March 6, 2019 -- Comtech Telecommunications Corp.

(NASDAQ:CMTL) today reported its operating results for the second

fiscal quarter ended January 31, 2019 and updated its fiscal

2019 guidance.

Fiscal 2019 Second Quarter Highlights

- Net sales for the second quarter of

fiscal 2019 were $164.1 million as compared to the $133.7 million

achieved during the second quarter of fiscal 2018, representing an

increase of $30.4 million, or 22.7%.

- Bookings during the second quarter of

fiscal 2019 were $123.3 million, with a company-wide book-to-bill

ratio (a measure defined as bookings divided by net sales) of

0.75.

- Backlog as of January 31, 2019 was

$586.4 million. Backlog does not include the portions of multi-year

contracts that have not been funded. As such, the total value of

multi-year contracts that Comtech has received is substantially

higher.

- Comtech received a number of strategic

contracts and orders, including: (i) $11.9 million of orders for

cyber security training solutions; (ii) $11.6 million in orders

from the U.S. Navy to purchase Comtech’s SLM-5650B satellite

modems, upgrade kits and related services; (iii) $6.9 million of

orders to provide ongoing sustainment services to the U.S. Army for

the AN/TSC-198A SNAP VSATs; (iv) $5.2 million of orders from the

U.S. Army to supply Manpack Satellite Terminals, networking

equipment and other advanced VSAT products; (v) a two-year

agreement worth $3.6 million from a Fortune 500 company to provide

location-based services (“LBS”) platforms and applications; (vi)

$3.0 million of orders for antenna feeds to be incorporated into

portable and inflatable 1.2-meter and 2.4-meter SATCOM terminals;

(vii) a $2.5 million order from a top-tier telecommunications

service provider for various LBS platforms and applications; (viii)

a $1.7 million order for satellite block up converters ("BUCs");

and (ix) $1.1 million of incremental funding from the U.S. Army to

support Blue Force Tracking-1 activities.

- GAAP operating income of $12.4 million,

GAAP net income of $7.8 million and GAAP earnings per diluted share

("EPS") of $0.32 reflects the impact of several steps taken by

Comtech to improve operating efficiencies and make progress towards

achieving its long-term business goals. As presented in more detail

in the below table, these steps include: (i) the incurrence of $1.8

million of acquisition plan expenses primarily associated with the

closing of its acquisition of Solacom Technologies Inc.

("Solacom"), which was completed on February 28, 2019; (ii) the

incurrence of $3.9 million of estimated contract settlement costs

related to an ongoing repositioning of Comtech's enterprise

technology product solutions that it initiated during the quarter;

and (iv) a benefit of $3.2 million related to a favorable

resolution of a TCS intellectual property litigation matter.

Excluding the financial impact of these steps, operating income

would have been $14.9 million, net income would have been $9.7

million and earnings per diluted share would have been $0.40.

- Adjusted EBITDA for the second quarter

of fiscal 2019 was $23.2 million as compared to the $14.5 million

achieved during the second quarter of fiscal 2018, representing an

increase of $8.7 million, or 60.0%. Adjusted EBITDA is a non-GAAP

financial measure which is reconciled to the most directly

comparable GAAP financial measure and is more fully defined in the

below table.

- Cash flows from operating activities

were $27.2 million.

In commenting on Comtech’s performance for the second quarter of

fiscal 2019, Fred Kornberg, President and Chief Executive Officer,

noted, "Our second quarter results exceeded our expectations on

almost every front. We generated strong operating results, our

business momentum remains strong and our pipeline of opportunities

is growing. Looking forward, I am very excited about the closing of

our strategic acquisition of Solacom, as it allows us to further

participate in the safety and security markets which we believe are

at growth inflection points. Given the successful execution of our

business strategies to-date and the positive trajectory of our

business, we are increasing our targeted goals for consolidated net

sales and Adjusted EBITDA for fiscal 2019."

