Current Report Filing (8-k)

March 22 2019 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 22, 2019 (March 21, 2019)

NEWELL BRANDS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-9608

|

|

36-3514169

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

221 River Street

Hoboken, New Jersey 07030

(Address of principal executive offices including zip code)

(201)

610-6600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 5.02.

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

|

(e) On March 14, 2019, Newell Brands Inc. (the “Company”) announced that Michael B. Polk, the

Company’s President, Chief Executive Officer and member of the Company’s Board of Directors (the “Board”), will retire from the Company.

In connection with Mr. Polk’s retirement from the Company on June 28, 2019 (the “Retirement Date”), the Company and

Mr. Polk have entered into a Retirement Agreement and General Release (the “Retirement Agreement”) pursuant to which Mr. Polk agreed to a customary release and restrictive covenants. The Retirement Agreement entitles

Mr. Polk to, among other things, (1) salary continuation payments for two years, totaling $2.7 million, unpaid amounts of which will be payable on August 1, 2019; (2) continued medical coverage for Mr. Polk and covered

dependents under the Company’s plans, at COBRA rates, until Mr. Polk and his spouse are eligible for Medicare (or coverage under the medical plans of a new employer); (3) a lump sum payment of approximately $19,500, which is the difference

between the aggregate premium for 24 months of medical coverage for Mr. Polk and his dependents, at the cost charged to active employees, and the aggregate premium for 24 months of such coverage at COBRA rates; (4) a portion of his annual

cash incentive award

pro-rated

through the Retirement Date under the 2019 Management Bonus Plan payable in March 2020 (subject to the satisfaction of applicable performance conditions); and

(5) reimbursement of legal fees associated with the Retirement Agreement, up to $10,000. Mr. Polk’s unexercised 2011 stock options will remain exercisable until expiration in July 2021 consistent with the terms of the underlying

option agreement. Additionally, Mr. Polk’s unvested performance-based restricted stock units (“RSUs”) awarded in February 2018 will continue to vest in February 2021 (subject to the satisfaction of applicable performance

conditions) and a

pro-rata

portion of the RSUs awarded to Mr. Polk in February 2019, reflecting four months of service and totaling 45,724 RSUs, will continue to vest in February 2022 (subject to the

satisfaction of applicable performance conditions). The provisions for the benefit of the Company included in any agreement previously entered into by Mr. Polk that by their applicable terms extend past his termination of employment, including

but not limited to confidentiality, invention assignment,

non-solicitation

and

non-competition

provisions, will remain in full force and effect.

The foregoing summary is qualified in its entirety by reference to the Retirement Agreement, a copy of which is filed as Exhibit 10.1 hereto

and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEWELL BRANDS INC.

|

|

|

|

|

|

|

Dated: March 22, 2019

|

|

|

|

By:

|

|

/s/ Bradford R. Turner

|

|

|

|

|

|

|

|

Bradford R. Turner

|

|

|

|

|

|

|

|

Chief Legal and Administrative Officer and Corporate Secretary

|

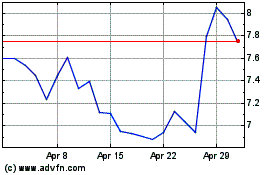

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

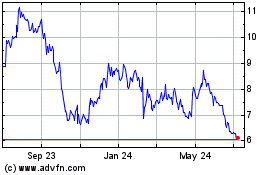

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Apr 2023 to Apr 2024