As filed with the Securities and Exchange Commission

on January 14, 2019

Registration No. 333-215204

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM F-1

ON

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMMURON LIMITED

(Exact Name of Registrant as Specified in its Charter)

|

Australia

|

|

|

|

Not Applicable

|

|

(State or Other Jurisdiction

of Incorporation or

Organization)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

Level 3, 62 Lygon Street

Carlton South, Victoria, 3053, Australia

Tel: +61 (0) 398 245 254

(Address and telephone number of Registrant’s

principal executive offices)

Puglisi & Associates

850 Library Avenue

Suite 204, Newark, DE 19711

Tel: (302) 738-6680

Fax: (302) 738-7210

(Name, address and telephone number of agent for

service)

Copies of all Correspondence to:

Steven J. Glusband, Esq.

Carter Ledyard & Milburn LLP

2 Wall Street

New York, NY 10005

Tel: 212-238-8605

Fax: 212-732-3232

Approximate date of commencement of proposed sale

to the public

:

From time to time after the effective date of this registration statement.

If the only securities being registered on this

form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this

form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the

following box: ☒

If this form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission,

acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

On December 21, 2016, we filed with the Securities

and Exchange Commission, or the SEC, a registration statement on Form F-1 (File No. 333-215204) (the “Registration Statement”

or the “Form F-1”), which was amended by pre-effective amendments filed on February 9, 2017, April 10, 2017, April

28, 2017, May 8, 2017, May 22, 2017, May 24, 2017, May 25, 2017 and May 26, 2017. The Registration Statement was declared effective

by the SEC on June 8, 2017. We also filed a registration statement on Form F-1 MEF with the SEC on June 8, 2017 (the Registration

Statement together with the Form F-1 MEF are also referred to as the “Registration Statement” and Form F-1”).

The Registration Statement related to our initial public offering whereby we offered and sold (i) 610,000 ADSs and (ii) 701,500

Warrants to purchase ADSs, all of the foregoing having been registered pursuant to the Registration Statement.

Among the purposes of this Post-Effective Amendment

on Form F-3, or, the “F-3 Post-Effective Amendment,” is to allow us to update the F-1 by including certain recent information

about our company as well as automatically incorporating by reference future filings made pursuant to the Securities Exchange Act

of 1934, as amended. This Post-Effective Amendment is also being filed to (i) convert the F-1 into a registration statement on

Form F-3, and (ii) to register only the exercise of the Warrants already issued and outstanding, consisting of an aggregate of

701,500 ADSs issuable upon exercise of the Warrants. No further offering will be made pursuant to this F-3 Post-Effective Amendment.

All filing fees payable in connection with the

registration of these securities were previously paid. This F-3 Post-Effective Amendment does not register any additional securities.

This F-3 Post-Effective Amendment is being filed in compliance with Section 10(a)(3) of the Securities Act of 1933, as amended.

The information contained in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer

to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 14, 2019

PROSPECTUS

701,500 WARRANTS TO PURCHASE ORDINARY SHARES

We are offering 701,500 American

Depositary Shares (each, an “ADS” and, collectively the “ADSs”), each representing forty (40) of our ordinary

shares, or the “Ordinary Shares,” issuable upon the exercise of currently outstanding warrants, or the “Warrants,”

that we issued in connection with our initial public offering of our ADSs and Warrants. The Warrants have an initial per ADS exercise

price of $10.00, subject to adjustment. The Warrants will expire on June 13, 2022, five years from their date of issuance. No securities

are being offered pursuant to this prospectus other than the ADSs that will be issued upon exercise of those currently outstanding

Warrants. We will not receive any proceeds from the sale of those ADSs. To the extent any of the Warrants are exercised for cash,

if at all, we will receive the exercise price for those Warrants.

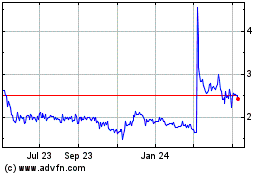

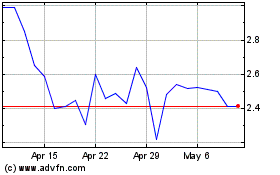

Our ADSs trade on

the NASDAQ Capital Market under the symbol “IMRN.” On January 11, 2019, the closing price of our ADSs on the NASDAQ

Capital Market was US$7.75 per ADS. The closing price of the Warrants on the NASDAQ Capital Market was US$1.61 on January 11,

2019. The ADSs and Warrants are sometimes referred to as the “securities.” Our Ordinary Shares are listed on the Australian

Stock Exchange under the symbol “IMC”. On January 11, 2019, the last reported sale price of the Ordinary Shares on

the Australian Stock Exchange was USD$0.195, based on a foreign exchange rate of AUD 1.00 to US$0.7220 as published by the Reserve

Bank of Australia on January 11, 2019.

We are an “emerging growth

company” as defined by the Jumpstart Our Business Startups Act of 2012 and as such, we have elected to comply with certain

reduced public company reporting requirements for this prospectus and future filings.

Investing in Securities

involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for certain factors you should

consider before investing in the ADSs.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 14, 2019

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We

have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus

or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for,

and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer

to sell only the ADSs offered hereby, and only under the circumstances and in the jurisdictions where it is lawful to do so. The

information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless

of its time of delivery or any sale of the securities. Our business, financial condition, results of operations and prospects may

have changed since that date.

For

investors outside the United States: We have not done anything that would permit this offering or possession or distribution of

this prospectus in any jurisdiction where action for that purpose is required, other than in the case of the U.S. Persons outside

the U.S. who come into possession of this prospectus, who must inform themselves of, and observe any restrictions relating to,

the offering of the securities and the distribution of this prospectus outside the United States.

Unless we have indicated otherwise

or the context otherwise requires, references in this prospectus and any supplement to this prospectus to “the Company,”

“Immuron,” “we,” “us” and “our” refer to Immuron Limited, a company organized under

the laws of Australia, and its wholly owned subsidiaries. In this prospectus, all references to “U.S. dollars” or “US$”

are to the currency of the United States, and all references to “Australian dollars,” “A$” or “AUD$”

are to the currency of Australia.

Our consolidated financial statements incorporated

by reference into this prospectus are prepared in Australian dollars and in accordance with the International Financial Reporting

Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our consolidated financial statements incorporated

into this prospectus comply with IFRS.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus, including

the information incorporated by reference into this prospectus, contains, and any prospectus supplement may contain, forward-looking

statements within the meaning of the federal securities laws. The use of the words “projects,” “expects,”

“may,” “plans” or “intends,” or words of similar import, identifies a statement as “forward-looking.”

The forward-looking statements included herein are based on current expectations that involve a number of risks and uncertainties.

