Report of Foreign Issuer (6-k)

March 22 2019 - 6:14AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule

13a-16

or

15d-16

of

the Securities Exchange Act of 1934

For the Month of March 2019

KOREA

ELECTRIC POWER CORPORATION

(Translation of registrant’s name into English)

55

Jeollyeok-ro,

Naju-si,

Jeollanam-do, 58217, Korea

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒

Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the

Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.

Yes ☐

No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82- .

At the annual general meeting (“AGM”) of shareholders of Korea Electric Power Corporation

(“KEPCO”) held on March 22, 2019, all the agendas set forth below submitted for shareholder approval were approved by the shareholders as originally proposed:

|

|

1.

|

Agendas for Shareholder Approval:

|

|

|

1)

|

Approval of financial statements for the fiscal year 2018

|

|

|

2)

|

Approval of the maximum aggregate amount of remuneration for directors in 2019

|

|

|

•

|

|

Aggregate ceiling on remuneration for direactros in 2019 : 2,174,564 thousand won

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agenda

|

|

Outstanding Shares

|

|

|

Attendant Shares

|

|

|

Shares for

|

|

|

1. 1)

|

|

|

641,964,077

|

|

|

|

525,181,688

|

|

|

|

491,395,343 (93.6%)

|

|

|

1. 2)

|

|

|

641,964,077

|

|

|

|

525,181,688

|

|

|

|

476,740,593 (90.8%)

|

|

Details on the proposed agenda for the AGM are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

By:

/s/ Kim,

Kab-soon

|

|

|

|

Name: Kim, Kab-soon

|

|

|

|

Title: Vice President

|

Date: March 22, 2019

Attachment

Agenda 1. Approval of Financial Statements for the Fiscal Year 2018

Disclaimer: The financial statements for the fiscal year 2018 as presented below is in accordance with the International Financial Reporting Standard adopted

in Korea

(K-IFRS),

and are subject to shareholders’ approval.

KOREA ELECTRIC POWER CORPORATION

AND SUBSIDIARIES

Consolidated Financial Statements

December 31, 2018

(With Independent Auditors’ Report

Thereon)

