UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

INFORMATION

STATEMENT PURSUANT TO SECTION14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Check

the appropriate box:

☒

Preliminary Information Statement

☐

Definitive Information Statement

☐Confidential for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

MOJO

Organics, Inc.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

☒ No

fee required

☐

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of

securities to which transaction applies:

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the

amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate

value of transaction:

|

|

(5)

|

Total fee paid:

|

☐ Fee

previously paid with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule

and the date of its filing.

|

(1)

|

Amount

previously paid:

|

|

(2)

|

Form, Schedule or

Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

MOJO

Organics, Inc.

185

Hudson Street, Floor 25

Jersey

City, New Jersey 07302

NOTICE

OF ACTION BY WRITTEN CONSENT OF HOLDERS OF

A

MAJORITY OF THE OUTSTANDING VOTING STOCK OF MOJO ORGANICS, INC.

February

__, 2019

Dear

MOJO Organics, Inc. Stockholder:

The

enclosed Information Statement is being distributed to the holders of record of common stock, par value $0.001 per share (“

Common

Stock

”) of MOJO Organics, Inc., a Delaware corporation (the “

Company

” or “

we

”),

as of the close of business on February 7, 2019 (the “

Record Date

”) under Rule 14c-2 of the Securities Exchange

Act of 1934, as amended (the “

Exchange Act

”). The purpose of the enclosed Information Statement is to inform

our stockholders of action taken by written consent by the holders of a majority of our outstanding voting stock. The enclosed

Information Statement shall be considered the notice required under the Delaware General Corporation Law (“

DGCL

”).

The

following action was authorized by written consent of a majority of our outstanding voting stock (the “

Written Consent

”):

|

•

|

|

Approval

of an amendment to the Company’s Certificate of Incorporation (the “

Amendment

”) to cancel its 10,000,000

shares of authorized preferred stock, par value $0.001.

|

The

Written Consent constitutes the only stockholder approval required under the DGCL, our Certificate of Incorporation and Bylaws

to approve the Amendment. Our Board of Directors is not soliciting your consent or your proxy in connection with this action,

and no consents or proxies are being requested from stockholders. The Amendment, as approved by the Written Consents, will not

become effective until 20 calendar days after the enclosed Information Statement is first mailed or otherwise delivered to our

stockholders entitled to receive notice thereof.

THIS

IS

NOT

A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS, AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED

HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

.

By

order of the Board of Directors

|

/s/ Glenn Simpson

|

|

|

|

Glenn Simpson

|

|

|

|

Chief Executive Officer and Director

|

|

|

MOJO

Organics, Inc.

185

Hudson Street, Floor 25

Jersey

City, New Jersey 07302

Tel.

201-633-6519

_____________________________________________________________________________________________

INFORMATION

STATEMENT

_____________________________________________________________________________________________

WE

ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A CONSENT OR PROXY.

INTRODUCTION

This

Information Statement advises stockholders of the approval by the Company’s Board of Directors, and by Written Consent

of the holders a majority of the Company’s voting stock of an amendment to the Company’s Certificate of Incorporation

(the “

Amendment

”) to cancel its 10,000,000 shares of authorized preferred stock, par value $0.001. A copy of

the Amendment is attached to this Information Statement as

Exhibit A

.

The

cancellation of the Company’s authorized preferred stock will become effective upon the filing of the Amendment with the

Secretary of State of Delaware, which filing will occur no less than 20 days after the date of the mailing of this Information

Statement to our stockholders.

AUTHORIZATION

BY THE BOARD OF DIRECTORS AND THE MAJORITY STOCKHOLDERS

Under

the DGCL and the Company’s Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken

without a meeting, without prior notice and without a vote if the holders of outstanding stock having not less than the minimum

number of votes necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present

and voted consent to such action in writing. Accordingly, approval of the Amendment required the affirmative vote or written consent

of a majority of the issued and outstanding shares of the Company’s Common Stock.

As

of February 7, 2019, the record date for the determination of stockholders entitled to notice of the approval of the Amendment

and to receive a copy of this Information Statement (the “Record Date”), we had 27,821,606 shares of Common Stock

and 0 shares of preferred stock outstanding. Each holder of Common Stock is entitled to one vote per share of Common Stock held.

As of the Record Date, outstanding shares represented 27,821,606 votes, all of which are attributable to Common Stock.

Our

Board of Directors unanimously adopted resolutions approving the Amendment, subject to stockholder approval, by unanimous

written consent on February 7, 2019, and, on February 7, 2019 we received the Written Consent from holders of our Common

Stock representing 15,239,350 voting shares, or approximately 54.77% of our outstanding voting class, approving the Amendment.