These forward-looking statements are based on the assumption that the Company will not lose a significant customer or customers

or experience increased fluctuations of demand or rescheduling of purchase orders, that our markets will be maintained in a manner

consistent with our historical experience, that our products will remain accepted within their respective markets and will not

be replaced by new technology, that competitive conditions within our markets will not change materially or adversely, that we

will retain key technical and management personnel, that our forecasts will accurately anticipate market demand, and that there

will be no material adverse change in our operations or business. Assumptions relating to the foregoing involve judgments with

respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which

are difficult or impossible to predict accurately and many of which are beyond our control. In addition, our business and operations

are subject to substantial risks which increase the uncertainty inherent in the forward-looking statements. In light of the significant

uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded

as a representation by us or any other person that our objectives or plans will be achieved. Factors that could cause actual results

to differ from our expectations or projections include the risks and uncertainties relating to our business as set forth under

the heading “Risk Factors” in our most recent Annual Report on Form 20-F filed with the SEC

and the risks relating

to our securities

described in this prospectus at “Risk Factors.” We caution you to carefully consider these risks

and not to place undue reliance on our forward-looking statements. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, and we assume no responsibility for updating any forward-looking statements.

PROSPECTUS SUMMARY

You should read

the following summary together with the more detailed information about us, the ordinary shares that may be sold from time to time,

and our financial statements and the notes to them, all of which appear elsewhere in this prospectus or in the documents incorporated

by reference in this prospectus.

We are a

clinical-stage biopharmaceutical company with a proprietary technology platform focused on the development and

commercialization of a novel class of immunomodulator polyclonal antibodies that we believe can address significant unmet

medical needs. Our oral polyclonal antibodies offer targeted delivery within the gastrointestinal (GI) track but do not cross

into the bloodstream, potentially leading to much improved safety and tolerability, without sacrificing efficacy. We believe

that our innovative immunotherapeutic products have the potential to transform the existing treatment paradigms for gut

mediated diseases.

We currently market an OTC

product, Travelan, in Australia for prevention of Traveler's Diarrhea. We also market Travelan in the U.S. and Canada as a dietary

supplement for digestive tract protection. Travelan is based on the same platform as our immudolator product candidates and targets

13 strains of E-coli. Global sales for fiscal year 2018 were gross A$2 million (net: A$1.8 million). We recently began to market

Protectyn, a health product targeting pathogenic bacteria and the toxins they produce in the gut to prevent gut dysbiosis, in

Australia. Sales of Protectyn have not been material to date.

Our American Depositary Shares

(each, an “ADS” and, collectively the “ADSs”) and warrants (each, a “Warrant”) are listed

on the NASDAQ Capital Market under the symbols “IMRN” and “IMRNW,” respectively. Each ADS represents forty

(40) of our ordinary shares. Each Warrant has a per ADS exercise price of US$10.00 and expires five years from the date of issuance.

Our ordinary shares are also listed on the Australian Securities Exchange under the symbol “IMC.”

THE OFFERING

|

ADSs being offered pursuant to exercise of Warrants

|

701,500 ADSs issuable upon exercise of Warrants (1)

|

|

ADSs to be outstanding if all of the Warrants are exercised

|

701,500 ADSs representing 28,060,000 ordinary shares (2)

|

|

Ordinary

shares to be outstanding if the Warrants are exercised in full

|

171,275,706 shares

(3)

|

|

NASDAQ Capital Market symbol

|

“IMRN”

|

|

Use of proceeds

|

We will receive the exercise price of ADSs we issue to the holders of the Warrants upon their exercise, to the extent any of the Warrants are exercised, if at all. Such proceeds, if any, will be used for general corporate purposes.

|

|

Risk factors

|

Prospective investors should carefully consider the Risk Factors beginning on Page 5 and under similar headings in the other documents that are incorporated by reference into this prospectus for a discussion of certain factors that should be considered before buying the ordinary shares offered hereby.

|

|

|

(1)

|

As of January, 11, 2019.

|

|

|

(2)

|

Includes 333,381 ADSs that are currently issued and outstanding.

|

|

|

(3)

|

Excludes 46,059,286 ordinary shares underlying outstanding exercisable option and 4,763,000 ordinary

shares underlying underwriters’ warrants issued in connection with our IPO

.

|

Corporate Information

We

were incorporated under the laws of the Commonwealth of Australia in 1994 and have been listed on the Australian Securities Exchange

(ASX) since April 30, 1999. Our principal executive office is located at Level 3, 62 Lygon Street, Carlton South, Victoria, Australia

3053 and our telephone number is +61 (0)3 9824 5254. Our website address is www.Immuron.com.au. The information on our website

is not incorporated by reference into this prospectus.

RISK FACTORS

Investing

in our ADSs pursuant to this prospectus may involve a high degree of risk. You should

carefully consider the important factors set forth under the heading “Risk Factors” in our most recent Annual Report

on Form 20-F filed with the SEC and incorporated herein by reference and the following risks relating to our securities described

below before investing in our ADSs issuable upon exercise of the Warrants. For further details, see the section entitled “Where You Can Find Additional Information”.

Any of the risk factors referred to above could

significantly and negatively affect our business, results of operations or financial condition, which may lower the trading price

of our ADSs. The risks referred to above are not the only ones that may exist. Additional risks not currently known by us or risks

that we deem immaterial may also impair our business operations. You may lose all or a part of your investment.

Risks Related to the Purchase of

Our Securities

The market price and trading

volume of our ADSs may be volatile and may be affected by economic conditions beyond our control.

The market price

of our ADSs may be highly volatile and subject to wide fluctuations. In addition, the trading volume of the ADSs may fluctuate and

cause significant price variations to occur. If the market price of the ADSs declines significantly, you may be unable to resell

your ADSs at or above the purchase price, if at all. We cannot assure you that the market price of the ADSs will not fluctuate or

significantly decline in the future.

Some specific factors

that could negatively affect the price of the ADSs or result in fluctuations in their price and trading volume include:

|

|

●

|

actual or expected fluctuations in our operating results;

|

|

|

●

|

changes in market valuations of similar companies;

|

|

|

●

|

changes in our key personnel;

|

|

|

●

|

changes in financial estimates or recommendations by securities analysts;

|

|

|

●

|

trading prices of our ordinary shares on the ASX;

|

|

|

●

|

changes in trading volume of ADSs on NASDAQ Capital Market, or NASDAQ, and of our ordinary shares

on the ASX;

|

|

|

●

|

sales of the ADSs or ordinary shares by us, our executive officers or our shareholders in the

future; and

|

|

|

●

|

conditions in the financial markets or changes in general economic conditions.

|

The dual listing of our ordinary shares and

the ADSs may adversely affect the liquidity and value of the ADSs.

Our ordinary shares

are listed on the ASX. We cannot predict the effect of this dual listing on the value of our ordinary shares and ADSs. However,

the dual listing of our ordinary shares and ADSs may dilute the liquidity of these securities in one or both markets and may impair

the development of an active trading market for the ADSs in the U.S. The trading price of the ADSs could also be adversely affected

by trading in our ordinary shares on the ASX.

