NetworkNewsWire

Editorial Coverage: Payment processing companies are seeing

impressive growth and may present attractive investment options by

providing diverse services.

- Changing technology and spending habits are forcing payment

systems to change.

- New providers are emerging to challenge banks and old

providers.

- By providing diverse services, these providers cater to a range

of specific markets.

- Adaptable technology helps to future proof these

innovations.

Net Element (NASDAQ: NETE) (NETE

Profile) is capitalizing on this growing space by

providing an integrated payment solution that includes online,

mobile and smart point-of-sale payments solutions for merchants in

diverse industries. Square Inc. (NYSE: SQ) is

working with trends such as bitcoin and in-app payment.

PayPal Holdings Inc. (NASDAQ: PYPL), the big name

in the sector, processes over $155 billion a year in mobile

payments. The process is still connected to the cash economy

through systems such as the ATMs of Euronet Worldwide Inc.

(NASDAQ: EEFT). Services being developed include shopping

without a checkout and online fundraising, areas Global

Payments Inc. (NYSE: GPN) is working on.

To view an infographic of this editorial, click here.

Boom Times for Payment Processing

The first quarter of 2019 has seen payment processing companies

continue their strong

performance. It’s a trend that reflects ongoing changes in the

way payments are made and the way the industry works. Once

dominated by banks, the payment industry is now a fractured and

diverse sector, with businesses catering to the shifting desires of

the millennial generation and to the specific needs of different

consumer markets.

This means that payment processing companies must adapt fast to

keep up with the times. From blockchain to security to contactless

payments on the high street, the pace of change has been relentless

and shows no sign of slowing. It’s no longer enough for payment

companies to respond to the latest trends — they have to be

preparing for an unknown future as well.

The Millennial Market

At the turn of the millennium, payment processing was almost

entirely driven by banks and the small number of companies

supporting them. But in the years since, the market has been

transformed, allowing newer companies such as technology-driven

group Net Element

(NASDAQ: NETE) to make its presence felt.

A number of factors have driven this change. One of the most

obvious is the rise of the internet and online shopping. These

online advances have created a need for online payment services,

such as PayOnline, which

allows retailers to quickly and easily get set up to take

electronic payments. More recently, the options have extended to

mobile payments, which have created a bridge between online and

offline shopping, as consumers use internet-enabled phones to make

payments on the high street.

Online shopping has contributed to the rise of a globalized

economy, in which people are increasingly making payments across

borders. Some newer payment companies such as Net Element have kept

a strong focus on growing markets, where

traditional payment systems are less developed and there is an even

greater need and desire for technological solutions. And with

prosperity rising in emerging markets such as China, the growth

potential is huge.

Then there’s the behavior of the millennial generation. An

increasing number of consumers have grown up with electronic

payments. These individuals are not just used to making

transactions without cash — they prefer it. This attitude has

created a space in which the domination of the banks has finally

been broken, and companies with innovative electronic payment

solutions can thrive.

A Diverse Industry Rising

From micropayments to macroeconomic trends, the whole market

seems set to support and encourage the growth of payment companies.

It’s a shift that saw Net Element named as

one of the top retail payment service companies in 2018, thanks

to its ability to provide the services customers are seeking; the

company has also made Deloitte's Fast Growth Companies list two

years in a row (2017 and 2018).

The conversation around payment processing is no longer driven

by banks. It’s primarily the work of fintech companies, which are

developing payment systems that work faster and more efficiently,

and at lower costs. Making these payment options user friendly is

crucial, as adoption is driven from the ground up by consumers.

The result has been a staggering rise in

the value of some older payment technology firms but also the

emergence of upstart contenders for the payment processing crown.

By covering a range of electronic payments, these newcomers can

quickly carve out important niches for themselves. For example, Net

Element’s mobile payments solution effectively turns mobile phones

into point-of-sale devices through Unified mPOS, its Unified Payments subsidiary. The company also covers

point-of-sale systems through subsidiaries such as Aptito and Restoactive,

online payments through PayOnline, and end-to-end solutions through

Tot Group, allowing it to profit from all areas of electronic

payments.

Catering to Specific Markets

The business side of payments isn’t the only piece of the

process that has become fractured — the customer base has also been

affected. Both individual customers and business customers seek

solutions better tailored to their specific needs and desires, and

the more agile companies are happy to help. Net Element has shown

how this can work by catering to specific industries.

