Why Generex Biotechnology Corporation (OTCMKTS:GNBT) Shares Just Caught Fire

January 09 2019 - 12:45PM

InvestorsHub NewsWire

By James Hudson - January 7, 2019

Shares of Generex Biotechnology Corporation

(OTCMKTS:GNBT) have

been ripping higher over recent days. To further flesh out the

story, the company just announced that it has completed the

acquisition of 51% of Regentys Corporation, a regenerative medicine

company focused on developing novel treatments for patients with

gastrointestinal (GI) disorders.

According to the release, “The terms of the deal include the

previously reported upfront payment of $400,000, plus $14.6 million

to be paid according to a milestone-based schedule. Details of the

transaction can be found in the Generex 8K filing with the

SEC.”

Shares of Generex Biotechnology Corporation

(OTCMKTS:GNBT) have

been ripping higher over recent days. To further flesh out the

story, the company just announced that it has completed the

acquisition of 51% of Regentys Corporation, a regenerative medicine

company focused on developing novel treatments for patients with

gastrointestinal (GI) disorders.

According to the release, “The terms of the deal include the

previously reported upfront payment of $400,000, plus $14.6 million

to be paid according to a milestone-based schedule. Details of the

transaction can be found in the Generex 8K filing with the

SEC.”

As noted above, GNBT just announced that it has completed the

acquisition of 51% of Regentys Corporation, a regenerative medicine

company focused on developing novel treatments for patients with

gastrointestinal (GI) disorders.

Recent action has seen 55% piled on for shareholders of the

listing during the trailing week. What’s more, the stock has

witnessed a pop in interest, as transaction volume levels have

recently pushed 72% beyond what we have been seeing over the larger

time frame.

Joe Moscato, CEO of Generex commented on the acquisition, “The

completion of this Regentys acquisition demonstrates our commitment

to build a world-class regenerative medicine business by acquiring

great companies with cutting-edge, patented technologies and

exceptional management teams. Our direct investment in the clinical

development of Regentys ECMH will provide long-term value to

Generex investors as we achieve milestones on the path to

commercialization in the billion dollar markets for ulcerative

colitis and other inflammatory bowel diseases.”

Currently trading at a market capitalization of $94.05M,

GNBT has a chunk ($2.4M) of cash on the books, which

stands against about $42.9M in total current liabilities. One

should also note that debt has been growing over recent quarters.

GNBT is pulling in trailing 12-month revenues of $2.4M. In

addition, the company is seeing major top-line growth, with y/y

quarterly revenues growing at 77408.9%. We will update the story

again soon as developments transpire. Sign-up for

continuing coverage on shares of $GNBT stock, as well as other hot

stock picks, get our free newsletter today and get our next

breakout pick!

Disclosure: we hold no position in $GNBT, either long or

short, and we have not been compensated for this article.

Oracle has also recently published articles on Potnetworks (POTN),

Charlotte's Web Holdings

(CWBHF), and Terra Tech Corp (TRTC).

Original Source: https://oracledispatch.com/2019/01/07/generex-biotechnology-corporation-otcmktsgnbt-shares-just-caught-fire/

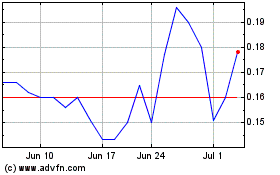

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

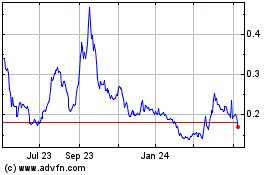

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Apr 2023 to Apr 2024