UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No.)

Filed

by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[X]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[ ]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

Digipath,

Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

5)

|

Total

fee paid:

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

1)

|

Amount

previously paid:

|

|

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

3)

|

Filing

Party:

|

|

|

|

|

4)

|

Date

Filed:

|

|

|

|

DIGIPATH,

INC.

6450

Cameron Blvd., Suite 113

Las

Vegas, NV 89118

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on _____ __, 2019

To

Our Stockholders:

You

are cordially invited to attend a Special Meeting of Stockholders of Digipath, Inc. (the “Company”) to be held ______

__, 2019, at 10:00 a.m., Pacific Standard Time, at 6450 Cameron Blvd., Suite 113, Las Vegas, NV 89118, for the following purposes:

1.

To approve an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of common

stock from 90,000,000 shares to 250,000,000 shares; and

2.

To transact such other business as may properly come before the special meeting or any adjournment or postponement thereof.

Stockholders

of record at the close of business on April 1, 2019 are entitled to notice and to vote at the special meeting and any adjournment

or postponement of the meeting.

Whether

or not you plan to attend the special meeting, it is important that your shares be represented and voted at the meeting. Therefore,

I urge you to promptly vote and submit your proxy by phone, via the Internet, or by signing, dating and returning the enclosed

proxy card in the enclosed envelope. If you decide to attend the special meeting, you will be able to vote in person, even if

you have previously submitted your proxy.

|

|

By

Order of the Board of Directors

|

|

|

|

|

|

Todd

Denkin

|

|

|

Chairman

of the Board and

|

|

|

Chief

Executive Officer

|

|

|

April

__, 2019

|

DIGIPATH,

INC.

6450

Cameron Blvd., Suite 113

Las

Vegas, NV 89118

PROXY

STATEMENT

Special

Meeting of Stockholders to be held on _______ __, 2019

The

enclosed proxy is solicited on behalf of the Board of Directors of Digipath, Inc., a Nevada corporation (the “Company”),

for use at the special meeting of stockholders to be held on __________ __, 2019, at 10:00 a.m., Pacific Standard Time, or at

any adjournment or postponement of the meeting, for the purposes set forth in this proxy statement and in the accompanying Notice

of Special Meeting.

The

special meeting will be held at 6450 Cameron Blvd., Suite 113, Las Vegas, NV 89118.

The

Company intends to mail this proxy statement and accompanying proxy card on or about April __, 2019 to all stockholders entitled

to vote at the special meeting.

All

expenses incurred in connection with this solicitation will be paid by the Company.

Purposes

of the Special Meeting

The

special meeting has been called for the following purposes:

1.

To approve an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of common

stock from 90,000,000 shares to 250,000,000 shares;

2.

To transact such other business as may properly come before the special meeting or any adjournment or postponement thereof.

VOTING

PROCEDURES

How

You Can Vote

You

may vote your shares by proxy or in person using one of the following methods:

|

|

●

|

Voting

by Internet. You may vote over the Internet using the directions on your proxy card by accessing the website address printed

on the card. The deadline for voting over the Internet is ______ __, 2019, at 11:59 p.m., Eastern Standard Time. If you received

a proxy card and vote over the Internet, you need not return your proxy card.

|

|

|

|

|

|

|

●

|

Voting

by Proxy Card. You may vote by completing and returning your signed proxy card. To vote using your proxy card, please mark,

date and sign the card and return it by mail in the accompanying postage-paid envelope. You should mail your signed proxy

card sufficiently in advance for it to be received by ______ __, 2019. Alternatively, you may fax the proxy card to the fax

number set forth on the proxy card. The deadline for voting by fax is ______ __, 2019, at 11:59 p.m., Eastern Standard Time.

|

|

|

|

|

|

|

●

|

Voting

by Telephone. If you hold your shares through a broker, bank or other nominee, you may vote using the directions on your proxy

card by calling the toll-free telephone number printed on the card. The deadline for voting by telephone is ______ __, 2019,

at 11:59 p.m., Eastern Standard Time. If you received a proxy card and vote by telephone, you need not return your proxy card.

|

|

|

●

|

Voting

in Person. You may vote in person at the special meeting if you are the record owner of the shares to be voted. You can also

vote in person at the special meeting if you present a properly signed proxy that authorizes you to vote shares on behalf

of the record owner.

