Amended Statement of Beneficial Ownership (sc 13d/a)

March 14 2019 - 4:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Sea Limited

(Name of Issuer)

Class A Ordinary Shares, par value US$0.0005

per share

(Title of Class of Securities)

81141R 100**

(CUSIP Number)

Forrest Xiaodong Li

Sea Limited

1 Fusionopolis Place, #17-10, Galaxis

Singapore 138522

+65 6270-8100

Copy to:

Yanjun Wang, Esq.

Sea Limited

1 Fusionopolis Place, #17-10, Galaxis

Singapore 138522

+65 6270-8100

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications)

March 1, 2019

(Date of Event Which Requires Filing

of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies

are to be sent.

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

**This CUSIP number applies to the Issuer’s

American depositary share, each representing one Class A ordinary share of the Issuer.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP NO.: 81141R 100

|

(1)

|

NAME OF REPORTING PERSONS

Forrest Xiaodong Li (“Mr. Li”)

|

|

(2)

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

¨

(b)

x

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE OF FUNDS*

PF

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(D) OR 2(E)

¨

|

|

(6)

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Singapore

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

(7)

|

SOLE VOTING POWER

67,239,357 Shares

|

|

(8)

|

SHARED VOTING POWER

46,573,653 Shares

1

|

|

(9)

|

SOLE DISPOSITIVE POWER

51,195,138 Shares

|

|

(10)

|

SHARED DISPOSITIVE POWER

0

|

|

(11)

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

113,813,010 Shares

2

|

|

(12)

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES*

¨

|

|

(13)

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

24.6%

3

|

|

(14)

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

Represents 46,573,653 Class B ordinary shares of par

value US$0.0005 per share (“Class B Ordinary Shares”) of the Issuer that are subject to an irrevocable proxy with

respect to all matters that require shareholder vote granted by Tencent to Mr. Li.

|

|

|

(2)

|

The Reporting Person is deemed to beneficially own 21,711,564

Class A ordinary shares of par value US$0.0005 per share (“Class A Ordinary Shares”) and 92,101,446 Class B Ordinary

Shares. Class A Ordinary Shares and Class B Ordinary Shares are collectively referred to as “Shares.” Each Class B

Ordinary Share is convertible into one Class A Ordinary Share, whereas Class A Ordinary Shares are not convertible into Class

B Ordinary Shares.

|

|

|

(3)

|

As a percentage of 444,968,055 outstanding Shares as

of March 8, 2019 immediately after the completion of the Issuer’s follow-on public offering, including 292,792,352 Class

A Ordinary Shares and 152,175,703 Class B Ordinary Shares. Each Class A Ordinary Share is entitled to one vote per share, and

each Class B Ordinary Share is entitled to three votes per share. Accordingly, and based on the foregoing, the Shares beneficially

owned by the Reporting Person represent approximately 38.9% of the aggregate voting power of the total issued and outstanding

Shares.

|

CUSIP NO.: 81141R 100

|

(1)

|

NAME OF REPORTING PERSONS

Blue Dolphins Venture Inc (“Blue Dolphins”)

|

|

(2)

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

¨

(b)

x

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE OF FUNDS*

AF

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(D) OR 2(E)

¨

|

|

(6)

|

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

(7)

|

SOLE VOTING POWER

39,416,870 Shares

|

|

(8)

|

SHARED VOTING POWER

0

|

|

(9)

|

SOLE DISPOSITIVE POWER

39,416,870 Shares

|

|

(10)

|

SHARED DISPOSITIVE POWER

0

|

|

(11)

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,416,870 Shares

4

|

|

(12)

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES*

¨

|

|

(13)

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%

5

|

|

(14)

|

TYPE OF REPORTING PERSON*

CO

|

|

|

|

|

|

|

|

(4)

|

Represents 39,416,870 Class B Ordinary Shares held by

the Reporting Person.

|

|

|

(5)

|

As a percentage of 444,968,055 outstanding Shares as

of March 8, 2019 immediately after the completion of the Issuer’s follow-on public offering.

|

Introductory Note

This Amendment No.

