SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2019

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ [National Register of Legal Entities] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

(the “

Company

”)

Extract of the Minutes of the Meeting of the Board of Directors of Ambev S.A.

held on March 25

th

, 2019, drawn up in summary form

1.

Date, Time and Venue

.

On March 25

th

, 2019, starting at 02:30 p.m., at the Company’s headquarters, located in the City of São Paulo, State of São Paulo, at Rua Dr. Renato Paes de Barros, 1,017, 4

th

floor.

2.

Call and Attendance

.

Call notice duly made pursuant to the Company’s bylaws.

Meeting with attendance of Mr.

Victorio Carlos De Marchi, copresident, and Messrs. Milton Seligman,

Roberto Moses Thompson Motta,

José Heitor Attilio Gracioso,

Vicente Falconi Campos, Luis Felipe Pedreira Dutra Leite, Cecília Sicupira, Nelson José Jamel, Antonio Carlos Augusto Ribeiro Bonchristiano and Marcos de Barros Lisboa.

3.

Board

.

Chairman: Victorio Carlos De Marchi; Secretary: Letícia Rudge Barbosa Kina.

4.

Resolutions

.

It was unanimously and unrestrictedly resolved by the Directors:

4.1.

Stock Option Plan and Capital Increase

. In accordance with the recommendation of the Operations, Finance and Compensation Committee at a meeting held on March 14, 2019, approve the flow of issuance of new shares to be delivered to beneficiaries of the Company's stock option programs exercising their respective options from now on, pursuant to article 166, item III, of Law 6,404/76, according to the following terms:

4.1.1. To authorize, within the limit of the authorized capital provided for in article 6 of the Company's by-laws, periodic capital increases conditioned upon the exercise of stock options granted by this Board of Directors until today under the Stock Option Plan, as approved by the Extraordinary Shareholders' Meeting held on July 30, 2013 ("

Stock Option Plan

").

4.1.2. To authorize the Chief Financial and Investor Relations Officer or the Controlling Officer to certify to the Company's registrar agent the compliance, by the beneficiaries exercising their stock options, with the conditions and requirements set forth in the Stock Option Plan and in the respective programs and contracts.

4.1.3. On a monthly basis, the Board of Directors will be informed of capital increases arising from the exercise of stock options that have occurred in the previous 30 days, formalizing them in minutes for registration and disclosure to the market, in accordance with the applicable legislation.

4.2.

Capital Increase - Stock Option Plan - 2019.2 Program

. As a result of the exercise of options granted under the “Second Stock Option Program for the year 2019”, approved by the Board of Directors on March 6, 2019, within the scope of the Stock Option Plan, to approve and homologate, within the limit of the authorized capital and pursuant to the terms of Article 6 of the Company’s Bylaws and Article 168 of Brazilian Law No. 6,404/76, the issuance of 570,387 new common shares, for the total issuance price of R$ 9,599,613.21, as a result of which the capital stock will increase from R$ 57,710,201,914.77 to R$ 57,719,801,527.98. As a result, the capital stock is divided into 15,722,717,698 registered common shares with no par value.

4.3.

Capital Increase - Stock Option Plan - 2014.1 Program

. To approve, within the limit of the authorized capital and pursuant to the terms of Article 6 of the Company’s Bylaws and Article 168 of Brazilian Law No. 6,404/76, the issuance of 4,124,599 new common shares, for the total issuance price of R$ 79,042,714.22, through the capitalization of capital reserve balance, as a result of which the capital stock will increase from R$ 57,719,801,527.98 to R$ 57,798,844,242.20, as a result of the exercise of options granted in accordance with the terms of the “First Stock Option Program for the year 2014”, approved by the Board of Directors on March 7, 2014, within the scope of the Stock Option Plan. As a result, the capital stock is divided into 15,726,842,297 registered common shares with no par value.

The new shares issued pursuant to items 4.2 and 4.3 above shall participate, under equal conditions with the other shares, of all the benefits and advantages that may be declared as of the date hereof.

4.4.

New Denomination - Related Parties and Antitrust Conducts Committee.

To approve the change of the denomination of the "Antitrust Compliance and Related Parties Committee" to "Related Parties and Antitrust Conducts Committee", in order to highlight the attribution given by this Board of Directos to said Committee, as provided in its internal regulation. As a result of such deliberation, the internal regulations of the Board of Directors and the Related Parties and Antitrust Conducts Committee will be adjusted to reflect the new denomination of the Related Parties and Antitrust Conducts Committee.

4.5.

