As filed with the Securities and Exchange

Commission on February 4, 2019

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AMERICAS

SILVER CORPORATION

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English (if applicable))

|

Canada

|

1040

|

Not applicable

|

|

(Province or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number

(if applicable))

|

(I.R.S. Employer Identification

Number (if applicable))

|

145 King Street West, Suite 2870

Toronto, Ontario, Canada M5H 1J8

(416) 848-9503

(Address and telephone number of Registrant’s principal executive offices)

C T Corporation System

1015 15th Street, NW, Suite 1000

Washington, District of Columbia 20005

(202) 572-3111

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

|

Michael Hickey

John Wilkin

Blake, Cassels & Graydon LLP

199 Bay Street

Suite 4000, Commerce Court West

Toronto, Ontario M5L 1A9

Canada

(416) 863-2400

|

Thomas M. Rose

Shona C. Smith

Troutman Sanders LLP

401 9

th

Street, NW

Suite 1000

Washington, DC 20004

(202) 274-2950

|

Approximate date of commencement of

proposed sale of the securities to the public

:

From time to time after the effective date

of this Registration Statement.

Province of Ontario

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become

effective (check appropriate box):

|

A.

|

|

¨

|

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

B.

|

|

x

|

|

at some future date (check appropriate box below)

|

|

|

|

1.

|

|

¨

|

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

|

2.

|

|

¨

|

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

|

3.

|

|

¨

|

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

|

4.

|

|

x

|

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s

shelf prospectus offering procedures, check the following box.

x

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount to be registered

(1) (2)

|

|

|

Proposed maximum aggregate

offering price (3) (4)

|

|

|

Amount of registration fee

|

|

|

Common Shares (no par value)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Subscription Receipts

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Warrants

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Units

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

US$

|

37,720,000

|

|

|

US$

|

37,720,000

|

|

|

US$

|

4,572

|

|

|

|

(1)

|

There are being registered under this Registration Statement such indeterminate number of common shares, preferred shares, subscription receipts, warrants and units of the Registrant (the “

Securities

”) as shall have an aggregate initial offering price of up to US$37,720,000. The proposed maximum offering price per Security will be determined, from time to time, by the Registrant in connection with the sale of the Securities under this Registration Statement. Prices, when determined, may be in U.S. dollars or the equivalent thereof in Canadian dollars. Any Securities registered under this Registration Statement may be sold separately or as units with other Securities registered under this Registration Statement.

|

|

|

(2)

|

If, as a result of stock splits, stock dividends or similar transactions, the number of securities purported to be registered on this Registration Statement changes, the provisions of Rule 416 shall apply to this Registration Statement.

|

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the United States Securities Act of 1933, as amended.

|

|

|

(4)

|

Determined based on the proposed maximum aggregate offering price in Canadian dollars of $50,000,000 converted into U.S. dollars based on the average exchange rate on January 25, 2019, as reported by the Bank of Canada, for the conversion of Canadian dollars into U.S. dollars of Cdn$1.00 equals US$0.7544.

|

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration

Statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting

pursuant to Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

No securities

regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

A

copy of this preliminary short form base shelf prospectus has been filed with the securities regulatory authorities in the provinces

of Alberta, British Columbia and Ontario but has not yet become final for the purposes of the sale of securities. Information

contained in this preliminary short form base shelf prospectus may not be complete and may have to be amended. The securities

may not be sold until after a receipt for the short form base shelf prospectus is obtained from the securities regulatory authorities.

This

short form prospectus has been filed under legislation in the provinces of Alberta, British Columbia and Ontario that permits

certain information about these securities to be determined after this prospectus has become final and that permits the omission

from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing

the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases

where an exemption from such delivery requirements has been obtained.

Information

contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with

the United States Securities and Exchange Commission but is not yet effective. These securities may not be sold nor may offers

to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be any sale of securities in any state in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Information

has been incorporated by reference in this prospectus from documents filed with the United States Securities and Exchange Commission

and with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference

may be obtained on request without charge from the Corporate Secretary of Americas Silver Corporation at 145 King Street West,

Suite 2870, Toronto, Ontario, M5H 1J8, telephone (416) 848-9503 and are also available electronically at www.sec.gov/edgar.shtml

or www.sedar.com

.

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

|

New Issue and/or Secondary Offering

|

|

February 4,

2019

|

AMERICAS SILVER CORPORATION

C$50,000,000

Common Shares

Subscription Receipts

Warrants

Units

Americas Silver Corporation (“

Americas

Silver

”, “

we

”, “

us

”, “

our

” or the “

Company

”)

may from time to time offer and issue the following securities: (i) common shares (the “

Common Shares

”); (ii)

subscription receipts (the “

Subscription Receipts

”); (iii) warrants (the “

Warrants

”); and

(iv) securities comprised of more than one of the Common Shares, Subscription Receipts and/or Warrants offered together as a unit

(the “

Units

”). The Common Shares, Subscription Receipts, Warrants and Units (collectively, the “

Securities

”)

may be offered separately or together, in separate series, in amounts, at prices and on terms to be set forth in one or more shelf

prospectus supplements (each a “

Prospectus Supplement

”) to be incorporated by reference in this short form base

shelf prospectus (the “

Prospectus

”) for the purpose of such offering. Certain current or future holders of Common

Shares (“Selling Securityholders”) may also offer and sell Common Shares pursuant to this Prospectus.

All shelf information not included

in this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with

this Prospectus, except in cases where an exemption from such delivery requirements has been obtained. The aggregate initial

offering price of Securities that may be sold pursuant to this Prospectus during the 25-month period that this Prospectus,

including any amendments hereto, remains valid is limited to C$50,000,000 (or the equivalent thereof in any other currency

used to denominate Securities based on the applicable exchange rate at the time of issuance of such Securities).

We are permitted, as a Canadian issuer,

under the multi-jurisdictional disclosure system adopted by the United States, to prepare this Prospectus

and any Prospectus Supplement in accordance with Canadian disclosure requirements. You should be aware that such requirements are

different from those of the United States.

The consolidated financial statements

of the Company incorporated by reference herein are reported in U.S. dollars and have been prepared in accordance with International

Financial Reporting Standards as issued by the International Accounting Standards Board and thus may not be comparable to financial

statements of United States companies.

Your ability to enforce civil liabilities

under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws

of Canada, that some or all of our officers and directors may be residents of Canada, that some or all of the experts named in

this Prospectus or in any Prospectus Supplement may be residents of Canada and that a substantial portion of our assets and all

or a substantial portion of the assets of such persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED

OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE OR CANADIAN SECURITIES

COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY

OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

You should be aware that the acquisition

of the Securities described herein may have tax consequences both in the United States and in Canada. Such tax consequences for

investors who are residents in, or citizens of, the United States may not be described fully herein or in any applicable Prospectus

Supplement. You should read the tax discussion in any applicable Prospectus Supplement; however, this Prospectus or any applicable

Prospectus Supplement may not fully describe these tax consequences, and you should consult your tax adviser prior to making any

investment in the Securities.

