Current Report Filing (8-k)

December 18 2018 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

:

December 1

2

, 201

8

Friedman Industries, Incorporated

(Exact name of registrant as specified in its charter)

|

Texas

(State or other jurisdiction

of incorporation)

|

1-07521

(Commission File Number)

|

74-1504405

(IRS Employer Identification No.)

|

|

|

|

|

|

1121 Judson Rd. Suite 124

Longview, TX

(Address of principal executive offices)

|

|

75601

(Zip Code)

|

|

|

|

|

|

|

(903) 758-3431

(Registrant’s telephone number, including area code)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|_| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|_| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|_| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On December 12, 2018, Friedman Industries, Inc. (the “Company”) entered into a Loan Agreement (the “Loan Agreement”) providing for a $5.0 million revolving line of credit facility (the “Credit Facility”) with Citizens National Bank (the “Bank”). Pursuant to the Loan Agreement, the Company entered into a Promissory Note on December 12, 2018, evidencing the Credit Facility (the “Promissory Note”). The Credit Facility expires on December 12, 2019. The Credit Facility takes the place of a prior facility that was disclosed previously on the Company’s Form 8-K dated December 15, 2017.

Borrowings under the Credit Facility bear interest at the Bank’s prime rate minus 0.55%. Interest payments on amounts advanced are due monthly, and principal payments may be made at any time without penalty. All outstanding principal and accrued interest is due upon expiration of the Credit Facility. Pursuant to a Commercial Security Agreement (the “Security Agreement”) executed by the Company on December 12, 2018, the Credit Facility is collateralized by certain accounts receivable and certain inventory of the Company, including the accounts receivable and inventory of the Company’s tubular segment. The tubular segment consists of the Company’s Texas Tubular Products (“TTP”) division in Lone Star, Texas. TTP is engaged in the manufacture, processing and distribution of tubular goods.

Access to funds under the Credit Facility is subject to a borrowing base requirement. The borrowing base is calculated as 80% of eligible tubular segment accounts receivable plus 40% of eligible tubular segment inventory. The total amount contributed to the borrowing base by eligible inventory shall not exceed $3.0 million.

The Credit Facility contains certain customary affirmative and negative covenants. Financial covenants contained in the Credit Facility include:

|

|

●

|

The Company will not permit at any time its total shareholders’ equity to be less than $50.0 million.

|

|

|

●

|

The Company will not permit at any time its total liabilities to exceed 50% of total shareholders’ equity.

|

|

|

●

|

The Company will not permit its debt service coverage ratio, measured as of the end of each calendar quarter, to be less than 2.00 to 1.00. The debt service coverage ratio is calculated on a trailing twelve month period as the ratio of earnings before interest, taxes, depreciation and amortization (EBITDA) to the sum of interest expense for such period, scheduled principal payments for such period on all indebtedness for money borrowed and capital leases, and the aggregate amount payable during such period under any operating leases.

|

In the event of an uncured event of default, amounts borrowed under the Credit Facility and all unpaid interest will become due immediately.

As of the filing date of this Current Report on Form 8-K, the Company has not borrowed any amount under the Credit Facility.

The foregoing descriptions of the Loan Agreement, Credit Facility, Promissory Note and Security Agreement are not complete and are qualified in their respective entireties by the full text of the Loan Agreement, Promissory Note, and Security Agreement filed as exhibits to this Current Report on Form 8-K.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 3.03 Material Modification to Rights of Security Holders

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 18, 2018

|

|

FRIEDMAN INDUSTRIES, INCORPORATED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Alex LaRue

|

|

|

|

|

Alex LaRue

|

|

|

|

|

Chief Financial Officer - Secretary and Treasurer

|

|

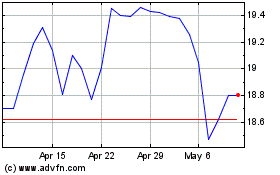

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

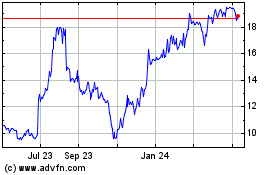

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Apr 2023 to Apr 2024