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Financial Position

As of

December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

Note

|

|

|

2018

|

|

|

2017

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

5,6,7,48

|

|

|

W

|

1,358,345

|

|

|

|

2,369,739

|

|

|

Current financial assets, net

|

|

|

5,9,12,13,14,15,48

|

|

|

|

2,359,895

|

|

|

|

1,958,357

|

|

|

Trade and other receivables, net

|

|

|

5,8,17,23,48,49,50

|

|

|

|

7,793,592

|

|

|

|

7,928,972

|

|

|

Inventories, net

|

|

|

16

|

|

|

|

7,188,253

|

|

|

|

6,002,086

|

|

|

Income tax refund receivables

|

|

|

44

|

|

|

|

143,214

|

|

|

|

100,590

|

|

|

Current

non-financial

assets

|

|

|

18

|

|

|

|

878,888

|

|

|

|

753,992

|

|

|

Assets

held-for-sale

|

|

|

45

|

|

|

|

22,881

|

|

|

|

27,971

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

|

|

|

|

19,745,068

|

|

|

|

19,141,707

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current

assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current

financial assets, net

|

|

|

5,6,9,10,11,12,13,14,15,48

|

|

|

|

2,113,613

|

|

|

|

2,038,913

|

|

|

Non-current

trade and other receivables, net

|

|

|

5,8,17,48,49,50

|

|

|

|

1,819,845

|

|

|

|

1,754,797

|

|

|

Property, plant and equipment, net

|

|

|

21,30,52

|

|

|

|

152,743,194

|

|

|

|

150,882,414

|

|

|

Investment properties, net

|

|

|

22,30

|

|

|

|

159,559

|

|

|

|

284,714

|

|

|

Goodwill

|

|

|

19

|

|

|

|

2,582

|

|

|

|

2,582

|

|

|

Intangible assets other than goodwill, net

|

|

|

24,30,49

|

|

|

|

1,225,942

|

|

|

|

1,187,121

|

|

|

Investments in associates

|

|

|

4,20

|

|

|

|

4,064,820

|

|

|

|

3,837,421

|

|

|

Investments in joint ventures

|

|

|

4,20

|

|

|

|

1,813,525

|

|

|

|

1,493,275

|

|

|

Deferred tax assets

|

|

|

44

|

|

|

|

1,233,761

|

|

|

|

919,153

|

|

|

Non-current

non-financial

assets

|

|

|

18

|

|

|

|

327,152

|

|

|

|

246,818

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

non-current

assets

|

|

|

|

|

|

|

165,503,993

|

|

|

|

162,647,208

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

4

|

|

|

W

|

185,249,061

|

|

|

|

181,788,915

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

1

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Financial Position, Continued

As

of December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

Note

|

|

|

2018

|

|

|

2017

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade and other payables, net

|

|

|

5,25,27,48,50

|

|

|

W

|

6,405,395

|

|

|

|

5,999,521

|

|

|

Current financial liabilities, net

|

|

|

5,14,26,48,50

|

|

|

|

7,981,879

|

|

|

|

9,194,552

|

|

|

Income tax payables

|

|

|

44

|

|

|

|

285,420

|

|

|

|

508,402

|

|

|

Current

non-financial

liabilities

|

|

|

23,31,32

|

|

|

|

5,574,041

|

|

|

|

5,584,308

|

|

|

Current provisions

|

|

|

29,48

|

|

|

|

1,594,798

|

|

|

|

2,137,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

|

21,841,533

|

|

|

|

23,424,281

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current

liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current

trade and other payables, net

|

|

|

5,25,27,48,50

|

|

|

|

2,941,696

|

|

|

|

3,223,480

|

|

|

Non-current

financial liabilities, net

|

|

|

5,14,26,48,50

|

|

|

|

53,364,911

|

|

|

|

45,980,899

|

|

|

Non-current

non-financial

liabilities

|

|

|

31,32

|

|

|

|

8,160,033

|

|

|

|

8,072,434

|

|

|

Employee benefits liabilities, net

|

|

|

28,48

|

|

|

|

1,645,069

|

|

|

|

1,483,069

|

|

|

Deferred tax liabilities

|

|

|

44

|

|

|

|

9,617,309

|

|

|

|

10,415,397

|

|

|

Non-current

provisions

|

|

|

29,48

|

|

|

|

16,585,748

|

|

|

|

16,224,714

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

non-current

liabilities

|

|

|

|

|

|

|

92,314,766

|

|

|

|

85,399,993

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

4

|

|

|

W

|

114,156,299

|

|

|

|

108,824,274

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributed capital

|

|

|

1,33,48

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

|

|

|

W

|

3,209,820

|

|

|

|

3,209,820

|

|

|

Share premium

|

|

|

|

|

|

|

843,758

|

|

|

|

843,758

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,053,578

|

|

|

|

4,053,578

|

|

|

Retained earnings

|

|

|

34

|

|

|

|

|

|

|

|

|

|

|

Legal reserves

|

|

|

|

|

|

|

1,604,910

|

|

|

|

1,604,910

|

|

|

Voluntary reserves

|

|

|

|

|

|

|

35,906,267

|

|

|

|

34,833,844

|

|

|

Unappropriated retained earnings

|

|

|

|

|

|

|

14,007,942

|

|

|

|

16,931,804

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51,519,119

|

|

|

|

53,370,558

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other components of equity

|

|

|

37

|

|

|

|

|

|

|

|

|

|

|

Other capital surplus

|

|

|

|

|

|

|

1,234,825

|

|

|

|

1,233,793

|

|

|

Accumulated other comprehensive loss

|

|

|

|

|

|

|

(358,570

|

)

|

|

|

(271,457

|

)

|

|

Other equity

|

|

|

|

|

|

|

13,294,973

|

|

|

|

13,294,973

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,171,228

|

|

|

|

14,257,309

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to owners of the controlling company

|

|

|

|

|

|

|

69,743,925

|

|

|

|

71,681,445

|

|

|

Non-controlling

interests

|

|

|

19,36

|

|

|

|

1,348,837

|

|

|

|

1,283,196

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

|

|

|

W

|

71,092,762

|

|

|

|

72,964,641

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity

|

|

|

|

|

|

W

|

185,249,061

|

|

|

|

181,788,915

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss)

