Table of Contents

Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control that may otherwise benefit holders of our common stock and may adversely affect the market price of the common stock and the voting and other rights of the holders of common stock. As of September 30, 2018, there were no shares of preferred stock outstanding and we have no current plans to issue any shares of preferred stock.

Anti-Takeover Effects of Provisions of Our Charter Documents and Delaware Law

Delaware Anti-Takeover Law

We are subject to Section 203 of the DGCL, or Section 203. Section 203 generally prohibits a public Delaware corporation from engaging in a

“

business combination

”

with an

“

interested stockholder

”

for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

•

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding upon consummation of the transaction, excluding for purposes of determining the number of shares outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

on or subsequent to the consummation of the transaction, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66

2

/

3

% of the outstanding voting stock which is not owned by the interested stockholder.

Section 203 defines a business combination to include:

•

any merger or consolidation involving the corporation and the interested stockholder;

•

any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation;

•

subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder;

•

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; and

•

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

Certificate of Incorporation and Bylaws

Provisions of our certificate of incorporation and bylaws may delay or discourage transactions involving an actual or potential change-in-control or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares or transactions that our stockholders might otherwise deem to be in their best interests. Therefore, these provisions could adversely affect the price of our common stock. Among other things, our certificate of incorporation and bylaws:

8

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File No. 001-35285):

•

Aviragen’s Annual Report on Form 10-K, as amended by Form 10-K/A, for the year ended June 30, 2017, filed with the SEC on September 1, 2017, and October 20, 2017, respectively;

•

Aviragen’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, filed with the SEC on November 7, 2017;

•

Aviragen’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2017, filed with the SEC on February 6, 2018;

•

the information specifically incorporated by reference into Aviragen’s Annual Report on Form 10-K for the year ended June 30, 2017, from our definitive proxy statement relating to our 2018 annual meeting of stockholders,

filed with the SEC on February 22, 2018;

•

Vaxart’s Current Report on Form 8-K/A, filed with the SEC on April 2, 2018, which contains the audited financial statements of Private Vaxart for the years ended December 31, 2016 and 2017;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, filed with the SEC on May 15, 2018;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, filed with the SEC on August 10, 2018;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, filed with the SEC on November 13, 2018;

•

our Current Reports on Form 8-K and Form 8-K/A (other than information furnished rather than filed) filed with the SEC on September 20, 2017, September 27, 2017, October 30, 2017

(excluding information furnished under Item 7.01)

, October 31, 2017, November 30, 2017, December 19, 2017, January 5, 2018, January 12, 2018, January 17, 2018, January 24, 2018, January 26, 2018, February 1, 2018, February 6, 2018, February 7, 2018, February 9, 2018, February 20, 2018, April 13, 2018, April 27, 2018, June 6, 2018, June 8, 2018, November 20, 2018 and December 18, 2018; and

•

the description of our common stock

contained in our Registration Statement on Form 10, filed with the SEC on May 4, 1970, as amended by our Current Report on Form 8-K (File No. 000-04829) filed with the SEC on August 15, 2003

.

All filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the shares of our common stock made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

14

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 27, 2018

PROSPECTUS

$4,250,000

Common Stock

_____________________

We have entered into a Sales Agreement, or the Sales Agreement, with B. Riley FBR, Inc., or B. Riley FBR, dated December 19, 2018

,

relating to shares of our common stock, par value $0.10 per share, offered by this prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $4,250,000 from time to time through B. Riley FBR, acting as agent.

Our common stock is listed on the Nasdaq Capital Market under the symbol “VXRT.” On December 26, 2018, the last reported sale price of our common stock on the Nasdaq Capital Market was $2.37 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus will be made in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. B. Riley FBR is not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between B. Riley FBR and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

As of December 27, 2018, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was $12,869,577, which was calculated based on 4,021,743 shares of outstanding common stock held by non-affiliates at a price of $3.20 per share, which was the closing price of our common stock on the Nasdaq Capital Market on November 28, 2018.Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the registration statement of which this prospectus is a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. As of the date hereof, we have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus.