The specific terms of

the Securities in respect of which this Prospectus is being delivered will be set forth in the applicable Prospectus Supplement

and may include, where applicable: (A) in the case of Common Shares, (i) the person offering the shares (the Company and/or the

Selling Securityholder(s)); (ii) the number of Common Shares offered; (iii) the offering price (in the event that the offering

is a fixed price distribution); (iv) the manner of determining the offering price(s) (in the event that the offering is not a

fixed price distribution); and (v) any other material specific terms; (B) in the case of Subscription Receipts, (i) the number

of Subscription Receipts; (ii) the price at which the Subscription Receipts will be offered and whether the price is payable in

instalments; (iii) conditions to the exchange of Subscription Receipts for Securities and the consequences of such conditions

not being satisfied; (iv) the procedures for the exchange of the Subscription Receipts for Securities; (v) the number of underlying

Securities that may be exchanged upon exercise of each Subscription Receipt; (vi) the dates or periods during which the Subscription

Receipts may be exchanged for Securities; (vii) whether the Subscription Receipts and underlying Securities will be listed on

any securities exchange; (viii) whether the Subscription Receipts and underlying Securities will be issued in fully registered

or “book-entry only” form; (ix) any other rights, privileges, restrictions and conditions attaching to the Subscription

Receipts; (x) any risk factors associated with the Subscription Receipts and underlying Securities; and (xi) any other material

specific terms; (C) in the case of Warrants, (i) the designation of the Warrants; (ii) the aggregate number of Warrants offered

and the offering price; (iii) the quantity and terms of the Securities purchasable upon exercise of the Warrants, and procedures

that will result in the adjustment of those numbers; (iv) the exercise price of the Warrants; (v) the dates or periods during

which the Warrants are exercisable; (vi) any minimum or maximum number of Warrants that may be exercised at any one time; (vii) whether

the Warrants will be listed on any securities exchange; (viii) any terms, procedures and limitations relating to the transferability

or exercise of the Warrants; (ix) whether the Warrants will be issued in fully registered or “book-entry only” form;

(x) any other rights, privileges, restrictions and conditions attaching to the Warrants; (xi) any risk factors associated with

the Warrants; and (xii) any other material specific terms; and (D) in the case of Units, (i) the designation and terms of the

Units and of the Securities comprising the Units, including whether and under what circumstances those Securities may be held

or transferred separately; (ii) any provisions for the issuance, payment, settlement, transfer or exchange of the Units or

of any Securities comprising the Units; (iii) whether the Units will be issued in fully registered or “book-entry only”

form; (iv) any risk factors associated with the Units; (v) whether the Units and the Securities comprising the Units will be listed

on any securities exchange; and (vi) any other material specific terms. A Prospectus Supplement may include specific variable

terms pertaining to the Securities that are not within the alternatives and parameters described in this Prospectus.

The outstanding Common Shares are listed

on the Toronto Stock Exchange (the “

TSX

”) under the symbol “USA” and on the NYSE American LLC (the

“

NYSE American

”) under the symbol “USAS”. On February 1, 2019, the last reported sale price of our

Common Shares on the TSX was C$2.28 per Common Share and on the NYSE American was US$1.75 per Common Share. Unless otherwise specified

in the applicable Prospectus Supplement, the Subscription Receipts, Warrants and Units will not be listed on any securities exchange.

There is no market through which these Securities may be sold and purchasers may not be able to resell any Subscription Receipts,

Warrants or Units purchased under this Prospectus and the applicable Prospectus Supplements. This may affect the pricing of such

Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities, and

the extent of issuer regulation. See “Risk Factors” as well as the “Risk Factors” section of the applicable

Prospectus Supplement.

The Securities may be sold to or through

underwriters or dealers purchasing as principals, by the Company and/or, in the case of Common Shares, the Selling Securityholders

or to one or more purchasers, directly pursuant to applicable statutory exemptions or through agents designated by the Company

and/or the Selling Securityholders, as the case may be, from time to time. The Securities may be sold from time to time in one

or more transactions at a fixed price or prices or at non-fixed prices. If offered on a non-fixed price basis, the Securities may

be offered at market prices prevailing at the time of sale (including, without limitation, sales deemed to be “at-the-market

distributions” as defined in National Instrument 44-102 –

Shelf Distributions

, including sales made directly

on the TSX and the NYSE American or other existing trading markets for the Securities), at prices determined by reference to the

prevailing price of a specified security in a specified market or at prices to be negotiated with purchasers, in which case the

compensation payable to an underwriter, dealer or agent in connection with any such sale will be decreased by the amount, if any,

by which the aggregate price paid for the Securities by the purchasers is less than the gross proceeds paid by the underwriter,

dealer or agent to the Corporation. The price at which the Securities will be offered and sold may vary from purchaser to purchaser

and during the period of distribution. See “Plan of Distribution”. Each Prospectus Supplement will identify the person

offering Securities (the Company and/or, in the case of Common Shares, the Selling Securityholders) and each underwriter, dealer

or agent engaged in connection with the offering and sale of those Securities to which the Prospectus Supplement relates, and will

also set forth the method of distribution and the terms of the offering of such Securities including the net proceeds to the Company

or, in the case of Common Shares, to the Company and/or the Selling Securityholders, as the case may be, and, to the extent applicable,

any fees, discounts or other compensation payable to the underwriters, dealers or agents. Unless otherwise specified in a Prospectus

Supplement, the offerings are subject to approval of certain legal matters by Blake, Cassels & Graydon LLP on behalf of the

Company and/or the Selling Securityholders.

Subject to any applicable securities legislation,

and other than in relation to an “at-the-market distribution”, in connection with any offering of the Securities (unless

otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect transactions which stabilize,

maintain or otherwise affect the market price of the Securities offered at levels other than those which might otherwise prevail

on the open market. These transactions may be commenced, interrupted or discontinued at any time. See “Plan of Distribution”.

Americas Silver’s head office and

registered office is located at 145 King Street West, Toronto, Ontario, M5H 1J8, Canada.

Alan Edwards and Manuel Rivera, two of

the Company’s directors, reside outside of Canada and each has appointed Americas Silver Corporation, 145 King Street West,

Toronto, Ontario, M5H 1J8, as agent for service of process. Purchasers are advised that it may not be possible for investors to

enforce judgments obtained in Canada against any person that resides outside of Canada, even if such person has appointed an agent

for service of process. See “Service of Process and Enforceability of Civil Liabilities”.

