Quarterly revenue of $299.0 million, up

39% year-over-year

Quarterly IFRS operating margin of (1%)

and non-IFRS operating margin of 25%

Quarterly cash flow from operations of $130.4

million and free cash flow of $122.6 million

Atlassian Corporation Plc (NASDAQ: TEAM), a leading provider of

team collaboration and productivity software, today announced

financial results for its second quarter of fiscal 2019 ended

December 31, 2018 and released a shareholder letter

on the Investor Relations section of its

website at https://investors.atlassian.com. All

financial results and targets are based on the new revenue

recognition standard IFRS 15, which the company adopted on July 1,

2018.

“The second quarter of fiscal 2019 capped off a fantastic

2018, as we eclipsed $1 billion in calendar year revenue for the

first time,” said Scott Farquhar, Atlassian’s co-CEO and

co-founder. “The quarter also highlighted the growing demand for

Atlassian products to drive digital transformation in businesses

large and small. Our flagship product, Jira Software, surpassed

65,000 customers, and we ended the quarter with more than 138,000

total customers, underscoring the growth opportunity for Jira

just within our installed base.”

Second Quarter Fiscal Year 2019 Financial Highlights:

On an IFRS basis, Atlassian reported:

- Revenue: Total revenue was

$299.0 million for the second quarter of fiscal 2019, up 39% from

$214.6 million for the second quarter of fiscal 2018.

- Operating Loss and Operating

Margin: Operating loss was $3.2 million for

the second quarter of fiscal 2019, compared with $13.0 million

for the second quarter of fiscal 2018. Operating

margin was (1%) for the second quarter of fiscal 2019,

compared with (6%) for the second quarter of fiscal 2018.

- Net Income/Loss and Net Income/Loss

Per Diluted Share: Net income was $45.2 million for

the second quarter of fiscal 2019, compared with a net loss of

$64.2 million for the second quarter of fiscal 2018. Net

income per diluted share was $0.18 for the second

quarter of fiscal 2019, compared with a net loss per

diluted share of $0.28 for the second quarter of fiscal

2018.Net income for the second quarter of fiscal 2019 included a

non-cash gain recorded in “other non-operating income” of $31.3

million, as a result of marking to fair value the exchange

feature of Atlassian’s exchangeable senior notes and the related

capped calls.

- Balance Sheet: Cash

and cash equivalents, and short-term investments at the

end of the second quarter of fiscal

2019 totaled $1.6 billion.

On a non-IFRS basis, Atlassian reported:

- Operating Income and Operating

Margin: Operating income was $74.8 million for

the second quarter of fiscal 2019, compared with $46.7 million

for the second quarter of fiscal 2018. Operating margin

was 25% for the second quarter of fiscal 2019, compared with

22% for the second quarter of fiscal 2018.

- Net Income and Net

Income Per Diluted Share: Net income was $61.7 million for

the second quarter of fiscal 2019, compared

with $32.0 million for the second quarter of fiscal

2018. Net income per diluted share was $0.25 for the second

quarter of fiscal 2019, compared with $0.13 per diluted share for

the second quarter of fiscal 2018.

- Free Cash Flow: Cash flow from

operations for the second quarter of fiscal 2019 was

$130.4 million, while capital expenditures totaled $7.8 million,

resulting in free cash flow of $122.6 million, an increase of 81%

year-over-year. Free cash flow margin for the second quarter of

fiscal 2019 was 41%.

A reconciliation of IFRS to non-IFRS financial measures has been

provided in the financial statement tables included in this press

release. An explanation of these measures is also included below,

under the heading “About Non-IFRS Financial Measures.”

Recent Business Highlights:

- Customer growth: Atlassian

ended the second quarter of fiscal 2019 with a total

customer count, on an active subscription or maintenance

agreement basis, of 138,235. Atlassian added 6,551 net new

customers during the quarter; this number benefited from an

increase of 1,396 customers as a result of our acquisition of

Opsgenie during the quarter. Excluding Opsgenie, Atlassian added

5,155 net new customers during the quarter.