1 to Schedule 13D (this “Amendment No. 1”) amends and supplements the Schedule 13D filed with the Securities and Exchange

Commission on November 3, 2017 (the “Original Schedule 13D”), and is being filed on behalf of Mr. Li and Blue Dolphins

in respect of the Class A ordinary shares, par value US$0.0005 per share (the “Class A Ordinary Shares”), and Class

B ordinary shares, par value US$0.0005 per share (the “Class B Ordinary Shares” and, together with the Class A Ordinary

Shares, the “Shares”), of Sea Limited, a limited liability company organized and existing under the laws of the Cayman

Islands (the “Issuer”).

Unless otherwise stated

herein, the Original Schedule 13D remains in full force and effect. All capitalized terms used in the Amendment No. 1 but not defined

herein shall have the meanings ascribed to them in the Original Schedule 13D.

Item 5. Interest in Securities of

the Issuer.

Item 5(a) and (b) of

the Original Schedule 13D is hereby amended and restated in its entirety as follows:

The below table sets

forth Mr. Li and Blue Dolphins’ beneficial ownership as of March 8, 2019, the latest practicable date for determining their

beneficial ownership:

|

|

|

|

|

|

|

|

Number of shares as to which such person has:

|

|

Name of

Reporting

Person

|

|

Amount

Beneficially

Owned

|

|

Percent of

Class

|

|

|

Sole Power to

Vote or

Direct the

Vote

|

|

Shared Power

to Vote or to

Direct the

Vote

|

|

|

Sole Power to

Dispose or to

Direct the

Disposition of

|

|

Shared Power

to Dispose or

to Direct the

Disposition of

|

|

|

Mr. Li

|

|

113,813,010 Shares

(1)

|

|

|

24.6

|

%

(2)

|

|

67,239,357 Shares

|

|

|

46,573,653 Shares

(3)

|

|

|

51,195,138 Shares

|

|

|

0

|

|

|

Blue Dolphins

|

|

39,416,870 Shares

(4)

|

|

|

8.9

|

%

(2)

|

|

39,416,870 Shares

|

|

|

0

|

|

|

39,416,870 Shares

|

|

|

0

|

|

|

|

(1)

|

The amount beneficially owned by Mr. Li includes (i)

6,110,923 Class B Ordinary Shares held by Mr. Li, (ii) 39,416,870 Class B Ordinary Shares held by Blue Dolphins, (iii) 540 Class

A Ordinary Shares beneficially owned by Mr. Li, (iv) 5,666,670 Class A Ordinary Shares issuable upon exercise of options held

by Mr. Li within 60 days from March 8, 2019, (v) 135 Class A Ordinary Shares issuable upon vesting of restricted shares units

held by Mr. Li within 60 days from March 8, 2019, (v) an aggregate of 16,044,219 Class A Ordinary Shares held by the directors

and employees of the Issuer and Garena ESOP Program (PTC) Limited that have given Mr. Li an irrevocable proxy to vote such shares,

including Class A Ordinary Shares issuable upon exercise of options and vesting of restricted shares and restricted share unit

awards within 60 days from March 8, 2019, and (vi) 46,573,653 Class B Ordinary Shares held by Tencent for which it has given Mr.

Li an irrevocable proxy to vote such Shares under the General Proxy (as defined in Item 6) (such Class B Ordinary Shares exclude

those shares covered solely by an irrevocable proxy giving Mr. Li the voting rights over matters relating to the Issuer’s

board size and composition under the Board Proxy (as defined in Item 6)).

|

|

|

(2)

|

As a percentage of 444,968,055 outstanding Shares as

of March 8, 2019 immediately after the completion of the Issuer’s follow-on public offering, including 292,792,352 Class

A Ordinary Shares and 152,175,703 Class B Ordinary Shares. Each Class A Ordinary Share is entitled to one vote per share, and

each Class B Ordinary Share is entitled to three votes per share. Accordingly, and based on the foregoing, the Shares beneficially

owned by the Reporting Person represent approximately 38.9% of the aggregate voting power of the total issued and outstanding

