Amended Statement of Ownership (sc 13g/a)

April 01 2019 - 8:43AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13G/A

(Amendment

No. 2)

Under

the Securities Exchange Act of 1934

DUO

WORLD, INC.

(Name

of Issuer)

Common

Stock, $.001 Par Value

(Title

of Class of Securities)

266037

100

(CUSIP

Number)

March

31, 2019

(Date

of Event Which Requires Filing of this Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

[ ]

Rule 13d-1(b)

[ ]

Rule 13d-1(c)

[X]

Rule 13d-1(d)

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

Persons

who respond to the collection of information contained in this form are not required to respond unless the form displays a currently

valid OMB control number.

|

CUSIP

No.: 266037 100

|

13G/A

|

Page

2 of 6 Pages

|

|

1

|

NAMES

OF REPORTING PERSONS Muhunthan

Canagasooryam

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY): Voluntarily withheld

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

[ ]

(b)

[

X

]

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Sri

Lanka

|

|

|

|

|

|

NUMBER

OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH:

|

5

6

7

8

|

SOLE

VOTING POWER

SHARED

VOTING POWER

SOLE

DISPOSITIVE POWER

SHARED

DISPOSITIVE POWER

|

85,000,000

(1)

-0-

85,000,000

(1)

-0-

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

85,000,000

(1)

|

|

10

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (See Instructions) [ ]

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11).

73.43

% of Common Stock

|

|

12

|

TYPE

OF REPORTING PERSON (See Instructions)

IN

|

|

|

(1)

|

Include

35,000,000 shares of Common Stock. Includes 5,000,000 shares of Series A Preferred Stock,

each share of which is entitled to one (1) vote per share on all matters presented for

a vote of shareholders. These votes are cast along with the votes cast by holders of

the issuer’s Common Stock and not as a separate class. Each share of Series A Preferred

Stock is convertible into 10 shares of the issuer’s Common Stock. In accordance

with Rule 13d-3, these 5,000,000 shares of Series A Preferred Stock equate to 50,000,000

shares of Common Stock. These 50,000,000 shares are included in both the numerator and

denominator for purposes of calculating Mr. Canagasooryam’s beneficial ownership

in the issuer’s Common Stock.

|

13G/A

Item

1.

|

|

(a)

|

Name

of Issuer

|

|

|

|

|

|

|

|

Duo

World, Inc.

|

|

|

|

|

|

|

(b)

|

Address

of Issuer’s Principal Executive Offices

|

|

|

|

|

|

|

|

c/o

Duo Software (Pvt.) Ltd., No. 6, Charles Terrace, Off Alfred Place,, Colombo 03, Sri

Lanka.

|

Item

2.

|

|

(a)

|

Name

of Person Filing

|

|

|

|

|

|

|

|

Muhunthan

Canagasooryam, President of Duo World, Inc.

|

|

|

|

|

|

|

(b)

|

Address

of Principal Business Office or, if none, Residence

|

|

|

|

|

|

|

|

No.

6, Charles Terrace, Off Alfred Place

|

|

|

|

Colombo

03, Sri Lanka

|

|

|

(c)

|

Citizenship

|

|

|

|

|

|

|

|

Sri

Lanka

|

|

|

|

|

|

|

(d)

|

Title

of Class of Securities

|

|

|

|

|

|

|

|

Common

Stock, $.001 par value

|

|

|

|

|

|

|

(e)

|

CUSIP

Number

|

|

|

|

|

|

|

|

266037

100

|

|

Item

3.

|

If

this statement is filed pursuant to section 240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a:

|

|

(a)

|

[ ]

|

Broker

or dealer registered under section 15 of the Act (15 U.S.C. 78o).

|

|

|

|

|

|

(b)

|

[ ]

|

Bank

as defined in section 3(a)(6) of the Act (15 U.S.C. 78c).

|

|

|

|

|

|

(c)

|

[ ]

|

Insurance

company as defined in section 3(a)19 of the Act (15 U.S.C. 78c).