As a foreign private issuer, we

are permitted, and we expect to follow certain home country corporate governance practices in lieu of certain NASDAQ requirements

applicable to domestic issuers. This may afford less protection to holders of our ADSs.

As a foreign private

issuer whose shares are listed on the NASDAQ Capital Market, we are permitted to follow certain home country corporate governance

practices instead of certain requirements of the NASDAQ Stock Market Rules. Among other things, as a foreign private issuer we

have elected to follow home country practice with regard to the composition of the board of directors and the audit committee,

the financial expert, director nomination procedure, compensation of officers and quorum at shareholders’ meetings. In addition,

we may follow our home country law, instead of the NASDAQ Stock Market Rules, which require that we obtain shareholder approval

for certain dilutive events, such as for the establishment or amendment of certain equity based compensation plans, an issuance

that will result in a change of control of the company, certain transactions other than a public offering involving issuances of

a 20% or more interest in the company and certain acquisitions of the stock or assets of another company. Accordingly, our shareholders

may not be afforded the same protection as provided under NASDAQ’s corporate governance rules.

As a foreign private issuer, we

are permitted to file less information with the SEC than a company incorporated in the U.S. Accordingly, there may be less publicly

available information concerning us than there is for companies incorporated in the U.S.

As a foreign private

issuer, we are exempt from certain rules under the Exchange Act that impose disclosure requirements as well as procedural requirements

for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are

exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act. Moreover,

we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as a company that

files as a U.S. company whose securities are registered under the Exchange Act, nor are we required to comply with the SEC’s

Regulation FD, which restricts the selective disclosure of material non-public information. Accordingly, there may be less information

publicly available concerning us than there is for a company that files as a domestic issuer.

We are an emerging growth company

as defined in the JOBS Act and the reduced disclosure requirements applicable to emerging growth companies may make the ADSs less

attractive to investors and, as a result, adversely affect the price of the ADSs and result in a less active trading market for

the ADSs.

We are an emerging

growth company as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements

that are applicable to other public companies that are not emerging growth companies. For example, we have elected to rely on an

exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act relating to internal control over

financial reporting, and we will not provide such an attestation from our auditors for so long as we qualify as an emerging growth

company.

We may avail ourselves

of these disclosure exemptions until we are no longer an emerging growth company. We cannot predict whether investors will find

the ADSs less attractive because of our reliance on some or all of these exemptions. If investors find the ADSs less attractive,

it may cause the trading price of the ADSs to decline and there may be a less active trading market for the ADSs.

We will cease to be an emerging growth

company upon the earliest of:

|

|

●

|

the end of the fiscal year in which the fifth anniversary of completion

of our IPO occurs;

|

|

|

●

|

the end of the first fiscal year in which the market value of our

ordinary shares held by non-affiliates exceeds US$700 million as of the end of the second quarter of such fiscal year;

|

|

|

●

|

the end of the first fiscal year in which we have total annual gross

revenues of at least US$1.07 billion; and

|

|

|

●

|

the date on which we have issued more than US$1 billion in non-convertible

debt securities in any rolling three-year period.

|

Management has identified certain

matters involving our internal controls over our financial reporting that are material weaknesses under applicable standards.

Our management is responsible

for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a015(f) of the Exchange

Act). We previously reported material weaknesses in our internal control over financial reporting surrounding our monitoring controls

when assessing certain significant transactions and properly performing certain reviews and monitoring controls in the preparation

of the financial statements in accordance with IFRS, as issued by IASB. Management has determined that, as at June 30, 2018, these material weaknesses in the Company’s

internal control over financial reporting related to the financial closing and reporting processes have not been remediated.

Management assessed the effectiveness

of our internal control over financial reporting as of June 30, 2018, utilizing the criteria described in Internal Control-Integrated

Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on this evaluation

and the criteria issued by COSO, our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

concluded that, as of June 30, 2018, our internal control over financial reporting was not effective because of the material weaknesses

described above.

Plan for Remediation of Material Weakness

Our Management is currently

addressing the material weaknesses in internal control over financial reporting and is committed to remediating it as expeditiously

as possible. Management intends to devote significant time and resources to the remediation effort. Management plans to take the

following steps to improve our internal control over financial reporting and to remediate the identified material weakness:

|

|

●

|

Evaluate the staffing level and qualifications of finance department

personnel, and make changes as deemed appropriate;

|

|

|

●

|

Evaluate the need to deploy additional software systems to assist

in automating and controlling certain processes within the finance function;

|

|

|

●

|

Enhance our processes and procedures through expanded use of checklists

for key tasks to improve effectiveness and efficiency: and

|

|

|

●

|

Evaluate the utilization of external resources, to provide greater

assurance that these resources are effectively managed, and deployed, and make changes as appropriate.

|

Any future failure

to maintain such internal controls could adversely impact our ability to report our financial results on a timely and accurate

basis, which could result in our inability to satisfy our reporting obligations or result in material misstatements in our financial

statements. If our financial statements are not accurate, investors may not have a complete understanding of our operations or

may lose confidence in our reported financial information, which could result in a material adverse effect on our business or have

a negative effect on the trading price of our ordinary shares and ADSs.

ADS holders may be subject to additional

risks related to holding ADSs rather than ordinary shares.

ADS holders do not hold ordinary shares

directly and, as such, are subject to, among others, the following additional risks:

|

|

●

|

As an ADS holder, we will not treat you as one of our shareholders

and you will not be able to exercise shareholder rights, except through the ADR depositary as permitted by the deposit agreement.

|

|

|

●

|

D

istributions

on the ordinary shares represented by your ADSs will be paid to the ADR depositary, and before the ADR depositary makes a distribution

to you on behalf of your ADSs, any withholding taxes that must be paid will be deducted. Additionally, if the exchange rate fluctuates

during a time when the ADR depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution.

|

|

|

●

|

We and the ADR depositary may amend or terminate the deposit agreement

without the ADS holders’ consent in a manner that could prejudice ADS holders.

|

You must act through the ADR depositary

to exercise your voting rights and, as a result, you may be unable to exercise your voting rights on a timely basis.

