Current Report Filing (8-k)

April 08 2019 - 2:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

March 27,

2019

PCT LTD

(Exact name of registrant as specified in its

charter)

|

Nevada

|

000-31549

|

90-0578516

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

4235 Commerce Street

Little River, South Carolina

|

29566

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

(843) 390-7900

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

☐

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not

to use the extended transit

ion period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

On March 27, 2019, the

Registrant entered into a binding letter of intent (the “LOI”) with Magnolia Columbia Limited (“Magnolia”),

a Canadian company traded on the TSXV under the symbol “MCO”. Pursuant to the terms of the LOI, the parties agreed

to negotiate and enter into a definitive agreement pursuant to which, by way of share exchange, amalgamation or other form of business

combination to be determined by the legal and tax advisors of the parties, Magnolia will acquire all of the issued and outstanding

shares of the Registrant in exchange for shares of Magnolia (the “Proposed Transaction”). Following completion of the

Proposed Transaction, the Registrant would become a wholly-owned subsidiary of Magnolia (the “Resulting Issuer”) and

will carry on the business of the Registrant assuming the PCT LTD name. Paradigm Convergence Technology Corporation (PCT Corp)

will be wholly owned by PCT Ltd and continue to be the operational entity based in the US and operating as PCT Corp..

Pursuant to the terms of

the LOI, the parties agreed to enter into a definitive agreement that will provide for the following, among other things:

|

1.

|

All of the common shares in the capital of the Registrant will be exchanged for common shares of Magnolia at a ratio resulting in the stockholders of the Registrant, including following the conversion of certain debt, owning 60% of the Resulting Issuer and the shareholders of the Company owning 40% of the Resulting Issuer on an undiluted basis.

|

|

|

|

|

2.

|

The Registrant will use its best efforts to convert a minimum of USD$1.4million of its current debt in shares of common stock.

|

|

|

|

|

3.

|

Magnolia will have no material liabilities, approximately CAD$1.8 million in cash and 57,977,098 common shares issued and outstanding along with options and warrants outstanding.

|

|

|

|

|

4.

|

Magnolia will loan the Registrant CAD$250,000 following execution of the LOI and Magnolia will arrange to have a third-party loan the Registrant an additional CAD$400,000. Both loans will convert into shares of common stock upon closing of the Proposed Transaction.

|

|

|

|

|

5.

|

The Board of Directors of the Resulting Issuer is expected to be comprised of six members, with three members nominated by Magnolia and three members nominated by the Registrant.

|

|

|

|

|

6.

|

The Resulting Issuer shall enter into consulting agreements with members of the Forbes & Manhattan team to provide services as the CFO, Secretary, Controller, Legal Clerk and Investors Relations Manager. In addition, the Resulting Issuer shall enter into a management contract with Jody Read, the current CEO of the Registrant.

|

The LOI provides that the

parties will carry out due diligence and will proceed reasonably and in good faith toward the negotiation and execution of definitive

documentation regarding the Proposed Transaction. The completion of the Proposed Transaction is subject to the receipt of all necessary

approvals, including without limitation stockholder approval of the Proposed Transaction, regulatory approval for the listing of

the common shares of Magnolia on the CSE and the concurrent delisting of the common shares of Magnolia from the TSXV. The proposed

delisting from the TSXV will also require the approval of the Magnolia Board as well as the consent of the majority of the minority

of the shareholders of Magnolia.

If a definitive agreement

is not executed by the parties on or before April 27, 2019 (or such other date agreed to by the parties), the LOI will terminate.

The foregoing description

of the LOI does not purport to be complete and is qualified in its entirety by reference to the full text of the LOI, a copy of

which is filed as Exhibit 10.1 to this current report on Form 8-K, and is incorporated herein by reference.

About Magnolia

Magnolia Colombia Ltd.

is an Ontario company listed on the TSX Venture Exchange (MCO.V) and has shifted its focus from oil and gas exploration to evaluating

potential domestic and international opportunities. Magnolia changed its name from Stetson Oil and Gas Ltd., on June 14, 2017.

Magnolia files financial

reports and other documents with Canadian Securities Administrators, which are available free of charge at www.sedar.com. Magnolia

currently has material liabilities and commitments (see Notes 6 [oil and gas reclamation liabilities] and 10 [management commitments

and Colombian $9.5mm dispute] of Magnolia’s September 30, 2018 financial statements), which will need to be settled prior

to completion of the Proposed Transaction.

Item 7.01 Regulation FD Disclosure.

On April 1, 2019, Magnolia

issued a press release announcing entry into the LOI. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

Description

|

|

|

|

|

10.1

|

Letter of Intent dated March 27, 2019

|

|

99.1

|

Magnolia press release dated April 1, 2019

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

PCT LTD

By:

/s/ Jody Read

Jody Read, CEO

Date: April 5, 2019

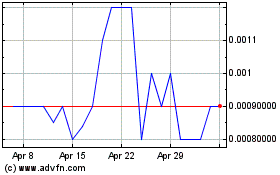

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Apr 2023 to Apr 2024