- Opsgenie acquisition

closing: On October 1, 2018, Atlassian closed its

acquisition of Opsgenie, whose technology enables companies to

better plan for and respond to IT service disruptions. When

outages occur, Opsgenie’s technology quickly routes alerts to

the appropriate IT teams, speeding diagnosis and resolution, and

reducing downtime. The acquisition was valued at approximately $295

million, of which approximately $259 million was paid in

cash and the remainder in Atlassian restricted shares subject

to continued vesting provisions.

- Acquisition of Butler for

Trello: In December, Atlassian announced the acquisition

of one of Trello’s most popular integrations, Butler for Trello,

bringing the power of workplace automation to Trello

boards. Trello will incorporate Butler’s automation technology

to allow teams of all kinds, such as HR, marketing, and finance, to

codify business processes. With Butler’s technology, Trello users

can take tasks that might require multiple manual steps and

automate them into one click.

- Investor session at Atlassian Summit

2019 - April 10, 2019: Atlassian will hold its Summit

user conference in Las Vegas for the first time, at the

Mandalay Bay South Convention Center, from April 9-11, 2019. The

company will host an Investor session at Summit 2019 on April 10.

General information on Atlassian Summit 2019 can be found

at https://www.atlassian.com/company/events/summit.

Financial Targets:

Atlassian is providing its financial targets for the third

quarter and full fiscal year 2019. The company’s financial targets

are as follows:

- Third Quarter Fiscal Year 2019:

- Total revenue is expected to be in the

range of $303 million to $305 million.

- Gross margin is expected to be

approximately 82% on an IFRS basis and approximately 86% on a

non-IFRS basis.

- Operating margin is expected to be

approximately (10%) on an IFRS basis and approximately 17% on a

non-IFRS basis.

- Net loss per diluted share is expected

to be approximately ($0.14) on an IFRS basis, and net income per

diluted share is expected to be approximately $0.18 on a non-IFRS

basis.

- Weighted average share count is

expected to be in the range of 238 million to 239 million shares

when calculating diluted IFRS net loss per share and in the range

of 248 million to 250 million shares when calculating diluted

non-IFRS net income per share.

- Fiscal Year 2019:

- Total revenue is expected to be in the

range of $1,195 million to $1,199 million.

- Gross margin is expected to be

approximately 83% on an IFRS basis and approximately 86% on a

non-IFRS basis.

- Operating margin is expected to be in

the range of (6%) to (5.5%) on an IFRS basis and in the range of

20% to 20.5% on a non-IFRS basis.

- Net loss per diluted share is expected

to be in the range of ($1.07) to ($1.06) on an IFRS

basis, and net income per diluted share is expected to be in the

range of $0.81 to $0.82 on a non-IFRS basis.

- Weighted average share count is

expected to be in the range of 238 million to 240 million

shares when calculating diluted IFRS net loss per share and in the

range of 248 million to 250 million shares when

calculating diluted non-IFRS net income per share.

- Cash flow from operations is expected

to be in the range of $410 million to $420 million and free cash

flow is expected to be in the range of $370 million to $380

million, which includes capital expenditures that are expected to

be approximately $40 million.

With respect to Atlassian’s expectations under “Financial

Targets” above, a reconciliation of IFRS to non-IFRS gross margin,

operating margin, net income per diluted share, and free cash flow

has been provided in the financial statement tables included in

this press release.

Shareholder Letter and Webcast/Conference Call

Details

A detailed shareholder letter is available on the Investor

Relations section of Atlassian’s website

at: https://investors.atlassian.com. Atlassian will host

a webcast and conference call to answer questions today:

- When: Thursday, January 17, 2019

at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

- Webcast: A live webcast of

the call can be accessed from the Investor Relations section of

Atlassian’s website

at: https://investors.atlassian.com. Following the call,

a replay will be available on the same website.