The

following table sets forth the name of the holder of the Common Stock, the number of shares of Common Stock held by such holder,

the total number of votes that such holder voted in favor of the Amendment and the percentage of the issued and outstanding voting

equity of the Company that voted in favor thereof:

|

Name of Voting Stockholder

|

|

Number of Common Stock held

|

|

Number of Series A Preferred held

|

|

Number of Votes held by such Voting Stockholder

|

|

Number of Votes that Voted in Favor of the Amendment

|

|

Percentage of the Voting Equity that Voted in Favor of the Amendment

|

|

Glenn Simpson

|

|

|

9,359,542

|

|

|

|

-0-

|

|

|

|

9,359,542

|

|

|

|

9,359,542

|

|

|

|

33.64

|

%

|

|

Peter Spinner

|

|

|

5,879,808

|

|

|

|

-0-

|

|

|

|

5,879,808

|

|

|

|

5,879,808

|

|

|

|

21.13

|

%

|

Accordingly,

we have obtained all necessary corporate approval in connection with the Amendment. We are not seeking written consent from any

other stockholder, and the other stockholders will not be given an opportunity to vote with respect to the actions described in

this Information Statement. This Information Statement is furnished solely for the purposes of advising stockholders of the action

approved by written consent and giving stockholders notice of the Amendment and forthcoming cancellation of our preferred stock

as required by the DGCL and the Exchange Act.

As

the Amendment was approved by written consent of the holders a majority of the Company’s voting stock, there will be no

stockholders’ meeting, and representatives of the principal accountants for the current year and for the most recently completed

fiscal year will not have the opportunity to make a statement if they desire to do so and will not be available to respond to

appropriate questions from our stockholders.

We

will, following the expiration of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the DGCL, file

the Amendment with the Delaware Secretary of State’s Office. The Amendment will become effective upon such filing and we

anticipate that such filing will occur approximately 20 days after this Information Statement is first mailed to our stockholders.

AMENDMENT

TO OUR CERTIFICATE OF INCORPORATION

Purpose

of and Rationale for the Amendment

We

are currently authorized to issue a total of 190,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, both

with a par value of $0.001. Of this amount, 27,821,606 shares of Common Stock and 0 shares of preferred stock were outstanding

as of February 7, 2019.

Our

Board of Directors has determined that it is in our best interest to cancel our 10,000,000 shares of authorized preferred stock.

As a Delaware corporation, we are required to pay Delaware franchise tax. The purpose of the cancellation is to reduce the amount

of Delaware Franchise Tax due each year.

Effect

of the Decrease of Authorized Stock

The

cancellation of our authorized preferred stock will not have any immediate effect on the rights of existing stockholders. The

Company’s board of directors has the authority to issue authorized shares of Common without requiring future stockholder

approval of such issuances. Due to the cancellation of our authorized preferred stock, in the future the Company will have fewer

shares available for issuance which may affect the Company’s ability to attract investors or raise capital. The Company,

however, believes that this is in the best interest of the shareholders to have one class of stock.

Interests

of Certain Persons in the Action

Certain

of the Company’s officers and directors have an interest in this corporate action as a result of their ownership of shares

of our common stock, as set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management”

below. However, we do not believe that our officers or directors have interests in this corporate action that are different from

or greater than those of any other of our stockholders.

DISSENTER’S

RIGHTS

Under

the DGCL, holders of our capital stock are not entitled to dissenter’s rights of appraisal with respect to a proposed amendment

to our Certificate of Incorporation, or to the adoption of the Amendment.

DISTRIBUTION

AND COSTS

We

will pay the cost of preparing, printing and distributing this Information Statement. Only one Information Statement will be delivered

to multiple stockholders sharing an address, unless contrary instructions are received from one or more of such stockholders.

Upon receipt of a written request at the address noted above, we will deliver a single copy of this Information Statement and

future stockholder communication documents to any stockholders sharing an address to which multiple copies are now delivered.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of February 7, 2019, certain information as to shares of our Common Stock owned by (i) each person

known by us to beneficially own more than 5% of our outstanding capital stock, (ii) each of our directors, and (iii) all of our

executive officers and directors as a group.

Except

as otherwise indicated, all shares are owned directly and the shareholders listed possesses sole voting and investment power with

respect to the shares shown. Unless otherwise indicated below, each entity or person listed below maintains an address of 185

Hudson Street, Floor 25 Jersey City, New Jersey 07302.

|

Name Of Owner

|

|

Number Of

Shares Owned

|

|

Percentage Of

Common Stock (1)

|

Glenn Simpson

Chairman and CEO

|

|

|

9,359,542

|

(2)

|

|

|

34

|

%

|

Jeffrey Devlin

Director

|

|

|

367,953

|

(3)

|

|

|

1

|

%

|

Robert Kaufman

Director

|

|

|

0

|

(4)

|

|

|

0

|

%

|

Peter Spinner

Director

|

|

|

5,879,808

|

(5)

|

|

|

21

|

%

|

|

All Officers and Directors As a Group (4 persons)

|

|

|

15,607,303

|

(6)

|

|

|

56

|

%

|

|

|

(1)

|

Beneficial

Ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect

to securities. Shares of Common Stock subject to options or warrants currently exercisable or convertible, or exercisable

or convertible within 60 days of February 7, 2019 are deemed outstanding for computing the percentage of the person holding

such option or warrant but are not deemed outstanding for computing the percentage of any other person.