For

the years ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won, except per share information

|

|

Note

|

|

|

2018

|

|

|

2017

|

|

|

Sales

|

|

|

4,38,48,50

|

|

|

|

|

|

|

|

|

|

|

Sales of goods

|

|

|

|

|

|

W

|

57,897,804

|

|

|

|

55,772,548

|

|

|

Sales of services

|

|

|

|

|

|

|

392,867

|

|

|

|

351,157

|

|

|

Sales of construction services

|

|

|

23

|

|

|

|

1,742,391

|

|

|

|

3,212,184

|

|

|

Revenue related to transfer of assets from customers

|

|

|

|

|

|

|

594,548

|

|

|

|

478,973

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60,627,610

|

|

|

|

59,814,862

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

16,28,46,50

|

|

|

|

|

|

|

|

|

|

|

Cost of sales of goods

|

|

|

|

|

|

|

(55,976,628

|

)

|

|

|

(48,454,036

|

)

|

|

Cost of sales of services

|

|

|

|

|

|

|

(592,224

|

)

|

|

|

(597,423

|

)

|

|

Cost of sales of construction services

|

|

|

|

|

|

|

(1,638,869

|

)

|

|

|

(3,047,396

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(58,207,721

|

)

|

|

|

(52,098,855

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

|

|

|

|

2,419,889

|

|

|

|

7,716,007

|

|

|

Selling and administrative expenses

|

|

|

28,39,46,50

|

|

|

|

(2,627,890

|

)

|

|

|

(2,762,855

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit (loss)

|

|

|

4

|

|

|

|

(208,001

|

)

|

|

|

4,953,152

|

|

|

Other

non-operating

income

|

|

|

40

|

|

|

|

375,346

|

|

|

|

390,145

|

|

|

Other

non-operating

expense

|

|

|

40

|

|

|

|

(231,330

|

)

|

|

|

(180,055

|

)

|

|

Other gains (losses), net

|

|

|

41

|

|

|

|

(621,124

|

)

|

|

|

156,627

|

|

|

Finance income

|

|

|

5,14,42

|

|

|

|

796,870

|

|

|

|

1,530,618

|

|

|

Finance expenses

|

|

|

5,14,43

|

|

|

|

(2,470,743

|

)

|

|

|

(3,127,952

|

)

|

|

Profit (loss) related to associates, joint ventures and subsidiaries

|

|

|

4,20

|

|

|

|

|

|

|

|

|

|

|

Share in profit of associates and joint ventures

|

|

|

|

|

|

|

473,269

|

|

|

|

241,537

|

|

|

Gain on disposal of investments in associates and joint ventures

|

|

|

|

|

|

|

5,079

|

|

|

|

609

|

|

|

Gain on disposal of investments in subsidiaries

|

|

|

|

|

|

|

73

|

|

|

|

—

|

|

|

Share in loss of associates and joint ventures

|

|

|

|

|

|

|

(110,168

|

)

|

|

|

(323,225

|

)

|

|

Loss on disposal of investments in associates and joint ventures

|

|

|

|

|

|

|

(2,183

|

)

|

|

|

—

|

|

|

Impairment loss on investments in associates and joint ventures

|

|

|

20

|

|

|

|

(7,907

|

)

|

|

|

(27,238

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

358,163

|

|

|

|

(108,317

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before income tax

|

|

|

|

|

|

|

(2,000,819

|

)

|

|

|

3,614,218

|

|

|

Income tax benefit (expense)

|

|

|

44

|

|

|

|

826,321

|

|

|

|

(2,172,824

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period

|

|

|

|

|

|

W

|

(1,174,498

|

)

|

|

|

1,441,394

|

|

(Continued)