- Dial in: To access the call

via telephone in North America, please dial 1-888-346-0688. For

international callers, please dial

1-412-902-4250. Participants should request the “Atlassian

call” after dialing in.

- Audio replay: An audio replay of

the call will be available via telephone for seven days, beginning

two hours after the call. To listen to the replay in North America,

please dial 1-877-344-7529 (access code 10127151).

International callers, please dial 1-412-317-0088 (access

code 10127151).

Atlassian has used, and will continue to use, its Investor

Relations website at https://investors.atlassian.com as a means of

making material information public and for complying with its

disclosure obligations.

About Atlassian

Atlassian unleashes the potential of every team. Our team

collaboration and productivity software helps teams organize,

discuss and complete shared work. Teams at more

than 138,000 customers, across large and small

organizations - including General Motors, Walmart Labs, Bank

of America Merrill Lynch, Lyft, Verizon, Spotify and NASA -

use Atlassian’s project tracking, content creation and sharing, and

service management products to work better together and deliver

quality results on time. Learn more about our products, including

Jira Software, Confluence, Trello, Bitbucket and Jira Service Desk,

at https://atlassian.com/.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, which statements involve substantial risks and uncertainties.

All statements other than statements of historical fact could be

deemed forward looking, including risks and uncertainties related

to statements about our products, customers, anticipated growth,

anticipated benefits of the Opsgenie and Butler for Trello

acquisitions, market expansion, technology and other key strategic

areas, and our financial targets such as revenue, share count and

IFRS and non-IFRS financial measures including gross margin,

operating margin, net income (loss) per diluted share, and free

cash flow.

We undertake no obligation to update any forward-looking

statements made in this press release to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

The achievement or success of the matters covered by such

forward-looking statements involves known and unknown risks,

uncertainties and assumptions. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our

results could differ materially from the results expressed or

implied by the forward-looking statements we make. You should not

rely upon forward-looking statements as predictions of future

events. Forward-looking statements represent our management’s

beliefs and assumptions only as of the date such statements are

made.

Further information on these and other factors that could affect

our financial results is included in filings we make with the

Securities and Exchange Commission from time to time, including the

section titled “Risk Factors” in our most recent Forms 20-F

and 6-K (reporting our quarterly results). These documents are

available on the SEC Filings section of the Investor Relations

section of our website

at: https://investors.atlassian.com/.

About Non-IFRS Financial Measures

Our reported results and financial targets include certain

non-IFRS financial measures, including non-IFRS gross profit,

non-IFRS operating income, non-IFRS net income, non-IFRS net income

per diluted share, and free cash flow. Management believes that the

use of these non-IFRS financial measures provides consistency and

comparability with our past financial performance, facilitates

period-to-period comparisons of our results of operations, and also

facilitates comparisons with peer companies, many of which use

similar non-IFRS or non-GAAP financial measures to supplement their

IFRS or GAAP results. Non-IFRS results are presented for

supplemental informational purposes only to aid in understanding

our operating results. The non-IFRS results should not be

considered a substitute for financial information presented in

accordance with IFRS, and may be different from non-IFRS or

non-GAAP measures used by other companies.

Our non-IFRS financial measures include:

- Non-IFRS gross profit. Excludes

expenses related to share-based compensation and amortization of

acquired intangible assets.

- Non-IFRS operating

income. Excludes expenses related to share-based compensation

and amortization of acquired intangible assets.

- Non-IFRS net income and non-IFRS net

income per diluted share. Excludes expenses related to share- based

compensation, amortization of acquired intangible assets,

non-coupon impact related to exchangeable senior notes and capped

calls, the related income tax effects on these items, and changes

in our assessment regarding the realizability of our deferred tax

assets.

- Free cash flow. Free cash flow is

defined as net cash provided by operating activities less capital

expenditures, which consists of purchases of property and

equipment.

