Current Report Filing (8-k)

March 14 2019 - 5:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

pursuant

to Section 13 or 15(d) of The Securities Act of 1934

Date of Report

(Date of earliest event reported): 03/14/19

Turner

Valley Oil & Gas, Inc.

(Exact name

of Registrant as specified in its charter)

Commission

File Number: 0-30891

|

Nevada

|

|

91-1980526

|

|

(Jurisdiction

of Incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

1600

West Loop South, Suite 600, Houston, Texas 77027

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code:

1-713-588-9453

INTRODUCTION

This Registrant (Reporting Company)

has elected to refer to itself, whenever possible, by normal English pronouns, such as "We", "Us" and "Our".

This Form 8-K may contain forward-looking statements. Such statements include statements concerning plans, objectives, goals,

strategies, future events, results or performances, and underlying assumptions that are not statements of historical fact. This

document and any other written or oral statements made by us or on our behalf may include forward-looking statements which reflect

our current views, with respect to future events or results and future financial performance. Certain words indicate forward-looking

statements, words like "believe", "expect", "anticipate", "intends", "estimates",

"forecast", "projects", and similar expressions.

Item 1.01. Entry

into a Material Definitive Agreement

Turner has entered into

a binding Purchase and Sale Agreement with Vision Services LLC D.B.A American Paving and Visco Paving to acquire all of its assets.

1. PURCHASE

AND SALE

1.1 Subject

to the terms of this Agreement, the Buyer agrees to purchase all of the Seller’s assets including but not limited to equipment,

brand, contracts, customer databases, 2018 1099 forms for all contractors and account receivables, as set forth in the attached

Exhibit A.

1.2 At

the Closing (as defined below), as consideration for the purchase of Seller’s assets, the Buyer shall issue and deliver

to the Seller:

|

|

(a)

|

$8,500.00

in cash as a downpayment after the execution of this agreement. These funds shall be

applied to the total purchase and refunded if the Seller does not complete the transaction.

|

|

|

(b)

|

$129,000.00

cash upon the conditions of this agreement being met.

|

|

|

(c)

|

$112,500.00

Series B Preferred Stock of Buyer’s company.

|

|

|

(i)

|

The

Series B Preferred Stock shall be calculated at 112,500.00 shares priced at $1 which

is converted to Common Stock of the Buyer at 100 to 1 (One Hundred to One).

|

|

|

(d)

|

the

Buyer shall, after the Closing, submit for shareholder approval resolutions that establish

the following rights and restrictions of shares of the Buyer’s preferred stock:

|

|

|

(i)

|

conversion

rights to shares of the Buyer’s Preferred Stock at a One Hundred (100) to one (1)

ratio;

|

|

|

(ii)

|

voting

rights for each share of the Buyer’s Preferred Stock equivalent to twenty (100)

shares of the Buyer’s common stock; and

|

|

|

(iii)

|

no

dividend or liquidation rights.

|

|

|

(iv)

|

any

forward or reverse splits in the future shall affect these shares and the respective

rights proportionately.

|

2. CLOSING

2.1 The

closing of the transactions contemplated by this Agreement (the “

Closing

”) shall occur within forty-five (45)

days once Agreement is executed by the parties hereto and the following conditions have been met, or longer if they have not been

met within this timeline or as otherwise mutually agreed to in writing,

2.2 As

a prerequisite of the closing,

(a) the Seller must provide

a detailed list of assets that a third-party professional can evaluate and provide an in depth professional appraisal on the

condition and value of all equipment assets.

(b) the Seller will

provide a list of all jobs completed in the last six (6) months, all current projects being completed, and all future jobs

currently under formal obligation and/or commitment.

(c) the Seller will provide

a list and documentation of all invoices for 2018 and through document execution.

The full agreement is

viewable on Turner’s corporate website here:

https://tvoginc.com/wp-content/uploads/2019/03/TVOG-VIsco-Paving-Final-PSA-Fully-Executed-03-06-19.pdf

Item

7.01. Regulation FD Disclosure.

The

Company intends to issue a press release on 03/15/19 to provide investors with updates regarding this acquisition. The update

is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release planned to issue

by the Company on 03/15/19

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, this Form 8-K has been signed below by the following person(s) on behalf of the Registrant

and in the capacity and on the date indicated.

Dated: 03/14/19

Turner

Valley Oil and Gas, Inc.

By:

/s/

Steve Helm

Steve Helm,

President/CEO/Director

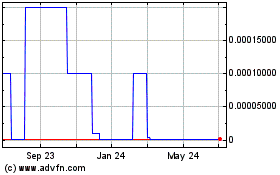

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

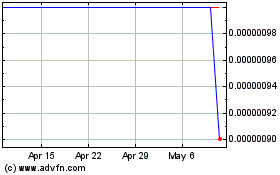

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Apr 2023 to Apr 2024