B. Riley FBR will be entitled to compensation under the terms of the Sales Agreement at a fixed commission a rate of 3.0% of the gross sales price per share sold. In connection with the sale of the common stock on our behalf, B. Riley FBR will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of B. Riley FBR will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to B. Riley FBR with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended.

RISK FACTORS

You should consider carefully the risks described below and discussed under the section titled “Risk Factors” contained in our Quarterly Report on Form 10-Q for the three months ended September 30, 2018 as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, each of which is incorporated by reference in this prospectus in their entirety, together with other information in this prospectus, and the information and documents incorporated by reference in this prospectus, and any free writing prospectus that we have authorized for use in connection with this offering before you make a decision to invest in our common stock. If any of the following events actually occur, our business, operating results, prospects or financial condition could be harmed. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks below and incorporated by reference in this prospectus are not the only ones we face. Additional risks not currently known to us or that we currently deem immaterial may also affect our business operations. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

Risks Relating to The Offering

Our stock price is and may continue to be volatile and you may not be able to resell our securities at or above the price you paid.

The market price for our common stock is volatile and may fluctuate significantly in response to a number of factors, most of which we cannot control, such as quarterly fluctuations in financial results, announcements of new technologies impacting our products, announcements by competitors or changes in securities analysts’ recommendations could cause the price of our stock to fluctuate substantially. Each of these factors, among others, could harm your investment in our common stock and could result in your being unable to resell the common stock that you purchase at a price equal to or above the price you paid.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public markets could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock would have on the market price of our common stock.

Our management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over the use of proceeds from this offering. The net proceeds from this offering will be used to support

the clinical and preclinical development of our product candidates, and conduct

clinical trials, including a

Phase I study with our bivalent norovirus vaccines and a Phase II challenge study with our GI.1 monovalent norovirus vaccine

. We may also use a portion of the net proceeds to in-license, acquire or invest in complementary businesses or products; however, we have no current commitments or obligations to do so.

Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our common stock.

You

may experience immediate and substantial dilution.

The offering price per share in this offering will exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that 1,793,248 shares of our common stock are sold in this offering, based on an assumed sale price of $2.37 per share, the last sale price of a share of our common stock on the Nasdaq Capital Market on December 26, 2018, you will experience immediate dilution, representing the difference between the price you pay and our as adjusted net tangible book value per share as of September 30, 2018, after giving effect to this offering, of $2.43 per share. The exercise of outstanding stock options or warrants may result in further dilution of your investment. See the section titled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

S-3

You may experience future dilution as a result of future equity offerings.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

•

our ability to fund our working capital requirements;

•

the amount and timing of royalties received on sales of Relenza® and Inavir®;

•

the timing and costs of our planned clinical trials for our product candidates, both tablet vaccines and small-molecule antiviral drugs;

•

our ability to obtain and maintain regulatory approval of our product candidates;

•

our ability to establish and scale commercial manufacturing capabilities

;

•

the rate and degree of market acceptance of our products, if any, that are approved;

•

our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing;

•

our ability to obtain and maintain intellectual property protection for our product candidates;

•

our ability to identify and develop new product candidates and the number and characteristics of product candidates that we pursue;

•

our ability to retain and recruit key personnel;

•

our planned use of the proceeds from this offering;

•

our financial performance;

•

our ability to become profitable and generate consistent cash flows to remain profitable; and

•

developments and projections relating to our competitors or our industry.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “intends,” “may,” “plans,” “potential,” “will,” “would,” or the negative of these terms or other similar expressions. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss in greater detail many of these risks in the section titled “Risk Factors” contained herein in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

S-5

Table of Contents

You should read this prospectus together with the documents we have filed with the SEC that are incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Table of Contents

USE OF PROCEEDS

We currently intend to use the net proceeds

from the sale of the securities offered by us hereunder

to support

the clinical and preclinical development of our product candidates, to conduct

clinical trials, including a

Phase I study with our bivalent norovirus vaccines and a Phase II challenge study with our GI.1 monovalent norovirus vaccine

, to support the manufacturing of vaccines for these clinical trials,

and to advance our therapeutic HPV vaccine candidate, and for general corporate and working capital purposes.

