UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE

SECURITIES EXCHANGE ACT OF 1934

|

x

|

Filed by the Registrant

|

|

|

|

|

¨

|

Filed by a Party other than the Registrant

|

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

¨

|

Definitive Information Statement Only

|

|

¨

|

Confidential, for Use of the Commission (as permitted by Rule 14c)

|

|

BARREL ENERGY INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

_____________________________________________________________

Name of Person(s) Filing Information Statement, if other than Registrant:

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14C-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount previously paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party: ____________________________

|

|

(4)

|

Date Filed: ____________________________

|

BARREL ENERGY INC.

8275 S. Eastern Ave., Suite 200

Las Vegas, NV 89123

(702) 595-2247

Copies of correspondence to:

Frederick C. Bauman, Esq.

Bauman & Associates Law Firm

6440 Sky Pointe Dr., Ste 140-149

Las Vegas, NV 89131

(702) 318-7218

NOTICE OF ACTION TAKEN WITHOUT A STOCKHOLDER MEETING

Date of Mailing: April ___, 2019

TO THE STOCKHOLDERS OF BARREL ENERGY INC.:

The attached Information Statement is furnished by the Board of Directors (the "Board") of Barrel Energy, Inc. (the "Company," "we" or "us"). The Company, a Nevada corporation, is a public company registered with the Securities and Exchange Commission.

On April 10, 2019, three stockholders holding 24,000,000 shares of $0.001 par value common stock (“Common Stock”), or approximately 64.03%, of our voting power, consented in writing to amend the Company's Articles of Incorporation (the "Articles of Amendment"). This consent was sufficient to approve the Articles of Amendment under Nevada law and our Articles of Incorporation. The attached Information Statement describes the Articles of Amendment that the common stockholders of the Company have approved, which will increase the Company’s authorized shares of common stock to 450,000,000 shares from 75,000,000 shares. The Articles of Amendment will become effective upon filing with the Nevada Secretary of State, which can occur no earlier than twenty (20) calendar days after the filing and dissemination of the Definitive Information Statement.

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

There are no stockholder dissenters' or appraisal rights in connection with any of the matters discussed in this Information Statement.

Please read this Notice and Information Statement carefully and in its entirety. It describes the terms of the actions taken by the stockholders.

Although you will not have an opportunity to vote on the approval of the Articles of Amendment, this Information Statement contains important information about the Articles of Amendment.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

/s/ Craig Alford

|

|

|

|

Craig Alford, President

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF INFORMATION STATEMENT MATERIALS IN CONNECTION WITH THIS NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT:

BARREL ENERGY, INC.

8275 S. Eastern Ave., Suite 200

Las Vegas, NV 89123

(702) 595-2247

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished to the stockholders of Barrel Energy, Inc., a Nevada corporation (the "Company," "we" or "us"), to advise them of the corporate actions that have been authorized by written consent of three of the Company's stockholders, who ows Common Stock with approximately 64.03% of the Company's power as of the record date of April____, 2019 (the "Record Date"). These actions are being taken without notice, meetings or votes in accordance with Article 78 of the Nevada Revised Statutes (NRS), the Company’s Articles of Incorporation and its Bylaws. This Information Statement is being mailed to the stockholders of the Company, as of the Record Date, on April ___, 2019.

On April 10, 2019, the Board of Directors approved, and recommended to the stockholders for approval, an amendment to the Company's Articles of Incorporation (the "Articles of Amendment") that will increase the Company’s authorized shares of common stock to 450,000,000 shares from 75,000,000 shares. The full text of the Articles of Amendment is attached to this Information Statement as Appendix A.

On April 10, 2019, three stockholders holding 24,000,000 shares of Common Stock, or approximately 64.03% of our voting power, consented in writing to the Articles of Amendment. This consent was sufficient to approve the Articles of Amendment under Nevada law.

NO VOTE REQUIRED

We are not soliciting consents to approve the Articles of Amendment. Nevada law and our Articles of Incorporation permit the Company to take any action which may be taken at an annual or special meeting of its stockholders by written consent, if the holders of a majority of the shares of its Common Stock sign and deliver a written consent to the action to the Company.