Updated 2019 Fiscal Year Financial Targets

- Comtech is increasing its fiscal 2019

consolidated net sales goal to a range of approximately $645.0

million to $660.0 million and is increasing its Adjusted EBITDA

goal to a range of approximately $85.0 million to $89.0 million as

compared to a prior goal for net sales of between $625.0 million to

$640.0 million and Adjusted EBITDA of $84.0 million to $88.0

million. These targets reflect the benefit of strong demand it

continues to see in many of its key product lines as well as a

nominal financial contribution from Solacom. If order flow remains

strong and Comtech can achieve all of its fiscal 2019 business

goals, it is possible that consolidated net sales and Adjusted

EBITDA could be higher than its targeted amounts.

- Comtech's updated GAAP EPS target for

fiscal 2019 is now within a range of $0.86 to $0.98 as compared to

the prior range of $0.95 to $1.08. This change in GAAP EPS reflects

the benefits of increased sales and operating performance, offset

by: (i) net operating expenses of $2.5 million or $0.08 per GAAP

EPS associated with steps taken during the second quarter of fiscal

2019 to improve operating efficiencies and make progress towards

achieving Comtech’s long-term business goals; (ii) an increase in

amortization of intangibles of $0.5 million or $0.02 per GAAP EPS

during the second half of fiscal 2019 related to the acquisition of

Solacom; (iii) an increase in estimated interest expense of $0.8

million or $0.03 per GAAP EPS; and (iv) $1.0 million or $0.03 per

GAAP EPS of acquisition plan expenses expected to be incurred

during the third quarter of fiscal 2019 related to a targeted

acquisition in addition to Solacom.

- Comtech’s updated fiscal 2019 targets

have been impacted by a number of shifts in the anticipated timing

of potential awards and overall product mix changes, including the

impact of the repositioning of its enterprise technology solution

offerings. As such, Comtech now expects third quarter net sales to

approximate the amount it achieved during the second quarter of

fiscal 2019 with GAAP operating income and Adjusted EBITDA

approximating $9.0 million and $20.0 million, respectively. Given

the strength of its backlog and timing of anticipated orders,

Comtech’s fourth quarter of fiscal 2019 is expected to be the peak

quarter of the fiscal year for Adjusted EBITDA.

- After considering the impact of all

GAAP operating expenses, Comtech anticipates consolidated GAAP

operating income, in dollars, to be higher than the $35.1 million

achieved in fiscal 2018 and, as a percentage of consolidated net

sales, to be similar to the 6.2% it achieved in fiscal 2018.

- Comtech's estimated effective income

tax rate for fiscal 2019 (excluding net discrete items) is expected

to approximate 23.0%.

- There is no certainty that Comtech’s

targeted acquisition plan will be successful and, except for the

$1.0 million of acquisition plan expenses anticipated in the third

quarter of fiscal 2019, Comtech’s updated fiscal 2019 financial

targets do not include any impact of such targeted acquisition

plan.Additional information about Comtech’s second quarter

financial results and Business Outlook for Fiscal 2019 is set forth

in Comtech's Quarterly Report on Form 10-Q filed with the SEC today

and Comtech’s second quarter investor presentation which is located

on its website at www.comtechtel.com.

Conference Call

Comtech has scheduled an investor conference call for 8:30 AM

(ET) on Thursday, March 7, 2019. Investors and the public are

invited to access a live webcast of the conference call from the

Investor Relations section of the Comtech website at

www.comtechtel.com. Alternatively, investors can access the

conference call by dialing (877) 876-9173 (domestic), or (785)

424-1667 (international) and using the conference I.D. "Comtech." A

replay of the conference call will be available for seven days by

dialing (800) 839-2435 or (402) 220-7212. In addition, an updated

investor presentation, including earnings guidance, is available on

Comtech's website.

About Comtech

Comtech Telecommunications Corp. designs, develops, produces and

markets innovative products, systems and services for advanced

communications solutions. Comtech sells products to a diverse

customer base in the global commercial and government

communications markets.