3

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss), Continued

For the years ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won, except per share information

|

|

Note

|

|

|

2018

|

|

|

2017

|

|

|

Other comprehensive income (loss)

|

|

|

5,14,28,34,37

|

|

|

|

|

|

|

|

|

|

|

Items that will not be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remeasurement of defined benefit liability, net of tax

|

|

|

28,34

|

|

|

W

|

(108,169

|

)

|

|

|

170,337

|

|

|

Share in other comprehensive income (loss) of associates and joint ventures, net of tax

|

|

|

34

|

|

|

|

(1,153

|

)

|

|

|

10,067

|

|

|

Net change in fair value of equity investments at fair value through other comprehensive income

(loss)

|

|

|

37

|

|

|

|

(34,185

|

)

|

|

|

—

|

|

|

Items that are or may be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in the unrealized fair value of

available-for-sale

financial assets, net of tax

|

|

|

37

|

|

|

|

—

|

|

|

|

(7,098

|

)

|

|

Net change in the unrealized fair value of derivatives using cash flow hedge accounting, net of

tax

|

|

|

5,14,37

|

|

|

|

211

|

|

|

|

20,868

|

|

|

Foreign currency translation of foreign operations, net of tax

|

|

|

37

|

|

|

|

(20,717

|

)

|

|

|

(134,196

|

)

|

|

Share in other comprehensive income (loss) of associates and joint ventures, net of tax

|

|

|

37

|

|

|

|

57,088

|

|

|

|

(154,694

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss, net of tax

|

|

|

|

|

|

|

(106,925

|

)

|

|

|

(94,716

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the period

|

|

|

|

|

|

W

|

(1,281,423

|

)

|

|

|

1,346,678

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the controlling company

|

|

|

47

|

|

|

W

|

(1,314,567

|

)

|

|

|

1,298,720

|

|

|

Non-controlling

interests

|

|

|

|

|

|

|

140,069

|

|

|

|

142,674

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W

|

(1,174,498

|

)

|

|

|

1,441,394

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the controlling company

|

|

|

|

|

|

W

|

(1,426,477

|

)

|

|

|

1,230,194

|

|

|

Non-controlling

interests

|

|

|

|

|

|

|

145,054

|

|

|

|

116,484

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W

|

(1,281,423

|

)

|

|

|

1,346,678

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share (in won)

|

|

|

47

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share

|

|

|

|

|

|

W

|

(2,048

|

)

|

|

|

2,023

|

|

4

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Changes in Equity

For the years

ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

Equity attributable to owners of the controlling company

|

|

|

Non-

controlling

interests

|

|

|

|

|

|

|

|

Contributed

capital

|

|

|

Retained

earnings

|

|

|

Other

components

of equity

|

|

|

Subtotal

|

|

|

Total

equity

|

|

|

Balance at January 1, 2017

|

|

W

|

4,053,578

|

|

|

|

53,173,871

|

|

|

|

14,496,244

|

|

|

|

71,723,693

|

|

|

|

1,326,852

|

|

|

|

73,050,545

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

—

|

|

|

|

1,298,720

|

|

|

|

—

|

|

|

|

1,298,720

|

|

|

|

142,674

|

|

|

|

1,441,394

|

|

|

Items that will not be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remeasurement of defined benefit liability, net of tax

|

|

|

—

|

|

|

|

158,991

|

|

|

|

—

|

|

|

|

158,991

|

|

|

|

11,346

|

|

|

|

170,337

|

|

|

Share in other comprehensive income of associates and joint ventures, net of tax

|

|

|

—

|

|

|

|

10,065

|

|

|

|

—

|

|

|

|

10,065

|

|

|

|

2

|

|

|

|

10,067

|

|

|

Items that are or may be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in the unrealized fair value of

available-for-sale

financial assets, net of tax

|

|

|

—

|

|

|

|

—

|

|

|

|

(7,102

|

)

|

|

|

(7,102

|

)

|

|

|

4

|

|

|

|

(7,098

|

)

|

|

Net change in the unrealized fair value of derivatives using cash flow hedge accounting, net of

tax

|

|

|

—

|

|

|

|

—

|

|

|

|

19,614

|

|

|

|

19,614

|

|

|

|

1,254

|

|

|

|

20,868

|

|

|

Foreign currency translation of foreign operations, net of tax

|

|

|

—

|

|

|

|

—

|

|

|

|

(95,103

|

)

|

|

|

(95,103

|

)

|

|

|

(39,093

|

)

|

|

|

(134,196

|

)

|

|

Share in other comprehensive income (loss) of associates and joint ventures, net of tax

|

|

|

—

|

|

|

|

—

|

|

|

|

(154,991

|

)

|

|

|

(154,991

|

)

|

|

|

297

|

|

|

|

(154,694

|

)

|

|

Transactions with owners of the Company, recognized directly in equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