Our non-IFRS financial measures reflect adjustments based on the

items below:

- Share-based compensation

- Amortization of acquired intangible

assets

- Non-coupon impact related to

exchangeable senior notes and capped calls:

- Amortization of notes discount and

issuance costs

- Mark to fair value of the exchangeable

senior notes exchange feature

- Mark to fair value of the related

capped call transactions

- The related income tax effects on these

items, and changes in our assessment regarding the realizability of

our deferred tax assets

We exclude expenses related to share-based compensation,

amortization of acquired intangible assets, non-coupon impact

related to exchangeable senior notes and capped calls, the related

income tax effects on these items, and changes in our assessment

regarding the realizability of our deferred tax assets from certain

of our non-IFRS financial measures as we believe this helps

investors understand our operational performance. In addition,

share-based compensation expense can be difficult to predict and

varies from period to period and company to company due to

differing valuation methodologies, subjective assumptions, and the

variety of equity instruments, as well as changes in stock price.

Management believes that providing non-IFRS financial measures that

exclude share-based compensation expense, amortization of acquired

intangible assets, non-coupon impact related to exchangeable senior

notes and capped calls, the related income tax effects on these

items, and changes in our assessment regarding the realizability of

our deferred tax assets allow for more meaningful comparisons

between our operating results from period to period.

Management considers free cash flow to be a liquidity measure

that provides useful information to management and investors about

the amount of cash generated by our business that can be used for

strategic opportunities, including investing in our business,

making strategic acquisitions, and strengthening our statement of

financial position.

Management uses non-IFRS gross profit, non-IFRS operating

income, non-IFRS net income, non-IFRS net income per diluted share,

and free cash flow:

- As measures of operating performance,

because these financial measures do not include the impact of items

not directly resulting from our core operations;

- For planning purposes, including the

preparation of our annual operating budget;

- To allocate resources to enhance the

financial performance of our business;

- To evaluate the effectiveness of our

business strategies; and

- In communications with our Board of

Directors concerning our financial performance.

The tables in this press release titled “Reconciliation of IFRS

to Non-IFRS Results” and “Reconciliation of IFRS to Non-IFRS

Financial Targets” provide reconciliations of non-IFRS financial

measures to the most recent directly comparable financial measures

calculated and presented in accordance with IFRS.

We understand that although non-IFRS gross profit, non-IFRS

operating income, non-IFRS net income, non-IFRS net income per

diluted share, and free cash flow are frequently used by investors

and securities analysts in their evaluation of companies, these

measures have limitations as analytical tools, and you should not

consider them in isolation or as substitutes for analysis of our

results of operations as reported under IFRS.

Atlassian Corporation Plc

Consolidated Statements of

Operations

(U.S. $ and shares in thousands, except

per share data)

(unaudited)

Three Months Ended December 31, Six Months Ended

December 31, 2018 2017 2018

2017 *As Adjusted *As Adjusted Revenues:

Subscription $ 152,500 $ 97,704 $ 286,565 $ 184,095 Maintenance

97,161 80,489 189,897 156,708 Perpetual license 25,778 21,444

47,617 40,892 Other 23,540 14,941 42,192

28,363 Total revenues 298,979 214,578 566,271 410,058 Cost

of revenues (1) (2) 49,782 43,164 94,967

83,254 Gross profit 249,197 171,414 471,304 326,804

Operating expenses: Research and development (1) (2) 131,364

101,324 255,744 196,186 Marketing and sales (1) (2) 68,950 44,519

121,212 89,611 General and administrative (1) 52,052 38,584

97,709 74,309 Total operating expenses 252,366

184,427 474,665 360,106 Operating loss

(3,169 ) (13,013 ) (3,361 ) (33,302 ) Other non-operating income

(expense), net 32,592 (493 ) (204,656 ) (1,158 ) Finance income

7,659 1,568 14,925 2,823 Finance costs (10,019 ) (7 ) (19,921 ) (16

) Income (loss) before income tax benefit (expense) 27,063 (11,945

) (213,013 ) (31,653 ) Income tax benefit (expense) 18,122

(52,264 ) 15,753 (44,026 ) Net income (loss) $ 45,185

$ (64,209 ) $ (197,260 ) $ (75,679 ) Net income (loss) per share

attributable to ordinary shareholders: Basic $ 0.19 $ (0.28

) $ (0.83 ) $ (0.33 ) Diluted $ 0.18 $ (0.28 ) $ (0.83 ) $

(0.33 ) Weighted-average shares outstanding used to compute net

income (loss) per share attributable to ordinary shareholders:

