Ares Management’s Real Estate Group and EDF Invest Acquire IKB Office Building in Düsseldorf, Germany

March 14 2019 - 3:00AM

Business Wire

A joint venture between real estate funds managed by Ares

Management Corporation (NYSE: ARES) and EDF Invest announced today

the acquisition of the IKB office building in Düsseldorf, Germany

from IKB Deutsche Industriebank. The transaction closed on February

28, 2019.

Built in 1997, the property comprises approximately 58,500

square meters of gross leasable area, split across two distinct but

connected buildings. It is located in Kennedydamm, a prominent

office submarket of Düsseldorf, and key tenants include IKB,

Helaba, Colt and Berkshire Hathaway. IKB will remain the largest

tenant in the building.

The joint venture plans to transform the property from a

primarily owner-occupied bank headquarters to a modern,

multi-tenant office campus. Cells Property Investors is the local

operating partner of the joint venture.

The transaction is the Ares Real Estate Group’s latest

acquisition in Germany and its fifth acquisition in Düsseldorf over

the last two years. Ares has transacted close to €1.8 billon in

Germany over the last 24 months.

About Ares Management Corporation

Ares Management Corporation is a publicly traded, leading global

alternative asset manager with approximately $130.7 billion of

assets under management as of December 31, 2018 and 18 offices in

the United States, Europe, Asia and Australia. Since its inception

in 1997, Ares has adhered to a disciplined investment philosophy

that focuses on delivering strong risk-adjusted investment returns

throughout market cycles. Ares believes each of its three distinct

but complementary investment groups in Credit, Private Equity and

Real Estate is a market leader based on assets under management and

investment performance. Ares was built upon the fundamental

principle that each group benefits from being part of the greater

whole. For more information, visit www.aresmgmt.com.

About EDF Invest

EDF Invest is the unlisted investment arm of EDF’s Dedicated

Assets, the asset portfolio which covers its long-term nuclear

decommissioning commitments in France. EDF Invest manages over €5.7

billion equity investments as of December 31, 2018. EDF Invest’s

portfolio is made of three asset classes: Infrastructure, Real

Estate and Private Equity. In Real Estate, EDF Invest’s current

assets include office properties, hotels and shopping centers in

France, Italy and Germany. For more information, visit

www.edfinvest.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190314005093/en/

For Ares Management

Corporation:Investors:Ares Management CorporationCarl Drake,

800-340-6597cdrake@aresmgmt.comorPriscila Roney,

212-808-1185proney@aresmgmt.com

Media:Mendel CommunicationsBill Mendel,

212-397-1030bill@mendelcommunications.com

For EDF Invest:Investors, analysts

and media:Service de presse EDF, +33 1 40 42 46

37service-de-presse@edf.fr

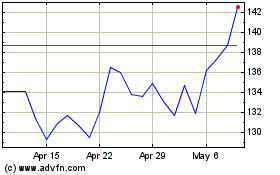

Ares Management (NYSE:ARES)

Historical Stock Chart

From Mar 2024 to Apr 2024

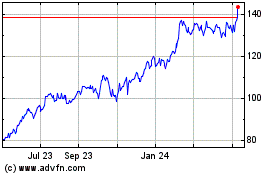

Ares Management (NYSE:ARES)

Historical Stock Chart

From Apr 2023 to Apr 2024