Amended Current Report Filing (8-k/a)

February 28 2019 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K/A

(Amendment No. 1)

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 7, 2019

EDGEWELL PERSONAL CARE COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Missouri

|

1-15401

|

43-1863181

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

6 Research Drive, Shelton, Connecticut 06484

(Address of principal executive offices)

203-977-5717

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

Emerging growth company

|

o

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Explanatory Note

This Amendment No. 1 to Current Report on Form 8-K amends the Current Report on Form 8-K of Edgewell Personal Care Company (“Edgewell” or the “Company”) filed with the Securities and Exchange Commission on February 7, 2019 (the “Original Filing”), which reported, among other items, the appointment of Rod R. Little as the Company’s President and Chief Executive Officer effective March 1, 2019. At the time of the Original Filing, Mr. Little’s compensatory arrangement had not been determined. The Company hereby amends the Original Filing to report Mr. Little’s compensatory arrangement effective March 1, 2019.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Mr. Little will receive an initial annual base salary of $900,000 and his target bonus opportunity for fiscal 2019 will be 110% of base salary. Mr. Little will receive a one-time promotional equity award of $1,225,000 to be granted upon his appointment to the position of Chief Executive Officer consisting of: $612,500 in Performance Restricted Stock Equivalents, which will vest after the date that the Company publicly releases earnings results for the fiscal year ending September 30, 2021; $367,500 of time based Restricted Stock Equivalents with a ratable three-year vesting period; and $245,000 in Stock Options with a ratable three-year vesting period in accordance with the terms of Edgewell’s 2018 Stock Incentive Plan. In addition, the Compensation Committee of the Board of Directors and the Board of Directors approved a Project Fuel Performance Restricted Stock Equivalent of $1,980,600 which will vest after the date that the Company publicly releases earnings results for the fiscal year ending September 30, 2021. Mr. Little will also be eligible for annual equity grants under Edgewell’s 2018 Stock Incentive Plan at a level commensurate with his title. The terms of the awards are expected to be consistent with the annual award program for other senior executives.

Mr. Little will continue to participate in Edgewell’s benefit plans available to executives, in accordance with the Company’s customary terms and policies and consistent with other executives.

In addition, Mr. Little will continue to participate in Edgewell’s executive severance plan, under the following modified terms: upon a qualifying termination of employment by Edgewell without Cause or voluntary termination of employment by Employee for Good Reason, Mr. Little will receive a lump sum payment equal to: (1) 2 times his annual base salary plus a severance bonus equal to the short-term incentive plan bonus for the most recently completed fiscal year; (ii) the accrued but unpaid paid time off available to him; and (iii) 1.5 times the monthly premium cost for group health plan benefits for Mr. Little and his dependents, as applicable, multiplied by 24. Such benefits are subject to reduction under certain circumstances, including to the extent necessary to avoid certain federal excise taxes. No benefits will be paid to the extent duplicative of benefits under a change of control or similar agreement with the Company.

Descriptions of the foregoing compensation and benefit plans are set forth in the Company’s Definitive Proxy Statement on Schedule 14A dated December 20, 2018, for the Company’s 2019 annual meeting of shareholders.

Other than the preceding disclosure, no other disclosure reported in the Original Filing is amended pursuant to this Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EDGEWELL PERSONAL CARE COMPANY

By:

/s/Marisa Iasenza

Marisa Iasenza

Chief Legal Officer

Dated: February 28, 2019

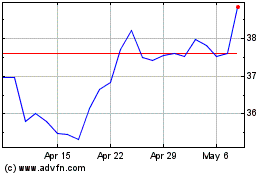

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

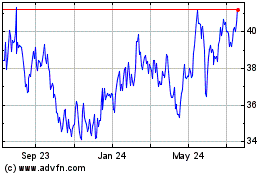

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024