As a holder of

ADSs (and not the ordinary shares underlying your ADSs), we will not treat you as one of our shareholders, and you will not be able

to exercise shareholder rights. The ADR depositary will be the holder of the ordinary shares underlying your ADSs, and ADS holders

will be able to exercise voting rights with respect to the ordinary shares represented by the ADS only in accordance with the deposit

agreement relating to the ADSs. There are practical limitations on the ability of ADS holders to exercise their voting rights due

to the additional procedural steps involved in communicating with these holders. For example, holders of our ordinary shares will

receive notice of shareholders’ meetings by mail and will be able to exercise their voting rights by either attending the

shareholders meeting in person or voting by proxy. ADS holders, by comparison, will not receive notice directly from us. Instead,

in accordance with the deposit agreement, we will provide notice to the ADR depositary of any such shareholders meeting and details

concerning the matters to be voted upon at least 30 days in advance of the meeting date. If we so instruct, the ADR depositary

will mail to holders of ADSs the notice of the meeting and a statement as to the manner in which voting instructions may be given

by holders as soon as practicable after receiving notice from us of any such meeting. To exercise their voting rights, ADS holders

must then instruct the ADR depositary as to voting the ordinary shares represented by their ADSs. Due to these procedural steps

involving the ADR depositary, the process for exercising voting rights may take longer for ADS holders than for holders of ordinary

shares. The ordinary shares represented by ADSs for which the ADR depositary fails to receive timely voting instructions will not

be voted.

If we are classified as a “passive

foreign investment company,” then our U.S. shareholders could suffer adverse tax consequences as a result.

Generally, if,

for any taxable year, at least 75% of our gross income is passive income (including our pro rata share of the gross income of our

25% or more owned corporate subsidiaries) or at least 50% of the average quarterly value of our gross assets (including our pro

rata share of the gross assets of our 25% or more owned corporate subsidiaries) is attributable to assets that produce passive

income or are held for the production of passive income, including cash, we would be characterized as a passive foreign investment

company, or PFIC, for U.S. federal income tax purposes. For purposes of these tests, passive income includes dividends, interest,

and gains from the sale or exchange of investment property and rents and royalties other than rents and royalties which are received

from unrelated parties in connection with the active conduct of a trade or business. If we are characterized as a PFIC, a U.S.

holder of our ordinary shares or ADSs may suffer adverse tax consequences, including having gains recognized on the sale of our

ordinary shares or ADSs treated as ordinary income, rather than capital gain, the loss of the preferential rate applicable to dividends

received on our ordinary shares or ADSs by individuals who are U.S. holders, and having interest charges added to their tax on

distributions from us and on gains from the sale of our ordinary shares or ADSs. See “Taxation.”

U.S. Federal Income Tax Considerations—

Passive

Foreign Investment Company

Our

status as a PFIC may also depend, in part, on how quickly we utilize the cash proceeds from our IPO, in our business. Since PFIC

status depends on the composition of our income and the composition and value of our assets, which may be determined in large

part by reference to the market value of our ordinary shares or ADSs, which may be volatile, there can be no assurance that we

will not be a PFIC for any taxable year. While we expect that we were not a PFIC for our taxable year ended June 30, 2018, no

assurance of our PFIC status can be provided for such taxable year or future taxable years. Prospective U.S. investors should

discuss the issue of our possible status as a PFIC with their tax advisors.

Currency fluctuations may adversely

affect the price of our ordinary shares and ADSs

Our ordinary shares

are quoted in Australian dollars on the ASX and the ADSs are quoted in U.S. dollars on NASDAQ. Movements in the Australian dollar/U.S.

dollar exchange rate may adversely affect the U.S. dollar price of the ADSs. In the past year the Australian dollar has generally

weakened against the U.S. dollar. However, this trend may not continue and may be reversed. If the Australian dollar weakens against

the U.S. dollar, the U.S. dollar price of the ADSs could decline, even if the price of our ordinary shares in Australian dollars

increases or remains unchanged.

We have never declared or paid

dividends on our ordinary shares and we do not anticipate paying dividends in the foreseeable future.

We have never declared

or paid cash dividends on our ordinary shares. For the foreseeable future, we currently intend to retain all available funds and

any future earnings to support our operations and to finance the growth and development of our business. Any future determination

to declare cash dividends will be made at the discretion of our board of directors, subject to compliance with applicable laws

and covenants under current or future credit facilities, which may restrict or limit our ability to pay dividends, and will depend

on our financial condition, operating results, capital requirements, general business conditions and other factors that our board

of directors may deem relevant. We do not anticipate paying any cash dividends on our ordinary shares in the foreseeable future.

As a result, a return on your investment will only occur if our ADS price appreciates.

You may not receive distributions

on our ordinary shares represented by the ADSs or any value for such distribution if it is illegal or impractical to make them available

to holders of ADSs.

While we do not

anticipate paying any dividends on our ordinary shares in the foreseeable future, if such a dividend is declared, the depositary

for the ADSs has agreed to pay to you the cash dividends or other distributions it or the custodian receives on our ordinary shares

or other deposited securities after deducting its fees and expenses. You will receive these distributions in proportion to the

number of our ordinary shares your ADSs represent. However, in accordance with the limitations set forth in the deposit agreement,

it may be unlawful or impractical to make a distribution available to holders of ADSs. We have no obligation to take any other action

to permit the distribution of the ADSs, ordinary shares, rights or anything else to holders of the ADSs. This means that you may

not receive the distributions we make on our ordinary shares or any value from them if it is unlawful or impractical to make them

available to you. These restrictions may have a material adverse effect on the value of your ADSs.

Australian takeover laws may discourage

takeover offers being made for us or may discourage the acquisition of a significant position in our ordinary shares or ADSs.

We are incorporated

in Australia and are subject to the takeover laws of Australia. Among other things, we are subject to the Australian Corporations

Act 2001, or the Corporations Act. Subject to a range of exceptions, the Corporations Act prohibits the acquisition of a direct

or indirect interest in our issued voting shares if the acquisition of that interest will lead to a person’s voting power

in us increasing to more than 20%, or increasing from a starting point that is above 20% and below 90%. Australian takeover laws

may discourage takeover offers being made for us or may discourage the acquisition of a significant position in our ordinary shares.

This may have the ancillary effect of entrenching our board of directors and may deprive or limit our shareholders’ or ADS

holders’ opportunity to sell their ordinary shares or ADSs and may further restrict the ability of our shareholders and ADS

holders to obtain a premium from such transactions.

Our Constitution and Australian

laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders.

As an Australian

company, we are subject to different corporate requirements than a corporation organized under the laws of the states of the U.S.

Our Constitution, as well as the Australian Corporations Act, set forth various rights and obligations that are unique to us as

an Australian company. These requirements may operate differently than those of many U.S. companies.

You will have limited ability to

bring an action against us or against our directors and officers, or to enforce a judgment against us or them, because we are incorporated

in Australia and certain of our directors and officers reside outside the U.S.

We are incorporated

in Australia, the majority of our directors and officers at present reside outside the U.S. and substantially all of the assets

owned by those persons are located outside of the U.S. also. As a result, it may be impracticable or at least more expensive for

you to bring an action against us or against these individuals in Australia in the event that you believe that your rights have

been infringed under the applicable securities laws or otherwise.

You may be subject to limitations

on transfer of the ADSs.

