UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

--------------------

SCHEDULE 13-D

Under the Securities Exchange Act of 1934

SUMMIT NETWORKS, INC.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

866194103

(CUSIP Number)

Richard W. Jones

Jones & Haley, P.C.

750 Hammond Drive

Building 12, Suite 100

Atlanta, Georgia 30328-6273

(770) 804-0500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 20, 2019

(Date of event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13-G to report the acquisition, which is the subject of this Schedule 13-D and is filing this Schedule because of Rule 13d-1 (b) or (4), check the following box. [ ]

-1-

|

|

|

|

|

|

1.

|

Names of Reporting Persons

|

Chi Ming Tso

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a) _________________________________

|

|

|

|

(b) _________________________________

|

|

|

3.

|

SEC Use Only

|

|

|

4.

|

Source of Funds (See Instructions)

|

PF

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

_______

|

|

6.

|

Citizenship or Place of Organization

|

Hong Kong

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

7.

|

Sole Voting Power

|

274,800

|

|

8.

|

Shared Voting Power

|

4,706,400

|

|

9.

|

Sole Dispositive Power

|

274,800

|

|

10.

|

Shared Dispositive Power

|

4,706,400

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

|

4,981,200

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

|

_______

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

|

81.5%

|

|

14.

|

Type of Reporting Person (See Instructions)

|

IN

|

-2-

SCHEDULE 13D

Item 1. Security and Issuer

.

This Schedule 13D relates to the common stock of Summit Networks, Inc., (“SNTW”) a Nevada corporation (the "Issuer"). The address of the principal executive office of the Issuer is Room 710A, 7/F, Ho King Commercial Centre, 2-16 Fa Yuen Street, Mong Kok,

Kowloon, Hong Kong.

Item 2. Identity and Background

.

(a) Name: Chi Ming Tso

(b) Residence address: 11G King Food Court, 173 Hau Temple Road, North Point, Hong Kong

(c) Principal Occupation: Consultant evaluating mining properties

(d) Criminal Convictions: N/A

(e) Civil Proceeding: N/A; Administrative Proceedings: N/A

(f) Citizenship: Hong Kong

Item 3. Source and Amount of Funds or Other Consideration

.

The Reporting Person acquired the shares of common stock of SNTW for $142,057 through the purchase of such shares from prior shareholders using personal funds.

Item 4. Purpose of the Transaction

.

The Reporting Person acquired his beneficial ownership in the shares as described in Item 3 above. Except as indicated below, the Reporting Person has no plans or proposals which relate to, or may result in, any of the matters listed in items 4(a)-(j) of Schedule 13D, including:

(a) The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

The reporting person may acquire additional shares through purchases in the open market.

(b) An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

SNTW may merge with another entity.

-3-

(c) A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

(d) Any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board;

It is expected that the officers and directors of the issuer will change following this transaction.

(e) Any material change in the present capitalization or dividend policy of the Issuer;

(f) Any other material change in the issuer's business or corporate structure including but not limited to, if the Issuer is a registered closed-end investment company, any plans or proposals to make any changes in its investment policy for which a vote is required by section 13 of the Investment Company Act of 1940;

(g) Changes in the Issuer's charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person;

(h) Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

(i) A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

(j) Any action similar to any of those enumerated above.

Item 5. Interest in Securities of the Issuer

.

(a) The Reporting Person is the direct beneficial owner of 4,981,200 (81.5%) of the outstanding shares of common stock of the Issuer (the "Shares"). The percentage of the outstanding shares is calculated based upon 6,104,999 shares of common stock outstanding as of February 20, 2019.

(b) The Reporting Person has the sole power to vote and direct the disposition of 274,800 Shares. Hass Group, Inc. owns 4,706,400 of the Issuer shares and Mr. Tso is an indirect beneficial owner of those shares because Mr. Tso is the controlling shareholder and sole officer and director of that Company.

(c) Except as otherwise disclosed herein, during the past 60 days the Reporting Person has not effected any transactions in the common stock of the Issuer.

(d) No other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares.

-4-

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

.

The Reporting Person is not a party to any contracts, arrangements, understandings or relationships (legal or otherwise) with any other person or any person with respect to securities of the Issuer, including but not limited to transfer or voting of any securities, finder's fees, joint ventures, loan or option agreements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Materials to be Filed as Exhibits

.

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete, and correct.

/s/Chi Ming Tso

Chi Ming Tso

Dated: February 22, 2019

-5-

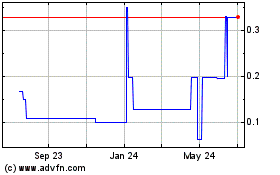

Summit Networks (QB) (USOTC:SNTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

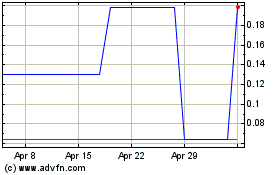

Summit Networks (QB) (USOTC:SNTW)

Historical Stock Chart

From Apr 2023 to Apr 2024