|

Record

Date and Voting Rights

The

Board has fixed the close of business on April 1, 2019 as the record date for the determination of stockholders entitled to receive

notice of and to vote at the special meeting and any adjournment or postponement of the special meeting. As of the close of business

on April 1, 2019 the Company had outstanding [46,932,277] shares of common stock and [1,325,942] shares of Series A Preferred

Stock. The holders of our common stock are entitled to one vote per share and the holders of our Series A Preferred Stock are

entitled to five votes per share (which is the number of shares of common stock each share of Series A Preferred Stock is convertible

into) and vote with the holders of our common stock as a single group on all matters submitted to a vote of our holders of common

stock. The presence at the special meeting, in person or by proxy, of the holders of a majority of the shares entitled to vote

at the special meeting will constitute a quorum.

How

You Can Vote Shares Held by a Broker, Bank or Other Nominee

If

your shares are held in the name of a broker, bank or other nominee, you will receive instructions from the holder of record.

You must follow the instructions of the holder of record in order for your shares to be voted. If your shares are not registered

in your own name and you plan to vote your shares in person at the special meeting, you should contact your broker or agent to

obtain a legal proxy or broker’s proxy card and bring it to the special meeting in order to vote.

For

shares held in “street name” through a broker, bank or other nominee, the broker, bank or nominee may not be permitted

to exercise voting discretion with respect to the matters to be acted upon. Thus, if you do not give your broker, bank or nominee

specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares

necessary for approval.

How

Your Proxy Will Be Voted

If

you vote by proxy, the proxy holders will vote your shares in the manner you indicate. You may specify whether your shares should

be voted for or against the proposed amendment to the Company’s Articles of Incorporation.

If

the proxy card is signed and returned, but voting directions are not made, the proxy will be voted in favor of the proposal set

forth in the accompanying “Notice of Special Meeting of Stockholders” and in such manner as the proxy holders named

on the enclosed proxy card in their discretion determine upon such other business as may properly come before the special meeting

or any adjournment or postponement thereof.

How

You Can Revoke Your Proxy and Change Your Vote

Any

proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted by:

|

|

●

|

attending

the special meeting and voting in person;

|

|

|

|

|

|

|

●

|

delivering

a written revocation to the Company’s Chief Executive Officer;

|

|

|

|

|

|

|

●

|

timely

submitting another signed proxy card bearing a later date; or

|

|

|

●

|

timely

voting by telephone or over the Internet as described above.

|

Your

most current proxy card, telephone, or Internet proxy is the one that will be counted.

Vote

Required

Assuming

the existence of a quorum, the proposal to amend our Articles of Incorporation will be approved if the votes cast for approval

of the proposal constitutes a majority of the shares entitled to a vote on such proposal. Accordingly, abstentions and broker

non-votes will have the same effect as votes against such proposal.

PROPOSAL

NO. 1

AMENDMENT

TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK

Overview

The

Company’s board of directors has unanimously approved a proposal to amend its Articles of Incorporation to increase the

authorized shares of common stock of the Company from 90,000,000 shares to 250,000,000 shares, subject to stockholder approval.

The board has declared this amendment to be advisable and recommended that this proposal be presented to the Company’s stockholders

for approval. The text of the form of proposed amendment to the Company’s Articles of Incorporation to increase the authorized

shares of common stock of Company to 250,000,000 shares is attached to this proxy statement as Appendix A.

If

the Company’s stockholders approve this Proposal, the Company expects to promptly file a Certificate of Amendment to the

Company’s Articles of Incorporation with the Secretary of State of the State of Nevada to increase the number of authorized

shares of common stock. Upon filing, the Certificate of Amendment to the Company’s Articles of Incorporation will increase

the number of authorized shares of common stock from 90,000,000 to 250,000,000.

Reasons

for the Increase in Authorized Shares

As

of April __, 2019, the record date for the special meeting, the Company had [46,932,277] shares of common stock outstanding, [1,325,942]

shares of Series A Preferred Stock outstanding convertible into an aggregate of [6,629,710] shares of common stock, outstanding

options to purchase an aggregate of 9,360,000 shares of common stock, warrants to purchase an aggregate of [4,100,461] shares

of common stock, and convertible notes under which approximately [3,610,000] shares of common stock may be issued. Accordingly,

at present, the Company has a limited number of authorized shares of its common stock available for future issuances.