Proposal for the Allocation of Net Profits – FY 2018

. To approve the submission to the Company’s shareholders in the next Ordinary General Meeting of the Company the following proposal on the net profit allocation for the fiscal year ended on December 31, 2018:

|

Net Profits

|

R$ 11,024,678,005.26

|

|

Amount allocated to the Tax Incentives Reserve

|

R$ 1,331,526,295.24

|

|

Amount allocated to the payment of dividends and/or interest on own capital (gross), declared based on the net profit relating to the fiscal year ended December 31, 2018

|

R$ 7,545,608,313.44

|

|

Amount allocated to the Investments Reserve

(1)

|

R$ 5,442,332,002.26

|

|

(1)

Including values relating to (i) reversion of effects of the revaluation of fixed assets in the amount of R$75,880,674.41; (ii) impact of the adoption of IFRS 15 in the amount of R$(355,382,291.78); (iii) effect of application of IAS 29/CPC 42 (hyperinflation) in the amount of R$3,544,180,000.00; (iv) tax incentive reserve in the amount of R$(1,331,526,295.24); and (v) expired dividends in the amount of R$30,110,223.05, as detailed in Exhibit A.II of the Management Proposal to be submitted to the general assembly.

|

4.6.

Compensation of Management and Members of the Fiscal Council - 2019

. To approve the submission to the Company’s shareholders in the next Ordinary General Meeting the following proposal on maximum limit for the overall compensation of the Company’s management and members of the Fiscal Council for the fiscal year of 2019 (

i.e.

, between January 1

st

, 2019 and December 31, 2019):

- Overall compensation of the managers in the total amount of up to R$101,728,287.00; and

- Overall compensation of the Fiscal Council in the annual amount of up to R$ 2,146,762.00, being the compensation due to the alternates equivalent to half of the amount received by the effective members, in accordance with Law No. 6,404/76.

|

Forecast for 2019

|

Board of

Directors

|

Board of

Officers

|

Fiscal

Council

|

Total

|

|

No. of Members

|

13.00

|

11.00

|

5.67

|

29.67

|

|

No. of members

receiving compensation

|

8.00

|

11.00

|

5.67

|

24.67

|

|

Annual Fixed Compensation

|

-

|

-

|

-

|

-

|

|

Salary/fees

|

5,590,281.00

|

14,057,324.00

|

1,788,968.00

|

21,436,573.00

|

|

Other

|

1,118,056.00

|

2,763,465.00

|

357,794.00

|

4,239,315.00

|

|

Description of other

fixed compensation

|

INSS

|

INSS

|

INSS

|

-

|

|

Variable Compensation

|

-

|

-

|

-

|

-

|

|

Profit sharing

|

5,609,855.00

|

41,089,772.00

|

-

|

46,699,627.00

|

|

Post-Employment Benefits

|

-

|

934,974.00

|

-

|

934,974.00

|

|

Share-based compensation, including stock options (i)

|

8,475,594.00

|

22,088,966.00

|

-

|

30,564,560.00

|

|

Total compensation

|

20,793,786.00

|

80,934,501.00

|

2,146,762.00

|

103,875,049.00

|

(i) Amounts arising from the accounting effects provided for in CPC 10 - Share-based Payment

.

4.7.

Amendment to the Company’s By-laws

. To approve the submission to the Company's shareholders in the next Extraordinary General Meeting of the following proposals to amend the Company's by-laws: (i) amendment of the heading of article 5

th

to reflect the capital increases approved, within the limit of authorized capital, by this Board of Directors, at a meeting held on March 26, 2018 and as of this date; and (ii) amendment of the heading of article 16 to reduce the maximum number of effective members of the Board of Directors and their respective alternates from 15 to 11, in order to reflect the reality of the composition of this Board of Directors in recent years, to maintain the quality of the discussions and to facilitate effective and timely decision making.

4.8.

Call Notice of the Ordinary and Extraordinary General Meetings of the Company

. To approve the call notice of the Company's ordinary and extraordinary general meetings and to resolve on the agenda as per the Call Notice, attached hereto as

Exhibit I

.

5.

Closure

.

With no further matters to be discussed, the present Minutes were drawn up and duly executed

.