|

|

|

|

|

|

|

(2)

|

Includes

(i) 9,359,542 shares of restricted Common Stock. Does not include (i)411,156 shares of Common Stock underlying stock

options granted pursuant to the Company’s 2012 Plan and (ii)806,390 shares of Common Stock underlying stock options

granted pursuant to the Company’s 2015 Plan.

|

|

|

(3)

|

Includes

(i) 367,953 shares of restricted Common Stock. Does not include 35,000 shares of Common Stock underlying stock options granted

pursuant to the Company’s 2012 Plan.

|

|

|

|

|

|

|

(4)

|

Does

not include 35,000 shares of Common Stock underlying stock options granted pursuant to the Company’s 2012 Plan.

|

|

|

|

|

|

|

(5)

|

Includes

5,879,808 shares of restricted Common Stock. Does not include (i) 3,291,209 shares of Common Stock underlying currently exercisable

warrants held by Wyatts; (ii) 392,602 shares of Common Stock owned individually and/or jointly with his spouse.

|

|

|

|

|

|

|

(6)

|

Includes

(i) 15,607,303 shares of restricted Common Stock.

|

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

We

will only deliver one information statement to multiple stockholders sharing an address, unless we have received contrary instructions

from one or more of the stockholders. Also, we will promptly deliver a separate copy of this information statement and future

stockholder communication documents to any stockholder at a shared address to which a single copy of this information statement

was delivered, or deliver a single copy of this information statement and future stockholder communication documents to any stockholder

or stockholders sharing an address to which multiple copies are now delivered, upon written request to us at our address noted

above. Stockholders may also address future requests regarding delivery of information statements and/or annual reports by contacting

us at the address noted above.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, proxy statements and other information with the SEC. The periodic reports and other

information we have filed with the SEC, may be inspected and copied at the SEC’s Public Reference Room at 100 F Street,

N.E., Washington DC 20549. You may obtain information as to the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The SEC also maintains a Web site that contains reports, proxy statements and other information about issuers, like the Company,

who file electronically with the SEC. The address of that site is www.sec.gov. Copies of these documents may also be obtained

by writing our secretary at the address specified above.

By

Order of the Board of Directors

February

__, 2019

|

/s/

Glenn Simpson

|

|

|

Glenn

Simpson

|

|

|

Chairman

and CEO

|

|

Exhibit

A

CERTIFICATE

OF AMENDMENT

TO

THE

CERTIFICATE

OF INCORPORATION

OF

MOJO

ORGANICS, INC.

Pursuant

to Section 242 of the

General

Corporation Law of the State of Delaware

MOJO

Organics, Inc., a Delaware corporation (the “Corporation”), does hereby certify as follows:

1. The

Board of Directors of the Corporation (the “Board”), acting by Unanimous Written Consent in accordance with Section

141(f) of the General Corporation Law of the State of Delaware (the “DGCL”) adopted a resolution authorizing the Corporation

to cancel its currently authorized 10,000,000 shares of preferred stock, $.001 par value per share (the “Preferred Stock”)

and to file this Certificate of Amendment:

Article

FOURTH of the Certificate of Incorporation shall be amended by deleting Article IV, Section A. in its entirety and submitting

therefor the following:

“A.

Classes of Stock

. The total number of shares which the Corporation is authorized to issue is 190,000,000 shares of common

stock, par value of $0.001.”

2. That

in lieu of a meeting and vote of stockholders, the holders of a majority in interest of record of the issued and outstanding shares

of Common Stock have given written consent to said amendment in accordance with the provisions of Section 228 of the DGCL.

3. That

the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the DGCL.

IN

WITNESS WHEREOF, MOJO Organics, Inc. has caused this Certificate of Amendment to be duly executed in its corporate name this 7

th

day of February, 2019.

|

MOJO ORGANICS, INC.

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

Glenn Simpson

|

|

|

|

|

Chief Executive Officer - Director

|

|

|

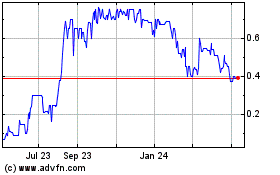

Equator Beverage (QB) (USOTC:MOJO)

Historical Stock Chart

From Mar 2024 to Apr 2024

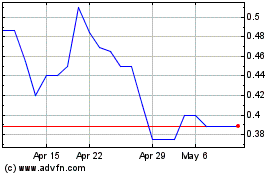

Equator Beverage (QB) (USOTC:MOJO)

Historical Stock Chart

From Apr 2023 to Apr 2024