Table of Contents

DILUTION

If you invest in our common stock, your interest will be diluted to the extent of the difference between the public offering price per share and the as adjusted net tangible book value per share of our common stock after this offering.

Our net tangible book value (deficit) as of September 30, 2018, was $(4.4) million, or $(0.62) per share. Net tangible book value (deficit) is total tangible assets less total liabilities divided by the total number of outstanding shares of common stock.

After giving effect to the sale of 1,793,248 shares of common stock in this offering at an assumed public offering price of $2.37 per share, which was the closing price of our common stock as reported on Nasdaq Capital Market on December 26, 2018, and after deducting commissions and estimated expenses payable by us, our net tangible book value (deficit) as of September 30, 2018, would have been $(0.5) million, or $(0.06) per share. This represents an immediate increase in as adjusted net tangible book value of $0.56 per share to our existing stockholders and immediate dilution in net tangible book value of $2.43 per share to investors participating in this offering. The following table illustrates this dilution per share to investors participating in this offering:

|

Assumed offering price per share

|

|

|

|

$

|

2.37

|

|

Net tangible book value (deficit) per share as of September 30, 2018

|

$

|

(0.62)

|

|

| |

|

Increase in as adjusted net tangible book value (deficit) per share attributable to new

investors in offering

|

|

0.56

|

|

|

|

|

As adjusted net tangible book value (deficit) per share after giving effect to this offering

|

|

|

|

|

(0.06)

|

|

Dilution per share to new investors in this offering

|

|

|

|

$

|

2.43

|

The table above assumes for illustrative purposes that an aggregate of 1,793,248 shares of our common stock are sold during the term of the sales agreement with B. Riley FBR at a price of $2.37 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on December 26, 2018, for aggregate gross proceeds of $4,250,000. The shares subject to the sales agreement with B. Riley FBR are being sold from time to time at various prices. An increase or decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $2.37 per share shown in the table above, assuming all of our common stock in the aggregate amount of $4,250,000 during the term of the sales agreement with B. Riley FBR is sold at that price, would increase/(decrease) our adjusted net tangible book value (deficit) per share after the offering by less than $0.01 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the actual offering price and the actual number of shares offered.

The above discussion and table are based on 7,141,189 shares of common stock outstanding as of September 30, 2018, and excludes:

•

960,888 shares issuable upon the exercise of outstanding stock options with a weighted average exercise price of $8.82 per share;

•

127,652 additional shares reserved for future issuance under our 2016 Equity Incentive Plan; and

•

10,914 shares issuable upon the exercise of outstanding warrants with a weighted average exercise price of $22.99 per share.

The above illustration of dilution per share to investors participating in this offering assumes no exercise of outstanding options or warrants to purchase our common stock. To the extent that any outstanding options or warrants are exercised, there will be further dilution to new investors.

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following summary description of our capital stock is based on the provisions of our amended and restated certificate of incorporation and amended and restated bylaws and the applicable provisions of the Delaware General Corporation Law. This information is qualified entirely by reference to the applicable provisions of our amended and restated certificate of incorporation, bylaws and the Delaware General Corporation Law. For information on how to obtain copies of our amended and restated certificate of incorporation and bylaws, which are exhibits to the registration statement of which this prospectus is a part, see the sections titled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus.

General

Our authorized capital stock consists of (i) 200,000,000 shares of common stock, par value $0.10 per share and (ii) 5,000,000 shares of preferred stock, par value $0.10 per share. As of September 30, 2018, there were 7,141,189 shares of common stock issued and outstanding, and no shares of preferred stock outstanding.

The following is a summary of the material provisions of the common stock and preferred stock provided for in our amended and restated certificate of incorporation and amended and restated bylaws.

Common Stock

Voting

Our common stock is entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, except that directors will be elected by a plurality of votes cast. Accordingly, the holders of a majority of the shares of common stock entitled to vote in any election of directors are able to elect all of the directors standing for election, if they so choose.

Dividends

Subject to preferences that may be applicable to any then outstanding preferred stock, the holders of common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds. We have never paid cash dividends and have no present intention to pay cash dividends.

Liquidation

In the event of a liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Rights and Preferences

Holders of our common stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock that we may designate and issue in the future.