|

|

|

|

|

|

(d)

|

[ ]

|

Investment

company registered under section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8).

|

|

|

|

|

|

(e)

|

[ ]

|

An

investment advisor in accordance with section 240.13d-1(b)(1)(ii)(E).

|

|

|

|

|

|

(f)

|

[ ]

|

An

employee benefit plan or endowment fund in accordance with section 240.13d-1(b)(1)(ii)(F).

|

|

|

|

|

|

(g)

|

[ ]

|

A

parent holding company or control person in accordance with section 240.13d-1(b)(1)(ii)(G).

|

|

|

|

|

|

(h)

|

[ ]

|

A

savings association as defined in section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813).

|

|

|

|

|

|

(i)

|

[ ]

|

A

church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company

Act of 1940 (15 U.S.C. 80a-3).

|

|

|

|

|

|

(j)

|

[ ]

|

Group,

in accordance with section 240.13d-1(b)(1)(ii)(J).

|

13G/A

Item

4. Ownership

|

|

(a)

|

Amount

beneficially owned.

|

|

|

|

|

|

|

|

See

item 9 on Cover Page to this Schedule 13G/A.

|

|

|

|

|

|

|

(b)

|

Percent

of class:

|

|

|

|

|

|

|

|

See

item 11 on Cover Page to this Schedule 13G/A. The percentages reported are based on 65,754,296

shares of Common Stock outstanding as of the date of this Schedule 13G/A, and take into

account the super voting rights afforded to the holders of Series A Preferred Stock (10

votes per share).

|

|

|

|

|

|

|

(c)

|

Number

of shares as to which such person has:

|

|

|

(i)

|

Sole

power to vote or to direct the vote

|

|

|

|

|

|

|

|

See

item 5 on Cover Page to this Schedule 13G/A.

|

|

|

|

|

|

|

(ii)

|

Shared

power to vote or to direct the vote

|

|

|

|

|

|

|

|

See

item 6 on Cover Page to this Schedule 13G/A.

|

|

|

|

|

|

|

(iii)

|

Sole

power to dispose or to direct the disposition of

|

|

|

|

|

|

|

|

See

item 7 on Cover Page to this Schedule 13G/A.

|

|

|

|

|

|

|

(iv)

|

Shared

power to dispose or to direct the disposition of

|

|

|

|

|

|

|

|

See

item 8 on Cover Page to this Schedule 13G/A.

|

|

Item

5.

|

Ownership

of Five Percent or Less of a Class

|

Not

applicable.

|

Item

6.

|

Ownership

of More than Five Percent on Behalf of Another Person

|

Not

applicable.

|

Item

7.

|

Identification

and Classification of the Subsidiary which Acquired the Security Being Reported on by the Parent Holding Company

|

Not

applicable.

13G/A

|

Item

8.

|

Identification

and Classification of Members of the Group

|

Not

applicable.

|

Item

9.

|

Notice

of Dissolution of Group

|

Not

applicable.

Not

applicable.

Special

Note:

Please

direct any questions you may have about this filing to my attorney, David E. Wise, Esq., WiseLaw, P.C., 9901 IH-10 West, Suite

800, San Antonio, Texas 78230. Tel.: (210) 323-6074.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date:

April 1, 2019

|

|

/s/

Muhunthan Canagasooryam

|

|

|

Signature

|

|

|

|

|

|

Muhunthan

Canagasooryam

|

|

|

Name

|

|

|

|

|

|

An

Individual

|

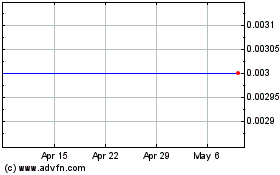

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Mar 2024 to Apr 2024

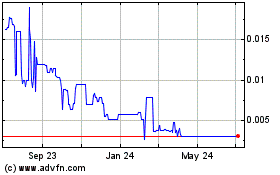

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Apr 2023 to Apr 2024