—

|

|

|

|

(1,271,089

|

)

|

|

|

—

|

|

|

|

(1,271,089

|

)

|

|

|

(70,252

|

)

|

|

|

(1,341,341

|

)

|

|

Issuance of shares of capital by subsidiaries and others

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,378

|

)

|

|

|

(1,378

|

)

|

|

|

18,381

|

|

|

|

17,003

|

|

|

Changes in consolidation scope

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,337

|

|

|

|

7,337

|

|

|

Dividends paid (hybrid securities)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(15,856

|

)

|

|

|

(15,856

|

)

|

|

Repayment of hybrid securities

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(99,750

|

)

|

|

|

(99,750

|

)

|

|

Others

|

|

|

—

|

|

|

|

—

|

|

|

|

25

|

|

|

|

25

|

|

|

|

—

|

|

|

|

25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2017

|

|

W

|

4,053,578

|

|

|

|

53,370,558

|

|

|

|

14,257,309

|

|

|

|

71,681,445

|

|

|

|

1,283,196

|

|

|

|

72,964,641

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

5

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Changes in Equity, Continued

For

the years ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

Equity attributable to owners of the controlling company

|

|

|

Non-

controlling

interests

|

|

|

|

|

|

|

|

Contributed

capital

|

|

|

Retained

earnings

|

|

|

Other

components

of equity

|

|

|

Subtotal

|

|

|

Total

equity

|

|

|

Balance at January 1, 2018

|

|

W

|

4,053,578

|

|

|

|

53,370,558

|

|

|

|

14,257,309

|

|

|

|

71,681,445

|

|

|

|

1,283,196

|

|

|

|

72,964,641

|

|

|

Effect of change in accounting policy

|

|

|

—

|

|

|

|

71,928

|

|

|

|

(76,851

|

)

|

|

|

(4,923

|

)

|

|

|

—

|

|

|

|

(4,923

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted balance at January 1, 2018

|

|

|

4,053,578

|

|

|

|

53,442,486

|

|

|

|

14,180,458

|

|

|

|

71,676,522

|

|

|

|

1,283,196

|

|

|

|

72,959,718

|

|

|

Total comprehensive income (loss) for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period

|

|

|

—

|

|

|

|

(1,314,567

|

)

|

|

|

—

|

|

|

|

(1,314,567

|

)

|

|

|

140,069

|

|

|

|

(1,174,498

|

)

|

|

Items that will not be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remeasurement of defined benefit liability, net of tax

|

|

|

—

|

|

|

|

(100,495

|

)

|

|

|

—

|

|

|

|

(100,495

|

)

|

|

|

(7,674

|

)

|

|

|

(108,169

|

)

|

|

Share in other comprehensive income of associates and joint ventures, net of tax

|

|

|

—

|

|

|

|

(1,153

|

)

|

|

|

—

|

|

|

|

(1,153

|

)

|

|

|

—

|

|

|

|

(1,153

|

)

|

|

Net change in fair value of equity investments at fair value through other comprehensive

income

|

|

|

—

|

|

|

|

—

|

|

|

|

(34,125

|

)

|

|

|

(34,125

|

)

|

|

|

(60

|

)

|

|

|

(34,185

|

)

|

|

Items that are or may be reclassified subsequently to profit or loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in the unrealized fair value of derivatives using cash flow hedge accounting, net of

tax

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,140

|

)

|

|

|

(1,140

|

)

|

|

|

1,351

|

|

|

|

211

|

|

|

Foreign currency translation of foreign operations, net of tax

|

|

|

—

|

|

|

|

—

|

|

|

|

(32,086

|

)

|

|

|

(32,086

|

)

|

|

|

11,369

|

|

|

|

(20,717

|

)

|

|

Share in other comprehensive income (loss) of associates and joint ventures, net of tax

|

|

|

—

|

|

|

|

—

|

|

|

|

57,089

|

|

|

|

57,089

|

|

|

|

(1

|

)

|

|

|

57,088

|

|

|

Transactions with owners of the Company, recognized directly in equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