The ADSs are only

transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to time

when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer

or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary

deem it advisable to do so because of any requirement of law or of any government or governmental body, or under any provision

of the Deposit Agreement, or for any other reason.

Australian companies may not be

able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests.

Australian companies

may not have standing to initiate a shareholder derivative action in a federal court of the U.S. The circumstances in which any

such action may be brought, and the procedures and defenses that may be available in respect to any such action, may result in

the rights of shareholders of an Australian company being more limited than those of shareholders of a company organized in the

U.S. Accordingly, shareholders may have fewer alternatives available to them if they believe that corporate wrongdoing has occurred.

Australian courts are also unlikely to recognize or enforce against us judgments of courts in the U.S. based on certain liability

provisions of U.S. securities law and to impose liabilities against us, in original actions brought in Australia, based on certain

liability provisions of U.S. securities laws that are penal in nature. There is no statutory recognition in Australia of judgments

obtained in the U.S., although the courts of Australia may recognize and enforce the non-penal judgment of a foreign court of competent

jurisdiction without retrial on the merits, upon being satisfied about all the relevant circumstances in which that judgment was

obtained.

Anti-takeover provisions in our

Constitution and our right to issue preference shares could make a third-party acquisition of us difficult.

Some provisions

of our Constitution may discourage, delay or prevent a change in control of our company or management that shareholders may consider

favorable, including provisions that only require one-third of our board of directors to be elected annually and authorize our

board of directors to issue an unlimited number of shares of capital stock and preference shares in one or more series and to designate

the price, rights, preferences, privileges and restrictions of such preference shares by amending the Constitution.

USE OF PROCEEDS

All

of the proceeds from the sale of any ordinary shares offered under this prospectus are for the account of the Selling Shareholders.

Accordingly, we will not receive any proceeds from the sales of these securities.

DIVIDEND POLICY

We have never declared or

paid any cash dividend on our ordinary shares. We currently intend to retain any future earnings and do not expect to pay any

dividends in the foreseeable future. Any further determination to pay dividends on our ordinary shares will be at the discretion

of our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, capital

requirements, general business conditions, and other factors that our board of directors considers relevant.

DESCRIPTION OF ORDINARY SHARES

General

The following description

of our ordinary shares is only a summary. We encourage you to read our Constitution, which is included as an exhibit to this registration

statement, of which this prospectus forms a part.

We are a public company limited

by shares registered under the Corporations Act by the Australian Securities and Investments Commission, or ASIC. Our corporate

affairs are principally governed by our Constitution, the Corporations Act and the ASX Listing Rules. Our ordinary shares trade

on the ASX, and our ADSs and Warrants trade on NASDAQ.

The Australian law applicable

to our Constitution is not significantly different than a U.S. company’s charter documents except we do not have a limit

on our authorized share capital, the concept of par value is not recognized under Australian law and as further discussed under

“—Our Constitution.”

Subject to restrictions on

the issue of securities in our Constitution, the Corporations Act and the ASX Listing Rules and any other applicable law, we may

at any time issue shares and grant options or warrants on any terms, with the rights and restrictions and for the consideration

that our board of directors determine.

The rights and restrictions

attaching to ordinary shares are derived through a combination of our Constitution, the common law applicable to Australia, the

ASX Listing Rules, the Corporations Act and other applicable law. A general summary of some of the rights and restrictions attaching

to our ordinary shares are summarized below. Each ordinary shareholder is entitled to receive notice of, and to be present, vote

and speak at, general meetings.

Our Constitution

Our Constitution is similar

in nature to the bylaws of a U.S. corporation. It does not provide for or prescribe any specific objectives or purposes of Immuron.

Our Constitution is subject to the terms of the ASX Listing Rules and the Corporations Act. It may be amended or repealed and replaced

by special resolution of shareholders, which is a resolution passed by at least 75% of the votes cast by shareholders entitled

to vote on the resolution.

Under Australian law, a company

has the legal capacity and powers of an individual both within and outside Australia. The material provisions of our Constitution

are summarized below. This summary is not intended to be complete nor to constitute a definitive statement of the rights and liabilities

of our shareholders. Our Constitution is filed as an exhibit to the registration statement, of which this prospectus forms a

part.

Interested Directors

A director may not vote in

respect of any contract or arrangement in which the director has, directly or indirectly, any material interest according to our

Constitution. Such director must not be counted in a quorum, must not vote on the matter and must not be present at the meeting

while the matter is being considered. However, that director may execute or otherwise act in respect of that contract or arrangement

notwithstanding any material personal interest.

Unless a relevant exception

applies, the Corporations Act requires our directors to provide disclosure of certain interests or conflicts of interests and prohibits

directors from voting on matters in which they have a material personal interest and from being present at the meeting while the

matter is being considered. In addition, the Corporations Act and the ASX Listing Rules require shareholder approval of any provision

of related party benefits to our directors.

Borrowing Powers Exercisable by

Directors

Pursuant to our Constitution,

the management and control of our business affairs are vested in our board of directors. Our board of directors has the power to

raise or borrow money, and charge any of our property or business or any uncalled capital, and may issue debentures or give any

other security for any of our debts, liabilities or obligations or of any other person, in each case, in the manner and on terms

it deems fit.

Retirement of Directors

Pursuant to our Constitution

and the ASX Listing Rules, there must be an election of Directors at each annual general meeting. The directors, other than the

managing director, who are to stand for election at each annual general meeting are: (i) any Director required to retire after

a period of 3 years in office, (ii) any Director appointed by the other Directors in the year preceding the annual general meeting,

(iii) any new directors, or (iv) if no person is standing for election for the aforementioned reasons then the director longest

in office since last being elected. A director, other than the director who is the Chief Executive Officer, must retire from office

at the conclusion of the third annual general meeting after which the director was elected. Retired directors are eligible for

a re-election to the board of directors unless disqualified from acting as a director under the Corporations Act or our Constitution.

Rights and Restrictions on Classes

of Shares

The rights attaching to our

ordinary shares are detailed in our Constitution. Our Constitution provides that our directors may issue shares with preferred,

deferred or other special rights, whether in relation to dividends, voting, return of share capital, or otherwise as our board

of directors may determine. Subject to any approval which is required from our shareholders under the Corporations Act and the

ASX Listing Rules (see “—Exemptions from Certain NASDAQ Corporate Governance Rules” and “—Change

of Control”), any rights and restrictions attached to a class of shares, we may issue further shares on such terms and conditions

as our board of directors resolve. Currently, our outstanding share capital consists of only one class of ordinary shares.

Dividend Rights

Our board of directors may

from time to time determine to pay dividends to shareholders. All dividends unclaimed for one year after having been declared may

be invested or otherwise made use of by our board of directors for our benefit until claimed or otherwise disposed of in accordance

with our Constitution.