Basic 237,740 230,208 236,979 229,182

Diluted 247,255 230,208 236,979 229,182

(1) Amounts include share-based

payment expense, as follows:

Three Months Ended December 31, Six Months Ended

December 31, 2018 2017 2018 2017

Cost of revenues $ 3,766 $ 3,180 $ 7,285 $ 6,172 Research and

development 32,976 27,020 59,822 52,991 Marketing and sales 9,850

6,136 17,611 12,345 General and administrative 13,912 9,015 24,166

17,968

(2) Amounts include

amortization of acquired intangible assets, as follows:

Three Months Ended December 31, Six Months Ended

December 31, 2018 2017 2018 2017

Cost of revenues $ 7,060 $ 5,294 $ 12,411 $ 10,587 Research and

development 21 — 21 — Marketing and sales 10,368 9,023 19,356

18,045

* As adjusted to reflect the impact of the

full retrospective adoption of IFRS 15.

Atlassian Corporation Plc

Consolidated Statements of Financial

Position

(U.S. $ in thousands)

(unaudited)

December 31, 2018 June 30, 2018 *As

Adjusted Assets Current assets: Cash and cash

equivalents $ 1,340,589 $ 1,410,339 Short-term investments 303,772

323,134 Trade receivables 71,207 46,141 Current tax receivables

1,423 12,622 Prepaid expenses and other current assets 47,741

29,795 Total current assets 1,764,732

1,822,031 Non-current assets: Property and equipment, net

63,716 51,656 Deferred tax assets 81,055 59,220 Goodwill 506,121

311,943 Intangible assets, net 120,942 63,577 Other non-current

assets 188,378 113,401 Total non-current assets

960,212 599,797 Total assets $ 2,724,944 $

2,421,828

Liabilities Current liabilities: Trade and

other payables $ 119,831 $ 113,105 Current tax liabilities 1,664

172 Provisions 7,504 7,215 Deferred revenue 383,776 324,394

Total current liabilities 512,775 444,886

Non-current liabilities: Deferred tax liabilities 32,976 12,160

Provisions 4,326 4,363 Deferred revenue 33,056 18,477 Exchangeable

senior notes, net 836,403 819,637 Other non-current liabilities

485,660 214,985 Total non-current liabilities

1,392,421 1,069,622 Total liabilities 1,905,196

1,514,508

Equity Share capital 23,844 23,531

Share premium 456,404 454,766 Other capital reserves 665,934

557,100 Other components of equity (1,158 ) (61 ) Accumulated

deficit (325,276 ) (128,016 ) Total equity 819,748 907,320

Total liabilities and equity $ 2,724,944 $ 2,421,828

* As adjusted to reflect the impact of the

full retrospective adoption of IFRS 15.

Atlassian Corporation Plc

Consolidated Statements of Cash

Flows

(U.S. $ in thousands)

(unaudited)

Three Months Ended December 31, Six Months Ended

December 31, 2018 2017 2018

2017 *As Adjusted *As Adjusted Operating

activities Income (loss) before income tax benefit (expense) $

27,063 $ (11,945 ) $ (213,013 ) $ (31,653 ) Adjustments to

reconcile income (loss) before income tax benefit (expense) to net

cash provided by operating activities: Depreciation and

amortization 20,685 20,990 38,100 41,570 Gain on sale of

investments and other assets (2,357 ) (16 ) (2,347 ) (32 ) Net

unrealized gain on investments (47 ) — (47 ) — Net unrealized

foreign currency loss (gain) 530 (142 ) 108 (162 ) Share-based

payment expense 60,504 45,351 108,884 89,476 Net unrealized (gain)

loss on exchange derivative and capped call transactions (31,348 )