Cautionary Statement Regarding Forward-Looking

Statements

Certain information in this press release contains

forward-looking statements, including but not limited to,

information relating to the Company's future performance and

financial condition, plans and objectives of the Company's

management and the Company's assumptions regarding such future

performance, financial condition, and plans and objectives that

involve certain significant known and unknown risks and

uncertainties and other factors not under the Company's control

which may cause its actual results, future performance and

financial condition, and achievement of plans and objectives of the

Company's management to be materially different from the results,

performance or other expectations implied by these forward-looking

statements. These factors include, among other things: the

possibility that the expected synergies from the acquisition of

Solacom Technologies Inc. (“Solacom”) will not be fully realized,

or will not be realized within the anticipated time period; the

risk that Comtech’s and Solacom’s businesses will not be integrated

successfully; the possibility of disruption from the Solacom

acquisition, making it more difficult to maintain business and

operational relationships or retain key personnel; the risk that

the Company will be unsuccessful in implementing a tactical shift

in its Government Solutions segment away from bidding on large

commodity service contracts and toward pursuing contracts for its

niche products with higher margins; the risks associated with

Comtech's ongoing evaluation and repositioning of its enterprise

technology solutions offering in its Commercial Solutions segment;

the nature and timing of receipt of, and the Company's performance

on, new or existing orders that can cause significant fluctuations

in net sales and operating results; the timing and funding of

government contracts; adjustments to gross profits on long-term

contracts; risks associated with international sales; rapid

technological change; evolving industry standards; new product

announcements and enhancements, including the risks associated with

the Company's recent launch of HeightsTM Dynamic Network Access

Technology ("HEIGHTS" or "HDNA"); changing customer demands and or

procurement strategies; changes in prevailing economic and

political conditions; changes in the price of oil in global

markets; changes in foreign currency exchange rates; risks

associated with the Company's legal proceedings, customer claims

for indemnification and other similar matters; risks associated

with the Company’s obligations under its Credit Facility; risks

associated with the Company's large contracts; the impact of H.R.1,

also known as the Tax Cuts and Jobs Act ("Tax Reform"), which was

enacted in December 2017 in the U.S.; and other factors described

in this and the Company's other filings with the Securities and

Exchange Commission.

COMTECH TELECOMMUNICATIONS

CORP.AND SUBSIDIARIESCondensed Consolidated Statements

of Operations(Unaudited)

Three months ended January 31, Six months

ended January 31, 2019 2018 2019 2018 Net

sales $ 164,133,000 133,731,000 $ 324,977,000 255,300,000 Cost of

sales 102,888,000 82,930,000 205,963,000

156,783,000 Gross profit 61,245,000 50,801,000

119,014,000 98,517,000 Expenses: Selling,

general and administrative 31,987,000 27,215,000 63,834,000

55,690,000 Research and development 13,983,000 13,435,000

27,193,000 27,185,000 Amortization of intangibles 4,288,000

5,268,000 8,577,000 10,537,000 Settlement of intellectual property

litigation (3,204,000 ) — (3,204,000 ) — Acquisition plan expenses

1,778,000 — 2,908,000 — 48,832,000

45,918,000 99,308,000 93,412,000

Operating income 12,413,000 4,883,000 19,706,000 5,105,000

Other expenses (income): Interest expense 2,267,000 2,519,000

4,936,000 5,107,000 Write-off of deferred financing costs — —

3,217,000 — Interest (income) and other (51,000 ) (48,000 ) 15,000

(9,000 ) Income before provision for (benefit from)