São Paulo, March 25

th

, 2019.

|

/s/ Victorio Carlos De Marchi

|

/s/ Marcos de Barros Lisboa

|

|

/s/ Milton Seligman

|

/s/ Roberto Moses Thompson Motta

|

|

/s/ José Heitor Attilio Gracioso

|

/s/ Vicente Falconi Campos

|

|

/s/ Luis Felipe Pedreira Dutra Leite

|

/s/ Cecília Sicupira

|

|

/s/ Nelson José Jamel

|

/s/ Antonio Carlos Augusto Ribeiro Bonchristiano

|

|

|

/s/

Letícia Rudge Barbosa Kina

Secretary

|

Exhibit 1

AMBEV S.A.

CNPJ [National Corporate Taxpayers Register] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

ORDINARY AND EXTRAORDINARY GENERAL MEETINGS

CALL NOTICE

The shareholders of Ambev S.A. (“

Company

”) are invited to attend the Ordinary and Extraordinary General Meetings (“

AGOE

”) to be held on April 26, 2019, at 2:00 p.m., at the Company’s headquarters, located at Rua Dr. Renato Paes de Barros, 1,017, 4

th

floor, Itaim Bibi, in the City and State of São Paulo, to resolve on the following agenda:

(a)

Ordinary General Meeting

:

(i)

analysis of the management accounts, with examination, discussion and voting on the financial statements related to the fiscal year ended December 31, 2018;

(ii)

allocation of the net profits for the fiscal year ended December 31, 2018 and ratification of the payment of interest on own capital and dividends related to the fiscal year ended on December 31, 2018, approved by the Board of Directors at meetings held on May 15

th

, 2018 and December 3

rd

, 2018;

(iii)

election of the members of the Company’s Fiscal Council and their respective alternates for a term in office until the Ordinary General Meeting to be held in 2020; and

(iv)

establishing the overall compensation of the management and of the members of the Fiscal Council for the fiscal year of 2019.

(b)

Extraordinary General Meeting

:

(i)

approve the amendment of the Company's bylaws to:

(a)

to amend the heading of article 5

th

, in order to reflect the capital increases approved by the Board of Directors up to the date of the AGOE, within the authorized capital limit; and

(b)

to amend the heading of article 16, in order to reduce the maximum number of effective members of the Board of Directors and their respective alternates from 15 (fifteen) to 11 (eleven), in order to reflect the reality of the composition of the Company's Board of Directors in recent years, to ensure the quality of discussions within the said body is maintained and to facilitate effective and timely decision-making; and

(c) to consolidate the Company's by-laws.

General Information:

-

On February 28

th

, 2019 the following documents were published on the newspapers “Diário Oficial do Estado de São Paulo” and “Valor Econômico”: (i) the annual management report; (ii) the financial statements regarding the fiscal year ended on December 31, 2018; (iii) the report of the independent accountant’s opinion; and (iv) the Fiscal Council’s opinion.

-

The documents and information referred to above and those listed in CVM Ruling No. 481/09 were presented to the Comissão de Valores Mobiliários – CVM by means of its information system

Empresas.Net

, in accordance with Article 6

th

of such Ruling, and are available to the shareholders at the Company’s headquarters, on its Investor Relations website (

ri.ambev.com.br

), and on the websites of B3 S.A. – Brasil, Bolsa Balcão (

www.b3.com.br

) and CVM (

www.cvm.gov.br

).

-

The shareholder or its legal agent must present valid identification in order to vote at the AGOE. Proxies containing special powers for representation in the general meeting shall be deposited at the Company’s headquarters (att. Mrs. Letícia Rudge Barbosa Kina, Chief Legal Officer), at least three (3) business days prior to the date scheduled for the meetings.

-

Shareholders taking part in the B3 S.A. – Brasil, Bolsa Balcão Registered Stocks Fungible Custody that plan on attending the AGOE shall submit a statement containing their respective stock ownership, issued by qualified entity, within forty-eight (48) hours prior to the meetings.

-

To participate at the AGOE, by means of the distance voting procedure, the shareholders must send the distance voting bulletin according to the instructions provided by item 12.2 of the Company’s Reference Form.

São Paulo, March 26

th

, 2019.

Victorio Carlos De Marchi

Co-Chairman of the Board of Directors

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 25, 2019

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Fernando Mommensohn Tennenbaum

|

|

|

Fernando Mommensohn Tennenbaum

Chief Financial and Investor Relations Officer

|

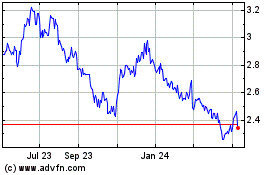

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

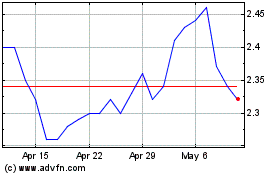

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024