Shares.

|

|

|

(3)

|

Represents 46,573,653 Class B Ordinary Shares that are

subject to an irrevocable proxy with respect to all matters that require shareholder vote granted by Tencent to Mr. Li.

|

|

|

(4)

|

Represents 39,416,870 Class B Ordinary Shares held by

Blue Dolphins.

|

The parties to the

Irrevocable Proxy may be deemed to be a “group” pursuant to Rule 13d-5 of the Exchange Act. If the parties to the Irrevocable

Proxy are deemed to be a group, the members of such group would be the Reporting Persons and Tencent.

Changes in the Reporting

Persons’ beneficial ownership during the 60-day period prior to March 8, 2019 included (i) vesting of 41,684 options and

540 restricted share units granted to Mr. Li under the 2009 share incentive plan of the Issuer, (ii) the expected vesting of 5

million options and 135 restricted shares units on April 30, 2019 pursuant to the share incentive awards to Mr. Li under the 2009

share incentive plan, which is within 60 days from March 8, 2019, and (iii) a change in the number of shares subject to the irrevocable

voting proxies granted by the directors and employees of the Issuer and Garena ESOP Program (PTC) Limited to Mr. Li.

Item 6. Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer.

Item 6 of the Original

Schedule 13D is hereby amended by adding the following at the end thereof:

In connection with

the Issuer’s follow-on offering in March 2019, Mr. Li has agreed that, without the prior written consent of Goldman Sachs

(Asia) L.L.C. and Morgan Stanley & Co. LLC, the joint bookrunners of the offering, he will not, during the period ending 90 days

after March 5, 2019, the date of the final prospectus of such offering, offer, sell, contract to sell, pledge, grant any option

to purchase, make any short sale or otherwise dispose of, or file, or participate in the filing of, a registration statement with

the SEC in respect of, any ordinary shares or ADSs, or any options or warrants to purchase any ordinary shares or ADSs, or any

securities convertible into, exchangeable for or that represent the right to receive ordinary shares or ADSs, whether now owned

or hereinafter acquired, owned directly by him or with respect to which he has beneficial ownership within the rules and regulations

of the SEC. The foregoing restriction is expressly agreed to preclude Mr. Li from engaging in any hedging or other transaction

which is designed to or which reasonably could be expected to lead to or result in a sale or disposition of his securities even

if such securities would be disposed of by someone other than himself. Such prohibited hedging or other transactions would include

without limitation any short sale or any purchase, swap or sale or grant of any right (including without limitation any put or

call option) with respect to any of his securities or with respect to any security that includes or relates to, or derives any

significant part of its value from such ordinary shares or ADSs. The restrictions above are subject to certain customary exceptions.

Item 7. Material to be Filed as Exhibits.

|

|

Exhibit 2

|

Form of Lock-Up Agreement (filed as Exhibit A to Exhibit

1.1 on Form 6-K, filed with the Securities and Exchange Commission on March 8, 2019, and incorporated herein by reference).

|

SIGNATURE

After reasonable inquiry

and to the best of its knowledge and belief, the undersigned certify that the information set forth in this statement is true,

complete and correct.

Dated: March 14, 2019

|

Forrest Xiaodong Li

|

/s/

Forrest Xiaodong Li

|

|

|

|

|

|

Blue Dolphins Venture Inc

|

By:

|

/s/

Forrest Xiaodong Li

|

|

|

Name:

|

Forrest Xiaodong Li

|

|

|

Title:

|

Director

|

[Signature Page to Schedule 13D/A]

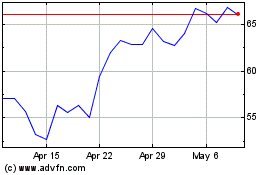

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

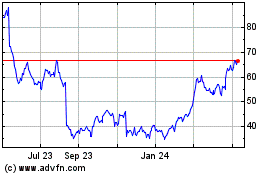

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024