income taxes 10,197,000 2,412,000 11,538,000 7,000 Provision for

(benefit from) income taxes 2,371,000 (13,349,000 ) 244,000

(14,094,000 ) Net income $ 7,826,000

15,761,000 $ 11,294,000 14,101,000 Net

income per share: Basic $ 0.33 0.66 $ 0.47

0.59 Diluted $ 0.32 0.66 $ 0.47 0.59

Weighted average number of common

sharesoutstanding – basic

24,034,000 23,816,000 24,017,000 23,805,000

Weighted average number of common and

commonequivalent shares outstanding – diluted

24,168,000 23,953,000 24,245,000 23,942,000

COMTECH TELECOMMUNICATIONS

CORP.AND SUBSIDIARIESCondensed Consolidated Balance

Sheets

January 31, 2019 July 31, 2018

(Unaudited) (Audited) Assets

Current assets: Cash and cash equivalents $ 45,997,000 43,484,000

Accounts receivable, net 138,920,000 147,439,000 Inventories, net

87,395,000 75,076,000 Prepaid expenses and other current assets

13,493,000 13,794,000 Total current assets

285,805,000 279,793,000 Property, plant and equipment, net

28,391,000 28,987,000 Goodwill 290,633,000 290,633,000 Intangibles

with finite lives, net 232,219,000 240,796,000 Deferred financing

costs, net 3,495,000 2,205,000 Other assets, net 2,784,000

2,743,000 Total assets $ 843,327,000 845,157,000

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable $ 30,057,000 43,928,000 Accrued expenses and other

current liabilities 60,343,000 65,034,000 Dividends payable

2,382,000 2,356,000 Contract liabilities 35,027,000 34,452,000

Current portion of long-term debt — 17,211,000 Current portion of

capital lease and other obligations 1,284,000 1,836,000 Interest

payable 640,000 499,000 Total current liabilities

129,733,000 165,316,000 Non-current portion of long-term debt, net

174,500,000 148,087,000 Non-current portion of capital lease and

other obligations 490,000 765,000 Income taxes payable 414,000

2,572,000 Deferred tax liability, net 13,521,000 10,927,000

Long-term contract liabilities 8,336,000 7,689,000 Other

liabilities 3,456,000 4,117,000 Total liabilities

330,450,000 339,473,000 Commitments and contingencies Stockholders’

equity: Preferred stock, par value $0.10 per share; shares

authorized and unissued 2,000,000 — —

Common stock, par value $0.10 per share;

authorized 100,000,000 shares;issued 38,950,547 shares and

38,860,571 shares at January 31, 2019and July 31, 2018,

respectively

3,895,000 3,886,000 Additional paid-in capital 539,273,000

538,453,000 Retained earnings 411,558,000 405,194,000

954,726,000 947,533,000 Less:

Treasury stock, at cost (15,033,317 shares

at January 31, 2019 and July 31, 2018)

(441,849,000 ) (441,849,000 ) Total stockholders’ equity

512,877,000 505,684,000 Total liabilities and

stockholders’ equity $ 843,327,000 845,157,000

COMTECH TELECOMMUNICATIONS

CORP.

AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures to GAAP Financial

Measures (Unaudited)

Use of Non-GAAP Financial Measures

In order to provide investors with additional information

regarding its financial results, this press release contains

"Non-GAAP financial measures" under the rules of the SEC. The

Company's Adjusted EBITDA is a Non-GAAP measure that represents

earnings (loss) before income taxes, interest (income) and other,

write-off of deferred financing costs, interest expense,

amortization of stock-based compensation, amortization of

intangibles, depreciation expense, estimated contract settlement

costs, acquisition plan expenses or strategic alternatives analysis

expenses, facility exit costs, settlement of intellectual property

litigation and other. The Company's definition of Adjusted EBITDA

may differ from the definition of EBITDA used by other companies

and therefore may not be comparable to similarly titled measures

used by other companies. Adjusted EBITDA is also a measure

frequently requested by the Company's investors and analysts. The

Company believes that investors and analysts may use Adjusted

EBITDA, along with other information contained in its SEC filings,

in assessing the Company's performance and comparability of its

results with other companies. The Company's Non-GAAP measures for

consolidated operating income, net income and net income per

diluted share reflect the GAAP measures as reported, adjusted for

certain items as discussed below. These Non-GAAP financial measures

have limitations as an analytical tool as they exclude the

financial impact of transactions necessary to conduct the Company’s

business, such as the granting of equity compensation awards, and

are not intended to be an alternative to financial measures

prepared in accordance with GAAP. These measures are adjusted as

described in the reconciliation of GAAP to Non-GAAP in the below

tables, but these adjustments should not be construed as an

inference that all of these adjustments or costs are unusual,

infrequent or non-recurring. Non-GAAP financial measures should be

considered in addition to, and not as a substitute for or superior

to, financial measures determined in accordance with GAAP.

