SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2019

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ/ME [National Corporate Taxpayers Register of the Ministry of Economy] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

MANAGEMENT PROPOSAL

ORDINARY AND EXTRAORDINARY SHAREHOLDERS’ MEETINGS

MARCH 26, 2019

AMBEV S.A.

CNPJ/ME [National Corporate Taxpayers Register of the Ministry of Economy] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

To the Shareholders,

We hereby present the following Management Proposal regarding the matters set forth in the agenda for the Ordinary and Extraordinary Shareholders’ Meetings of Ambev S.A. (“

Company

” and “

AGOE

”, respectively) to be held, cumulatively, on April 26, 2019, at 2:00 p.m. (“

Proposal

”):

A. Annual Shareholders’ Meeting:

1. Analysis of the management accounts, with examination, discussion and voting on the financial statements for the fiscal year ended December 31, 2018.

We propose the approval of the management accounts and financial statements for the fiscal year ended December 31, 2018, as published on February 28, 2019 on the websites of the Brazilian Securities Commission (“

CVM

”) and the B3 S.A. -Brasil, Bolsa, Balcão through the Periodical Information System, the Company’s website (ri.ambev.com.br) and the

Valor Econômico

newspaper and the Official Gazette of the State of São Paulo (“

Financial Statements

”).

We stress that, pursuant to Article 9, item III, of CVM Instruction Nº 481 on December 17, 2009 (“

CVM Instruction Nº 481/09

”), the information set forth in

Exhibit A.I

of this Proposal, reflects our comments on the financial status of the Company.

2. Allocation of the net profits for the year ended December 31, 2018, and ratification of the payments of dividends and interest on own capital for the year ended December 31, 2018, approved by the Board of Directors at meetings held on May 15, 2018 and December 3, 2018.

We propose that the net profits for the Fiscal Year ended December 31, 2018 be allocated as indicated below and as defined in detail in

Exhibit A.II

of this Proposal, drawn up in compliance with Article 9, sole paragraph, Item II, of CVM Instruction No. 481/09. It is further proposed to ratify the payments of dividends and interest on own capital for the year ended December 31, 2018, approved by the Board of Directors at meetings held May 15, 2018 and December 3, 2018.

|

Net Profits

|

R

$

11,024,678,005.26

|

|

Amount allocated to the Tax Incentives Reserve

|

R$ 1,331,526,295.24

|

|

Amount allocated to payment of dividends and / or interest on own capital (gross), declared based on the net profit relating to the fiscal year ended December 31, 2018

|

R$ 7,545,608,313.44

|

|

Amount allocated to the Investments Reserve

(1)

|

R$ 5,442,332,002.26

|

|

(1)

Including values relating to (i) reversion of effects of the revaluation of fixed assets in the amount of R$75,880,674.41; (ii) impact of the adoption of IFRS 15 in the amount of R$ (355,382,291.78); (iii) effect of application of IAS 29/CPC 42 (hyperinflation) in the amount of R$ 3,544,180,000.00; (iv) tax incentive reserve in the amount of R$ (1,331,526,295.24), and (v) expired dividends in the amount of R$30,110,223.05, as detailed in

Exhibit A.II

.

|

3. Election of the members of the Fiscal Council and their respective alternates for a term of office ending at the Annual Shareholders’ Meeting to be held in 2020, pursuant to the Company's bylaws.

The controlling shareholders appoint as members of the Fiscal Council the individuals qualified below, who will compose the “Controlling Company Slate”:

(i)

election of

Elidie Palma Bifano

, Brazilian, married, lawyer, bearer of Identity Card RG No. 3.076.167SSP/SP, enrolled with the CPF/ME under No. 395.907.558-87, resident and domiciled in the City of São Paulo, State of São Paulo,

to take office as a regular member of the Fiscal Council of the Company;

(ii)

by reelection,

José Ronaldo Vilela Rezende

, Brazilian, married, accountant, bearer of Identity Card RG No. M-2.399.128 SSP/MG, enrolled with the CPF/ME under No. 501.889.846-15, resident and domiciled in the City of São Paulo, State of São Paulo, to take office as a regular member of the Fiscal Council of the Company;

(iii)

by reelection,

Emanuel Sotelino Schifferle

, Brazilian, married, engineer, bearer of Identity Card RG No. 01.433.665-5 IFP/RJ, enrolled with the CPF/ME under No. 009.251.367-00, resident and domiciled in the City of Rio de Janeiro, State of Rio de Janeiro, to take office as an alternate member of the Fiscal Council of the Company; and

(iv)

by reelection,

Ary Waddington

, Brazilian, married, economist, bearer of Identity Card No. 01.139.7777-5 IFP/RJ, enrolled with the CPF/ME under No. 004.469.397-49, resident and domiciled in the City of Armação dos Búzios, State of Rio de Janeiro, to take office as an alternate member of the Fiscal Council of the Company;

Additionally, Caixa de Previdência dos Funcionários do Banco do Brasil – PREVI, pursuant to article 161, paragraph 4, item “a”, of Law No. 6404/76 informed the Company's management that it will appoint for the position of members of the Fiscal Council,

(i)

by reelection, Mr.

Aldo Luiz Mendes

, Brazilian citizen, divorced, bank employee and economist, bearer of Identity Card RG No. 468.756 SSP/DF, enrolled with the CPF/ME under No. 210.530.301-34, resident and domiciled in the City of Brasília, in the Federal District, to take office as a regular member of the Company's Fiscal Council; and

(ii)

by reelection, Mr.

Vinicius Balbino Bouhid

, Brazilian citizen, single, bank employee and economist, bearer of Identity Card No. 029.562.824 - DETRAN/RJ, enrolled with the CPF/ME under No. 667.460.867/04, resident and domiciled in the City of Rio de Janeiro, State of Rio de Janeiro, to take office as an alternate member of the Company's Fiscal Council.