Although

the Company has no current commitments or agreements to issue additional shares of common stock, it desires to have additional

shares available to provide additional flexibility to use its capital stock for business and financial purposes in the future.

These purposes may include, among others:

|

|

●

|

raising

capital;

|

|

|

|

|

|

|

●

|

the

acquisition of other businesses;

|

|

|

|

|

|

|

●

|

providing

equity incentives to employees, officers or directors; and

|

|

|

●

|

establishing

strategic relationships with other companies.

|

The

terms of additional shares of common stock will be identical to those of the currently outstanding shares of the Company’s

common stock. However, because holders of the Company’s common stock have no preemptive rights to purchase or subscribe

for any unissued stock of the Company, the issuance of any additional shares of common stock authorized as a result of the increase

in the number of authorized shares of common stock will reduce the current stockholders’ percentage of ownership interest

in the total outstanding shares of common stock.

Effects

of the Increase in Authorized Shares

The

proposed increase in the authorized number of shares of common stock could have a number of effects on the stockholders of the

Company depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The increase

could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in

one or more transactions that could make a change in control or takeover of the Company more difficult. For example, additional

shares could be issued by the Company so as to dilute the stock ownership or voting rights of persons seeking to obtain control

of the Company. Similarly, the issuance of additional shares to certain persons allied with the Company’ management could

have the effect of making it more difficult to remove the Company’ management by diluting the stock ownership or voting

rights of persons seeking to cause such removal.

The

proposed amendment to Company’s Articles of Incorporation to increase the number of authorized shares of common stock from

90,000,000 shares to 250,000,000 shares will be effective upon the filing of the Certificate of Amendment with the Secretary of

State of the State of Nevada. The Company expects to file the proposed Certificate of Amendment promptly following approval of

this Proposal.

Vote

Required; Recommendation of Company Board of Directors

Assuming

the existence of a quorum, this proposal will be approved if the number of shares voted in favor of this Proposal No. 1 constitutes

a majority of the shares entitled to a vote on the proposal. Accordingly, abstentions and broker non-votes will have the same

effect as votes against this proposal, but will be counted for determining the existence of a quorum.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL NO. 1 TO AMEND THE ARTICLES OF INCORPORATION

INCREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK TO 250,000,000.

OTHER

MATTERS

The

Board of Directors does not know of any other matters which will be presented at the special meeting. If any other matters are

properly brought before the special meeting, the proxy holders named on the enclosed proxy card will vote on such matter in accordance

with their best judgment.

Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The

following table sets forth, as of April 1, 2019, certain information with regard to the record and beneficial ownership of the

Company’s common stock by (i) each person known to the Company to be the record or beneficial owner of 5% or more of the

Company’s common stock, (ii) each director of the Company, (iii) each of the named executive officers, and (iv) all executive

officers and directors of the Company as a group. The address of each of our directors and executive officers named in the table

is c/o Digipath, Inc., 6450 Cameron Street, Suite 113, Las Vegas, Nevada 89118:

|

|

|

|

|

|

Series A

|

|

|

|

|

Common

Stock

|

|

|

Preferred

Stock

|

|

|

Name

of Beneficial Owner

(1)

|

|

Number

of

Shares

|

|

|

%

of

Class

(2)

|

|

|

Number

of

Shares

|

|

|

%

of

Class

|

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Todd Denkin,

CEO and Chairman

(3)

|

|

|

3,176,611

|

|

|

|

6.4

|

%

|

|

|

-

|

|

|

|

-

|

|

|

Todd A. Peterson, CFO

(4)

|

|

|

1,156,528

|

|

|

|

2.5

|

%

|

|

|

-

|

|

|

|

-

|

|

|

Dr. Cindy Orser, Director

(5)

|

|

|

850,000

|

|

|

|

1.8

|

%

|

|

|

-

|

|

|

|

-

|

|

|

Bruce

Raben, Director

(6)