Voting Rights

Under our Constitution, and

subject to any voting exclusions imposed under the ASX Listing Rules (which typically exclude parties from voting on resolutions

in which they have an interest), the rights and restrictions attaching to a class of shares, each shareholder has one vote on a

show of hands at a meeting of the shareholders unless a poll is demanded under the Constitution or the Corporations Act. On a poll

vote, each shareholder shall have one vote for each fully paid share and a fractional vote for each share held by that shareholder

that is not fully paid, such fraction being equivalent to the proportion of the amount that has been paid to such date on that

share. Shareholders may vote in person or by proxy, attorney or representative. Under Australian law, shareholders of a public

company are not permitted to approve corporate matters by written consent. Our Constitution does not provide for cumulative voting.

Note that ADS holders may

not directly vote at a meeting of the shareholders but may instruct the depositary to vote the number of deposited ordinary shares

their ADSs represent.

Right to Share in Our Profits

Pursuant to our Constitution,

our shareholders are entitled to participate in our profits only by payment of dividends. Our board of directors may from time

to time determine to pay dividends to the shareholders; however, no dividend is payable except in accordance with the thresholds

set out in the Corporations Act.

Rights to Share in the Surplus

in the Event of Liquidation

Our Constitution provides

for the right of shareholders to participate in a surplus in the event of our liquidation, subject to the rights attaching to a

class of shares.

No Redemption Provision for Ordinary

Shares

There are no redemption provisions

in our Constitution in relation to ordinary shares. Under our Constitution, any preference shares may be issued on the terms that

they are, or may at our option be, liable to be redeemed.

Variation or Cancellation of Share Rights

Subject to the terms of issue

of shares of that class, the rights attached to shares in a class of shares may only be varied or cancelled by a special resolution

of Immuron together with either:

|

|

●

|

a special resolution passed at a separate general meeting of members holding shares in the class; or

|

|

|

●

|

the written consent of members with at least 75% of the shares in the class.

|

Directors May Make Calls

Our Constitution provides

that subject to the terms on which the shares have been issued directors may make calls on a shareholder for amounts unpaid on

shares held by that shareholder, other than monies payable at fixed times under the conditions of allotment. Shares represented

by the ADSs issued in this offering will be fully paid and will not be subject to calls by directors.

General Meetings of Shareholders

General meetings of shareholders

may be called by our board of directors. Except as permitted under the Corporations Act, shareholders may not convene a meeting.

The Corporations Act requires the directors to call and arrange to hold a general meeting on the request of shareholders with at

least 5% of the votes that may be cast at a general meeting or at least 100 shareholders who are entitled to vote at the general

meeting. Notice of the proposed meeting of our shareholders is required at least 28 clear days prior to such meeting under

the Corporations Act.

Foreign Ownership Regulation

There are no limitations on

the rights to own securities imposed by our Constitution. However, acquisitions and proposed acquisitions of securities in Australian

companies may be subject to review and approval by the Australian Federal Treasurer under the Foreign Acquisitions and Takeovers

Act 1975, or the FATA, which generally applies to acquisitions or proposed acquisitions:

|

|

●

|

by a foreign person (as defined in the FATA) or associated foreign persons that would result in such persons having an interest in 20% or more of the issued shares of, or control of 20% or more of the voting power in, an Australian company; and

|

|

|

●

|

by non-associated foreign persons that would result in such foreign person having an interest in 40% or more of the issued shares of, or control of 40% or more of the voting power in, an Australian company, where the Australian company is valued above the monetary threshold prescribed by FATA.

|

However, no such review or

approval under the FATA is required if the foreign acquirer is a U.S. entity and the value of the target is less than AUD$1,094

million.

The Australian Federal Treasurer

may prevent a proposed acquisition in the above categories or impose conditions on such acquisition if the Treasurer is satisfied

that the acquisition would be contrary to the national interest. If a foreign person acquires shares or an interest in shares in

an Australian company in contravention of the FATA, the Australian Federal Treasurer may order the divestiture of such person’s

shares or interest in shares in that Australian company.

Ownership Threshold

There

are no provisions in our Constitution that require a shareholder to disclose ownership above a certain threshold. The Corporations

Act, however, requires a shareholder to notify us and the ASX once it, together with its associates, acquires a 5% interest in

our ordinary shares, at which point the shareholder will be considered to be a “substantial” shareholder. Further,

once a shareholder owns a 5% interest in us, such shareholder must notify us and the ASX of any increase or decrease of 1% or

more in its holding of our ordinary shares, and must also notify us and the ASX on its ceasing to be a “substantial”

shareholder. Upon becoming a U.S. public company, our shareholders become subject to disclosure requirements under U.S. securities

laws.

Issues of Shares and Change in Capital

Subject to our Constitution,

the Corporations Act, the ASX Listing Rules and any other applicable law, we may at any time issue shares and grant options or

warrants on any terms, with preferred, deferred or other special rights and restrictions and for the consideration and other terms

that the directors determine.

Subject to the requirements

of our Constitution, the Corporations Act, the ASX Listing Rules and any other applicable law, including relevant shareholder approvals,

we may consolidate or divide our share capital into a larger or smaller number by resolution, reduce our share capital (provided

that the reduction is fair and reasonable to our shareholders as a whole and does not materially prejudice our ability to pay creditors)

or buy back our ordinary shares whether under an equal access buy-back or on a selective basis.

Change of Control

Takeovers of listed Australian

public companies, such as Immuron are regulated by the Corporations Act, which prohibits the acquisition of a “relevant interest”

in issued voting shares in a listed company if the acquisition will lead to that person’s or someone else’s voting

power in Immuron increasing from 20% or below to more than 20% or increasing from a starting point that is above 20% and below

90%, subject to a range of exceptions.

Generally, a person will have

a relevant interest in securities if the person:

|

|

●

|

is the holder of the securities;

|

|

|

●

|

has power to exercise, or control the exercise of, a right to vote attached to the securities; or

|

|

|

●

|

has the power to dispose of, or control the exercise of a power to dispose of, the securities, including any indirect or direct power or control.

|

If, at a particular time, a person has

a relevant interest in issued securities and the person:

|

|

●

|

has entered or enters into an agreement with another person with respect to the securities;

|

|

|

●

|

has given or gives another person an enforceable right, or has been or is given an enforceable right by another person, in relation to the securities (whether the right is enforceable presently or in the future and whether or not on the fulfillment of a condition);

|

|

|

●

|

has granted or grants an option to, or has been or is granted an option by, another person with respect to the securities; or

|

|

|

●

|

the other person would have a relevant interest in the securities if the agreement were performed, the right enforced or the option exercised;

|

the other person is taken to already have a relevant

interest in the securities.