No underwriter has been involved in

the preparation of this Prospectus or performed any review of the contents of this Prospectus.

Except as noted, all dollar amounts

are expressed in U.S. Dollars. All references to “US$” or “$” are to U.S. Dollars and all references to

“C$” are to Canadian Dollars.

TABLE OF CONTENTS

CAUTION

REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements

made in this Prospectus, including the documents incorporated by reference herein, contain forward-looking information within the

meaning of applicable securities laws (“

forward-looking statements

”). These forward-looking statements are presented

for the purpose of assisting the Company’s securityholders in understanding management’s views regarding those future

outcomes and may not be appropriate for other purposes. When used in this Prospectus, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”,

“seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate

to the Company, are intended to identify forward-looking statements. Specific forward-looking statements in this Prospectus, including

the documents incorporated by reference herein, include, but are not limited to: any objectives, expectations, intentions, plans,

results, levels of activity, goals or achievements; estimates of mineral reserves and resources; the realization of mineral reserve

estimates; the impairment of mining interests and non-producing properties; the timing and amount of estimated future production,

production guidance, costs of production, capital expenditures, costs and timing of development; the success of exploration and

development activities; permitting timelines; government regulation of mining operations; environmental risks; the going concern

assumption; the timing and possible outcomes of pending disputes or litigation; negotiations or regulatory investigations; exchange

rate fluctuations; cyclical or seasonal aspects of our business; our dividend policy; capital expenditures; the transactions (the

“

Transaction

”) contemplated by the agreement and plan of merger (the “

Merger Agreement

”)

dated as of September 28, 2018 by and among Americas Silver, R Merger Sub, Inc. and Pershing Gold Corporation (“

Pershing

Gold

”); covenants and obligations of Americas Silver and Pershing Gold pursuant to the Merger Agreement; the timing for

the implementation of the Transaction; the potential benefits of the Transaction to shareholders of Americas Silver; the likelihood

of the Transaction being completed; the steps required for the completion of the Transaction; the board composition of Americas

Silver following completion of the Transaction; the share capital of Americas Silver following completion of the Transaction; statements

relating to the financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of Americas

Silver; the liquidity of the Common Shares and Americas Silver’s non-voting preferred shares to be created pursuant to the

Transaction; statements based on the unaudited pro forma financial statements of Americas Silver attached as Appendix “G”

to the Special Meeting Circular (as defined herein); and other events or conditions that may occur in the future.

Inherent in the forward-looking

statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict,

that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business

or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied

by such forward-looking statements. Some of the risks and other factors, some of which are beyond Americas Silver’s control,

which could cause results to differ materially from those expressed in the forward-looking statements and information contained

in this Prospectus, including the documents incorporated by reference herein, include, but are not limited to: risks associated

with market fluctuations in commodity prices; risks related to changing global economic conditions, which may affect the Company’s

results of operations and financial condition; the Company is dependent on the success of the San Rafael project as its Cosalá

Operations and the Galena Complex, which are both exposed to operational risks; risks related to mineral reserves and mineral resources,

development and production and the Company’s ability to sustain or increase present production; risks related to global financial

and economic conditions; risks related to government regulation and environmental compliance; risks related to mining property

claims and titles, and surface rights and access; risks related to labour relations, employee recruitment and retention and pension

funding; some of the Company’s material properties are located in Mexico and are subject to changes in political and economic

conditions and regulations in that country; risks related to the Company’s relationship with the communities where it operates;

risks related to actions by certain non-governmental organizations; substantially all of the Company’s assets are located

outside of Canada, which could impact the enforcement of civil liabilities obtained in Canadian and U.S. courts; risks related

to currency fluctuations that may adversely affect the financial condition of the Company; the Company may need additional capital

in the future and may be unable to obtain it or to obtain it on favourable terms; risks associated with the Company’s outstanding

debt and our ability to make scheduled payments of interest and principal thereon; the Company may engage in hedging activities;

risks associated with the Company’s business objectives; risks related to competition in the mining industry; and there is

currently no trading market for any Subscription Receipts, Warrants or Units that may be offered pursuant to this Prospectus and

any Prospectus Supplement. The Company is also subject to risks and factors related to the Transaction – see “

Risk

Factors

”, beginning on page 76 of the Special Meeting Circular (as defined herein).

This is not an exhaustive

list of the factors that may affect any of the Company’s forward-looking statements. Some of these and other factors are

discussed in more detail in the section entitled “Forward-Looking Statements” in the “Management’s Discussion

and Analysis” contained in our Annual Report (as defined herein). Investors and others should carefully consider these and

other factors and not place undue reliance on the forward-looking statements. Further information regarding these and other risk

factors is included in the Company’s public filings with provincial securities regulatory authorities which can be found

on the System for Electronic Document Analysis and Retrieval (“

SEDAR

”) website at www.sedar.com and with the

SEC which can be found on the Electronic Data-Gathering, Analysis and Retrieval (“

EDGAR

”) website at www.sec.gov/edgar.shtml.

The forward-looking

statements contained in this Prospectus represent the Company’s views only as of the date such statements were made. Forward-looking

statements contained in this Prospectus are based on management’s plans, estimates, projections, beliefs and opinions as

at the time such statements were made and the assumptions related to these plans, estimates, projections, beliefs and opinions

may change. Although the Company believes that the expectations reflected in the forward-looking statements were reasonable at

the time such statements were made, there can be no assurance that such expectations will prove to be correct. The Company cannot

guarantee future results, levels of activity, performance or achievements and actual results or developments may differ materially

from those contemplated by the forward-looking statements. While the Company anticipates that subsequent events and developments

may cause the Company’s views to change, the Company does not undertake to update any forward-looking statements, except

to the extent required by applicable securities laws.

CAUTIONARY

NOTE TO UNITED STATES INVESTORS REGARDING PRESENTATION OF

MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

This Prospectus, including

the documents incorporated by reference herein, has been prepared in accordance with the requirements of the securities laws in

effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise

defined have the meanings set forth in National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“

NI

43-101

”). The definitions of Proven and Probable Reserves (“

Mineral Reserves

” or “

Reserves

”)

used in NI 43-101 differ from the definitions in the SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final”

or “bankable” feasibility study is required to report reserves, the three-year history average price is used in any

reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate

governmental authority.

In addition, the terms

“Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred

Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under

SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors

are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

“Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded

to a higher category. Under Canadian securities laws, estimates of Inferred Mineral Resources may not form the basis of feasibility

or prefeasibility studies, except in certain specific cases. Additionally, disclosure of “contained ounces” in a resource

is permitted disclosure under Canadian securities laws, however the SEC normally only permits issuers to report mineralization

that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements.