An example of Net Element’s flexibility and agility is how it

serves the U.S. events industry. Currently, this sector is worth

hundreds of billions of dollars and employs millions of people.

Large events have complex requirements, selling different sorts of

tickets, tracking those sales, taking payments at events, and so

on. The solution offered

by Unified Payments, a Net Element subsidiary, caters to the

unique needs of a large, established industry making seasonal sales

for huge events.

Net Element is also eyeing other underserved industries to

identify ways in which it can provide the services these sectors

are searching for. By catering to specific business sectors,

payment companies such as Net Element can ensure the satisfaction

of their customers and distinguish themselves from the rest of the

market.

Future Proofing

One of the big challenges for payment providers is future

proofing. So much has changed over the past 20 years, and that pace

of development looks set to accelerate rather than slow. To ensure

long-term survival, providers have to create systems that can

adjust to changing habits, security concerns, technology and

regulations.

This sort of flexibility is shown in Net Element’s payments platform Netevia. A

multichannel platform, Netevia provides end-to-end payment

processing from multiple different inputs. By integrating with

other payment platforms, it allows users to adapt to circumstances,

while additional security and fraud prevention features help

retailers to keep their payments and their customers’ information

secure.

The company also launched Netevia Light POS, a seamless and

secure mobile payments acceptance software that operates on smart

terminals by PAX technology. Combined together, Netevia Light POS

and PAX’s Android-based interactive smart payment terminals provide

a robust, flexible, state-of-the-art solution that offers a

convenient way to do day-by-day operations through a modern,

accessible user interface and allows seamless transactions across

multiple touch points.

Changing with the Financial Times

Different companies are adapting payment systems in different

ways. Mobile payment provider Square Inc. (NYSE:

SQ) is one of those that has made technology to help

merchants turn their phones and computers into point-of-sale

systems. This approach makes it easier to adopt electronic systems,

both for businesses and for customers. Last year, the company

worked on integrating

bitcoin into its systems, as that experiment in online currency

reached its peak, a move that boosted Square’s share price. It has

since announced a software development

kit for in-app payments, which will allow the creators of apps

to integrate Square’s system for easy payments within those apps.

This puts the company squarely at the heart of one of the decade’s

biggest technological and social trends.

No company better represents the changing face of payment than

PayPal Holdings Inc. (NASDAQ: PYPL), whose

email-based payment system has become ubiquitous. Last year, the

company added to its capabilities through the acquisition of Hyperwallet, which had created a

comprehensive payments solution including multicurrency payment

distribution and disbursement options. PayPal processed $155 billion in mobile payments in

2017, and as a major player in the mobile payments game, it

looks set to keep growing.

With a focus on making payments convenient and affordable,

Euronet Worldwide Inc. (NASDAQ: EEFT) is showing

the customer-friendly approach that payment companies need to

prosper. Though digital payments are replacing physical ones, many

people and transactions still rely on cash, and Euronet caters to

payments of both types. The company provides ATM networks and has

recently made a deal with a

Spanish bank that will provide that bank’s customers easier

access to their funds.

Global Payments Inc. (NYSE: GPN) is

experimenting with another approach to commerce in the form of

unattended retail, or grab-and-go solutions. In this model,

shoppers can select items from the shelves and walk out of the

store without having to deal with checkout, and the process is

predicted to be worth $13 billion within five years. As well as

catering to retailers, Global Payments is supporting charity

fundraisers through its Greater Giving software, which has recently been expanded to Canada. Online fundraising

has become increasingly important in recent years, and companies

such as Global Payments are making it easier.

By covering a range of needs, from cash to cryptocurrency and

fundraising to fast checkout, payment processors are helping the

global economy move forward at ever greater speed. Net Element

appears to be one of the companies leading the way forward, and

savvy investors are paying attention.

For more information on Net Element, visit Net Element

(NASDAQ: NETE)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, (5) a full array

of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a

multifaceted organization with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

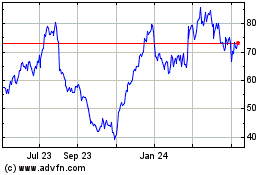

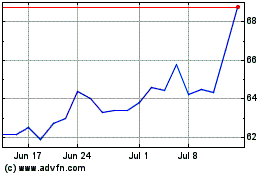

Block (NYSE:SQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Block (NYSE:SQ)

Historical Stock Chart

From Apr 2023 to Apr 2024