There are a number of exceptions

to the above prohibition on acquiring a relevant interest in issued voting shares above 20%. In general terms, some of the more

significant exceptions include:

|

|

●

|

when the acquisition results from the acceptance of an offer under a formal takeover bid;

|

|

|

●

|

when the acquisition is conducted on market by or on behalf of the bidder under a takeover bid, the acquisition occurs during the bid period, the bid is for all the voting shares in a bid class and the bid is unconditional or only conditioned on prescribed matters set out in the Corporations Act;

|

|

|

●

|

when shareholders of Immuron approve the takeover by resolution passed at general meeting;

|

|

|

●

|

an acquisition by a person if, throughout the six months before the acquisition, that person or any other person has had voting power in Immuron of at least 19% and, as a result of the acquisition, none of the relevant persons would have voting power in Immuron more than three percentage points higher than they had six months before the acquisition;

|

|

|

|

|

|

|

●

|

when the acquisition results from the issue of securities under a rights issue;

|

|

|

|

|

|

|

●

|

when the acquisition results from the issue of securities under dividend reinvestment schemes;

|

|

|

|

|

|

|

●

|

when the acquisition results from the issue of securities under underwriting arrangements;

|

|

|

|

|

|

|

●

|

when the acquisition results from the issue of securities through operation of law;

|

|

|

|

|

|

|

●

|

an acquisition that arises through the acquisition of a relevant interest in another listed company which is listed on a prescribed financial market or a financial market approved by ASIC;

|

|

|

|

|

|

|

●

|

an acquisition arising from an auction of forfeited shares conducted on-market; or

|

|

|

|

|

|

|

●

|

an acquisition arising through a compromise, arrangement, liquidation or buy-back.

|

|

Breaches of the takeovers provisions of the Corporations Act are criminal offenses. ASIC and the Australian Takeover Panel have

a wide range of powers relating to breaches of takeover provisions, including the ability to make orders canceling contracts,

freezing transfers of, and rights attached to, securities, and forcing a party to dispose of securities. There are certain defenses

to breaches of the takeover provisions provided in the Corporations Act.

|

|

|

|

|

Access to and Inspection of Documents

|

|

|

|

|

Inspection of our records is governed by the Corporations Act. Any member of the public has the right to inspect or obtain copies

of our registers on the payment of a prescribed fee. Shareholders are not required to pay a fee for inspection of our registers

or minute books of the meetings of shareholders. Other corporate records, including minutes of directors’ meetings, financial

records and other documents, are not open for inspection by shareholders. Where a shareholder is acting in good faith and an inspection

is deemed to be made for a proper purpose, a shareholder may apply to the court to make an order for inspection of our books.

|

|

|

|

|

Exemptions from Certain NASDAQ Corporate Governance Rules

|

|

|

|

|

The NASDAQ listing rules allow for a foreign private issuer, such as Immuron, to follow its home country practices in lieu of

certain of the NASDAQ’s corporate governance standards. We rely on exemptions from certain corporate governance standards

that are contrary to the laws, rules, regulations or generally accepted business practices in Australia. These exemptions being

sought are described below:

|

|

|

|

●

|

We rely on an exemption from the independence requirements for a majority of our board of directors as prescribed by NASDAQ Listing Rules. The ASX Listing Rules do not require us to have a majority of independent directors although ASX Corporate Governance Principles and Recommendations do recommend a majority of independent directors. During fiscal 2018, we did not have a majority of directors who were “independent” as defined in the ASX Corporate Governance Principles and Recommendations, which definition differs from NASDAQ’s definition. Accordingly, because Australian law and generally accepted business practices in Australia regarding director independence differ to the independence requirements under NASDAQ Listing Rules, we seek to claim this exemption.

|

|

|

●

|

We rely on an exemption from the requirement that our independent directors meet regularly in executive sessions under NASDAQ Listing Rules. The ASX Listing Rules and the Corporations Act do not require the independent directors of an Australian company to have such executive sessions and, accordingly, we seek to claim this exemption.

|

|

|

|

|

|

|

●

|

We rely on an exemption from the requirement prescribed by NASDAQ Listing Rules that issuers obtain shareholder approval prior to the issuance of securities in connection with certain acquisitions, private placements of securities, or the establishment or amendment of certain stock option, purchase or other compensation plans. Applicable Australian law and the ASX Listing Rules differ from NASDAQ requirements, with the ASX Listing Rules providing generally for prior shareholder approval in numerous circumstances, including (i) issuance of equity securities exceeding 15% of our issued share capital in any 12-month period (but, in determining the 15% limit, securities issued under an exception to the rule or with shareholder approval are not counted), (ii) issuance of equity securities to related parties (as defined in the ASX Listing Rules) and (iii) issuances of securities to directors or their associates under an employee incentive plan. Due to differences between Australian law and rules and the NASDAQ shareholder approval requirements, we seek to claim this exemption.

|

|

|

|

|

|

|

●

|

We rely on an exemption from the requirement that issuers must maintain charters for each of the following committees in compliance with NASDAQ Listing Rules: audit committee, nomination committee and compensation committee. In addition, we rely on an exemption from the requirement that issuers must maintain a code of conduct in compliance with NASDAQ Listing Rules. Applicable Australian law does not require the Company to maintain any charters for their committees nor does such law require the Company maintain a code of conduct.

|

Ordinary Shares Eligible For Future Sale

Future sales of substantial

amounts of our ordinary shares or ADSs in the public market in the United States or in Australia, including ordinary shares issued

upon exercise of outstanding Warrants or options, or the possibility of such sales, could negatively affect the market price in

the United States of the ADSs and our ability to raise equity capital in the future.

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

American Depositary Shares

The Bank of New York Mellon,

as depositary, will register and deliver American Depositary Shares, also referred to as ADSs. Each ADS will represent forty (40)

shares (or a right to receive forty (40) shares) deposited with the principal Melbourne, Victoria, Australia offices of Australia

and New Zealand Banking Group Ltd, Hongkong Bank of Australia and National Australia Bank Limited as custodian for the depositary.

Each ADS will also represent any other securities, cash or other property which may be held by the depositary. The depositary’s

office at which the ADSs will be administered is located at 101 Barclay Street, New York, New York 10286. The Bank of New York

Mellon’s principal executive office is located at 225 Liberty Street, New York, New York 10286.

You may hold ADSs either (A)

directly (i) by having an American Depositary Receipt, also referred to as an ADR, which is a certificate evidencing a specific

number of ADSs, registered in your name, or (ii) by having ADSs registered in your name in the Direct Registration System, or (B)

indirectly by holding a security entitlement in ADSs through your broker or other financial institution. If you hold ADSs directly,

you are a registered ADS holder, also referred to as an ADS holder. This description assumes you are an ADS holder. If you hold

the ADSs indirectly, you must rely on the procedures of your broker or other financial institution to assert the rights of ADS

holders described in this section. You should consult with your broker or financial institution to find out what those procedures

are.