Accordingly, information

contained in this Prospectus and the documents incorporated by reference herein containing descriptions of the Company’s

mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and

disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

See Appendix A to the

Annual Information Form (as defined herein), which is incorporated by reference herein, for a description of certain of the mining

terms used in this Prospectus and the documents incorporated by reference herein.

DOCUMENTS

INCORPORATED BY REFERENCE

Information has

been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada.

The following documents

of the Company, filed with the securities commissions or similar authorities in the provinces of Alberta, British Columbia and

Ontario, are specifically incorporated by reference in and form an integral part of this Prospectus:

|

|

(a)

|

the

Company’s annual information form dated March 5, 2018 for the year ended December

31, 2017 (the “

Annual Information Form

”);

|

|

|

(b)

|

the

audited consolidated financial statements of the Company as at and for the years ended December 31, 2017 and 2016 and the reports

of the auditors thereon;

|

|

|

(c)

|

management’s

discussion and analysis of the Company for the year ended December 31, 2017 contained

in Americas Silver’s Annual Report to the Shareholders for the year ended December

31, 2017 (the “

Annual Report

”);

|

|

|

(d)

|

the

condensed interim consolidated financial statements of the Company for the nine months ended September 30, 2018 and 2017;

|

|

|

(e)

|

management’s

discussion and analysis of the Company for the three and nine months ended September

30, 2018 (the “

Interim MD&A

”);

|

|

|

(f)

|

the

management information circular of the Company dated December 4, 2018 with respect to the special meeting of shareholders of the

Company held on January 9, 2019;

|

|

|

(g)

|

the

management information circular dated April 5, 2018 with respect to the annual and special meeting of shareholders of the Company

held on May 15, 2018; and

|

|

|

(h)

|

the

material change report of the Company dated October 5, 2018.

|

All documents of the

Company of the type described in Section 11.1(1) of Form 44-101F1 —

Short Form Prospectus

to National Instrument 44-101

—

Short Form Prospectus Distributions

(“

NI 44-101”

), if filed by the Company with the provincial

securities commissions or similar authorities in Canada after the date of this Prospectus and during the currency of this Prospectus,

shall be deemed to be incorporated by reference into this Prospectus. In addition, to the extent that any document or information

incorporated by reference into this Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective

successor form) that is filed with or furnished to the SEC after the date of this Prospectus, such document or information shall

be deemed to be incorporated by reference as an exhibit to the registration statement on Form F-10 of which this Prospectus forms

a part. In addition, the Company may incorporate by reference into this Prospectus, or the registration statement on Form F-10

of which it forms a part, other information from documents that the Company will file with or furnish to the SEC pursuant to Section

13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, if and to the extent expressly provided therein.

Copies of the documents

incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at its head

office at 145 King Street West, Suite 2870, Toronto, Ontario, M5H 1J8, Canada, telephone (416) 848-9503, and are also available

electronically in Canada through the SEDAR at www.sedar.com or in the United States through EDGAR at the website of the SEC at

www.sec.gov. The filings of the Company through SEDAR and EDGAR are not incorporated by reference in this Prospectus except as

specifically set out herein.

Any template version

of any “marketing materials” (as such term is defined in NI 44-101) filed after the date of a Prospectus Supplement

and before the termination of the distribution of the Securities offered pursuant to such Prospectus Supplement (together with

this Prospectus) is deemed to be incorporated by reference in such Prospectus Supplement.

A Prospectus Supplement

containing the specific terms in respect of any Securities and the offering thereof will be delivered, together with this Prospectus,

to purchasers of such Securities (except in cases where an exemption from such delivery requirements has been obtained) and will

be deemed to be incorporated into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement,

but only for the purposes of the distribution of the Securities to which such Prospectus Supplement pertains.

Any statement contained

herein, including any document (or part of a document) incorporated or deemed to be incorporated by reference herein, shall be

deemed to be modified or superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any

other currently or subsequently filed document (or part of a document) that is later dated and also is or is deemed to be incorporated

by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified

or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The

making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded

statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material

fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which

it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a

part of this Prospectus.

Upon a new interim

financial report and related management’s discussion and analysis of the Company being filed with the applicable securities

regulatory authorities during the currency of this Prospectus, the previous interim financial report and related management’s

discussion and analysis of the Company most recently filed shall be deemed no longer to be incorporated by reference into this

Prospectus for purposes of future offers and sales of Securities hereunder. Upon new annual financial statements and related management’s

discussion and analysis of the Company being filed with the applicable securities regulatory authorities during the currency of

this Prospectus, the previous annual financial statements and related management’s discussion and analysis of the Company

and the previous interim financial report and related management’s discussion and analysis of the Company most recently filed

shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities

hereunder. Upon a new annual information form of the Company being filed with the applicable securities regulatory authorities

during the currency of this Prospectus, notwithstanding anything herein to the contrary, the following documents shall be deemed

no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder:

(i) the previous annual information form; (ii) material change reports filed by the Company prior to the end of the financial year

in respect of which the new annual information form is filed; (iii) business acquisition reports filed by the Company for acquisitions

completed prior to the beginning of the financial year in respect of which the new annual information form is filed; and (iv) any

information circular of the Company filed prior to the beginning of the Company’s financial year in respect of which the

new annual information form is filed. Upon a new management information circular prepared in connection with an annual general

meeting of shareholders of the Company being filed with the applicable securities regulatory authorities during the currency of

this Prospectus, the previous management information circular prepared in connection with an annual general meeting of the Company

shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities

hereunder.

DESCRIPTION

OF THE BUSINESS

General

Americas Silver is a

publicly-listed mining company engaged in the evaluation, acquisition, exploration, development and operation of precious and polymetallic

mineral properties in North America, primarily those with the potential for near-term production or exhibiting potential for hosting

a major mineralized deposit. Americas Silver’s mission is to profitably expand its precious metals production through the

development of its own projects and consolidation of complimentary projects. Americas Silver is currently operating in two of the

world’s leading silver camps: the Cosalá Operations in Sinaloa, Mexico, which includes the Nuestra Señora silver-zinc-copper-lead

mine, the San Rafael silver-zinc-lead mine and the Zone 120 silver-copper exploration project, and the Galena Complex, in Idaho,

United States. Americas Silver holds an option to purchase the San Felipe development project in Sonora, Mexico.

Americas Silver was

incorporated as “Scorpio Mining Corporation” pursuant to articles of incorporation dated May 12, 1998 under the

Canada

Business Corporations Act

. On December 23, 2014, a merger of equals transaction between Scorpio Mining Corporation and U.S.

