Current Report Filing (8-k)

February 01 2019 - 3:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or

15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 2

8

,

201

9

|

Innovative Food Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Florida

|

0-

9376

|

20-1167761

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

28411 Race Track Road, Bonita Springs, Florida

|

34135

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(239) 596-0204

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1

.0

1

.

Entry into a Material Definitive Agreement

.

As of January 28, 2019, upon approval by the Company’s compensation committee comprised solely of independent directors, we entered into an employment agreement with Mr. Sam Klepfish, our CEO, having an effective date of January 28, 2019 and terminating three years thereafter with up to two two-year extension periods. The agreement provides a base salary in the amount of $300,000 with annual increases of at least $25,000 and annual stock compensation of 50% of the base salary. The agreement also provides for additional bonuses of up to 25% of base compensation, based on increases in EBITDA (as defined in the agreement) and increases in our stock price as reflected in our market capitalization and other perquisites and benefits as detailed therein. The agreement also contains change of control, confidentiality, non-compete and non-solicitation provisions.

As of January 28, 2019, upon approval by the Company’s compensation committee, we entered into an employment agreement with Mr. Justin Wiernasz, our Director of Strategic Acquisitions, having an effective date of January 28, 2019 and terminating three years thereafter with up to two extension periods; one for two years and one for one year. The agreement provides a base salary in the amount of $326,000 with annual increases of at least 5% and annual stock compensation of 5% of the base salary. The agreement also provides for additional bonuses of up to 35% of base compensation, and based upon increases in our stock price as reflected in our market capitalization and other perquisites and benefits as detailed therein. The agreement also contains change of control, confidentiality, non-compete and non-solicitation provisions.

As of January 28, 2019 upon approval by the Company’s compensation committee we entered into a Director Agreement which provides for an initial one time of grant of $45,000 cash and $45,000 of stock to two non-employee directors. The Director Agreement also provides for annual compensation to non-employee directors of $30,000 cash, payable quarterly and $30,000 of stock, vesting in equal quarterly amounts over three years. In addition, as compensation for 2019-2021, all directors shall receive a grant of 450,000 stock options which vest quarterly over three years and which are exercisable for five years from the date of grant at exercise prices ranging from $0.62 - $1.20. The Director Agreement also contains confidentiality, non-compete and non-solicitation provisions.

The above purports to be only a summary of the terms of the documents and is qualified in its entirety by the terms of the full documents, copies of which are filed as exhibits hereto.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INNOVATIVE FOOD HOLDINGS, INC.

|

|

|

|

|

Dated: February 1, 2019

|

|

|

|

By:

/s/

SAM KLEPFISH

Sam Klepfish, CEO

|

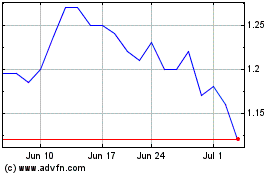

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

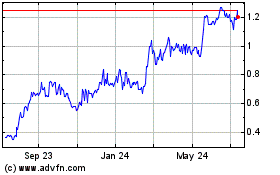

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Apr 2023 to Apr 2024