The Direct Registration System,

also referred to as DRS, is a system administered by The Depository Trust Company, also referred to DTC, under which the depositary

may register the ownership of uncertificated ADSs, which ownership is confirmed by statements sent by the depositary to the registered

holders of uncertificated ADSs.

As an ADS holder, we will

not treat you as one of our shareholders and you will not have shareholder rights. Australian law governs shareholder rights. The

depositary will be the holder of the shares underlying your ADSs. As a registered holder of ADSs, you will have ADS holder rights.

A deposit agreement among us, the depositary, ADS holders and all other persons indirectly or beneficially holding ADSs sets out

ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

The following is a summary

of the material provisions of the deposit agreement. Because it is a summary, it does not contain all the information that may

be important to you. For more complete information, you should read the entire deposit agreement and the form of ADR which summarizes

certain terms of your ADSs. A copy of the deposit agreement is filed as an exhibit to the registration statement of which this

prospectus forms a part. You may also obtain a copy of the deposit agreement at the SEC’s Public Reference Room which is

located at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by

calling the SEC at 1-800-732-0330. You may also find the registration statement and the deposit agreement on the SEC’s website

at http://www.sec.gov.

Dividends and Other Distributions

How will you receive dividends and other distributions

on the shares?

The depositary has agreed

to pay to ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited securities,

after deducting its fees and expenses. You will receive these distributions in proportion to the number of shares your ADSs represent.

|

|

●

|

Cash.

The depositary will convert any cash dividend or other cash distribution we pay on the shares into U.S. dollars, if it can do so on a reasonable basis and can transfer the U.S. dollars to the United States. If that is not possible or if any government approval is needed and cannot be obtained, the deposit agreement allows the depositary to distribute the foreign currency only to those ADS holders to whom it is possible to do so. It will hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid. It will not invest the foreign currency and it will not be liable for any interest.

|

Before making a distribution, any withholding

taxes, or other governmental charges that must be paid will be deducted. It will distribute only whole U.S. dollars and cents and

will round fractional cents to the nearest whole cent. If the exchange rates fluctuate during a time when the depositary cannot

convert the foreign currency, you may lose some or all of the value of the distribution.

|

|

●

|

Shares.

The depositary may distribute additional ADSs representing any shares we distribute as a dividend or free distribution. The depositary will only distribute whole ADSs. It will sell shares which would require it to deliver a fraction of an ADS (or ADSs representing those shares) and distribute the net proceeds in the same way as it does with cash. If the depositary does not distribute additional ADSs, the outstanding ADSs will also represent the new shares. The depositary may sell a portion of the distributed shares sufficient to pay its fees and expenses in connection with that distribution (or ADSs representing those shares).

|

|

|

●

|

Rights to purchase additional shares.

If we offer holders of our securities any rights to subscribe for additional shares or any other rights, the depositary may make these rights available to ADS holders. If the depositary decides it is not legal and practical to make the rights available but that it is practical to sell the rights, the depositary will use reasonable efforts to sell the rights and distribute the proceeds in the same way as it does with cash. The depositary will allow rights that are not distributed or sold to lapse. In that case, you will receive no value for them.

|

If the depositary makes rights available

to ADS holders, it will exercise the rights and purchase the shares on your behalf. The depositary will then deposit the shares

and deliver ADSs to the persons entitled to them. It will only exercise rights if you pay it the exercise price and any other charges

the rights require you to pay.

U.S. securities laws may restrict transfers

and cancellation of the ADSs represented by shares purchased upon exercise of rights. For example, you may not be able to trade

these ADSs freely in the United States. In this case, the depositary may deliver restricted depositary shares that have the same

terms as the ADSs described in this section except for changes needed to put the necessary restrictions in place.

|

|

●

|

Other Distributions.

The depositary will send to ADS holders anything else we distribute on deposited securities by any means it thinks is legal, fair and practical. If it cannot make the distribution in that way, the depositary has a choice. It may decide to sell what we distributed and distribute the net proceeds, in the same way as it does with cash. Or, it may decide to hold what we distributed, in which case ADSs will also represent the newly distributed property. However, the depositary is not required to distribute any securities (other than ADSs) to ADS holders unless it receives satisfactory evidence from us that it is legal to make that distribution. The depositary may sell a portion of the distributed securities or property sufficient to pay its fees and expenses in connection with that distribution.

|

The depositary is not responsible

if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. We have no obligation to

register ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take any other action

to permit the distribution of ADSs, shares, rights or anything else to ADS holders. This means that you may not receive the distributions

we make on our shares or any value for them if it is illegal or impractical for us to make them available to you.

Deposit, Withdrawal and Cancellation

How are ADSs issued?

The depositary will deliver

ADSs if you or your broker deposits shares or evidence of rights to receive shares with the custodian. Upon payment of its fees

and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register the

appropriate number of ADSs in the names you request and will deliver the ADSs to or upon the order of the person or persons that

made the deposit.

How

can ADS holders withdraw the deposited securities?

You may surrender your ADSs

at the depositary’s office. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock

transfer taxes or fees, the depositary will deliver the shares and any other deposited securities underlying the ADSs to the ADS

holder or a person the ADS holder designates at the office of the custodian. Or, at your request, risk and expense, the depositary

will deliver the deposited securities at its office, if feasible.

How do ADS holders interchange

between certificated ADSs and uncertificated ADSs?

You may surrender your ADR

to the depositary for the purpose of exchanging your ADR for uncertificated ADSs. The depositary will cancel that ADR and will

send to the ADS holder a statement confirming that the ADS holder is the registered holder of uncertificated ADSs. Alternatively,

upon receipt by the depositary of a proper instruction from a registered holder of uncertificated ADSs requesting the exchange

of uncertificated ADSs for certificated ADSs, the depositary will execute and deliver to the ADS holder an ADR evidencing those

ADSs.

Voting Rights

How do you vote?

ADS holders may instruct the

depositary how to vote the number of deposited shares their ADSs represent. Otherwise, you won’t be able to exercise your

right to vote unless you withdraw the shares. However, you may not know about the meeting enough in advance to withdraw the shares.

The depositary will notify

ADS holders of shareholders’ meetings and arrange to deliver our voting materials to them if we ask it to. Those materials

will describe the matters to be voted on and explain how ADS holders may instruct the depositary how to vote. For instructions

to be valid, they much reach the depositary by a date set by the depositary.

The depositary will try, as

far as practical, subject to the laws of Australia and of our articles of association or similar documents, to vote or to have

its agents vote the shares or other deposited securities as instructed by ADS holders. The depositary will only vote or attempt

to vote as instructed.

We cannot assure you that

you will receive the voting materials in time to ensure that you can instruct the depositary to vote your shares. In addition,

the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out

voting instructions. This means that you may not be able to exercise your right to vote and there may be nothing you can do if

your shares are not voted as you requested.