Fully Paid and Nonassessable

All of our outstanding shares of common stock are fully paid and nonassessable.

Preferred Stock

Our board of directors has the authority, without further action by the stockholders, to issue up to 5,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such series, to fix the rights, preferences and privileges of the shares of each wholly unissued series and any qualifications, limitations or restrictions thereon and to increase or decrease the number of shares of any such series, but not below the number of shares of such series then outstanding.

S-9

Table of Contents

Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control that may otherwise benefit holders of our common stock and may adversely affect the market price of the common stock and the voting and other rights of the holders of common stock. As of September 30, 2018, there were no shares of preferred stock outstanding and we have no current plans to issue any shares of preferred stock.

Anti-Takeover Effects of Provisions of Our Charter Documents and Delaware Law

Delaware Anti-Takeover Law

We are subject to Section 203 of the DGCL, or Section 203. Section 203 generally prohibits a public Delaware corporation from engaging in a

“

business combination

”

with an

“

interested stockholder

”

for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

•

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding upon consummation of the transaction, excluding for purposes of determining the number of shares outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

on or subsequent to the consummation of the transaction, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66

2

/

3

% of the outstanding voting stock which is not owned by the interested stockholder.

Section 203 defines a business combination to include:

•

any merger or consolidation involving the corporation and the interested stockholder;

•

any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation;

•

subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder;

•

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; and

•

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

Certificate of Incorporation and Bylaws

Provisions of our certificate of incorporation and bylaws may delay or discourage transactions involving an actual or potential change-in-control or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares or transactions that our stockholders might otherwise deem to be in their best interests. Therefore, these provisions could adversely affect the price of our common stock. Among other things, our certificate of incorporation and bylaws:

S-10

Table of Contents

•

permit our board of directors to issue up to 5,000,000 shares of preferred stock, with any rights, preferences and privileges as they may designate (including the right to approve an acquisition or other change in control);

•

provide that the authorized number of directors may be changed only by resolution adopted by a majority of the board of directors;

•

provide that all vacancies, including newly created directorships, may, except as otherwise required by law or subject to the rights of holders of preferred stock as designated from time to time, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum;

•

require that any action to be taken by our stockholders must be effected at a duly called annual or special meeting of stockholders or by action taken by written consent;

•

provide that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors at a meeting of stockholders must provide notice in writing in a timely manner and also specify requirements as to the form and content of a stockholder

’

s notice; and

•

provide that special meetings of our stockholders may be called only by the chairman of the board, the president or by our board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors (whether or not there exist any vacancies).

Nasdaq Capital Market Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol

“

VXRT.

”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. The transfer agent and registrar

’

s address is 6201 15th Avenue, Brooklyn, New York 11219.

S-11

PLAN OF DISTRIBUTION

We have entered into the sales agreement with B. Riley FBR under which we may issue and sell our common stock from time to time through B. Riley FBR acting as sales agent. Sales of shares of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method that is deemed an “at the market offering” as defined in Rule 415 promulgated under the Securities Act. We may instruct B. Riley FBR not to sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or B. Riley FBR may suspend the offering of common stock upon notice and subject to other conditions.

B. Riley FBR will offer our common stock subject to the terms and conditions of the sales agreement as agreed upon by us and B. Riley FBR. Each time we wish to issue and sell common stock under the sales agreement, we will notify B. Riley FBR of the number or dollar value of shares to be issued, the time period during which such sales are requested to be made, any limitation on the number of shares that may be sold in one day, any minimum price below which sales may not be made and other sales parameters as we deem appropriate. Once we have so instructed B. Riley FBR, unless B. Riley FBR declines to accept the terms of the notice, B. Riley FBR has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of B. Riley FBR under the sales agreement to sell our common stock are subject to a number of conditions that we must meet.

We will pay B. Riley FBR commissions for its services in acting as agent in the sale of common stock at a commission rate equal to 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse B. Riley FBR for certain specified expenses, including the fees and disbursements of its legal counsel in an amount not to exceed $35,000. We estimate that the total expenses for the offering, excluding commissions and reimbursements payable to B. Riley FBR under the terms of the sales agreement, will be approximately $200,000.