— 205,005 — Amortization of debt discount and issuance cost 8,433 —

16,766 — Interest income (7,545 ) (1,568 ) (14,811 ) (2,823 )

Interest expense 1,585 — 3,155 — Changes in assets and liabilities:

Trade receivables (17,769 ) (4,668 ) (23,140 ) (8,387 ) Prepaid

expenses and other assets (18,885 ) (3,023 ) (17,207 ) (328 ) Trade

and other payables, provisions and other non-current liabilities

32,252 5,105 17,974 6,258 Deferred revenue 51,097 21,653 72,745

42,894 Interest received 6,981 1,361 13,721 2,791 (Income tax paid)

tax refunds received, net (743 ) (770 ) 9,472 (2,027 ) Net

cash provided by operating activities 130,436 72,328 215,365

137,577

Investing activities Business combinations, net of

cash acquired (263,554 ) — (263,554 ) — Purchases of intangible

assets — — (850 ) — Purchases of property and equipment (7,807 )

(4,550 ) (18,523 ) (7,114 ) Proceeds from sales of property,

equipment and intangible assets 3,000 — 3,721 — Purchases of

investments (129,948 ) (124,787 ) (194,389 ) (227,128 ) Proceeds

from maturities of investments 93,581 31,119 185,914 81,887

Proceeds from sales of investments 151 32,674 5,672 82,058 Increase

in restricted cash (552 ) (3,009 ) (552 ) (3,141 ) Net cash used in

investing activities (305,129 ) (68,553 ) (282,561 ) (73,438 )

Financing activities Proceeds from exercise of share options

707 1,278 1,704 2,155 Payment of exchangeable senior notes issuance

costs — — (410 ) — Interest paid (3,194 ) — (3,194 ) —

Net cash (used in) provided by financing activities (2,487 )

1,278 (1,900 ) 2,155

Effect of exchange rate

changes on cash and cash equivalents (11 ) (19 ) (654 ) 191

Net (decrease) increase in cash and cash equivalents

(177,191 ) 5,034 (69,750 ) 66,485

Cash and cash equivalents at

beginning of period 1,517,780 305,871 1,410,339

244,420

Cash and cash equivalents at end of

period $ 1,340,589 $ 310,905 $ 1,340,589 $

310,905

* As adjusted to reflect the impact of the

full retrospective adoption of IFRS 15.

Atlassian Corporation Plc

Reconciliation of IFRS to Non-IFRS

Results

(U.S. $ and shares in thousands, except

per share data)

(unaudited)

Three Months Ended December 31, Six Months Ended

December 31, 2018 2017 2018

2017 *As Adjusted *As Adjusted

Gross

profit

IFRS gross profit $ 249,197 $ 171,414 $ 471,304 $ 326,804 Plus:

Share-based payment expense 3,766 3,180 7,285 6,172 Plus:

Amortization of acquired intangible assets 7,060 5,294

12,411 10,587 Non-IFRS gross profit $ 260,023

$ 179,888 $ 491,000 $ 343,563

Operating

income

IFRS operating loss $ (3,169 ) $ (13,013 ) $ (3,361 ) $ (33,302 )

Plus: Share-based payment expense 60,504 45,351 108,884 89,476

Plus: Amortization of acquired intangible assets 17,449

14,317 31,788 28,632 Non-IFRS operating income

$ 74,784 $ 46,655 $ 137,311 $ 84,806

Net

income

IFRS net income (loss) $ 45,185 $ (64,209 ) $ (197,260 ) $ (75,679

) Plus: Share-based payment expense 60,504 45,351 108,884 89,476

Plus: Amortization of acquired intangible assets 17,449 14,317

31,788 28,632 Plus: Non-coupon impact related to exchangeable

senior notes and capped calls (22,915 ) — 221,771 — Less: Income

tax effects and adjustments (38,528 ) 36,564 (54,262 )