Investors are advised to carefully review the GAAP financial

results that are disclosed in the Company’s SEC filings. The

Company has not quantitatively reconciled its fiscal 2019 Adjusted

EBITDA target to the most directly comparable GAAP measure because

items such as stock-based compensation, adjustments to the

provision for income taxes, amortization of intangibles and

interest expense, which are specific items that impact these

measures, have not yet occurred, are out of the Company's control,

or cannot be predicted. For example, quantification of stock-based

compensation expense requires inputs such as the number of shares

granted and market price that are not currently ascertainable.

Accordingly, reconciliations to the Non-GAAP forward looking

metrics are not available without unreasonable effort and such

unavailable reconciling items could significantly impact the

Company's financial results.

Three months ended

Six months ended Fiscal January 31, January 31, Year 2019

2018 2019 2018 2018

Reconciliation of GAAP Net Income to

Adjusted EBITDA: Net income $ 7,826,000 15,761,000 $ 11,294,000

14,101,000 $ 29,769,000 Provision for (benefit from) income taxes

2,371,000 (13,349,000 ) 244,000 (14,094,000 ) (5,143,000 ) Interest

(income) and other (51,000 ) (48,000 ) 15,000 (9,000 ) 254,000

Write-off of deferred financing costs — — 3,217,000 — — Interest

expense 2,267,000 2,519,000 4,936,000 5,107,000 10,195,000

Amortization of stock-based compensation 1,191,000 1,080,000

2,237,000 1,827,000 8,569,000 Amortization of intangibles 4,288,000

5,268,000 8,577,000 10,537,000 21,075,000 Depreciation 2,849,000

3,317,000 5,700,000 6,663,000 13,655,000 Estimated contract

settlement costs 3,886,000 — 3,886,000 — — Settlement of

intellectual property litigation (3,204,000 ) — (3,204,000 ) — —

Acquisition plan expenses 1,778,000 — 2,908,000 — — Facility exit

costs — — 1,373,000 — — Adjusted

EBITDA $ 23,201,000 14,548,000 $ 41,183,000

24,132,000 $ 78,374,000

In addition, a reconciliation of Comtech's GAAP consolidated

operating income, net income and net income per diluted share for

the three and six months ended January 31, 2019 to the

corresponding non-GAAP measures is shown in the table below:

January 31, 2019 Three months ended Six

months ended

OperatingIncome

Net Income

Net Incomeper DilutedShare*

OperatingIncome

Net Income

Net Incomeper DilutedShare*

Reconciliation of GAAP to Non-GAAP Earnings: GAAP measures,

as reported $ 12,413,000 $ 7,826,000 $ 0.32 $ 19,706,000 $

11,294,000 $ 0.47 Estimated contract settlement costs 3,886,000

2,992,000 0.12 3,886,000 2,992,000 0.12 Settlement of intellectual

property litigation (3,204,000 ) (2,467,000 ) (0.10 ) (3,204,000 )

(2,467,000 ) (0.10 ) Acquisition plan expenses 1,778,000 1,369,000

0.06 2,908,000 2,239,000 0.09 Facility exit costs — — — 1,373,000

1,057,000 0.04 Write-off of deferred financing costs — — — —

2,477,000 0.10 Net discrete tax benefit — — —

— (2,432,000 ) (0.10 ) Non-GAAP measures $ 14,873,000

$ 9,720,000 $ 0.40 $ 24,669,000 $ 15,160,000

$ 0.63

* Per share amounts may not foot due to rounding.

ECMTL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190306005792/en/

Media:Michael D. Porcelain, Senior Vice President and

Chief Operating Officer(631) 962-7000Info@comtechtel.com

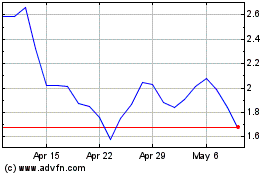

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Apr 2023 to Apr 2024