Axovant Sciences (NASDAQ:

AXON), a

clinical-stage company developing innovative gene therapies, today

provided financial results and corporate updates for its third

fiscal quarter and nine months ended December 31, 2018.

“With the addition of new investigational gene therapies for the

treatment of GM1 gangliosidosis, Tay-Sachs, and Sandhoff diseases,

we are excited about having built a deep pipeline of potentially

transformative gene therapies addressing serious conditions. Over

the last year, Axovant has become leaner and more cutting-edge in

its scientific approach, but we are no less ambitious in our drive

to make a difference for patients,” said Pavan Cheruvu, M.D., Chief

Executive Officer of Axovant. “We look forward to continuing this

momentum with a rich set of clinical development milestones this

quarter, including the first data readouts in our AXO-Lenti-PD and

AXO-AAV-GM2 programs next month, and additional milestones across

our pipeline throughout 2019.”

Key Highlights and Development

Updates

- In-licensed two programs, AXO-AAV-GM1 and AXO-AAV-GM2, for GM1

gangliosidosis, Tay-Sachs and Sandhoff diseases from the University

of Massachusetts (UMass) Medical School in December 2018. The

programs aim to restore enzymes that are deficient in these

diseases by introducing a functional copy of the defective

genes.

- First patient dosed with AXO-AAV-GM2 in an

investigator-initiated study with initial data expected in March

2019. Plan to dose first patient with AXO-AAV-GM1 in the first half

of calendar year 2019.

- Two patients were dosed with AXO-Lenti-PD in the SUNRISE-PD

trial for patients with Parkinson’s disease. Initial data is

expected in March 2019.

- FDA confirmed that studies previously conducted using first

generation ProSavin® may be considered part of a single development

program with AXO-Lenti-PD, including the preclinical data and over

10 years of clinical data of ProSavin. The FDA also provided

feedback on the design of the SUNRISE-PD phase 2 study of

AXO-Lenti-PD and agreed that current manufacturing and quality

control plans were adequate for the clinical program.

- Hired five new senior leaders with decades of collective gene

therapy expertise in key areas such as clinical development, vector

optimization and delivery, regulatory affairs, manufacturing and

commercialization. Assembled a Scientific Advisory Board of

pre-eminent leaders in gene therapy to provide strategic guidance

across all development programs.

- Shankar Ramaswamy, MD, was named Chief Business Officer and is

responsible for the identification, evaluation, and negotiation of

transactions for new gene therapy pipeline assets and other

business development opportunities. He was most recently Senior

Vice President of Business Development and Operations.

- Axovant Sciences plans to change its name to Axovant Gene

Therapies and its stock symbol to “AXGT” to reflect its exclusive

focus on the development and commercialization of innovative gene

therapies. The company’s name change is expected to take effect in

March 2019. Common stock will begin trading under a new ticker

symbol “AXGT” at the opening of trading on February 14, 2019. The

former ticker symbol “AXON” will remain effective through market

close on February 13, 2019.

- Completed $30 million equity financing in December 2018 led by

Deerfield Management Company, Sphera Funds Management and Roivant

Sciences.

Third-Quarter Financial

Summary

For the third fiscal quarter ended December 31, 2018,

research and development expenses were $21.5 million, of which

$10.0 million was attributable to the upfront licensing fee paid to

UMass Medical School and $1.9 million was attributable to non-cash,

share-based compensation expense, net of forfeitures. General and

administrative expenses for the third fiscal quarter ended December

31, 2018 were $10.9 million, of which $2.6 million was non-cash,

share-based compensation expense. Net loss for the quarter ended

December 31, 2018 was $34.3 million, or $0.27 per share.

Nine-Months Financial

Summary

For the nine months ended December 31, 2018, research and

development expenses were $80.4 million, of which $25.0 million was

attributable to the upfront licensing fee paid to Oxford BioMedica,

$10.0 million was attributable to the upfront licensing fee paid to

Benitec Biopharma, $10.0 million was attributable to the upfront

licensing fee paid to UMass Medical School and $3.3 million was

attributable to non-cash, share-based compensation expense, net of

forfeitures. General and administrative expenses for the nine

months ended December 31, 2018 were $33.3 million, of which

$9.6 million was attributable to non-cash, share-based compensation

expense. Net loss for the nine months ended December 31, 2018

was $120.0 million, or $1.01 per share.