Silver & Gold Inc. was completed to combine their respective businesses by way of a plan of arrangement of U.S. Silver pursuant

to section 182 of the

Business Corporations Act (Ontario)

. Following the merger of equals, the combined company changed

its name to “Americas Silver Corporation” by way of articles of amendment dated May 19, 2015.

Americas Silver’s

head office and registered office is located at 145 King Street West, Toronto, Ontario, M5H 1J8, Canada and our general corporate

phone number is (416) 848-9503.

Consistent with past

practice and in the normal course, the Company may have outstanding non-binding letters of intent and/or conditional agreements

or may otherwise be engaged in discussions with respect to possible acquisitions and/or investments which may or may not be material.

However, there can be no assurance that any of these letters, agreements and/or discussions will result in an acquisition or investment

and, if they do, what the final terms or timing of any acquisition or investment would be. The Company expects to continue to actively

pursue acquisition and investment opportunities during the period that this Prospectus remains valid.

Recent Developments

Proposed Merger Transaction with Pershing Gold Corporation

On September 30, 2018,

Americas Silver and Pershing Gold announced that they had entered into the Merger Agreement to complete the Transaction. Pursuant

to the terms of the Merger Agreement, holders of Pershing Gold common stock, as of the effective time for the Transaction, will

receive 0.715 common shares of Americas Silver for each share of common stock of Pershing Gold (the “

Exchange Ratio

”).

Each outstanding share of Pershing Gold series E preferred stock (“

Series E Preferred Stock

”) will, at the

election of the holder, either (i) be converted into the right to receive 461.440 new non-voting preferred shares in the capital

of Americas Silver (“

Preferred Shares

”), or (ii) be converted into the right to receive the number of Common

Shares to which the holder would be entitled if each share of Series E Preferred Stock held was converted into Pershing Gold common

stock and then exchanged for Common Shares at the Exchange Ratio. For detailed information regarding the Transaction, see “

The

Transaction

”, beginning on page 75 of the Special Meeting Circular, which is incorporated by reference herein. A copy

of the Merger Agreement can be found on SEDAR at

www.sedar.com

and on EDGAR at

www.sec.gov

,

and is attached as Appendix “H” – “

Merger Agreement

” to the Special Meeting Circular.

Each of Americas Silver

and Pershing Gold has received the requisite shareholder approvals from their respective shareholders in respect of the Transaction.

Completion of the Transaction remains subject to satisfaction or waiver of certain customary conditions and the completion of review

and approval by the Committee on Foreign Investment in the United States (“

CFIUS

”). All deadlines for declarations

and transactions under review by CFIUS were tolled due to the lapse in appropriations attributable to the recent partial

U.S. government shutdown.

For more information

regarding Americas Silver assuming completion of the Transaction, see Appendix “F” – “

Information Concerning

Americas Silver Following Completion of the Transaction

” to the Special Meeting Circular, which is incorporated by reference

herein.

DESCRIPTION

OF SHARE CAPITAL

The Company’s

authorized share capital consists of an unlimited number of Common Shares. As of the date of this Prospectus, 44,975,323 Common

Shares have been issued and are outstanding.

Prior to the completion of the Merger, Americas

Silver’s articles of incorporation will be amended to create the Americas Silver Preferred Shares. The authorized share capital

of Americas Silver upon completion of the Transaction will consist of an unlimited number of Americas Silver Common Shares and

8,000,000 Americas Silver Preferred Shares.

For detailed information

regarding Americas Silver’s share capital assuming completion of the Merger, see Appendix “F” – “

Information

Concerning Americas Silver Following Completion of the Transaction

” of the Special Meeting Circular, which is incorporated

by reference herein.

DESCRIPTION

OF COMMON SHARES

Each Common Share entitles

the holder to: (i) one vote at all meetings of shareholders (except meetings at which only holders of a specified class of shares

are entitled to vote); (ii) receive, subject to the holders of another class of shares, any dividend declared by Americas Silver;

and (iii) receive, subject to the rights of the holders of another class of shares, the remaining property of Americas Silver on

the liquidation, dissolution or winding up of Americas Silver, whether voluntary or involuntary. Any Prospectus Supplement for

Common Shares will set forth the terms and other information with respect to the Common Shares being offered thereby, including:

(i) the person offering the shares (the Company and/or the Selling Securityholder(s)); (ii) the number of Common Shares offered;

(iii) the offering price (in the event that the offering is a fixed price distribution); (iv) the manner of determining the offering

price(s) (in the event that the offering is not a fixed price distribution); and (v) any other material specific terms.

DESCRIPTION

OF SUBSCRIPTION RECEIPTS

The following sets

forth certain general terms and provisions of the Subscription Receipts. The Company may issue Subscription Receipts that may be

exchanged by the holders thereof for Securities upon the satisfaction of certain conditions. The particular terms and provisions

of the Subscription Receipts offered pursuant to a Prospectus Supplement, and the extent to which the general terms described below

apply to those Subscription Receipts, will be described in such Prospectus Supplement. The following description and any description

of Subscription Receipts in the applicable Prospectus Supplement does not purport to be complete and is subject to and qualified

in its entirety by reference to the applicable subscription receipt agreement and, if applicable, collateral arrangements and depositary

arrangements relating to such Subscription Receipts.

The Subscription Receipts

will be issued under one or more subscription receipt agreements.

Any

Prospectus Supplement for Subscription Receipts will contain the terms and conditions and other information with respect to

the Subscription Receipts being offered thereby, and may include, where applicable: (i) the number of Subscription Receipts;

(ii) the price at which the Subscription Receipts will be offered and whether the price is payable in instalments;

(iii) conditions to the exchange of Subscription Receipts for Securities and the consequences of such conditions not being

satisfied; (iv) the procedures for the exchange of the Subscription Receipts for Securities; (v) the number of underlying

Securities and that may be exchanged upon exercise of each Subscription Receipt; (vi) the dates or periods during which the

Subscription Receipts may be exchanged for Securities; (vii) whether the Subscription Receipts and underlying Securities will

be listed on any securities exchange; (viii) whether the Subscription Receipts and underlying Securities will be issued

in fully registered or “book-entry only” form; (ix) any other rights, privileges, restrictions and conditions

attaching to the Subscription Receipts; (x) any risk factors associated with the Subscription Receipts and underlying

Securities; and (xi) any other material specific terms.

DESCRIPTION

OF WARRANTS

The following sets

forth certain general terms and provisions of the Warrants. The particular terms and provisions of the Warrants offered pursuant

to a Prospectus Supplement, and the extent to which the general terms described below apply to those Warrants, will be described

in such Prospectus Supplement. The following description and any description of Warrants in the applicable Prospectus Supplement

does not purport to be complete and is subject to and qualified in its entirety by reference to the applicable warrant agreement

and, if applicable, collateral arrangements relating to such Warrants.