—

|

|

|

|

(507,152

|

)

|

|

|

—

|

|

|

|

(507,152

|

)

|

|

|

(92,741

|

)

|

|

|

(599,893

|

)

|

|

Issuance of shares of capital by subsidiaries and others

|

|

|

—

|

|

|

|

—

|

|

|

|

1,032

|

|

|

|

1,032

|

|

|

|

17,183

|

|

|

|

18,215

|

|

|

Changes in consolidation scope

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

9,530

|

|

|

|

9,530

|

|

|

Dividends paid (hybrid bond)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(13,385

|

)

|

|

|

(13,385

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2018

|

|

W

|

4,053,578

|

|

|

|

51,519,119

|

|

|

|

14,171,228

|

|

|

|

69,743,925

|

|

|

|

1,348,837

|

|

|

|

71,092,762

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the years ended

December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

2018

|

|

|

2017

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period

|

|

W

|

(1,174,498

|

)

|

|

|

1,441,394

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for:

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

(826,321

|

)

|

|

|

2,172,824

|

|

|

Depreciation

|

|

|

9,905,856

|

|

|

|

9,660,039

|

|

|

Amortization

|

|

|

118,938

|

|

|

|

113,672

|

|

|

Employee benefit expense

|

|

|

360,575

|

|

|

|

391,360

|

|

|

Bad debt expense

|

|

|

57,468

|

|

|

|

126,326

|

|

|

Interest expense

|

|

|

1,868,458

|

|

|

|

1,789,552

|

|

|

Loss on sale of financial assets

|

|

|

1

|

|

|

|

2,343

|

|

|

Loss on disposal of property, plant and equipment

|

|

|

60,704

|

|

|

|

70,514

|

|

|

Loss on abandonment of property, plant, and equipment

|

|

|

481,176

|

|

|

|

424,091

|

|

|

Loss on impairment of property, plant, and equipment

|

|

|

710,162

|

|

|

|

51,067

|

|

|

Loss on impairment of intangible assets

|

|

|

8,112

|

|

|

|

20

|

|

|

Loss on disposal of intangible assets

|

|

|

43

|

|

|

|

183

|

|

|

Increase to provisions

|

|

|

1,056,994

|

|

|

|

1,690,120

|

|

|

Loss (gain) on foreign currency translation, net

|

|

|

243,378

|

|

|

|

(902,878

|

)

|

|

Gain on valuation of financial assets at fair value through profit or loss

|

|

|

(8,495

|

)

|

|

|

—

|

|

|

Loss on valuation of financial assets at fair value through profit or loss

|

|

|

6,616

|

|

|

|

—

|

|

|

Valuation and transaction loss (gain) on derivative instruments, net

|

|

|

(300,500

|

)

|

|

|

1,043,628

|

|

|

Share in loss (income) of associates and joint ventures, net

|

|

|

(363,101

|

)

|

|

|

81,688

|

|

|

Gain on sale of financial assets

|

|

|

(1,838

|

)

|

|

|

(1,130

|

)

|

|

Gain on disposal of property, plant and equipment

|

|

|

(98,077

|

)

|

|

|

(48,316

|

)

|

|

Gain on disposal of intangible assets

|

|

|

(12

|

)

|

|

|

(564

|

)

|

|

Gain on disposal of associates and joint ventures

|

|

|

(5,079

|

)

|

|

|

(609

|

)

|

|

Loss on disposal of associates and joint ventures

|

|

|

2,183

|

|

|

|

—

|

|

|

Impairment loss on associates and joint ventures

|

|

|

7,907

|

|

|

|

27,238

|

|

|

Gain on disposal of subsidiaries

|

|

|

(72

|

)