As of December 31, 2018, the Company had $84.9 million of

cash and cash equivalents, working capital of $46.2 million, and

long-term debt of $28.3 million. Net cash used in operating

activities was $121.5 million for the nine months ended December

31, 2018, which includes the $30.0 million upfront payment to

Oxford BioMedica, $5.0 million of which was applied as a credit

against the process development work and clinical supply that

Oxford BioMedica will provide to us, the $10.0 million upfront

payment to Benitec BioPharma and the $10.0 million upfront payment

to UMass Medical School.

About Axovant Sciences

Axovant Sciences is a clinical-stage gene therapy company

focused on developing a pipeline of innovative product candidates

for debilitating neurological and neuromuscular diseases. The

company’s current pipeline of gene therapy candidates targets GM1

gangliosidosis, GM2 gangliosidosis (including Tay-Sachs disease and

Sandhoff disease), Parkinson’s disease, oculopharyngeal muscular

dystrophy (OPMD), amyotrophic lateral sclerosis (ALS) and

frontotemporal dementia. Axovant is focused on accelerating product

candidates into and through clinical trials with a team of experts

in gene therapy development and through external partnerships with

leading gene therapy organizations. For more information, visit

www.axovant.com.

Forward-Looking Statements

This press release contains forward-looking statements for the

purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

The use of words such as “may,” “might,” “will,” “would,” “should,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,”

“intend,” “future,” “potential,” “continue,” or “well-positioned”

and other similar expressions are intended to identify

forward-looking statements. For example, all statements Axovant

makes regarding the initiation, timing, progress, and reporting of

results of its preclinical programs, clinical trials, and research

and development programs; its ability to advance its gene therapy

product candidates into and successfully initiate, enroll, and

complete clinical trials; the potential clinical utility of its

product candidates; its ability to continue to develop its gene

therapy platforms; its ability to develop and manufacture its

products and successfully transition manufacturing processes; its

ability to perform under existing collaborations with, among

others, Oxford BioMedica, Benitec and UMass Medical School, and to

add new programs to its pipeline; its ability to enter into new

partnerships or collaborations; its ability to retain and

successfully integrate its leadership and personnel; the timing or

likelihood of its regulatory filings and approvals, and the timing

of its expected name change and ticker symbol change are

forward-looking. All forward-looking statements are based on

estimates and assumptions by Axovant’s management that, although

Axovant believes to be reasonable, are inherently uncertain. All

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those that

Axovant expected. Such risks and uncertainties include, among

others, the initiation and conduct of preclinical studies and

clinical trials; the availability of data from clinical trials; the

expectations for regulatory submissions and approvals; the

continued development of its gene therapy product candidates and

platforms; Axovant’s scientific approach and general development

progress; and the availability or commercial potential of Axovant’s

product candidates. These statements are also subject to a number

of material risks and uncertainties that are described in Axovant’s

most recent Quarterly Report on Form 10-Q filed with the Securities

and Exchange Commission on February 7, 2019, as updated by its

subsequent filings with the Securities and Exchange Commission. Any

forward-looking statement speaks only as of the date on which it

was made. Axovant undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

Contacts:

Media and Investors

Tricia Truehart(631)

892-7014media@axovant.cominvestors@axovant.com

SOURCE Axovant Sciences

AXOVANT SCIENCES

LTD.Condensed Consolidated Statements of

Operations(Unaudited, in thousands, except share and per

share amounts)

| |

|

|

|

|

|

|

|

|

| |

|

Three Months EndedDecember 31, |

|

Nine Months EndedDecember 31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research and

