Enters Strategic OpCo-PropCo Sale-Leaseback

with Macquarie Infrastructure Partners to Acquire Bluebird Network,

LLC and Combine with Uniti Fiber’s Midwest Business

Uniti Group Inc. (“Uniti” or the “Company”) (Nasdaq: UNIT)

announced today strategic transactions involving its leasing and

fiber business units. Kenny Gunderman, President and Chief

Executive Officer of Uniti, commented, “We are excited about the

announcement of these strategic transactions. We believe they

will create value for our investors and sharpen our strategic

focus.”

STRATEGIC PARTNERSHIP WITH

MACQUARIE

Uniti has entered into an OpCo-PropCo partnership with Macquarie

Infrastructure Partners (“MIP”) to acquire Bluebird Network, LLC

(“Bluebird”). MIP operates within the Macquarie

Infrastructure and Real Assets ("MIRA") division of Macquarie

Group. Bluebird’s network consists of approximately 178,000

fiber strand miles in the Midwest across Missouri, Kansas,

Illinois, and Oklahoma. In the transaction, Uniti has agreed to

purchase the Bluebird fiber network and MIP has agreed to purchase

the Bluebird operations. In addition, Uniti has agreed to sell

Uniti Fiber’s Midwest operations to MIP, while Uniti will retain

its existing Midwest fiber network.

Concurrently with the closing of these transactions, Uniti will

lease the Bluebird fiber network and its Midwest fiber network, on

a combined basis, to MIP under a long-term triple net lease. The

initial lease term will be 20 years with multiple renewal options

at MIP’s discretion. Initial annual cash rent will be approximately

$20.3 million representing an initial cash yield of 9.6%.

Kenny Gunderman commented, “MIP is a highly respected investor

in communications infrastructure assets, and we are excited to

enter into this strategic partnership with them. We believe the

deal structure can be replicated with other operating partners in

the future and today’s announcement lays the foundation for similar

transactions.”

“We are pleased to enter this partnership with Uniti’s

experienced leadership as MIP expands its portfolio of investments

in communications infrastructure,” said Karl Kuchel, CEO of MIP.

“We look forward to the continued growth of this platform in the

years to come.”

Uniti is acquiring the fiber network of Bluebird for $319

million, of which $175 million will be funded by Uniti in cash and

$144 million from pre-paid rent to be received from MIP at closing.

As mentioned earlier, MIP has agreed to purchase the Bluebird

operations for an undisclosed purchase price. In connection

with the sale of the Company’s Midwest operations, Uniti will

receive total upfront cash of approximately $37 million, including

related prepaid rent to be received from MIP at closing. The

transactions are subject to regulatory and other customary closing

conditions, and are expected to close by the end of the third

quarter of 2019.

Wells Fargo Securities, LLC acted as exclusive financial advisor

to MIP and Uniti. Barclays provided committed financing to Uniti in

connection with the transaction.

EVALUATING POTENTIAL SALE OF LATIN AMERICA TOWER

PORTFOLIO

Separately, Uniti is evaluating the potential sale of its Uniti

Towers’ business in Latin America as the Company has received

inquiries from interested third parties in acquiring its

approximately 500 towers located across Mexico, Colombia and

Nicaragua.

Kenny Gunderman commented, “We are currently in discussions

regarding the potential sale of our Latin America tower business,

which we believe would realize substantial value for our

stockholders, and allow us to focus on communications

infrastructure growth opportunities in the U.S. Uniti Towers

continues to be a significant component of our strategy to provide

a full suite of solutions to wireless carriers and other

customers.”

ABOUT UNITI

Uniti, an internally managed real estate investment trust, is

engaged in the acquisition and construction of mission critical

communications infrastructure, and is a leading provider of

wireless infrastructure solutions for the communications

industry. As of September 30, 2018, Uniti owns 5.4 million

fiber strand miles, approximately 850 wireless towers, and other

communications real estate throughout the United States and Latin

America. Additional information about Uniti can be found on its

website at www.uniti.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended from time to

time. Those forward-looking statements include all statements that

are not historical statements of fact, including, without

limitation, those regarding our business strategies, growth

prospects, and the closings and anticipated benefits of the

sale-leaseback transaction with MIP and the potential disposition

of the Uniti Towers Latin America tower portfolio.

Words such as "anticipate(s)," "expect(s)," "intend(s),"

“estimate(s),” “foresee(s),” "plan(s)," "believe(s)," "may,"

"will," "would," "could," "should," "seek(s)" and similar

expressions, or the negative of these terms, are intended to

identify such forward-looking statements. These statements are

based on management's current expectations and beliefs and are

subject to a number of risks and uncertainties that could lead to

actual results differing materially from those projected,

forecasted or expected. Although we believe that the assumptions

underlying the forward-looking statements are reasonable, we can

give no assurance that our expectations will be attained. Factors

which could materially alter our expectations include, but are not

limited to, the ability and willingness of our customers to meet

and/or perform their obligations under any contractual arrangements

entered into with us; the ability and willingness of our customers

to renew their leases with us upon their expiration, and the

ability to reposition our properties on the same or better terms in

the event of nonrenewal or in the event we replace an existing

tenant; the adverse impact of litigation affecting us or our

customers; our ability to renew, extend or obtain contracts with

significant customers (including customers of the businesses we

acquire); the availability of and our ability to identify suitable

acquisition opportunities and our ability to acquire and lease the

respective properties on favorable terms; the risk that we fail to

fully realize the potential benefits of acquisitions or have

difficulty integrating acquired companies; our ability to generate

sufficient cash flows to service our outstanding indebtedness; our

ability to access debt and equity capital markets; the impact on

our business or the business of our customers as a result of credit

rating downgrades and fluctuating interest rates; our ability to

retain our key management personnel; our ability to qualify or

maintain our status as a real estate investment trust (“REIT”);

changes in the U.S. tax law and other state, federal or local laws,

whether or not specific to REITs; covenants in our debt agreements

that may limit our operational flexibility; other risks inherent in

the communications industry and in the ownership of communications

distribution systems, including potential liability relating to

environmental matters and illiquidity of real estate investments;

the risk that the agreements relating to our pending transactions

may be modified or terminated prior to closing; the risks related

to satisfying the conditions to our pending transactions; and

additional factors described in our reports filed with the SEC.

Uniti expressly disclaims any obligation to release publicly any

updates or revisions to any of the forward-looking statements set

forth in this press release to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any statement is based.

INVESTOR AND MEDIA CONTACTS:

Mark A. Wallace, 501-850-0866Executive Vice President, Chief

Financial Officer & Treasurermark.wallace@uniti.com

Bill DiTullio, 501-850-0872Director, Finance and Investor

Relationsbill.ditullio@uniti.com

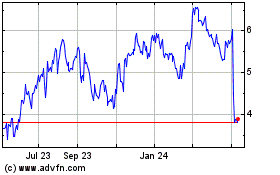

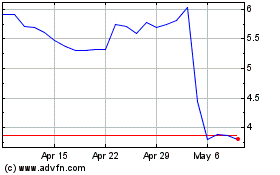

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Apr 2023 to Apr 2024