|

|

|

—

|

|

|

Interest income

|

|

|

(223,767

|

)

|

|

|

(206,143

|

)

|

|

Dividend income

|

|

|

(12,777

|

)

|

|

|

(11,477

|

)

|

|

Impairment loss on

available-for-sale

securities

|

|

|

—

|

|

|

|

2,713

|

|

|

Others, net

|

|

|

81,317

|

|

|

|

16,679

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,129,849

|

|

|

|

16,492,940

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in:

|

|

|

|

|

|

|

|

|

|

Trade receivables

|

|

|

246,755

|

|

|

|

(218,328

|

)

|

|

Non-trade

receivables

|

|

|

154,580

|

|

|

|

(31,807

|

)

|

|

Accrued income

|

|

|

(484,718

|

)

|

|

|

577,838

|

|

|

Other receivables

|

|

|

(61,961

|

)

|

|

|

(1,271

|

)

|

|

Other current assets

|

|

|

(148,509

|

)

|

|

|

37,576

|

|

|

Inventories

|

|

|

(1,771,550

|

)

|

|

|

(1,373,438

|

)

|

|

Other

non-current

assets

|

|

|

(54,148

|

)

|

|

|

(46,079

|

)

|

|

Trade payables

|

|

|

478,744

|

|

|

|

342,126

|

|

|

Non-trade

payables

|

|

|

(292,912

|

)

|

|

|

(214,704

|

)

|

|

Accrued expenses

|

|

|

(361,204

|

)

|

|

|

(715,305

|

)

|

|

Other payables

|

|

|

—

|

|

|

|

292

|

|

|

Other current liabilities

|

|

|

250,112

|

|

|

|

(126,323

|

)

|

|

Other

non-current

liabilities

|

|

|

287,488

|

|

|

|

763,958

|

|

|

Investments in associates and joint ventures (dividends received)

|

|

|

175,175

|

|

|

|

106,983

|

|

|

Provisions

|

|

|

(1,132,969

|

)

|

|

|

(1,390,606

|

)

|

|

Payments of employee benefit obligations

|

|

|

(89,253

|

)

|

|

|

(69,489

|

)

|

|

Plan assets

|

|

|

(330,064

|

)

|

|

|

(325,080

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W

|

(3,134,434

|

)

|

|

|

(2,683,657

|

)

|

|

|

|

|

|

|

|

|

|

|

(Continued)

7

KOREA ELECTRIC POWER CORPORATION AND SUBSIDIARIES

Notes to the Consolidated Financial Statements, Continued

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

In millions of won

|

|

2018

|

|

|

2017

|

|

|

Cash generated from operating activities

|

|

W

|

8,820,917

|

|

|

|

15,250,677

|

|

|

Dividends received (financial assets at fair value through other comprehensive income)

|

|

|

11,182

|

|

|

|

10,590

|

|

|

Interest paid

|

|

|

(1,895,898

|

)

|

|

|

(1,886,303

|

)

|

|

Interest received

|

|

|

194,221

|

|

|

|

173,226

|

|

|

Income taxes paid

|

|

|

(450,290

|

)

|

|

|

(2,298,296

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash from operating activities

|

|

|

6,680,132

|

|

|

|

11,249,894

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from disposals of associates and joint ventures

|

|

|

1,617

|

|

|

|

10,542

|

|

|

Acquisition of associates and joint ventures

|

|

|

(319,425

|

)

|

|

|

(206,753

|

)

|

|

Proceeds from disposals of property, plant and equipment

|

|

|

234,138

|

|

|

|

85,801

|

|

|

Acquisition of property, plant and equipment

|

|

|

(12,266,870

|

)

|

|

|

(12,535,958

|

)

|

|

Proceeds from disposals of intangible assets

|

|

|

13

|

|

|

|

1,072

|

|

|

Acquisition of intangible assets

|

|

|

(110,587

|

)

|

|

|

(143,887

|

)

|

|

Proceeds from disposals of financial assets

|

|

|

2,419,259

|

|

|

|

5,296,680

|

|

|

Acquisition of financial assets

|

|

|

(2,841,651

|

)