Settlement for sales of common stock will generally occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and B. Riley FBR in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of the common stock on our behalf, B. Riley FBR will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of B. Riley FBR will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to B. Riley FBR against certain civil liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the sales agreement will terminate upon the earlier of (i) the sale of all of our common stock subject to the sales agreement, or (ii) termination of the sales agreement as provided therein.

B. Riley FBR and its affiliates may in the future provide various investment banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees.

Table of Contents

LEGAL MATTERS

Cooley LLP, Palo Alto, California, will pass upon the validity of the shares of common stock offered hereby. B. Riley FBR has been represented by Duane Morris LLP, New York, New York.

EXPERTS

On February 13, 2018, privately-held Vaxart, Inc., or Private Vaxart, and Aviragen Therapeutics, Inc., or Aviragen, completed a business combination in accordance with the terms

an agreement and plan of merger and reorganization, dated

October 27, 2017

, by and among Aviragen, Agora Merger Sub, Inc., or Merger Sub, and Private Vaxart, pursuant to which Merger Sub merged with and into Private Vaxart, with Private Vaxart surviving as a wholly-owned subsidiary of Aviragen, or the Merger. Aviragen changed its name at the closing of the Merger to Vaxart, Inc., or the Combined Company, and Private Vaxart changed its name to Vaxart Biosciences, Inc.

For accounting purposes, Aviragen was deemed to be the acquired entity in the Merger, and the financial statements of Private Vaxart became the historical financial statements of the Combined Company following the Merger.

The consolidated financial statements of Aviragen Therapeutics, Inc. appearing in Aviragen Therapeutics, Inc.’s Annual Report on Form 10-K for the year ended June 30, 2017 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon included therein, and incorporated herein by reference. Such financial statements are incorporated herein in reliance upon the report of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

The financial statements of

Vaxart Biosciences, Inc. as of December 31, 2017 and 2016,

and for each of the years in the two-year period ended December 31, 2017,

have been incorporated by reference herein and in the registration statement in reliance upon the report of

KPMG LLP

, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report covering the December 31, 2017 financial statements contains an

explanatory paragraph that states that Vaxart Biosciences, Inc. has suffered recurring losses from operations, has an accumulated deficit, and has debt obligations which raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of that uncertainty.

In connection with the closing of the Merger on February 13, 2018, the board of directors of Vaxart, Inc. dismissed Ernst & Young LLP

as its independent registered public accounting firm, effective immediately

.

The reports of Ernst & Young LLP on Aviragen Therapeutics, Inc.’s consolidated financial statements for the fiscal years ended June 30, 2017 and 2016 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. During the fiscal years ended June 30, 2017 and 2016, and the subsequent interim period through February 13, 2018 there were no: (1) disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) with Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreement if not resolved to the satisfaction of Ernst & Young LLP would have caused Ernst & Young LLP to make reference thereto in its reports on the consolidated financial statements for such years, or (2) reportable events (as described in Item 304(a)(1)(v) of Regulation S-K)

.

On February 13, 2018, t

he board of directors of Vaxart, Inc., in connection with the Merger and the dismissal of Ernst & Young LLP, approved the engagement of KPMG LLP as the Combined Company’s independent registered public accounting firm for the year ending December 31, 2017.

S-13

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

We maintain a website at www.vaxart.com. Information contained in or accessible through our website does not constitute a part of this prospectus.

S-14

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File No. 001-35285):

•

Aviragen’s Annual Report on Form 10-K, as amended by Form 10-K/A, for the year ended June 30, 2017, which were filed with the SEC on September 1, 2017, and October 20, 2017, respectively;

•

Aviragen’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, which was filed with the SEC on November 7, 2017;

•

Aviragen’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2017, which was filed with the SEC on February 6, 2018;

•

the information specifically incorporated by reference into Aviragen’s Annual Report on Form 10-K for the year ended June 30, 2017, from our definitive proxy statement relating to our 2018 annual meeting of stockholders,

filed with the SEC on February 22, 2018;