NO APPRAISAL RIGHTS

Under Nevada corporate law, stockholders have no appraisal or dissenters' rights in connection with the Articles of Amendment.

INTERESTS OF CERTAIN PARTIES IN THE MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Company has any substantial interest resulting from the Articles of Amendment that is not shared by all other stockholders pro rata, and in accordance with their respective interests.

COST OF THIS INFORMATION STATEMENT

The entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held of record by them.

HOUSEHOLDING OF STOCKHOLDER MATERIALS

In some instances we may deliver only one copy of this Information Statement to multiple stockholders sharing a common address. If requested by phone or in writing, we will promptly provide a separate copy to a stockholder sharing an address with another stockholder. Requests by phone should be directed to Harpreet Sangha, our CEO, at (702) 595-2247, and requests in writing should be sent to Barrel Energy, Inc., Attention President, 8275 S. Eastern Ave, Suite 200, Las Vegas, NV 89123. Stockholders sharing an address who currently receive multiple copies and wish to receive only a single copy should contact their broker or send a signed, written request to us at the above address.

AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK.

General

Our Articles of Incorporation currently authorizes 75,000,000 shares of common stock.

On April 10, 2019 the Board of Directors, and on April 10, 2019 the consenting stockholder(s), approved the filing of an amendment to our Articles of Incorporation to increase the authorized shares of common stock to 450,000,000 shares from 75,000,000 shares (the “Amendment”).

Reasons for the Increase in Authorized Shares of Common Stock

Our Articles of Incorporation presently authorize 75,000,000 shares of common stock. As of February 27, 2019, there were 37,476,352 shares of common stock outstanding. In order to provide funding for the Company’s operations and exploration program, it will be necessary to issue additional shares of common stock, or promissory notes that are convertible into common stock. Most lenders that fund convertible notes require that the borrower direct its stock transfer agent to establish a reserve of authorized shares to be available for conversion of the lender’s convertible notes. If the market price of the borrower’s convertible stock declines, the reserve may be required to be increased. In the event that there are insufficient authorized shares to honor a conversion notice, there may be contractual penalties payable by the borrower. The increase in the Company’s authorized shares to 450,000,000 shares from 75,000,000 shares is intended to provide adequate authorized shares to cover the Company’s funding needs for at least the next 12 months.

Principal Effects of the Increase in Authorized Shares of Common Stock

While the authorization of additional shares of common stock is intended to increase our financial flexibility, it could also lead to dilution of the existing stockholders in the event that additional shares are sold for less than the current market price (or in the case of convertible debt, if the conversion price is less than our present market price). This is likely in the case of convertible debt, as convertible lenders typically require that they be permitted to convert at a discount from the market price at the time of conversion.

Effective Date

Under Rule 14c-2, promulgated pursuant to the Securities Exchange Act of 1934, as amended, the Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of the Company. We anticipate the effective date to be on or about May ___, 2019.

(a) SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of February 27, 2019, with respect to the holdings of (1) each person who is the beneficial owner of more than 5% of our common stock, (2) each of our directors, (3) each executive officer, and (4) all of our current directors and executive officers as a group.

Beneficial ownership of the common stock is determined in accordance with the rules of the Securities and Exchange Commission and includes any shares of common stock over which a person exercises sole or shared voting or investment power, or of which a person has a right to acquire ownership at any time within 60 days of February 27, 2019. Except as otherwise indicated, we believe that the persons named in this table have sole voting and investment power with respect to all shares of common stock held by them. Applicable percentage ownership in the following table is based on 37,476,332 shares of common stock outstanding as February 27, 2019 plus, for each individual, any securities that individual has the right to acquire within 60 days of February 27, 2019.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership (1) (2)

|

|

|

Percent of

Class

|

|

|

|

|

|

|

|

|

|

|

Gurminder Sangha

|

|

|

10,000,000

|

|

|

|

26.68

|

%

|

|

8275 S. Eastern Ave.

|

|

|

|

|

|

|

|

|

|

Suite 200

|

|

|

|

|

|

|

|

|

|

Las Vegas, NV 89123

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harpreet Sangha (3)