|

|

|

450,000

|

|

|

|

1.0

|

%

|

|

|

-

|

|

|

|

-

|

|

|

Directors

and Officers as a Group (4 persons)

|

|

|

5,633,139

|

|

|

|

11.8

|

%

|

|

|

-

|

|

|

|

-

|

|

|

5% Holders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estate

of Joseph Bianco

(7)

|

|

|

5,457,852

|

|

|

|

11.1

|

%

|

|

|

-

|

|

|

|

-

|

|

*

less than 1%

|

(1)

|

Except

as indicated in the footnotes to this table and pursuant to applicable community property

laws, the persons named in the table have sole voting and investment power with respect

to all shares of Common Stock or Series A Preferred Stock owned by such person.

|

|

|

|

|

(2)

|

Percentage

of beneficial ownership is based upon [46,932,277] shares of Common Stock outstanding

as of April 1, 2019. For each named person, this percentage includes Common Stock that

the person has the right to acquire either currently or within 60 days of April 1, 2019,

including through the exercise of an option; however, such Common Stock is not deemed

outstanding for the purpose of computing the percentage owned by any other person.

|

|

|

|

|

(3)

|

Includes

options to purchase 3,000,000 shares of common stock exercisable at $0.13 per share.

|

|

|

|

|

(4)

|

Includes

options to purchase 100,000 shares of common stock exercisable at $0.13 per share.

|

|

|

|

|

(5)

|

Includes

options to purchase 550,000 shares of common stock exercisable at $0.13 per share.

|

|

|

|

|

(6)

|

Includes

options to purchase 250,000 shares of common stock exercisable at $0.13 per share.

|

|

|

|

|

(7)

|

Includes

options to purchase 4,750,000 shares of common stock exercisable at $0.20 per share.

|

SUBMISSION

OF STOCKHOLDER PROPOSALS

Pursuant

to Rules 14a-4 and 14a-5(e) under the Exchange Act, to be included in the proxy statement for our next Annual Meeting of Stockholders,

stockholder proposals must be received by us at our principal executive office a reasonable time before we begin to print and

send proxy materials for such meeting.

DELIVERY

OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

Stockholders

who share a single address will receive only one proxy statement at that address unless we have received instructions to the contrary

from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and

postage costs. However, if a stockholder of record residing at such an address wishes to receive a separate copy of this proxy

statement or of future proxy statements, he or she may contact Todd Denkin, our Chief Executive Officer, or Todd Peterson, our

Chief Financial Officer, Digipath, Inc., 6450 Cameron Street, Suite 113, Las Vegas, Nevada 89118 (telephone number (702) 527-2060).

We will deliver separate copies of this proxy statement promptly upon written or oral request. If you are a stockholder of record

receiving multiple copies of this proxy statement, you can request householding by contacting us in the same manner. If you own

your shares of our common stock through a bank, broker or other stockholder of record, you can request additional copies of this

proxy statement or request householding by contacting the stockholder of record.

ADDITIONAL

INFORMATION

Additional

information concerning the Company, including its annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports

on Form 8-K, which have been filed with the Securities and Exchange Commission, may be accessed through the EDGAR archives at

www.sec.gov.

EXPENSES

The

Company will pay all expenses incurred in connection with this solicitation, including postage, printing, handling and the actual

expenses incurred by custodians, nominees and fiduciaries in forwarding proxy materials to beneficial owners. In addition to solicitation

by mail, certain of the Company’s officers, directors and regular employees, who will receive no additional compensation

for their services, may solicit proxies by telephone, personal communication or other means. The Company will also reimburse brokerage

firms and other persons representing beneficial owners of shares for reasonable expenses incurred in forwarding proxy soliciting

materials to the beneficial owners.

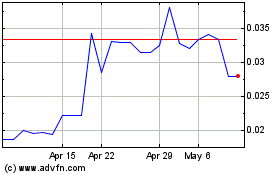

Digipath (PK) (USOTC:DIGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

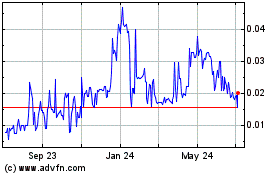

Digipath (PK) (USOTC:DIGP)

Historical Stock Chart

From Apr 2023 to Apr 2024