22,062 Non-IFRS net income $ 61,695 $ 32,023 $

110,921 $ 64,491

Net income per

share

IFRS net income (loss) per share - diluted $ 0.18 $ (0.28 ) $ (0.83

) $ (0.33 ) Plus: Share-based payment expense 0.24 0.20 0.47 0.39

Plus: Amortization of acquired intangible assets 0.07 0.06 0.13

0.12 Plus: Non-coupon impact related to exchangeable senior notes

and capped calls (0.08 ) — 0.90 — Less: Income tax effects and

adjustments (0.16 ) 0.15 (0.22 ) 0.09 Non-IFRS net

income per share - diluted $ 0.25 $ 0.13 $ 0.45

$ 0.27

Weighted-average

diluted shares outstanding

Weighted-average shares used in computing diluted IFRS net income

(loss) per share 247,255 230,208 236,979 229,182 Plus: Dilution

from share options and RSUs (1) — 13,170 10,066

13,124 Weighted-average shares used in computing

diluted non-IFRS net income per share 247,255 243,378

247,045 242,306

Free cash

flow

IFRS net cash provided by operating activities $ 130,436 $ 72,328 $

215,365 $ 137,577 Less: Capital expenditures (7,807 ) (4,550 )

(18,523 ) (7,114 ) Free cash flow $ 122,629 $ 67,778

$ 196,842 $ 130,463

* As adjusted to reflect the impact of the

full retrospective adoption of IFRS 15.

(1) The effects of these dilutive securities were not

included in the IFRS calculation of diluted net loss per share for

the three months ended December 31, 2017 and the six months ended

December 31, 2018 and 2017 because the effect would have been

anti-dilutive.

Atlassian Corporation Plc

Reconciliation of IFRS to Non-IFRS

Financial Targets

(U.S. $)

Three Months EndingMarch 31, 2019 Fiscal

Year EndingJune 30, 2019 Revenue $303 million

to $305 million $1,195 million to $1,199 million

IFRS gross margin 82% 83% Plus: Share-based

payment expense 2 1 Plus: Amortization of acquired intangible

assets 2 2

Non-IFRS gross margin 86% 86%

IFRS operating margin (10%) (6%) to

(5.5%) Plus: Share-based payment expense 23 21 Plus:

Amortization of acquired intangible assets 4 5

Non-IFRS

operating margin 17% 20% to 20.5% IFRS

net loss per share - diluted ($0.14) ($1.07) to

($1.06) Plus: Share-based payment expense 0.29 1.01 Plus:

Amortization of acquired intangible assets 0.05 0.22 Plus:

Non-coupon impact related to exchangeable senior notes and capped

calls 0.03 0.97 Less: Income tax effects and adjustments (0.05)

(0.32)

Non-IFRS net income per share - diluted $0.18

$0.81 to $0.82 Weighted-average shares used in

computing diluted IFRS net loss per share 238 million to 239

million 238 million to 240 million Dilution from share

options and RSUs (1) 10 million to 11 million 10 million

Weighted-average shares used in computing diluted non-IFRS net

income per share 248 million to 250 million 248

million to 250 million IFRS net cash provided by

operating activities $410 million to $420 million Less:

Capital expenditures (40 million)

Free cash flow $370

million to $380 million (1) The effects of these dilutive

securities are not included in our IFRS calculation of diluted net

loss per share for the three months ending March 31, 2019 and

fiscal year ending June 30, 2019 because the effect would be

anti-dilutive.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190117005779/en/

Investor Relations ContactIan

LeeIR@atlassian.com

Media ContactGabe Madwaypress@atlassian.com

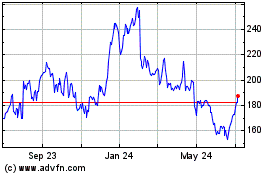

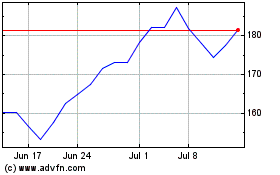

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Apr 2023 to Apr 2024