The Company may issue

Warrants for the purchase of Common Shares of the Company. Warrants will be issued under one or more warrant agreements between

the Company and a warrant agent that the Company will name in the applicable Prospectus Supplement.

Any Prospectus Supplement

for Warrants will contain the terms and other information with respect to the Warrants being offered thereby, and may include,

where applicable: (i) the designation of the Warrants; (ii) the aggregate number of Warrants offered and the offering price;

(iii) the quantity and terms of the Securities purchasable upon exercise of the Warrants, and procedures that will result in the

adjustment of those numbers; (iv) the exercise price of the Warrants; (v) the dates or periods during which the Warrants are exercisable;

(vi) any minimum or maximum number of Warrants that may be exercised at any one time; (vii) whether the Warrants will be listed

on any securities exchange; (viii) any terms, procedures and limitations relating to the transferability or exercise of the Warrants

and the underlying Common Shares; (ix) whether the Warrants and underlying Common Shares will be issued in fully registered or

“book-entry only” form; (x) any other rights, privileges, restrictions and conditions attaching to the Warrants; (xi)

any risk factors associated with the Warrants; and (xii) any other material specific terms.

DESCRIPTION

OF UNITS

The following sets

forth certain general terms and provisions of the Units. The particular terms and provisions of the Units offered pursuant to a

Prospectus Supplement, and the extent to which the general terms described below apply to those Units, will be described in such

Prospectus Supplement. The following description and any description of Units in the applicable Prospectus Supplement does not

purport to be complete and is subject to and qualified in its entirety by reference to any agreement and collateral arrangements

relating to such Units.

The Company may issue

Units comprised of more than one of the other Securities described in this Prospectus in any combination. Each Unit will be issued

so that the holder of the Unit is also the holder of each Security included in the Unit. Thus, the holder of a Unit will have the

rights and obligations of a holder of each included Security. Any unit agreement under which a Unit is issued may provide that

the Securities included in the Unit may not be held or transferred separately, at any time or at any time before a specified date.

Any Prospectus Supplement

for Units will contain the terms and other information with respect to the Units being offered thereby, and may include, where

applicable: (i) the designation and terms of the Units and of the Securities comprising the Units, including whether and under

what circumstances those Securities may be held or transferred separately; (ii) any provisions for the issuance, payment,

settlement, transfer or exchange of the Units or of any Securities comprising the Units; (iii) whether the Units will be issued

in fully registered or “book-entry only” form; (iv) any risk factors associated with the Units; (v) whether the units

and the Securities comprising the Units will be listed on any securities exchange; and (vi) any other material specific terms.

EARNINGS

COVERAGE RATIOS

Earnings coverage

ratios will be provided as required in the Prospectus Supplement with respect to the issuance of Securities pursuant to such Prospectus

Supplement.

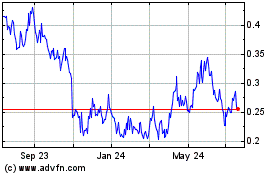

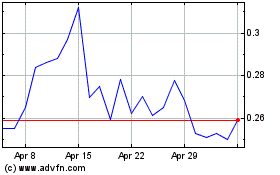

TRADING

PRICE AND VOLUME

Trading prices and

volume of our Securities will be provided, as required, in the Prospectus Supplement.

CAPITALIZATION

There have been

no material changes in the Company’s share or loan capital on a consolidated basis since September 30, 2018, the date of

the most recently filed unaudited consolidated financial statements of the Company.

In connection with

the Transaction, the Company expects to issue Common Shares to holders of Pershing Gold common stock and Common Shares and/or Preferred

Shares to holders of Series E Preferred Stock (in accordance with such holders’ elections). See “

Americas Silver

Post-Transaction – Selected Pro Forma Financial Information – Fully-Diluted Share Capital

” of Appendix “F”

– “

Information Concerning Americas Silver Following Completion of the Transaction

” to the Special Meeting

Circular, which is incorporated by reference herein, for a description and summary of the expected share capital of Americas Silver

following completion of the Transaction.

PRIOR SALES

Prior sales of our

Securities will be provided as required in the Prospectus Supplement with respect to the issuance of Securities pursuant to such

Prospectus Supplement.

USE OF PROCEEDS

The use of proceeds

of the sale of each issuance of Securities will be described in the Prospectus Supplement relating to the specific issuance of

Securities. The Company will not receive any proceeds from any sale of Common Shares by Selling Securityholders.

PLAN OF

DISTRIBUTION

The Securities may be

sold (i) to or through underwriters or dealers purchasing as principals, (ii) directly to one or more purchasers pursuant to applicable

statutory exemptions, or (iii) through agents designated by the Company and/or the Selling Securityholders, as the case may be,

from time to time. The Securities may be sold from time to time in one or more transactions at a fixed price or prices or at non-fixed

prices. If offered on a non-fixed price basis, the Securities may be offered at market prices prevailing at the time of sale (including,

without limitation, sales deemed to be “at-the-market distributions” as defined in National Instrument 44-102 –

Shelf Distributions

, including sales made directly on the TSX and the NYSE American or other existing trading markets for

the Securities), at prices determined by reference to the prevailing price of a specified security in a specified market or at

prices to be negotiated with purchasers, in which case the compensation payable to an underwriter, dealer or agent in connection

with any such sale will be decreased by the amount, if any, by which the aggregate price paid for the Securities by the purchasers

is less than the gross proceeds paid by the underwriter, dealer or agent to the Corporation. The price at which the Securities

will be offered and sold may vary from purchaser to purchaser and during the period of distribution. The Prospectus Supplement

for any of the Securities being offered thereby will identify the person offering Securities (the Company and/or, in the case of

Common Shares, the Selling Securityholders) and will set forth the method of distribution and the terms of the offering of such

Securities, including the type of Security being offered, the name or names of any underwriters, dealers or agents, the purchase

price of such Securities, the proceeds to, and the portion of expenses borne by, the Company from such sale, any underwriting discounts

and other items constituting underwriters’ compensation, any public offering price and any discounts or concessions allowed

or re-allowed or paid to dealers. Only underwriters so named in the Prospectus Supplement are deemed to be underwriters in connection

with the Securities offered thereby.

If underwriters are

used in the sale, the Securities will be acquired by the underwriters for their own account and may be resold from time to time

in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined

at the time of sale, at market prices prevailing at the time of sale or at prices related to such prevailing market prices. The

obligations of the underwriters to purchase such Securities will be subject to certain conditions precedent, and the underwriters

will be obligated to purchase all the Securities offered by the Prospectus Supplement if any of such Securities are purchased.

Any public offering price and any discounts or concessions allowed or re-allowed or paid to underwriters, dealers or agents may

be changed from time to time.