development expenses(1) |

|

|

|

|

|

|

|

|

| (includes total

share-based compensation expense of $1,910 and $2,453 for the three

months ended December 31, 2018 and 2017 and $3,299 and $14,625 for

the nine months ended December 31, 2018 and 2017,

respectively) |

|

$ |

21,483 |

|

|

$ |

37,346 |

|

|

$ |

80,403 |

|

|

$ |

119,613 |

|

| General and

administrative expenses(2) |

|

|

|

|

|

|

|

|

| (includes

share-based compensation expense of $2,648 and $8,186 for the three

months ended December 31, 2018 and 2017 and $9,575 and $26,954 for

the nine months ended December 31, 2018 and 2017,

respectively) |

|

10,933 |

|

|

18,032 |

|

|

33,309 |

|

|

69,662 |

|

| Total

operating expenses |

|

32,416 |

|

|

55,378 |

|

|

113,712 |

|

|

189,275 |

|

| Other expenses: |

|

|

|

|

|

|

|

|

| Interest

expense |

|

1,906 |

|

|

1,950 |

|

|

5,808 |

|

|

5,702 |

|

| Other

expense (income) |

|

(78 |

) |

|

550 |

|

|

275 |

|

|

324 |

|

| Loss before income tax

expense |

|

(34,244 |

) |

|

(57,878 |

) |

|

(119,795 |

) |

|

(195,301 |

) |

| Income tax expense |

|

52 |

|

|

24 |

|

|

224 |

|

|

953 |

|

| Net loss |

|

$ |

(34,296 |

) |

|

$ |

(57,902 |

) |

|

$ |

(120,019 |

) |

|

$ |

(196,254 |

) |

| Net loss per common

share — basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.01 |

) |

|

$ |

(1.83 |

) |

| Weighted average common

shares outstanding — basic and diluted |

|

128,771,900 |

|

|

107,719,476 |

|

|

119,183,117 |

|

|

107,241,043 |

|

(1) Includes total costs allocated from Roivant Sciences Ltd.

(“RSL”), Roivant Sciences, Inc. (“RSI”) and Roivant Sciences GmbH

(“RSG”) of $0 and $409 for the three months ended December 31, 2018

and 2017, respectively, and $(450) and $5,667 for the nine months

ended December 31, 2018 and 2017, respectively.

(2) Includes total costs allocated from RSL, RSI and RSG of $698

and $1,440 for the three months ended December 31, 2018 and 2017,

respectively, and $2,772 and $4,936 for the nine months ended

December 31, 2018 and 2017, respectively.

AXOVANT SCIENCES

LTD.Condensed Consolidated Balance

Sheets(in thousands)

| |

|

December 31, 2018 |

|

March 31, 2018 |

|

Assets |

|

(unaudited) |

|

|

| Current assets: |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

84,939 |

|

|

$ |

154,337 |

|

| Prepaid

expenses and other current assets |

|

4,883 |

|

|

2,174 |

|

| Income

tax receivable |

|

1,580 |

|

|

1,751 |

|

| Total

current assets |

|

91,402 |

|

|

158,262 |

|

| Other non-current

assets |

|

3,449 |

|

|

— |

|

| Property and equipment,

net |

|

1,365 |

|

|

2,524 |

|

| Total

assets |

|

$ |

96,216 |

|

|

$ |

160,786 |

|

| |

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

1,018 |

|

|

$ |

3,949 |

|

| Due to

RSL, RSI and RSG |

|

693 |

|

|

1,011 |

|

| Accrued

expenses |

|

22,911 |

|

|

31,862 |

|

| Current

portion of long-term debt |

|

20,583 |

|

|

9,753 |

|

| Total

current liabilities |

|

45,205 |

|

|

46,575 |

|

| Long-term debt |

|

28,251 |

|

|

42,925 |

|

| Total

liabilities |

|

73,456 |

|

|

89,500 |

|

|

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

| Common

shares, par value $0.00001 per share, 1,000,000,000 shares

authorized, 155,527,771 and 107,788,074 issued and outstanding at

December 31, 2018 and March 31, 2018, respectively |

|

2 |

|

|

1 |

|

|

Additional paid-in capital |

|

699,064 |

|

|

628,110 |

|

|

Accumulated deficit |

|

(676,970 |

) |

|

(556,951 |

) |

|

Accumulated other comprehensive income |

|

664 |

|

|

126 |

|

| Total

shareholders’ equity |

|

22,760 |

|

|

71,286 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

96,216 |

|

|

$ |

160,786 |

|

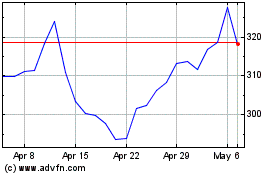

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Mar 2024 to Apr 2024

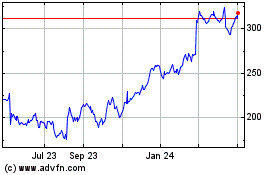

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Apr 2023 to Apr 2024