|

|

|

(4,786,717

|

)

|

|

Increase in loans

|

|

|

(188,675

|

)

|

|

|

(218,698

|

)

|

|

Collection of loans

|

|

|

100,010

|

|

|

|

120,967

|

|

|

Increase in deposits

|

|

|

(299,564

|

)

|

|

|

(397,078

|

)

|

|

Decrease in deposits

|

|

|

259,930

|

|

|

|

110,383

|

|

|

Proceeds from disposals of assets

held-for-sale

|

|

|

18,716

|

|

|

|

—

|

|

|

Receipt of government grants

|

|

|

30,416

|

|

|

|

55,533

|

|

|

Net cash inflow from changes in consolidation scope

|

|

|

2,141

|

|

|

|

—

|

|

|

Other cash inflow (outflow) from investing activities, net

|

|

|

(53,769

|

)

|

|

|

1,414

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(13,014,301

|

)

|

|

|

(12,606,699

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from (repayment of) short-term borrowings, net

|

|

|

(183,660

|

)

|

|

|

370,328

|

|

|

Proceeds from long-term borrowings and debt securities

|

|

|

14,251,586

|

|

|

|

10,098,067

|

|

|

Repayment of long-term borrowings and debt securities

|

|

|

(8,095,590

|

)

|

|

|

(8,198,882

|

)

|

|

Payment of finance lease liabilities

|

|

|

(134,454

|

)

|

|

|

(122,919

|

)

|

|

Settlement of derivative instruments, net

|

|

|

60,907

|

|

|

|

33,434

|

|

|

Change in

non-controlling

interest

|

|

|

20,113

|

|

|

|

23,582

|

|

|

Repayment of hybrid bond

|

|

|

—

|

|

|

|

(99,750

|

)

|

|

Dividends paid (hybrid bond)

|

|

|

(17,658

|

)

|

|

|

(15,856

|

)

|

|

Dividends paid

|

|

|

(599,391

|

)

|

|

|

(1,340,387

|

)

|

|

Other cash outflow from financing activities, net

|

|

|

(175

|

)

|

|

|

(2,023

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash from financing activities

|

|

|

5,301,678

|

|

|

|

745,594

|

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents before effect of exchange rate

fluctuations

|

|

|

(1,032,491

|

)

|

|

|

(611,211

|

)

|

|

Effect of exchange rate fluctuations on cash held

|

|

|

21,097

|

|

|

|

(70,403

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(1,011,394

|

)

|

|

|

(681,614

|

)

|

|

Cash and cash equivalents at January 1

|

|

|

2,369,739

|

|

|

|

3,051,353

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at December 31

|

|

W

|

1,358,345

|

|

|

|

2,369,739

|

|

|

|

|

|

|

|

|

|

|

|

8

Agenda 2. Approval of the ceiling amount of remuneration for directors

|

|

•

|

|

Proposed aggregate ceiling on remuneration for directors:

|

|

|

•

|

|

2,174,564 thousand won in fiscal year 2019 (total number of directors: 15; number of

non-standing

directors: 8)

|

|

|

•

|

|

2,120,796 thousand won in fiscal year 2018 (total number of directors: 15; number of

non-standing

directors: 8)

|

|

|

•

|

|

We proposed to increase the maximum aggregate amount of remuneration for directors in 2019 by 2.54% compared to

2018 as a result of (i) the notification by the Government to increase the remuneration for directors of government controlled entities by 1.8% and (ii) the increased severance payments due to the increase in the average incumbency of our

directors from 19 months to 20 months.

|

Korea Electric Power (NYSE:KEP)

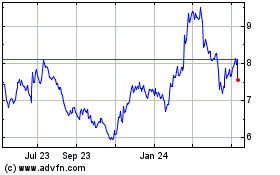

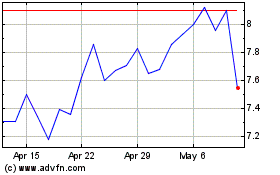

Historical Stock Chart

From Mar 2024 to Apr 2024

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Apr 2023 to Apr 2024