First Trust Advisors L.P. Announces Portfolio Manager Update for First Trust/Aberdeen Global Opportunity Income Fund & First ...

March 14 2019 - 4:21PM

Business Wire

First Trust Advisors L.P. (“FTA”) announced today that Aberdeen

Standard Investments Inc. (“ASII”), (formerly, Aberdeen Asset

Management Inc.), investment sub-advisor for First Trust/Aberdeen

Global Opportunity Income Fund (NYSE: FAM) and First Trust/Aberdeen

Emerging Opportunity Fund (NYSE: FEO) (each a “Fund” or

collectively, the “Funds”), will release an update on the market

and the Funds for financial advisors and investors. The update will

be available Monday, March 18, 2019, at

5:00 P.M. Eastern Time until 11:59 P.M. Eastern Time on Thursday,

April 18, 2019. To listen to the update, follow these

instructions:

-- Dial: (888) 203-1112; International (719) 457-0820; and

Passcode # 4970041 and PIN # 7859. The update will be available

from Monday, March 18, 2019, at 5:00 P.M. Eastern Time until 11:59

P.M. Eastern Time on Thursday, April 18, 2019.

FAM is a diversified, closed-end management investment company

that pursues a high level of current income. As a secondary

objective, the Fund pursues capital appreciation. The Fund pursues

these investment objectives by investing in the world bond markets

through a diversified portfolio of investment grade and

below-investment grade government and corporate debt securities.

The Fund may invest up to 60% of its managed assets in

non-investment grade securities.

FEO is a diversified, closed-end management investment company

that seeks to provide a high level of total return. The Fund seeks

to achieve its investment objective by investing at least 80% of

its managed assets in a diversified portfolio of equity and

fixed-income securities of issuers in emerging market

countries.

FTA is a federally registered investment advisor and serves as

the Funds' investment advisor. FTA and its affiliate First Trust

Portfolios L.P. (“FTP”), a FINRA registered broker-dealer, are

privately-held companies that provide a variety of investment

services. FTA has collective assets under management or supervision

of approximately $125 billion as of February 28, 2019 through unit

investment trusts, exchange-traded funds, closed-end funds, mutual

funds and separate managed accounts. FTA is the supervisor of the

First Trust unit investment trusts, while FTP is the sponsor. FTP

is also a distributor of mutual fund shares and exchange-traded

fund creation units. FTA and FTP are based in Wheaton,

Illinois.

ASII is an indirect wholly-owned subsidiary of Standard Life

Aberdeen plc. Aberdeen Standard Investments is the brand name for

the asset management group of Standard Life Aberdeen plc, managing

approximately $735.5 billion in assets as of June 30, 2018, for a

range of pension funds, financial institutions, investment trusts,

unit trusts, offshore funds, charities and private clients. In

order to comply with applicable securities laws, Aberdeen Standard

Investments’ total firm assets under management for Q4 2018 will

not be available until financial results are released in March

2019.

Investment return and market value of an investment in the Funds

will fluctuate. Shares, when sold, may be worth more or less than

their original cost. There can be no assurance that the Funds’

investment objectives will be achieved. The Funds may not be

appropriate for all investors.

Principal Risk Factors: The Funds invest in securities of

non-U.S. issuers which are subject to higher volatility than

securities of U.S. issuers. Risks may be heightened for securities

of companies located in, or with significant operations in,

emerging market countries. Because the Funds invest in non-U.S.

securities, you may lose money if the local currency of a non-U.S.

market depreciates against the U.S. dollar.

The Funds invest in non-investment grade debt instruments,

commonly referred to as "high-yield securities". High yield

securities are subject to greater market fluctuations and risk of

loss than securities with higher ratings. Lower-quality debt tends

to be less liquid than higher-quality debt.

The debt securities in which the Funds invest are subject to

certain risks, including issuer risk, reinvestment risk, prepayment

risk, credit risk, and interest rate risk. Issuer risk is the risk

that the value of fixed-income securities may decline for a number

of reasons which directly relate to the issuer. Reinvestment risk

is the risk that income from the Funds’ portfolios will decline if

the Funds invest the proceeds from matured, traded or called bonds

at market interest rates that are below the Funds’ portfolios

current earnings rate. Prepayment risk is the risk that, upon a

prepayment, the actual outstanding debt on which the Funds derive

interest income will be reduced. Credit risk is the risk that an

issuer of a security will be unable or unwilling to make dividend,

interest and/or principal payments when due and that the value of a

security may decline as a result. Interest rate risk is the risk

that fixed-income securities will decline in value because of

changes in market interest rates.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in each Fund are spelled out in the

prospectus, shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial advisors are responsible for evaluating investment risks

independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

The Funds’ daily New York Stock Exchange closing price and net

asset value per share as well as other related information can be

found at www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190314005867/en/

CONTACT: JEFF MARGOLIN — (630) 915-6784

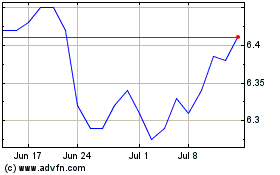

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

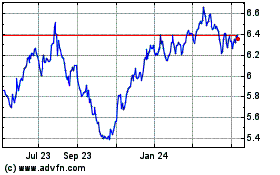

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Apr 2023 to Apr 2024