•

Vaxart’s Current Report on Form 8-K/A, filed with the SEC on April 2, 2018, which contains the audited financial statements of Private Vaxart for the years ended December 31, 2016 and 2017;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which was filed with the SEC on May 15, 2018;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, which was filed with the SEC on August 10, 2018;

•

Vaxart’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, which was filed with the SEC on November 13, 2018;

•

our Current Reports on Form 8-K and Form 8-K/A (other than information furnished rather than filed) filed with the SEC on September 20, 2017, September 27, 2017, October 30, 2017

(excluding information furnished under Item 7.01)

, October 31, 2017, November 30, 2017, December 19, 2017, January 5, 2018, January 12, 2018, January 17, 2018, January 24, 2018, January 26, 2018, February 1, 2018, February 6, 2018, February 7, 2018, February 9, 2018, February 20, 2018, April 13, 2018, April 27, 2018, June 6, 2018, June 8, 2018, November 20, 2018, and December 18, 2018; and

•

the description of our common stock

contained in our Registration Statement on Form 10, filed with the SEC on May 4, 1970, as amended by our Current Report on Form 8-K (File No. 000-04829) filed with the SEC on August 15, 2003

.

All filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the shares of our common stock made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

S-15

Table of Contents

You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Vaxart, Inc.

290 Utah Ave

Suite 200

South San Francisco, CA 94080

Attn: Secretary

(650) 550-3500

Table of Contents

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14.

Other Expenses of Issuance and Distribution

The following table sets forth an estimate of the fees and expenses, other than the underwriting discounts and commissions, payable by us in connection with the issuance and distribution of the securities being registered. All the amounts shown are estimates, except for the SEC registration fee, Nasdaq Capital Market fee and the FINRA filing fee.

|

|

Amount

|

|

SEC registration fee

|

$

|

3,030

|

|

Nasdaq Capital Market fee

|

|

*

|

|

FINRA filing fee

|

|

4,250

|

|

Accounting fees and expenses

|

|

*

|

|

Legal fees and expenses

|

|

*

|

|

Transfer agent and registrar fees and expenses

|

|

*

|

|

Printing and miscellaneous fees and expenses

|

|

*

|

|

Total

|

$

|

*

|

* These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

Item 15.

Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act.

Our amended and restated certificate of incorporation, as amended, and amended and restated bylaws provide that we will indemnify our directors and officers, and may indemnify our employees and other agents, to the fullest extent permitted by the Delaware General Corporation Law. However, Delaware law prohibits our certificate of incorporation from limiting the liability of our directors for the following:

·

any breach of the director’s duty of loyalty to us or to our stockholders;

·

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

·

unlawful payment of dividends or unlawful stock repurchases or redemptions; and

·

any transaction from which the director derived an improper personal benefit.

We have entered into agreements to indemnify each of our directors and officers. These agreements provide for the indemnification of such persons for all reasonable expenses and liabilities incurred in connection with any action or proceeding brought against them by reason of the fact that they are or were serving in such capacity.

We maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the Exchange Act that might be incurred by any director or officer in his capacity as such. We have obtained director and officer liability insurance to cover liabilities our directors and officers may incur in connection with their services to us.

In the sales agreement we are entering into, and filed as Exhibit 1.2 hereto, in connection with the sale of our common stock being registered hereby, the sales agent has agreed to indemnify, under certain circumstances, us, our officers, our directors, and our controlling persons within the meaning of the Securities Act, against certain liabilities.

In any underwriting agreement we enter into in connection with the sale of our common stock being registered hereby, the underwriters will agree to indemnify, under certain circumstances, us, our officers, our directors, and our controlling persons within the meaning of the Securities Act, against certain liabilities

.

II-1

Table of Contents

Item 16.

