By Jonathan D. Rockoff and Sara Randazzo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 18, 2018).

Johnson & Johnson faced continued concerns on Wall Street

about the threat posed by lawsuits over the safety of the company's

signature baby powder.

Shares fell 2.9% Monday, after dropping 10% Friday following

news reports saying J&J knew for years some of its talcum

powder contained asbestos. The slide continued even though J&J

mounted an aggressive counterattack, including taking out full-page

newspaper ads.

The plunge, which has cut J&J's market capitalization by

$50.2 billion, illustrates the risk companies take fighting

litigation tooth-and-nail, rather than settling. Companies

sometimes calculate it is better to resolve sprawling litigation

with one payout rather than face the expense and reputational

damage of taking dozens of cases to trial.

J&J executives and lawyers have long insisted the signature

powder is safe and asbestos-free. Settling would set a "really bad

precedent when the science and facts [are] on our side," Chief

Financial Officer Joseph Wolk said in an interview Monday.

Any acknowledgment that the powder isn't safe could imperil not

just sales but the entire company's image, marketing experts say.

The Johnson's franchise of soaps, shampoos and powders is one of

the few brands to use the company's name. It rings up about $1.5

billion in annual sales.

Several analysts have minimized concerns about the lawsuits'

potential financial impact. But the downside to J&J's steadfast

defense has been repeated legal and public-relations hits.

"You're taking a product you used to associate with good health

or being clean, and all of a sudden, you associate it with cancer,"

said Witold Henisz, a management professor at the University of

Pennsylvania's Wharton School.

Several juries have ruled against the company in the 18 cases to

go to trial in recent years, including a jury in St. Louis that in

July awarded $4.7 billion in damages to 22 women and their families

who blamed ovarian-cancer cases on asbestos in the baby powder.

J&J has appealed the verdict, and other judgments against

it.

Imerys SA, which supplied the talc in the powder at issue in the

St. Louis case and was also named as a defendant, had agreed to

settle before the trial began for an undisclosed amount.

"Imerys Talc America is committed to the quality and safety of

its products, as evidenced by our quality testing results that

consistently show no asbestos," the company said in a statement

following the settlement.

J&J appeals have resulted in verdicts reversed, and the

company has also won several trials while others ended in

mistrials.

The overall record has persuaded the company and its lawyers

that its aggressive defense is the right approach, according to Mr.

Wolk. He said he expected J&J shares to regain value lost as

investors refocus on the company's fundamentals. "We will recover

from this recent downturn," he said.

The plaintiffs' strategy has shifted as the litigation has

evolved. Earlier trials claimed Johnson's talcum powder itself

caused ovarian cancer. In more recent cases, plaintiffs allege

asbestos in the powder is to blame for mesothelioma, as well as for

ovarian cancer.

The company said in a recent earnings report it faces 11,700

claims over its talcum-based body powders.

In dispute between the plaintiffs and J&J is whether the

talcum powder actually contained asbestos and if it did, how that

would cause a life-threatening disease. Plaintiffs' lawyers contend

J&J had evidence that the powder could be harmful but hid those

revelations from the public.

The American Cancer Society says some talc contains asbestos, a

carcinogen, in its natural form, but that talc-based cosmetics

products are supposed to be free of asbestos. Studies of talcum

powder not focused on asbestos have found a small increase in risk

of ovarian cancer if any risk at all, according to the

organization.

The recent stock hit, J&J's worst two-day stretch since

2002, came after Reuters and then the New York Times reported the

company knew testing from the 1970s to early 2000s sometimes found

asbestos tainted its talc but failed to alert regulators or the

public.

J&J says thousands of tests conducted by the company, health

regulators and outside labs found the talc used in the baby powder

was asbestos-free, and the company behaved appropriately.

J&J has sought to counter the articles. Ahead of their

publication, the company established a website --

www.factsabouttalc.com.

Since Friday, Mr. Wolk and CEO Alex Gorsky have reached out to

top investors to offer reassurance. "We don't see these folks

selling," Mr. Wolk said of the investors.

J&J said after Monday's market close that its board had

authorized the repurchase of up to $5 billion in shares.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Sara Randazzo at sara.randazzo@wsj.com

(END) Dow Jones Newswires

December 18, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

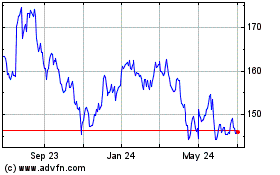

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

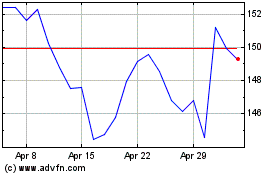

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024