|

|

|

10,000,000

|

|

|

|

26.68

|

%

|

|

8275 S. Eastern Ave.

|

|

|

|

|

|

|

|

|

|

Suite 200

|

|

|

|

|

|

|

|

|

|

Las Vegas, NV 89123

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Craig Alford (3)

|

|

|

4,000,000

|

|

|

|

10.67

|

%

|

|

8275 S. Eastern Ave.

|

|

|

|

|

|

|

|

|

|

Suite 200

|

|

|

|

|

|

|

|

|

|

Las Vegas, NV 89123

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Officers and Directors as a Group

|

|

|

14,000,000

|

|

|

|

37.35

|

%

|

(1) All ownership is beneficial and of record, unless indicated otherwise.

(2) The beneficial owner has sole voting and investment power with respect to the shares shown.

(3) An officer and director of the Company.

Securities Authorized for Issuance under Equity Compensation Plans

None

(b)

Changes in Control

We know of no arrangements which may at a subsequent date result in a change in control of the Company.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This Information Statement may contain "forward-looking statements." All statements other than statements of historical fact are "forward-looking statements" for purposes of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives of management for future operations, and any statement of assumptions underlying any of the foregoing. These statements may contain words such as "expects," "anticipates," "plans," "believes," "projects," and words of similar meaning. These statements relate to our future business and financial performance.

Actual outcomes may differ materially from these statements. The risks listed in this Information Statement as well as any cautionary language in this Information Statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from any expectations we describe in our forward-looking statements. There may be other risks that we have not described that may adversely affect our business and financial condition. We disclaim any obligation to update or revise any of the forward-looking statements contained in this Information Statement. We caution you not to rely upon any forward-looking statement as representing our views as of any date after the date of this Information Statement. You should carefully review the information and risk factors set forth in other reports and documents that we file from time to time with the SEC.

ADDITIONAL INFORMATION

This Information Statement should be read in conjunction with certain reports that we previously filed with the SEC, including our:

* Annual Report on Form 10-K for the fiscal year ended September 30, 2018 and

* Quarterly Reports on Form 10-Q for the periods ended March 31, 2018, June 30, 2018 and December 31, 2018.

The reports we file with the SEC and the accompanying exhibits may be inspected without charge at the Public Reference Section of the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such materials may also be obtained from the SEC at prescribed rates. The SEC also maintains a Web site that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of the Reports may be obtained from the SEC's EDGAR archives at http://www.sec.gov. We will also mail copies of our prior reports to any stockholder upon written request.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

/s/ Craig Alford

|

|

|

|

Craig Alford, President

|

|

|

|

Las Vegas, Nevada

|

|

|

|

April ___, 2019

|

|

Articles of Amendment

To the

Articles of Incorporation

Pursuant to the provisions of Article 78 of the Nevada Revised Statutes (NRS), the undersigned corporation adopts the following Articles of Amendment to its Articles of Incorporation:

1. Name of corporation:

BARREL ENERGY, INC.

2. The Articles of Incorporation have been amended as follows:

Article 3 (Authorized Stock) is deleted in its entirety and replaced with the following:

“3. Authoried Stock: The Capital Stock shall consist of 450,000,000 shares of common stock, $0.001 par value, all of which stock shall be entitled to voting power. The Corporation may issue the shares of stock for such consideration as may be fixed by the Board of Directors.”

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the Articles of incorporation have voted in favor of the amendment is 64.03%.

4. Effective date and time of filing: (optional) Date: _______________ Time: _________________

5. Signature: (required)

/s/ Craig Alford

Signature of Officer: Craig Alford, President

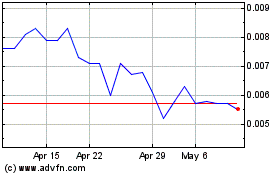

Barrel Energy (PK) (USOTC:BRLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

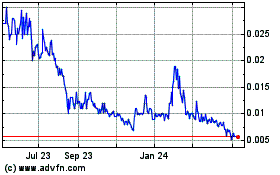

Barrel Energy (PK) (USOTC:BRLL)

Historical Stock Chart

From Apr 2023 to Apr 2024