Exhibits

|

Exhibit No.

|

|

Exhibit Description

|

|

Schedule / Form

|

|

File Number

|

|

Exhibit

|

|

Filing Date

|

|

1.1+

|

|

Form of Underwriting Agreement

|

|

|

|

|

|

|

| |

|

1.2

|

|

Form of Sales Agreement dated December 19, 2018 by and between Vaxart, Inc. and B. Riley FBR, Inc.

|

|

S-3

|

|

333-228910

|

|

1.2

|

|

December 20, 2018

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation

|

|

10-K

|

|

001-35285

|

|

3.1

|

|

September 13, 2016

|

|

3.2

|

|

Certificate of Amendment to Restated Certificate of Incorporation of Aviragen Therapeutics, Inc.

|

|

8-K

|

|

001-35285

|

|

3.1

|

|

February 20, 2018

|

|

3.3

|

|

Certificate of Amendment to Restated Certificate of Incorporation of Vaxart, Inc.

|

|

8-K

|

|

001-35285

|

|

3.2

|

|

February 20, 2018

|

|

3.4

|

|

Restated Bylaws of Vaxart, Inc.

|

|

10-K

|

|

001-35285

|

|

3.2

|

|

September 13, 2016

|

|

4.1

|

|

Reference is made to Exhibits 3.1 through 3.3

|

|

|

|

|

|

|

| |

|

4.2

|

|

Form of Common Stock Certificate.

|

|

S-3

|

|

333-228910

|

|

4.2

|

|

December 20, 2018

|

|

5.1

|

|

Opinion of Cooley LLP.

|

|

S-3

|

|

333-228910

|

|

5.1

|

|

December 20, 2018

|

|

23.1

|

|

Consent of Ernst & Young LLP, independent registered public accounting firm.

|

|

S-3

|

|

333-228910

|

|

23.1

|

|

December 20, 2018

|

|

23.2*

|

|

Consent of KPMG LLP, independent registered public accounting firm.

|

|

|

|

|

|

|

| |

|

23.3

|

|

Consent of Cooley LLP (included in Exhibit 5.1).

|

|

S-3

|

|

333-228910

|

|

23.3

|

|

December 20, 2018

|

|

24.1

|

|

Power of Attorney (included on the signature page of the original filing).

|

|

S-3

|

|

333-228910

|

|

24.1

|

|

December 20, 2018

|

_____________

+ To be filed by amendment or as an exhibit to a Current Report on Form 8-K and incorporated herein by reference, if applicable.

* Filed herewith.

Item 17.

Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

II-2

Table of Contents

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) That, for purposes of determining any liability under the Securities Act of 1933:

(i) the information omitted from the form of prospectus filed as part of the registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the registrant pursuant to Rule 424(b)(l) or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be a part of the registration statement as of the time it was declared effective; and

II-3

Table of Contents

(ii) each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Amendment No. 1 to Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of South San Francisco, State of California, on December 27, 2018.

|

|

|

VAXART, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Wouter W. Latour, M.D.

|

|

|

|

|

Wouter W. Latour, M.D.

|

|

|

|

|

President and Chief Executive Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Amendment No. 1 to Registration Statement has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

Date

|

|

/s/ Wouter W. Latour, M.D.

|

|

President, Chief Executive Officer and Director

|

December 27, 2018

|

|

Wouter W. Latour, M.D.

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

/s/ John M. Harland

|

|

Chief Financial Officer and Secretary

|

December 27, 2018

|

|

John M. Harland

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

*

|

|

Chairman of the Board

|

December 27, 2018

|

|

Richard Markham

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

December 27, 2018

|

|

Michael J. Finney, Ph.D.

|

|

|

|

|

|

|

| |

|

*

|

|

Director

|

December 27, 2018

|

|

Anne VanLent

|

|

| |

Table of Contents

|

|

|

|

|

|

Signature

|

|

Title

|

Date

|

|

|

|

|

|

|

*

|

|

Director

|

December 27, 2018

|

|

Geoffrey F. Cox, Ph.D.

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

December 27, 2018

|

|

John P. Richard

|

|

|

|

|

|

|

*By:

|

/s/ Wouter W. Latour, M.D.

|

|

|

|

Wouter W. Latour, M.D.

|

|

|

|

Attorney-in-fact

|

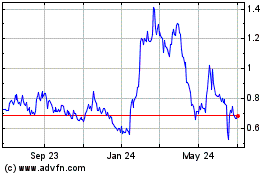

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

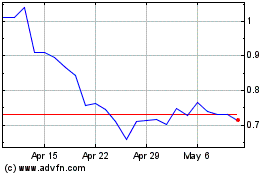

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Apr 2023 to Apr 2024