The Securities may also

be sold (i) directly by the Company and/or, in the case of Common Shares, the Selling Securityholders at such prices and upon such

terms as agreed to by the Company and/or the Selling Securityholders, as applicable, and the purchaser or (ii) through agents designated

by the Company and/or the Selling Securityholders, as the case may be, from time to time. Any agent involved in the offering and

sale of the Securities in respect of which this Prospectus is delivered will be named, and any commissions payable by the Company

and/or the Selling Securityholders, as applicable, to such agent will be set forth, in the Prospectus Supplement. Unless otherwise

indicated in the Prospectus Supplement, any agent is acting on a best efforts basis for the period of its appointment.

The Company and/or the

Selling Securityholders, as applicable, may agree to pay any underwriters used in the sale of Securities a commission for various

services relating to the issue and sale of any Securities. Any such commission payable by the Company will be paid out of the general

corporate funds of the Company. Underwriters, dealers and agents who participate in the distribution of the Securities may be entitled

under agreements to be entered into with the Company and/or the Selling Securityholders to indemnification by the Company and/or

the Selling Securityholders, as applicable, against certain liabilities, including liabilities under securities legislation, or

to contribution with respect to payments which such underwriters, dealers or agents may be required to make in respect thereof.

Subject to any applicable

securities legislation, and other than in relation to an “at-the-market distribution”, in connection with any offering

of the Securities (unless otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect

transactions which stabilize, maintain or otherwise affect the market price of the Securities offered at levels other than those

which might otherwise prevail on the open market. These transactions may be commenced, interrupted or discontinued at any time.

SELLING

SECURITYHOLDERS

Common Shares may be

sold under this Prospectus by way of secondary offering by Selling Securityholders. The Prospectus Supplement for or including

any offering of Common Shares by Selling Securityholders will include the following information, to the extent required by applicable

securities laws:

|

|

·

|

the names of the Selling Securityholders;

|

|

|

·

|

the number or amount of Common Shares owned, controlled or directed by each Selling Securityholder;

|

|

|

·

|

the number or amount of Common Shares being distributed for the account of each Selling Securityholder;

|

|

|

·

|

the number or amount of Common Shares to be owned by the Selling Securityholders after the distribution

and the percentage that number or amount represents of the total number of our outstanding Common Shares;

|

|

|

·

|

whether the Common Shares are owned by the Selling Securityholders both of record and beneficially,

of record only, or beneficially only;

|

|

|

·

|

the date or dates the Selling Securityholder acquired the Common Shares;

|

|

|

·

|

if the Selling Securityholder acquired any Common Shares in the 12 months preceding the date of

the applicable Prospectus Supplement, the cost thereof to the securityholder in the aggregate and on an average cost per security

basis; and

|

|

|

·

|

if the Selling Securityholder is an associate or affiliate of another person or company named as

a principal holder of voting securities in the Company’s information circular, the material facts of the relationship.

|

RISK FACTORS

Prospective investors

in a particular offering of the Securities should carefully consider, in addition to information contained in the Prospectus Supplement

relating to that offering and the information incorporated by reference herein (including, without limitation, the Special Meeting

Circular) for the purposes of that offering, the risk factor listed below and risks described in the documents incorporated by

reference in the Prospectus as supplemented by the Prospectus Supplement relating to that offering, including the Company’s

then-current annual information form, as well as the Company’s then-current annual management’s discussion and analysis

and interim management’s discussion and analysis, if applicable, to the extent incorporated by reference herein for the purposes

of that particular offering of Securities.

No Market for the

Securities

There is currently no

trading market for any Subscription Receipts, Warrants or Units that may be offered. No assurance can be given that an active or

liquid trading market for these securities will develop or be sustained. If an active or liquid market for these Securities fails

to develop or be sustained, the prices at which these Securities trade may be adversely affected. Whether or not these Securities

will trade at lower prices depends on many factors, including liquidity of these Securities, prevailing interest rates and the

markets for similar securities, the market price of the Company’s other securities, general economic conditions and the Company’s

financial condition, historic financial performance and future prospects.

CERTAIN

INCOME TAX CONSIDERATIONS

The applicable Prospectus

Supplement will describe certain material Canadian federal income tax consequences to an investor who is a resident of Canada or

who is a non-resident of Canada of the acquisition, ownership and disposition of any Securities offered thereunder, including whether

the payment of dividends will be subject to Canadian non-resident withholding tax.

The applicable Prospectus

Supplement will also describe certain material U.S. federal income tax consequences of the acquisition, ownership and disposition

of any Securities offered thereunder by an initial investor who is a U.S. person (within the meaning of the United States Internal

Revenue Code of 1986, as amended).

LEGAL MATTERS

Unless otherwise specified

in a Prospectus Supplement, certain legal matters in connection with offered Securities will be passed upon by Blake, Cassels &

Graydon LLP with respect to matters of Canadian law on behalf of the Company and/or the Selling Securityholders.

AUDITORS,

TRANSFER AGENT AND REGISTRAR

The

audited consolidated financial statements of the Company and its subsidiaries as at and for the years ended December 31, 2017 and

2016 have been incorporated by reference into the Special Meeting Circular and this Prospectus in reliance on the report of PricewaterhouseCoopers

LLP,

Independent Registered Public Accounting Firm, of Toronto, Ontario located at 18 York Street, Suite 2600, Toronto,

ON M5J 0B2,

as set forth in their report appearing in Americas Silver’s

Annual Report. PricewaterhouseCoopers LLP, as auditors of the Company, have advised that they are independent

with respect

to the Company within the meaning of the Chartered Professional Accountants of Ontario CPA Code of Professional Conduct and in

accordance with the independence rules of the SEC and the Public Company Accounting Oversight Board.

The financial statements

of Pershing Gold and its subsidiaries for the years ended December 31, 2017 and 2016 have been incorporated by reference into the

Special Meeting Circular and this Prospectus in reliance on the report of KBL, LLP, an independent registered public accounting

firm, as set forth in their report appearing in Pershing Gold’s Form 10-K Annual Report for the year ended December 31, 2017.

KBL, LLP, as auditors of Pershing Gold, have advised that they are independent of Pershing Gold as required by U.S. federal securities

laws and the applicable rules and regulations of the SEC and the Public Company Accounting Oversight Board (United States).

The transfer agent and

registrar for the Common Shares is Computershare Investor Services Inc. located at its principal offices in Toronto, Ontario.

INTEREST

OF EXPERTS

Certain of the scientific

and technical information relating to the Company’s mineral projects in the documents incorporated by reference herein has

been derived from technical reports prepared by the experts named below and has been included in reliance on such person’s

expertise. Copies of the technical reports can be accessed online on SEDAR at

www.sedar.com

and on EDGAR at

www.sec.gov

.

