

2,914 2,712 2,760 2,507 2,704 2,784 2,834 2 % 7 %

Client

Assets (in billions of dollars) Beginning Client Assets 3,328.8

3,305.4 3,312.1 3,378.1 3,397.0 3,447.9 3,555.9 3,563.7 3,388.1

3,431.9 3,252.2 3,447.7 3,533.0 Net New Assets (1) 20.2 0.4 19.4

24.1 16.3 20.8 16.4 14.9 15.6 24.8 15.1 18.3 18.3 — (9 )% Net

Market Gains (Losses) (43.6 ) 6.3 46.6

(5.2 ) 64.6 57.2 (8.6 )

(190.5 ) 28.2 (204.5 ) 180.4

67.0 34.1 Total Client Assets (at month end)

3,305.4 3,312.1 3,378.1

3,397.0 3,477.9 3,555.9

3,563.7 3,388.1 3,431.9

3,252.2 3,447.7 3,533.0 3,585.4

1 % 8 % Core Net New Assets (2) 25.6 9.9 19.4 24.1 16.3 20.8 16.4

14.9 15.6 24.8 15.1 18.3 18.3 — (29 )% Receiving Ongoing Advisory

Services (at month end) Investor Services 273.2 274.7 279.1 280.0

287.0 292.0 292.7 280.3 284.7 272.4 286.9 294.2 298.4 1 % 9 %

Advisor Services (3) 1,444.4 1,451.6 1,478.0 1,488.7 1,525.5

1,555.3 1,559.2 1,485.8 1,510.1 1,436.1 1,514.2 1,551.6 1,572.8 1 %

9 %

Client Accounts (at month end, in thousands) Active

Brokerage Accounts (4) 11,005 11,081 11,145 11,202 11,243 11,310

11,423 11,479 11,529 11,593 11,653 11,712 11,787 1 % 7 % Banking

Accounts (5) 1,221 1,230 1,240 1,250 1,262 1,274 1,283 1,289 1,297

1,302 1,312 1,313 1,300 (1 )% 6 % Corporate Retirement Plan

Participants 1,594 1,599 1,599 1,599 1,611 1,621 1,627 1,634 1,639

1,655 1,679 1,685 1,684 — 6 %

Client Activity New Brokerage

Accounts (in thousands) 140 141 122 121 118 132 119 133 115 132 131

115 140 22 % — Inbound Calls (in thousands) 2,145 2,034 1,852 1,814

1,849 1,964 1,715 1,976 1,681 1,839 1,924 1,742 1,882 8 % (12 )%

Web Logins (in thousands) 58,906 55,980 56,234 56,491 57,137 62,797

53,923 59,261 54,654 53,920 64,563 60,121 63,692 6 % 8 % Client

Cash as a Percentage of Client Assets (6) 11.0 % 10.9 % 10.6 % 10.7

% 10.5 % 10.4 % 10.3 % 11.1 % 11.2 % 12.8 % 11.7 % 11.5 % 11.3 %

(20) bp 30 bp

Mutual Fund and Exchange-Traded Fund

Net Buys (Sells) (7, 8) (in millions of dollars)

Large Capitalization Stock (158 ) 410 953 981 486 918 311 308 331

717 1,343 1,109 1,045 Small / Mid Capitalization Stock 130 359 753

1,195 768 (186 ) 151 (1,344 ) (456 ) (1,414 ) 1,329 638 302

International 1,546 809 372 (498 ) (529 ) 186 (88 ) (109 ) (418 )

(2,163 ) 2,212 1,086 1,274 Specialized 326 122 (19 ) 383 520 (245 )

73 (914 ) (397 ) (2,105 ) 124 609 750 Hybrid 529 (541 ) (241 ) (288

) (548 ) (678 ) (324 ) (1,313 ) (1,248 ) (2,985 ) (321 ) (309 )

(357 ) Taxable Bond 2,117 1,661 1,002 928 879 965 1,371 (351 ) (836

) (4,342 ) 3,956 2,871 1,923 Tax-Free Bond 247 (113 ) 449 588 306

559 262 (591 ) (407 ) (409 ) 1,184 1,111 1,133

Net Buy (Sell)

Activity (in millions of dollars) Mutual Funds (7) 1,976 (36 )

(88 ) 555 (522 ) (1,936 ) (1,538 ) (5,734 ) (7,955 ) (21,372 )

6,740 2,312 1,850 Exchange-Traded Funds (8) 2,761 2,743 3,357 2,734

2,404 3,455 3,294 1,420 4,524 8,671 3,087 4,803 4,220 Money Market

Funds (9,100 ) (4,156 ) (2,245 ) (4,919 ) (4,801 ) 704 (1,933 )

2,546 8,515 13,548 4,944 (1,577 ) 1,785

Average Interest-Earning Assets (9)

(in millions of dollars)

241,049 239,833 242,584 249,432

254,211 259,137 261,741 264,156 265,648

274,913 277,068 270,718 272,727

1 % 13 % (1) April and March 2018 include

outflows of $9.5 billion and $5.4 billion, respectively, from

certain mutual fund clearing services clients. (2) Net new assets

before significant one-time inflows or outflows, such as

acquisitions/divestitures or extraordinary flows (generally greater

than $10 billion) relating to a specific client. These flows may

span multiple reporting periods. (3) Excludes Retirement Business

Services. (4) In September 2018, the definition of active brokerage

accounts was standardized across all account types as accounts with

activity within the preceding 270 days. This change increased

active accounts by approximately 63,000. (5) In March 2019, banking

accounts were reduced by approximately 23,000 as a result of

inactive account closures. (6) Schwab One®, certain cash

equivalents, bank deposits, and money market fund balances as a

percentage of total client assets. (7) Represents the principal

value of client mutual fund transactions handled by Schwab,

including transactions in proprietary funds. Includes institutional

funds available only to Investment Managers. Excludes money market

fund transactions. (8) Represents the principal value of client ETF

transactions handled by Schwab, including transactions in

proprietary ETFs. (9) Represents average total interest-earning

assets on the company’s balance sheet.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190415005169/en/

MEDIA:Mayura HooperCharles SchwabPhone:

415-667-1525INVESTORS/ANALYSTS:Rich FowlerCharles

SchwabPhone: 415-667-1841

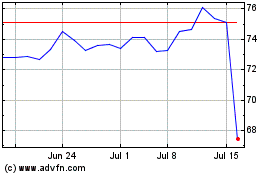

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

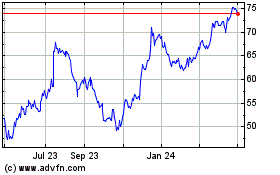

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024