We explain that, pursuant to Article 10 of CVM Instruction No. 481/09, the information on the candidates nominated as Members of the Fiscal Council Member of the Company listed above is presented in detail in

Exhibit A.III

of this Proposal.

4.

Establishment

of the overall Compensation of the Management and the members of the Fiscal Council for year 2019.

We propose that the overall compensation for the year 2019 (that is, between January 1, 2019 and December 31, 2019) be established in the global amount of up to R$ 101,728,287.00.

Pursuant to CVM’s instruction (item 3.4.5 of Directive Release/CVM/SEP/No. 03/2019 – “Release”), the global compensation amount of the management to be approved in an Annual Shareholders’ Meeting pursuant to Article 152 of Law No. 6404/76 must include, in addition to the short term fixed and variable compensation of the management, the expenses associated to the recognition of the fair value of the stock options that the Company intends to grant in the year. Therefore, we clarify that the global compensation amount of the management includes (i) the expenses associated to the recognition of the fair value of the stock options that the Company intends to grant this year, based on the Company’s Stock Option Plan, dated June 30, 2013, and (ii) the expenses associated to recognition of the fair value of the compensation based on shares that the Company intends to conduct this year, based on the Share-Based Compensation Plan, dated April 29, 2016, both cases with the accounting and non-financial effects provided for in CPC 10.

As far as the overall compensation of the Fiscal Council is concerned, for the year 2019 (that is, between January 1, 2019 and December 31, 2019), we propose the fixation of the global amount of up to R$ 2,146,762.00, with the compensation of the alternate members corresponding to half of the amount received by the effective members, which is in compliance with Law No. 6404/76.

We inform that the amounts paid out as overall compensation for the Management and members of the Fiscal Council of the Company for Fiscal Year 2018 were R$ 54,874,293.00 and R$ 1,789,560.00, respectively. Such amounts are lower than the limits approved by the Annual Shareholders’ Meeting held on April 27, 2018, of R$ 83,292,928.00 for the management and of R$ 2,041,187.00 for the members of the Fiscal Council. The difference between the limits approved by the Annual Shareholders’ Meeting held on April 27, 2018 and the amounts actually paid as global compensation attributed to management is justified, mainly, by the variable component of the compensation, which is connected to management and Company specific performance targets, which were not fully achieved. On the other hand, the difference related to the overall compensation attributed to the members of the Fiscal Council is justified, mainly, by the decrease of the number of members, due to the death of an effective member on July 9, 2018.

We explain that the information required for the necessary analysis of the Proposal presented on the compensation of the Management and the Fiscal Council, as set forth in Article 12 of CVM Instruction Nº 481/09, is set forth in

Exhibit A.IV

of this Proposal, particularly items 13.1 to 13.4.

B. Extraordinary Shareholders’ Meeting:

5.

Amendment to the heading of Article 5 of the Company’s By-Laws

We propose that the amendment of the heading of article 5 of the Company’s by-laws, under the form of this Proposal, be approved to reflect the increases of capital approved within the capital limit approved by the Board of Directors of the Company at meetings held on March 26, 2018 and March 25, 2019.

If the Proposal is approved, the Company’s capital stock described on the heading of article 5 of the Company’s by-laws will be R$57,798,844,242.20, divided in 15,726,842,297 registered common shares, with no par value. Thus, we propose that the heading of article 5 of the Company’s by-laws, which provides for the Company’s capital stock, be amended, as follows:

|

Current Writing

|

Proposed Writing

|

|

Article 5

– The Capital Stock is R$57,508,839,341.45, divided in 15,699,508,401 registered common shares, with no par value.

|

Article 5

– The Capital Stock is R$57,798,844,242.20, divided in 15,726,842,297 registered common shares, with no par value.

|

6. Amendment to the heading of Article 16 of the Company’s By-Laws

In order to reflect the reality of the composition of the Company’s Board of Directors in recent years, ensure that the quality of the discussions within such body is maintained, and facilitate the effective and timely decision-making, it is proposed that the maximum number of effective members of the Board of Directors and the respective alternates be reduced from 15 to 11, so that the heading of article 16 of the Company’s by-laws shall read as follows:

|

Current Writing

|

Proposed Writing

|

|

Article 16

– The Board of Directors shall be composed of three (3) to fifteen (15) effective members, with two (2) to fifteen (15) alternates, bounded or not to a specific effective Director, and shall be elected by the Shareholder’s Meeting and be dismissed thereby at any time, with a term of office of three (3) years, reelection being permitted.

|

Article 16

– The Board of Directors shall be composed of three (3) to eleven (11) effective members, with two (2) to eleven (11) alternates, bounded or not to a specific effective Director, and shall be elected by the Shareholder’s Meeting and be dismissed thereby at any time, with a term of office of three (3) years, reelection being permitted.

|

7. Restatement of the Company’s By-laws

In order to reflect the foregoing amendments, we propose that the restatement of the Company’s By-Laws, under the terms of Exhibit B hereof, be approved.

São Paulo, March 26, 2019.

The Management

Ambev S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 26, 2019

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Fernando Mommensohn Tennenbaum

|

|

|

Fernando Mommensohn Tennenbaum

Chief Financial and Investor Relations Officer

|

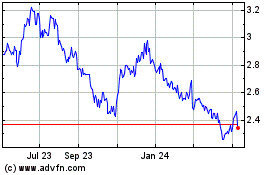

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

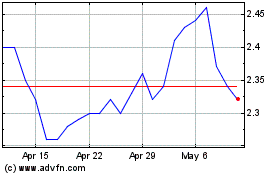

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024