Thomas L. Dyer, P.E.,

Edwin R. Peralta, P.E., Paul Tietz, C.P.G. and Randy Powell, Q.P.M. of Mine Development Associates, Inc. (“

MDA

”)

have acted as qualified persons in connection with the technical report entitled “Technical Report and Preliminary Feasibility

Study for the San Rafael property, Sinaloa, Mexico” dated April 29, 2016 and prepared in accordance with NI 43-101 (the “

San

Rafael Technical Report

”) and have reviewed and approved the information related to the San Rafael project contained

or incorporated by reference in this Prospectus.

Jim Atkinson, P.Geo.,

Daren Dell, P.Eng, and Dan Hussey, C.P.G. have acted as qualified persons in connection with the technical report entitled “Technical

Report, Galena Complex, Shoshone County, Idaho, USA” dated December 23, 2016 and prepared in accordance with NI 43-101 (the

“

Galena Technical Report

”) and have reviewed and approved the information related to the Galena Complex contained

or incorporated by reference in this Prospectus.

Paul Tietz of MDA has

acted as a qualified person in connection with the technical report entitled “Technical Report and Estimated Resources for

the San Felipe Project, Sonora, Mexico” dated May 3, 2018 and prepared in accordance with NI 43-101 (the “

San Felipe

Technical Report

”) and has reviewed and approved the information related to the San Felipe project contained or incorporated

by reference in this Prospectus.

All other scientific

and technical information in this Prospectus and relating to mineral projects or properties material to Americas Silver, including

information about the San Rafael project, the Galena Complex and the San Felipe project given after the date of the applicable

technical report, has been reviewed and approved by Daren Dell, P.Eng, the Chief Operating Officer of the Corporation, who is a

qualified person under NI 43-101.

Each of the aforementioned

firms or persons held less than one percent of any class of our securities or of any of our associates or affiliates when they

prepared the technical reports referred to above or following the preparation of such technical reports. None of the aforementioned

firms or persons received any direct or indirect interest in any of our securities or property or of any of our associates or affiliates

in connection with the preparation of such technical reports.

None of the aforementioned

firms or persons, nor any directors, officers or employees of such firms, are currently expected to be elected, appointed or employed

as a director, officer or employee of the Company or of any of its associates or affiliates, other than Jim Atkinson, P.Geo., Daren

Dell, P.Eng, and Dan Hussey, C.P.G., each of whom was, at the time of preparation of the Galena Technical Report, and, in the case

of Mr. Dell, continues to be employed by the Company or one of its subsidiaries.

Paul Tietz, P.Geo.

and Neil B. Prenn, P.Eng of MDA Carl E. Defilippi, R.M SME. of Kappes, Cassiday and Associates and Mark Jorgensen, Q.P. of Jorgensen

Engineering and Technical Services have acted as qualified persons in connection with the technical report entitled “Technical

Report and Feasibility Study for the Relief Canyon Project, Pershing County, Nevada, U.S.A.” dated July 6, 2018 and prepared

in accordance with NI 43-101 and have reviewed and approved the information related to the Relief Canyon Project contained or incorporated

by reference in this Prospectus. As of the date hereof, each of the foregoing individuals beneficially owns, directly or indirectly,

an aggregate of less than 1% of the issued and outstanding securities of the Company.

PURCHASERS’

STATUTORY AND CONTRACTUAL RIGHTS

Securities legislation

in certain of the provinces of Canada provides purchasers with the right to withdraw from an agreement to purchase securities.

This right may be exercised within two business days after receipt or deemed receipt of a prospectus and any amendment. In several

of the provinces, the securities legislation further provides a purchaser with remedies for rescission or, in some jurisdictions,

revision of the price or damages if the prospectus and any amendment contains a misrepresentation or is not delivered to the purchaser,

provided that the remedies for rescission, revision of the price or damages are exercised by the purchaser within the time limit

prescribed by the securities legislation of the purchaser’s province. The purchaser should refer to any applicable provisions

of the securities legislation of the purchaser’s province for the particulars of these rights or consult with a legal adviser.

In addition, original

purchasers of convertible or exchangeable Subscription Receipts or Warrants, unless the Warrants are reasonably regarded by the

Company as incidental to the applicable offering as a whole (or Units comprised wholly or partly of such Securities), will have

a contractual right of rescission against the Company in respect of the conversion, exchange or exercise of such Securities. The

contractual right of rescission will be further described in any applicable Prospectus Supplement, but will, in general, entitle

such original purchasers to receive the amount paid for the applicable convertible, exchangeable or exercisable security upon surrender

of the underlying securities acquired thereby, in the event that this Prospectus (as supplemented or amended) contains a misrepresentation,

provided that: (i) the conversion, exchange or exercise takes place within 180 days of the date of the purchase of the convertible,

exchangeable or exercisable security under this Prospectus; and (ii) the right of rescission is exercised within 180 days of the

date of the purchase of the convertible, exchangeable or exercisable security under this Prospectus.

In an offering of convertible

or exchangeable Subscription Receipts or Warrants (or Units comprised wholly or partly of such Securities), investors are cautioned

that the statutory right of action for damages for a misrepresentation contained in the prospectus is limited, in certain provincial

securities legislation, to the price at which convertible or exchangeable Subscription Receipts or Warrants (or Units comprised

wholly or partly of such Securities) are offered to the public under the prospectus offering. This means that, under the securities

legislation of certain provinces, if the purchaser pays additional amounts upon the conversion, exchange or exercise of the security,

those amounts may not be recoverable under the statutory right of action for damages that applies in those provinces. The purchaser

should refer to any applicable provisions of the securities legislation of the purchaser’s province for the particulars of

this right of action for damages or consult with a legal adviser.

SERVICE

OF PROCESS AND ENFORCEABILITY OF CIVIL LIABILITIES

We are a Canadian company.

Some of our directors and executive officers live outside the United States. Some of the assets of our directors and executive

officers and some of our assets are located outside the United States. As a result, it may be difficult or impossible to serve

process on us or on such persons in the United States or to obtain or enforce judgments obtained in United States courts or Canadian

courts against them or us based on the civil liability provisions of the federal securities laws of the United States. There is

doubt as to whether Canadian courts would enforce the civil liability claims brought under United States federal securities laws

in original actions and/or enforce claims for punitive damages. A final judgment for a liquidated sum in favour of a private litigant

granted by a United States court and predicated solely upon civil liability under United States federal securities laws would,

subject to certain exceptions identified in the law of individual provinces of Canada, likely be enforceable in Canada if the United

States court in which the judgment was obtained had a basis for jurisdiction in the matter that would be recognized by the domestic